ACER REPORT ON TRANSMISSION AND DISTRIBUTION TARIFF METHODOLOGIES IN EUROPE

2

Contents

Executive summary ................................................................................................................................. 6

1. Introduction ...................................................................................................................................... 9

2. Definitions ...................................................................................................................................... 11

3. Cost model and cost cascading .................................................................................................... 14

3.1. Cost model .......................................................................................................................... 14

3.2. Cost cascading .................................................................................................................... 18

3.3. Conclusions and recommendations .................................................................................... 22

4. Injection charges ........................................................................................................................... 24

4.1. General overview ................................................................................................................ 24

4.2. Producers ............................................................................................................................ 34

4.3. Storage facilities .................................................................................................................. 35

4.4. Prosumers ........................................................................................................................... 38

4.5. Conclusions and recommendations .................................................................................... 39

5. Connection charges ...................................................................................................................... 42

5.1. General overview ................................................................................................................ 42

5.2. Producers ............................................................................................................................ 46

5.3. Consumers .......................................................................................................................... 48

5.4. Storage facilities .................................................................................................................. 49

5.5. Prosumers ........................................................................................................................... 50

5.6. Conclusions and recommendations .................................................................................... 50

6. Reactive energy charges ............................................................................................................... 51

6.1. General overview ................................................................................................................ 51

6.2. Structure of reactive energy charges .................................................................................. 52

6.3. Values and differentiation of reactive energy charges ........................................................ 53

6.4. Conclusions and recommendations .................................................................................... 54

7. Time-of-use network charges ........................................................................................................ 55

7.1. General overview ................................................................................................................ 55

7.2. Design of time-of-use network charges .............................................................................. 58

7.3. Mandatory vs optional use of time-of-use signals ............................................................... 62

7.4. Other measures to provide time signals to the network users ............................................ 63

7.5. Effective impacts of the usage of time-of-use network charges ......................................... 64

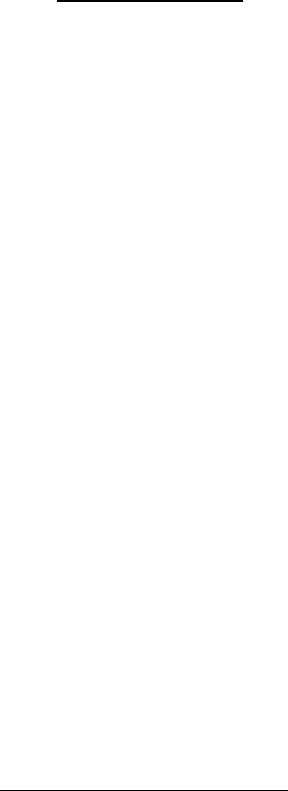

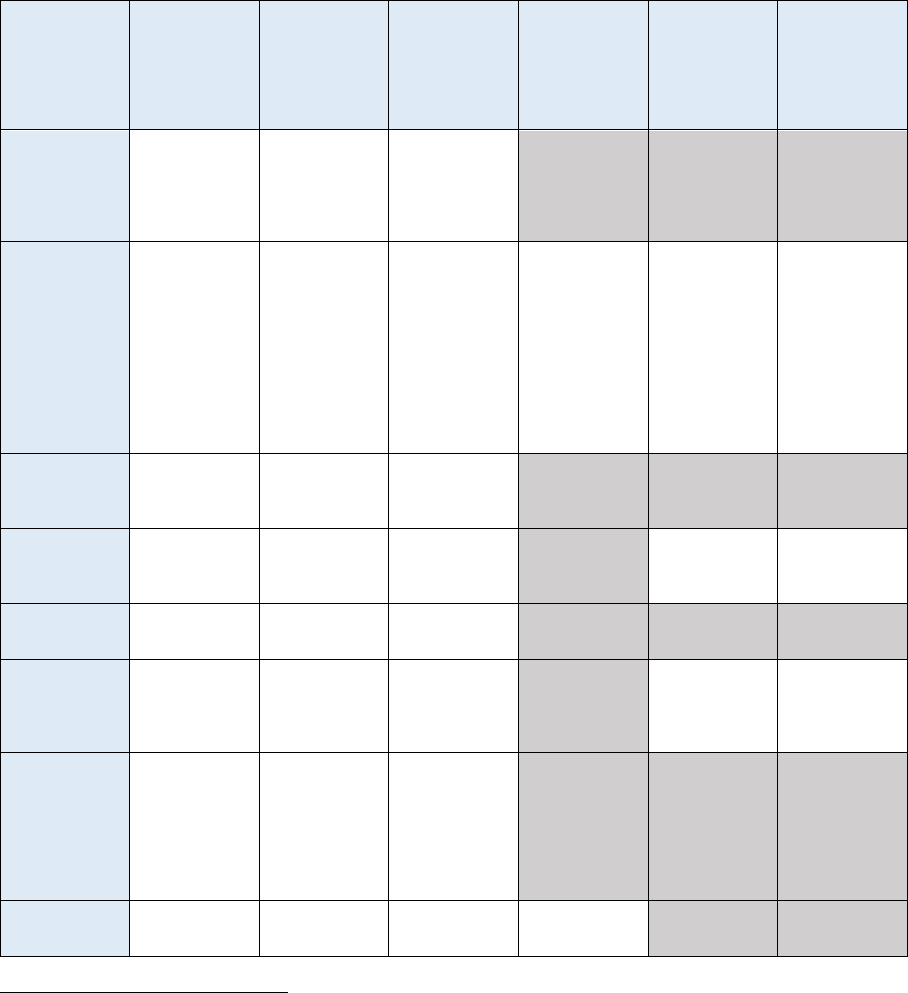

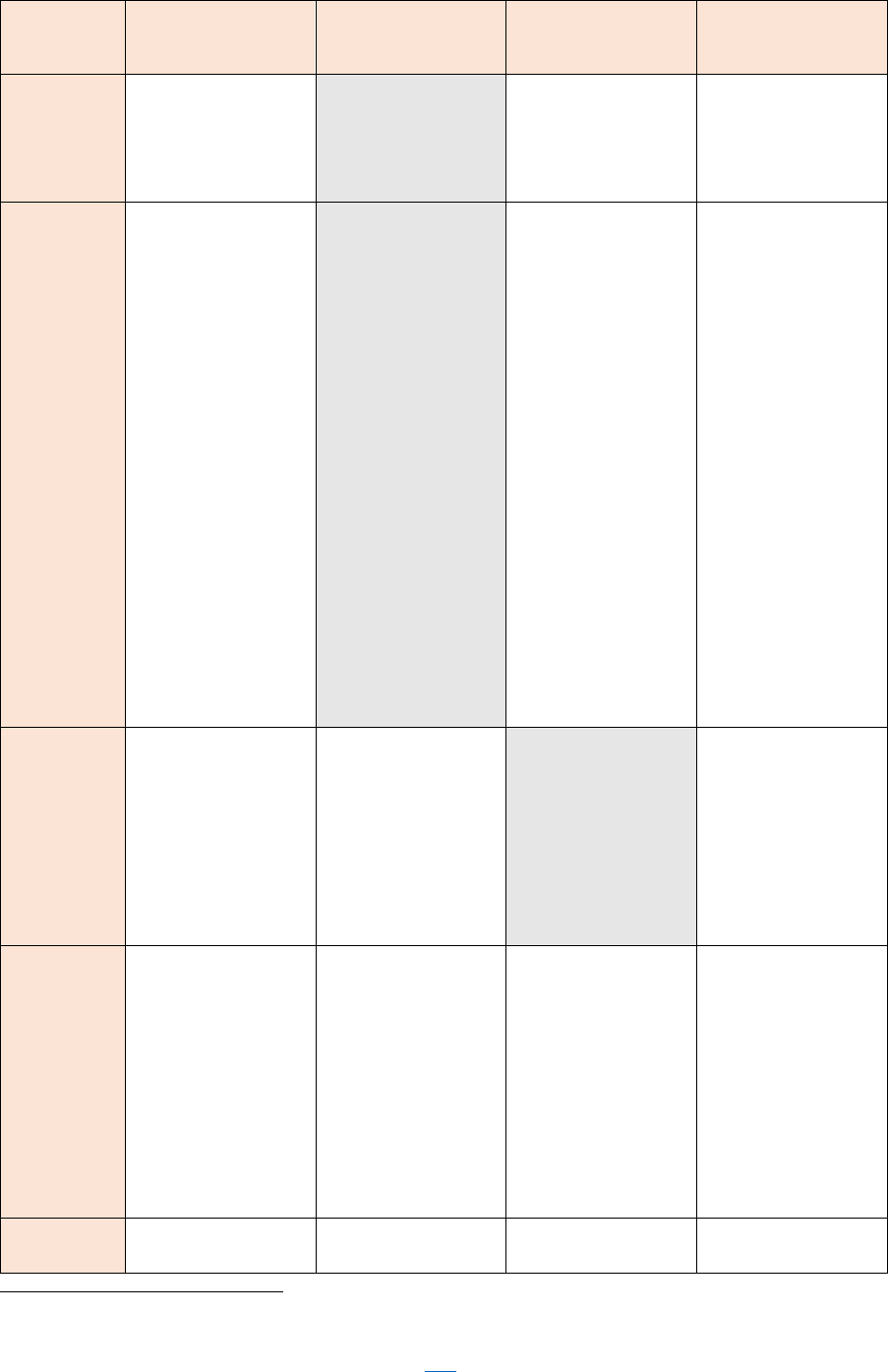

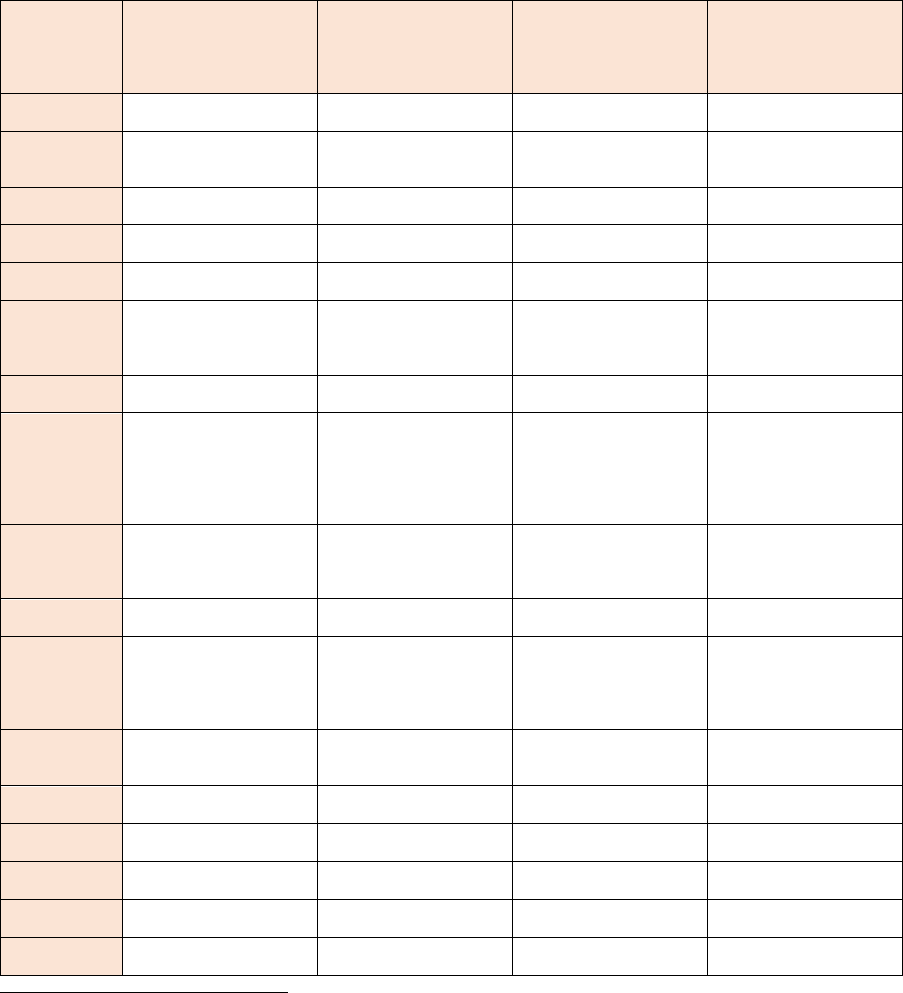

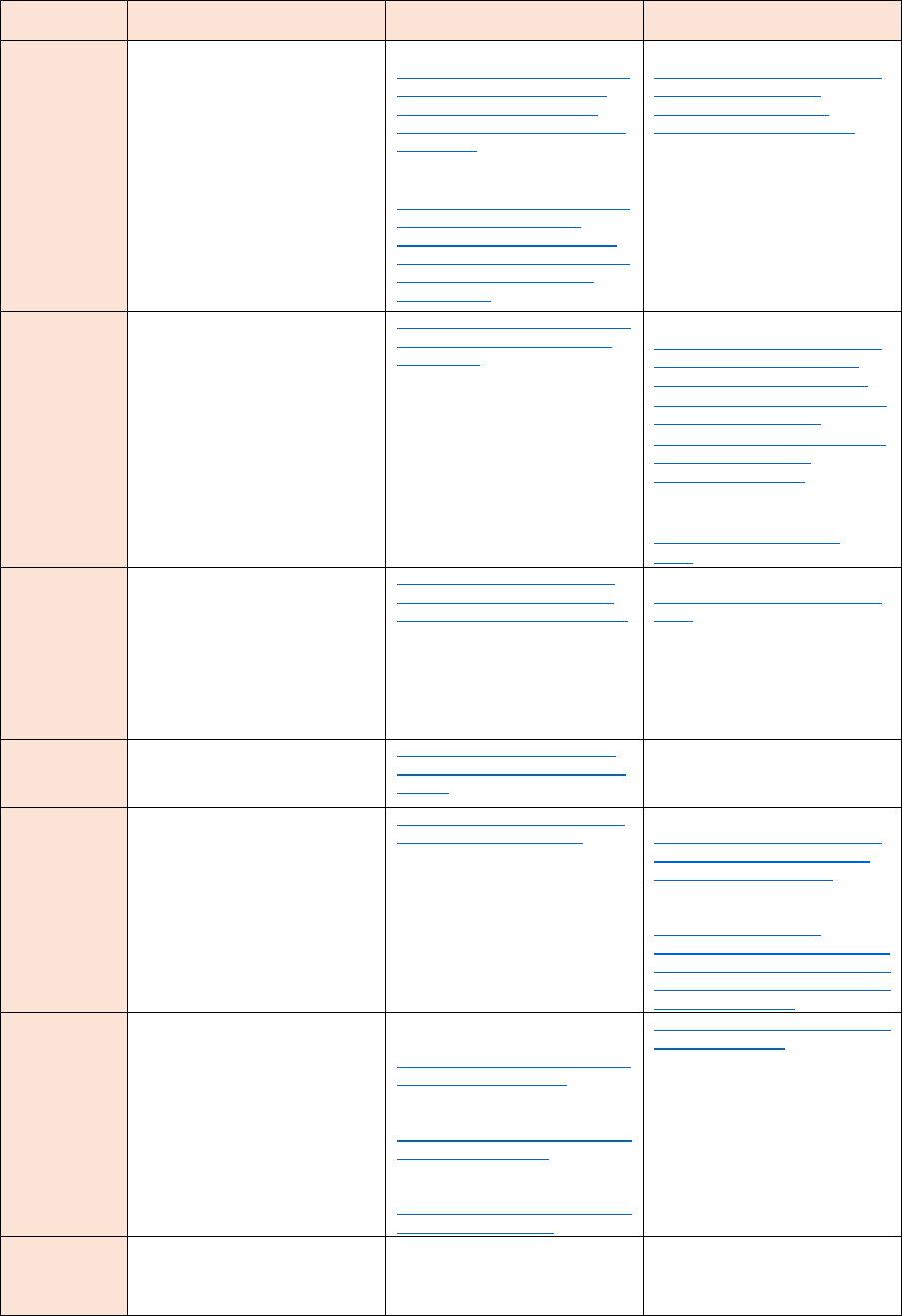

7.6. Conclusions and recommendations .................................................................................... 66

8. Other network tariff topics ............................................................................................................. 67

8.1. NRAs role in tariff setting .................................................................................................... 67

8.2. Tariff setting principles ........................................................................................................ 68

8.3. Frequency of tariff methodologies revision and of tariff value updates .............................. 68

8.4. Stakeholder involvement ..................................................................................................... 69

8.5. Transparency in tariff setting ............................................................................................... 70

ACER REPORT ON TRANSMISSION AND DISTRIBUTION TARIFF METHODOLOGIES IN EUROPE

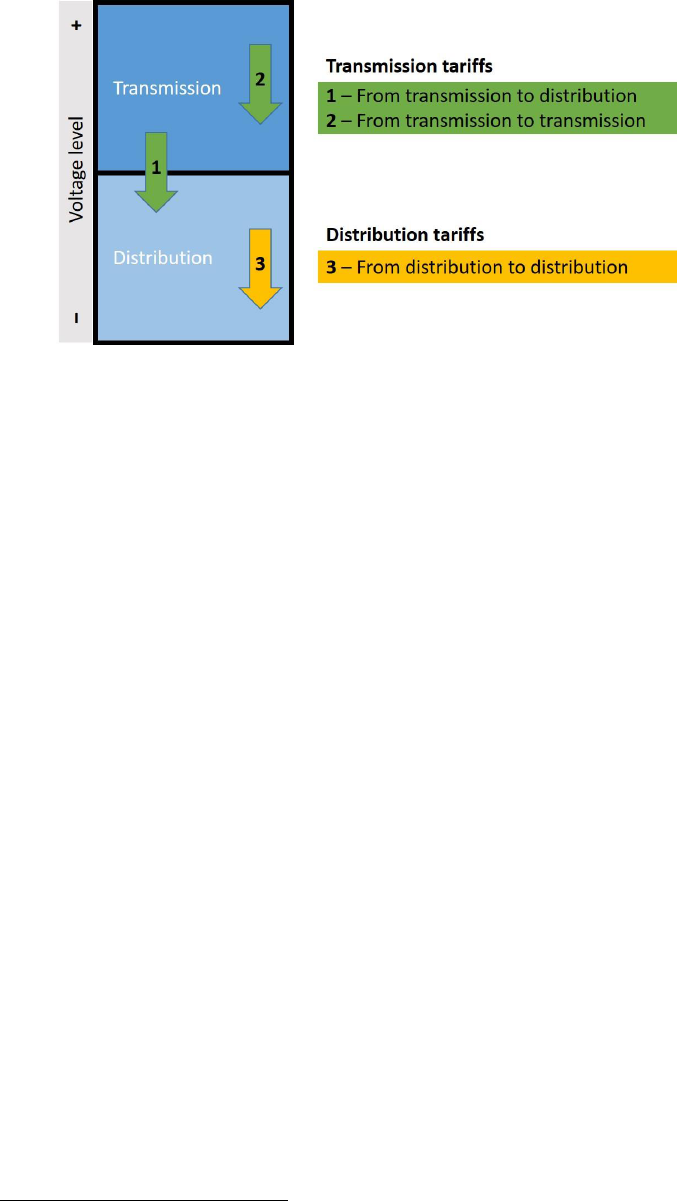

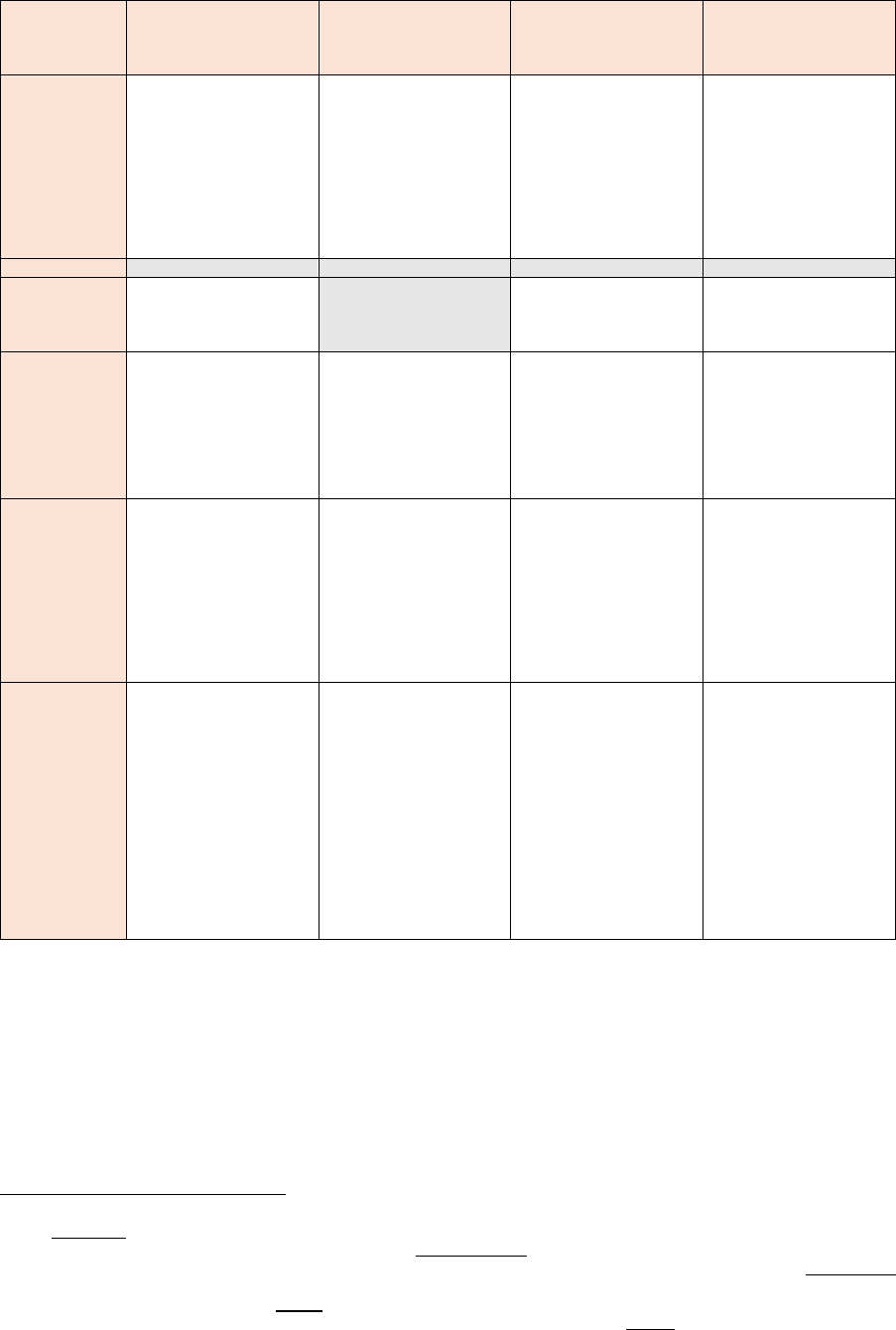

3

8.6. Tariff structure and cost recovery ....................................................................................... 70

8.7. Withdrawal charges ............................................................................................................. 71

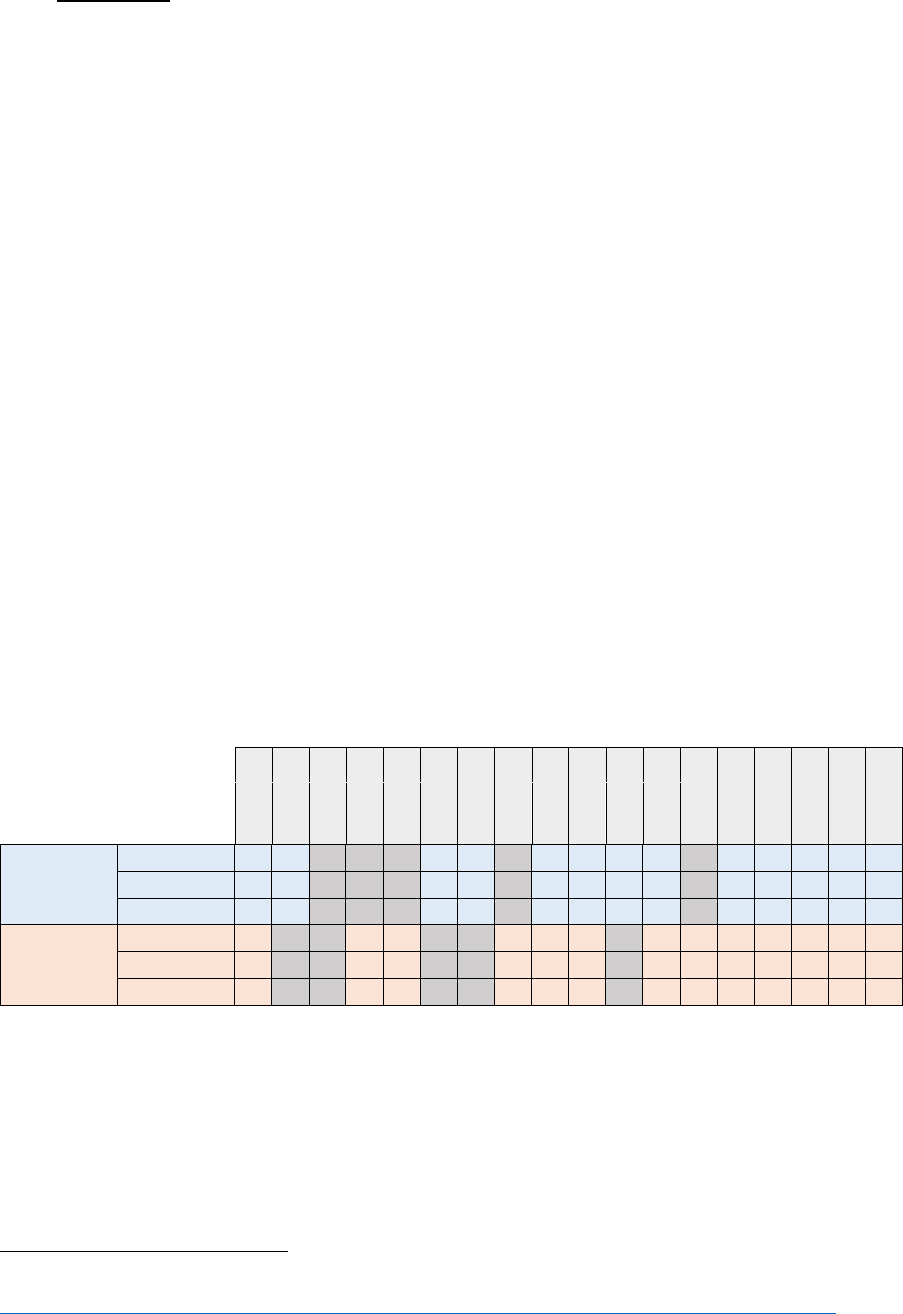

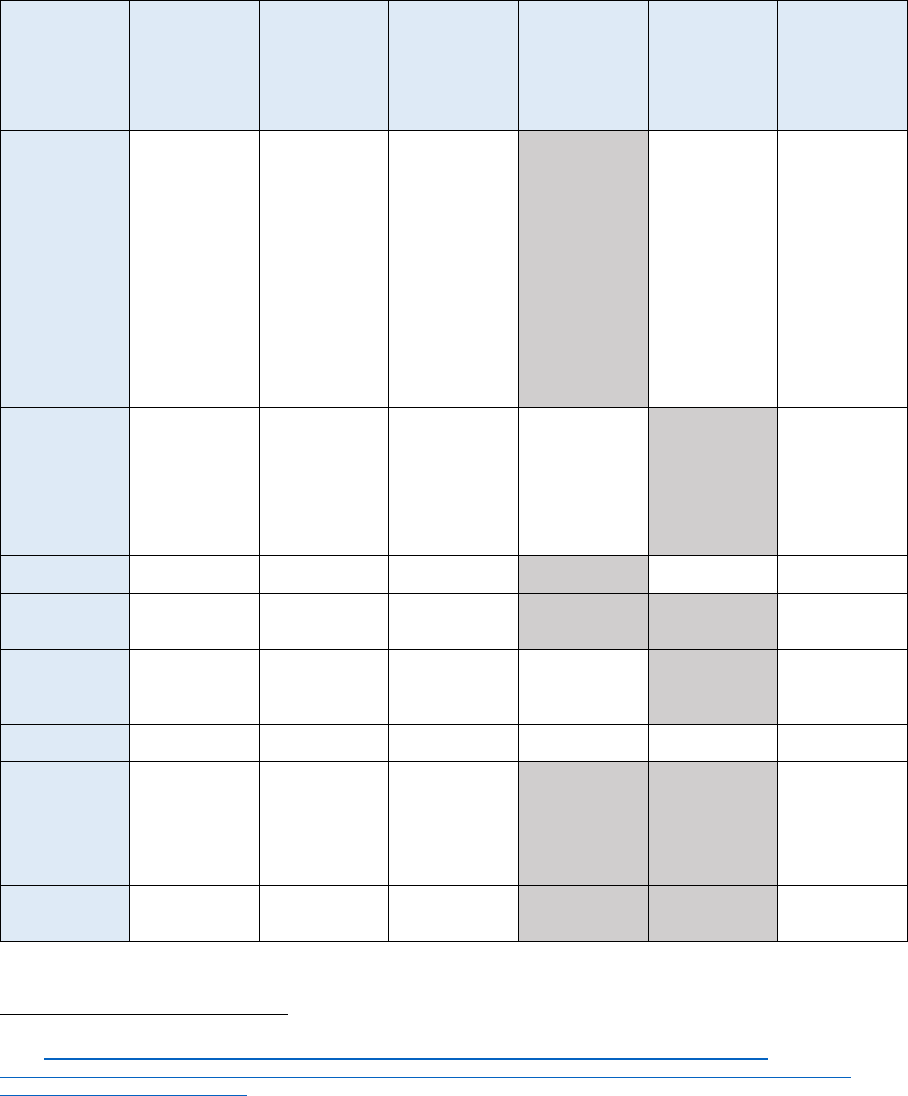

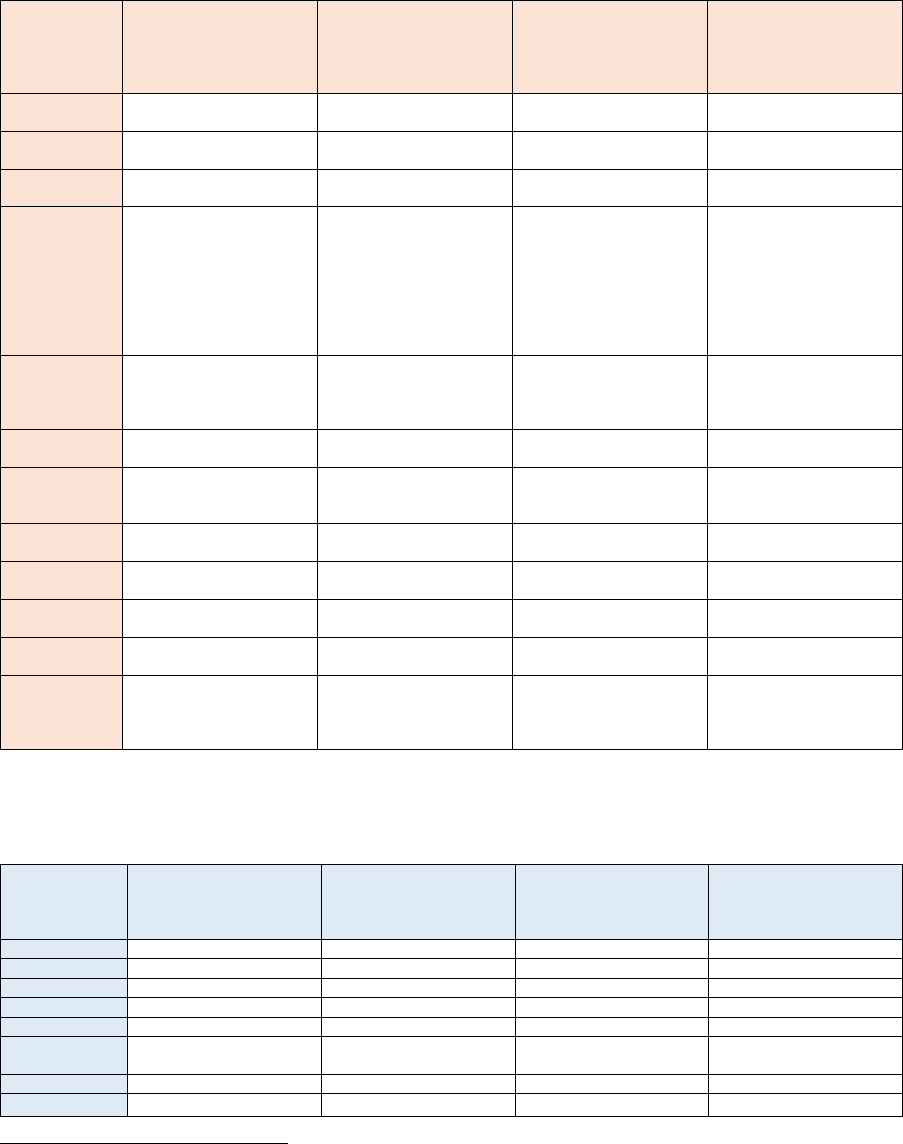

8.8. Emerging network users linked to the energy transition ..................................................... 72

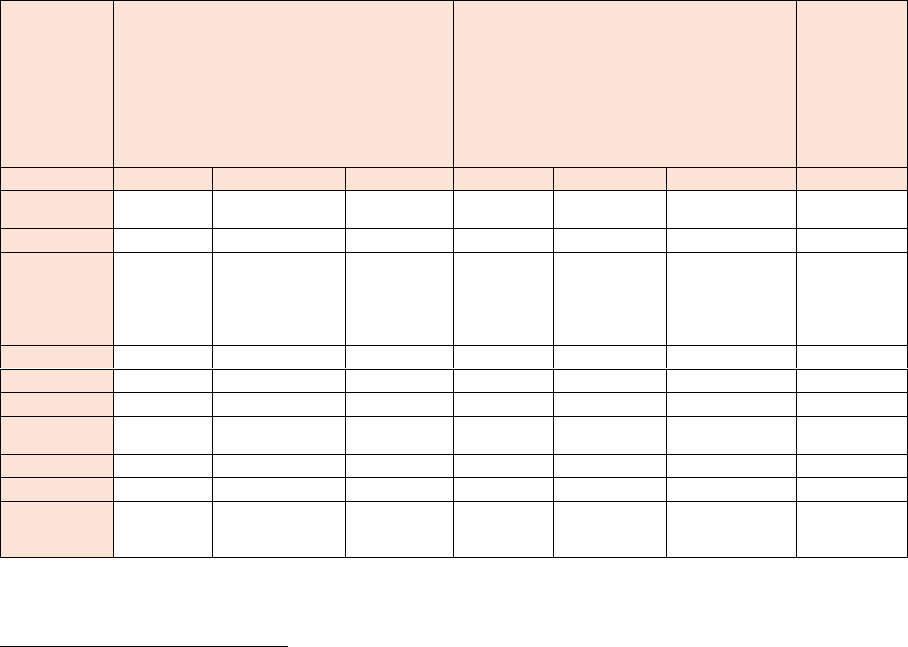

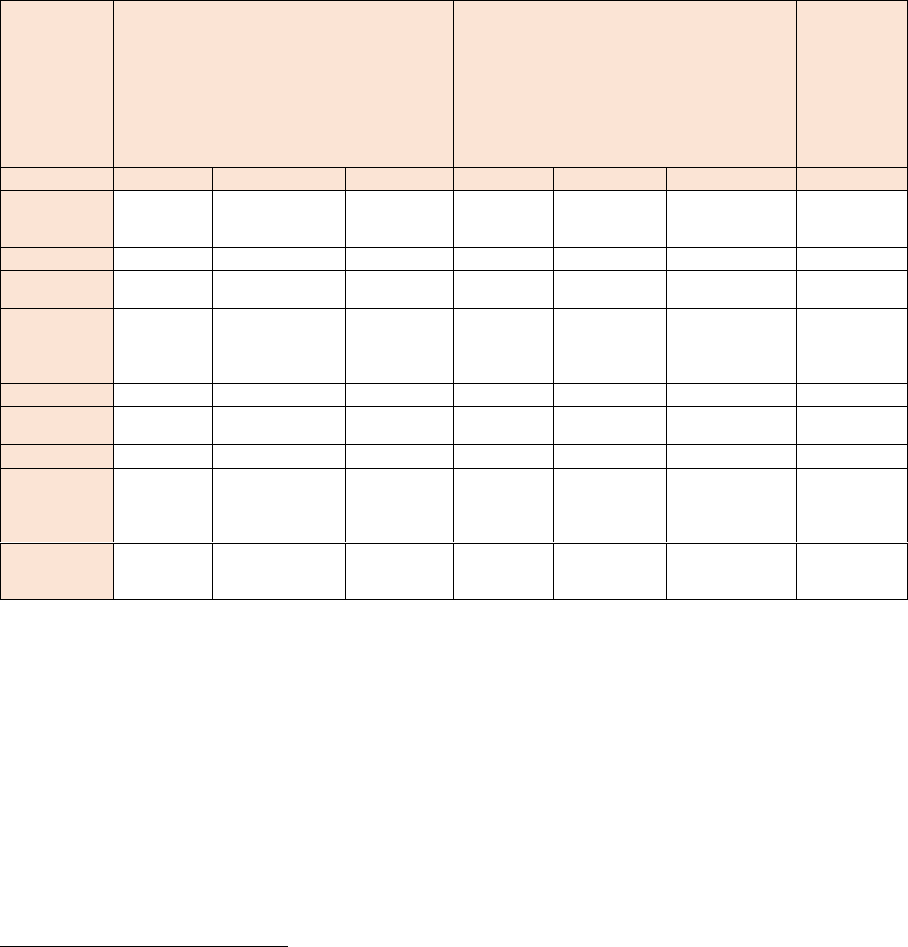

Annex 1: Summary tables of national tariff practices ............................................................................ 75

Annex 2: Links to national tariff methodologies and tariff values ........................................................ 157

Annex 3:Tariff-related measures to protect vulnerable customers and cope with high energy prices165

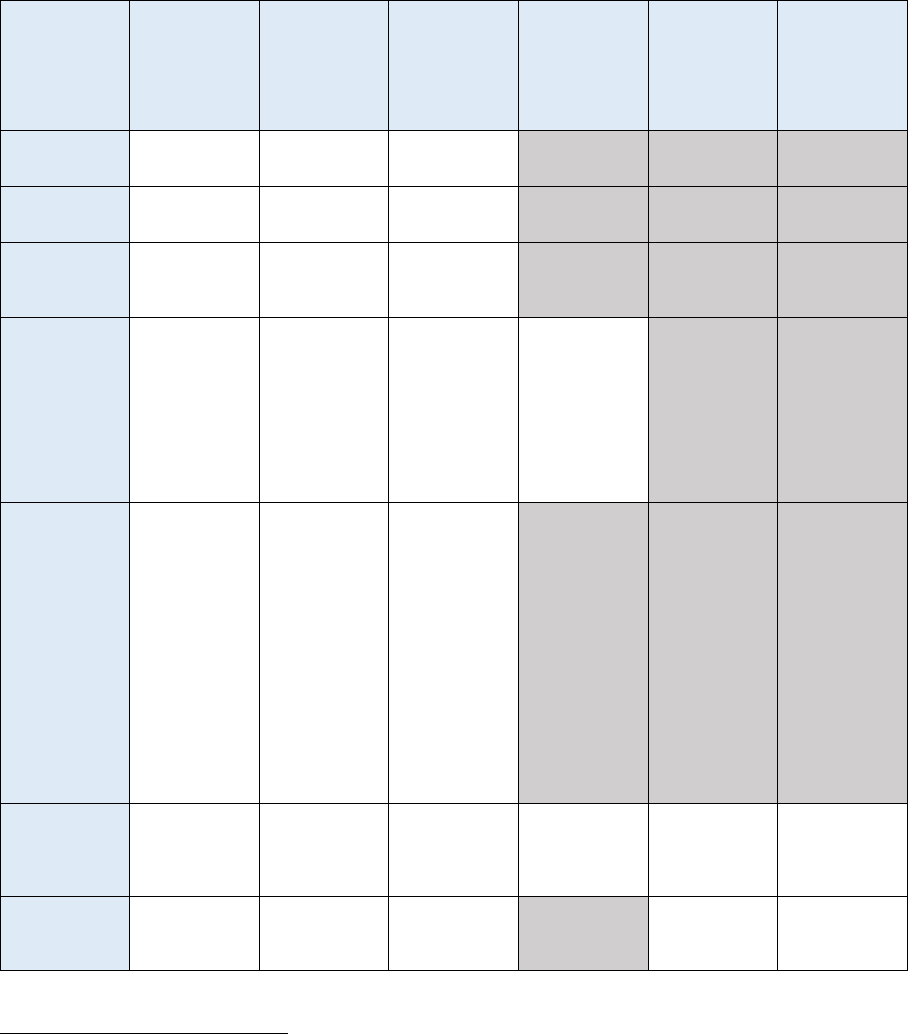

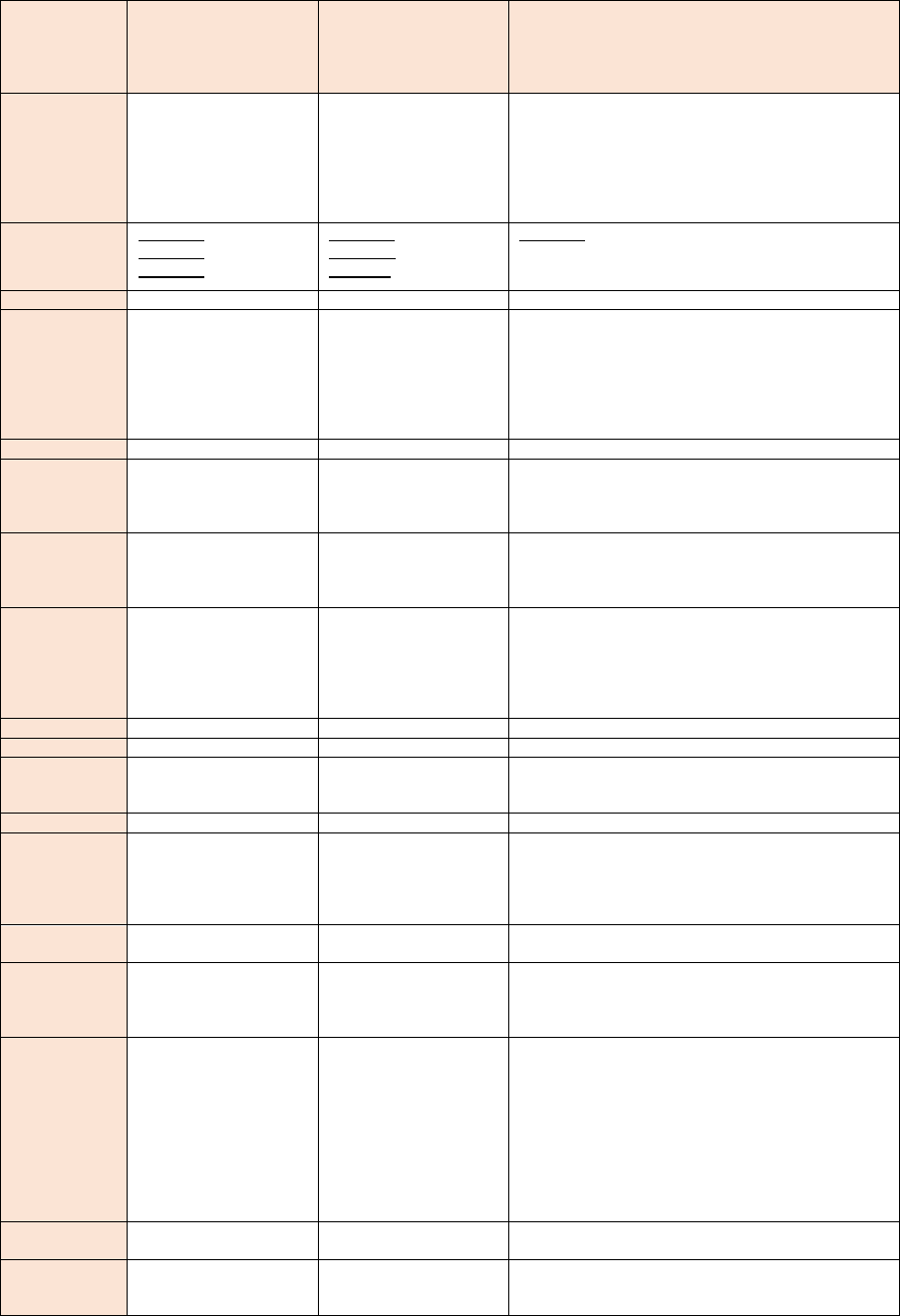

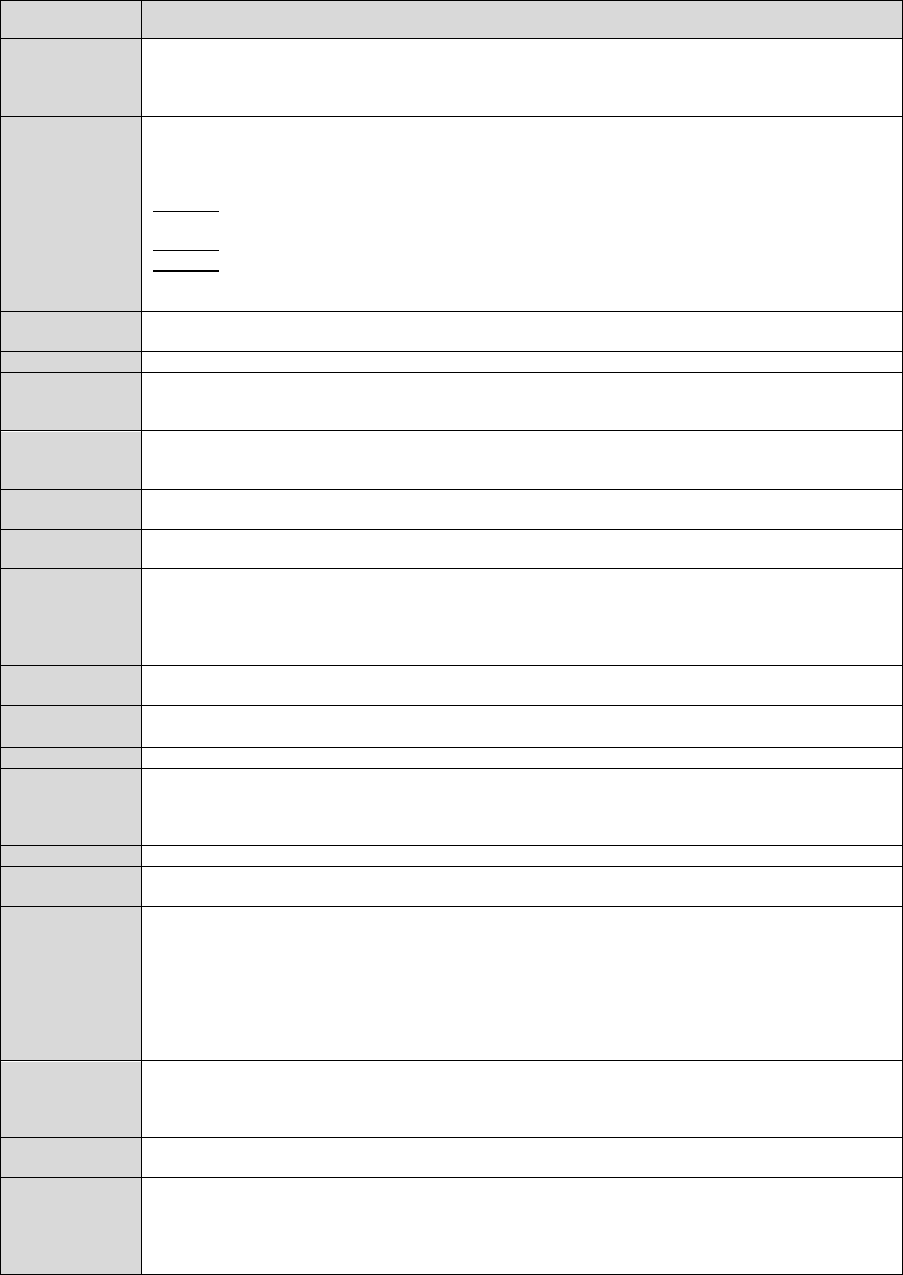

List of Figures

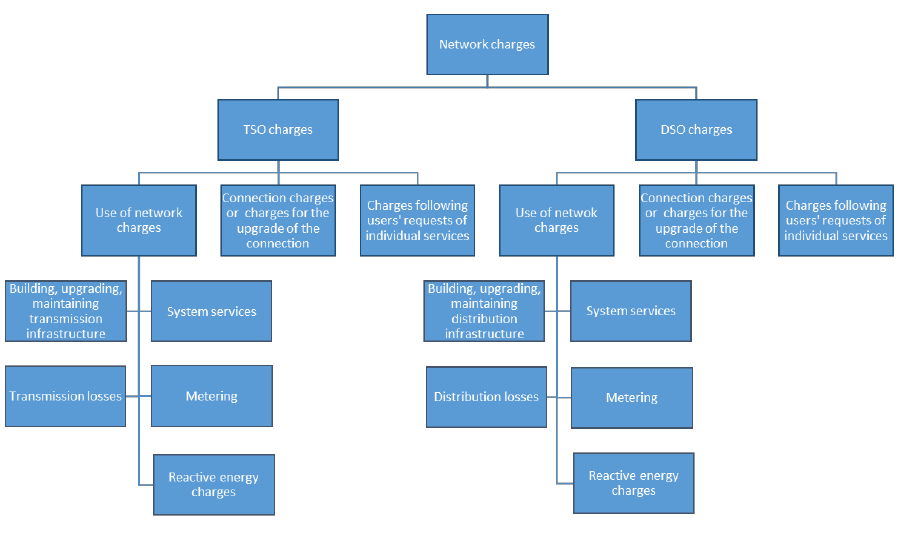

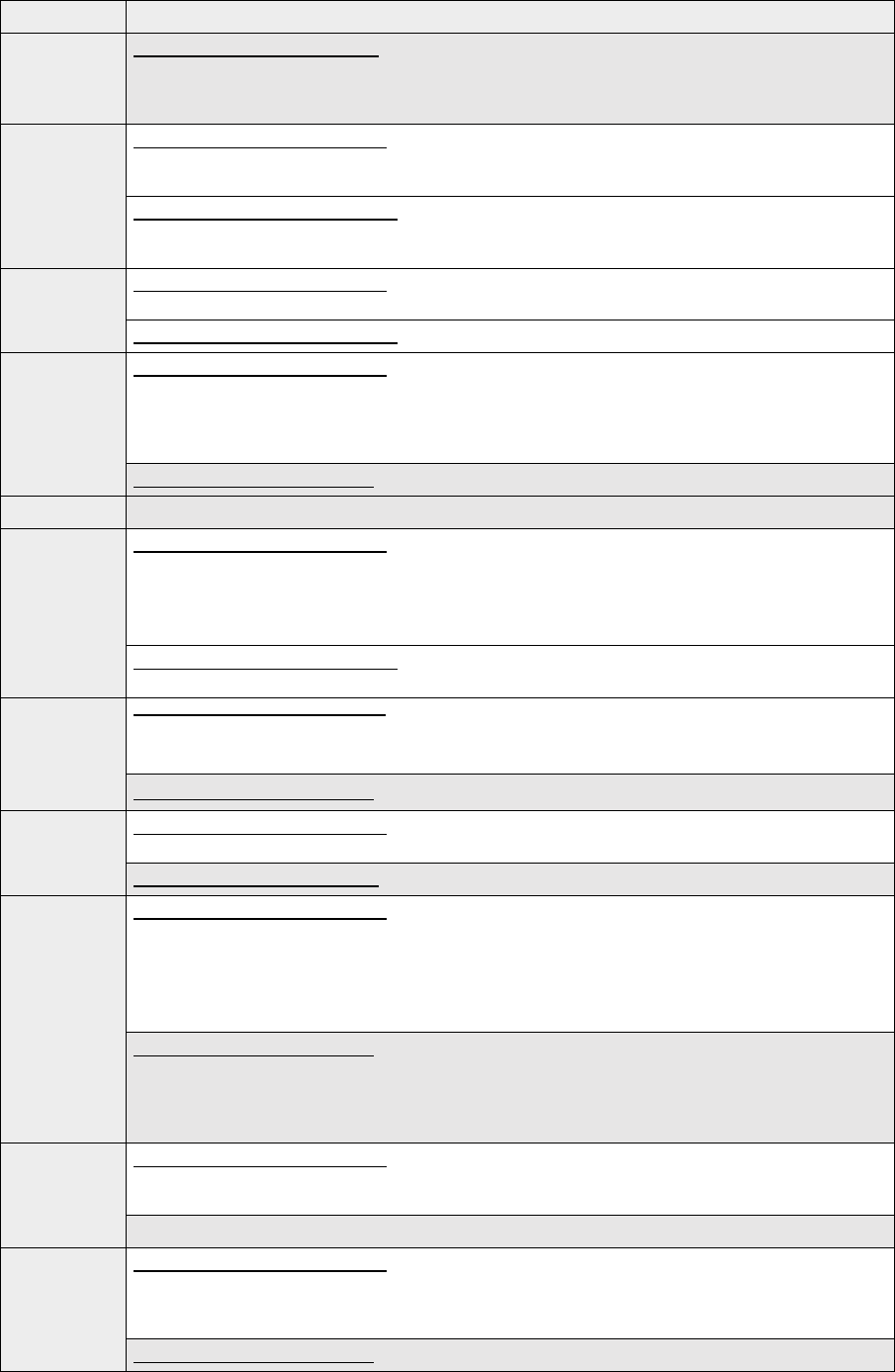

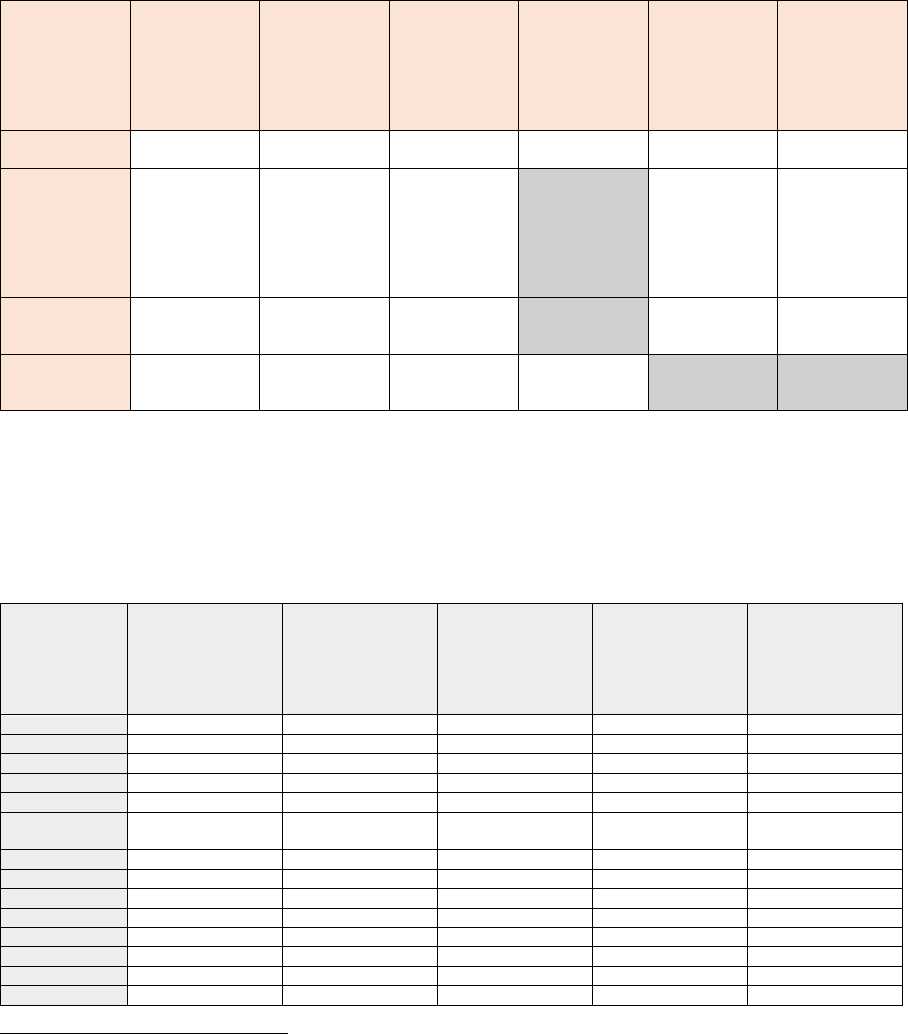

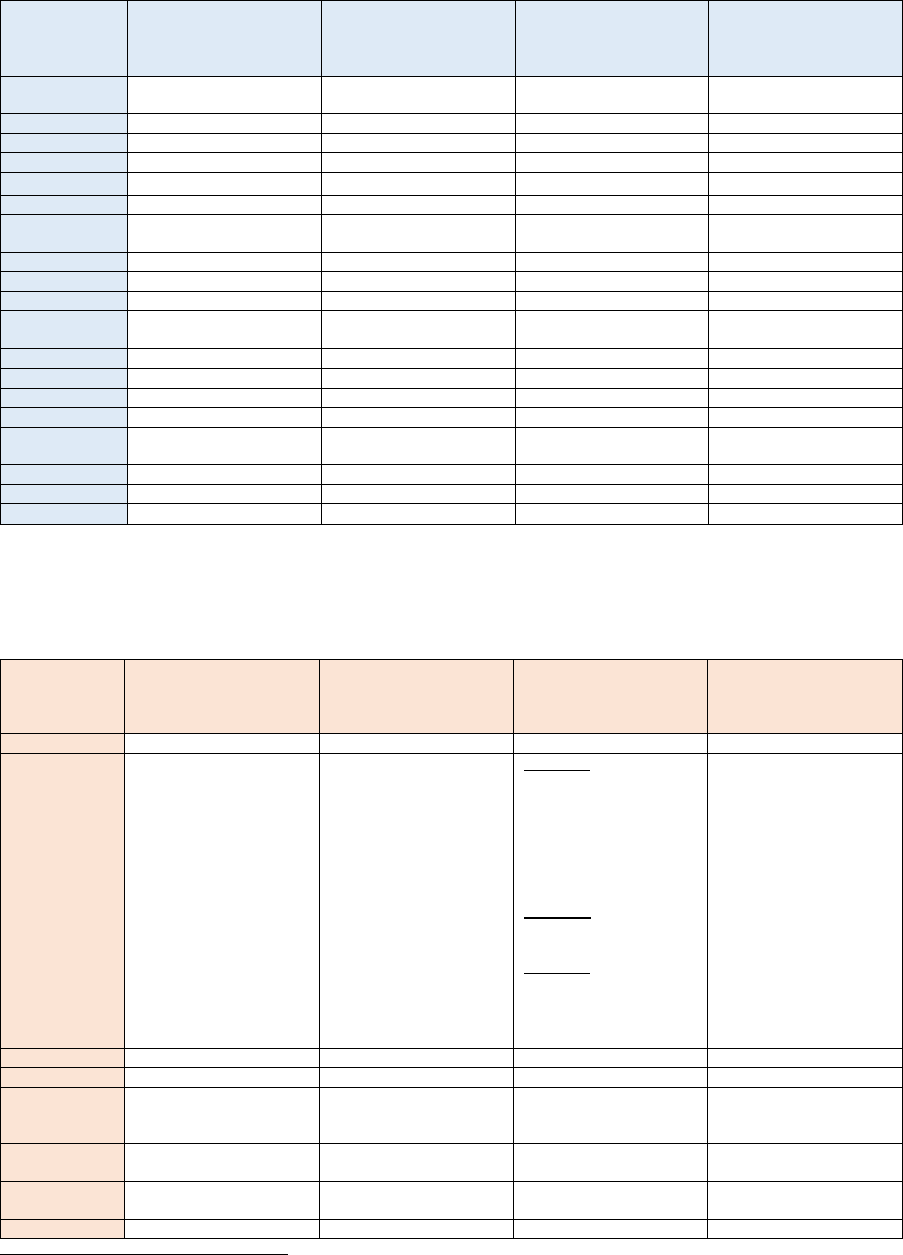

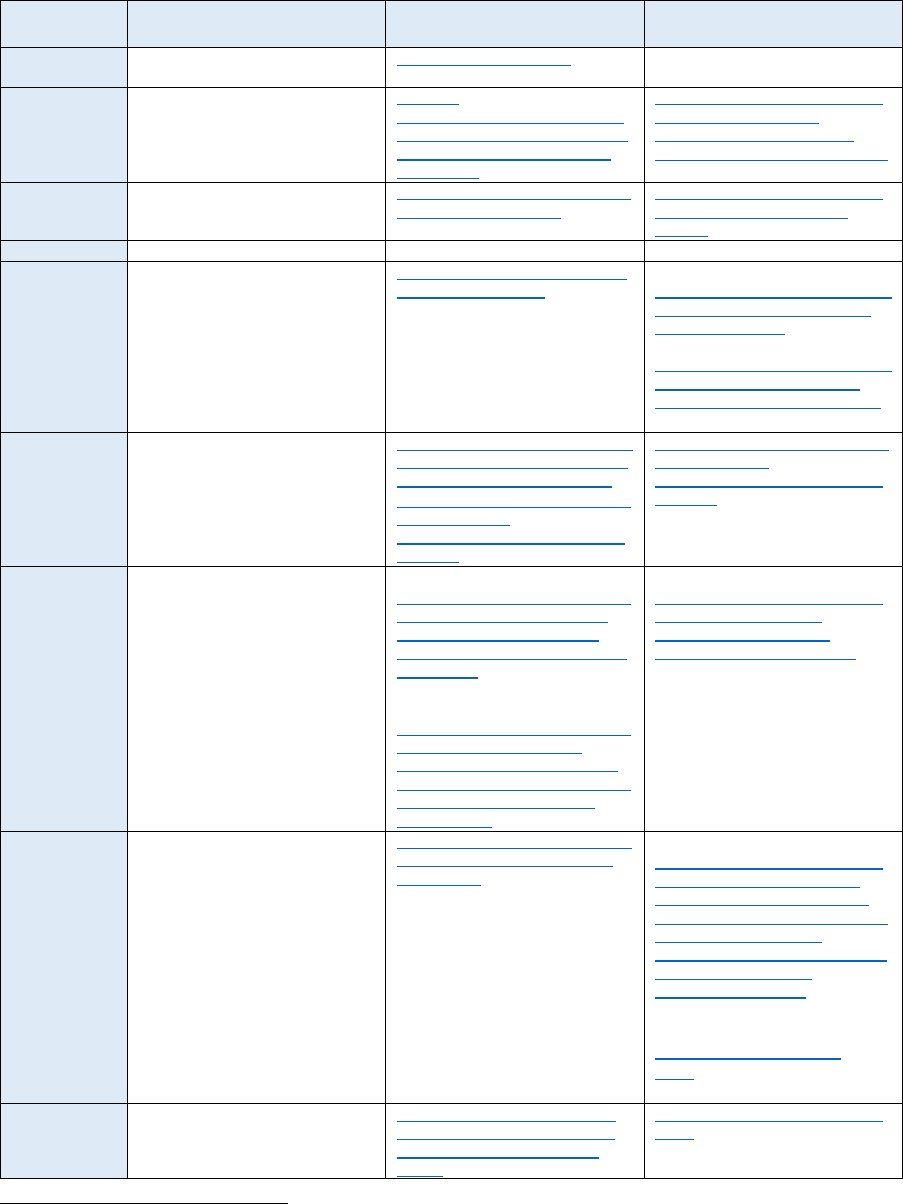

Figure 1: Segmentation of network charges ......................................................................................... 14

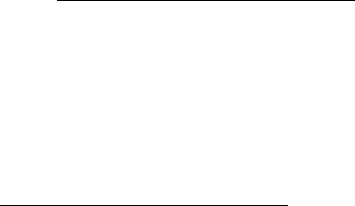

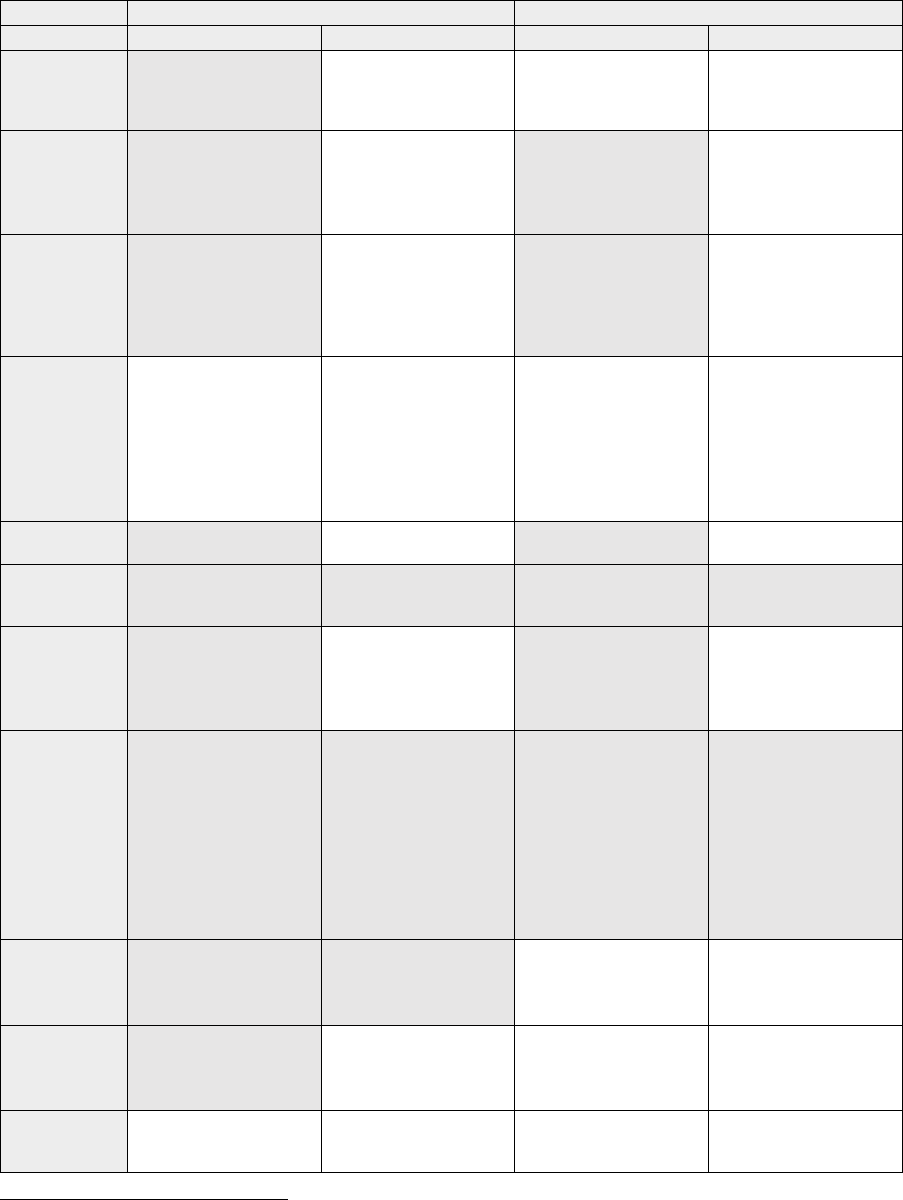

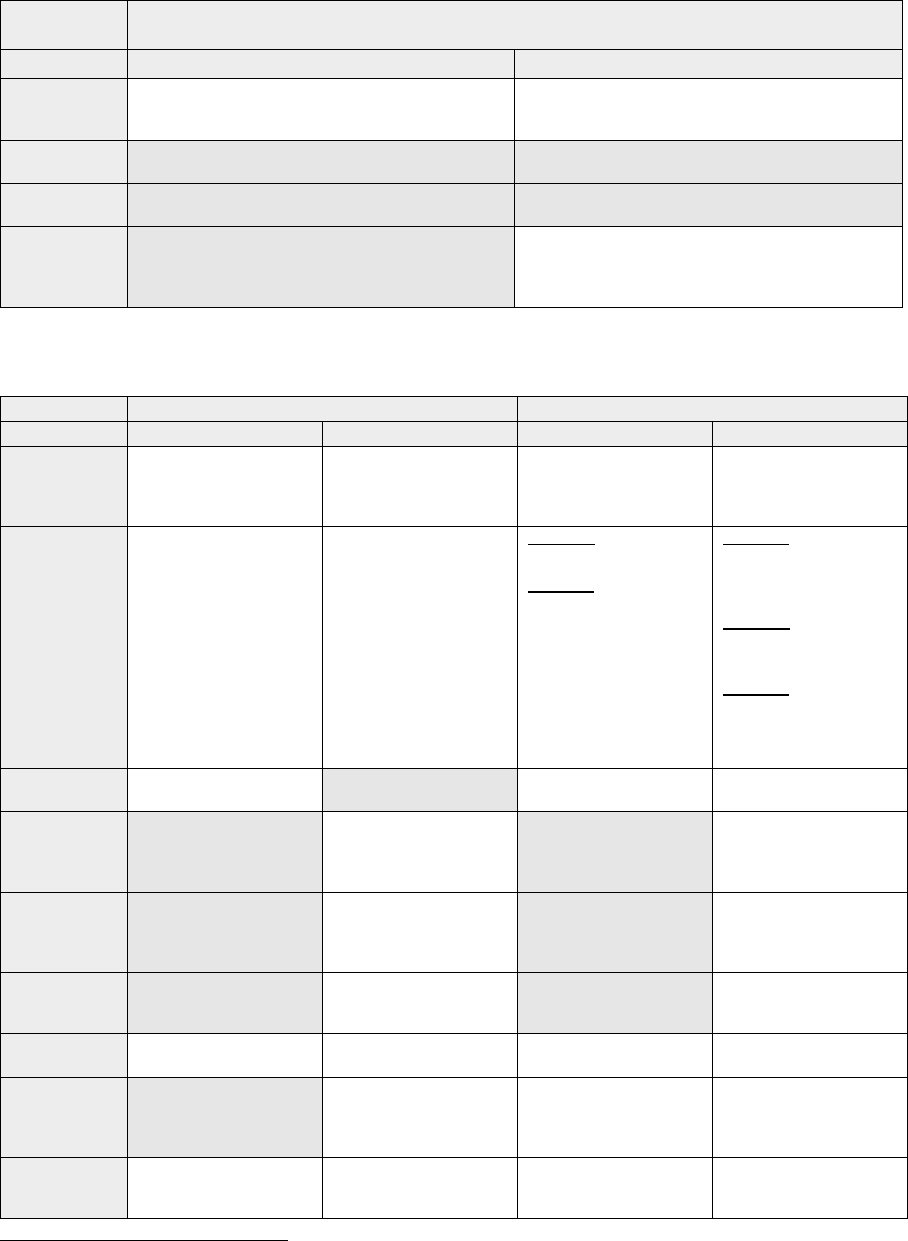

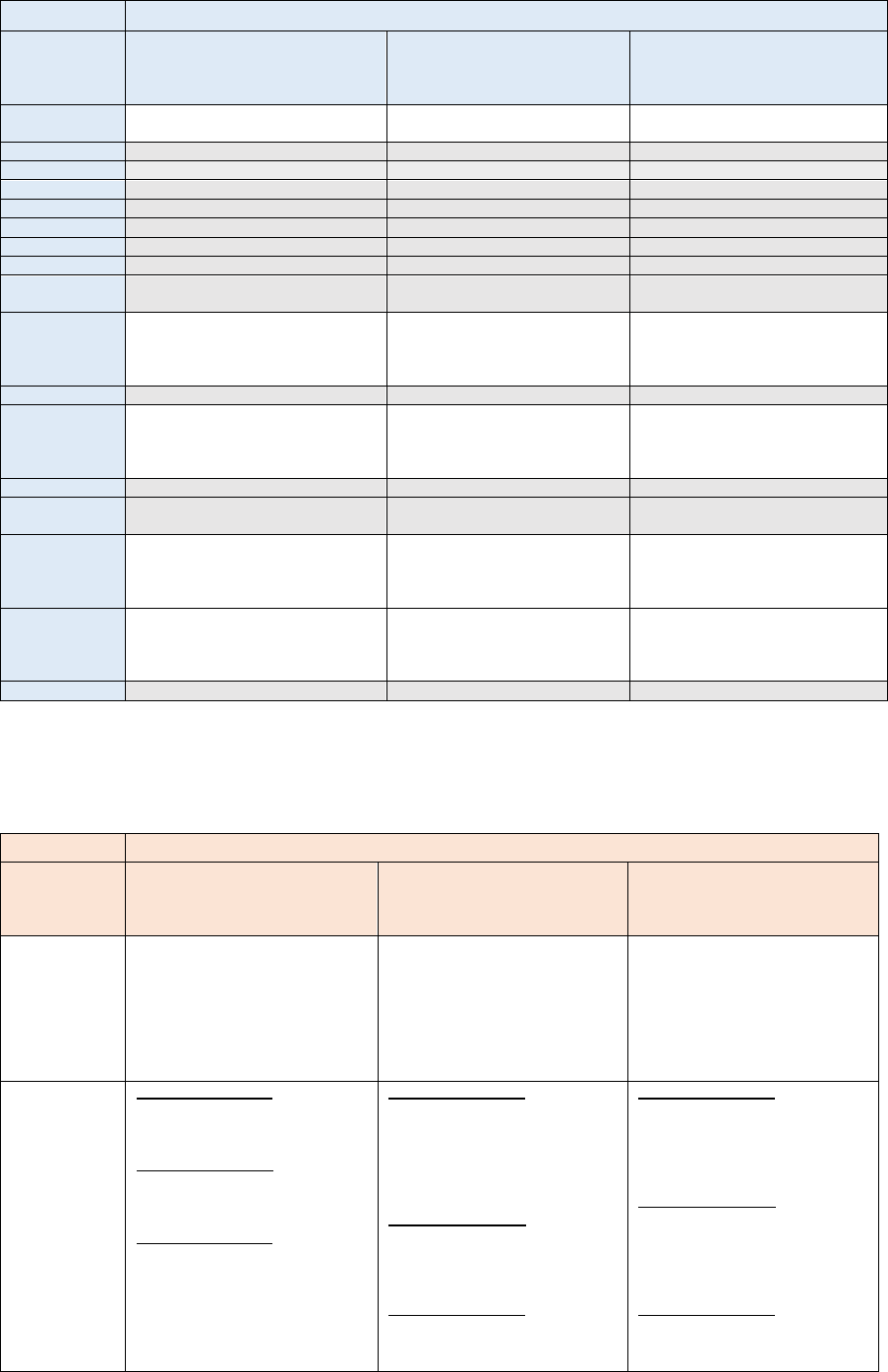

Figure 2: Cost models for setting network tariffs................................................................................... 15

Figure 3: Schematic comparison of the cost models for tariff-setting ................................................... 16

Figure 4: Cost models applied to network tariffs in Europe .................................................................. 17

Figure 5: Forms of cost cascading applied to transmission and distribution tariffs .............................. 19

Figure 6: Forms of cost cascading applied to transmission and distribution tariffs, by country ............ 20

Figure 7: Degree of cost cascading from transmission to distribution (%) ........................................... 21

Figure 8: Type of payment of cost-cascading from transmission to distribution ................................... 22

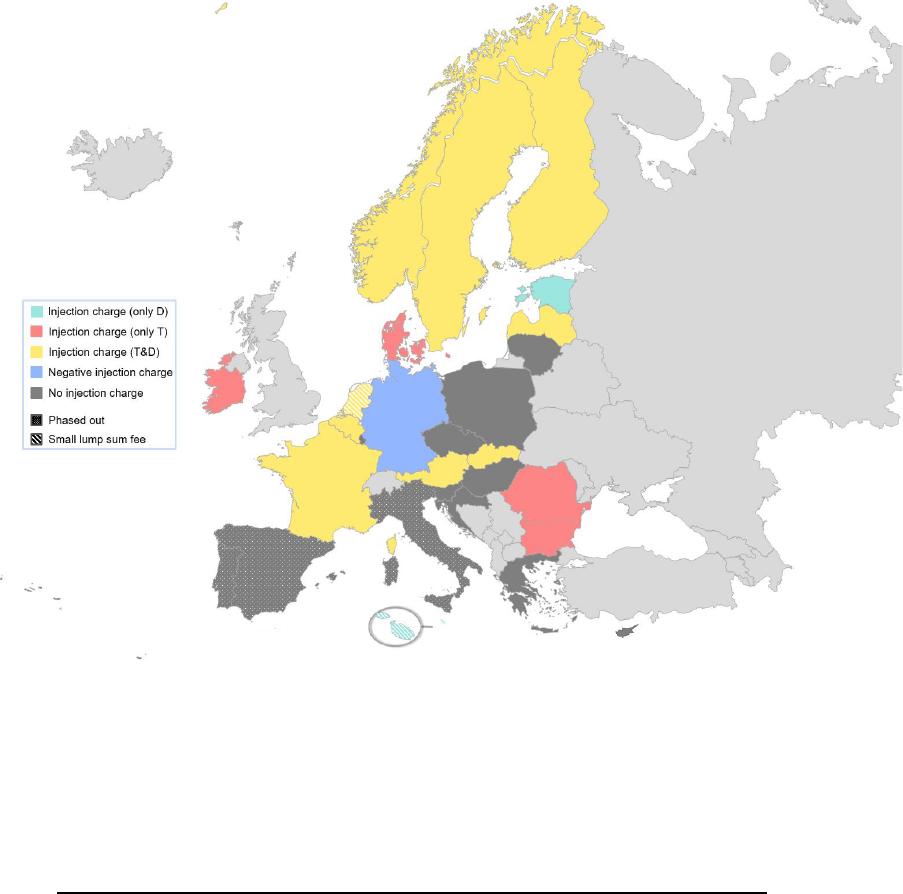

Figure 9: Application of injection charges in Europe (2022) ................................................................. 26

Figure 10: Payment of network costs by distribution-connected network users who inject into the grid

(2022) .................................................................................................................................................... 28

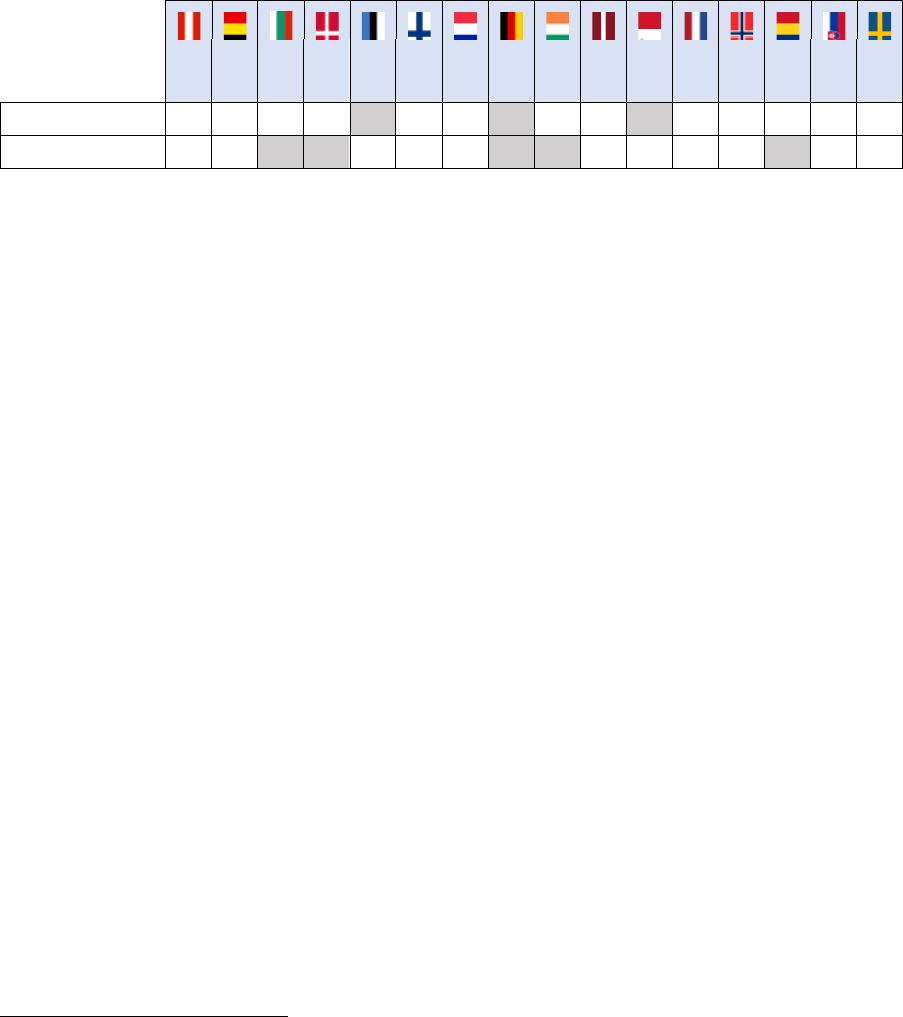

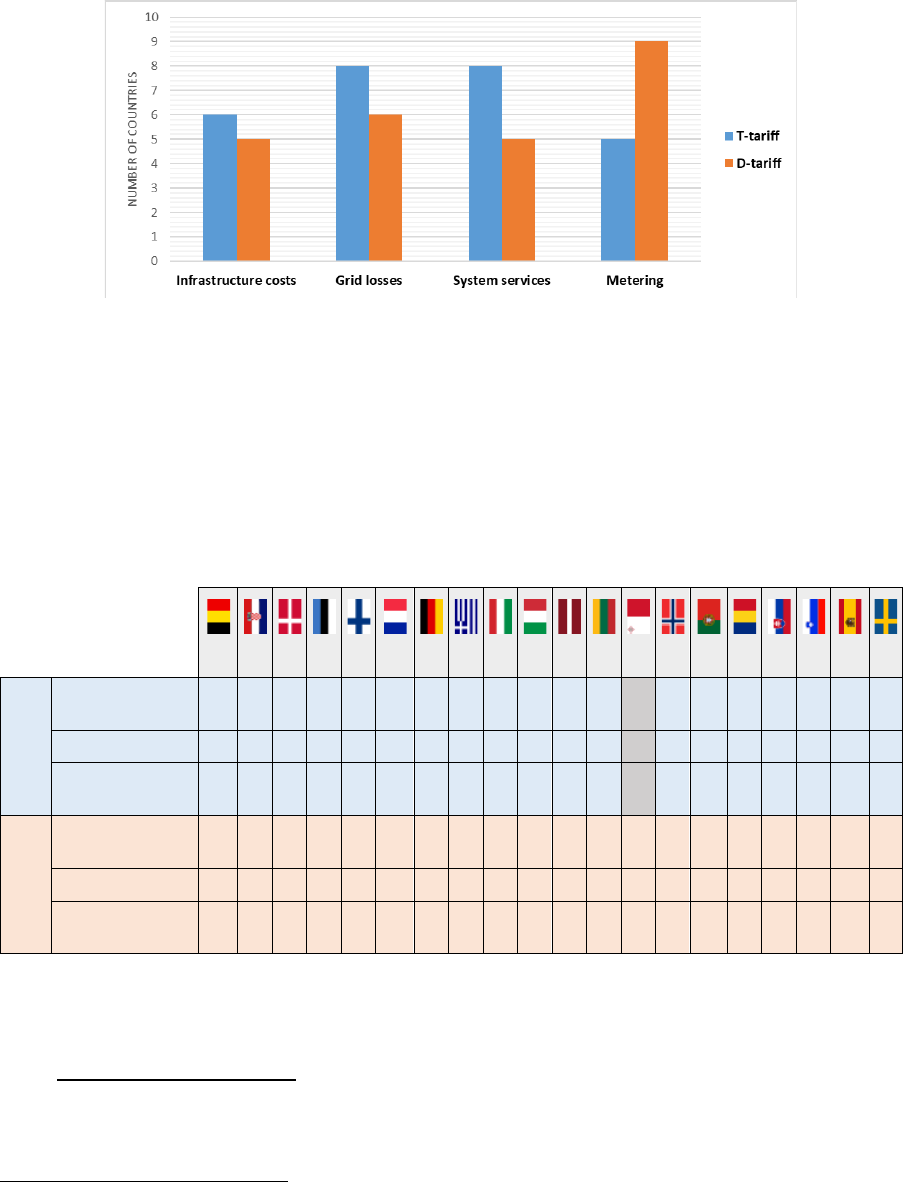

Figure 11: Recovery of specific cost categories via injection charges ................................................. 29

Figure 12: Not injection charge related cost burdens on network users injecting into the grid ............ 29

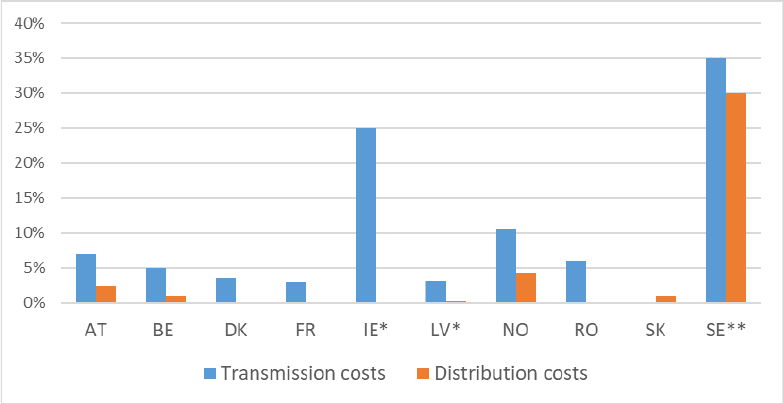

Figure 13: Share of network costs recovered via injection charges ..................................................... 30

Figure 14: Tariff basis for injection charges .......................................................................................... 31

Figure 15: Application of network charges to storage facilities ............................................................. 36

Figure 16: Application of shallow and deep connection charges .......................................................... 43

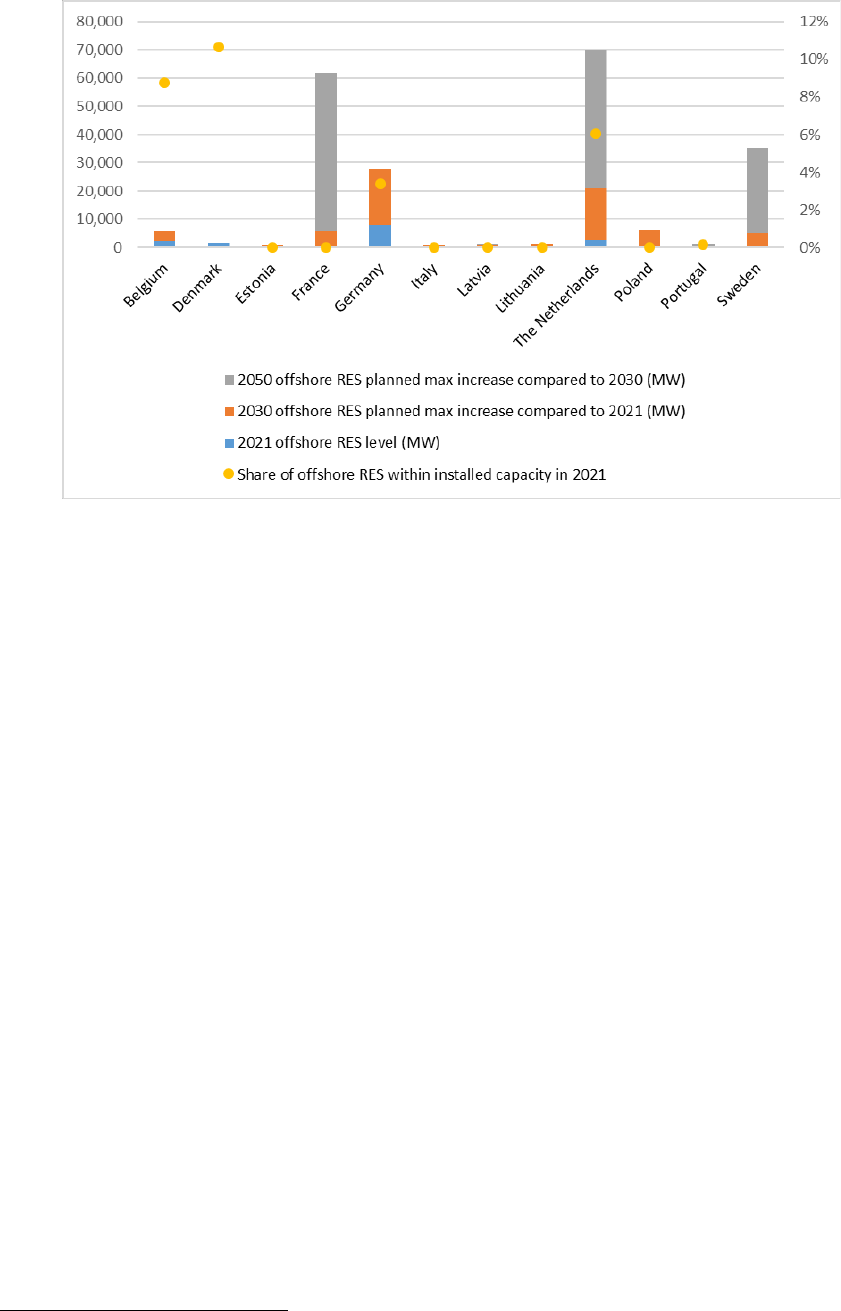

Figure 17: Planned offshore RES capacity by 2030 and 2050 (in MW) ............................................... 48

Figure 18: Application of charges for reactive energy .......................................................................... 51

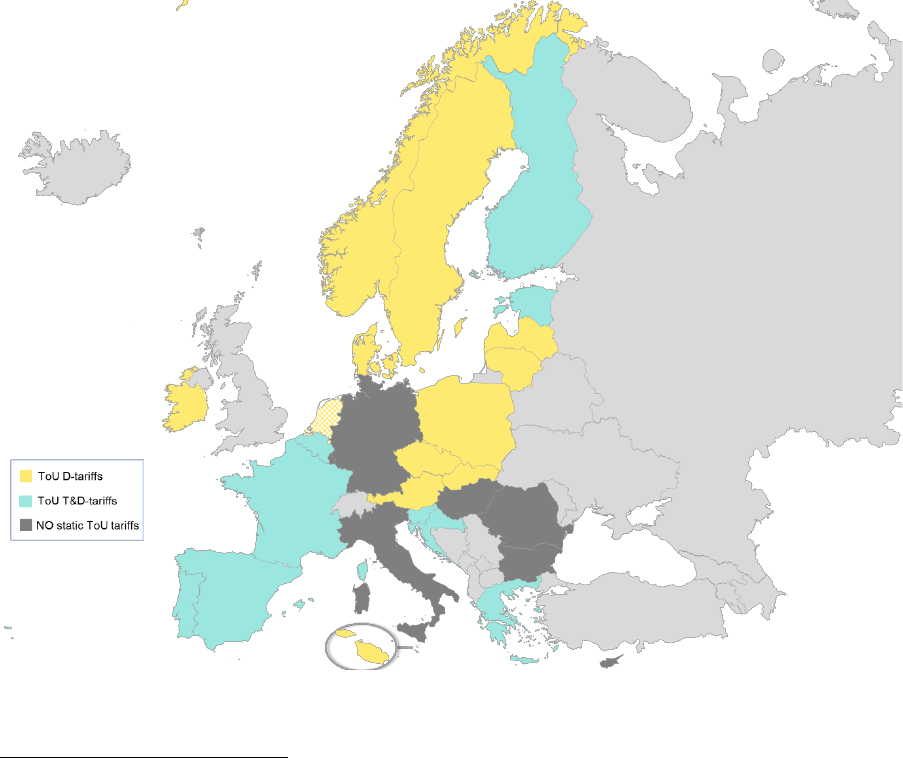

Figure 19: Application of static time-of-use (ToU) network charges in Europe (2022) ......................... 56

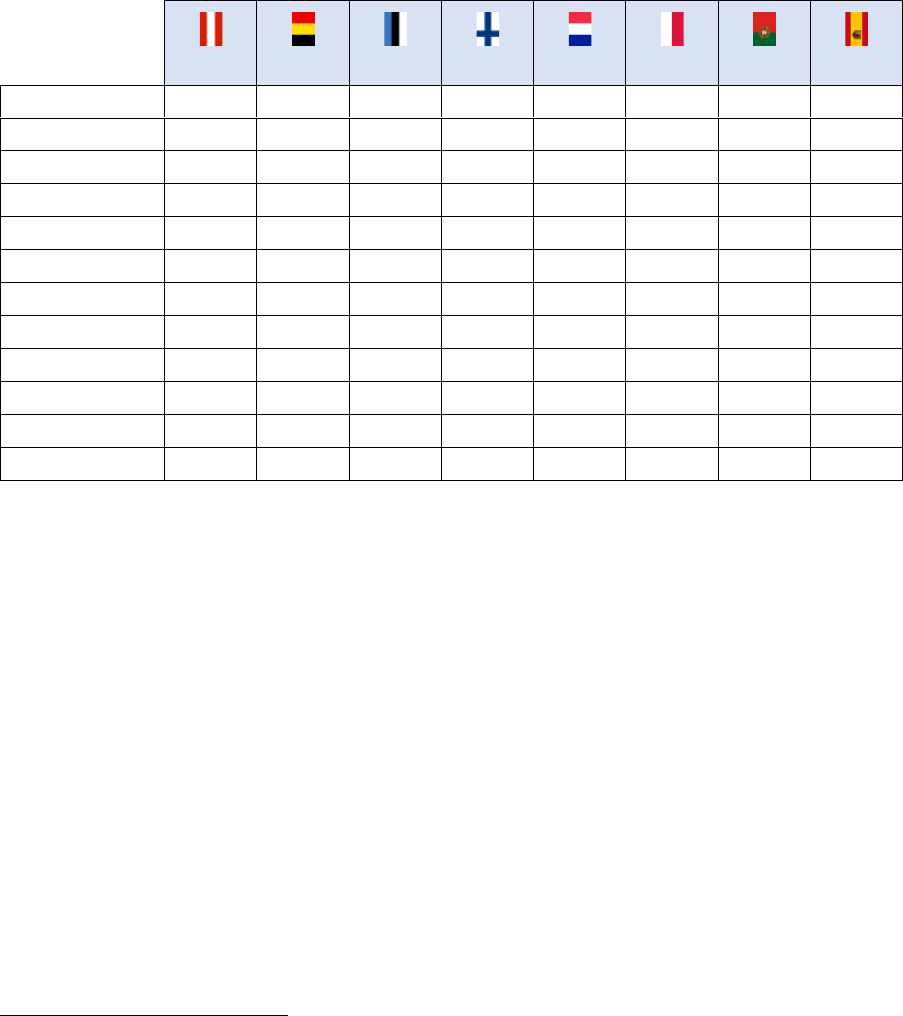

Figure 20: Tariff basis embedding the time-of-use signal ..................................................................... 59

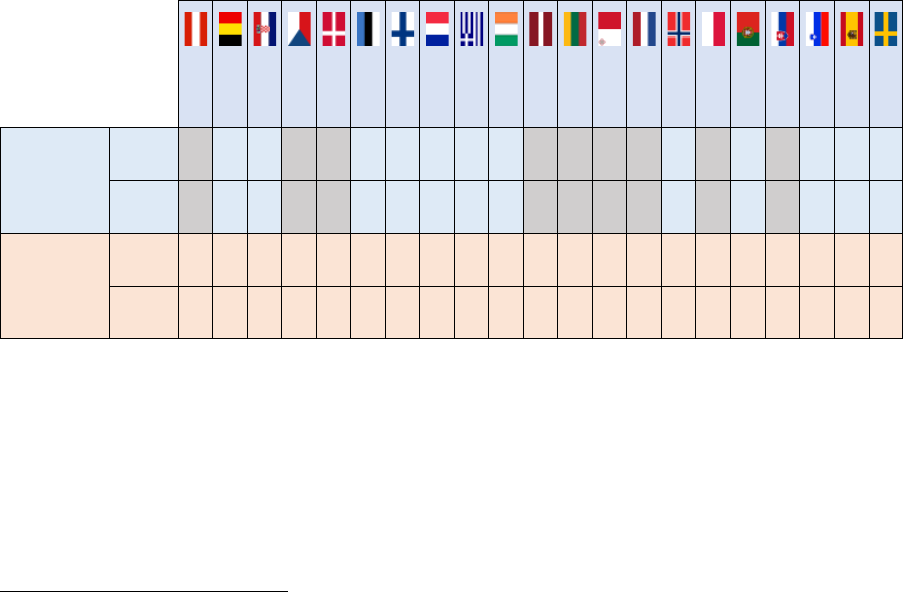

Figure 21: Peak months in the time-of-use schedule for transmission and distribution tariffs ............. 60

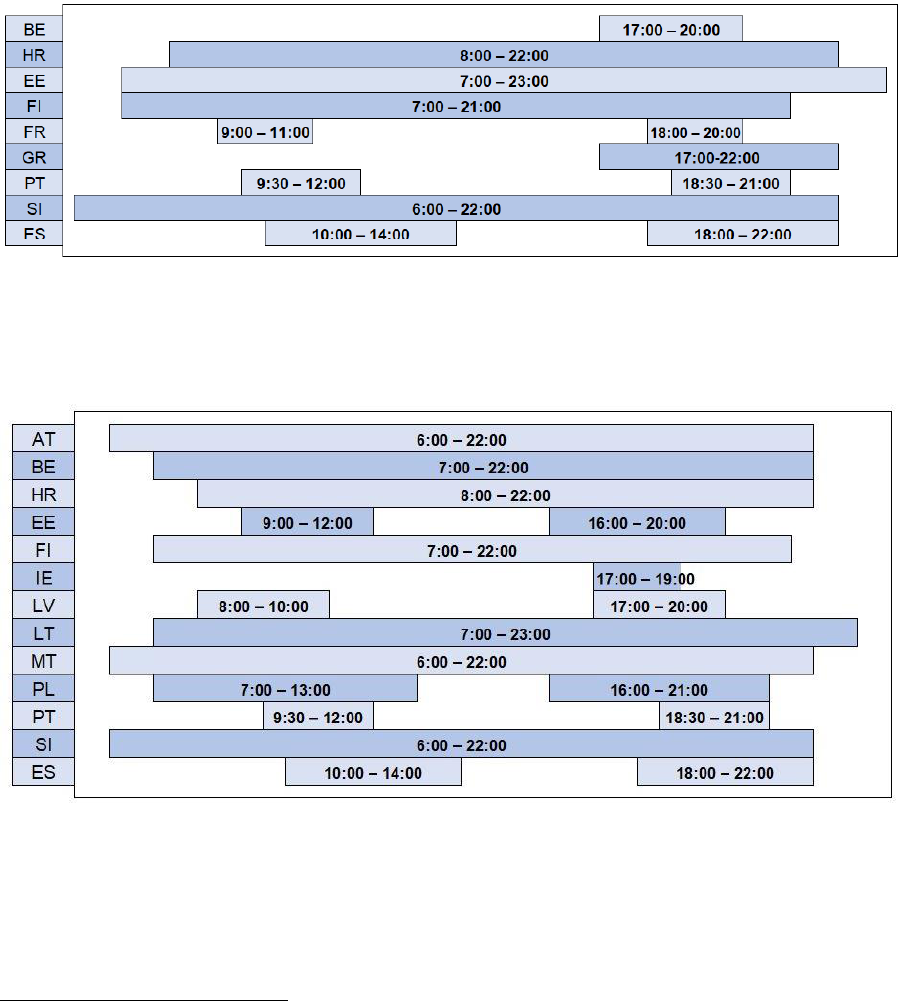

Figure 22: Peak hours in the time-of-use schedule for transmission tariffs .......................................... 61

Figure 23: Peak hours in the time-of-use schedule for distribution tariffs ............................................. 61

Figure 24: Share of the network users with meters capable of measuring withdrawal from the grid for

different time-of-use .............................................................................................................................. 63

Figure 25: Default metering intervals applied to withdrawal in Europe ................................................. 63

ACER REPORT ON TRANSMISSION AND DISTRIBUTION TARIFF METHODOLOGIES IN EUROPE

4

List of Tables

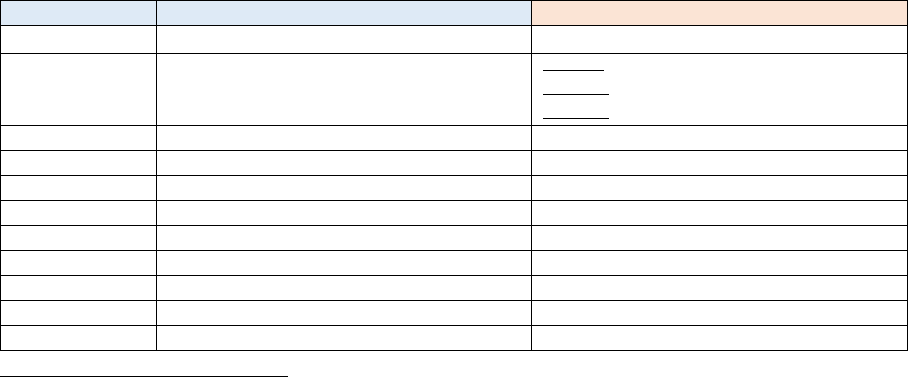

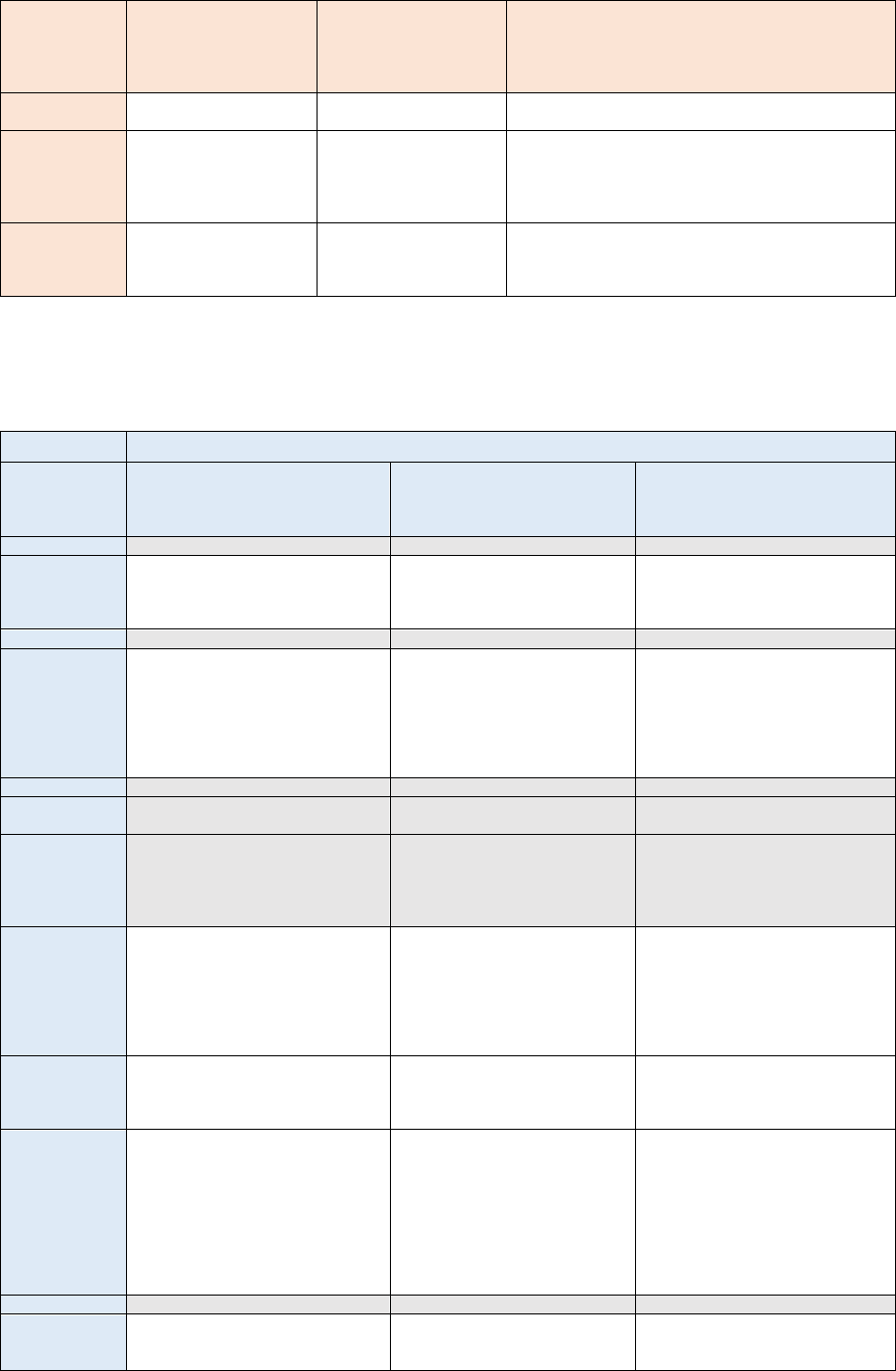

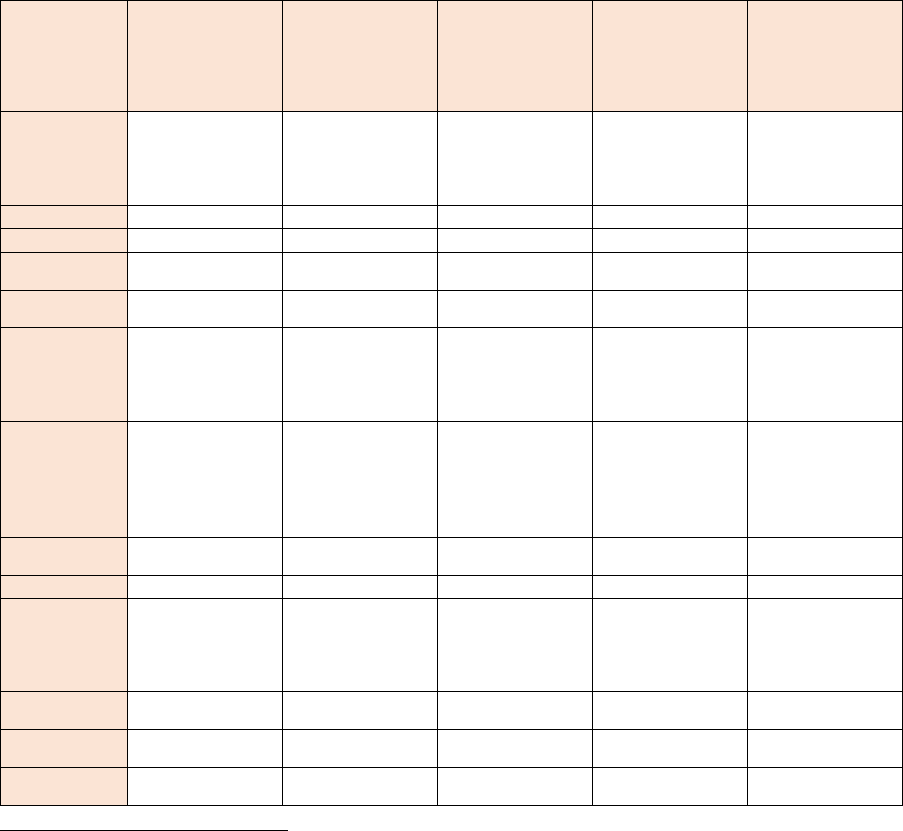

Table 1: Further details on countries adopting an incremental or forward-looking cost model ............ 75

Table 2: Allocation of residual costs ..................................................................................................... 76

Table 3: Details on cost cascading applied to transmission tariffs ....................................................... 77

Table 4: Details on cost cascading applied to distribution tariffs .......................................................... 80

Table 5: Description of any partial or differentiated cost-cascading either for transmission costs and/or

for distribution costs .............................................................................................................................. 83

Table 6: Exemptions from cost-cascading applicable to some groups of network users ..................... 83

Table 7: Recent changes to the cost models or cost cascading or planned future changes ............... 84

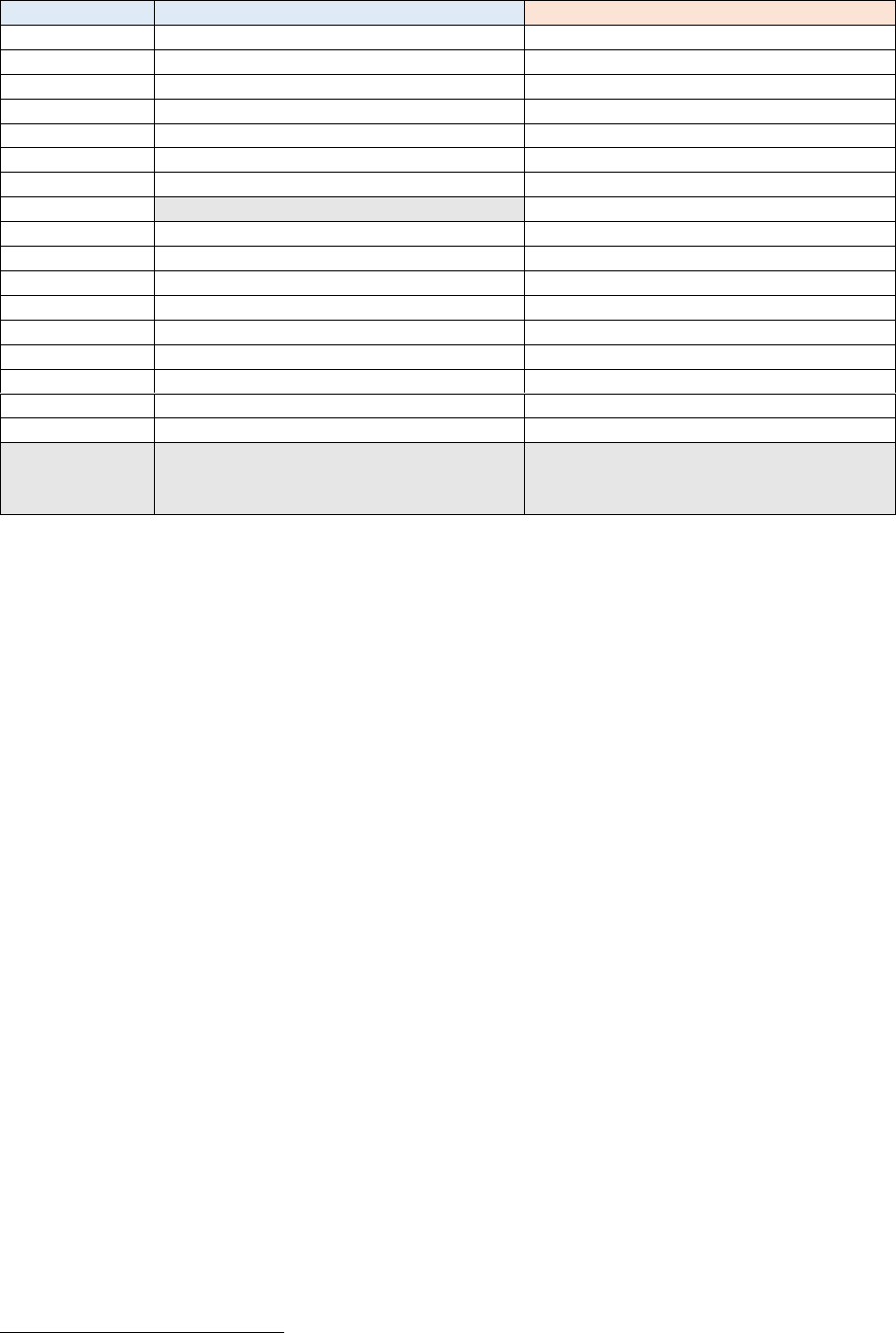

Table 8: Application of injection charges, reasons behind and actions that preceded the decision on

them ...................................................................................................................................................... 85

Table 9: TSO costs (partially) recovered via transmission charges for injection .................................. 89

Table 10: DSO costs (partially) recovered via distribution charges for injection .................................. 90

Table 11: Value for annual total transmission G-Charges paid by the producers [M€] ........................ 91

Table 12: Total measured energy injected annually by the producers to the transmission system

[TWh] ..................................................................................................................................................... 91

Table 13: Annual average transmission G-charges paid by producers [€/MWh] ................................. 92

Table 14: Percentage of transmission costs covered via injection charges and allocation method ..... 92

Table 15: Percentage of distribution costs covered via injection charges and allocation method ........ 94

Table 16: Tariff basis, variation and differentiation of the transmission tariffs for injection .................. 95

Table 17: Tariff basis, variation and differentiation of the distribution tariffs for injection ..................... 96

Table 18: Exemption, discount or differentiation of unit tariff values or tariff basis between producers

.............................................................................................................................................................. 96

Table 19: Transmission and distribution tariffs for storage facilities ..................................................... 97

Table 20: Exemption, discount or differentiation of unit tariff values or tariff basis between storage

facilities ................................................................................................................................................ 101

Table 21: Transmission and distribution tariffs for prosumers ............................................................ 103

Table 22: Exemption, discount or differentiation of unit tariff values or tariff basis between prosumers

............................................................................................................................................................ 105

Table 23: Application of gross or net injection/withdrawal in case of energy-based charging ........... 107

Table 24: Cost-offsetting in case both injection and withdrawal charges are applied in the country . 109

Table 25: Recent changes to the injection charges or planned future changes ................................. 110

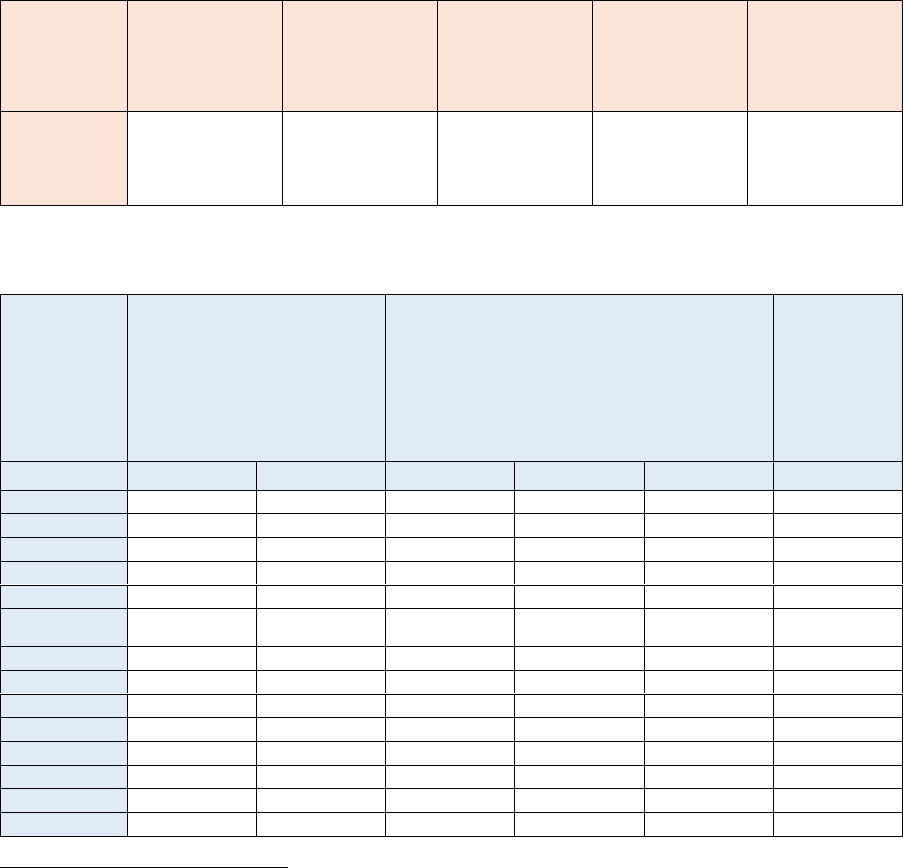

Table 26: Connection charges at transmission level .......................................................................... 111

Table 27: Connection charges at distribution level ............................................................................. 114

Table 28: Current and planned offshore RES generation capacity by country ................................... 119

Table 29: Cost sharing problem of grid connection ............................................................................ 120

Table 30: Transfer or split of some of the connection charge revenues between DSOs ................... 121

Table 31: Application of charges for reactive energy at distribution level ........................................... 122

Table 32: Actual values of charges for reactive energy at distribution level ....................................... 122

Table 33: Application of time-of-use signals in T-tariffs and the temporal granularity of time-of-use T-

tariff structures .................................................................................................................................... 123

ACER REPORT ON TRANSMISSION AND DISTRIBUTION TARIFF METHODOLOGIES IN EUROPE

5

Table 34: Possibility of choice between different time-of-use signal options (in transmission) and

availability of different ToU T-tariffs for different network users .......................................................... 126

Table 35: Application of Time-of-use signals in D-tariffs and temporal granularity of time-of-use D-tariff

structures............................................................................................................................................. 127

Table 36: Possibility of choice between different ToU signal options (in distribution) and availability of

different ToU D-tariffs for different network users ............................................................................... 133

Table 37: Overview of which T-connected users are subject to time-of-use tariffs and whether time-of-

use tariffs are mandatory for the network user or the user can opt in or opt out ................................ 134

Table 38: Overview of which D-connected users are subject to time-of-use tariffs and whether time-of-

use tariffs are mandatory for the network user or the user can opt in or opt out ................................ 135

Table 39: Other measures than ToU in tariff structures to give time related signals to network users

............................................................................................................................................................ 138

Table 40: Implementation status of local markets for system operation services .............................. 139

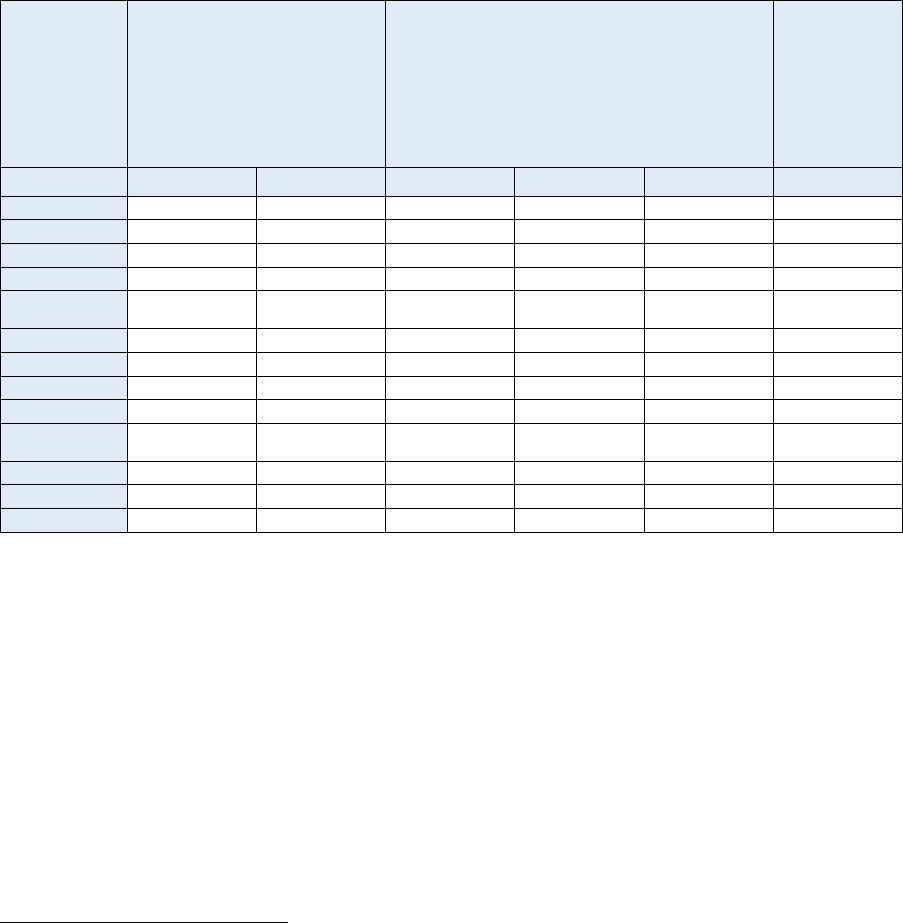

Table 41: Transmission tariff methodology setting process ................................................................ 141

Table 42: Distribution tariff methodology setting process ................................................................... 143

Table 43: Transmission tariff transparency ......................................................................................... 144

Table 44: Distribution tariff transparency ............................................................................................ 145

Table 45: Cost recovery via withdrawal charges at transmission level .............................................. 147

Table 46: Cost recovery via withdrawal charges at distribution level ................................................. 150

Table 47: Tariff basis, variation and differentiation of the transmission tariffs for withdrawal ............ 152

Table 48: Tariff basis, variation and differentiation of the distribution tariffs for withdrawal ............... 154

Table 49: Links to transmission tariff methodologies and transmission tariff values .......................... 157

Table 50: Links to distribution tariff methodologies and distribution tariff values ................................ 161

Table 51: Tariff-related measures to protect vulnerable customers and/or cope with high energy prices

............................................................................................................................................................ 166

ACER REPORT ON TRANSMISSION AND DISTRIBUTION TARIFF METHODOLOGIES IN EUROPE

6

Executive summary

(1) The electricity transmission and distribution networks represent the backbone of the national and

European energy systems and play a key role in the energy transition. Network tariffs have the

core objective to recover the costs incurred by transmission and distribution system operators.

In the Member States the National Regulatory Authorities (NRAs) have to fix or to approve

transmission or distribution tariffs or their methodologies.

(2) Tariff methodologies shall neutrally support overall system efficiency over the long run through

price signals to network users. Since charges related to transmission and distribution networks

can constitute a considerable cost to the network users, the way how tariffs are set can provide

additional incentives (additional to those given by energy pricing) to the network users to adapt

their behaviour. The effectiveness of such signals depends on factors such as the type of network

user and the share of the network costs in the final bill.

(3) Network tariffs, among other requirements set by EU law, shall be cost-reflective, transparent

and non-discriminatory. Tariffs can be designed in multiple ways. Finding the right balance

between various tariff-setting principles (e.g. cost recovery, cost reflectivity, efficiency, non-

discrimination, transparency, non-distortion, simplicity, stability, predictability and sustainability)

is a complex task and it involves different trade-offs, where different NRAs may identify different

approaches according to the pursued principles in each national context. The complexities

increase even more under a rapidly evolving energy system featured by increased integration of

renewable energy sources, increased demand by electrification as well as by a more active role

of network users, and require a regular reassessment of whether the tariff methodologies

continue to be appropriate. Finally, the recent energy crisis and an increasing consideration for

the affordability of the final energy bill pose extra challenges, and may also have an impact on

the network tariffs setting.

(4) In order to increase transparency and comparability in tariff-setting where binding harmonisation

is not seen as adequate

1

, ACER shall provide and update, at least every two years, a best

practice report on transmission and distribution tariff methodologies. NRAs shall duly take the

best practice report into consideration when fixing or approving transmission or distribution tariffs,

or their methodologies

2

.

(5) This Report provides a review of transmission and distribution tariff methodologies across EU

Member States and Norway. This third edition focuses on selected tariff-related topics, for which

a more extensive data collection and analysis was carried out. For other tariff-related topics not

covered in detail in this third edition, an update of the information at country level was carried out.

On the latter topics, this Report provides the updated main findings as well as the still valid ACER

recommendations from previous editions of the Report.

(6) A summary of the novel and previous ACER recommendations is provided in the below Summary

Table. For more details on the recommendations, please refer to the corresponding chapter of

this Report.

1

Cf. Recital (40) of Regulation (EU) No 2019/943.

2

Cf. Article 18(10) of Regulation (EU) No 2019/943.

ACER REPORT ON TRANSMISSION AND DISTRIBUTION TARIFF METHODOLOGIES IN EUROPE

7

(7) Finally, looking towards the fourth edition of the Report, planned towards the end of 2024/early

2025, ACER intends to follow-up on how NRAs are taking into consideration the ACER

recommendations.

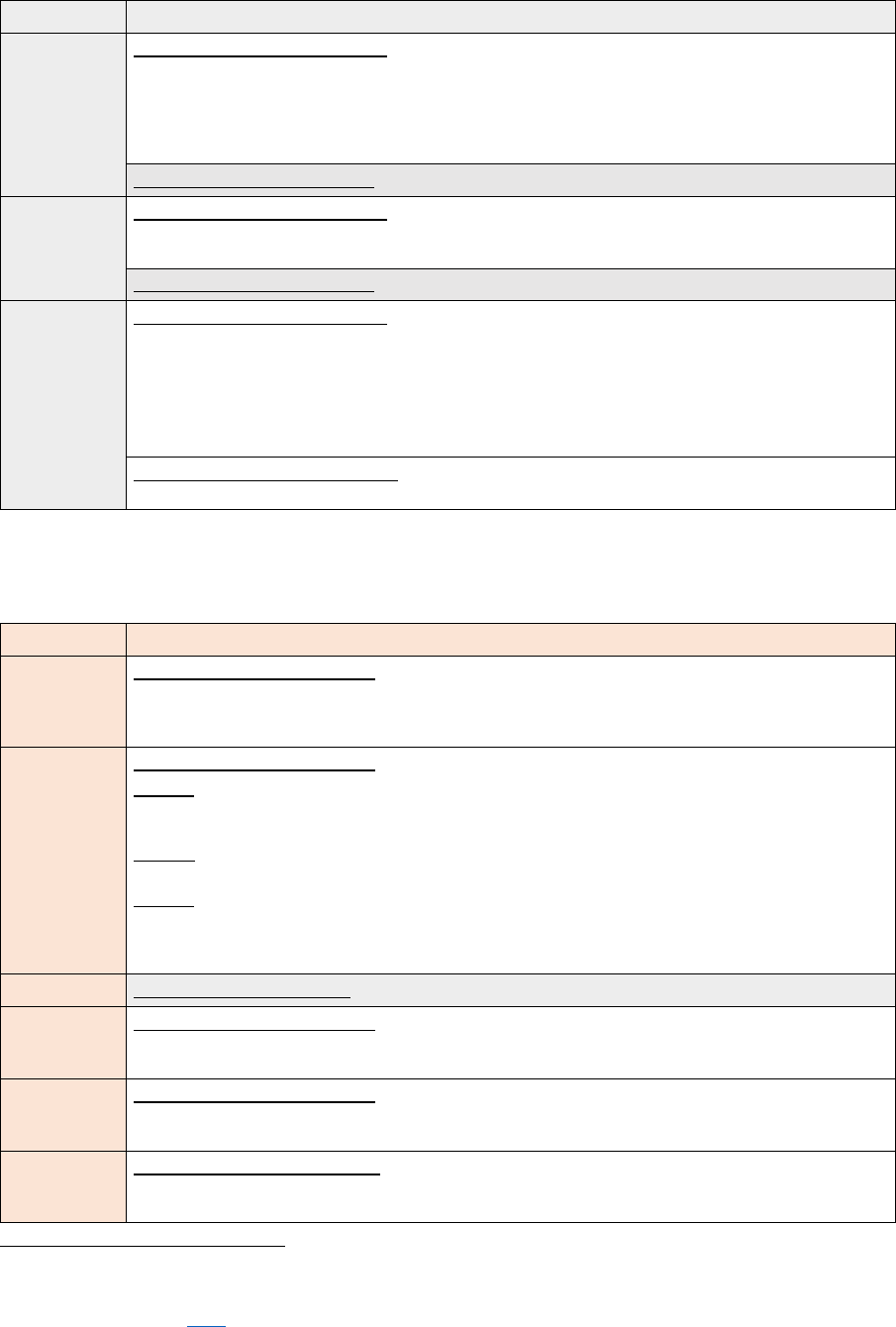

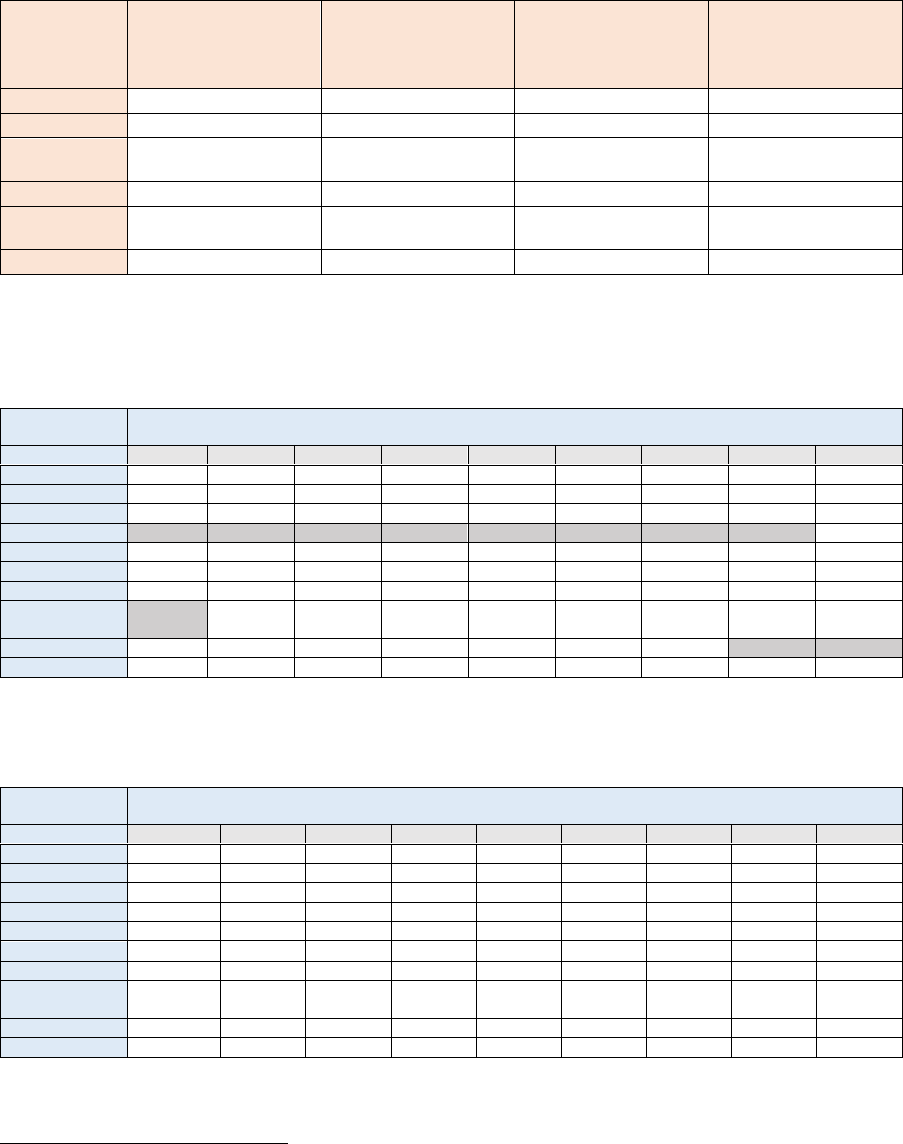

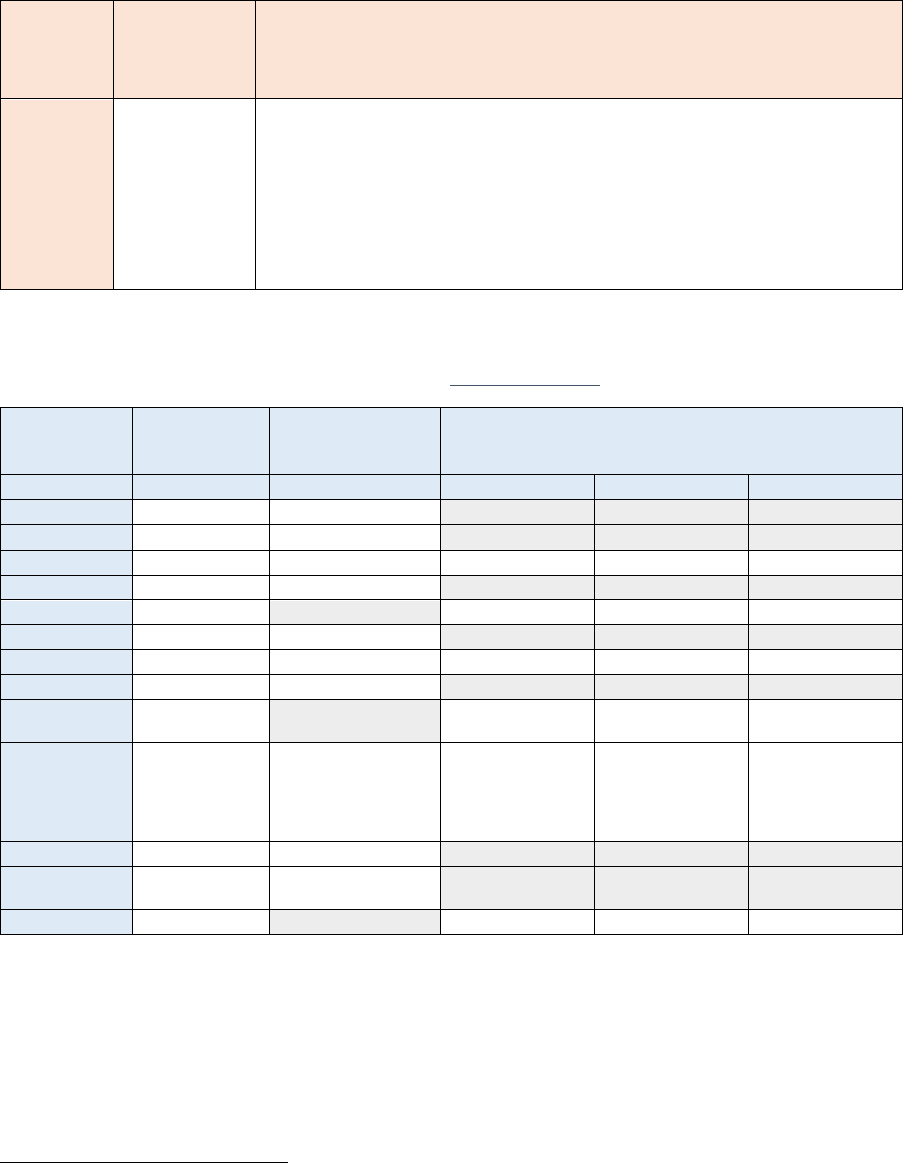

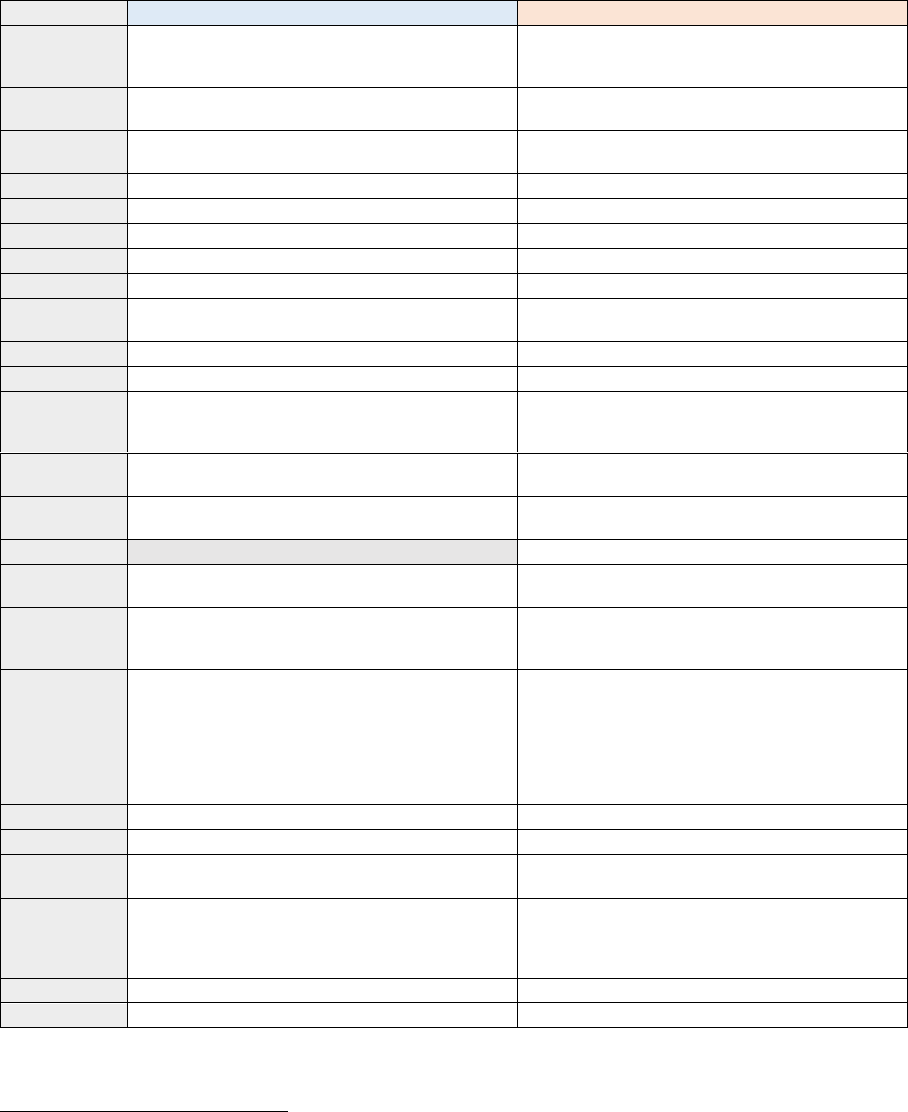

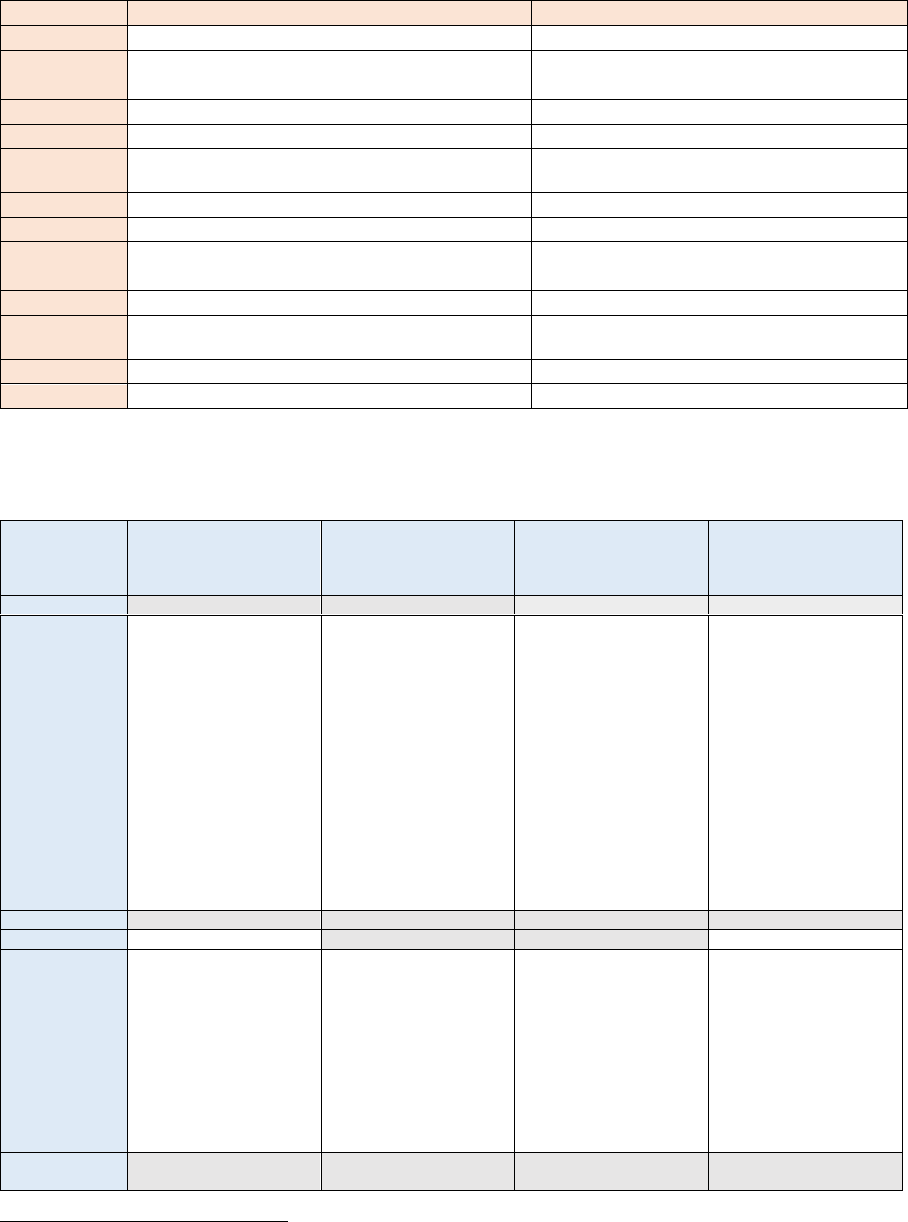

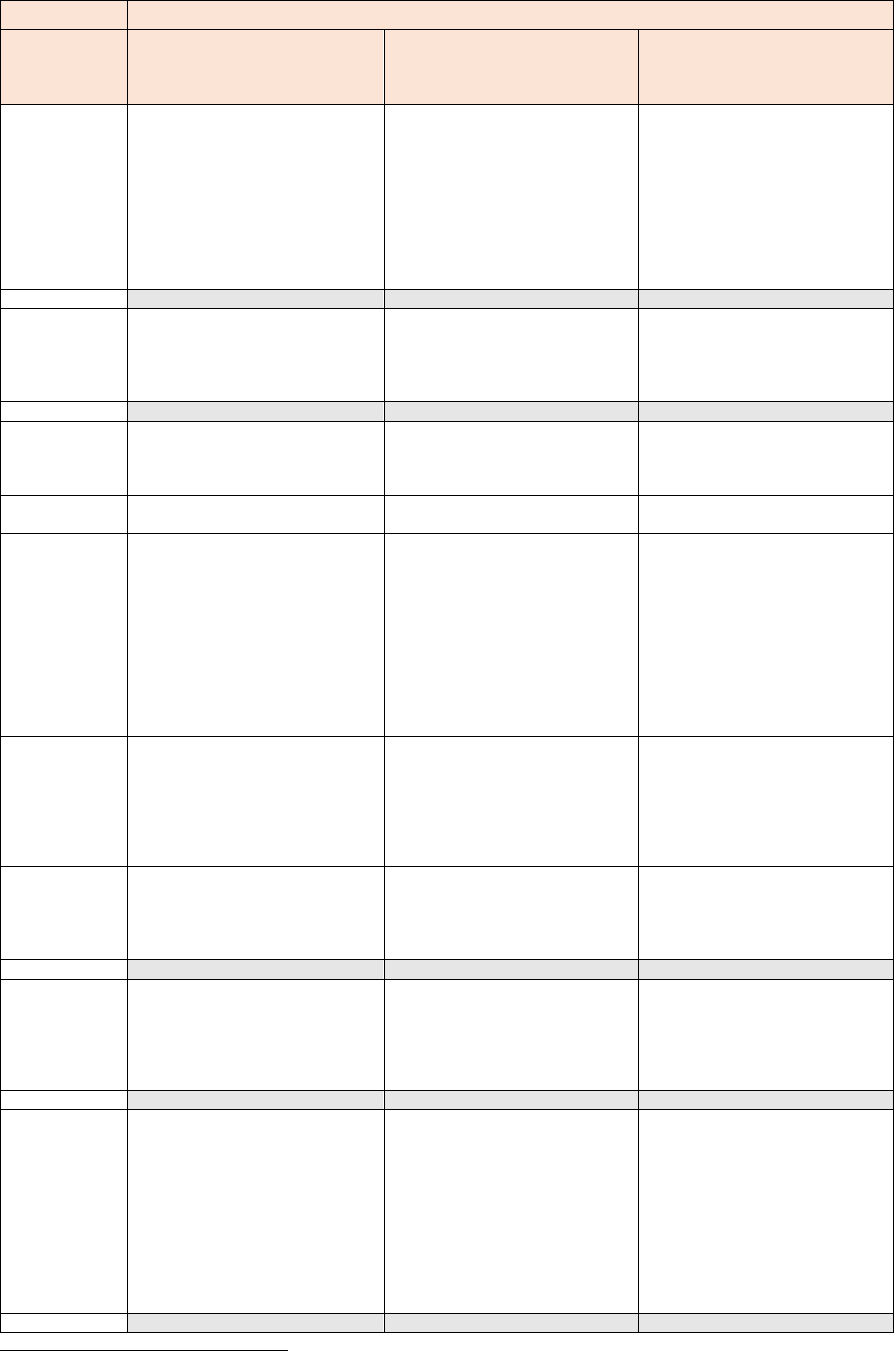

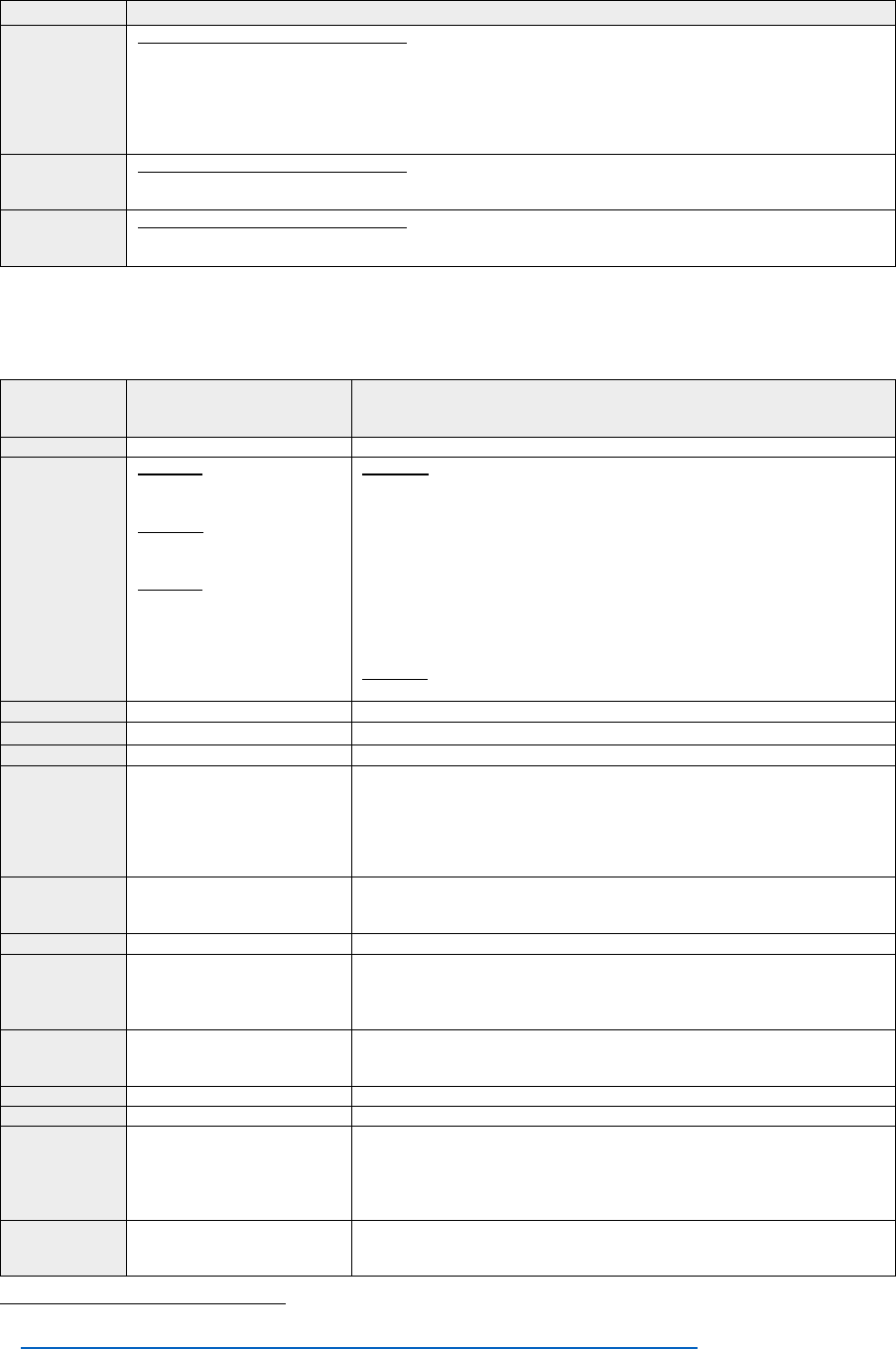

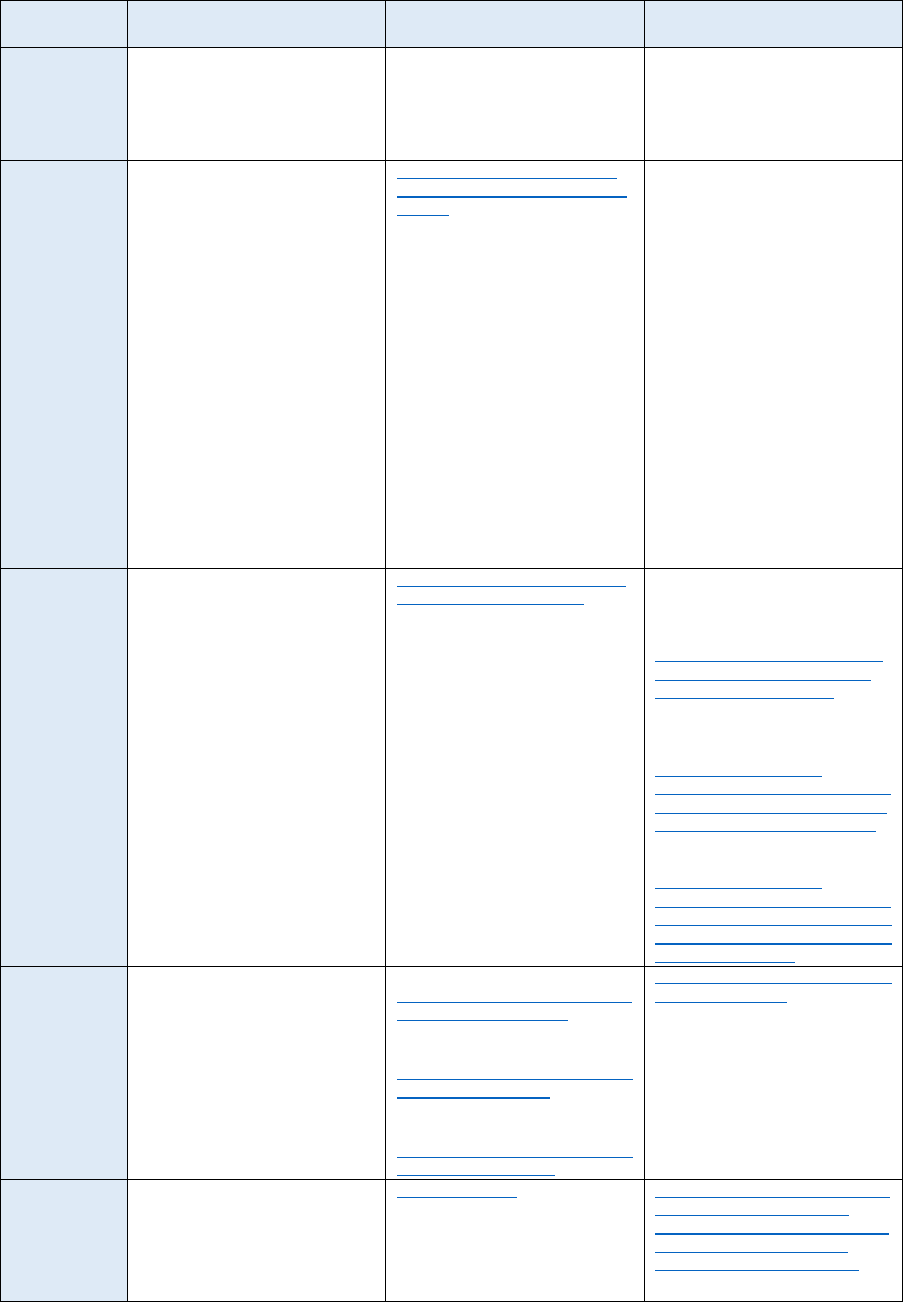

Summary Table of the ACER recommendations

Cost model:

3

(more information in Chapter 3)

Within the next 4 years, subject to available resources of the NRAs, NRAs should evaluate the advantages

and disadvantages of applying incremental or forward-looking cost models.

Cost cascading:

4

(more information in Chapter 3)

Network users should contribute to the costs of each network level used by them.

NRAs should collect network costs, where feasible and cost-effective, classified by different voltage levels, as

this is a pre-requisite to apply the cost-cascading method.

NRAs should collect data on power flows, including the occurrence of inverted power flows, and the volume

of injection and withdrawal per voltage level, to determine whether cost-cascading is still an adequate

approach.

NRAs should ensure transparency on the cost categories not subject to cost-cascading, providing the

economic rationale for this decision.

Exemptions on the application of the cost-cascading principle (e.g. to certain network user groups) should be

justified and regularly re-evaluated.

Injection charges: (more information in Chapter 4)

The costs caused by a network user should be properly reflected in its tariffs. If a network user only

withdraws from or only injects into the transmission or distribution grid, in principle, only the costs relevant for

withdrawal or the costs relevant for injection should be attributed to this network user.

If a network user both withdraws from and injects into the grid, both network uses should be considered when

setting the tariffs, by properly taking into account the potential cost-offsetting effect and the overall cost-

impact to the network.

Where volumetric charges apply, net-metering should be avoided.

Injection charges should be consistently defined across transmission and distribution to avoid undue

incentives for connection towards one of the network levels.

NRAs should consult at least the NRAs of neighbouring countries of any substantial change regarding

injection charges in advance.

When setting injection charges, all network-related cost-burdens on the concerned network users should be

considered, including those recovered via withdrawal charges, connection charges, or other means, to avoid

any double-charging.

Energy-based injection charges should not be used to recover infrastructure costs. Costs, which do not show

correlation with neither capacity nor energy, but rather with the number of network users or the number of

meters, in principle, should be recovered via lump sum charges.

Connection charges: (more information in Chapter 5)

Where deep connection charges apply and the connection of a network user serves future network users,

cost-sharing between current and future network users should be considered.

Within the next 4 years, NRAs should evaluate the advantages and disadvantages of enabling interruptible or

flexible connection agreements.

Reactive energy charges: (more information in Chapter 6)

NRAs should monitor the evolution of costs due to voltage control and reactive energy management.

Where such costs are deemed significant, the NRA should consider a review of reactive energy charging.

3

In this Report, ‘cost model’ means the approach followed in the tariff methodology to set the charges of the network tariffs, such

as the average cost, incremental cost or forward-looking cost models.

4

In this Report, ‘cost cascading’ means the tariff-setting method implying an allocation of some costs of a certain voltage level

towards network users connected at a lower voltage level, but not the other way around.

ACER REPORT ON TRANSMISSION AND DISTRIBUTION TARIFF METHODOLOGIES IN EUROPE

8

NRA should take into account the frequently used thresholds for reactive charging and the frequently used

values across Europe.

Time-of-use network charges: (more information in Chapter 7)

Where time-of-use signals are introduced to reflect system costs, the network tariff structures and the signals

should be mandatory for all network users, without a possibility to opt-out (optionality may be temporarily

reasonable during transition).

Where no time-of-use signals are applied, the NRA should investigate the need from cost-efficiency and/or

network congestion point of view to introduce such signals. Such studies should aim to identify which

elements affect their effectiveness and efficiency.

Where time-of-use is already applied, the NRA should regularly evaluate their impacts and their

appropriateness. NRAs should improve data collection and analysis regarding individual network users.

Where fit-for-time-of-use meters are largely missing, as a temporary solution, NRAs may design network

tariffs by determining for different user profiles their contribution to the system peak.

NRAs role in tariff setting: (more information in Chapter 8)

The NRA should directly set the transmission and distribution tariff methodologies or, as a strict minimum,

approve them.

Tariff structure and cost recovery: (more information in Chapter 8)

NRAs should differentiate the network costs at least according to the following categories: transmission

infrastructure; transmission losses; distribution infrastructure; distribution losses; metering services; system

operator purchases of system services; costs due to reactive power;

NRAs should obtain sufficiently granular data on network development and system operation and identify for

each of these cost categories the most appropriate cost drivers;

NRAs should be able to differentiate at the level of individual network charges the share of each cost category

listed above.

Frequency of tariff setting methodologies: (more information in Chapter 8)

The length of the tariff methodology period should be at least 4 years (the set methodology may be subject to

revision before, due to rapid changes in the sector, if duly justified).

Network tariff values should be updated at least yearly based on variations of the drivers defined by the tariff

methodology and on inflation.

A multi-year transition process should be preferred when changes in the tariff methodology significantly

impact the tariff values for individual grid users.

Stakeholder involvement: (more information in Chapter 8)

Public consultations should be used systematically to interact transparently and inclusively with stakeholders.

Transparency in tariff-setting: (more information in Chapter 8)

At least the following information should be published in each Member State:

o the detailed methodology to set transmission and distribution tariffs, including in particular the cost

categories covered by them;

o at least when the tariff methodology is set, the amounts recovered by each tariff element; and

o each year, the transmission and distribution tariff values for each network user group.

ACER REPORT ON TRANSMISSION AND DISTRIBUTION TARIFF METHODOLOGIES IN EUROPE

9

1. Introduction

(8) The electricity transmission and distribution networks represent the backbone of the national and

European energy systems and play a key role in the energy transition. Network tariffs have the

core objective to recover the costs incurred by transmission and distribution system operators.

(9) Pursuant to Article 59(1)(a) of Directive (EU) 2019/944

5

, each national regulatory authority (NRA)

has the duty of fixing or approving, in accordance with transparent criteria, network tariffs or their

methodologies, or both.

(10) In line with Regulation (EU) 2019/943

6

, tariff methodologies shall reflect the fixed costs of

transmission system operators (TSOs) and distribution system operators (DSOs) and shall

provide appropriate incentives to the transmission and distribution system operators to increase

efficiencies, to foster market integration and security of supply, to support efficient investments,

to support related research activities, and to facilitate innovation in the interest of consumers in

areas such as digitalisation, flexibility services and interconnection.

(11) Article 18(1) of the same Regulation establishes that charges applied by network operators for

access to networks, including charges for connection to the networks, charges for use of

networks, and, where applicable, charges for related network reinforcements, shall be cost-

reflective, transparent, take into account the need for network security and flexibility and reflect

actual costs incurred insofar as they correspond to those of an efficient and structurally

comparable network operator and are applied in a non-discriminatory manner.

(12) Tariff methodologies shall also neutrally support overall system efficiency over the long run

through price signals to network users, and shall not discriminate, positively or negatively,

production, energy storage and aggregation. It also shall not create disincentives for self-

generation, self-consumption and for participation in demand response. Since charges related to

transmission and distribution networks can constitute a considerable cost for network users, the

way how tariffs are set can provide additional incentives (additional to those given by energy

pricing) to the network users to adapt their behaviour. The effectiveness of such signals depends

on factors such as the type of network user and the share of the network costs in the final bill.

(13) Tariffs can be designed in multiple ways. Finding the right balance between various tariff-setting

principles (e.g. cost recovery, cost reflectivity, efficiency, non-discrimination, transparency, non-

distortion, simplicity, stability, predictability and sustainability) is a complex task and it involves

different trade-offs, where NRAs may identify different approaches as most suitable according to

the pursued principles in each national context. The complexities increase even more under a

rapidly evolving energy system featured by increased integration of renewable energy sources,

increased demand by electrification as well as by a more active role of network users, and require

a regular reassessment of whether the tariff methodologies continue to be appropriate. Finally,

the recent energy crisis and an increasing consideration for the affordability of the final energy

bill pose extra challenges, and may also have an impact on the network tariffs setting.

5

Directive (EU) 2019/944 of the European Parliament and of the Council of 5 June 2019 on common rules for the internal market

for electricity and amending Directive 2012/27/EU. OJ L 158, 14.6.2019, p. 125. Cf. Article 37(1)(a) of Directive 2009/72/EC

6

Regulation (EU) 2019/943 of the European Parliament and of the Council of 5 June 2019 on the internal market for electricity.

OJ L 158, 14.6.2019, p. 82. Cf. Article 14 of Regulation (EC) No 714/2009

ACER REPORT ON TRANSMISSION AND DISTRIBUTION TARIFF METHODOLOGIES IN EUROPE

10

(14) In order to increase transparency and comparability in tariff-setting where binding harmonisation

is not seen as adequate

7

, ACER shall provide and update, at least every two years, a best

practice report on transmission and distribution tariff methodologies in accordance with Article

18(9) of Regulation (EU) 2019/943, while taking account of national specificities. Pursuant to

Article 18(10) of that Regulation, NRAs shall duly take the best practice report into consideration

when fixing or approving transmission or distribution tariffs, or their methodologies.

(15) This Report constitutes the third edition of the best practice report foreseen in Regulation (EU)

2019/943, following the ACER 2019 report on practices regarding transmission tariff

methodologies

8

, as well as the ACER 2021 report on practices regarding distribution tariff

methodologies

9

. It is the first edition covering information both on transmission and distribution

tariffs.

(16) This Report provides a review of transmission and distribution tariff methodologies across EU

Member States and Norway. It focuses on a limited number of tariff-related topics, - which were

deemed as of particular interest to NRAs in view of recent or ongoing tariff works and/or based

on targeted consultations by ACER

10

-, for which a more extensive data collection and analysis

was carried out. For other tariff-related topics not covered in detail in this third edition, an update

of the information at country level was carried out.

(17) This edition of the Report features five topics in focus. First, it investigates the cost models used

across countries to set the economic signals of the network tariffs and the application of the cost-

cascading method. Second, it investigates the application of injection charges, including ACER’s

regular monitoring of the appropriateness of the ranges of allowable transmission charges paid

by producers (G-charge), pursuant to annex Part B of Commission Regulation (EU) No

838/2010.

11

Third, it reviews the connection charges applied when producers, consumers and

other network users connect to the grid. Fourth, it investigates the application of reactive energy

charges. Fifth, it discusses the time-of-use signals embedded into network tariffs. For other tariff-

related topics, not in focus in this edition, the updated main findings as well as the still valid ACER

recommendations from previous editions of the Report can be found in Chapter 8.

(18) This Report is based on the input provided by NRAs between February 2022 and December

2022

12

on their respective transmission and distribution tariff methodologies. For transmission

tariffs in Ireland and distribution tariffs in Bulgaria, in lack of inputs, with some exceptions

13

, the

Report builds on the information provided by the respective NRAs to ACER in 2019 and 2020

7

Cf. Recital (40) of Regulation (EU) No 2019/943.

8

ACER report on transmission tariff methodologies in Europe, December 2019

https://www.acer.europa.eu/Official_documents/Acts_of_the_Agency/Publication/ACER%20Practice%20report%20on%20trans

mission%20tariff%20methodologies%20in%20Europe.pdf

9

ACER report on distribution tariff methodologies in Europe, February 2021

https://www.acer.europa.eu/Official_documents/Acts_of_the_Agency/Publication/ACER%20Report%20on%20D-

Tariff%20Methodologies.pdf

10

Cf. ACER webinars on electricity network tariffs for injection (10 Nov 2021) and on time-of-use electricity network tariffs (16

Nov. 2021):

https://www.acer.europa.eu/public-events/acer-webinar-electricity-network-tariffs-injection-targeted-consultation;

https://www.acer.europa.eu/public-events/acer-webinar-time-use-electricity-network-tariffs-targeted-consultation

11

The term ‘G-charge’ refers to the transmission charges paid by producers, excluding connection charges, charges related to

ancillary services and specific system loss charges, and whose annual average value is capped by Commission Regulation (EU)

No 838/2010. In contrast, the term ‘injection charge’ means all transmission and distribution charges paid by producers for the

use of the network (i.e. it also excludes connection charges, but it includes other non-connection charges, such as charges related

to ancillary services and system losses)

12

Most information was collected in the first semester, complemented with additional clarifications in the second semester.

13

Some information required for the G-charge monitoring has been provided for Ireland.

ACER REPORT ON TRANSMISSION AND DISTRIBUTION TARIFF METHODOLOGIES IN EUROPE

11

(for the previous ACER tariff reports), to the extent possible. The detailed input provided by

NRAs, which is analysed across the different chapters of the Report, is provided in Annex 1.

(19) In light of the unprecedented surge in electricity prices since mid-2021, ACER also carried out a

general review of the tariff designs supporting vulnerable customers and any temporary tariff

measures to ease or redistribute tariff burdens. The findings of this assessment, with information

collected mainly in the first semester of 2022, are provided in Annex 3 of this report.

(20) It is worth reminding that network tariff-setting is the result of a three-step process. First, the

allowed or target revenues of the network operators (including the remuneration method for TSO

or DSO costs) and other relevant costs are determined. Second, the tariff structure is defined.

Third, the costs are allocated to each of the tariff structure’s items (i.e. charges paid by network

users). This Report focuses on the last two steps.

(21) The rest of this Report is structured as follows:

Chapter 2 provides the definitions used in the Report;

Chapter 3 investigates the cost models applied and cost cascading;

Chapter 4 investigates the transmission and distribution tariffs for injection;

Chapter 5 analyses the structure of connection charges;

Chapter 6 investigates the reactive energy charges;

Chapter 7 discusses the time variation of tariffs;

Chapter 8 provides the main findings and recommendations on those tariff-related topics

that are not in-focus in this edition;

Annex 1 provides the input from NRAs, which is analysed across the different chapters of

the Report;

Annex 2 provides the relevant links to the tariff methodologies and some other tariff-related

information in each country;

Annex 3 deals with tariff-related measures to protect vulnerable customers and/or cope with

high energy prices.

2. Definitions

(22) According to the definitions set by Directive (EU) 2019/944 and Regulation (EU) 2019/943:

a) ‘Distribution’ means the transport of electricity on high-voltage, medium-voltage and low-

voltage distribution systems with a view to its delivery to customers, but does not include supply;

b) ‘Distribution system operator’ means a natural or legal person who is responsible for operating,

ensuring the maintenance of and, if necessary, developing the distribution system in a given

area and, where applicable, its interconnections with other systems, and for ensuring the long-

term ability of the system to meet reasonable demands for the distribution of electricity;

ACER REPORT ON TRANSMISSION AND DISTRIBUTION TARIFF METHODOLOGIES IN EUROPE

12

c) ‘Producer’ means a natural or legal person who generates electricity;

d) ‘Smart metering system’ means an electronic system that is capable of measuring electricity

fed into the grid or electricity consumed from the grid, providing more information than a

conventional meter, and that is capable of transmitting and receiving data for information,

monitoring and control purposes, using a form of electronic communication;

e) ‘Transmission’ means the transport of electricity on the extra high-voltage and high-voltage

interconnected system with a view to its delivery to final customers or to distributors, but does

not include supply;

f) ‘Transmission system operator’ means a natural or legal person who is responsible for

operating, ensuring the maintenance of and, if necessary, developing the transmission system

in a given area and, where applicable, its interconnections with other systems, and for ensuring

the long-term ability of the system to meet reasonable demands for the transmission of

electricity.

(23) In addition, for the purpose of this Report, the following additional definitions apply:

a) ‘Connection charge’ means charge, typically one-off charge, covering the costs (or part of the

costs) of connecting new users to the transmission or distribution system or upgrading the

connection. Connection charges may be shallow or deep. In case of shallow connection

charges the network users pay for the infrastructure connecting its installation to the

transmission or distribution grid (line/cable and other necessary equipment), while in case of

deep connection charges, the network users pay (additionally) for the costs of other

reinforcements/extensions in the existing network, required in the transmission or distribution

grid to enable the grid user to be connected;

b) ‘Distribution tariff methodology’ defines the rules for allocating distribution costs to (groups of)

network users. The tariff methodology as defined in this Report does not include the

determination of allowed or target revenues of the network operators;

c) ‘G-charge’ means the transmission charges paid by producers in each Member State, as

referred to in annex Part B of Commission Regulation (EU) No 838/2010, excluding connection

charges, charges related to ancillary services and specific system loss charges;

d) ‘Household consumer’ means a network user who withdraws electricity from the grid for the

consumer's own household consumption, excluding commercial or professional activities;

e) ‘Injection charge’ means all transmission and distribution charges paid by producers, except for

charges for physical assets required for connection to the system or the upgrade of the

connection (i.e. connection charges), but including other non-connection charges (such as

charges related to ancillary services and system losses);

f) ‘Network user’ means a natural or legal person connected to the transmission or distribution

network (excluding the DSO and TSO), who injects electricity in and/or withdraws electricity

from the network;

g) ‘Payment for reactive energy/power’ means the charge for withdrawing and/or for injecting

reactive power outside the allowed limits;

ACER REPORT ON TRANSMISSION AND DISTRIBUTION TARIFF METHODOLOGIES IN EUROPE

13

h) ‘Public consultation’ means a publicly announced consultation, in which any individual, group

or organisation is allowed to participate;

i) ‘Tariff methodology period’ means the period for which the general rules for the tariffs are set.

During this period the tariff values may be updated several times;

j) ‘Time-of-use network tariffs’ (or tariff time elements) means charges for network service(s) that

vary according to when the service is used e.g. by peak/off-peak, season, month,

weekdays/weekends, hour;

k) ‘Transmission tariff methodology’ defines the rules for allocating transmission costs to (groups

of) network users. The tariff methodology as defined in this Report does not include the

determination of allowed or target revenues of the network operators;

(24) In this Report, the term “network charges” includes all charges paid to the TSO and DSO. As

illustrated in Figure 1, among these charges ACER differentiates between:

a) the charges for use of the network (i.e. charges due to the costs developing and operating the

transmission and the distribution grid and system which are recurring every year);

b) the charges for connection to the system or the upgrade of the connection, which are typically

one-off charges;

c) the charges for individual (specific) services provided by the TSO or DSO at the request of the

network user (e.g. installation of a new meter upon user’s request or reconnecting a network

user in case of disconnection due to late payments, etc.);

(25) Inside the charges for use of the network, ACER differentiates further between the transmission

and distribution tariffs for building, upgrading and maintaining infrastructure and the transmission

and distribution tariffs for losses, from other charges, such as the charges for system services,

charges for metering and charges which are paid for withdrawing and/or for injecting reactive

power outside the allowed limits (i.e. reactive energy charges).

(26) Network charges shall not include unrelated costs supporting unrelated policy objectives.

ACER REPORT ON TRANSMISSION AND DISTRIBUTION TARIFF METHODOLOGIES IN EUROPE

14

Figure 1: Segmentation of network charges

3. Cost model and cost cascading

3.1. Cost model

(27) In this Report, the expression “cost model” refers to the conceptual approach for determining the

network tariff values. National approaches are categorised according to three cost models,

whether they are based on an average cost, an incremental cost or a forward-looking cost. Figure

2 below provides a general description of the three approaches, as well as a reference on how

cost recovery is ensured in each case.

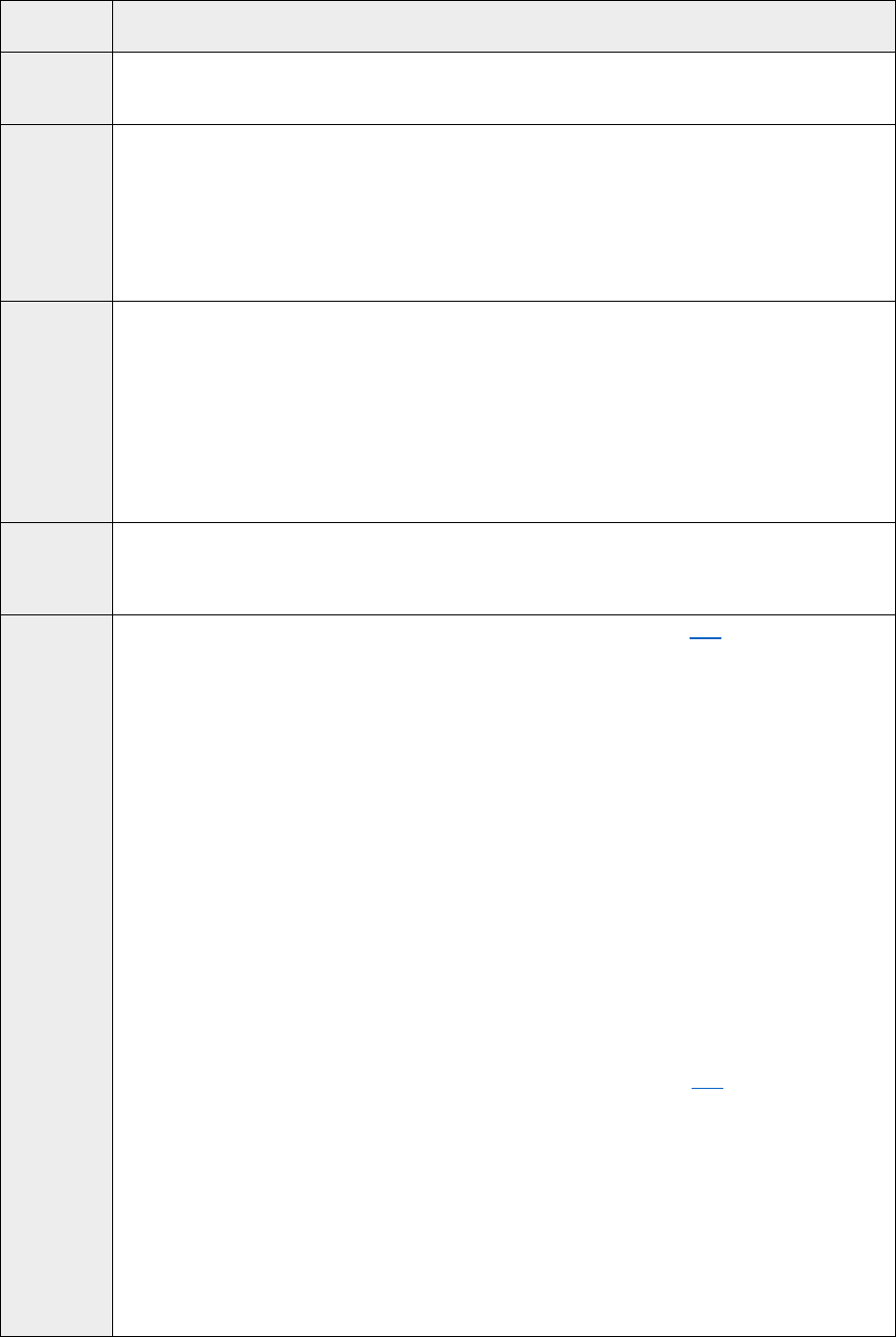

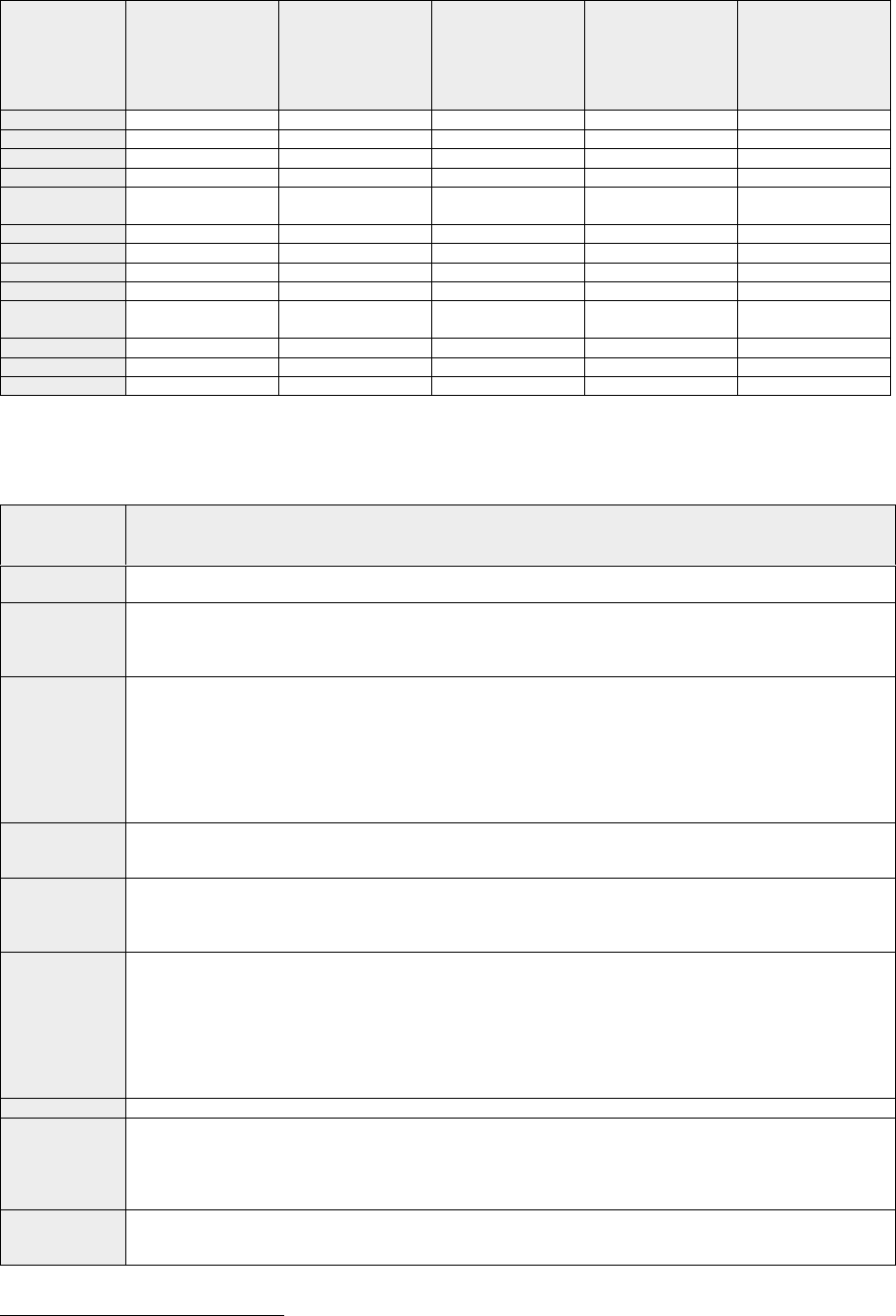

(28) Cost models are not to be confused with the methodology for setting the allowed or target

revenues of the network operator. Cost models are used to determine the unit prices of the

network tariffs, given the level of allowed or target revenues to recover and the level of forecasted

quantities.

ACER REPORT ON TRANSMISSION AND DISTRIBUTION TARIFF METHODOLOGIES IN EUROPE

15

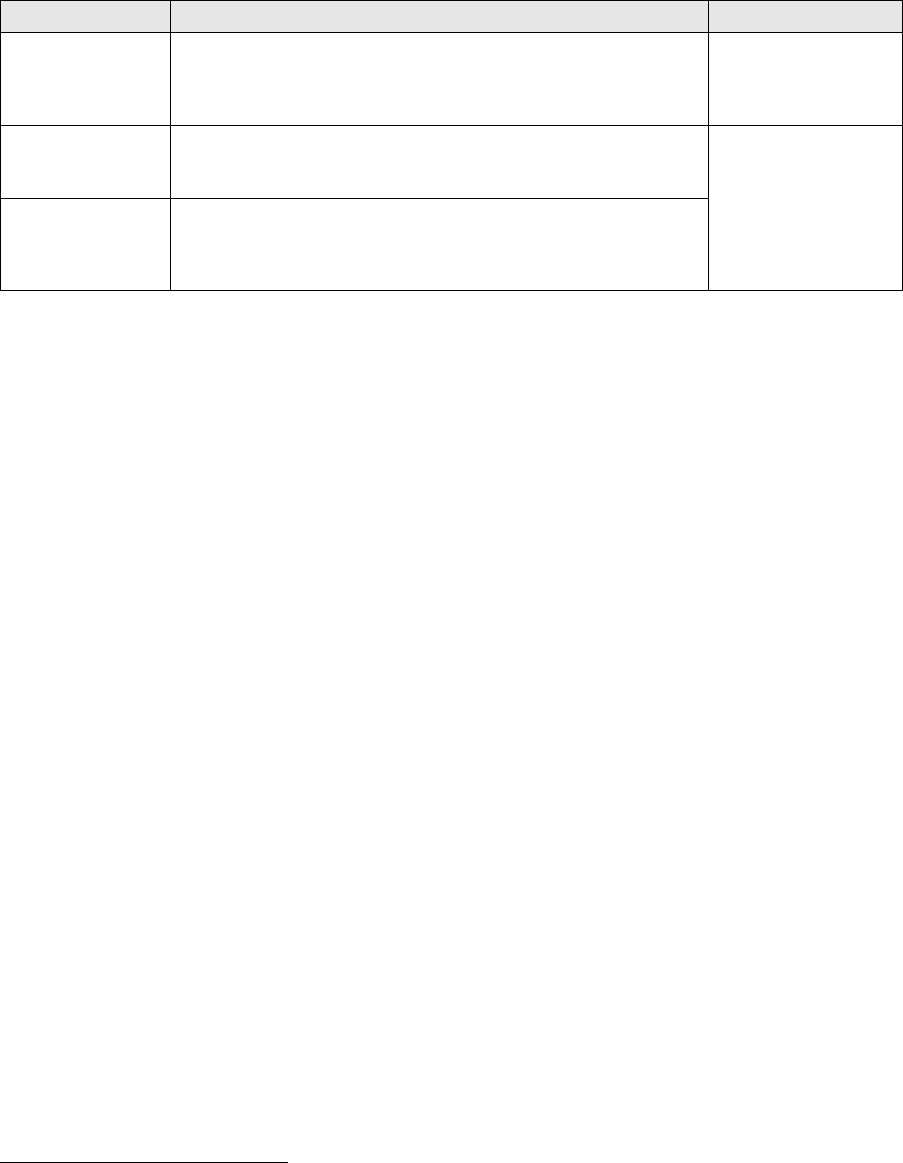

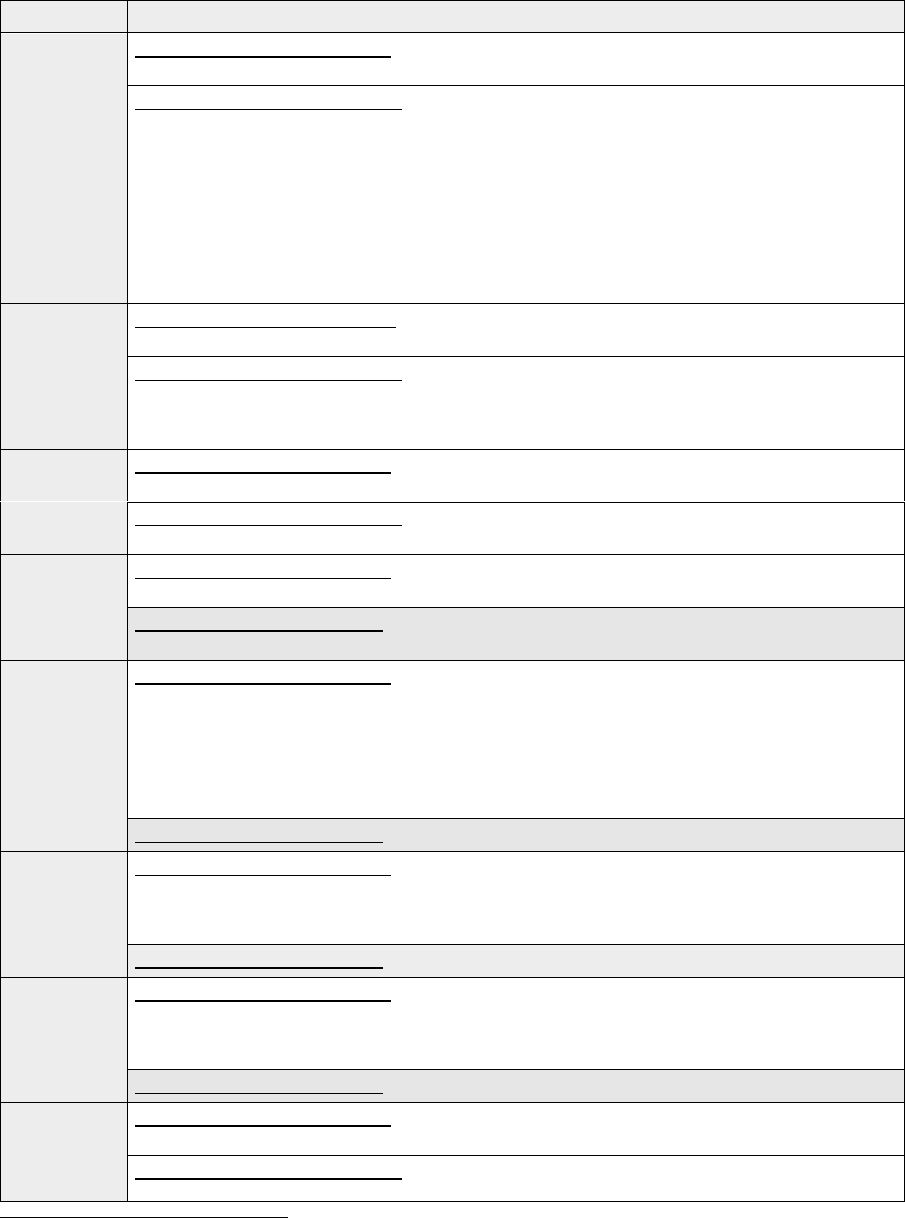

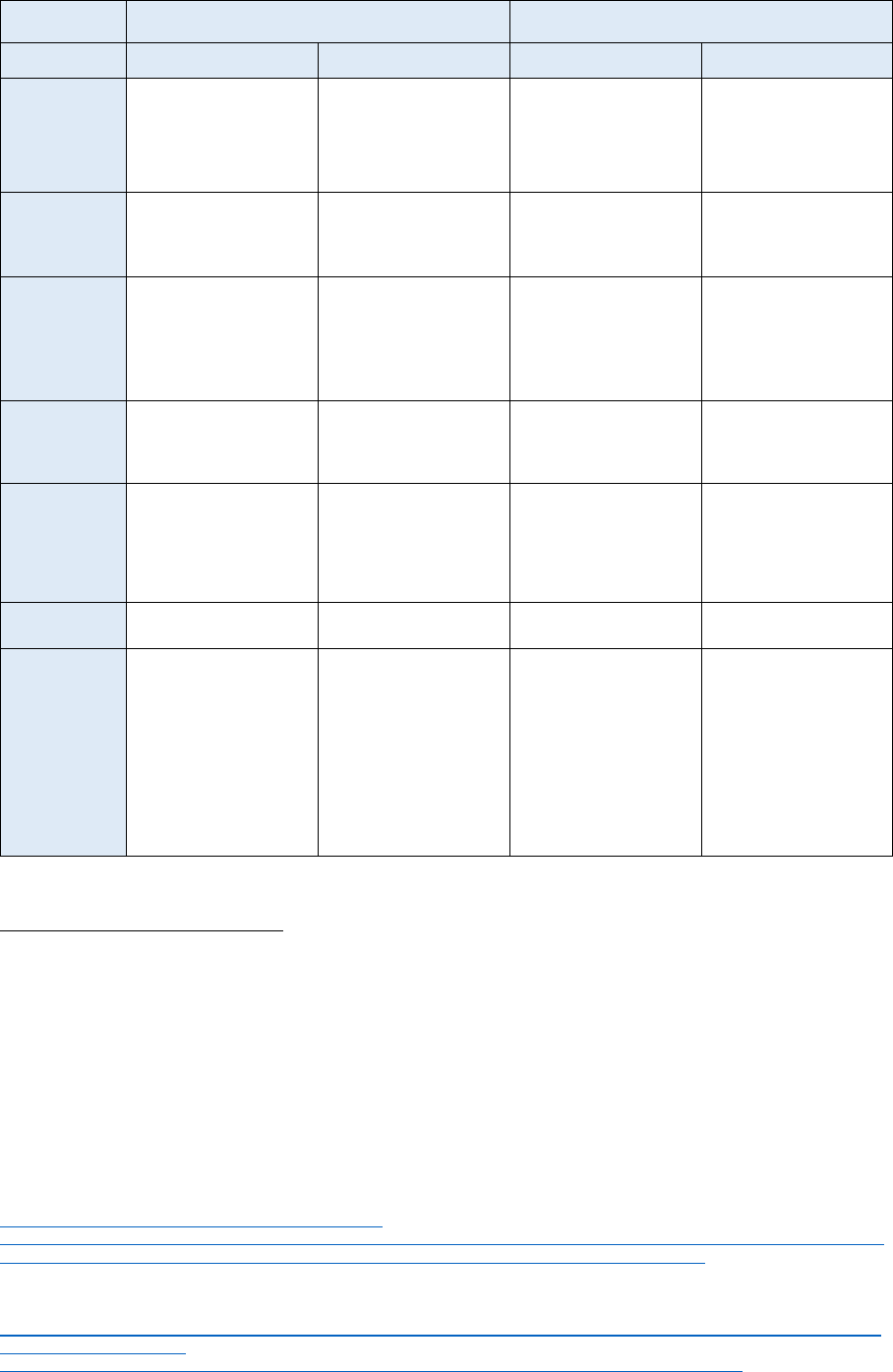

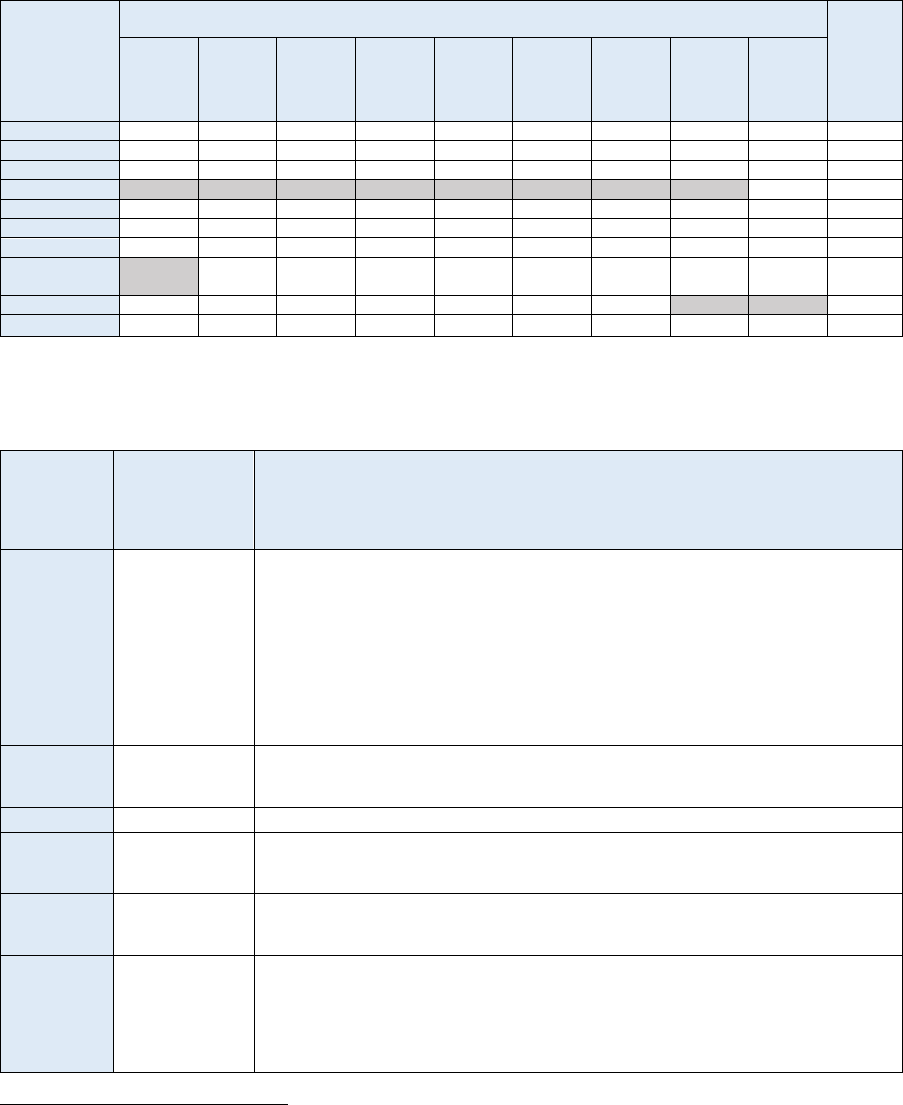

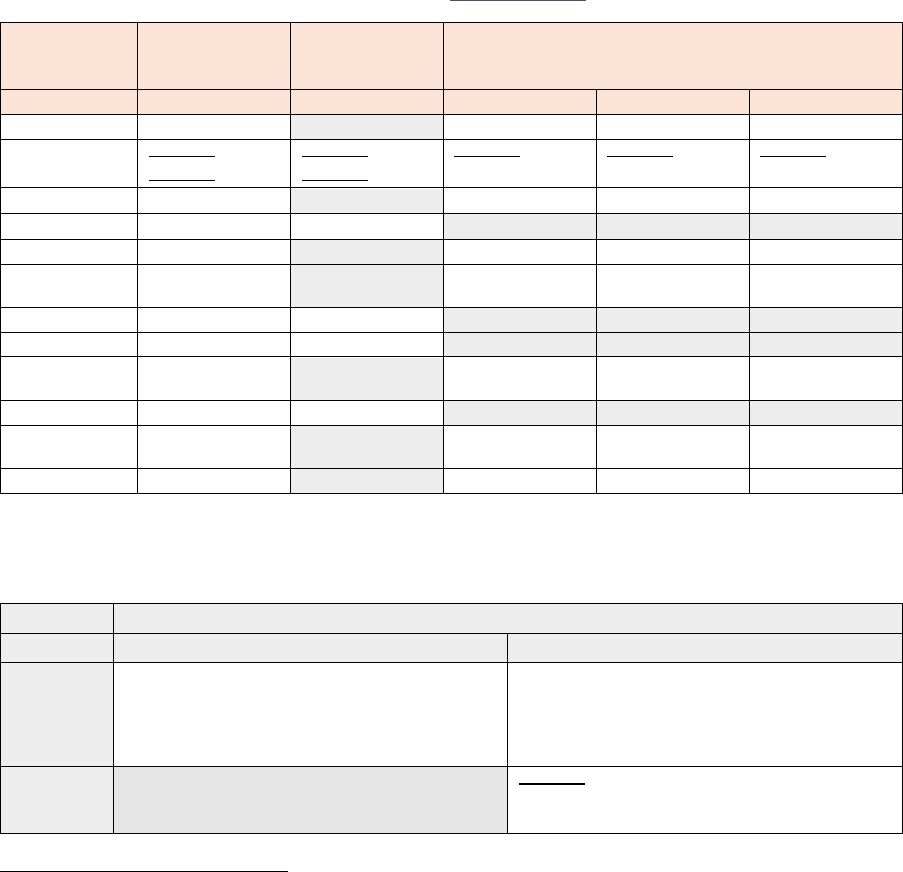

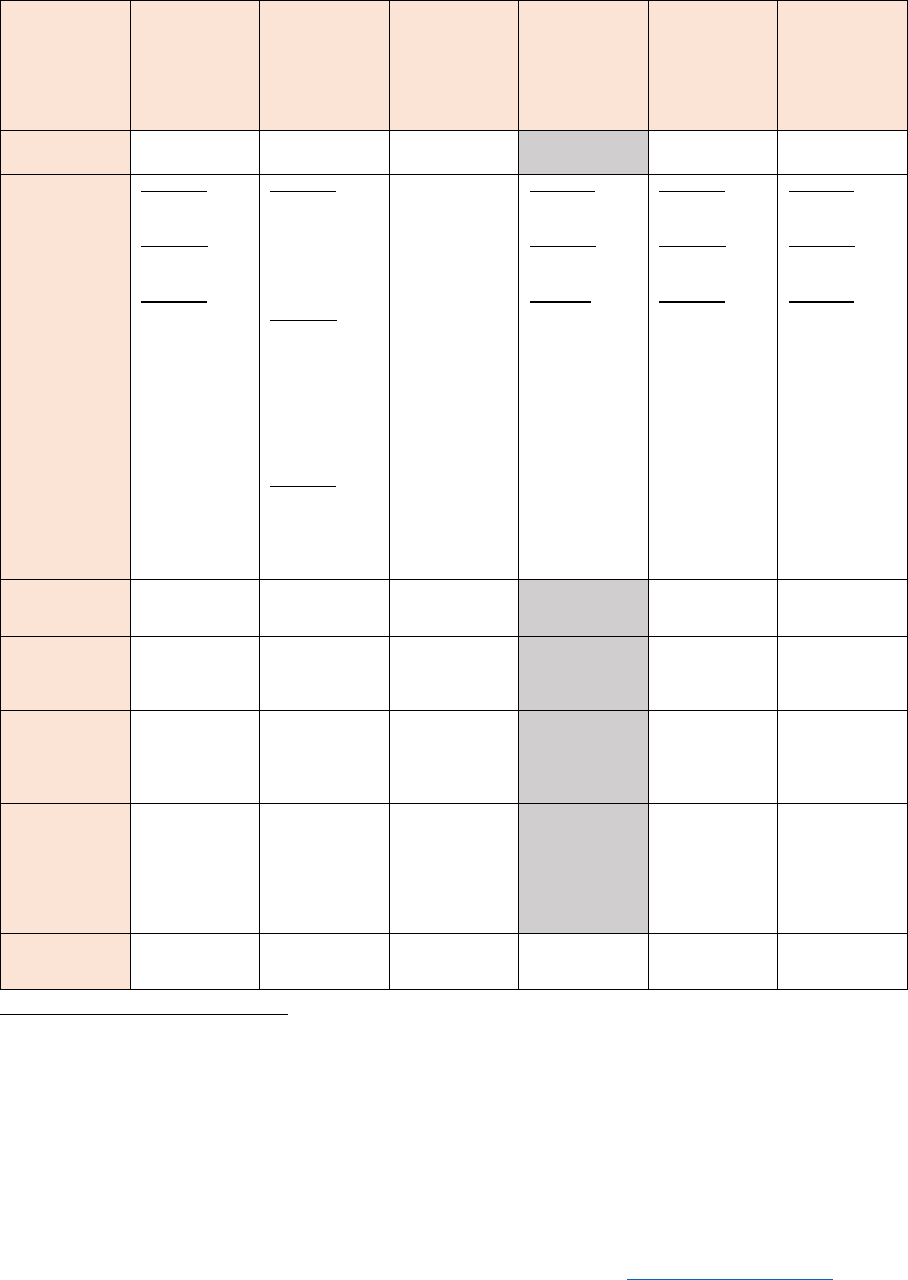

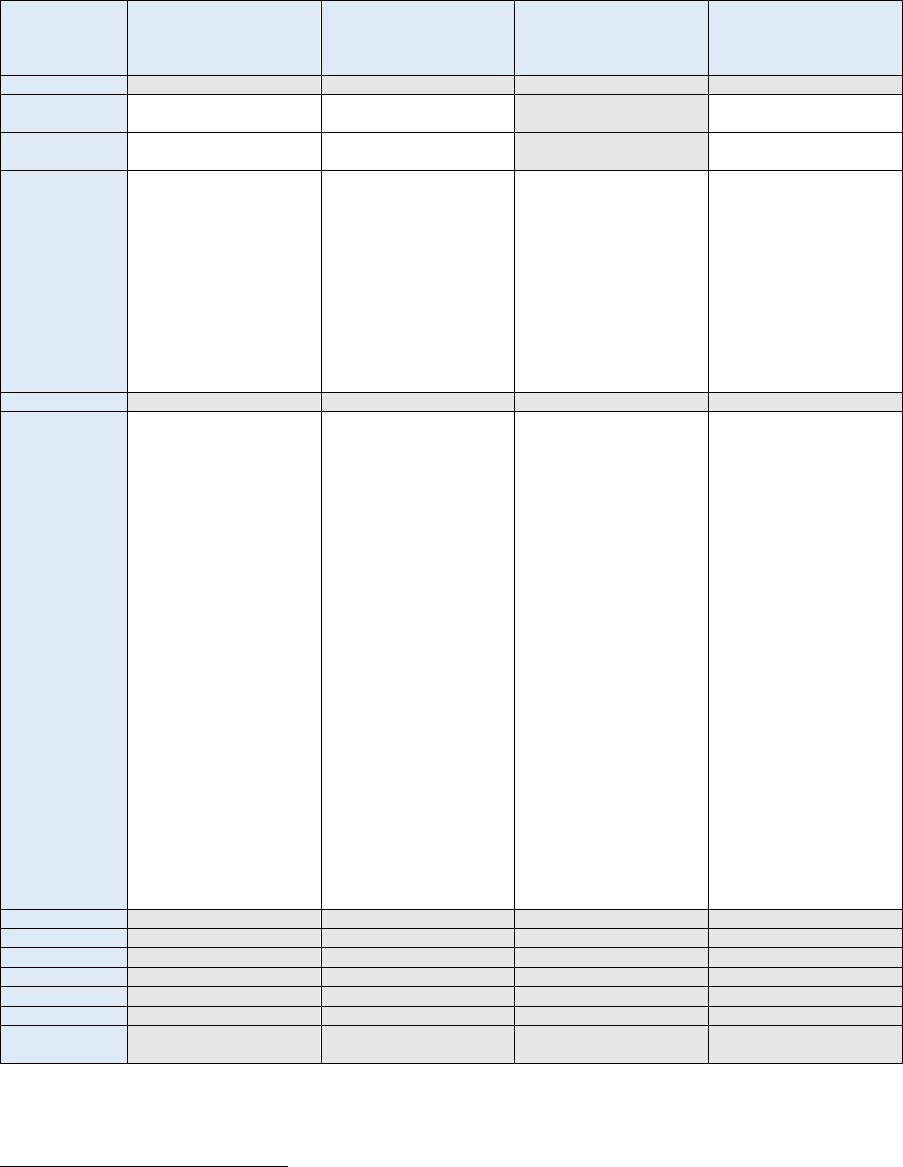

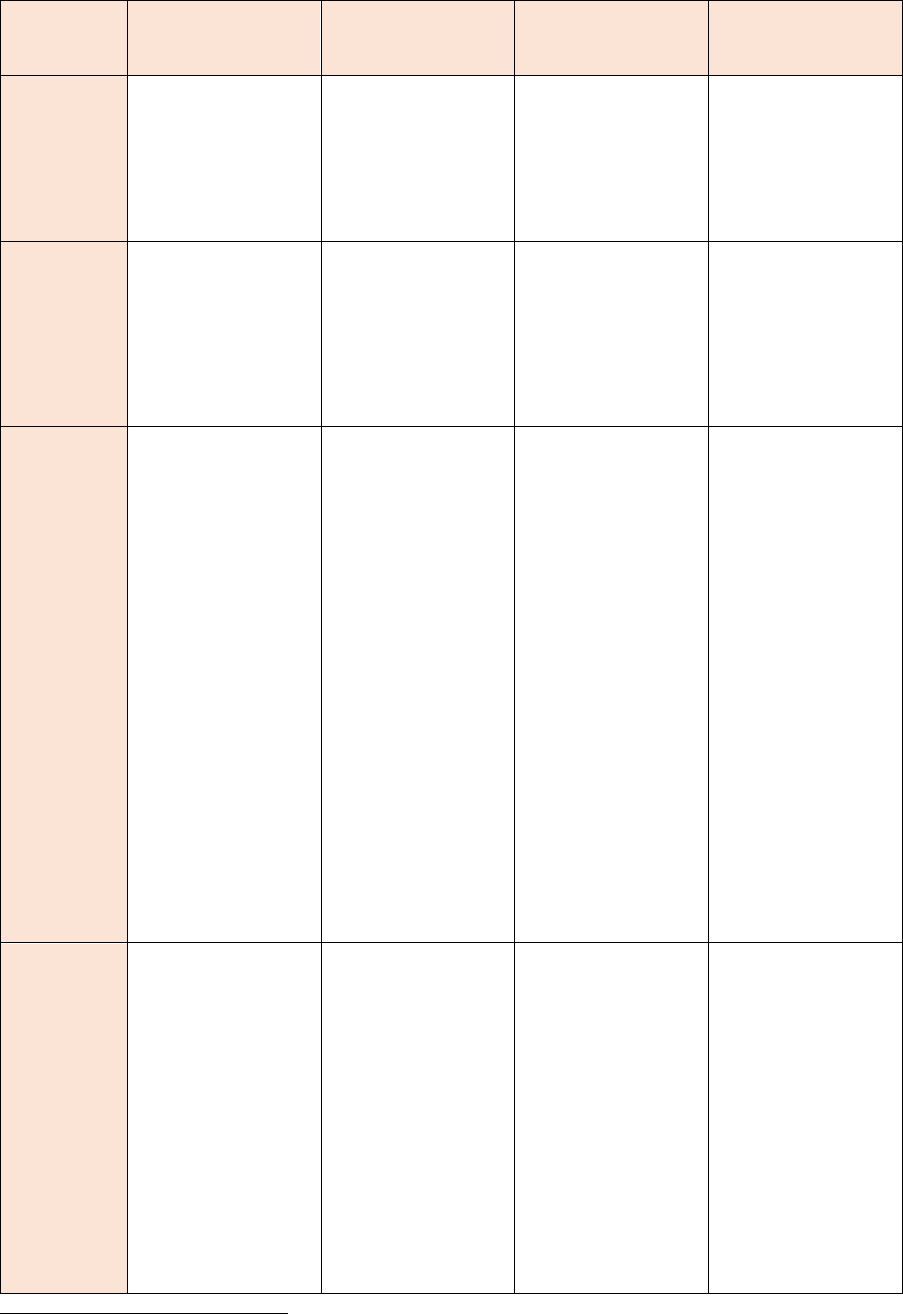

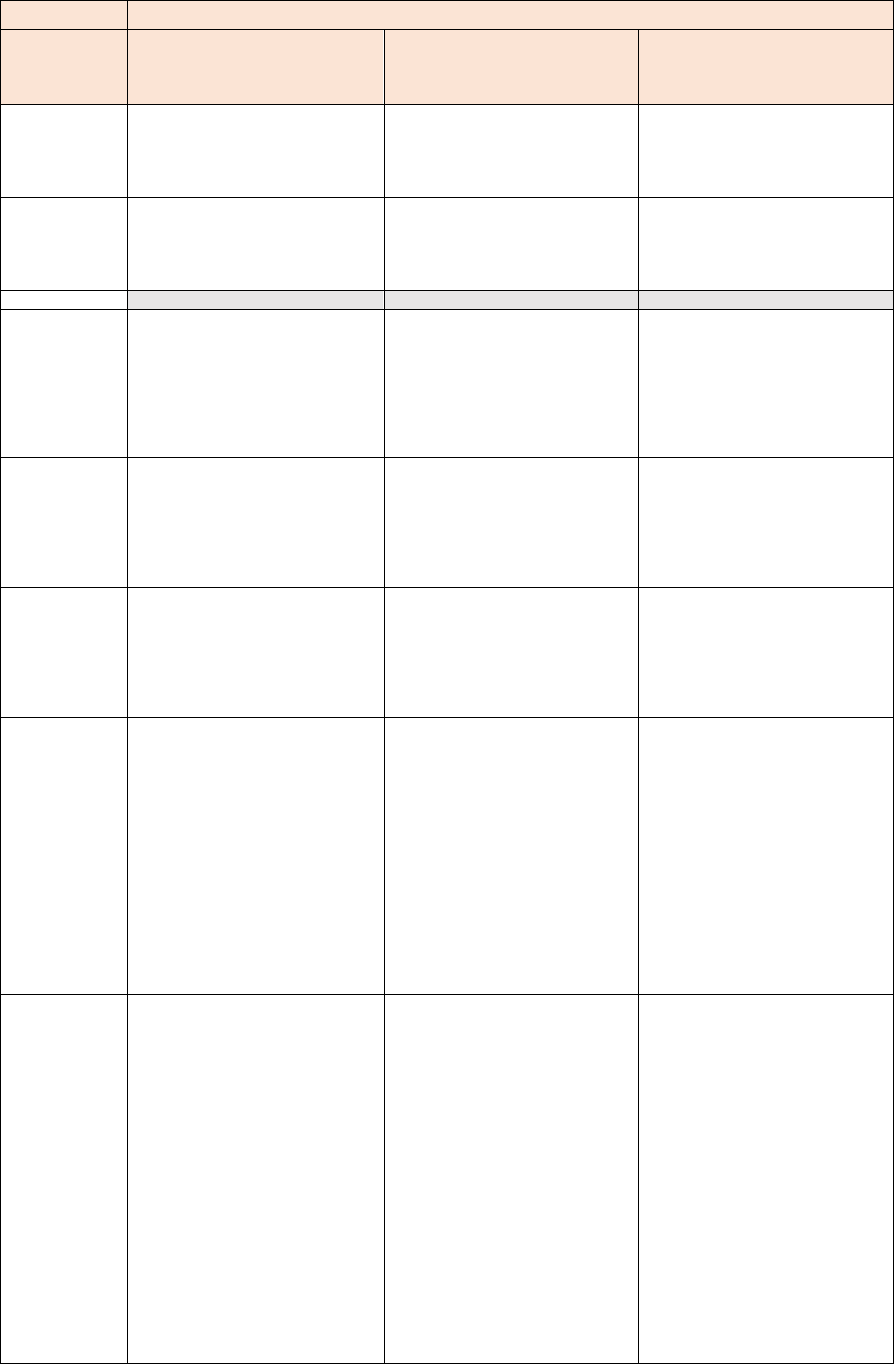

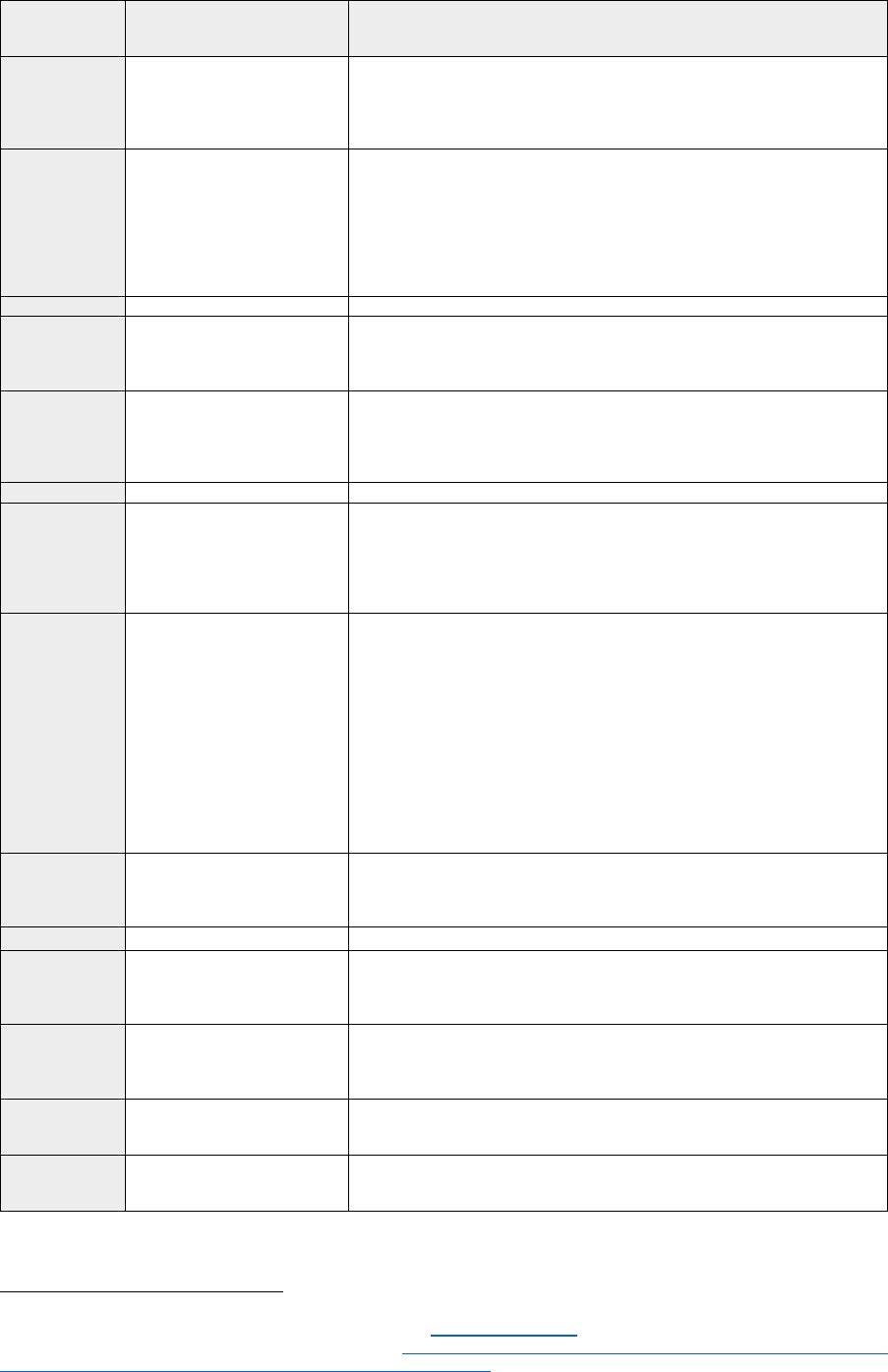

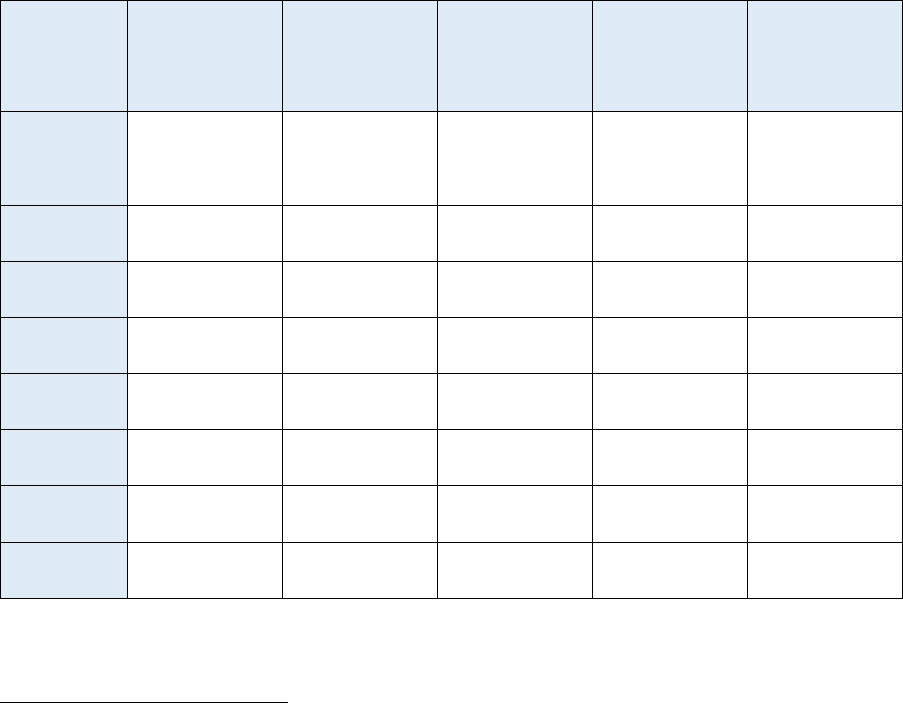

Figure 2: Cost models for setting network tariffs

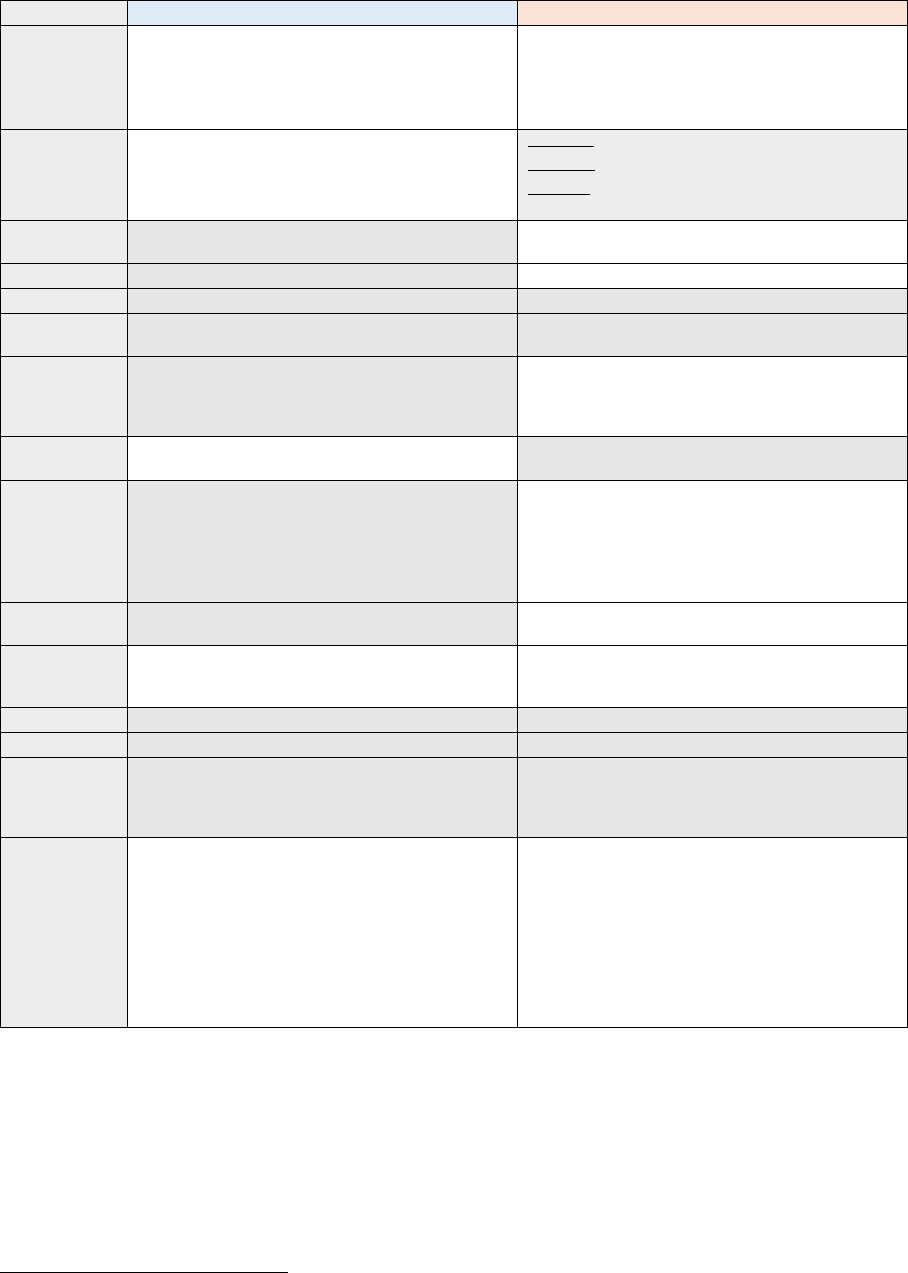

Cost model

Description

Cost recovery

Average cost

The allowed or target revenues of network operators are allocated to the

cost drivers as an average cost, meaning the ratio between revenues and

quantities.

Full cost recovery is

ensured by design, if the

quantities are correctly

forecasted

Incremental cost

Increments in network costs are associated to increments in cost drivers,

where data used refers mainly to historic data. The incremental cost per

cost driver represents an average long-run marginal cost.

May result in residual

costs that need to be

accounted for to ensure

full cost recovery.

Forward-looking cost

Increments in network costs are associated to increments in cost drivers,

where data used refers mainly to forecasted data and/or simulation

models. The incremental cost per cost driver represents a long-run

marginal cost.

(29) The average cost model determines unit prices of the network tariff by dividing the allowed or

target revenues by the forecasted quantities (such as demand).

14

This cost model is backward-

looking as it considers costs that have already been incurred in the past. In contrast, the

incremental and forward-looking cost models estimate the unit prices of the network tariff through

an incremental or marginal approach, by estimating additional (incremental) costs due to an

increase (increment) of a cost driver.

15

As a result, and assuming that quantities for the next tariff

period are correctly forecasted, the average cost model ensures full recovery of the allowed or

targeted revenues by design, while the incremental (or marginal) costs of the other two

approaches may result in a lower level of revenues compared to the allowed or targeted

revenues

16

. The difference of that revenue level with the level of allowed or target revenues is

often labelled as “residual cost”.

(30) As cost recovery is the core objective of tariff-setting, a tariff methodology based on the

incremental or forward-looking cost models needs to employ some adjustment to ensure full cost

recovery, bringing the residual cost to zero. From a theoretical perspective, the tools to overcome

this problem are either a fixed “lump sum” term to avoid the distortion of economic decision-

making or, if that is not feasible, a rule of Ramsey-pricing

17

. From a practical perspective, the

solution usually involves multiplicative or additive adjustment of all or some prices to ensure cost

recovery.

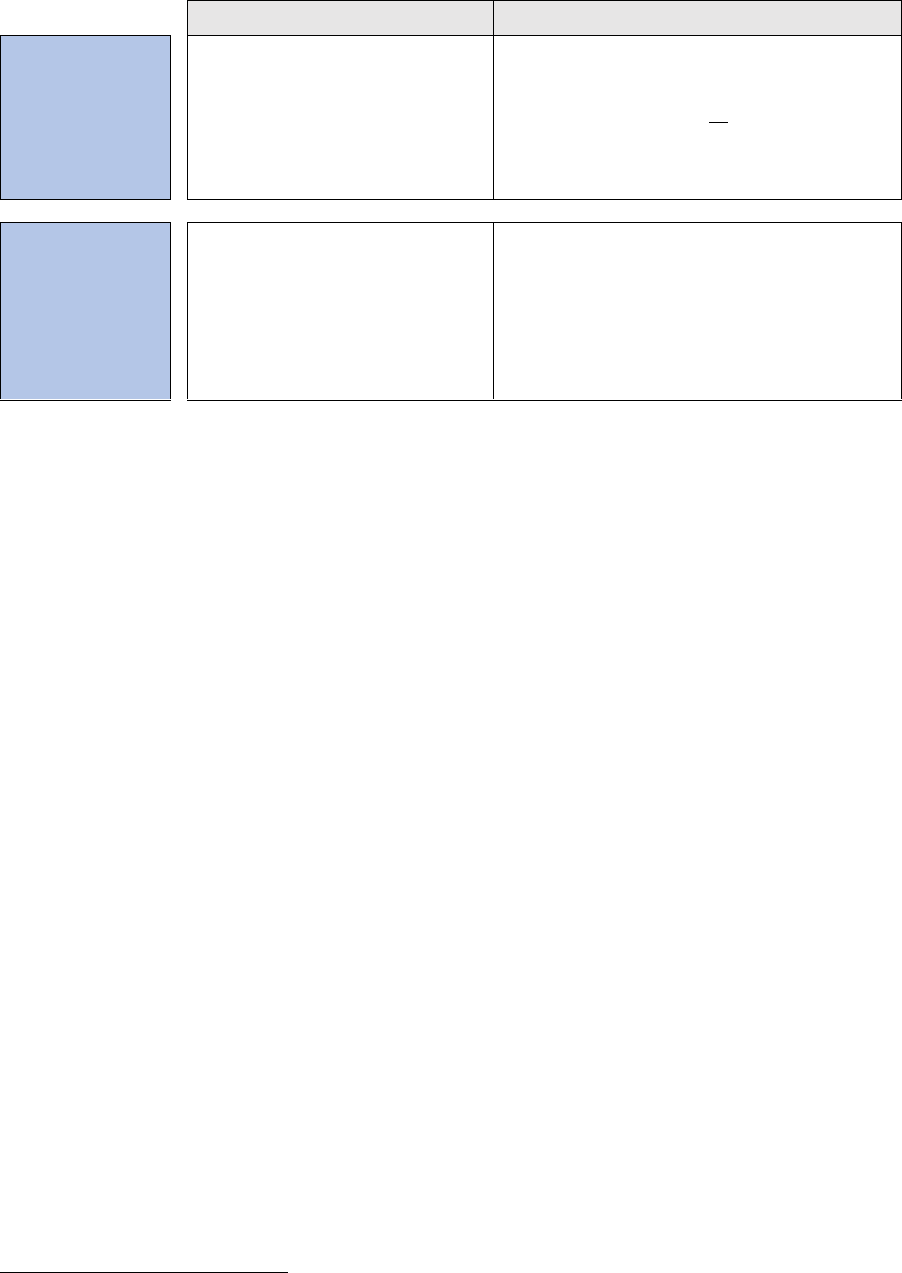

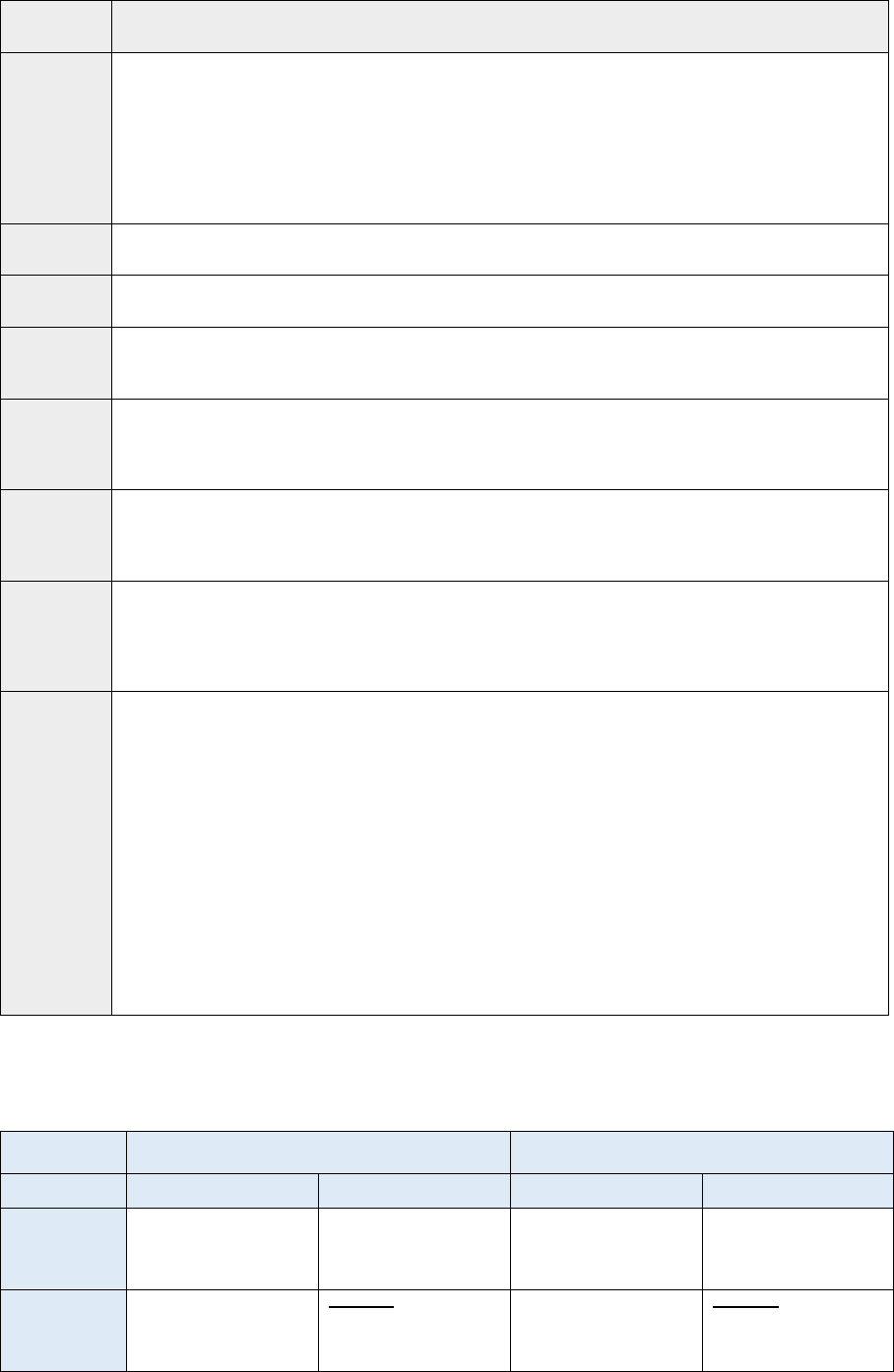

(31) Figure 3 provides a schematic comparison of the three cost models in terms of inputs and outputs

for tariff-setting. The main difference is that the incremental and forward-looking cost models use

a set of unit prices as inputs to the tariff-setting, which in the output phase need to be adjusted

to ensure cost recovery.

18

14

For instance, dividing revenues, in euros (EUR), by forecasted consumption, in MWh, to obtain an energy-based price, in

EUR/MWh.

15

The difference between these two approaches is that the incremental cost model resorts mainly to historic data, while the

forward-looking cost model requires a simulation model to forecast the future network investments.

16

I.e. due to economies of scale

17

Ramsey pricing consists in adjusting the unit prices in a differentiated way in order to reach the overall revenue goal. More

precisely, the prices applied to the more (less) elastic demand should be less (more) adjusted as this will minimize the overall

economic distortion.

18

The unit prices used as inputs are computed ex ante, before the tariff-setting process.

ACER REPORT ON TRANSMISSION AND DISTRIBUTION TARIFF METHODOLOGIES IN EUROPE

16

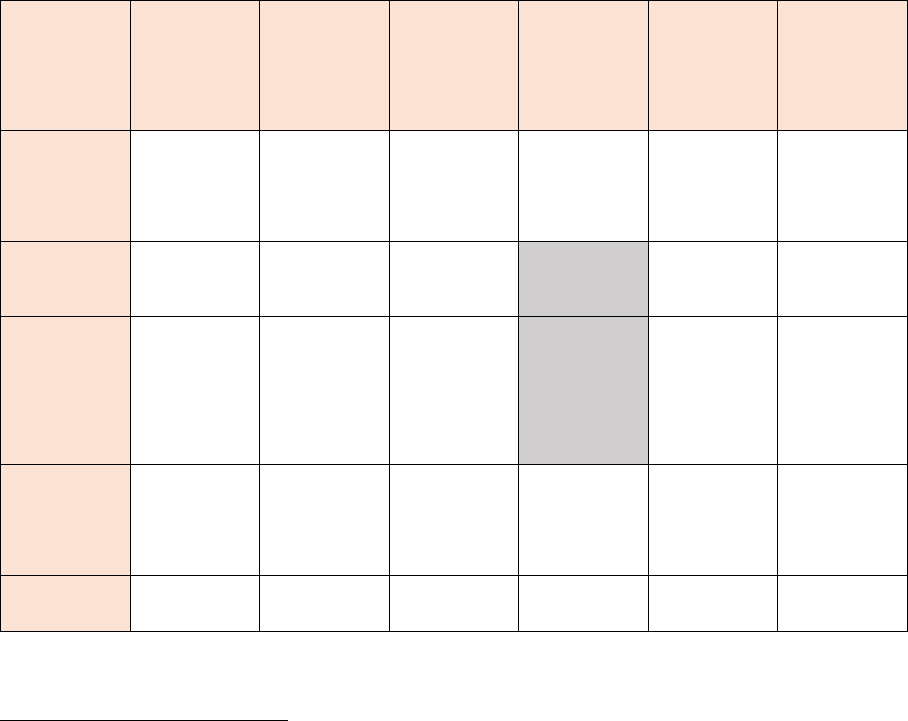

Figure 3: Schematic comparison of the cost models for tariff-setting

Input

Output

Average cost

model

Incremental or

Forward-looking

cost model

Note: The index represents the range of subcategories that exist in tariff-setting, for instance different voltage

levels and/or different billing variables (e.g. contracted power, energy).

(32) In theory, the incremental or forward-looking cost models are better approaches to signal the true

cost of using the network, if the residual cost is recovered in a non-distortive way (i.e. via lump

sum charges).

(33) To illustrate the potential of these cost models, one may consider the case of electricity networks,

where the main cost is usually related to the development of the network, which is typically

correlated with peak demand. In the extreme case where the network has excess capacity, to

the point that it is unlikely to require further investments over the next decades, from an economic

perspective the true (incremental) cost of using the network during the peak is close to zero.

Hence, the unit prices to be used as inputs for tariff-setting would also be close to zero. Obviously,

such unit prices would not recover the target or allowed revenues of the network operator, leading

to a revenue shortfall (residual cost) and to the need to adjust the unit prices. If that adjustment

is performed in a least-distortive manner, the incremental or forward-looking cost models can be

preferred when compared to an average cost model.

19

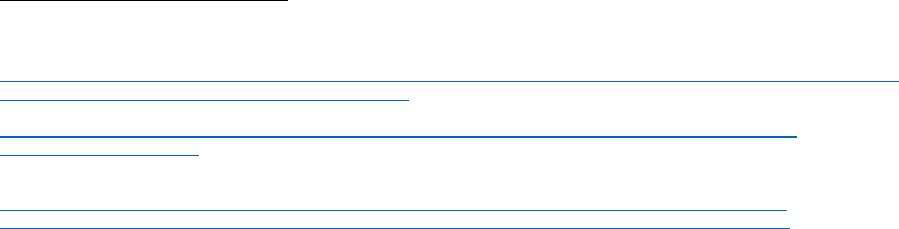

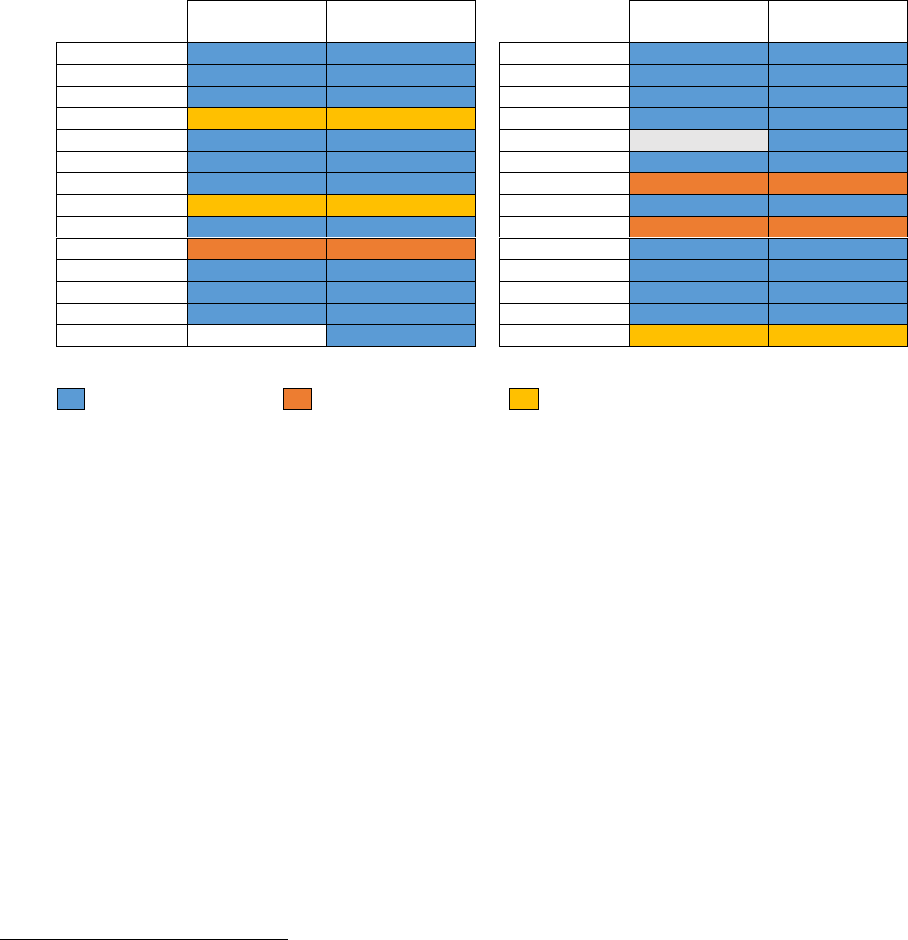

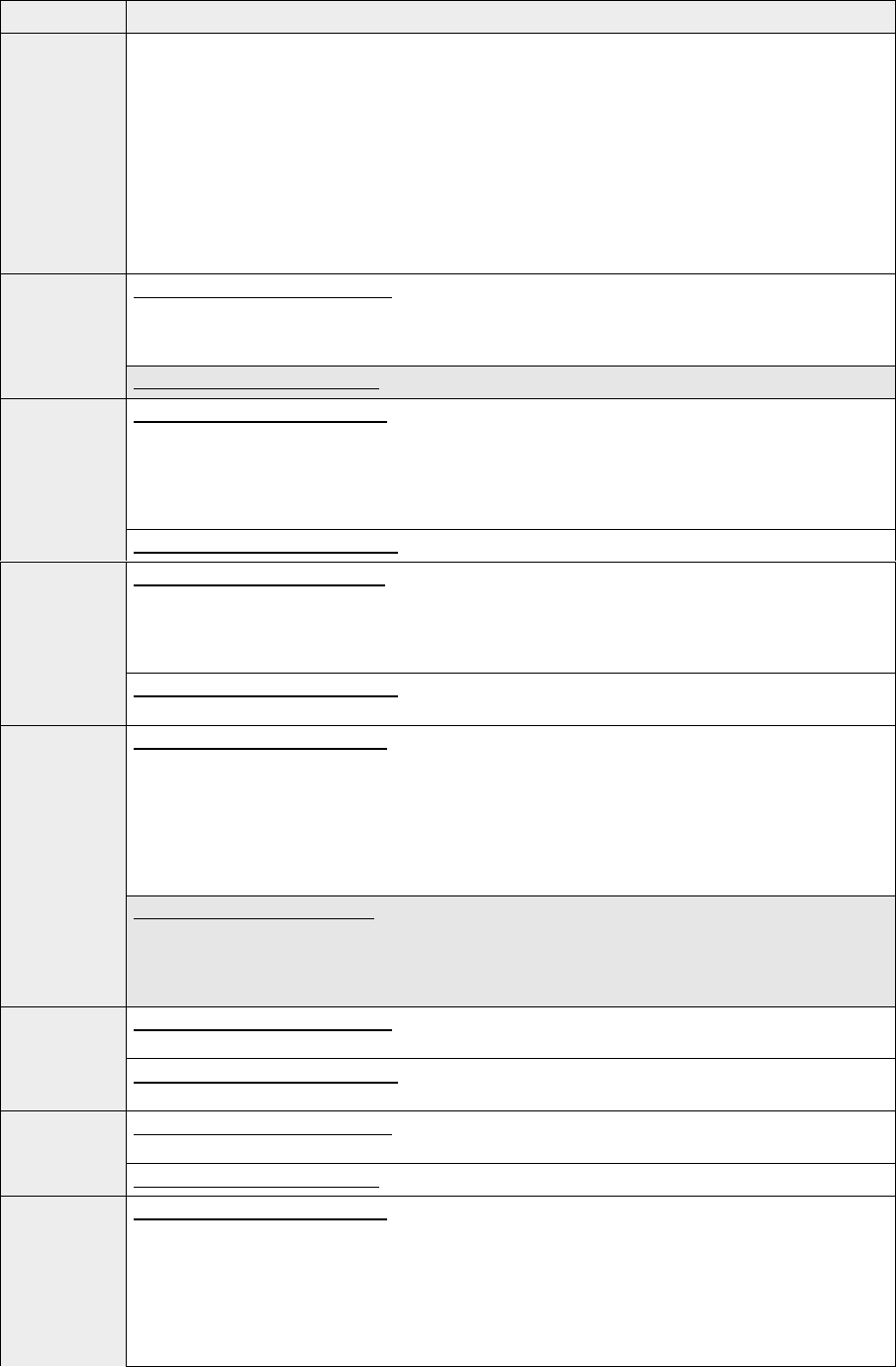

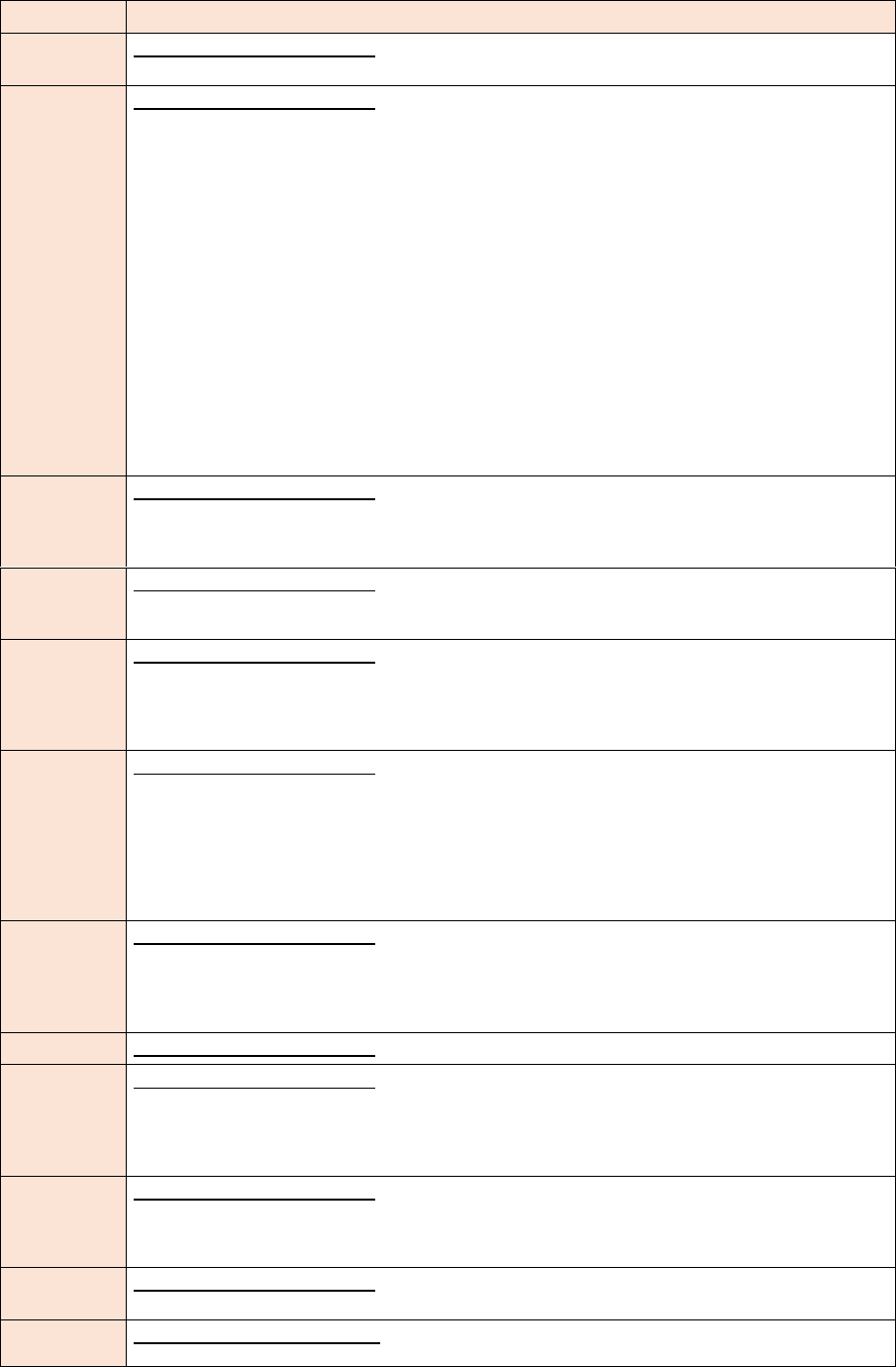

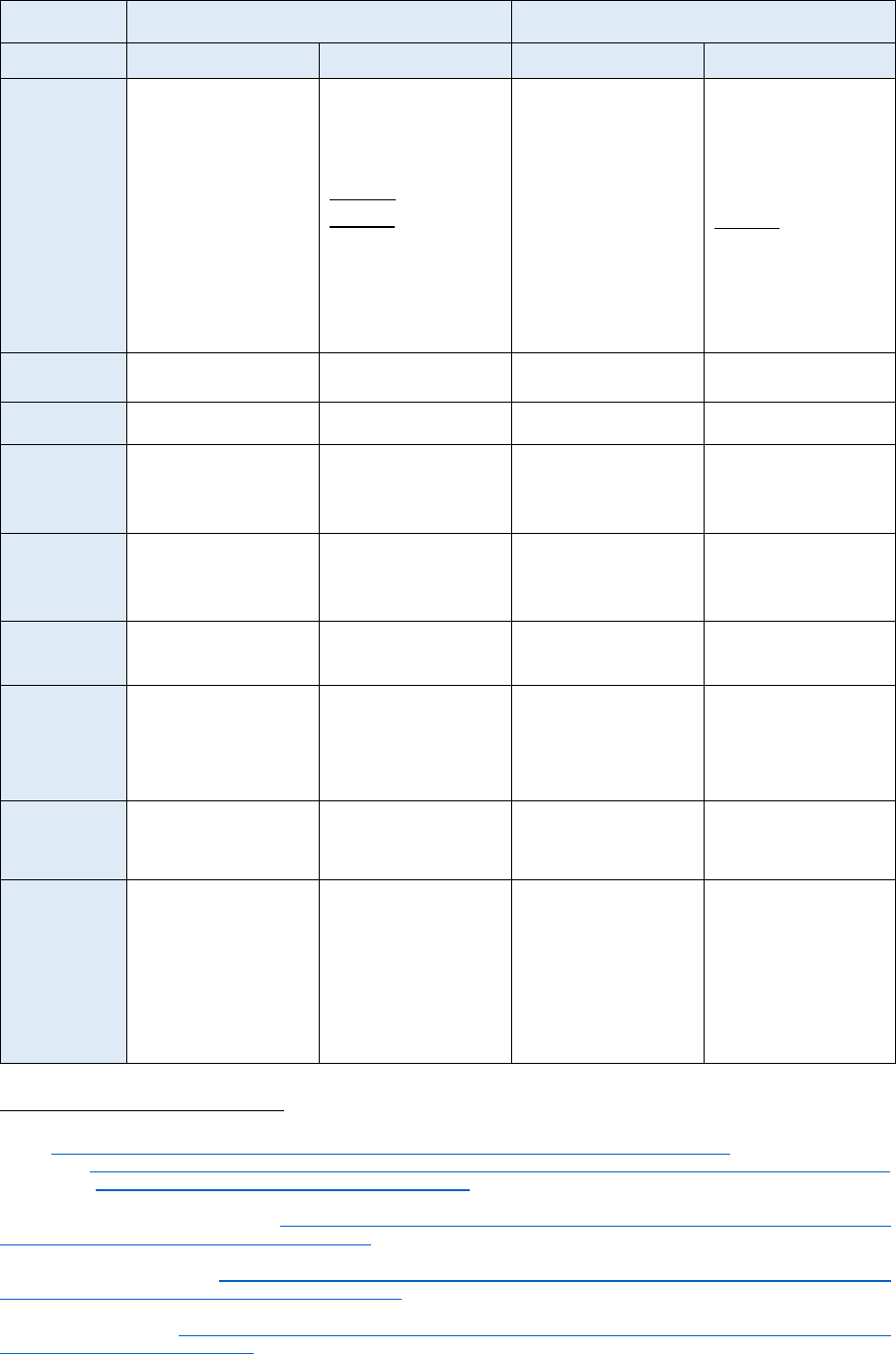

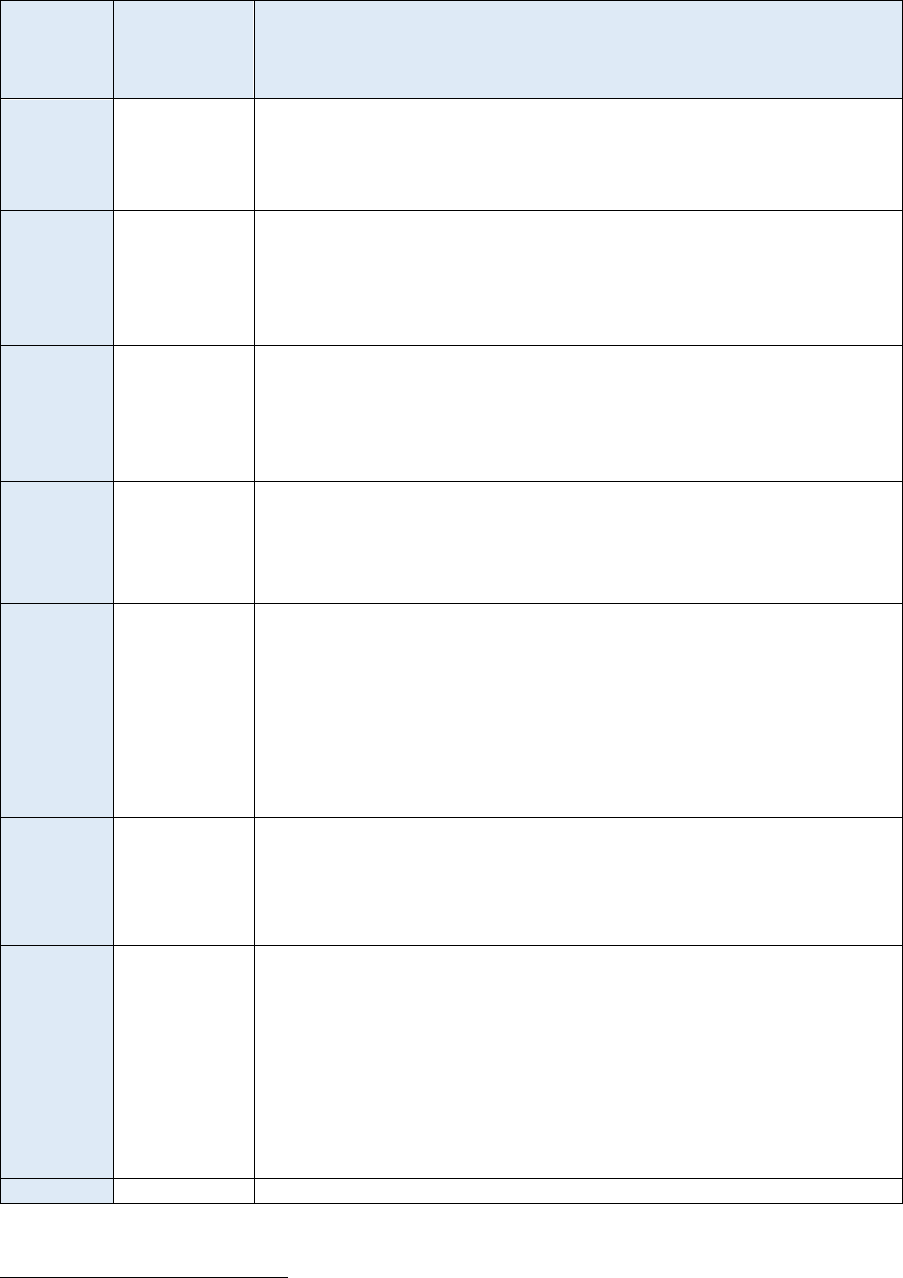

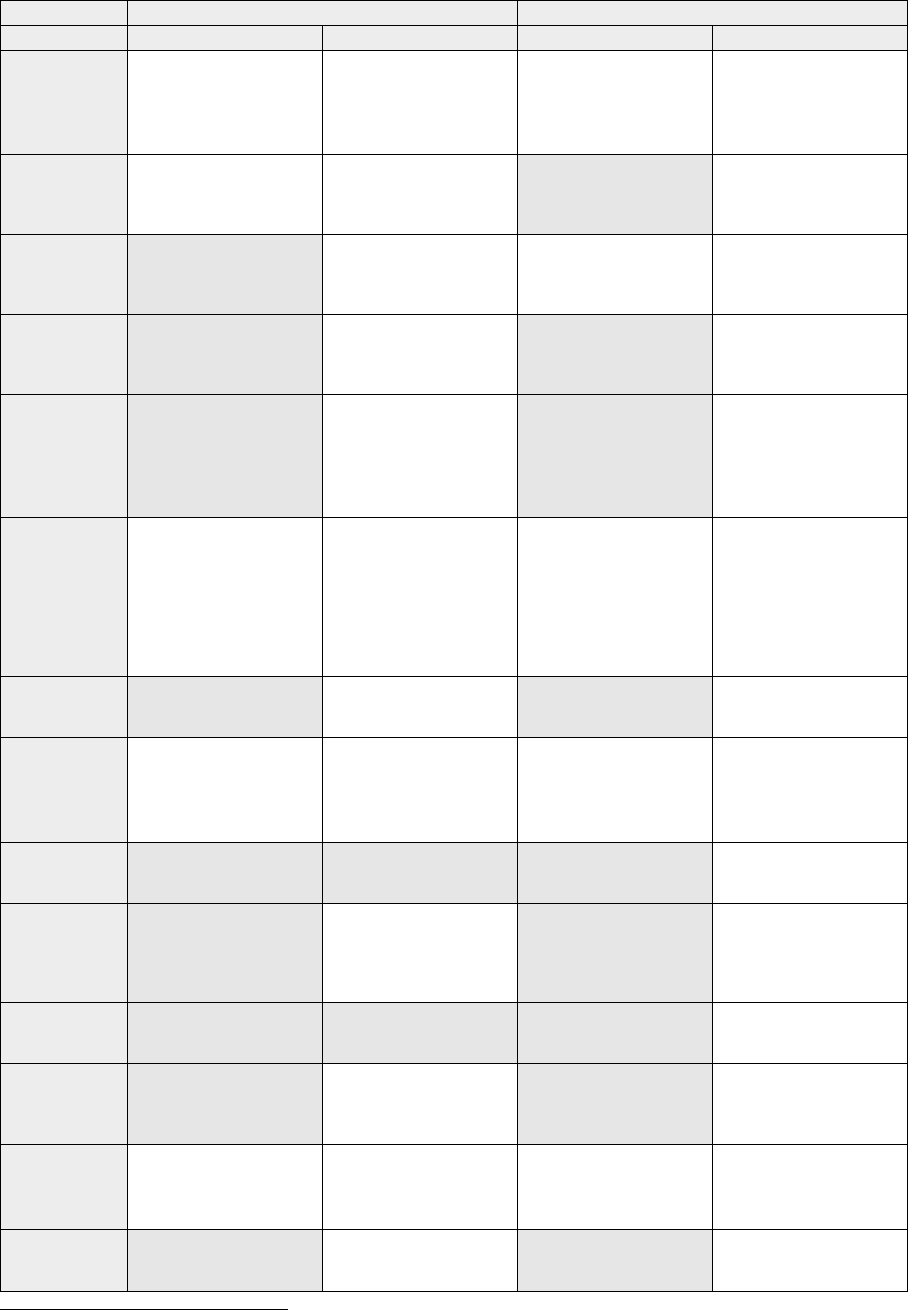

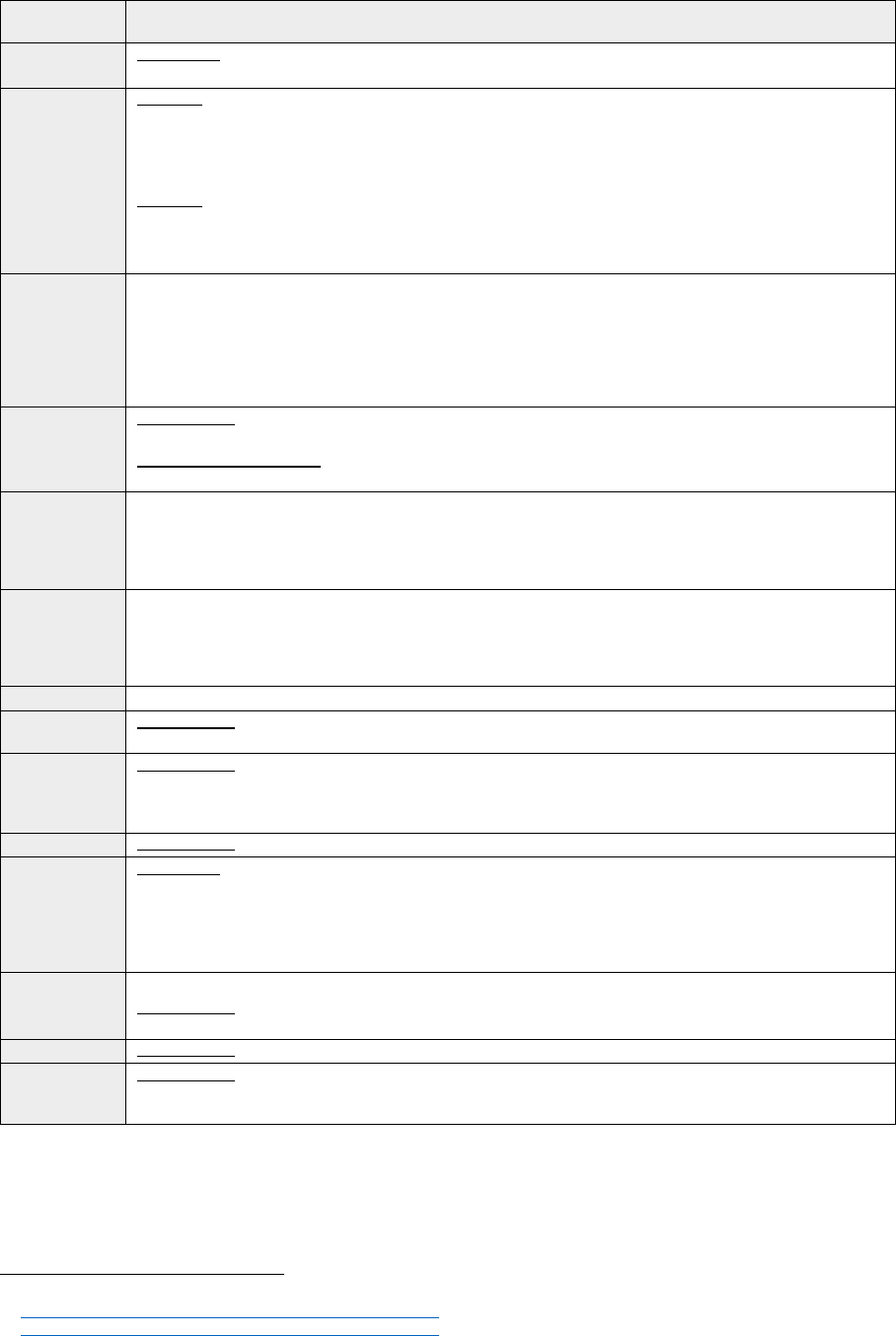

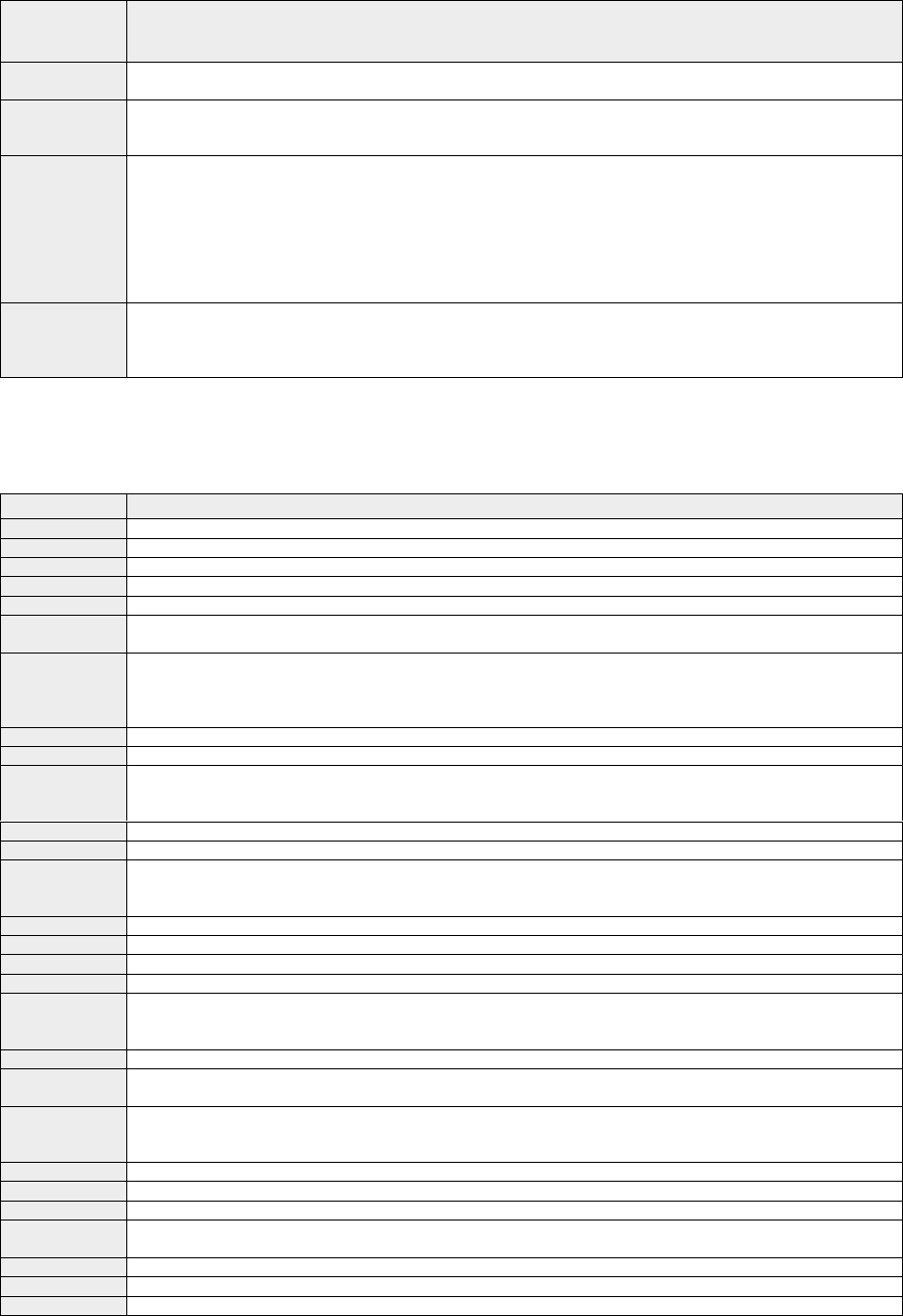

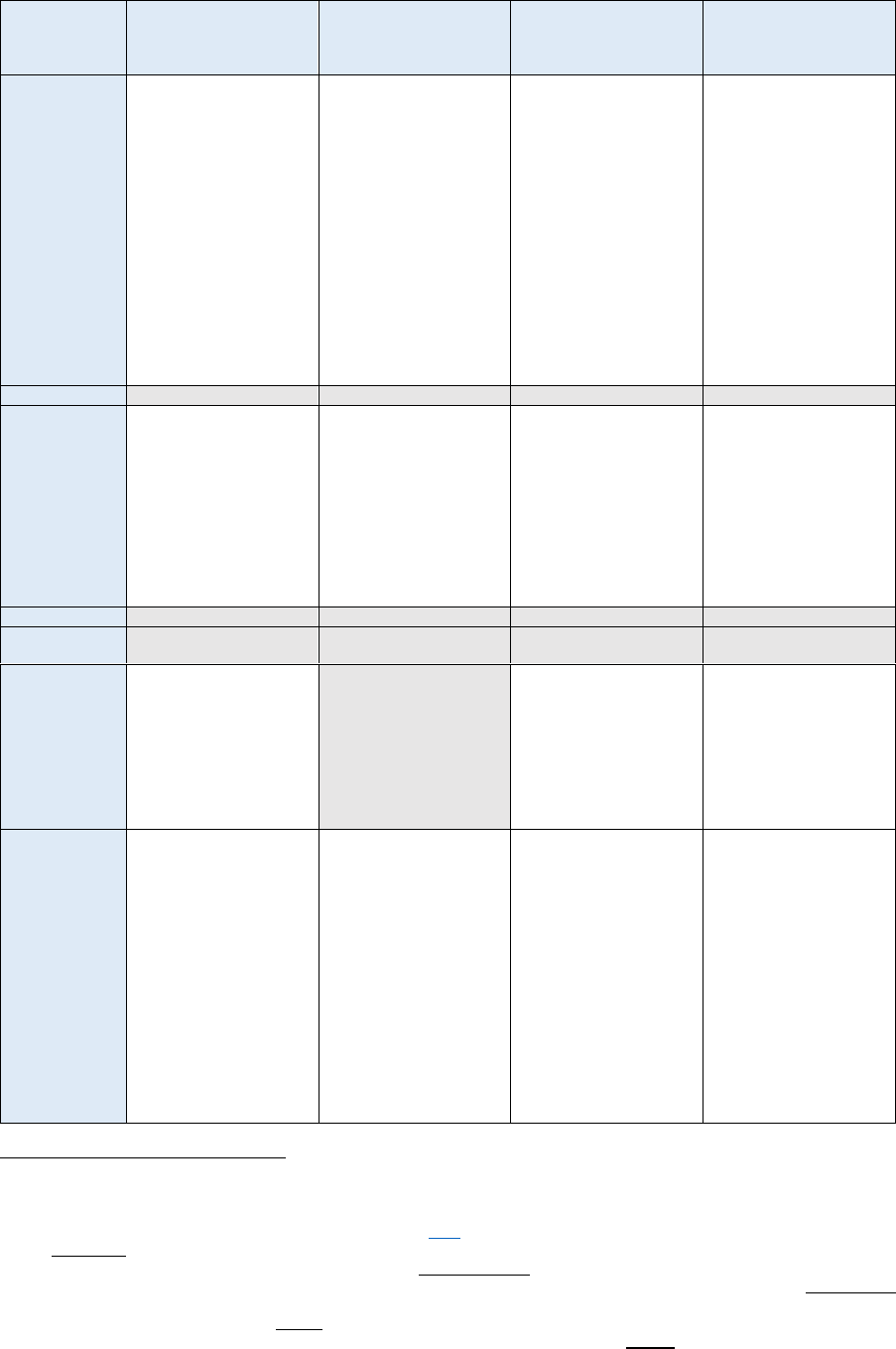

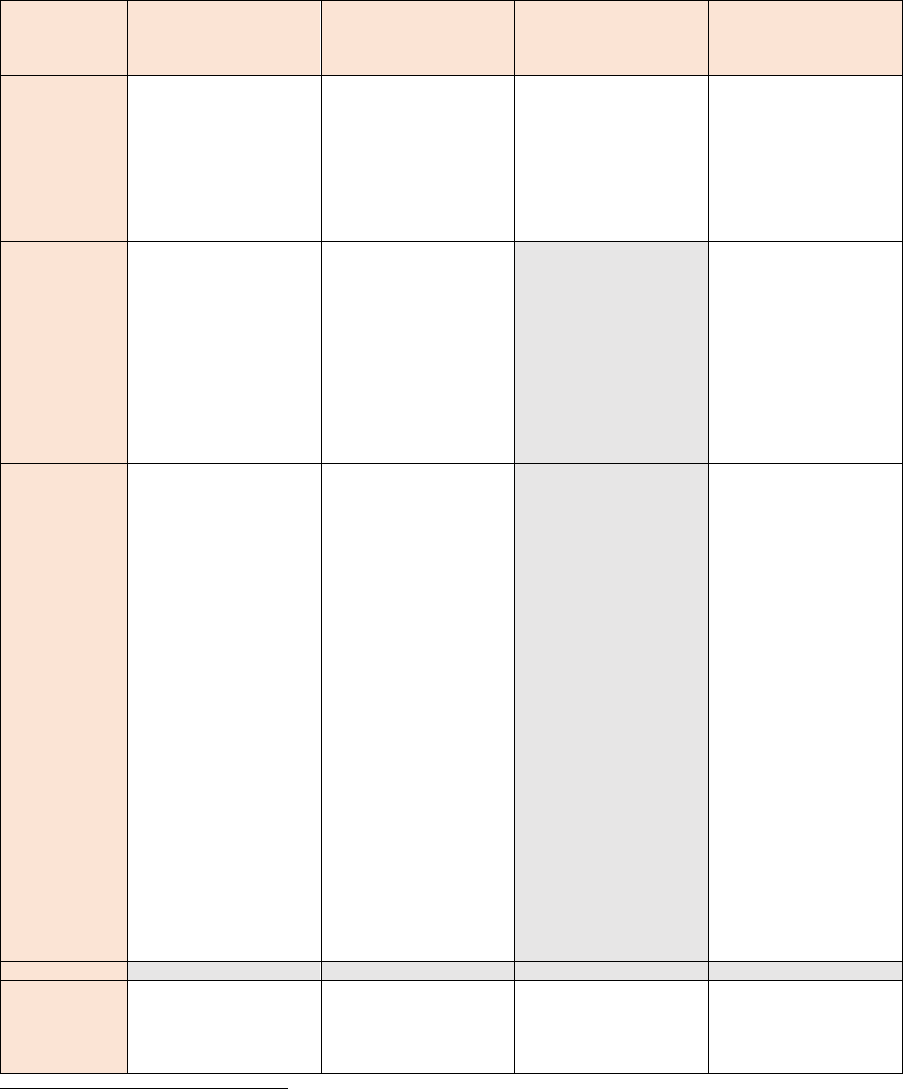

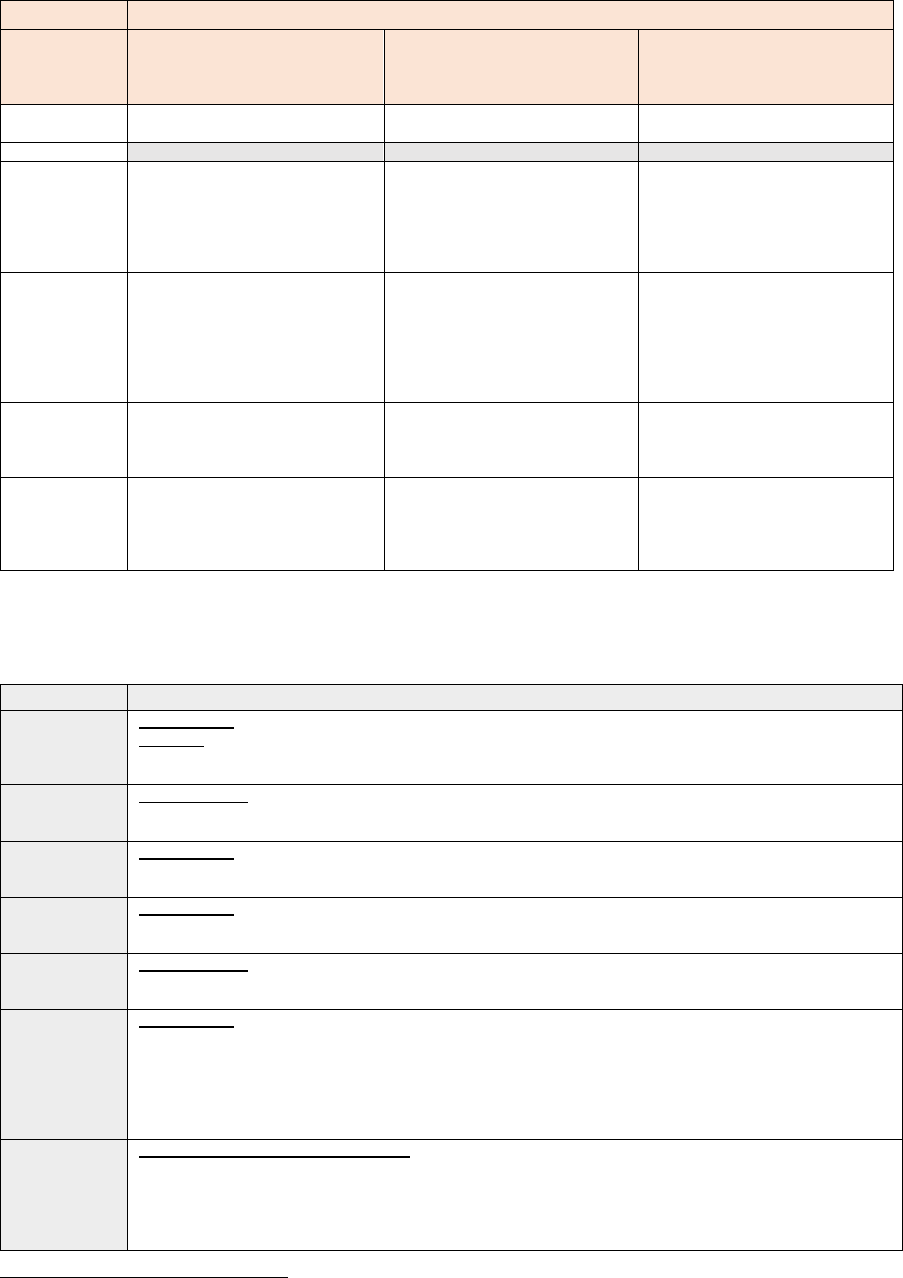

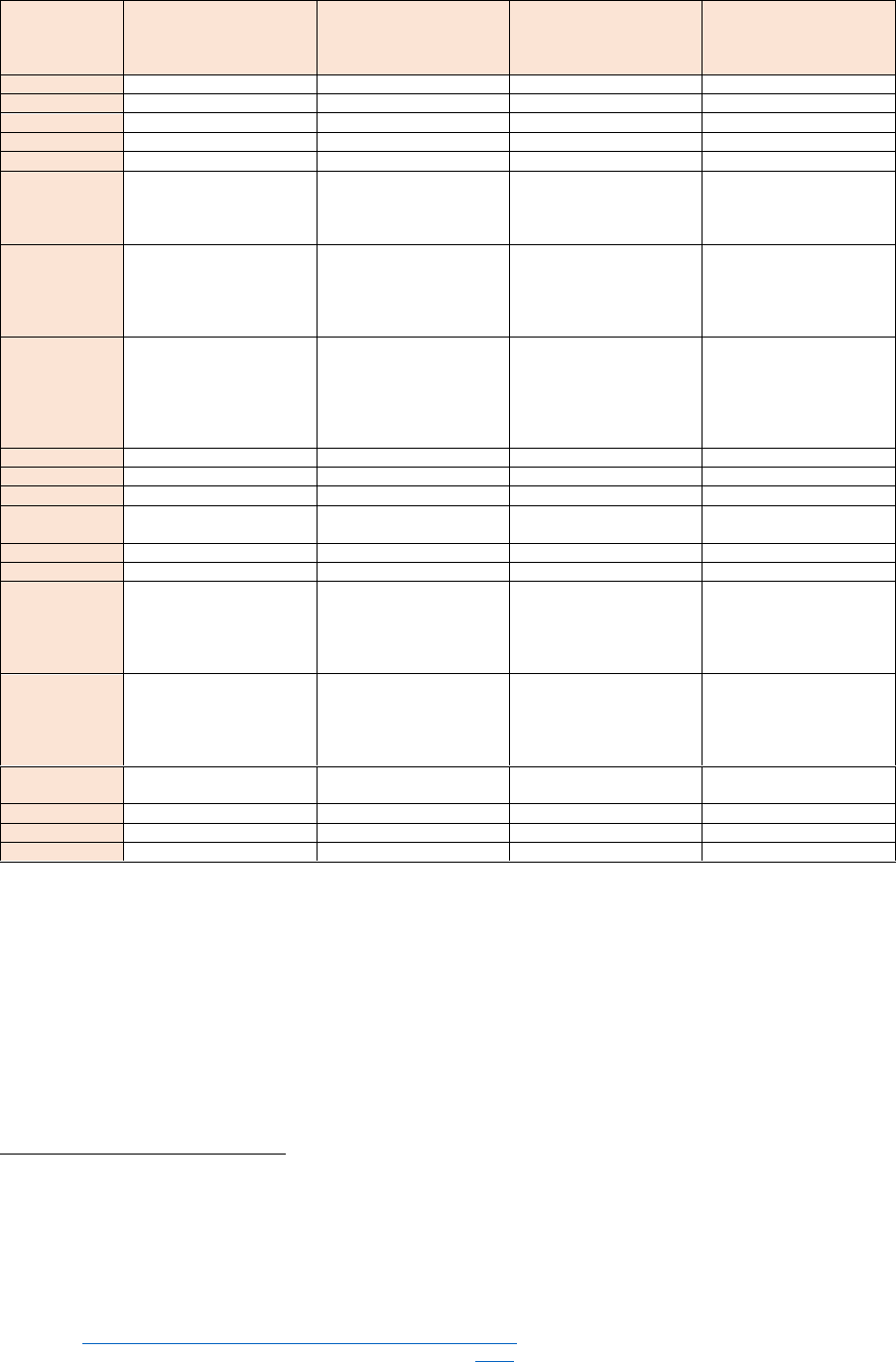

(34) Figure 4 shows the application of these cost models in Europe. Most countries follow an average

cost approach, which is probably related to the advantages in terms of cost recovery, as it

ensures recovery of the allowed or target revenues by design, and to the complexities in

modelling incremental or forward-looking costs.

(35) Based on the answers provided by NRAs, three countries (FR, NO, PT) apply models based on

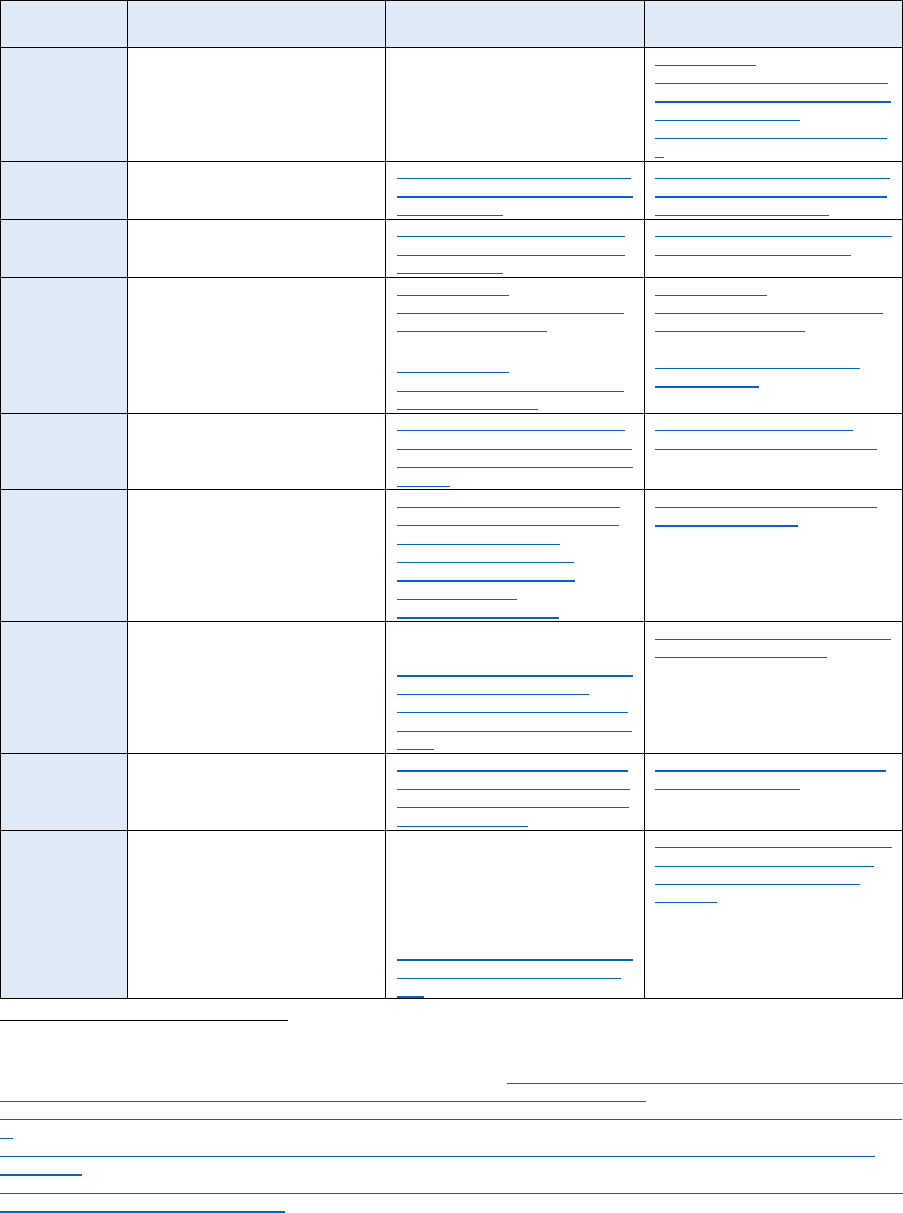

incremental costs and another three countries (HR, EE, SE) follow a forward-looking cost model.

For the countries applying these cost models, it becomes necessary to define how to allocate the

residual cost resulting in the tariff-setting process.

19

If the network has excess capacity, it would not be efficient to signal to end-users a high price during peak periods (which could

result from an average cost approach, signalling the cost of peak-related network investments from the past). This would

unnecessarily lead to load shifting, affecting consumer’s welfare and economic activity.

ACER REPORT ON TRANSMISSION AND DISTRIBUTION TARIFF METHODOLOGIES IN EUROPE

17

(36) All assessed countries reported that they apply the same cost model across transmission and

distribution tariffs, which might stem from the need to have a coherent tariff methodology across

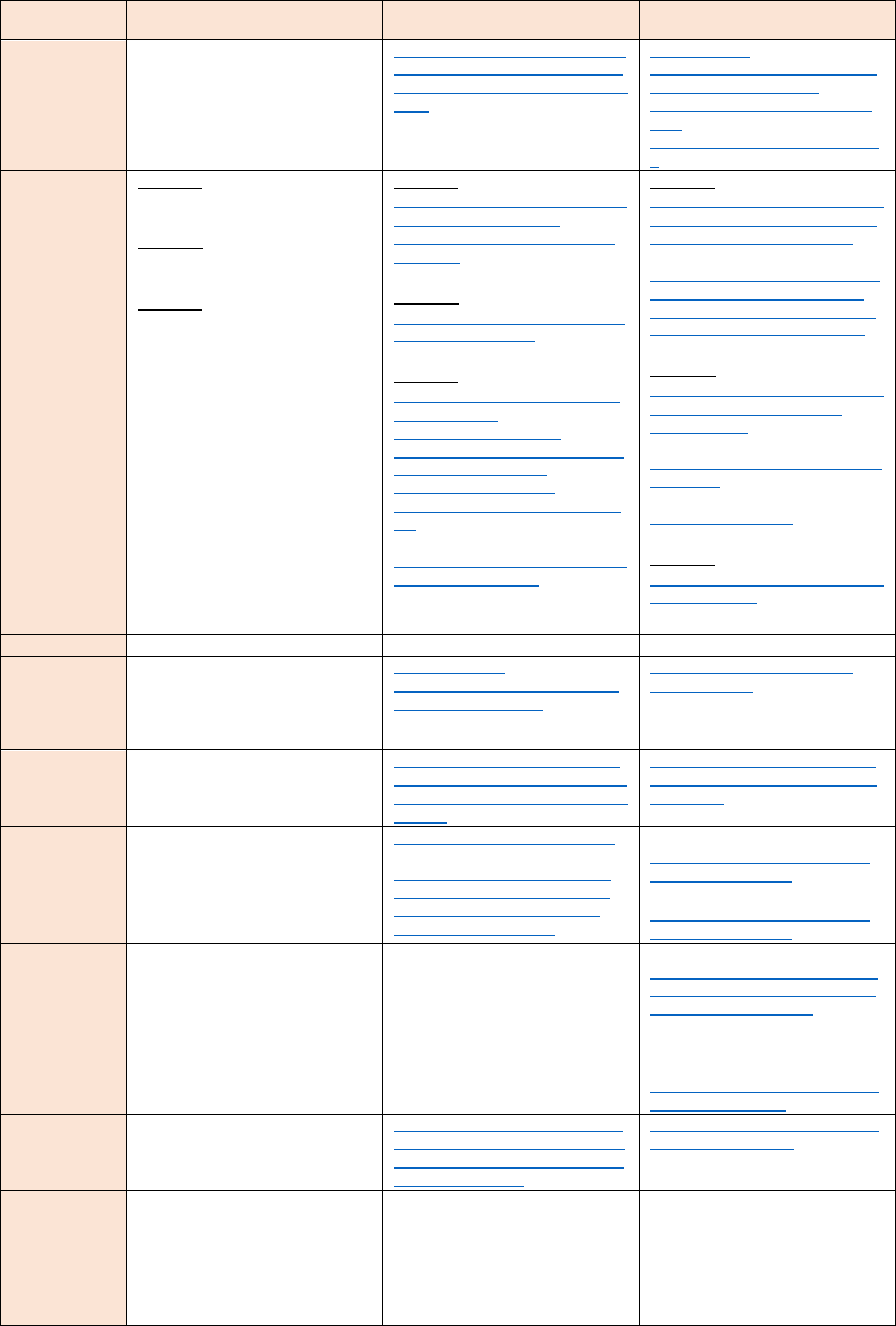

transmission and distribution.

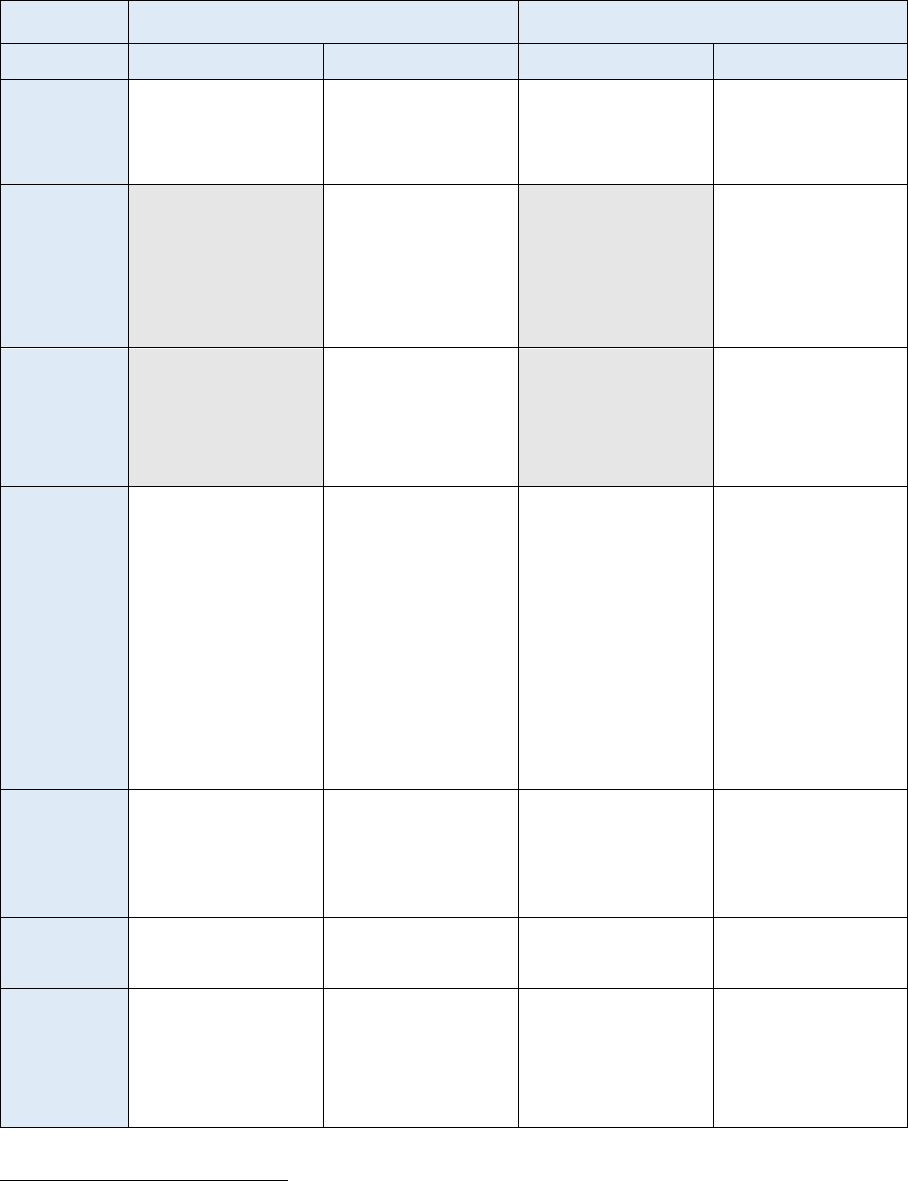

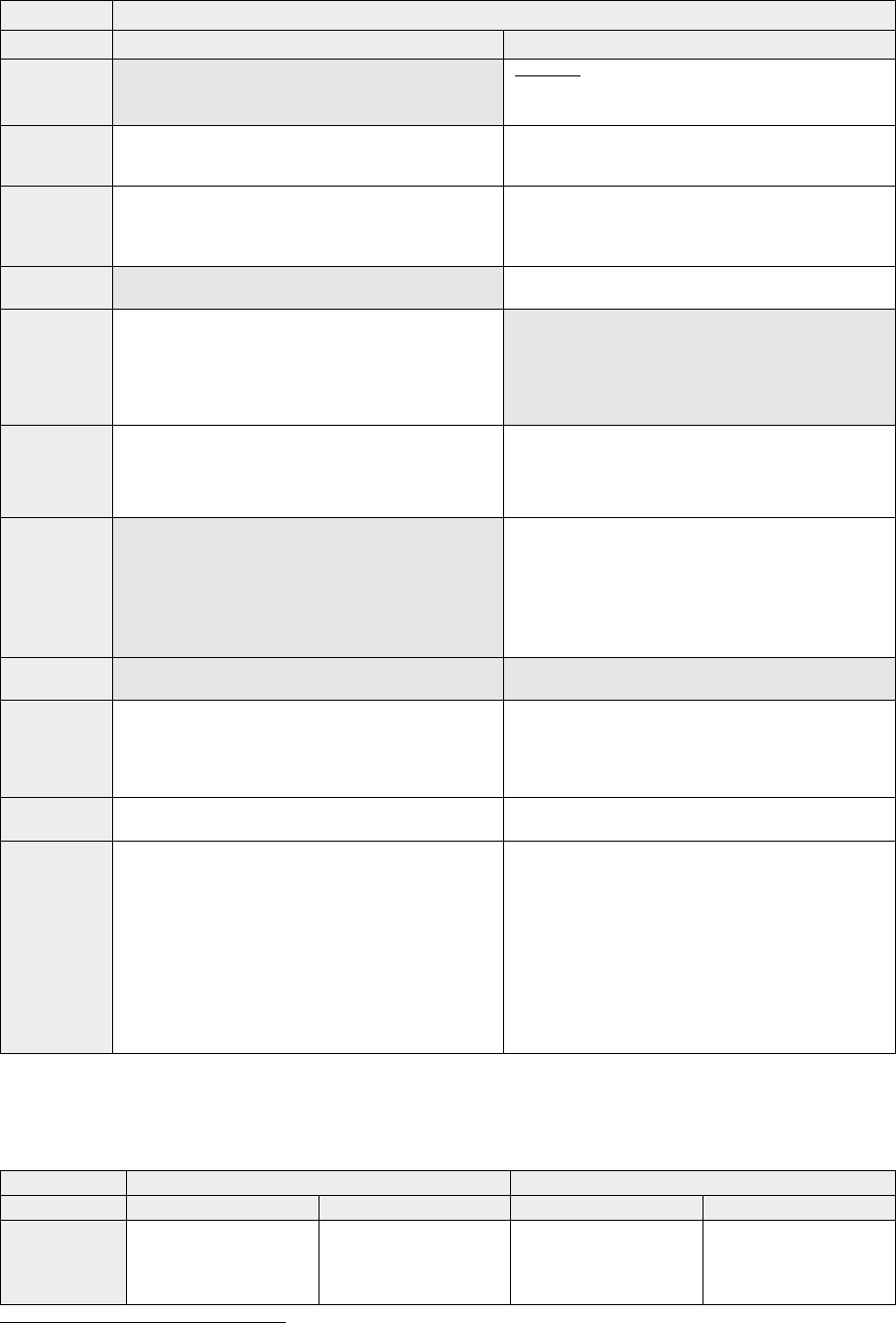

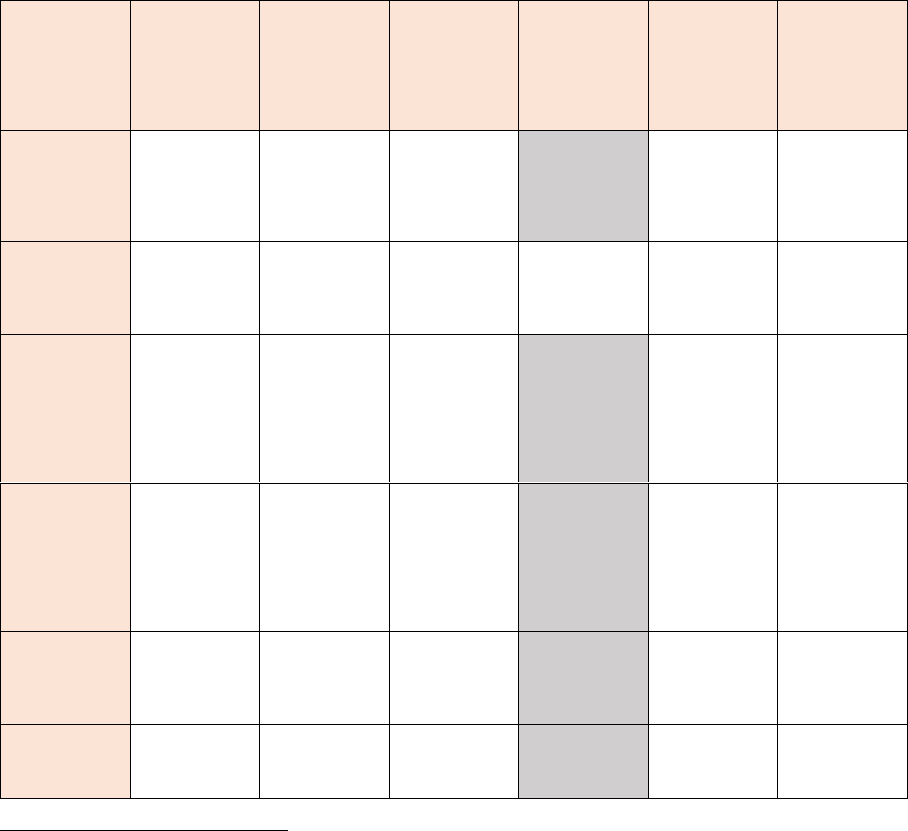

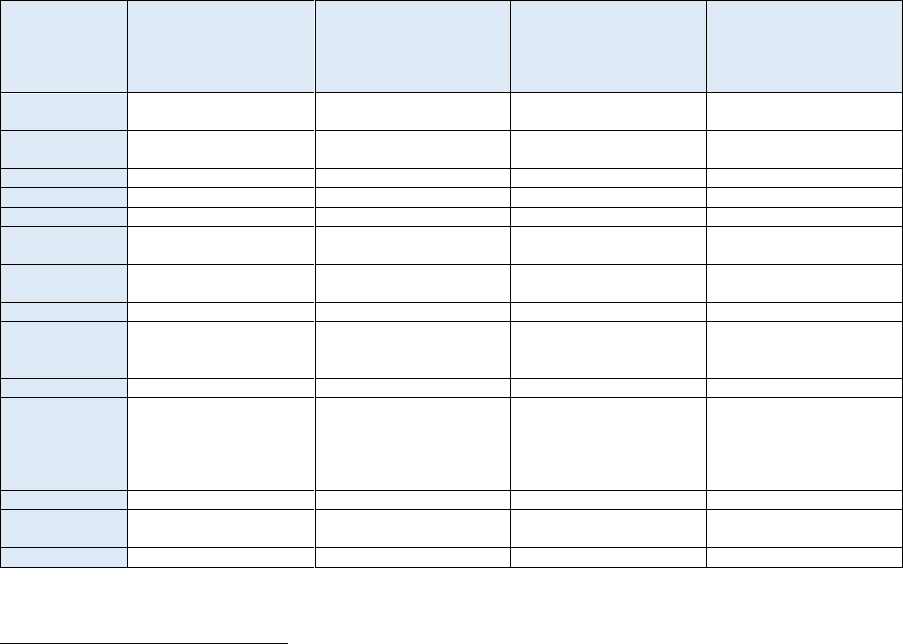

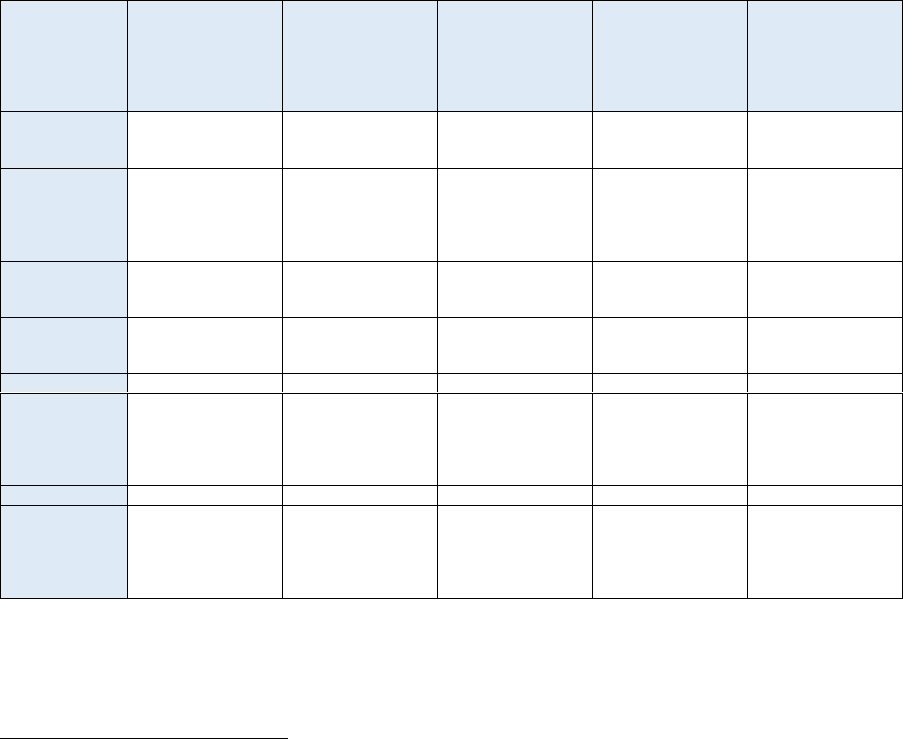

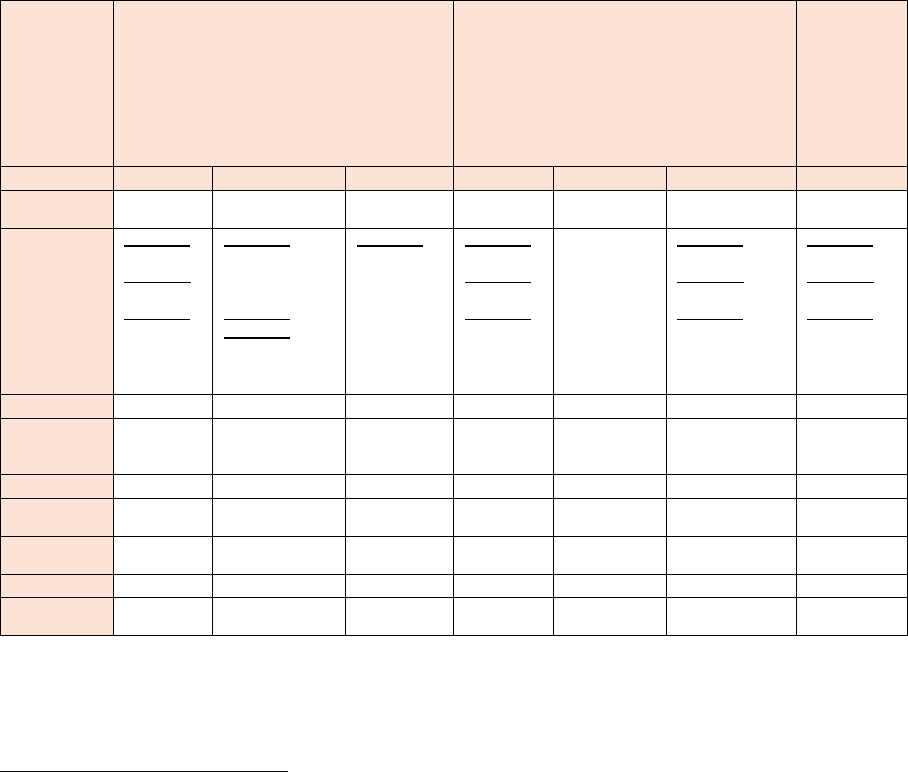

Figure 4: Cost models applied to network tariffs in Europe

Transmission

tariff

Distribution

tariff

Transmission

tariff

Distribution

tariff

AT

IT

BE

LV

BG

LT

HR

LU

CY

MT

N/A

CZ

NL

.

DK

NO

EE

PL

FI

PT

FR

RO

DE

SK

GR

SI

HU

ES

IE

No data

SE

Partially

Partially

Average cost

Incremental cost

Forward-looking cost

Note: The analysis is not applicable for the transmission tariff in MT, in lack of a transmission network. In some

cases the inputs provided by NRAs (BG, IE, LV, PL) were interpreted by ACER as corresponding to an average

cost model, in lack of required clarifications.

(37) Estonia and Croatia reported the use of a forward-looking cost model, to account for costs that

are changing during the application of the network charges. Sweden only applies the forward-

looking cost model to the capacity-based charges of the network tariff, while other approaches

apply to other cost elements.

20

In the case of France, Norway and Portugal, these countries

reported the use of incremental cost models, which determine price signals reflecting the costs

of expanding the network by certain increments.

21

Across these countries, different billing

variables are used for the main price signal of the cost model: Estonia uses an energy-based

charge; Sweden and Norway

22

use a power-based charge; Portugal

23

uses two power-based

charges and Croatia and France use a combination of energy- and power-based charges.

(38) Across these six countries (HR, EE, FR, NO, PT, SE), because they employ the incremental or

forward-looking cost models, ensuring cost recovery requires dealing with residual costs.

24

In

Estonia, the law does not allow to apply any additive or multiplicative adjustment to account for

20

SE: The forward-looking costs are power-based, and will be charged with a power-based charge (preferably during the peak

hours), and the variable costs for the network losses will be charged with an energy charge. Overall, there are four components

that make up the tariff, one energy charge (based on the variable costs), one power-based charge (based on forward-looking

costs), and two fixed charges (one for customer related costs, and lastly a semi-fixed component for the residual costs).

21

The incremental price signal indicates what is the incremental cost for the network to accommodate an increment in the cost

driver (e.g. peak power or consumption).

22

NO: While the main billing variable to recover network costs is a power-based charge, the incremental cost model only applies

to the energy-based charge, which is determined from an analysis of marginal losses in each connection point.

23

PT: Portugal also indicates that when applying the network tariff to users connected at normal low voltage (≤ 41.4 kVA), the

unit price of one of the power-based charges is converted into an energy-based charge, as the former does not exist as billing

variable for these users.

24

As explained earlier, applying directly the prices signals from the incremental or forward-looking cost models may result in a

different level of revenues compared to the allowed or targeted revenues. The difference of that revenue level with the level of

allowed or target revenues is labelled here as residual cost (i.e. the residual cost is positive/negative if the former is higher/lower).

ACER REPORT ON TRANSMISSION AND DISTRIBUTION TARIFF METHODOLOGIES IN EUROPE

18

any residual cost. If network costs are higher than the revenues obtained from the incremental

unit price, the network operator has the right to submit a request for approval of new network

charges. France and Portugal apply a multiplicative adjustment of the unit charges to account for

the residual cost. Norway recovers the residual costs through fixed and power-based charges.

Sweden applies a separate component to recover the residual cost.

25

Croatia did not provide this

information.

(39) Additional information

regarding the practices of the countries employing the incremental or

forward-looking cost models is presented in Table 1 in Annex 1.

26

The description on how the

residual cost is dealt with in these costs models, is presented in Table 2 in Annex 1.

(40) In terms of cost models, several countries reported recent changes on the computation of network

tariffs. Details on the changes can be found in Table 7 in Annex 1.

3.2. Cost cascading

(41) When setting network tariffs, cost cascading traditionally refers to the allocation of some costs of

a certain voltage level towards network users connected at a lower voltage level, but not the other

way around. It means that network costs are cascaded in a top-down paradigm, reflecting the

traditional organisation of the power sector where generators are (almost) exclusively connected

at the transmission level. Ultimately, it implies that network users connected at a lower voltage

level pay (all-together) higher network tariffs, since they pay the costs of the voltage level of

connection, as well as the costs related to higher voltage levels.

(42) In the case of transmission tariffs, this may exist in two forms. First, it may occur from

transmission to distribution, meaning that costs related to the transmission network are cascaded

towards network users connected to the distribution network. Second, it may occur from

transmission to transmission, where costs of a higher voltage level of the transmission network

are cascaded towards network users connected at a lower voltage level of the transmission

network. In addition, a third form of cost cascading can also occur at the level of distribution

tariffs, from distribution to distribution, where costs of a higher voltage level of the distribution

network are cascaded towards network users connected at a lower voltage level of the

distribution network. The three forms of cost cascading are illustrated in the Figure 5 below.

25

SE: The NRA refers to it as a semi-fixed component.

26

That information describes the objectives, the main billing variable, the major computational steps and the differences between

transmission and distribution, if any.

ACER REPORT ON TRANSMISSION AND DISTRIBUTION TARIFF METHODOLOGIES IN EUROPE

19

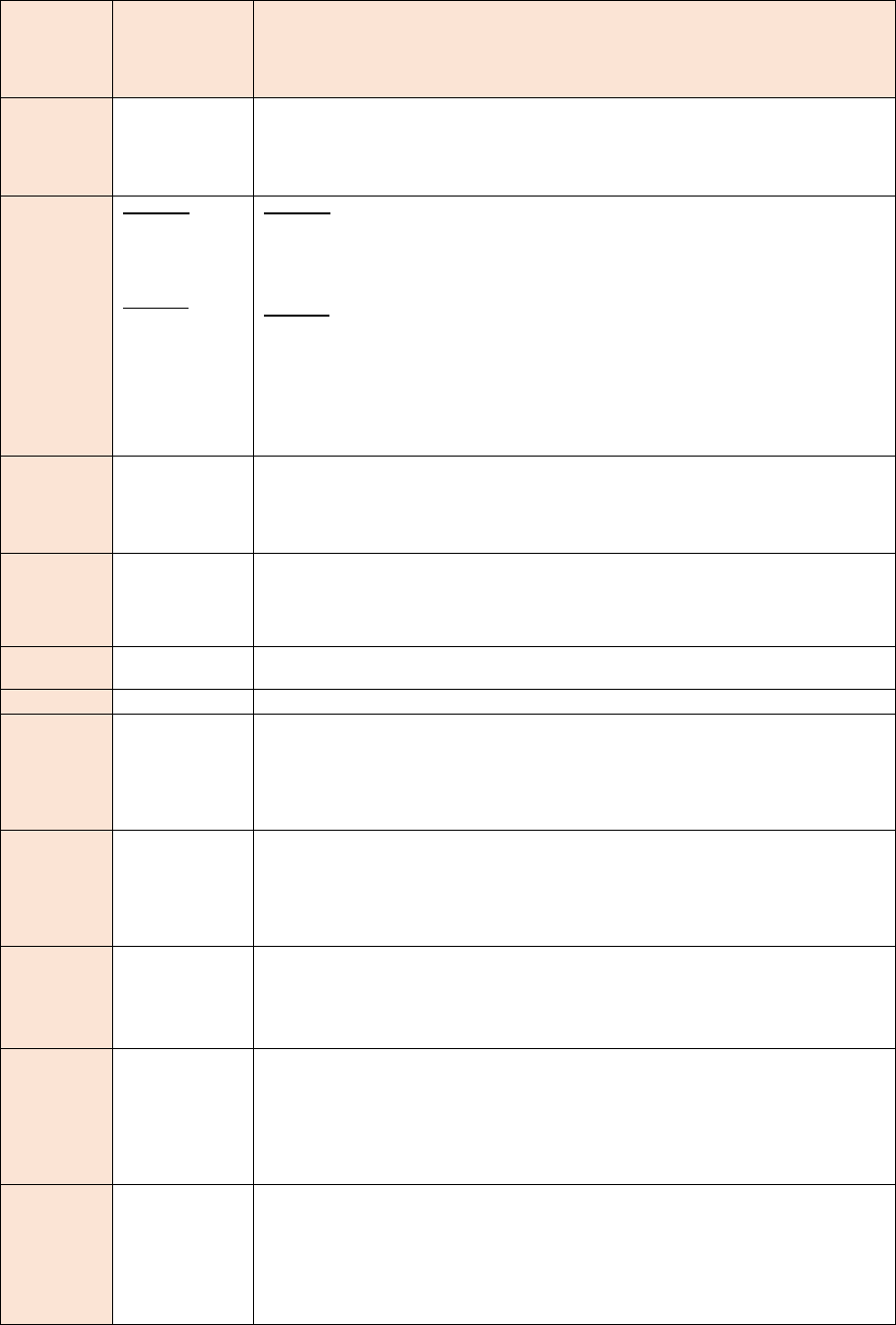

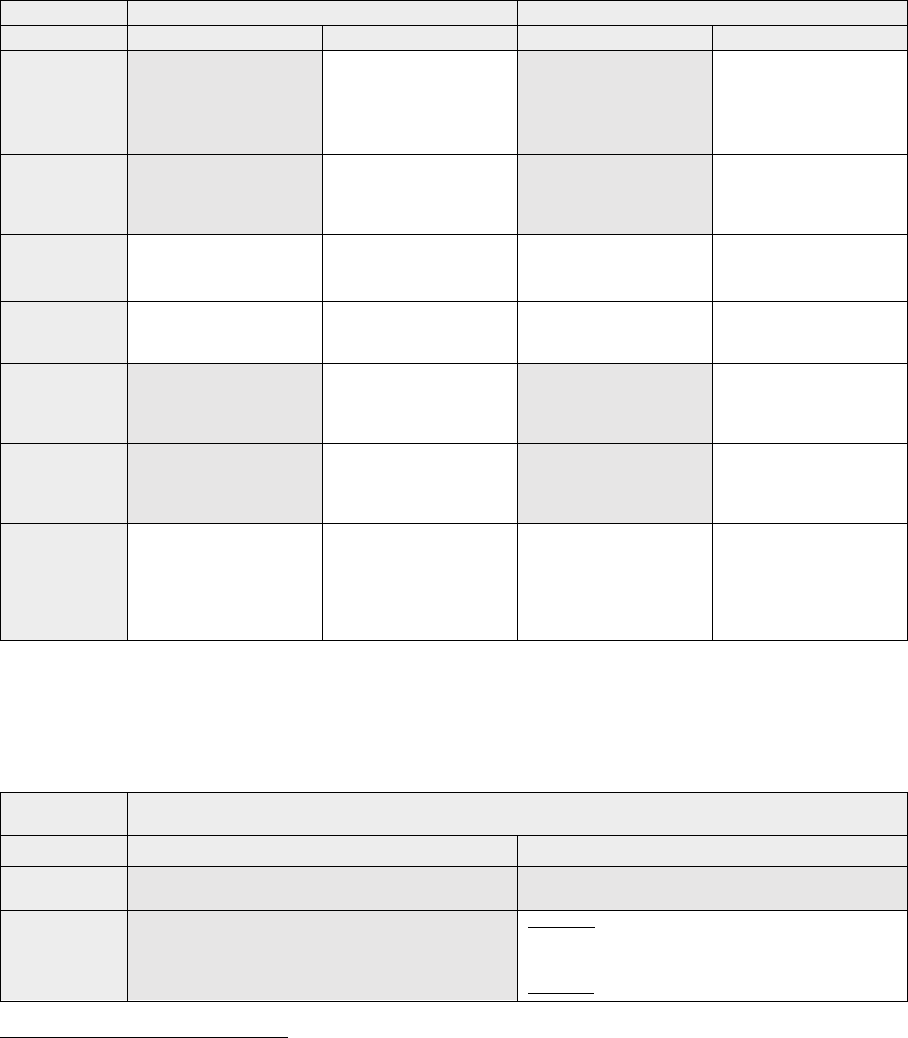

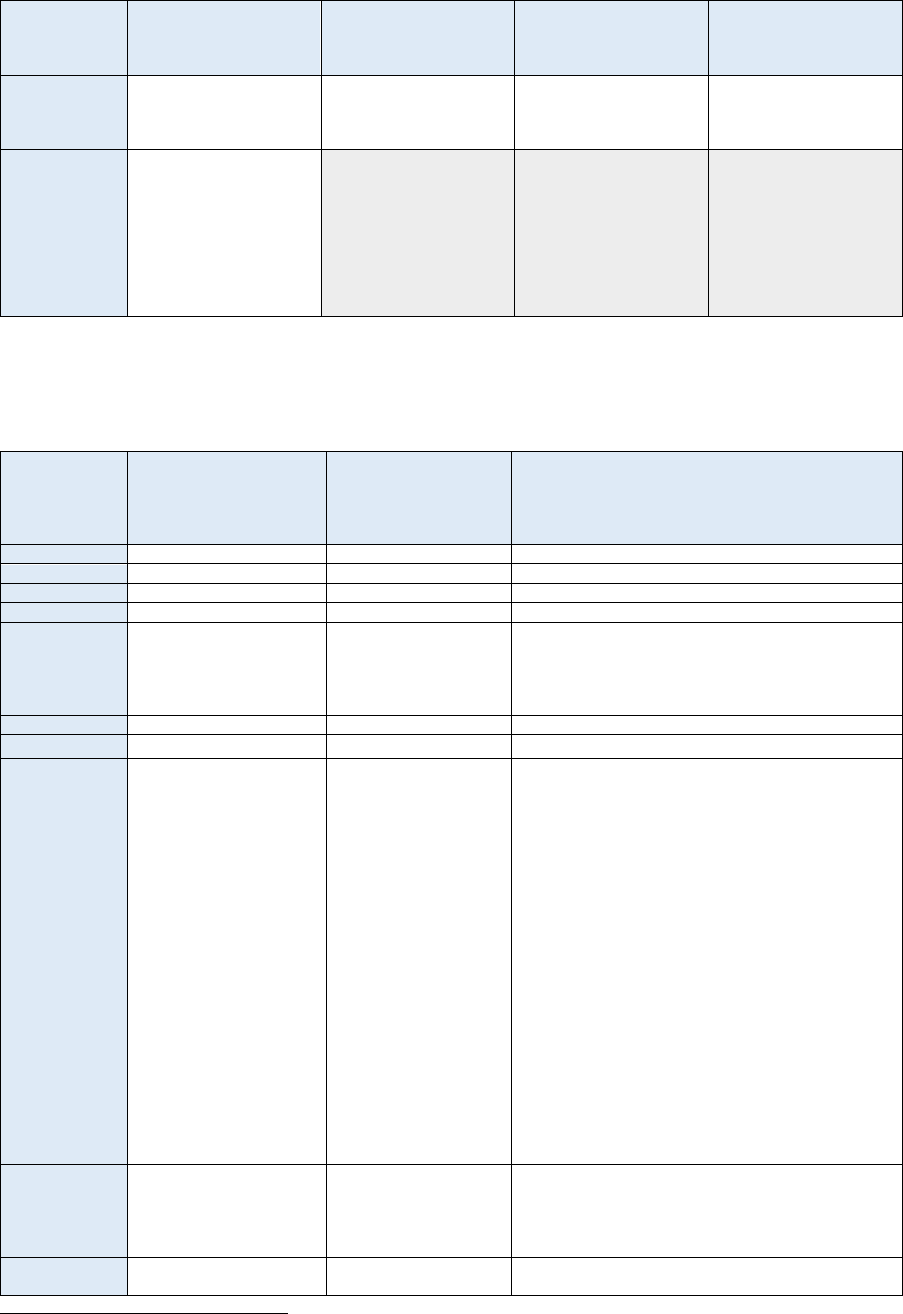

Figure 5: Forms of cost cascading applied to transmission and distribution tariffs

(43) The second and third forms of cost cascading (i.e. from transmission to transmission and from

distribution to distribution) require a network segmentation by voltage level. For instance, cost

cascading from transmission to transmission can exist if transmission costs for the extra-high

voltage (EHV) level are cascaded downwards to users connected at the high voltage (HV) level

of transmission, while the costs of the HV level are not borne by the users connected at EHV.

Moreover, cost cascading from distribution to distribution can exist if distribution costs for the

medium voltage (MV) level are cascaded downwards to users connected at the low voltage (LV)

level of distribution, while the costs of the LV level are not borne by users connected at MV level.

(44) In the case of cost-cascading from transmission to distribution, the transmission costs may be

billed to distribution-connected users in two different forms. Distribution-connected users may

pay explicitly a transmission tariff related to the transmission costs (e.g. via a transmission tariff

element in their final electricity bill) or they pay the transmission costs implicitly through their

distribution tariff (e.g. only the DSO is explicitly charged for costs of the transmission network,

which are then reflected in its distribution tariff).

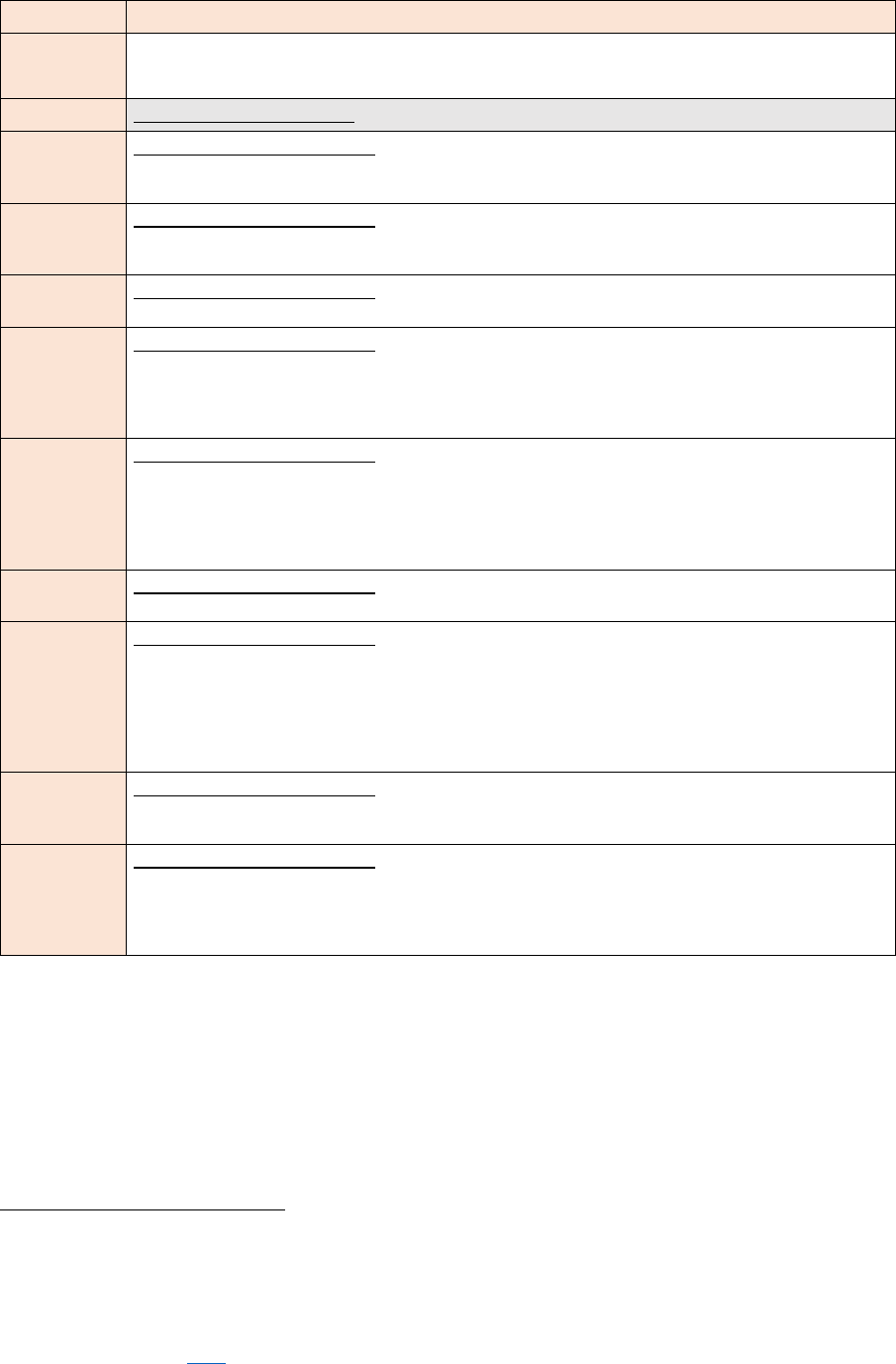

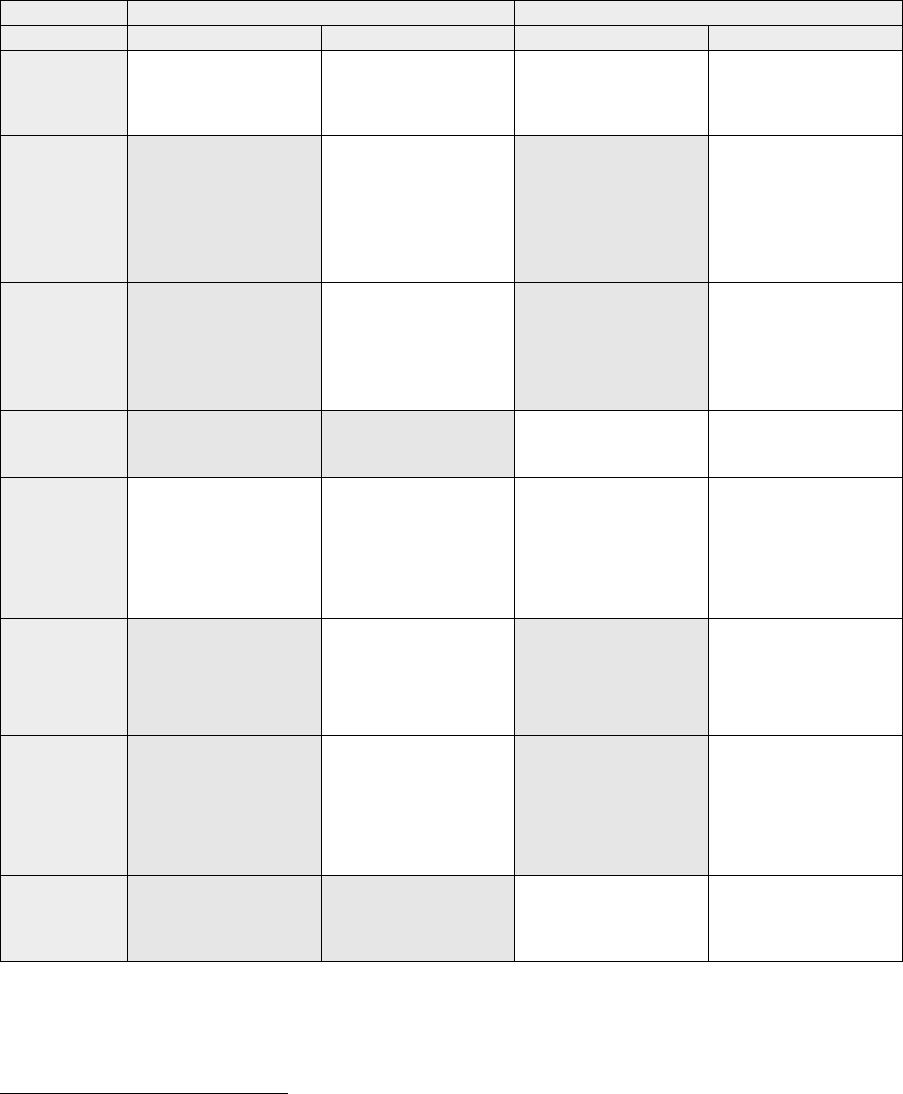

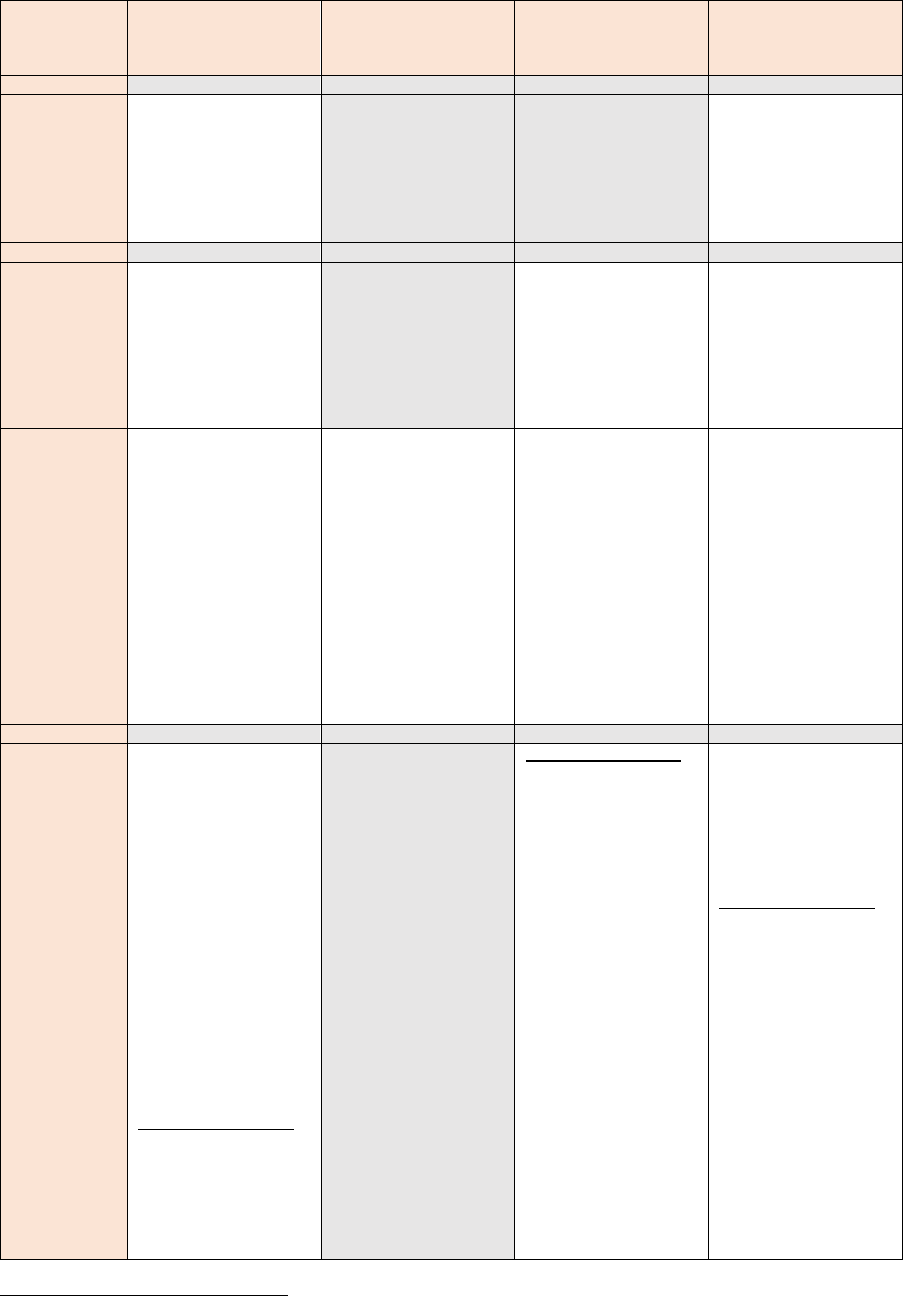

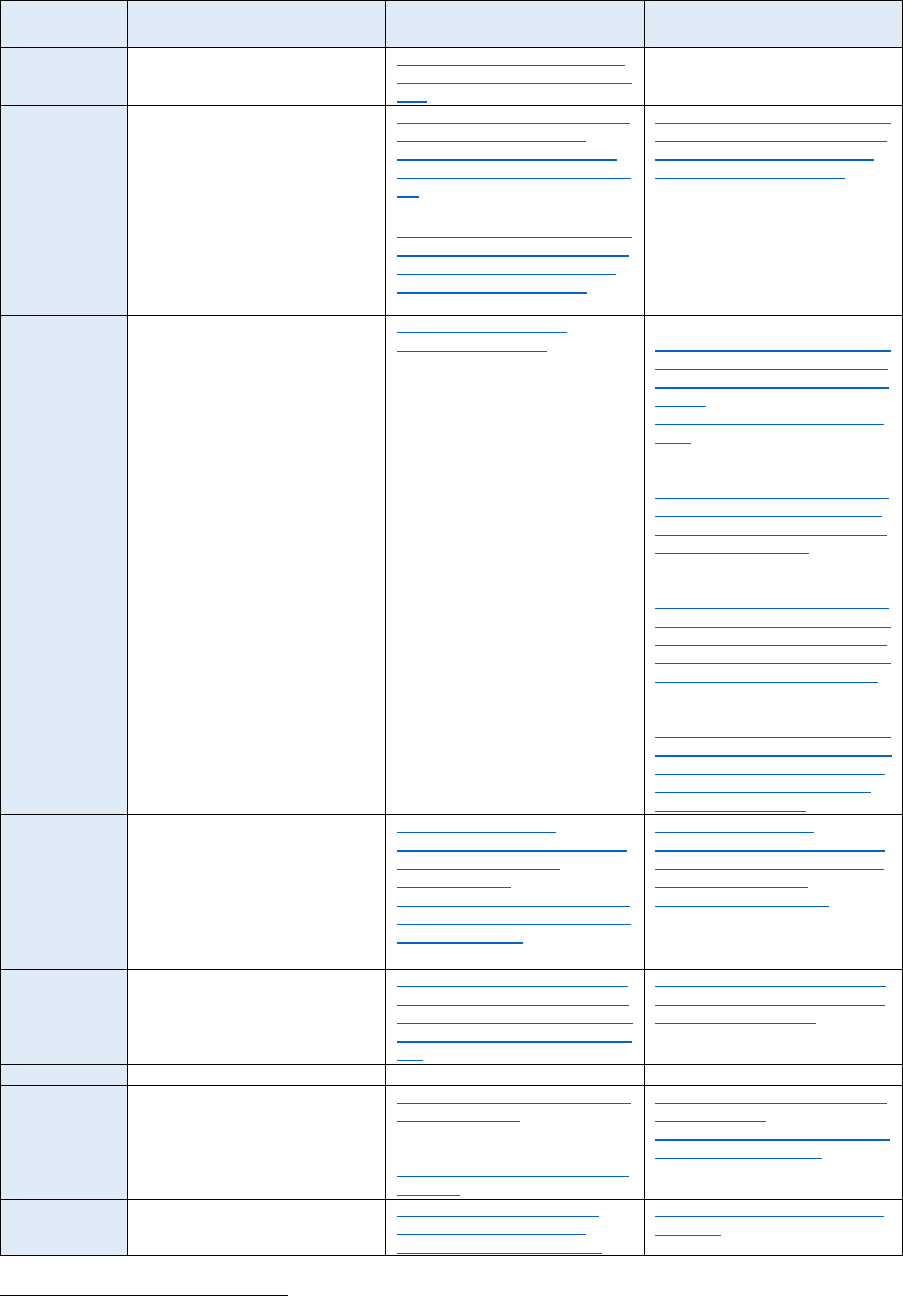

(45) Figure 6 summarises the application of cost cascading across countries. Cost-cascading from

transmission to distribution exists in each of the assessed countries with a transmission

network,

27

while cost-cascading inside the transmission and inside the distribution networks

occurs in 9 and 26 countries, respectively

28

. Nine countries (AT, BE, EE, FR, DE, HU, LV

29

, NL,

SE) apply all three forms of cost cascading.

27

In the case of MT, cost-cascading of transmission tariffs (from transmission to transmission / from transmission to distribution)

cannot exist by definition, as there is no transmission network.

28

Cases where all transmission costs are allocated in bulk to all network users is not considered as a form of cost cascading in

this Report, and has therefore not been considered in the analysis. In a few instances (BG, IE) cost-cascading from transmission

to transmission was not confirmed or sufficiently clarified.

29

LV: There is only one TSO and it operates the grid in 330 kV and in 110 kV. Tariffs are calculated only for 110 kV users, so all

costs from 330 kV are allocated to lower voltage transmission levels.

ACER REPORT ON TRANSMISSION AND DISTRIBUTION TARIFF METHODOLOGIES IN EUROPE

20

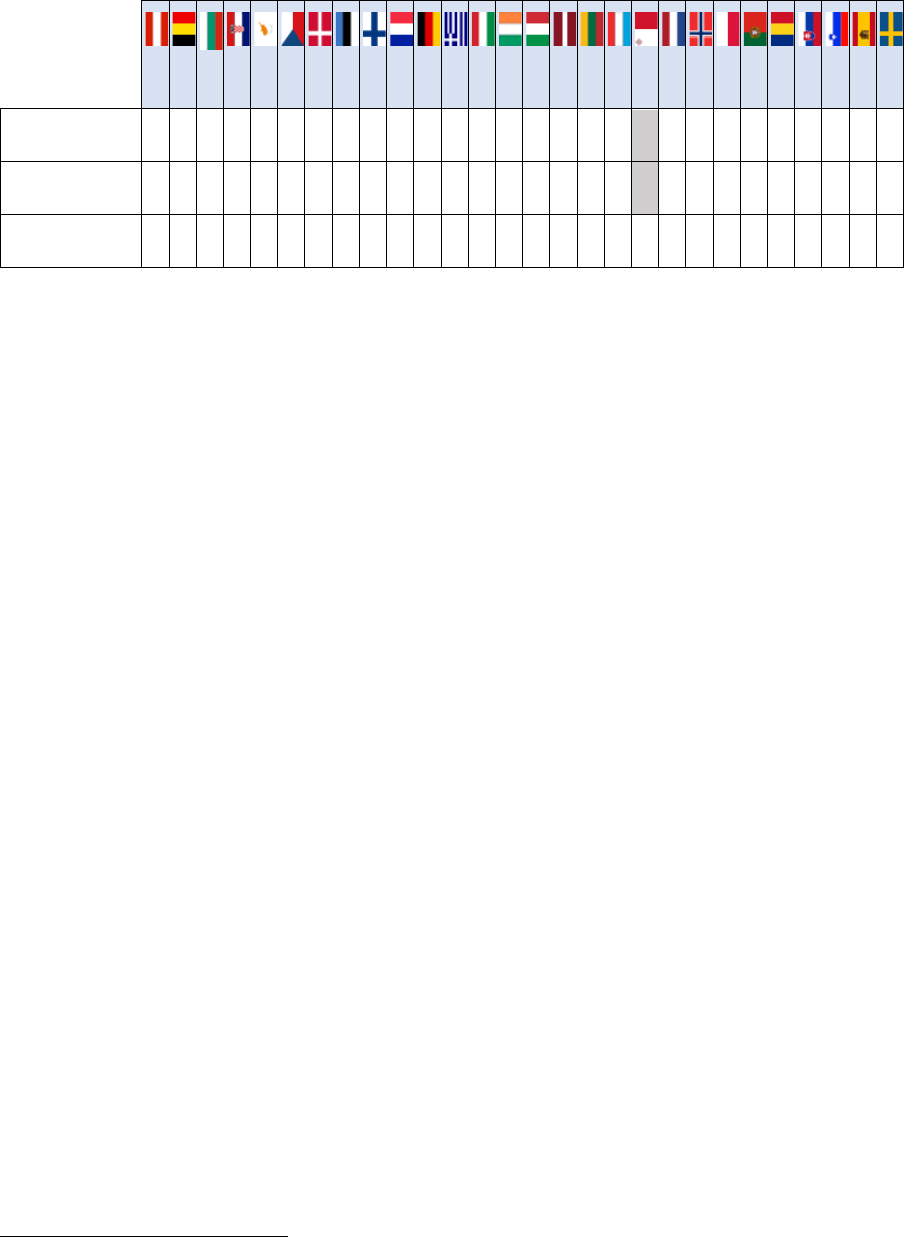

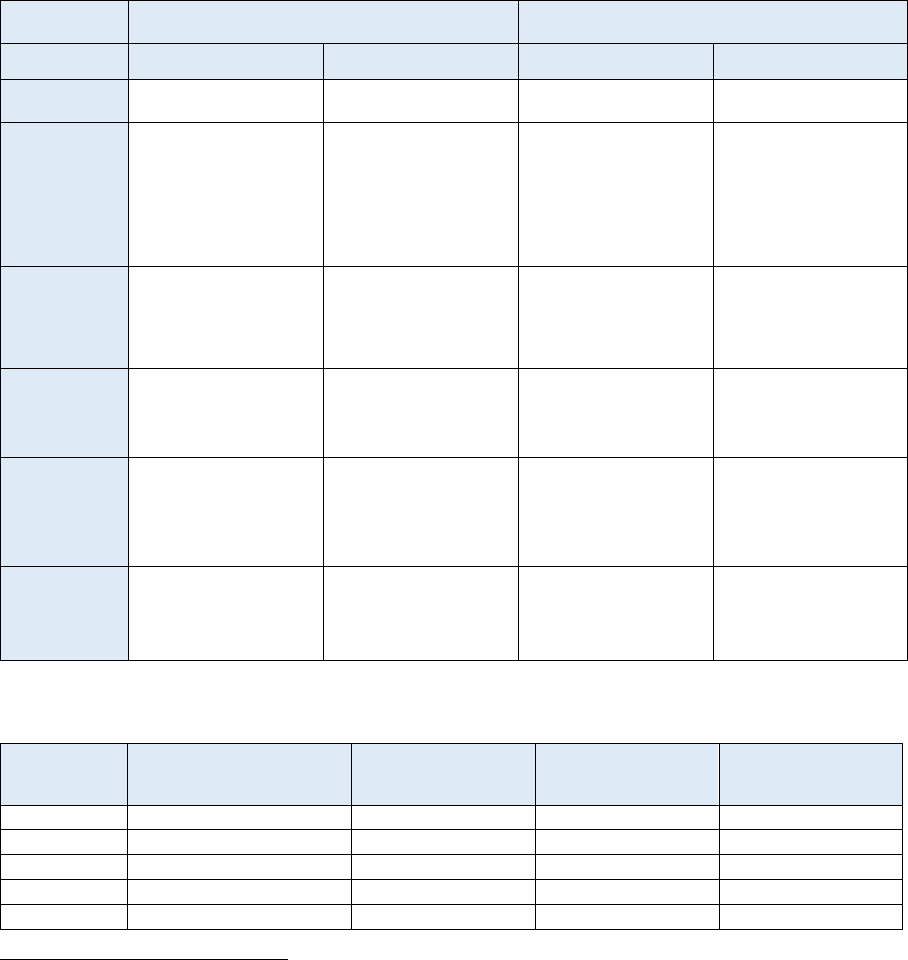

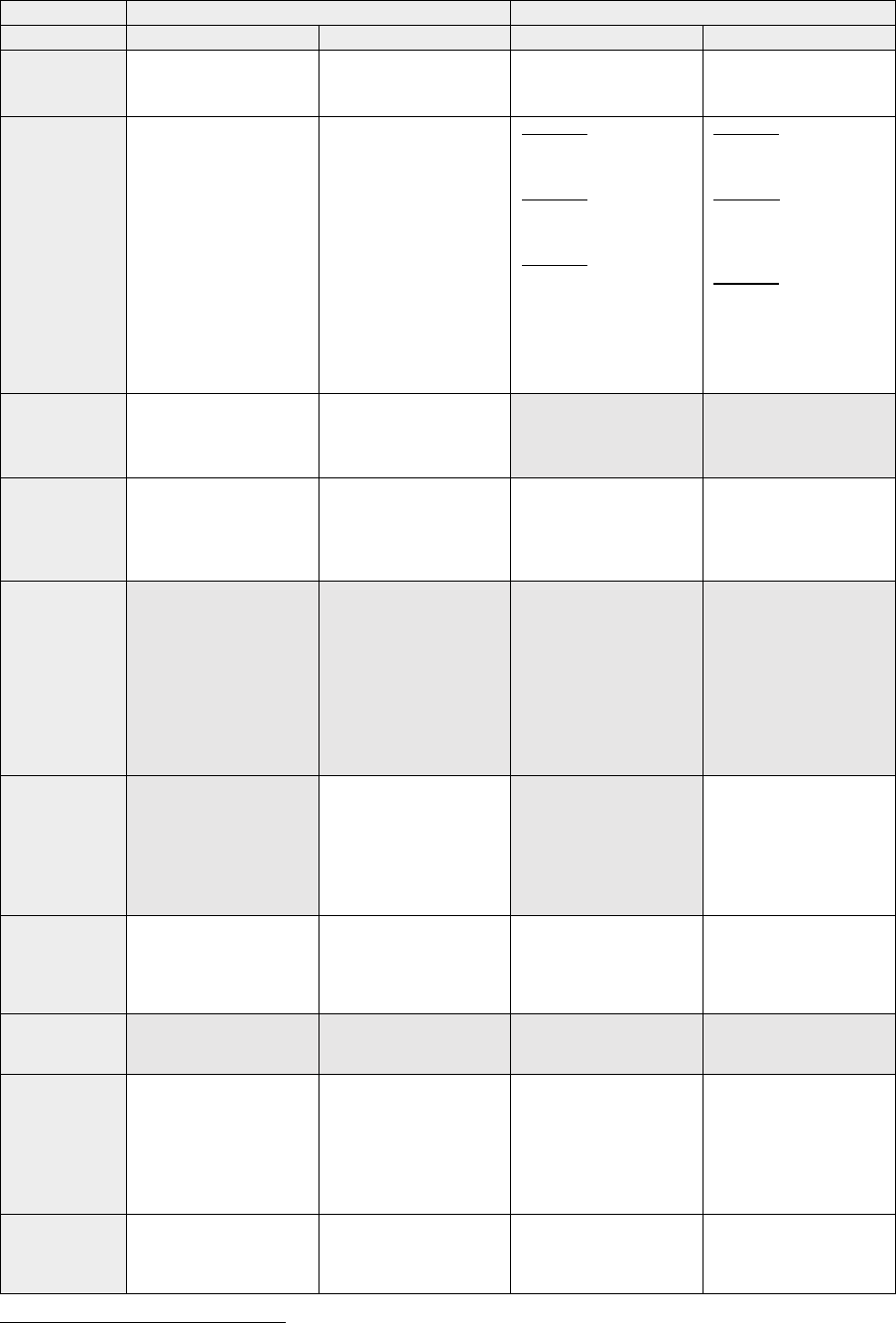

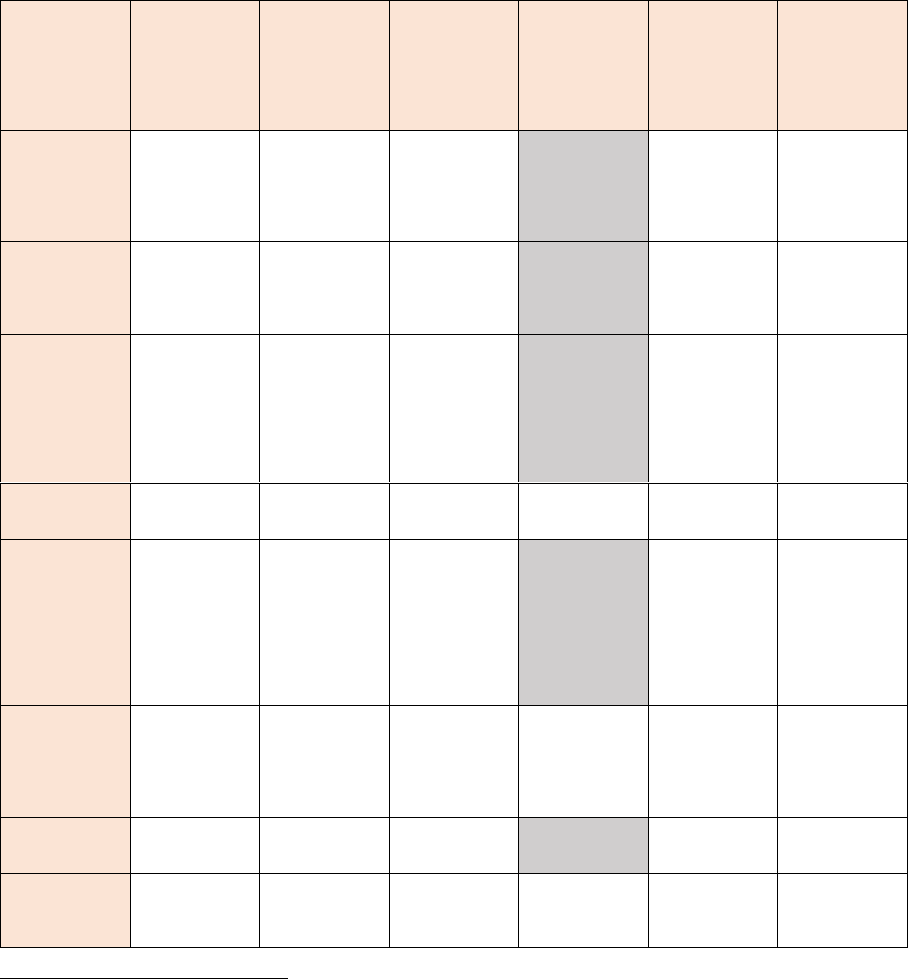

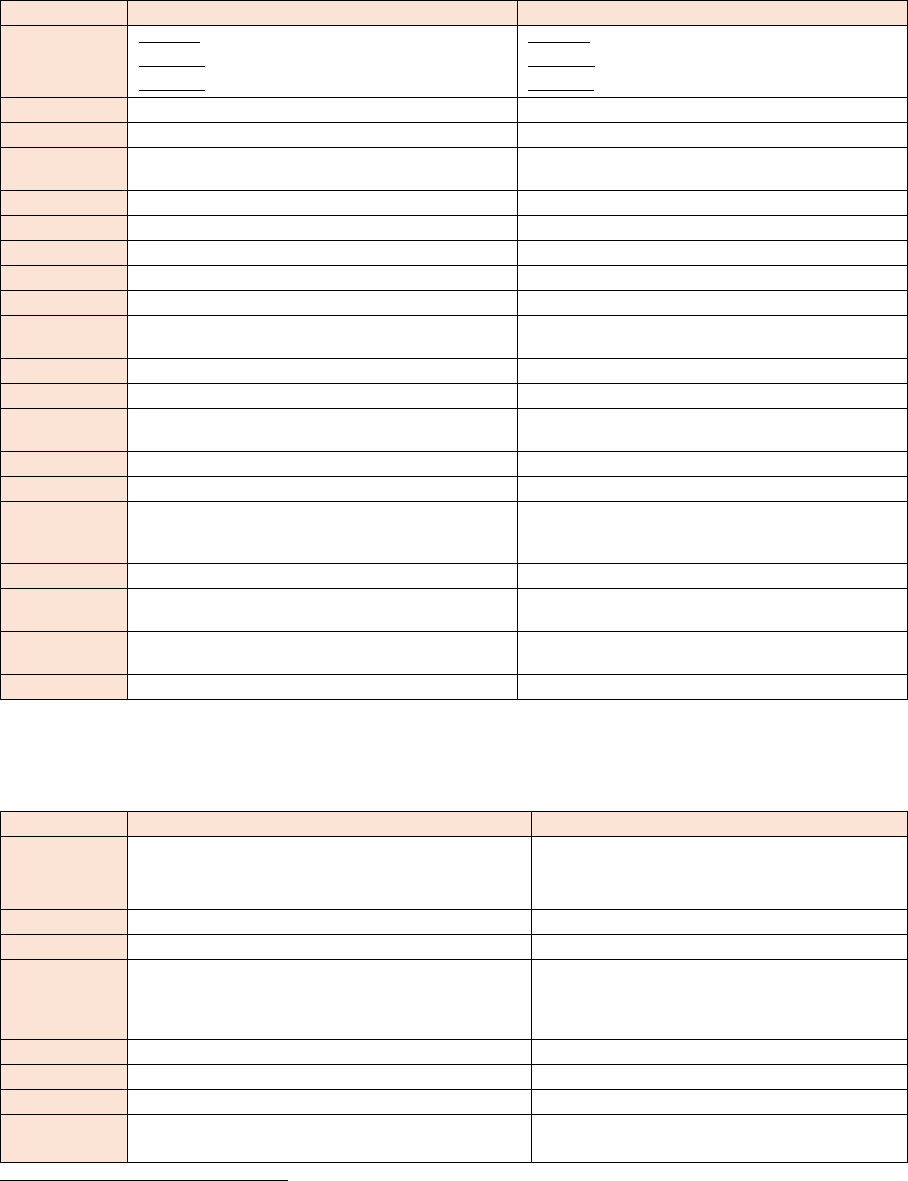

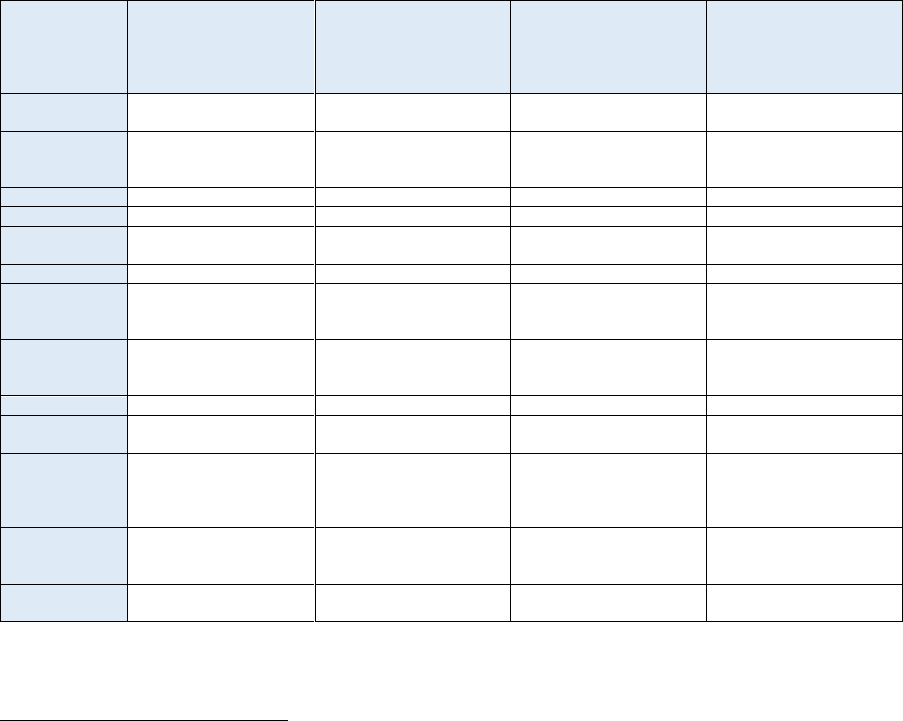

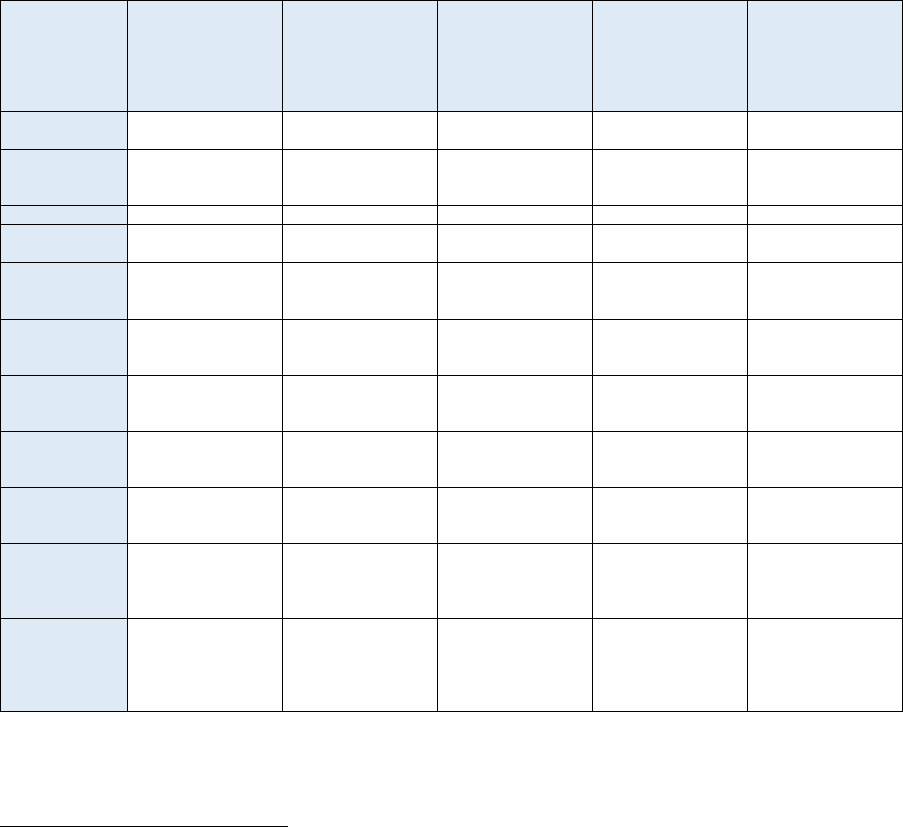

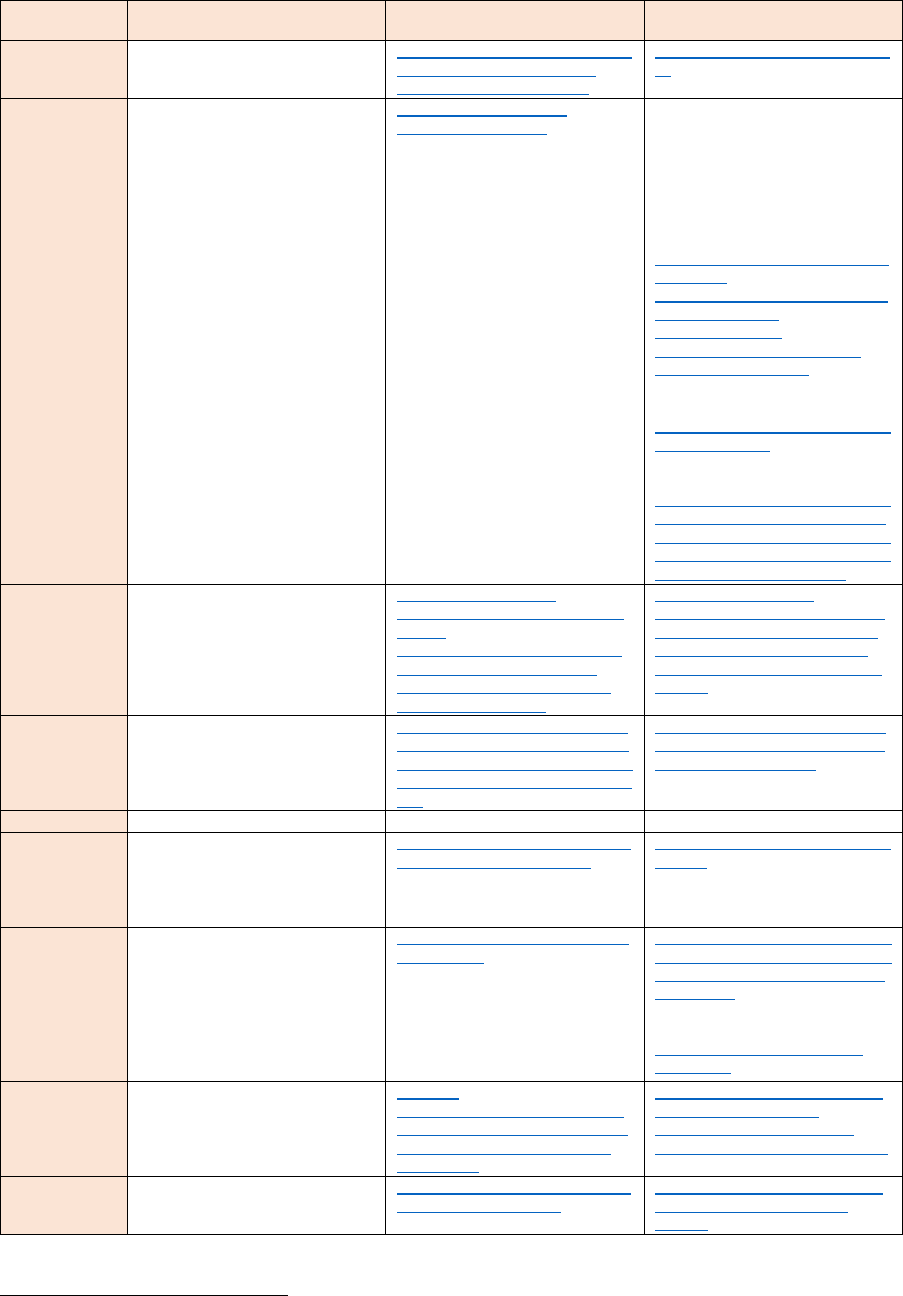

Figure 6: Forms of cost cascading applied to transmission and distribution tariffs, by country

AT

BE

BG

HR

CY

CZ

DK

EE

FI

FR

DE

GR

HU

IE

IT

LV

LT

LU

MT

NL

NO

PL

PT

RO

SK

SI

ES

SE

From transmission

to distribution

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

From transmission

to transmission

●

●

●

●

●

●

●

●

●

From distribution

to distribution

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

●

Note: In a few instances (BG, IE) cost-cascading from transmission to transmission was not confirmed or sufficiently

clarified. MT has no transmission network.

(46) The lack of cost-cascading inside transmission and/or inside distribution was often explained by

the NRAs due to a lack of cost collection/ cost differentiation per voltage level or that the

transmission network consists of only one network level. More details on the different forms of

cost-cascading applied to transmission and distribution tariffs across the countries can be found

in Table 3 and Table 4 in Annex 1.

(47) In most countries, cost cascading applies to all cost categories under the same rules. However,

there are several cases of partial or differentiated cost-cascading for certain costs. Partial cost-

cascading exists when some cost categories are not cascaded, while differentiated cost-

cascading occurs when different cascading criteria are applied to different cost categories and/or

to different network users. For example, costs more directly related to serving users connected

at a certain voltage level, such as metering and billing, are not cascaded downwards in some

countries (HR, DK, GR, HU), resulting in partial cost-cascading. In an additional country (BE)

ancillary services and system integration costs are not cascaded, as they cannot be differentiated

according to the user groups or voltage levels.

30

One country (PT) described a differentiated cost-

cascading, where the unit price of the network tariff is adjusted when it is applied to lower voltage

levels. More information on partial or differentiated cost cascading is provided in Table 5 in Annex

1.

(48) As shown in Table 6 in Annex 1, two countries (AT, PT) reported that they apply exemptions

31

from cost-cascading to specific groups of network users. The exemptions were justified by cost-

reflectivity (e.g. the concerned network users are exempted because they are deemed not to use

voltage levels above the one they are connected to or because their network use provides other

benefits to the system).

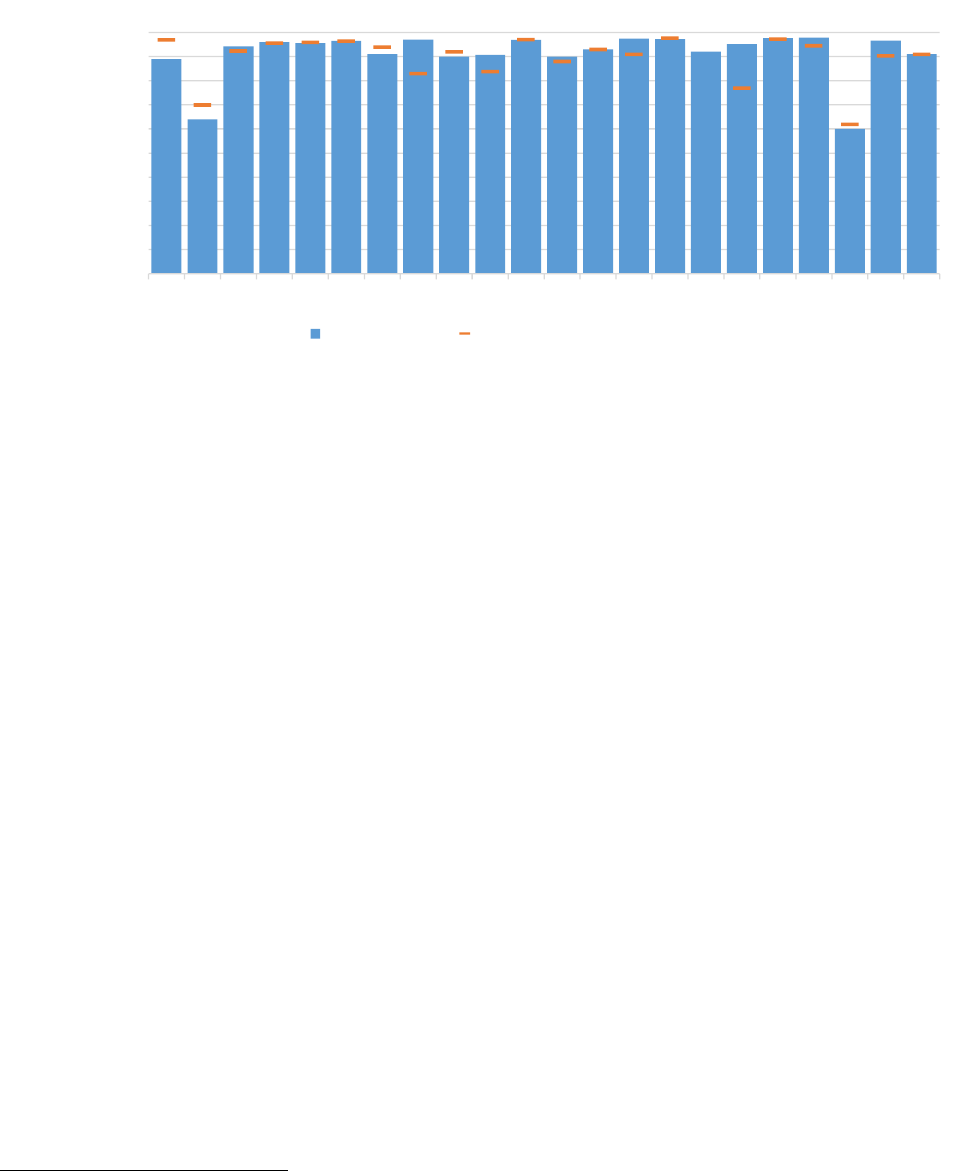

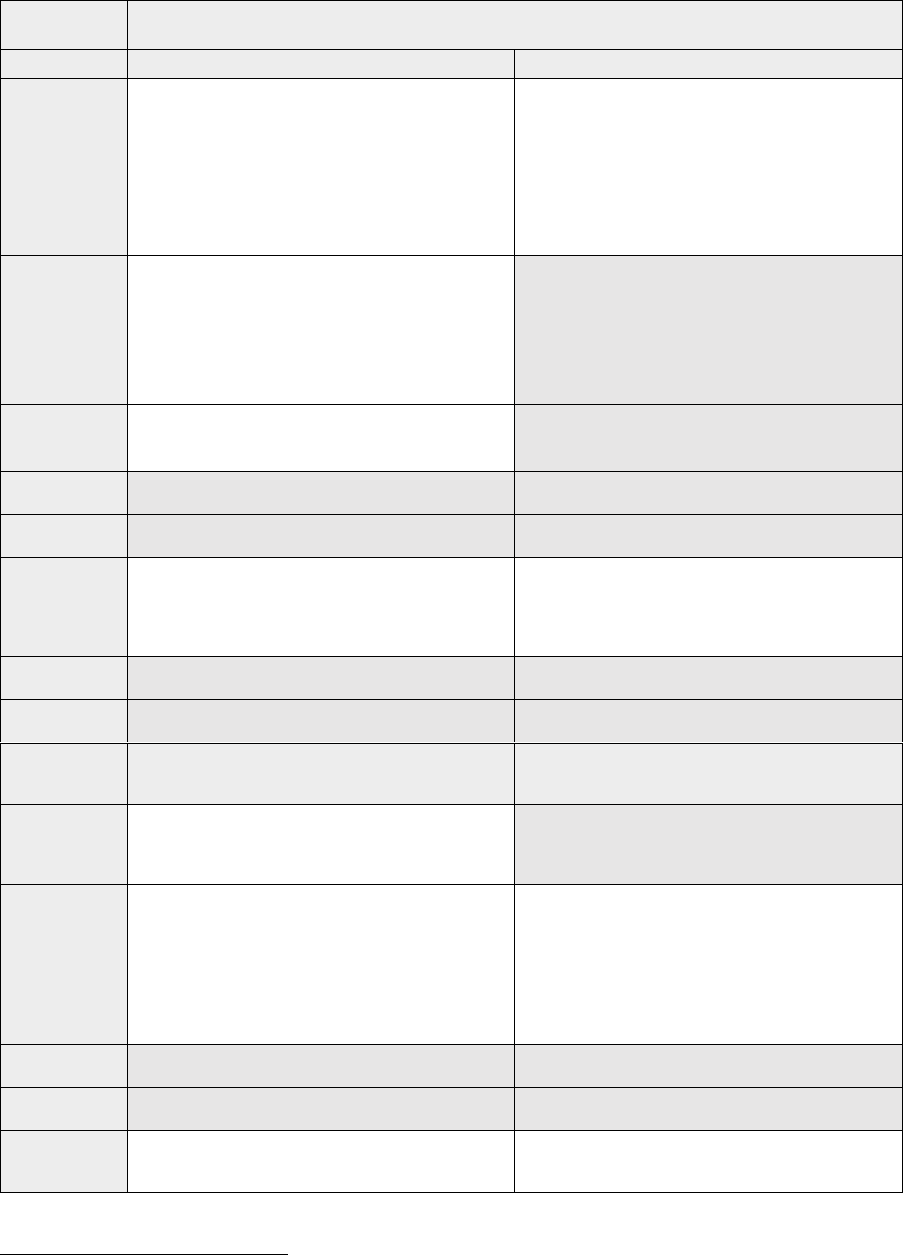

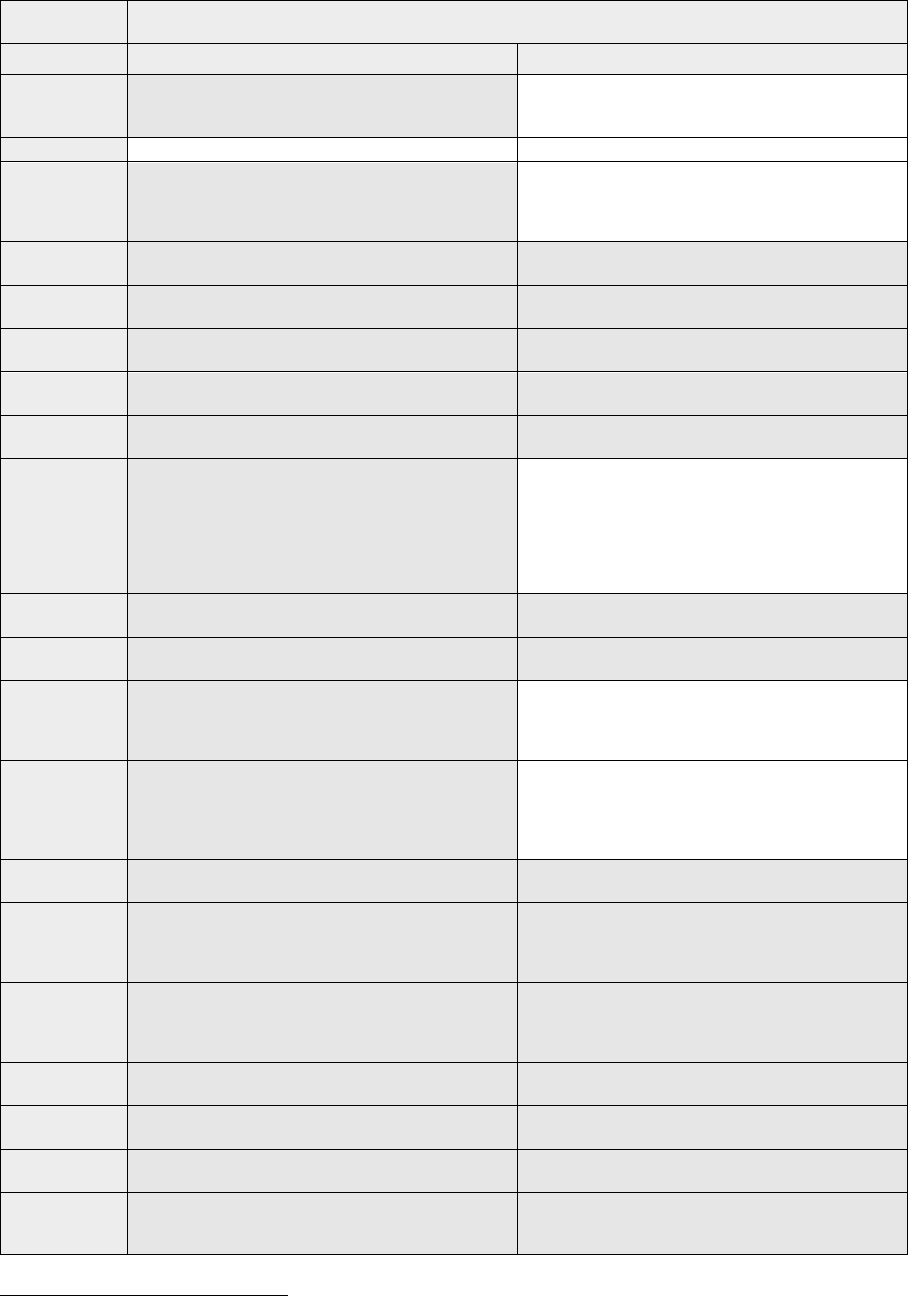

(49) Figure 7 below shows the degree of cost cascading from transmission to distribution across

countries, by representing the share of the transmission revenues that is collected from network

users connected at distribution level. In order to have a reference value for the relevance of the

30

BE: Moreover, in the case of the Flanders region, all distribution costs that aren't (directly) related to a certain voltage level are

not cascaded, namely: costs of system services, management costs, costs of capital, public service obligations, pension schemes

and local retributions

31

Countries that apply overall exemptions from network tariffs to specific groups of network users have not been considered for

the assessment of this specific form of exemption.

ACER REPORT ON TRANSMISSION AND DISTRIBUTION TARIFF METHODOLOGIES IN EUROPE

21

transmission and distribution networks, the percentage of consumption occurring at distribution

level is also indicated in Figure 7.

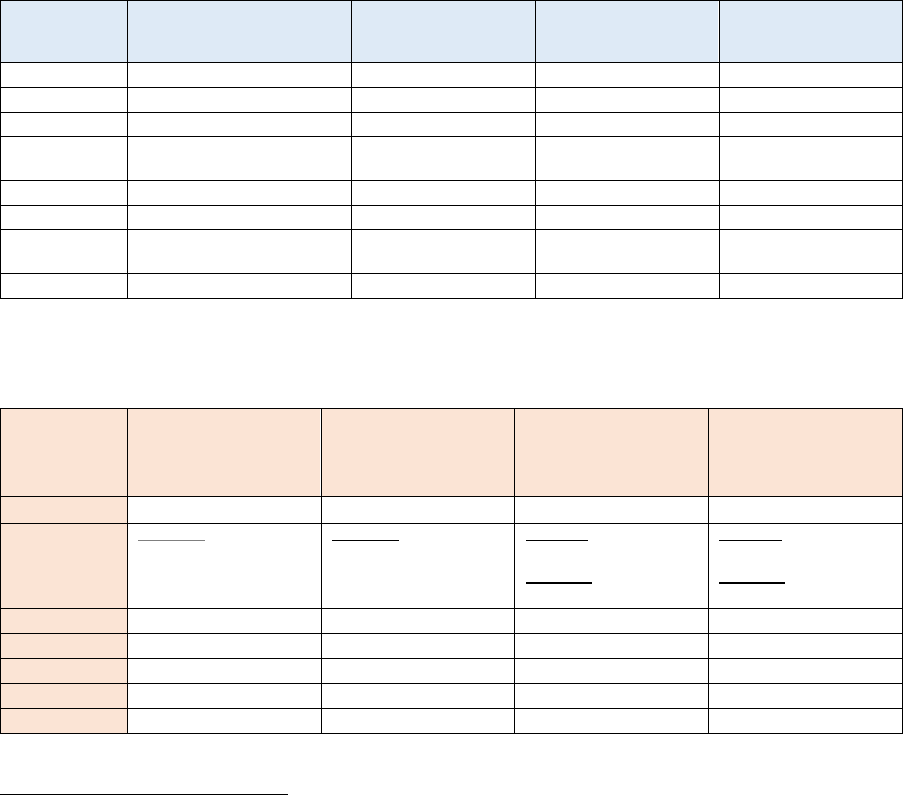

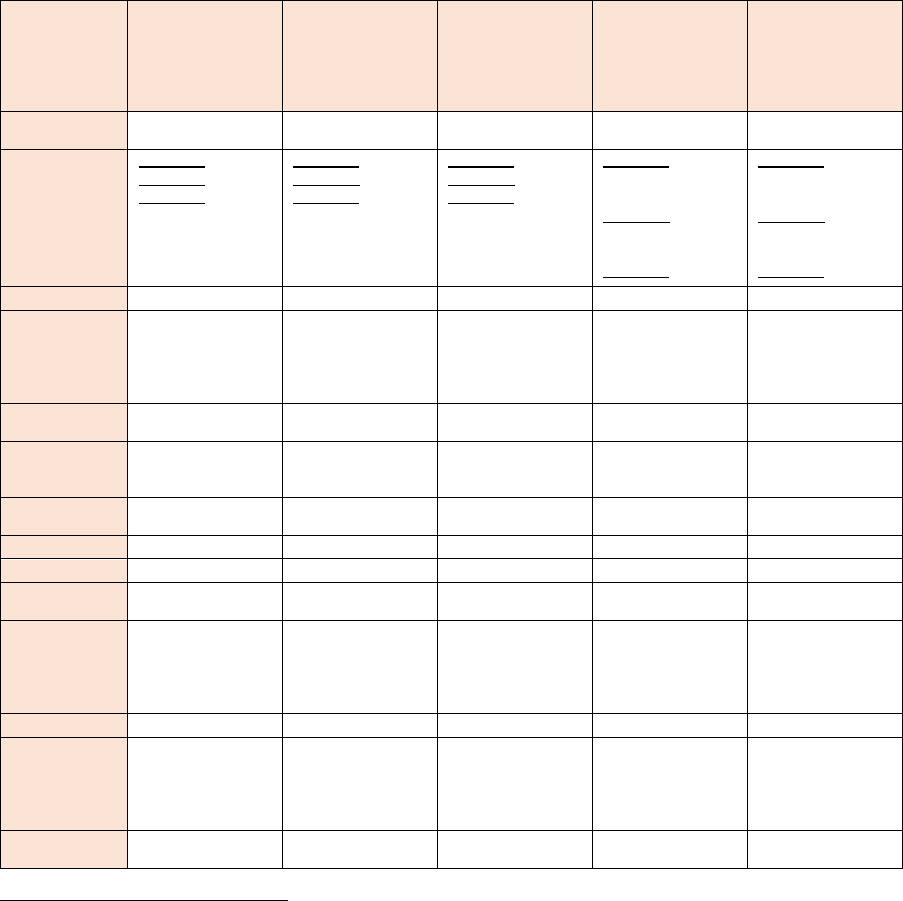

Figure 7: Degree of cost cascading from transmission to distribution (%)

Note: “Cost cascading” in this figure measures the share of transmission costs paid by distribution-connected users.

“Consumption at distribution level” measures the share of energy withdrawal from the distribution grid, compared

to overall energy withdrawal (measured at end users’ meters). This analysis is not applicable to MT because it has

no transmission network. Consumption data is not available for NL. Information is missing for: BG, FI, IE, RO, SE.

(50) ACER observes that in all countries - where this information was available - at least 89% of the

transmission costs are cascaded downwards to the distribution level, except for two countries

(BE, SK), where this share is lower than 65%. In all countries the share of cost cascading is

broadly in line with the relative share of consumption occurring at distribution level in each

country.

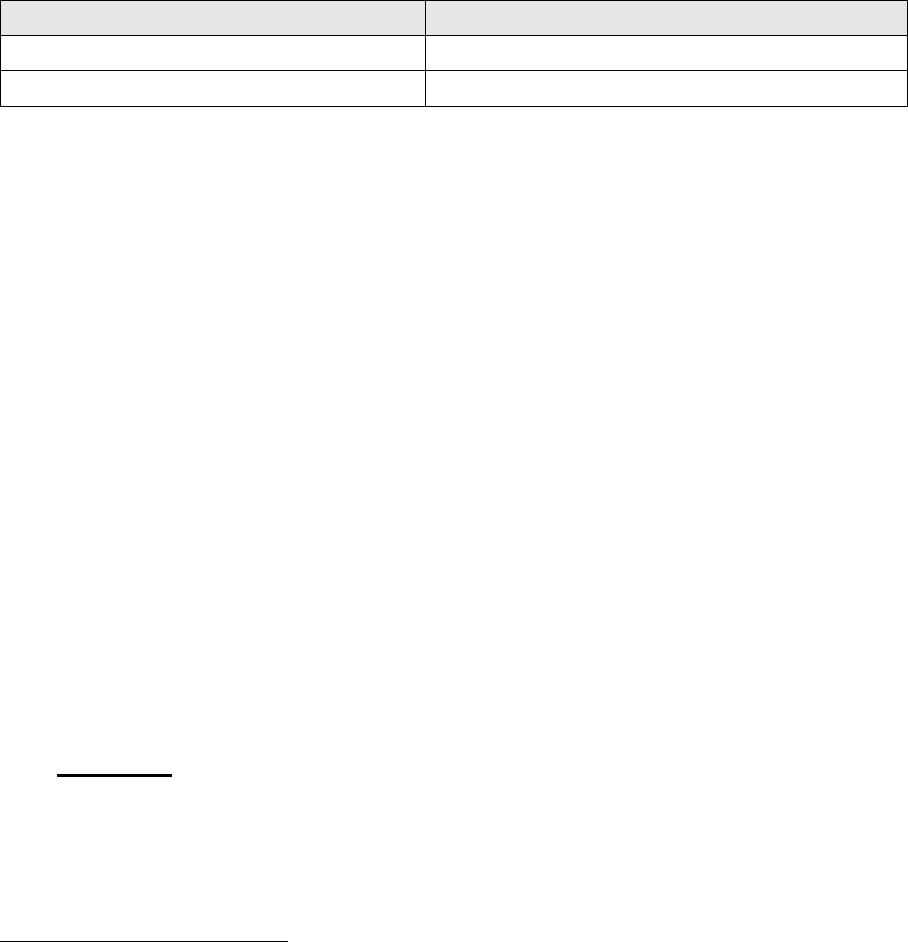

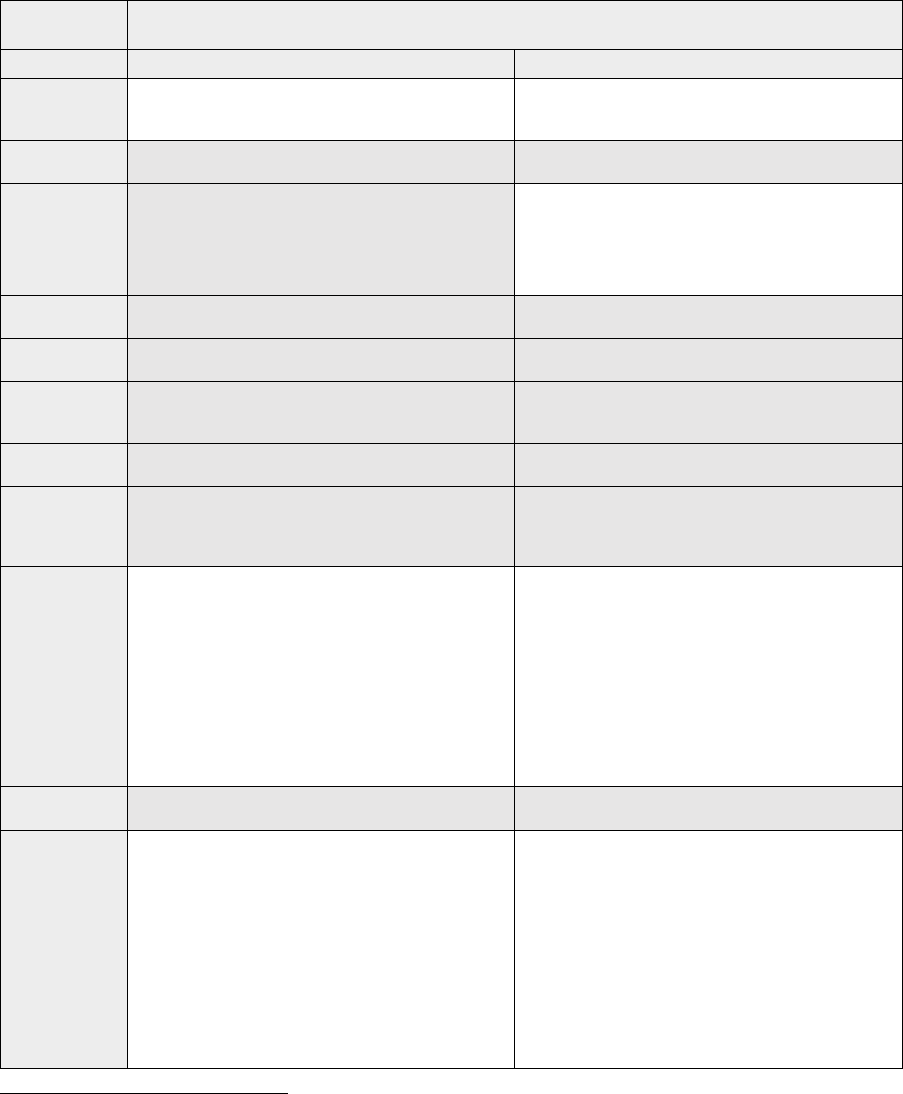

(51) Since the findings above imply that a significant share of network costs of a certain network level

is paid by users not directly connected to that network level, it is worthwhile to analyse whether

end users are provided with information on this fact. In about half of the countries the payment

of the cost-cascading from transmission to distribution occurs explicitly, with a separate tariff or

tariff element providing information on the magnitude of this cost-cascading.

32

However, in the

other half of the countries it exists on an implicit basis, where no separate tariff or tariff element

exists to quantify the value of the cost-cascading effect.

33

The list of countries with explicit and

implicit payment of cost-cascading is presented in Figure 8 below.

32

This information may be provided directly in the power bill or on some online platform that can be easily accessed by end users.

33

One example of implicit payment occurs when the cascaded transmission costs are incorporated into the distribution tariff,

without allowing end-users to understand what share relates to the transmission costs.

89 64 94 96 96 97 91 97 90 91 97 90 93 97 97 92 95 98 98 60 97 91

97

70

92

96

96

97

94

83

92

84

97

88

93

91

98

77

97

95

62

90

91

0

10

20

30

40

50

60

70

80

90

100

AT BE HR CY CZ DK EE FR DE EL HU IT LV LT LU NL NO PL PT SK SI ES

%

Cost cascading Consumption at distribution level

ACER REPORT ON TRANSMISSION AND DISTRIBUTION TARIFF METHODOLOGIES IN EUROPE

22

Figure 8: Type of payment of cost-cascading from transmission to distribution

Type of payment

Country

Explicit (separate tariff or tariff element)

BE, BG, HR, CY, DK, GR, IE, IT, PT, RO

34

, SK, SI

35

, ES

Implicit (no separate tariff or tariff element)

AT, CZ, EE, FI, FR, DE, HU, LV, LT, LU, NL, NO, PL

36

, SE

(52) More recently, some academic literature

37

has begun to question the traditional cost-cascading

approach, to the extent that inverted power flows, from a lower voltage level to a higher voltage

level, are becoming more frequent. Inverted power flows, if more dominant, challenge the idea

of a top-down cascading of costs, implying that some form of reverse cost-cascading may be

necessary.

38

(53) Based on NRAs responses only two countries (DE, SE) consider the use of (explicit) reverse

cost-cascading in the future. The vast majority of the countries are not considering its application

in the near future. In many cases NRAs (AT, FI, FR, GR, HU, IT

39

, LT, LU, NL, NO, RO, PT

40

,

SK

41

, SI) indicate that inverted power flows are not a frequent phenomenon or argue that there

is no evidence of benefits for higher voltage users arising from low voltage investments (BE, CZ).

In some instances such explicit reverse cost cascading would be hindered by the fact that the

costs are not collected per voltage level (MT) or the lack of sufficient information on the flows in

the network (ES).

(54) No NRA reported any recent changes regarding cost-cascading, but it is under review or

consideration in a few countries (PT, SE). Details on the changes can be found in Table 7 in

Annex 1.

3.3. Conclusions and recommendations

Cost model:

(55) The majority of countries follow an average cost model when setting network tariffs, both for

transmission and for distribution.

34

RO: Transmission tariffs are separate from distribution tariffs and both are indicated in the final bill.

35

SI: There is a separate tariff or tariff element for T-costs, but in the final bill it is merged with D-costs. TSO and DSO are obliged

to publish their separate tariffs on their web pages.

36

PL: Transmission costs are merged with distribution costs into the distribution tariff. The TSO and DSO are obliged to publish

their separate tariffs on their web pages.

37

E.g. Massachusetts Institute of Technology, “Utility of the Future: An MIT Energy Initiative response to an industry in transition”

(Dec. 2016).

38

From a conceptual point of view, the non-segmentation of a network across voltage levels can be considered as some form of

reverse cost-cascading. For instance, if there is only an overall distribution tariff, covering simultaneously the costs of MV and

LV, one can argue that MV users are already contributing towards LV assets. This may be interpreted as a coexistence of cost-

cascading and reverse cost-cascading.

39

IT: No clear evidence that this is needed, but the NRA is collecting data that could support a potential future reform of this

approach. Reverse cost cascading hasn’t been applied so far as reverse flows are still a relatively small phenomenon and its

introduction would be justifiable only in the framework of a thorough redesign of allocation criteria.

40

PT: The existence of inverted power flows is now being studied in PT. As a result, the regulatory rules foresee that in the case

of the self-consumption regime the exemption from cost-cascading may be reduced (which is not the same as true reverse cost-

cascading). There has not yet been sufficient evidence for following a reverse cost-cascading approach.

41

SK: T-costs which are serving or are partially caused by the users in lower voltage level and T-costs which serve for operational

security of whole electricity system as such are cascaded due to the fact, that the NRA cannot identify which market participant

caused these costs or are caused by the users in distribution. The NRA has not yet identified costs that should be reversely

cascaded.

ACER REPORT ON TRANSMISSION AND DISTRIBUTION TARIFF METHODOLOGIES IN EUROPE

23

(56) Although economic theory suggests that incremental or forward-looking cost models are better

approaches to signal the true cost of using the network, if the residual cost is recovered in a non-

distortive way, ACER observes that these cost models are less frequently applied in practice.

This might be the result of a lack of knowledge regarding the advantages and disadvantages of

implementing these models, including a lack of information on the effectiveness and impact of

these signals, risks and barriers (e.g. due to non-availability of the necessary data or complexity

in the analysis) to depart from the currently applied cost model.

(57) When incremental cost or forward-looking cost approaches are applied, there is a need to

allocate what is known as the ‘residual cost’, corresponding to the difference between the allowed

or target revenues and the revenue resulting from the price signals predicted by the cost model.

From an economic perspective, the residual cost should be allocated in a way that has the least

distortive effect on the price signals provided by the cost-reflective network tariffs for efficient

network use (e.g. ideally via fixed lump sum charges), while also keeping a balance with other

tariff-setting objectives, such as non-discrimination or sustainability.

(58) ACER recommends that:

a) Within the next 4 years, subject to their available resources, NRAs should evaluate the

advantages and disadvantages of applying incremental or forward-looking approaches, and

consult the results of such studies with their stakeholders. Special care should be given to the

way the residual cost would be recovered from network users.

Cost cascading:

(59) The principle of cost-cascading is embedded into the network tariff design in all countries, (except

Malta, which has only a distribution network, but no transmission network), as an important

element of cost-reflectivity. In almost all countries, more than 90% of transmission costs are paid

by network users connected to distribution. No country applies the option of reverse cost-

cascading as a result of inverted power flows in the grid, but two countries are considering it for

the future.

(60) In several instances, the lack of cost cascading within transmission and/or within distribution is

explained by lack of identification of costs per voltage level (e.g. extra high voltage, high voltage,

medium voltage, low voltage).

(61) ACER deems that in countries where the predominant direction of the electricity flow is from