4

th

ENTSO-E Guideline for Cost

Benefit Analysis of Grid Development

Projects

Version 4.1 for ACER/EC/MS opinion

24 April 2023

Foreword

This document presents the fourth version of the ENTSO-E Guideline for Cost Benefit Analysis of Grid

Development Projects (short: 4

th

CBA Guideline).

This updated guideline is the result of ‘learning by implementing’ and considering stakeholder suggestions

over a one-year development process initially based on the 3

rd

CBA Guideline. During this period, Member

States and National Regulators were consulted, following which the guideline was submitted for the official

opinion of the Agency for Cooperation of Energy Regulators (ACER) and the European Commission (EC).

The Regulation (EC) 2022/869 mandates that ENTSO-E drafts a European Cost Benefit Analysis (CBA)

guideline by 24 April 2023, which shall be further used for the assessment of the Ten-Year Network

Development portfolio.

The first official CBA Guideline drafted by ENTSO-E was approved and published by the EC on 5 February

2015, and the second official CBA Guideline drafted by ENTSO-E was approved by the EC on 27

September 2018 and published by ENTSO-E on 11 October 2018. The 3

rd

CBA Guideline was submitted

to the EC on 27 October 2022 for approval.

The first edition of the CBA Guideline was used by ENTSO-E to assess projects in the Ten-Year Network

Development Plan (TYNDP) 2014 and 2016. ENTSO-E registered the impact of the TYNDP project

assessment results on the European Commission Projects of Common Interest (EC PCI) process. This

experience demonstrated the need for a better guideline that enables a more consistent and comprehensive

assessment of pan-European transmission projects.

The 2

nd

CBA Guideline has a more general approach than its predecessor and assumes that the project

selection and definition, in addition to the scenario’s description, is within the frame of the TYNDP and,

therefore, not defined in the assessment guideline in detail. With this approach, ENTSO-E aims to develop

a CBA Guideline that can be used for one TYNDP as well as including strong principles that will stand for

a longer period. The 2

nd

CBA Guideline has been used by ENTSO-E to assess project benefits in the

TYNDP 2018. However, although improvements were included in the 2

nd

CBA Guideline, some so called

‘missing benefits’ were added to the TYNDP 2018 in addition to that which is defined in the 2

nd

CBA

Guideline. This, together with the constant efforts of ENTSO-E to improve the CBA Guideline, highlighted

the need for a 3

rd

version of the CBA Guideline.

The 3

rd

CBA Guideline contains improved methodologies for already existing indicators and an

introduction to new indicators. Among these, some new indicators stem from the lessons learnt from the

‘Missing Benefits’ process established for TYNDP 2018; however, the complexity of some of these new

indicators does not enable a Pan-European assessment. For this reason, the 3

rd

CBA Guideline includes new

‘non-mature indicators’, the nature of which is clarified in Chapter 3.4. On 7 November 2017, ENTSO-E

began to involve external stakeholders by hosting a public workshop to start the improvements which would

lead to a 3rd edition of the CBA Guideline. Subsequently, three work streams under public participation,

considering improvements on Security of Supply (SoS), Socioeconomic Welfare (SEW) and Storage

Projects, were organised from December 2017 to May 2018. The outcomes from these work streams were

considered for the drafting of the 3rd CBA Guideline which was presented at a public workshop on 18

December 2018. In 2019, ENTSO-E focused the work on the improvements on the 3rd CBA Guideline,

together with ACER and the EC. The updated draft 3rd CBA Guideline was presented to the stakeholders

during the open workshop on 8 November 2019 and released for public consultation on 9 November 2019.

The Guideline was officially submitted to ACER on 11 February 2020. On 6 May 2020 ACER delivered

their official opinion. ENTSO-E received the partial rejection of the 3

rd

CBA Guideline from the EC on 24

March 2022.

The 4

th

CBA Guideline follows the main idea and structure of the 3

rd

CBA Guideline, while including

corrections, clarifications, minor updates and some newly introduced concepts. A list of the main changes

compared to the 3

rd

CBA Guideline is given within the ‘Accompanying Documents’ submitted together

with the 4

th

CBA Guideline. Some were already included within the TYNDP 2022 Implementation

Guidelines.

Why is the 4

th

CBA Guideline important?

• It is the only European guideline that consistently allows the assessment of TYNDP

transmission and across Europe.

• The outcomes of the CBA Guideline represent the main input for the EC Project of Common

Interest and Projects of Mutual Interests lists.

• The European CBA Guideline can also be used as a source for national CBAs.

Table of Contents

1 Introduction .................................................................................................................... 14

1.1 Scope of the document .............................................................................................. 14

1.2 Overview of the document ........................................................................................ 16

1.3 CBA Implementation Guideline and other complementary documents ............................ 17

2 General approach ............................................................................................................ 20

2.1 Scenarios ................................................................................................................ 20

2.2 Study horizons ......................................................................................................... 21

2.3 Cross-border versus internal projects .......................................................................... 22

2.4 Modelling framework ............................................................................................... 22

2.4.1 Multi-sectorial market simulations ............................................................................23

2.4.2 Power market simulations .......................................................................................23

2.4.3 Power network simulations ......................................................................................24

2.4.4 Redispatch simulations ...........................................................................................24

2.4.5 Multi-case analysis .................................................................................................25

2.5 Reference network ................................................................................................... 25

2.6 Sensitivities ............................................................................................................. 28

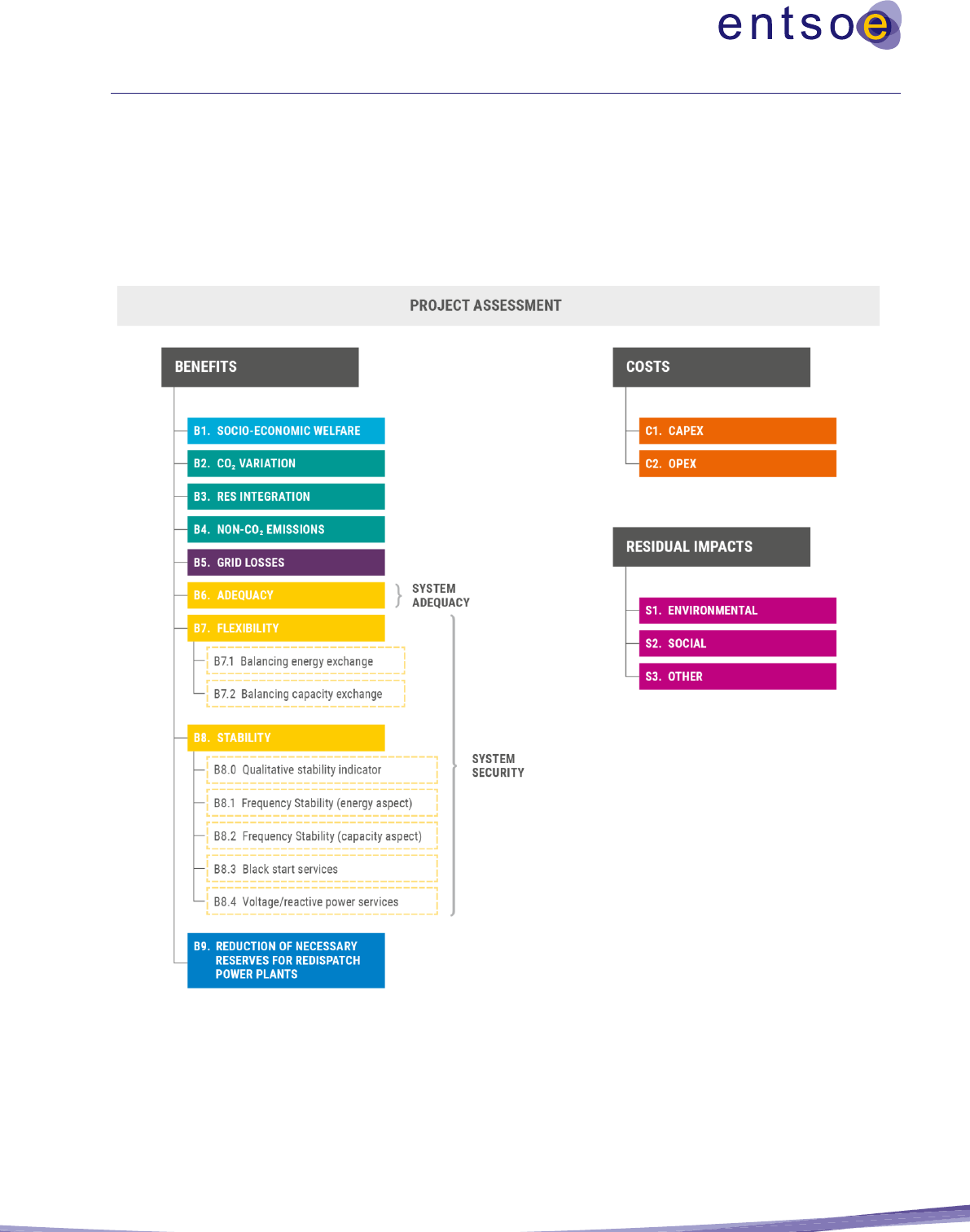

3 Project assessment ........................................................................................................... 32

3.1 Multi-criteria and cost benefit analysis assessment ....................................................... 32

3.2 General assumptions ................................................................................................. 34

3.2.1 Clustering of investments ........................................................................................34

3.2.2 TOOT and PINT ....................................................................................................35

3.2.3 Transfer capability calculation .................................................................................38

3.2.4 Geographical scope ................................................................................................40

3.2.5 Investment value calculation ....................................................................................40

3.3 Assessment framework ............................................................................................. 42

3.4 Non-mature indicators .............................................................................................. 43

4 Concluding remarks ........................................................................................................ 44

5 Benefits, costs and residual impacts .................................................................................. 45

5.1 B1: Methodology for Socioeconomic Welfare Benefit .................................................. 52

5.2 B2: Methodology for Additional Societal benefit due to CO

2

variation ........................... 57

5.3 B3: Methodology for RES Integration Benefit ............................................................. 61

5.4 B4: Methodology for Non-Direct Greenhouse Emissions Benefit ................................... 63

5.5 B5: Methodology for Variation in Grid Losses Benefit ................................................. 66

5.6 B6: Methodology for Security of Supply: Adequacy to Meet Demand Benefit ................. 73

5.7 B7: Methodology for Security of Supply – System Flexibility Benefit ............................ 76

5.7.1 B7.1: Balancing energy exchange (aFRR, mFRR, RR) ................................................77

5.7.2 B7.2: Balancing capacity exchange/sharing (aFRR, mFRR, RR) ..................................80

5.8 B8: Methodology for Security of Supply: System Stability Benefit ................................ 81

5.8.1 B8.0: Qualitative stability indicator ..........................................................................82

5.8.2 B8.1: Frequency Stability (energy aspect) .................................................................83

5.8.3 B8.2 Frequency Stability (capacity aspect) ................................................................85

5.8.4 B8.3: Black start services ........................................................................................87

5.8.5 B8.4 Voltage/reactive power services .......................................................................87

5.9 B9: Reduction of Necessary Reserve for Redispatch Power Plants ................................. 88

5.10 C1: Methodology for CAPital EXpenditure (CAPEX) .................................................. 91

5.11 C2: Methodology for OPerating EXpenditure (OPEX) .................................................. 95

5.12 General Statements on Residual Impacts ..................................................................... 96

5.13 S1: Methodology for Residual Environmental Impact ................................................... 99

5.14 S2: Methodology for Residual Social impact ............................................................. 101

5.15 S3: Methodology for Other Residual Impact .............................................................. 103

6 Supplemental methodologies .......................................................................................... 104

6.1 Contribution to Union Energy Targets (ET) ............................................................... 104

6.2 Methodology for the assessment of Hybrid Projects ................................................... 105

6.2.1 Context ............................................................................................................... 105

6.2.2 Hybrid interconnector definition ............................................................................ 106

6.2.3 Hybrid interconnection CBA configuration ............................................................. 107

6.2.4 Radial projects: .................................................................................................... 110

6.2.5 NTCs .................................................................................................................. 110

6.3 Redispatch simulations for project assessment ........................................................... 110

6.4 Value of Lost Load ................................................................................................. 116

6.5 Climate adaptation measures ................................................................................... 117

I. Generation cost approach .............................................................................................. 119

II. Total surplus approach .................................................................................................. 120

III. Example of ΔNTC calculation ........................................................................................ 125

General definitions

Boundary

A boundary represents a barrier to power exchange in Europe. It represents a section

(transmission corridor) within the grid where the capacity to transport the power-flow

related to the (targeted level of) power exchange in Europe is insufficient.

In this context, a boundary is referred to as a section through the grid in general. A

boundary can:

• Be the border between two bidding zones or countries;

• Span multiple borders between multiple bidding zones or countries; or

• Be located inside a bidding zone or country, dividing the area into two or multiple

sub-areas.

Competing

transmission

projects/investments

Two or more transmission projects are regarded as competing if they serve the same

purpose.

In cases where competing projects are proposed to achieve a transmission capacity

increase, the projects typically (but not exclusively):

a) Increase NTC on the same boundary; and

b) Their socioeconomic viability is reduced if assessed under the assumption that the

other project is also realised. Therefore, the overall net benefit of realising both

projects is lower than the sum of the individual net benefits.

Current grid

(starting grid)

The current grid is the existing transmission grid and is determined at a specific date that

is dependent on the point in time of the respective study. It can also be considered the

starting point or initial state of building the reference grid by including the most probable

projects as described in this 4

th

CBA Guideline.

Generation power

shift

Generation power-shift is the deviation from the cost-optimal power plant dispatch

(determined by market simulations) for the purpose of influencing grid utilisation.

1

It

considers the loading of a line across a boundary that separates system A from system B

(with energy transported from A to B), arrived at as a result of optimum dispatch.

Generation is incrementally increased in area A and decreased in area B. This process is

conducted up to the point where the line loading security criteria in System A or System

B are reached. The volume of the power shift represents the additional market exchange

possible between these systems and should be reflected by the variation in NTC that is

assumed in market simulations. Generation power shift is used to modify the market

exchange across a specified boundary to find the maximum change in generation made

possible by the grid.

Grid Transfer

Capacity (GTC)

The GTC is defined as the greatest (physical) power-flow that can be transported across

a boundary without the occurrence of grid congestions, considering standard system

security criteria.

1

This can also be seen as the definition of the re-dispatch. To avoid confusion in this case it is referred to generation power-shift as in reality the

re-dispatch is used to reduce the grid utilisation and to heal congestions. However, as described in this guideline, the re-dispatch will also be used

to determine the theoretical maximum grid utilisation by bringing the system to the edge of security.

Hybrid Projects

A hybrid project is a project which enables an interconnector function between bidding

zones (either onshore or offshore) while simultaneously facilitating a client connection

with a certain technology (RES or non-RES; generation or load; AC or DC)

Interdependent

Projects

An interdependent project is a project the realisation of which is dependent on the

realisation of another project, e.g. where a project needs to be built as a prerequisite

before the interdependent project can fulfil its full potential. This might also apply to two

or more projects interdependent from each other.

Interlinked Model

Interlinked (sector) models simulate energy market transactions and interactions with

other sectors of different energy carriers. The interlinked model is necessary to assess

projects from a ‘one energy system’ perspective.

Investment

An investment is the smallest set of assets that together can be used to transmit electrical

power and that effectively add transmission infrastructure capacity. An example of an

investment is a new circuit, the necessary terminal equipment and any associated

transformers.

Investment need

The need to develop capacity across a boundary is referred to as an investment need. As

different scenarios may result in different power flows, the amount of capacity required

to transport these power flows across a boundary and, consequently, the amount of

investment needed, is likely to differ from scenario to scenario.

Investment status

The investment status is defined depending on its stage of development, according to one

of the following six options:

• Under consideration: Investments in the phase of planning studies and under

consideration for inclusion in national plan(s) and Regional/EU-wide Ten-Year

Network Development Plans (TYNDPs) of ENTSO-E.

• Planned, but not yet in permitting: Investments included in the national

development plan and that have completed the initial studies phase (e.g. completed

pre-feasibility or feasibility study), but have not yet initiated the permitting

application.

• Permitting: Investments for which the project promoters have applied for the first

permit required for its implementation and the application is valid.

• Under construction: The investment is in its construction phase.

• Commissioned: Investments that have come into first operation.

• Cancelled.

Main investment

In the case of a project that consists of a number of investments, one investment (e.g. an

interconnector) is to be defined as a main investment with one or more supporting

investments attached. This is required when clustering investments. The main investment

is planned to achieve the specific goal, e.g. an interconnector between two bidding areas,

with the supporting investments (as part of the project) required to achieve the full

potential of that main investment. The full potential of the main investment represents its

maximum transmission capacity in normal operation conditions.

Net Transfer

Capacity (NTC)

The NTC is the maximum foreseen magnitudes of power exchange programmes that can

be operated between two bidding zones while respecting the system security

requirements of the areas involved. The NTC is used in market modelling to represent

the power exchange capability between bidding zones.

Planning cases

The representation of how the power system (i.e. the generation and transmission system)

could be managed at a point in time. They are used to represent a detailed model of the

grid for that point in time, or a snapshot, and are used in network studies. Planning cases

are selected inter alia based on:

a) The outputs from market studies, such as system dispatch, frequency and magnitude

of constraints;

b) Regional considerations, such as wind and solar profiles or cold/heat spells; and

c) Results of pan-European Power Transfer Distribution Factor (PTDF) analysis, when

available.

Project

A project is defined as a single investment or group of investments. Therefore, it can

comprise a main investment with supporting investments that must be realised together

to enable the main investment to realise its intended goal, i.e. the full potential, which is

defined as the capacity increase of the main investment. In cases where there are no

supporting investments, the project consists of the main investment alone and will

nonetheless be described as a ‘project’ in this CBA Guideline.

Put IN one at the

Time (PINT)

A methodology that considers each new investment/project (line, substation, phase

shifting transformer (PST), or other transmission network device) on the given network

structure one-by-one and evaluates the load flows over the lines with and without the

examined network investment/project reinforcement.

Radial Projects

A radial project enables the connection of a certain technology (RES or non-RES

generation) to a bidding zone.

Reference network

The reference network is the version of the network used to calculate the incremental

contribution of the project that is assessed. Therefore, it is used as the starting point for

the computation of and the respective benefit indicators.

Renewable Energy

Sources (RES)

RES means energy from renewable non-fossil sources, namely wind, solar (solar thermal

and solar photovoltaic) and geothermal energy, ambient energy, tide, wave and other

ocean energy, hydropower, biomass, landfill gas, sewage treatment plant gas, and biogas

ESAB. A detailed overview is also provided within the study specific Implementation

Guidelines.

Respective study

The study in which the CBA assessment is performed, e.g. the TYNDP.

Scenario

A set of assumptions for modelling purposes related to a possible future situation in which

certain conditions regarding demand, installed generation capacity, infrastructures, fuel

prices and global context occur.

Societal cost of CO

2

The societal cost of carbon can represent two concepts:

• The social cost that represents the total net damage of an extra metric ton of CO

2

emissions due to the associated climate change;

2

and

2

IPCC Special report on the impacts of global warming of 1.5°C (2018) - Chapter 2

• The shadow price that is determined by the climate goal under consideration. It can

be interpreted as the willingness to pay for imposing the goal as a political

constraint.

3

Take Out One at the

Time (TOOT)

A methodology that consists of excluding projects from the forecasted network structure

on a one-by-one basis to compare the system performance with and without the project

under assessment.

Ten-Year Network

Development Plan

(TYNDP)

The European Union-wide report examining the development requirements for the next

ten years, carried out by ENTSO-E every other year as part of its regulatory obligations

defined under Article 8, paragraph 10 of the Regulation (EU) 2019/943.

Time step

Simulation models compute their results at a given temporal level of detail. This temporal

level of detail is referred to as the time step. Smaller time steps generally increase

simulation run time, whereas larger time steps decrease simulation run time. Typically,

simulations are done using hourly time steps, but this level of granularity may vary

depending on the level of detail required in the results.

Abbreviations

The following list shows abbreviations used in the 4th ENTSO-E Guideline for Cost Benefit Analysis of

Grid Development Projects:

ΔNTC

Increase in NTC

AC

Alternating Current

ACER

European Union Agency for the Co-operation of Energy Regulators

aFRR

Automatic Frequency Restoration Reserve

BCR

Benefit-to-Cost Ratio

CAPEX

Capital Expenditure Cost

CBA

Cost-Benefit Analysis

CBCA

Cross-Border Cost Allocation

CE

Continental Europe

CEER

Council of European Energy Regulators

CF

Complexity Factor

CIGRE

Council on Large Electric Systems

3

IPCC Special report on the impacts of global warming of 1.5°C (2018) - Chapter 2

CONE

Cost of New Entrant

DA

Day-ahead Market

DC

Direct Current

DSR

Demand Side Response

EC

European Commission

EBGL

Electricity Balancing Guideline

EED

Energy Efficiency Directive

EENS

Expected Energy Not Served

ENTSO-E

European Network of Transmission System Operators for Electricity

ENS

Energy Not Served

EPRI

Electric Power Research Institute

ET

Energy Targets

ETS

Emissions Trading Scheme

EU

European Union

FCR

Frequency Containment Reserve

FE

Frequency Exchange

FO

Frequency Optimisation

FN

Frequency Netting

FRR

Frequency Restoration Reserve

FV

Future Value (Cost or Benefit)

GTC

Grid Transfer Capability

HVDC

High Voltage DC

ID

Intraday Market

ILM

Interlinked Model

IPS

Integrated Power System

LFC

Load Frequency Control

LOLE

Loss of Load Expectation

MES

Multi-Energy System

mFRR

Manual Frequency Restoration Reserve

MS

Member States

MSC

Mechanically Switched Capacitors

MSR

Mechanically Switched Reactors

NECP

National Energy and Climate Plan

NPV

Net Present Value

NRA

National Regulatory Authority

NTC

Net Transfer Capacity

OBZ

Offshore Bidding Zone

OHL

Overhead Line

OPEX

Operating Expenditure Cost

P2G

Power-to-Gas

PCI

Projects of Common Interest

PINT

Put IN one at the Time

PMI

Project of Mutual Interest

PP

Project Promoter

PST

Phase Shifting Transformer

PTDF

Power Transfer Distribution Factor

PV

Present Value

RES

Renewable Energy Sources

RoCoF

Rate of Change of Frequency

RR

Replacement Reserves

SA

Synchronous Area

SA-OA

Synchronous Area Operational Agreements

SEA

Strategic Environmental Assessment

SEW

Socioeconomic Welfare

SMC

Submarine Cable

SOC

System Operations Committee

SOGL

Commission Regulation (EU) 2017/1485: Establishing a Guideline on Electricity Transmission

System Operation

SoS

Security of Supply

STATCOM

Static Synchronous Compensator

SVC

Static Var Compensator

TOOT

Take Out One at the Time

TRM

Transmission Reliability Margin

TSO

Transmission System Operator

TTC

Total Transfer Capacity

TYNDP

Ten-Year Network Development Plan

UGC

Underground Cable

VOLL

Value of Lost Load

XB

Cross-border

1 Introduction

This Guideline for Cost Benefit Analysis of Grid Development Projects was prepared by the European

Network of Transmission System Operators for Electricity (ENTSO-E) in compliance with the

requirements of the EU Regulation (EU) 2022/869 on guidelines for trans-European energy infrastructure

(referred to as 'the Regulation').

This Guideline is the fourth version of this document produced by ENTSO-E (referred to as the 4

th

CBA

Guideline) and will be further updated and improved following the results of an extensive consultation

process. The consultation process plans to involve the public, stakeholder organisations, national authorities

and their national regulatory authorities, the Agency for Cooperation of Energy Regulators (ACER), and

the European Commission (EC), following the requirements as defined in the Regulation (Article 11 2.).

This updated version of the guideline (version 4.1) will be sent to Member States (MS), the EC and ACER

by 24 April 2023 following the Regulation (Article 11 1.). After receiving the feedback from theses

stakeholders, ENTSO-E will include amendments accordingly and submit the updated guideline (version

4.2) to the EC for approval.

The indicators that have been developed enable a harmonised, system-wide cost–benefit analysis (CBA) of

projects. They facilitate a uniform approach in which all projects and promoters (either TSO or third party)

are treated and assessed in the same manner.

The guideline’s primary use is to describe the projects contained in the ENTSO-E Ten-Year Network

Development Plan (TYNDP), including the Projects of Common Interest (PCI) and Projects of Mutual

Interest (PMI) that are identified from the list of TYNDP projects. It is also recommended to be used for

the cross-border cost allocation (CBCA) process as required by the Regulation (Article 16 4.(a)).

4

The methodologies developed in this Guideline are of general relevance to the electricity industry and may

therefore be useful to anyone seeking to assess transmission investments. Some of the indicators are

developed to meet specific requirements of the Regulation concerning market integration, security of supply

(SoS) and sustainability, including the integration of renewable energy and energy storage among others.

Of particular reference, the indicators are designed to comply with Article 4.3(a), Article 11, Annex IV and

Annex V of the Regulation.

1.1 Scope of the document

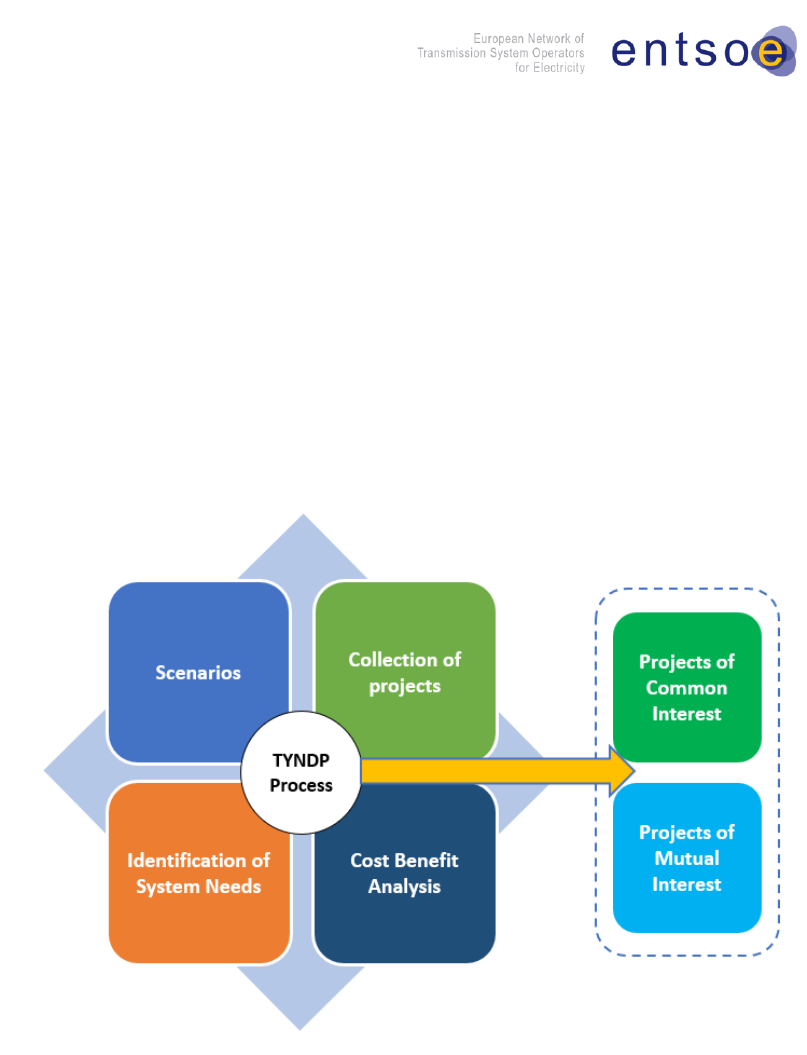

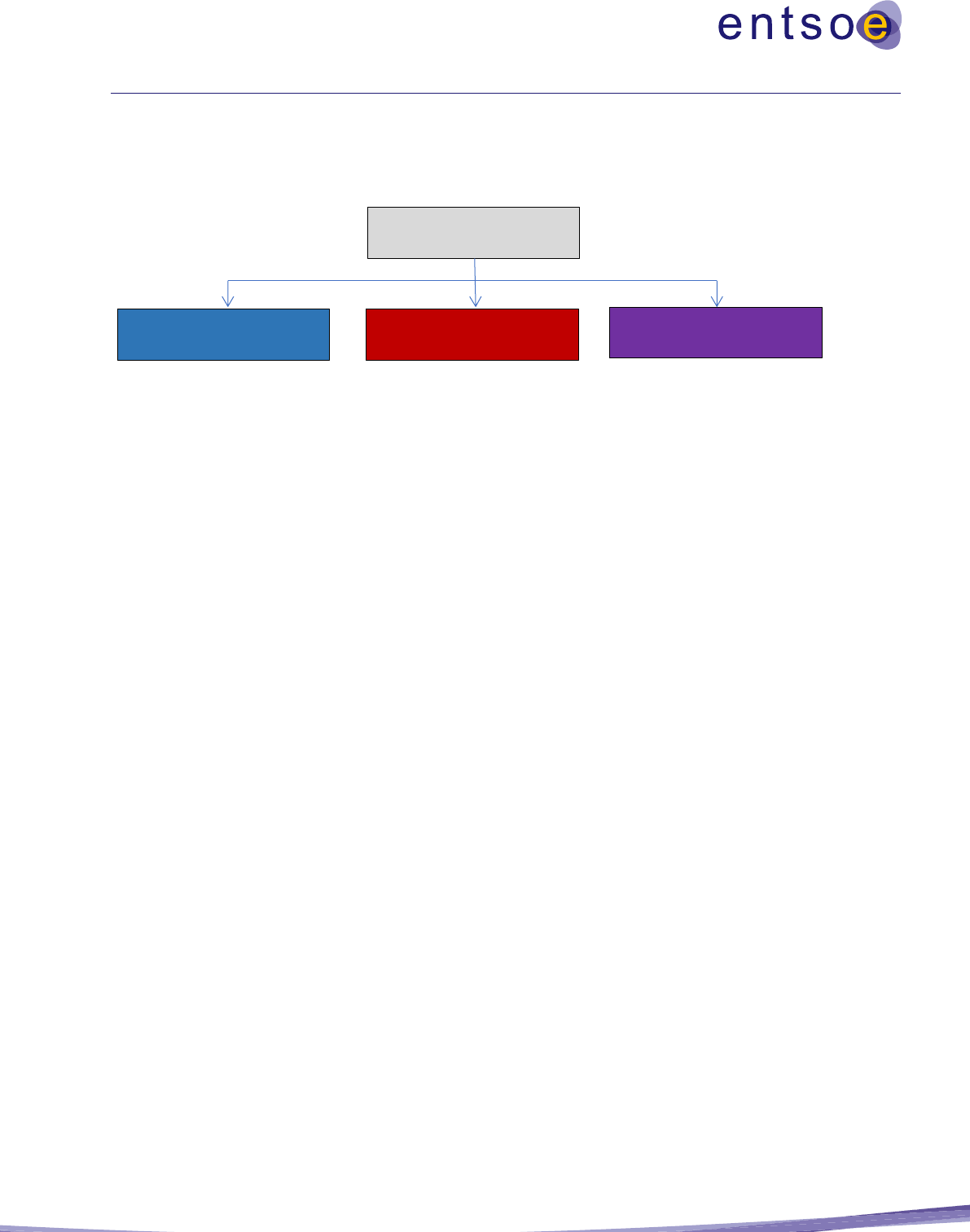

The TYNDP process consists of four main processes, illustrated in Figure 1 below: the building of

scenarios, the project collection, the identification of system needs, and the CBA. This complies with the

Regulation, which requires projects to be assessed under different planning scenarios, each of which

represents a possible future development of the energy system. Although project costs are scenario

independent, the benefits strongly correlate with scenario-specific assumptions. Therefore, scenarios that

4

Additional information can be found at the ENTSO-E’s TYNDP webpage: https://tyndp.entsoe.eu/

define potential future developments of the energy system are used to gain insight into the future benefits

of transmission projects.

A system-needs assessment determines the impact of those scenarios on the transmission system,

identifying network bottlenecks and additional investment needs. This requires network power-flow,

stability and market analyses.

This document aims to provide guidance for how to perform the last step: an energy system-wide CBA.

Only where needed for the understanding of this CBA Guideline is general information on the other steps

given, whereas more detailed information and guidance about the other processes can be found on ENTSO-

E’s website.

Figure 1: Overview of the assessment process inside the TYNDP and for identifying PCIs and PMIs

The aim of the 4

th

CBA Guideline is to deliver general guidance on how to assess projects from a CBA

perspective. The Guideline describes the ENTSO-E’s criteria for performing CBA in addition to the

common principles and methodologies used in the necessary network studies, market analyses and

interlinked modelling methodologies. Because of this general approach which allows for the application to

different studies, not all study-specific details and requirements can be described in detail within the scope

of this document. In addition to the 4

th

CBA Guideline, study-specific complementary Implementation

Guidelines require publishing along with the respective TYNDP study, containing all relevant input data,

data sources and assumptions utilised in the CBA implementation. An overview of the required

complementary information, provided within the implementation guidelines and other documentation

within the TYNDP, is given in Section 1.3. The implementation guidelines for the respective TNYDP will

be part of the TYNDP package and will therefore also be publicly consulted on.

To ensure a full assessment of all transmission benefits, ENTSO-E applies a multi-criteria approach to

describe the indicators associated with each project. This means that some of the indicators are monetised,

whereas others are quantified in their typical physical units (i.e. tons or GWh). The set of common indicators

contained in this guideline form a complete and solid basis for project assessment across Europe, both

within the scope of the TYNDP as well as for project portfolio development in the PCI selection process.

5

As the TYNDP is a continuously evolving process, this document will be reviewed periodically, in line

with prudent planning practice and further editions of the TYNDP, or upon request (as foreseen by Article

11.13 of the Regulation).

1.2 Overview of the document

This CBA Guideline uses a modular approach to enable more efficient updates of the Guideline and to

allow stakeholders to better focus on specific content without necessarily going through the whole

document.

To enable the modular approach, the 4

th

CBA Guideline is structured into six main chapters, supported by

a number of detailed sections. Chapter 5 presents the indicator-specific information and provides a full

description of all the indicators. It describes the methodology to be used and defines the principles and the

requirements to properly assess the relevant indicator. Chapter 6 contains additional methodologies used in

the CBA assessment but is not indicator-specific. The application for the TYNDP is further supported with

supplemental implementation guidelines that will be provided separately.

Chapter 1 introduces the Guideline and provides a context to the indicators that have been developed for

use in CBA..

Chapter 2 discusses general approach matters. This includes, among others, a discussion regarding

scenarios and study horizons, cross-border and internal projects, reference network descriptions, and

sensitivities.

A detailed description of the overall assessment, including the modelling assumptions and indicator

structure, is given in Chapter 3. A general overview of the indicators is given in Section 3.3. This set of

common indicators forms a complete and solid basis for project assessment across Europe, both within the

scope of the TYNDP and for project portfolio development in the PCI selection process.

5

Chapter 4 concludes and provides a summary of the aim of the 4

th

CBA Guideline.

5

It should be noted that the TYNDP does not select PCI projects. Regulation (EU) 2022/869 (art 4.5) states that ‘each Group shall determine its

assessment method on the basis of the aggregated contribution to the criteria […] this assessment shall lead to a ranking of projects for internal

use of the Group. Neither the regional list nor the Union list shall contain any ranking, nor shall the ranking be used for any subsequent purpose.’

The benefit indicators, costs description and residual impacts are described in detail in Chapter 5. In Chapter

6, the details of the main concepts of the methodologies that are not indicator-specific are explained.

1.3 CBA Implementation Guideline and other complementary

documents

As the CBA Guideline is a general guidance document for the assessment of projects, it would be

impractical to include detailed methodologies, parameters or specific assumptions for the calculation of

each indicator were in this document. Therefore, the CBA Guideline needs to be complemented by

additional detailed information on how the simulations are to be performed. This additional information

requires publishing within the respective TYNDP study and shall specify which method is to be used in

the event the CBA Guideline allows for more than one possibility, as well as how to interpret the rules

defined in the CBA Guideline.

For the CBA phase of the TYNDP process, Implementation Guidelines will be prepared that contain all of

the necessary details required to calculate the indicators, considering the modelling possibilities and

assumptions that can be applied in the relevant TYNDP. Together with the Scenario Report (where all the

scenario-specific details not defined in the 4

th

CBA Guideline are given) and the Implementation Guideline,

the CBA Guideline provides an exhaustive guidance on how to perform the project specific assessment

within the TYNDP process. The Implementation Guidelines is considered a part of the TYNDP package,

and will therefore be publicly consulted on, together with the rest of the package, every other year.

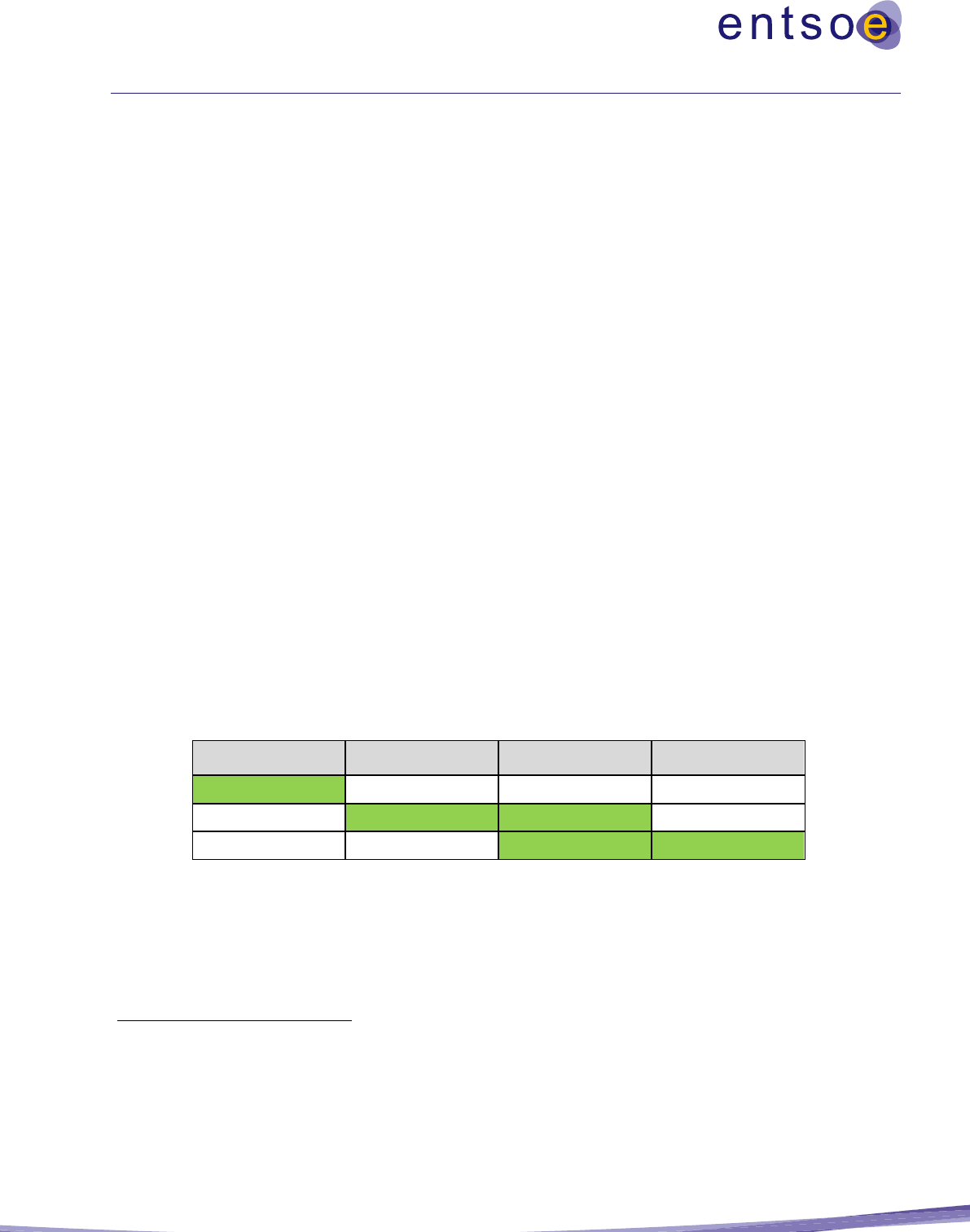

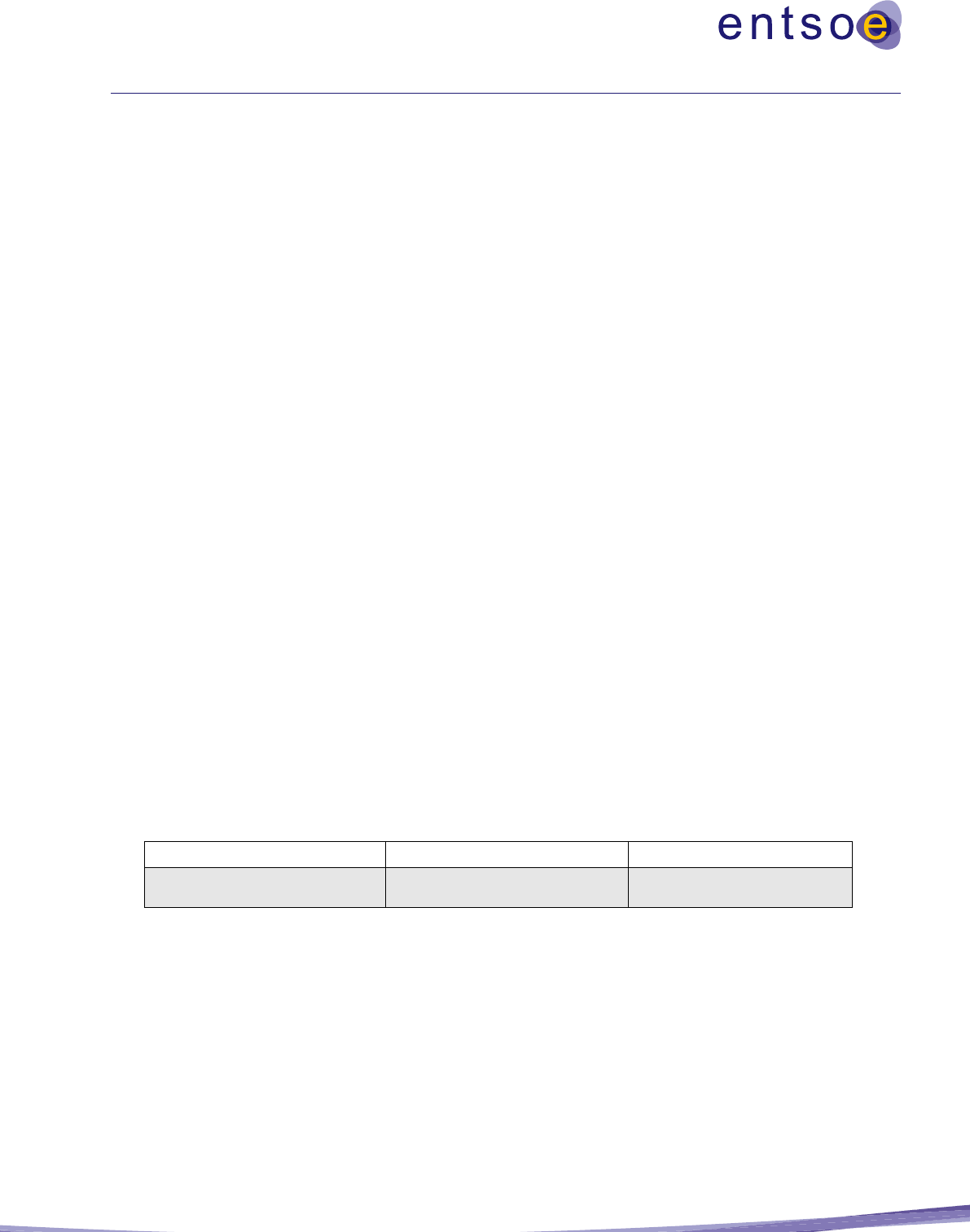

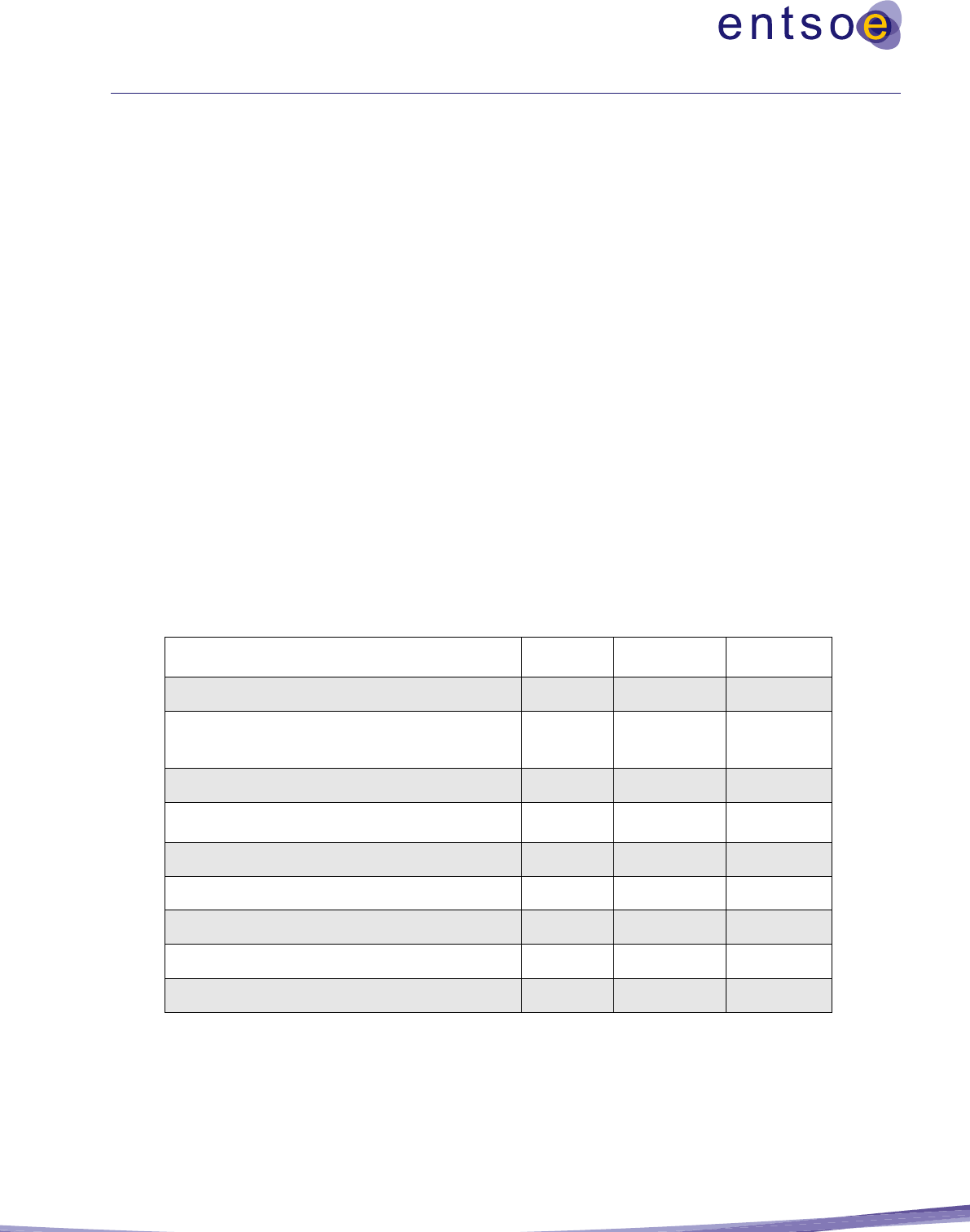

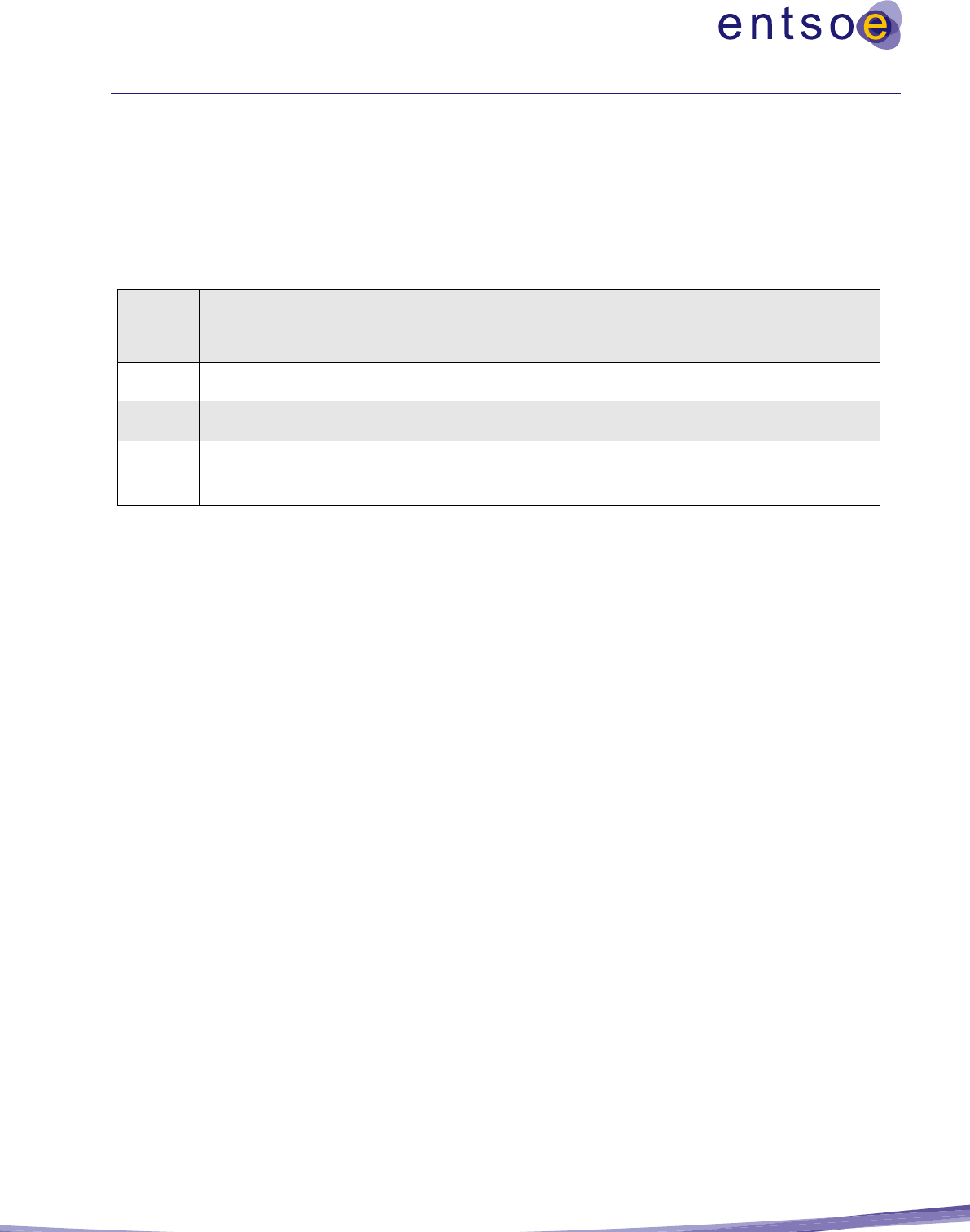

Table 1 contains a summary of details for certain indicators to be defined in complementary documents,

which focus on the TYNDP process. If applied to other studies, these details must also be given within the

respective study.

Table 1: Summary of indicators for which complementary documents are to be defined.

Defined in:

Indicator or rule

Information required to be provided

Implementation Guidelines

Transfer capability calculation

Power shift method to be applied (generation shift and/or load shift; how to scale the generation units or loads in the system when

applying the power shift).

Selection of contingencies and critical branches.

Details of internal GTC calculation.

Impacts of third-countries

Method to remove the effects of non-European countries from the pan-European results and overview of the general perimeter used for

the simulations and CBA evaluation.

Assessment of commissioning years

Detailed explanation of the methodology and definition of needed parameters; the outcome of this assessment has to be given in the

project sheets

Market simulations

Value of hurdle cost to be used.

Number of climate years to be used.

Sectors to be included in the simulations

Network simulations

Mapping the market results to the network model (nodal level)

Load-flow method to be applied with explanation (whether AC or DC)

Sensitivities

The applied sensitivities together with an overview of the assessment framework that are being applied (e.g. climate years, scenarios

etc.)

List of projects to which the respective sensitivities are being applied

Motivation with explanation on the choice of the respective sensitivities

Transfer Capability Calculations

Steps of the NTC calculations process including for each step: input, modelling tools and output

For each project: the information whether power shift or load shift has been used.

For each project: the tool used for the calculation

For each project: information on whether year-round calculations or PiT have been used

Information on the usage of TRM and TTC

Percentile value used as a threshold

Geographical scope

An overview of the geographical scope on which the costs and benefits are applied needs to be given, e.g. how costs and benefits in

non-EU MS are being considered and in- or excluded from the final results.

B1. Socioeconomic Welfare

Method for reporting the part of SEW from fuel savings due to the integration of RES (SEW–RES) and the avoided CO

2

cost (SEW–

CO

2

).

In the event of redispatch simulations, a detailed description of the methodology used

For each project: the methodology used to assess each project

B2. CO

2

Emissions

Societal cost to be used.

B3. RES Integration

How to report avoided RES spillage (dump energy) from the market simulation results.

B4. Non-direct greenhouse Emission

List of emission types and factors per generation category.

Implementation Guidelines

B5. Variation in Grid Losses

Monetisation of losses on HVDCs between different market nodes.

Assumption to apply for the compensation of partial double counting with SEW.

Number of climate years to be used.

Information regarding whether points in time were used and the specific points in time used.

B6. SoS: Adequacy to Meet Demand

Method for introducing peaking units in TOOT cases.

Definition of which sanity check method is to be used.

Details of the treatment of strategic reserves

Details of Monte-Carlo approach.

Value of VOLL and CONE.

B7.1 SoS – System Flexibility Benefit

Description of the methodology of how the qualitative indicators are defined

B8.1

Detailed motivations and a clear descriptions of the chosen system splits, together with the formula and all relevant parameters for the

RoCoF calculation

B8.2. Black start services

6

Definition of the necessary assumptions

Project Costs

Definition of the costs delivered within the project sheets.

CAPEX

Table of standard costs

OPEX

Definition of a yearly percentage of CAPEX for non-mature investments

Investment value calculation

The assessment period and real discount rate could be confirmed or updated with respect to what is indicated in the CBA Guideline

Sanity check for hybrid and radial

projects assessment

Detailed methodology on how to apply the sanity check

Definition of what RES includes

To be applied for the calculation of B3 and the RES penetration ET3

Project Sheets

The content of the project sheet should be defined in the Implementation Guidelines

Storage

Information on how storage projects are modelled

Documentation

of the

respective

study

Simulation tools used to perform the

assessment

List of tools used for Market, Network and Redispatch simulations.

For each project: tool(s) used to perform the calculation

Transfer Capability Calculations

Links to the databases used in the calculations

Database

Description of the main databases used for the CBA assessment

Reference

network

Specific document on the reference grid

and Implementation Guidelines

Definition of the reference grid together with a justification for the chosen reference grid/s.

List of all projects within the reference grid

Treatment of interdependent projects

6

Or given by the project promoters

20

2 General approach

The general approach used to assess projects considers the following:

• The range of future energy scenarios and study horizons;

• Internal and cross-border considerations;

• The modelling framework to be used in undertaking the analysis;

• The identification of a reference network used to assess the impact of the reinforcement against;

• The use of multi-case analysis to simplify analysis; and

• The approach to sensitivity studies.

These are discussed in detail below.

2.1 Scenarios

Regulation (EU) 2022/869 states that ENTSO-E is required to use scenarios as the basis for the TYNDP

and for the calculation of the CBA used to determine EU funding for electricity and gas infrastructure PCI

and PMI. Consequently, ENTSO-E, together with ENTSOG, design scenarios specifically for this purpose

every two years.

The scenarios are a description of plausible futures that can be characterised by: a generation portfolio; a

demand forecast and power exchange patterns between the study region and other power systems. They

provide the framework which the future is likely to occur within, but do not attach a probability of

occurrence to them. The scenarios represent a means of addressing future uncertainties and the interactions

between those uncertainties. Some TYNDP scenarios have a stronger national focus than others; some are

‘top-down’ whereas others are ‘bottom-up’. There is no right or wrong, likely or unlikely option; all

scenarios have to be treated equally and, because of the uncertainties of the future energy sector, no scenario

can be defined as a ‘leading scenario’.

The objective of using scenario analysis is to construct sufficiently contrasting future developments that

differ enough from each other to capture a plausible range of possible futures that result in different

challenges for the grid. These different future developments can be used as input parameter sets for

subsequent simulations.

The scenarios are constructed at the level of the European electricity system and can be adapted in more

detail at a regional level. When constructed, the scenarios must reflect both European and national

legislation that is in force at the time of the analysis and its effect on the development of these elements.

The scenarios are, when possible, derived from official EU and Member-State data sources and are intended

to provide a quantitative basis for the infrastructure investment planning.

One of the key principles of the EU energy policy is the Energy Efficiency First principle. By considering

this principle in the scenarios, it is ensured that it will also be considered in products that build upon the

scenarios. The scenarios are constructed so that they align with the energy efficiency targets as they are

defined in the Energy Efficiency Directive (EU) 2018/2002 (EED). This can, for example, be observed in

21

the level of energy demand. The scenarios aim to be in line with the final energy levels as defined in the

EED or based on the latest figures available when the scenario project freezes the data.

As mentioned above, scenarios can be built as ‘bottom-up’, which means that the scenario is built based on

the National Energy and Climate Plans (NECP) from MS. According to the (EU) regulation 2018/1999,

MS are required to establish a ten-year integrated NECP for 2021–2030, outlining how it intends to

contribute, inter alia, to the 2030 target for energy efficiency. The EED states that MS should consider the

Energy Efficiency First principle for all sectors and technologies defined and should be a part of the NECP.

Consequently, the Energy Efficiency First principle is implemented via a bottom-up approach.

For the top-down scenarios, the Energy Efficiency First principle is applied on the final energy levels

according to the current regulations and these are applied by selecting the most efficient technology and

energy carrier according to the storyline. Moreover, by implementing flexibility options such as DSR, V2G,

storages and batteries within the scenario models, the energy reduction will be further helped.

Detailed information on the joint ENTSOG and ENTSO-E scenarios can be found in the respective scenario

reports.

7

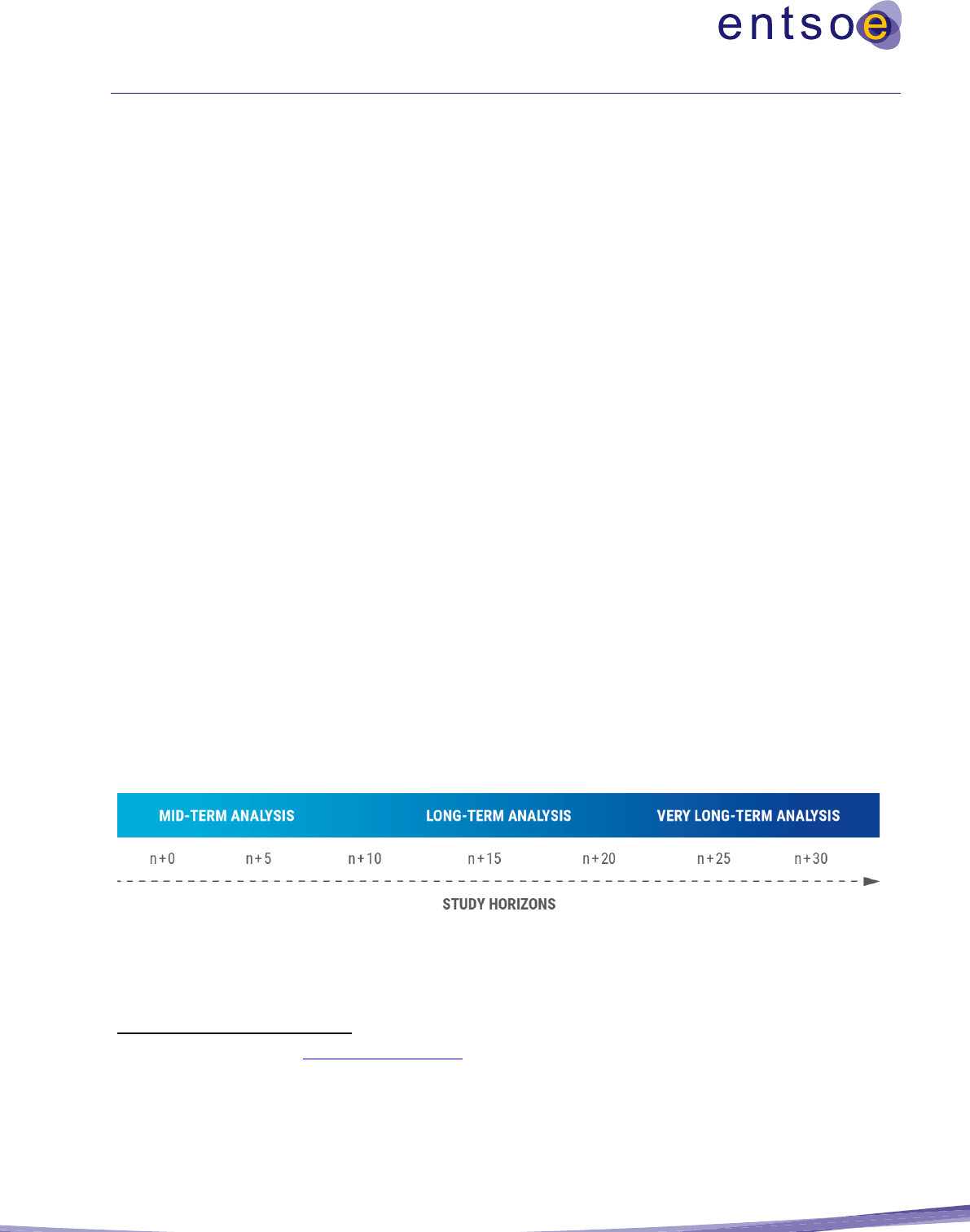

2.2 Study horizons

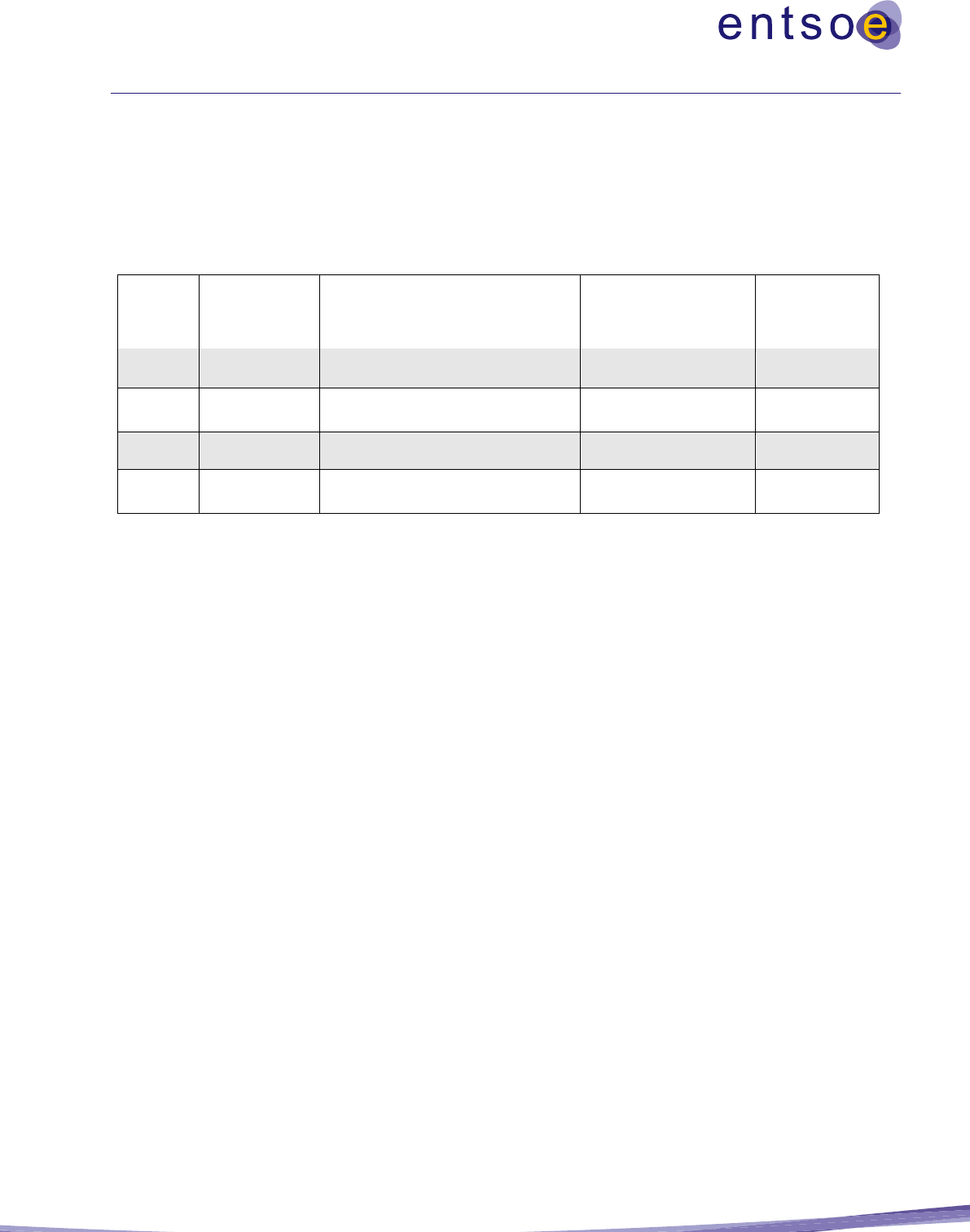

Scenarios can be distinguished depending on the time horizon, as illustrated in

Figure 2, and can be described as follows:

• Mid-term horizon (typically 5 to 10 years): mid-term analyses should be based on a forecast for

this time horizon;

• Long-term horizon (typically 10 to 20 years): long-term analyses will be systematically assessed

and should be based on common ENTSO-E scenarios.

• Very long-term horizon (typically 30 to 40 years). Analysis or qualitative considerations could be

based on the ENTSO-E 2050-reports; and

• Horizons which are not covered by separate data sets will be described through interpolation or

extrapolation techniques.

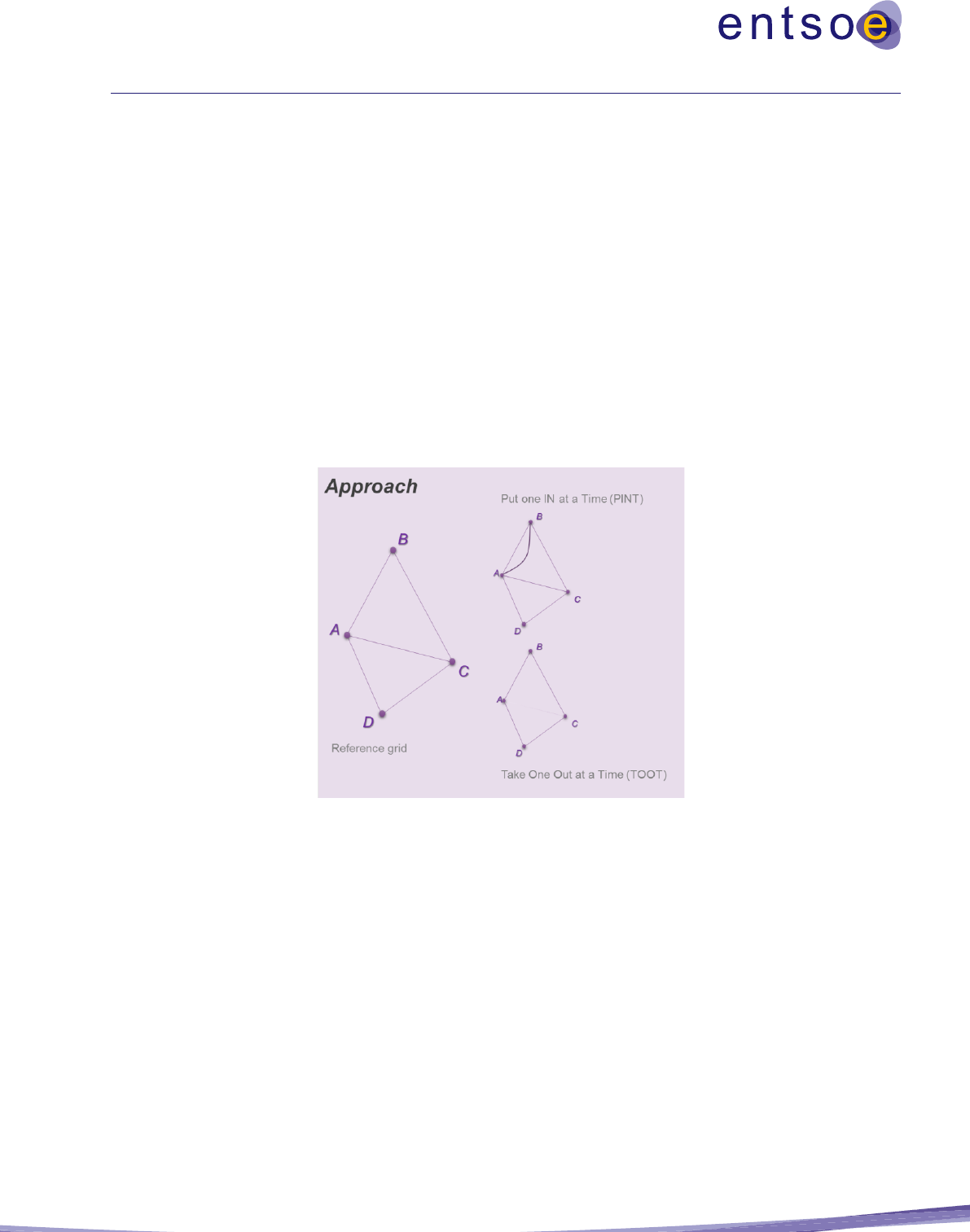

Figure 2: Continuous timeline with future study years and corresponding study horizons

8

.

As shown in

7

Link to the latest scenario report: TYNDP 2022 Scenario Report

8

There is no strict definition of the beginning and end of the horizons, and an overlap might appear, indicated by the gradual colour gradients

used in the figure.

22

Figure 2, the scenarios developed for the long-term perspective may be used as a bridge between the mid-

term horizon and the very long-term horizon (i.e. n+20 to n+40). The aim of the perspectives beyond n+20

should be that the pathway realised in the future should fall within the range described by the scenarios

with a reasonable level of likelihood.

The scenarios on which to conduct the assessment of the projects will be given for fixed years and rounded

to full five years (e.g. 2025 instead of 2023 for n+5 in TYNDP 2018). For the mid-term horizon, the

scenarios must be representative of at least two study years. For example, for the TYNDP 2020, the study

years of the mid-term horizon are 2025 (n+5) and 2030 (n+10).

2.3 Cross-border versus internal projects

Assessing projects using only the impact on the transfer capacities across certain international borders can

lead to an underestimation of the project-specific benefits as most projects also show significant positive

benefits that cannot be covered by only increasing the capacities of a certain border. This effect is the

strongest for, but not limited to, internal projects.

Internal projects do not necessarily have a significant impact on cross-border capacities, which makes it

difficult to assess them using market simulations that consider only one node per country without a flow-

based model.

Both internal and cross-border projects can be classified as having pan-European relevance. However, they

all develop grid transfer capability (GTC) over a certain boundary, which may, or may not, be an

international border (and sometimes several boundaries).

Depending on the types of project, a suitable method should be used. At this point, it is recognised that

there is no unified method available that can address the specific aspects of all these projects adequately.

Therefore, three alternative methods are given for the calculation of the benefits:

• Market simulations;

• Network simulations; and

• Combined market and network simulations, i.e. redispatch simulations

Both market and network simulations provide different types of information; they generally complement

one another so they are frequently used in an iterative manner. These methods are discussed in detail in the

following chapter.

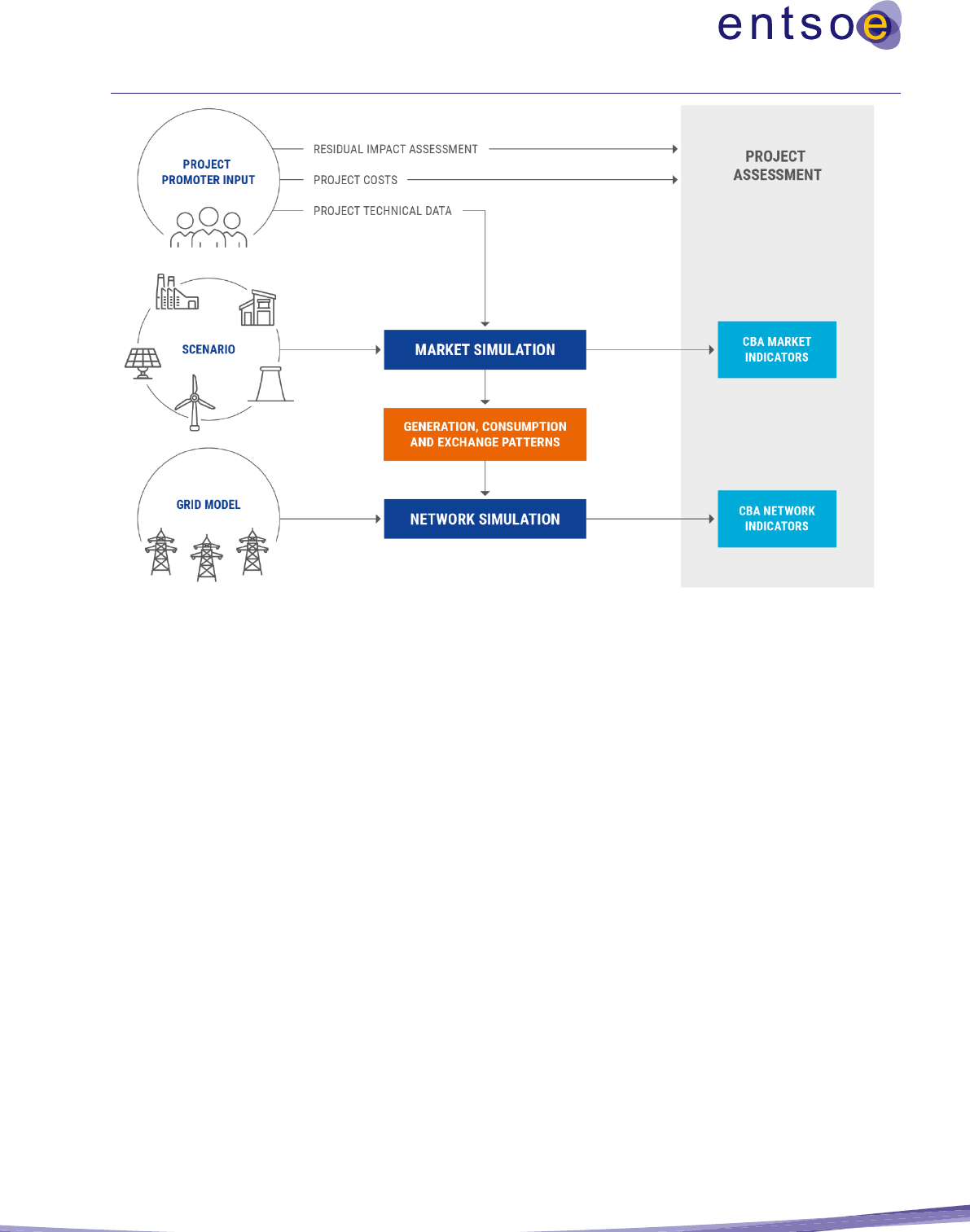

2.4 Modelling framework

As the indicators described in Chapter 5 generally rely on different principles, they also need to be achieved

under the use of different models. An overview of these models, i.e. Market simulations, Network

simulations and Redispatch simulations, is given in this section.

It should be noted that most of the indicators can be achieved using more than one of the described models;

this information will be given in an overview table at the end of the respective indicator.

23

2.4.1 Multi-sectorial market simulations

In general, energy markets can be organised by exchanges. These entities collect, for a certain commodity,

buy and sell orders from consumers and producers. The orders are stacked in the form of demand and supply

curves. Under uniform price auction schemes, the markets are cleared by matching demand and supply

curves to obtain market clearing prices for the corresponding commodities. Market models are able to

capture these principles and are essential for the project assessment. By running market simulations, they

are applied to reflect realistic market outcomes.

Interlinked (sector) models or integrated multi-energy system (MES) models capture energy market

transactions and interactions with different sectors. In this regard, sectors correspond to energy carriers for

which corresponding markets for energy trading exist. MES models could contain energy carriers such as

electricity, hydrogen, methane, heat, biomass, coal etc. Components that couple markets across space are

transport infrastructures, e.g. power transmission lines and pipelines, whereas components, e.g.

electrolysers and hydrogen gas turbines, introduce a sectorial market coupling.

Projects that introduce mutual influences across sectors can undergo a multi-sector or multi-system CBA

assessment. This guideline pursues a general approach to performing multi-sector CBA assessments.

Without any limitation, any sector and/ or multiple sectors can be included. Sectors either represent energy

carriers or end-use sectors associated with energy carriers comprising transport, industry or building sectors.

Details on the sector inclusion will be drafted in the respective TYNDP Implementation Guidelines.

2.4.2 Power market simulations

Power market simulations incorporate solely the electricity sector. They can be considered a special case

of multi-sectorial market simulations. Interactions with other sectors can be modelled exogenously. Power

market simulations are used to calculate the cost-optimal dispatch of generation units. This is done under

the constraint that the demand for electricity is fulfilled, considering demand-side response (DSR), in each

bidding area and in every modelled time step.

9

In addition to the dispatch of generation and demand (if

modelled endogenously), power market simulations also compute the market exchanges between bidding

areas and corresponding marginal costs for every time step.

The simulations consider several constraints, such as:

• The flexibility and availability of thermal generating units;

• Hydrologic conditions impacting hydro generating units;

• Wind and solar generation profiles;

• Load profiles; and

• The occurrence of outages.

Power market simulations are used to determine the benefits of providing additional capacity, enabling

more efficient use of the generation units available in the different locations across the bidding areas. They

facilitate the measurement of savings in generation costs as a result of the investments in grid projects. The

9

Typically, market simulations apply a one-hour time step, which is in accordance with the time step used in most electricity wholesale markets.

However, this CBA Guideline is independent from the chosen time step.

24

results of power market simulations, therefore, enable the computations of some of the indicators specified

in this guideline.

The output of the power market simulations, i.e. the defined generation, consumption and power flowing

across the transmission grid, is subsequently used as an input to the network simulations.

Different options represent the transmission network in market models, namely:

• Net transfer capacity (NTC)-based market simulations

Bidding areas are represented as a network of interconnected nodes, connected by a transport

capacity that is available for market exchanges using a simplified NTC model of the physical grid.

These NTC values represent an approximation of the potential for market exchanges using the

physical (direct or indirect

10

) interconnections that exist between each pair of bidding areas. Thus,

the market studies analyse the cost-optimal generation pattern for every time step under the

assumption of perfect competition.

• Flow-based simulations

Flow-based market simulations combine market and network studies. They consider the inter-

relation between the power-flow obtained from network simulations and the corresponding

potential for market exchanges. Flow-based market simulations consider the relationships between

each potential market exchange and their corresponding utilisation of the physical grid capacities

(cross-border as well as internal grid). Flow-based market simulations, therefore, use a

representation of physical grid capacities to define the market exchange constraints rather than a

set of independent NTC values.

2.4.3 Power network simulations

Power network simulations utilise models that represent the power transmission network in a high level of

detail. They are used to calculate the power flowing on the power transmission network for a given

generation–load–market exchange condition. Power network simulations enable the identification of

bottlenecks in the grid corresponding to the power-flows resulting from the market exchanges.

The results of the power network simulations allow the computation of some of the indicators contained in

this Guideline.

2.4.4 Redispatch simulations

Redispatch simulations compute the costs of alleviating constraints on the transmission network, identified

by network simulations taken from market simulations, by adjusting the initial dispatch of generation. This

is done while observing the same power plant-specific constraints that are applied to the market simulations,

such as the minimum up- and down-times, ramp rates, must-run obligations, variable costs, etc. Redispatch

10

In general, the market flow is different from the corresponding physical flow, as getting the trading capacities e.g., ring flows, do not need to

be considered. The important information is the trading capacity between two markets.

25

simulations can, therefore, be considered a combination of both network and market simulations delivering

the same indicators as the latter.

Redispatch simulations assist in the computation of indicators contained in this Guideline. They particularly

relate to the evaluation of projects using the initial generation dispatch from NTC-based market simulations

as a starting point.

More details on how to perform redispatch calculations are provided in Section 6.3 Redispatch simulations

for project assessment.

2.4.5 Multi-case analysis

System planning simulations are conducted using the results of market simulations as an input. The network

simulations produce load flow calculations for each time step for which the market simulations produce

their results, typically hourly.

To simplify the volume of network calculations, network simulations may group results from several time

steps into one planning case. This can only be done if the hours that are grouped together are sufficiently

similar regarding the generation dispatch, load dispatch and market exchange within the area under

consideration. These results for each planning case are then considered as representative for all the time

steps linked to it.

It is crucial that the choice of planning cases and the time steps they represent are adequate, i.e. that the

planning cases selected out of the available cases for each time step adequately represent the year-round

effect. The process of obtaining a representative set of planning cases depends greatly on the combination

of dispatch, load, exchange profiles, and especially on the availability profiles for variable RES.

2.5 Reference network

The reference network is the version of the network used to calculate the incremental contribution of the

projects being assessed, and is used as the starting point for the computation. The reference network is

therefore constituted of the already existing grid, and the projects that have a strong probability of being

implemented by the dates considered in the scenarios.

To determine the incremental contribution of each project, market and network simulations are performed

where the project is either included, or removed, from the reference grid (see section 3.2.2.). The results

are then compared with the market and network simulations of the reference grid alone. The incremental

benefits would be the difference between the two results, and these are reflected in the indicators contained

in this Guideline.

The selection of the projects that comprise the reference network directly impact the calculation of the

indicators. Consequently, a clear explanation of which projects are considered in the reference network is

required. This should also include an explanation of the initial state of the grid (i.e. the existing grid as

defined in the year of the study). The Reference network shall be made available and accessible to the

public.

26

Proof of maturity

A project should only be included in the reference grid when its capacity is available in the year for which

a simulation is performed. Hence, only those projects whose timely commissioning is reasonably certain

are to be included in the reference network. This can be assessed by considering the development status of

the project and including the most mature projects that either:

a) Are in the construction phase; or

b) Have successfully completed the environmental impact assessments; or

c) Are in ‘permitting’ or ‘planned, but not yet permitting’, and their timely realisation is most likely

(e.g. when the project is supported by country-specific legal requirements or the permitting and

construction phase can be assumed to be short, such as for transformers, phase shifters etc.). This

requirement can be strengthened by applying further criteria, such as:

• The project is considered in the National Development Plan of the country where it is

expected to be located;

• The project fulfils the legal requirements as stated in the specific national framework where

the project is expected to be located;

• The project has a defined position with respect to the Final Investment Decision related to

its implementation;

• There is a documented reference to the request for permits;

• A clearly defined system need, to which a project contributes, could help to identify the

reference grid; and

• Year of commissioning: chosen depending on the year of the study and the scenario horizon

used to perform the study.

In general, it is reasonable to define different reference grids for different time horizons. Although the above

given maturity criteria can be applied for all time horizons, the reference grid for the first study year of the

mid-term horizon has to be based on the criteria given under a) and b). Based on this, the reference grid for

the second year of the mid-term horizon and the long-term horizon can be defined by including projects

following the criteria as given under c).

In cases where a cross-border project involves countries with different permitting processes and procedures,

it would be advisable to use expert evidence-based judgement.

For interdependent projects it may be the case that, based on its respective realisation, one (or more) of the

interdependent projects is (are) included in the reference grid although the project(s) it depends on is (are)

not. In that case, the standard assessment methodology as described in section 3.2.2 cannot be applied and

case-specific applications as also described in the same section need to be applied.

Whatever criteria have been chosen, the proof of maturity, and for interdependent projects additional

concrete information on its treatment, needs to be given in the respective study specific Implementation

Guidelines. It should also be mentioned that smaller projects (e.g. line upgrades) will most likely need less

time to run through the approval process. This has to be considered when defining the reference grid.

27

Ultimately, the reference grid should assume the most probable and realistic grid for the respective time

horizon.

Commissioning dates

In addition to the above discussed maturity criteria, the assessment date of the projects also has to be

considered when defining the reference grid. For this purpose, it can be assumed that only projects with

commissioning dates equal to or earlier than the respective time horizon the reference grid is defined for

can become part of the reference grid. As the development of new infrastructure projects is a complex

process which might be subject to delays based on several factors, the commissioning dates have to be

assessed after the project submission to the respective study. This assessment should not only be applied to

possible reference grid candidates (before the reference grid definition) but also to all projects submitted to

the CBA assessment. The results of the assessment of commissioning dates have to be used as follows:

a) For all projects falling under the category of reference grid candidates, the commissioning dates

need to be agreed between the national TSOs and respective National Regulatory Authorities

(NRAs). For this agreement, the result of the assessment of commissioning dates has to be used as

additional source of discussion together with the information published in the actual network

development plans and/or additional direct agreements between TSOs and NRAs.

b) For all projects submitted to the CBA assessment, the result of the assessment of commissioning

dates has to be published within the study-specific project sheets as additional information giving

an indication of whether the displayed commissioning date submitted by the project promoters

appears realistic. There will be no approval of the commissioning dates or any project rejection

based on this assessment. It should be seen as additional information and, in the event of

discrepancies, as input for further discussions.

The detailed methodology and definition of parameters for the assessment of commissioning dates has to

be given within the study specific Implementation Guidelines and should result in the definition of concrete

commissioning dates based on the following principles:

• The starting point for the definition of the commissioning date has to be the year of the respective

study

• The time t for the duration until projects submitted to the study will be commissioned can be

calculated as:

Where:

o t

pre-perm

is the assumed mean standard time of all projects for entering the permission period;

o t

perm

is the assumed mean standard time for the permitting process;

o t

const

is the assumed mean standard time for the construction phase;

o f

1

is a standard factor indicating the complexity of the project with respect to its technology

(AC or DC);

28

o f

2

is a standard factor indicating the complexity of the project with respect to its setup:

whether it is an overhead line, cable, substation etc;

o f

3

is a standard factor indicating the complexity of the project with respect to whether it is

an on- or offshore project;

o f

4

is a standard factor indicating the complexity of the project with respect to whether it is

a completely new project or an update; and

o f

5

is a standard factor indicating the complexity of the project with respect to the

environmental and social impacts of the project (see sections 5.13, 5.14 and 5.15).

The duration times t

x

are to be defined dependent on the respective project status (e.g. for projects

in the construction phase t

pre-perm

and t

perm

are to be set to zero) and have to consider the length of

the projects (e.g. the construction time is assumed to take longer for a long project compared to a

short project).

• The result of the assessment of the commissioning date can then be calculated by adding the

duration time t to the year of the respective study.

2.6 Sensitivities

Given the uncertainties when defining possible future scenarios, for each CBA study, sensitivity analysis

should be conducted to increase the validity of the CBA results.

Sensitivity analysis can be performed to observe how the variation of parameters, either one parameter or

a set of interlinked parameters, affects the model results. This provides a deeper understanding of the

system’s behaviour with respect to the chosen parameter or interlinked parameters. It has to be noted that

interdependencies between the below listed sensitivities can occur, e.g. the variation in CO

2

costs will in

general also have an impact on the installed generation units. However, as a robust investigation on these

interdependencies can become very complex, this goes beyond the single treatment of sensitivities as

addition to the CBA assessment and can instead be treated within specific studies. The aim of a sensitivity

analysis is not to define complete new sets of scenarios but quick insights in the system behaviour with

respect to single (few) changes in specific parameters.

In general, a sensitivity analysis must be performed on a uniform level, i.e. the sensitivity needs to be

applied to all projects under assessment in the respective study. However, in some cases the added value of

the sensitivity might be given only for specific projects. In such cases it is, together with a sufficient

argumentation within the study specific Implementation Guidelines, reasonable to apply the respective

sensitivity only to the relevant projects. In principle, each individual model parameter can be used for a

sensitivity analysis to obtain the desired information. Furthermore, different parameters can have a different

impact on the results depending on the scenario; therefore, it is recommended to perform detailed scenario-

specific studies to determine the most impacting parameters rather than just picking them. For this

purpose, detailed information explaining the criteria and methodologies used to select the parameters

to conduct the respective sensitivity analysis must be given within the study-specific Implementation

Guidelines.

29

Based on the experience of previous TYNDPs, the parameters listed below can be used to perform

sensitivity studies. This list is not exhaustive and provides some examples of useful sensitivities within the

boundaries of the scenario storylines, together with a short overview of the expected actions necessary to

perform the respective sensitivity analysis.

• Fuel and CO

2

-Price

A global set of values for fuel prices is defined as part of the scenario development process. A

degree of uncertainty regarding these values and prices is unavoidable. Fuel and CO

2

-prices

determine the specific costs of conventional power plants and, thus, the merit order. Therefore,

varying fuel and CO

2

-prices impact the merit order, which in turn have an impact on the related

indicators required to be reported on as part of this guideline.

New market simulations using the changed prices followed by network simulations have to be

performed to properly evaluate this sensitivity.

• Long-term societal cost of CO

2

emissions

The cost of CO

2

included in the generation costs may understate (or overstate) the full long-term

societal value of avoiding CO

2.

Therefore, a sensitivity study could be performed in which the cost

of CO

2

is valued at a long-term societal price. To perform this sensitivity without introducing a risk

of double-counting with the generation cost indicator, the following process is advised:

a) Derive the delta volume of CO

2

;

b) Consider the CO

2

price internalised in the generation cost indicator; and

c) Adopt a long-term societal price of CO

2

.

By multiplying the volume arising from (a) by the difference in prices described by (b) and (c), the

monetisation of the sensitivity of an increased value of CO

2

can be calculated.

For this sensitivity, there is no adjustment in the merit order or the dispatch for the generation cost

indicator for the higher carbon price and it can be applied as ex post calculation.

• Climate year

Using historical climate data from different years might influence the benefits of a project. For

example, the indicator RES-integration depends on the infeed of RES and weather conditions. For

this reason, performing an analysis with different climate years would lead to a deeper

understanding of how market results depend on weather conditions. This can be used to understand

how the indicators are impacted by climatic conditions.

For each climate year, new market simulations followed by network simulations have to be

performed to properly evaluate this sensitivity.

30

• Load

Regarding the development of load, two opposed drivers can be identified. On the one hand, energy

efficiency will lead to decreasing load, but on the other hand, an increasing number of applications

will be electrified (e.g. e-mobility, heat pumps, etc.), which will lead to an increase in load.

Technology phase-out/phase-in

Due to external circumstances, a phase-out/phase-in of a specific technology (e.g. nuclear or lignite)

could occur and lead to a transition of the whole energy system within a member state. Such

developments cannot be foreseen and are not considered within the scenario framework and can,

therefore, be treated within sensitivity studies.

New market simulations using the changed load profiles followed by network simulations have to

be performed to properly evaluate this sensitivity.

• Must-run

If thermal power plants provide electrical power and heat, then thermal power ‘must-run’ boundary

conditions are used in market simulations, i.e. these power plants cannot be shut down and have to

operate in specific time frames, and at a minimum level, to ensure heat production. By assuming

different must-run conditions for conventional power plants, market results will differ.

New market simulations using the changed must-run profiles, followed by network simulations,

have to be performed to properly evaluate this sensitivity.

• Installed generation capacity (including storage and RES)

The volume of installed generation capacity is defined within the scenarios. However, it may be,

as past political discussions and decisions have shown, that changes to single generation categories

such as coal or nuclear phase out can have an impact on the possible future scenarios also at

relatively short notice. Furthermore, amendments to the national or EU-wide RES goals could lead

to dominant impacts on the results of the CBA assessment. For this sensitivity, it is crucial to not

overdo the changes in the generation portfolio, and it is advised to only change one generation

category for each sensitivity – more fundamental changes would instead lead to the definition of

new scenarios. If the changes in generation capacity would lead to unrealistic high or low adequacy

levels, additional single measures could be applied carefully to reach reasonable adequacy levels

in the respective sensitivity.

Sensitivity studies in which the installed RES capacity is varied could be performed to assess the

impact of a delay or an advancement of RES capacity delivery on the indicators contained in this

Guideline.

New market simulations using the changed capacities, followed by network simulations, have to be

performed to properly evaluate this sensitivity.

31

• Flexibility of demand and generation

This sensitivity needs to be clearly demarcated from B7 flexibility indicator, as here it is not the

general system flexibility that is of interest. Flexibility in the context of this sensitivity must be

understood as the change in possible flexible generation dispatch dependent on pre-defined demand

and vice versa. This sensitivity could include the change in the behaviour of DSR or how

electrolysers are modelled.

New market simulations using the changed DSR and electrolyser modelling followed by network

simulations have to be performed to properly evaluate this sensitivity.

• Availability of storage

The volume of installed storage capacity is defined for each scenario, and its variation as sensitivity

is described under ‘Installed generation capacity’. Sensitivity studies in which the availability of

storage is varied could be performed to assess the impact of uncertainties to any future change of

storage technologies, such as increased efficiency for batteries. It must be noted that a change in

the availability of hydro storage needs to be discussed, together with the ‘climate year’ sensitivity.

New market simulations using the changed availabilities, followed by network simulations, have to

be performed to properly evaluate this sensitivity.

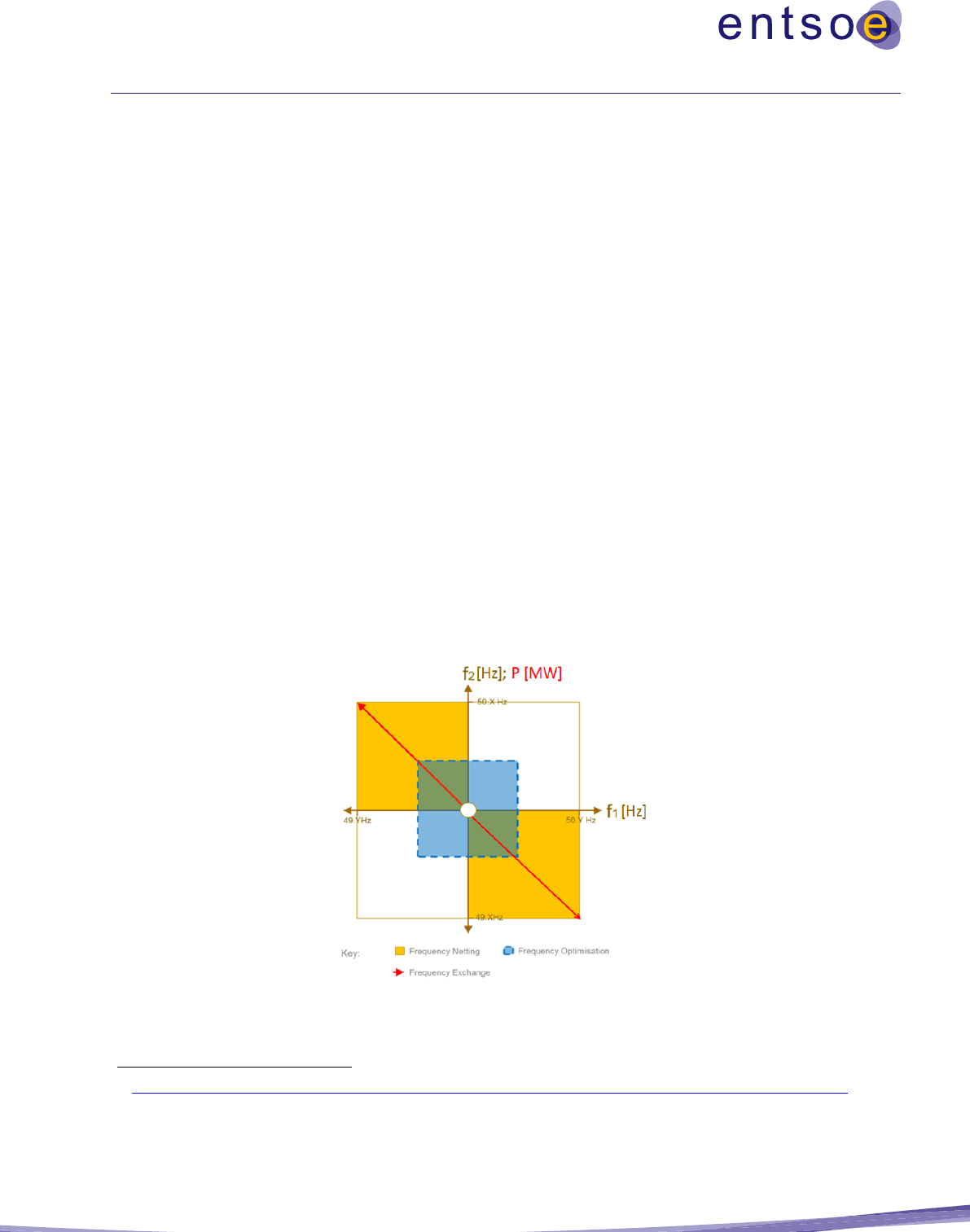

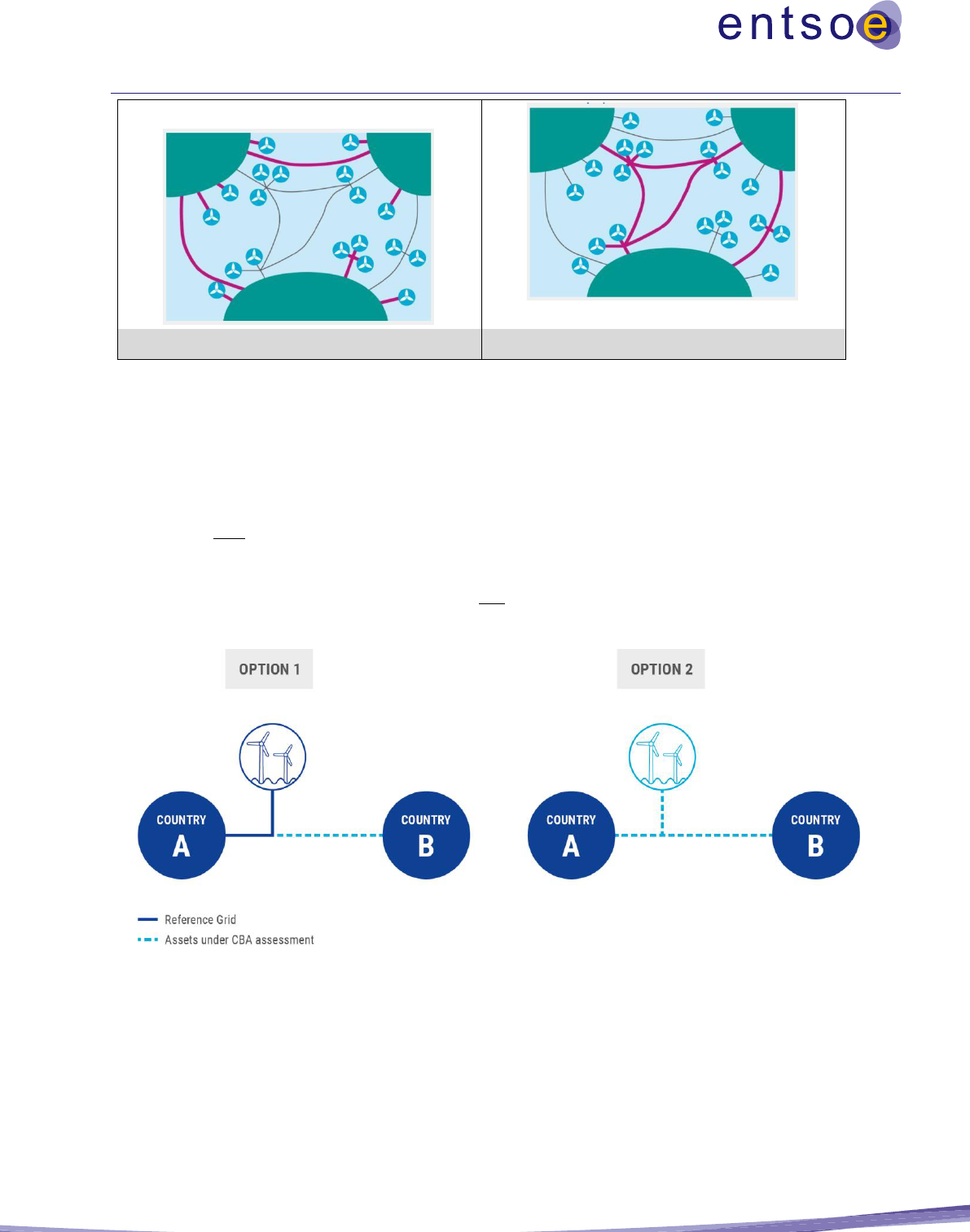

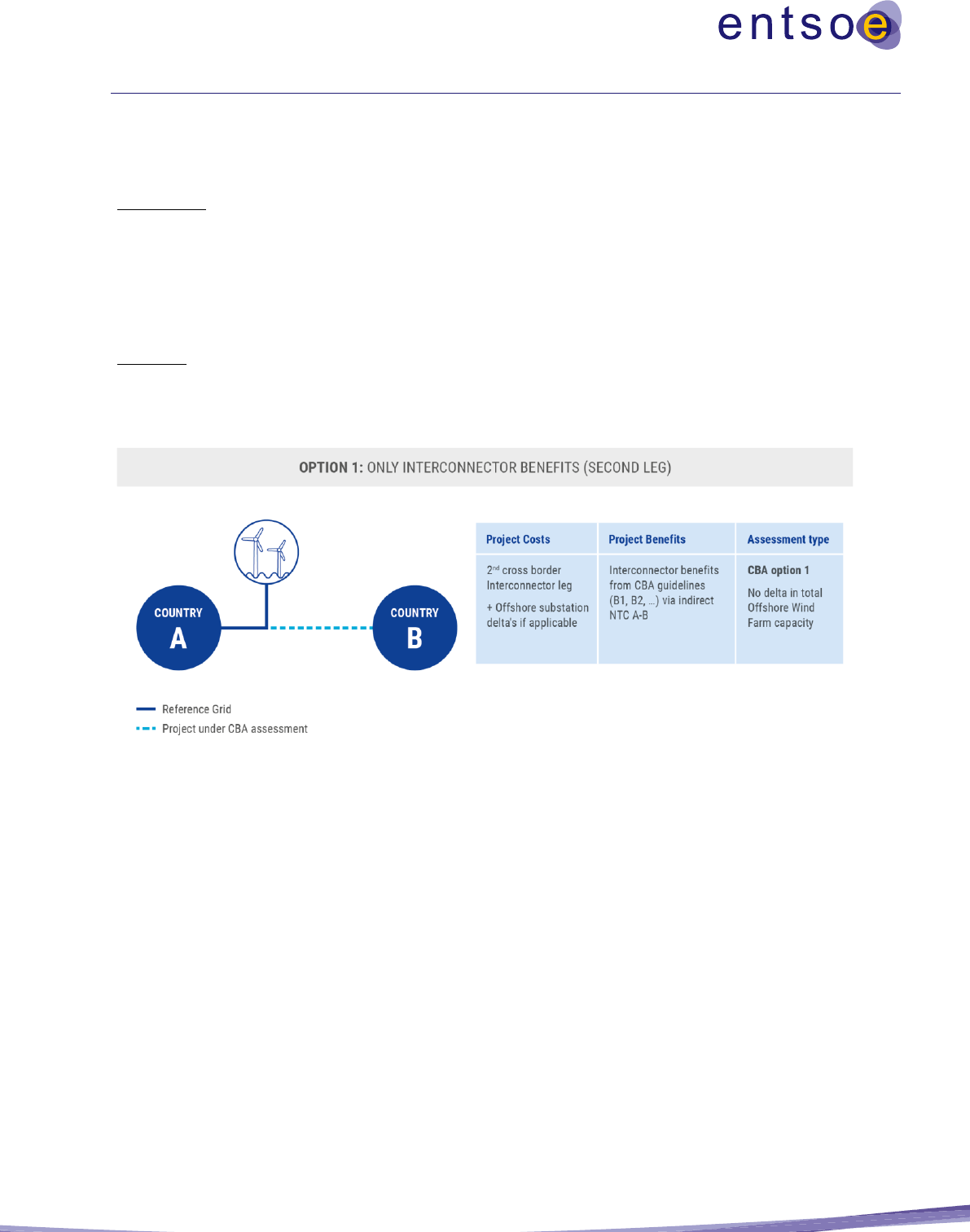

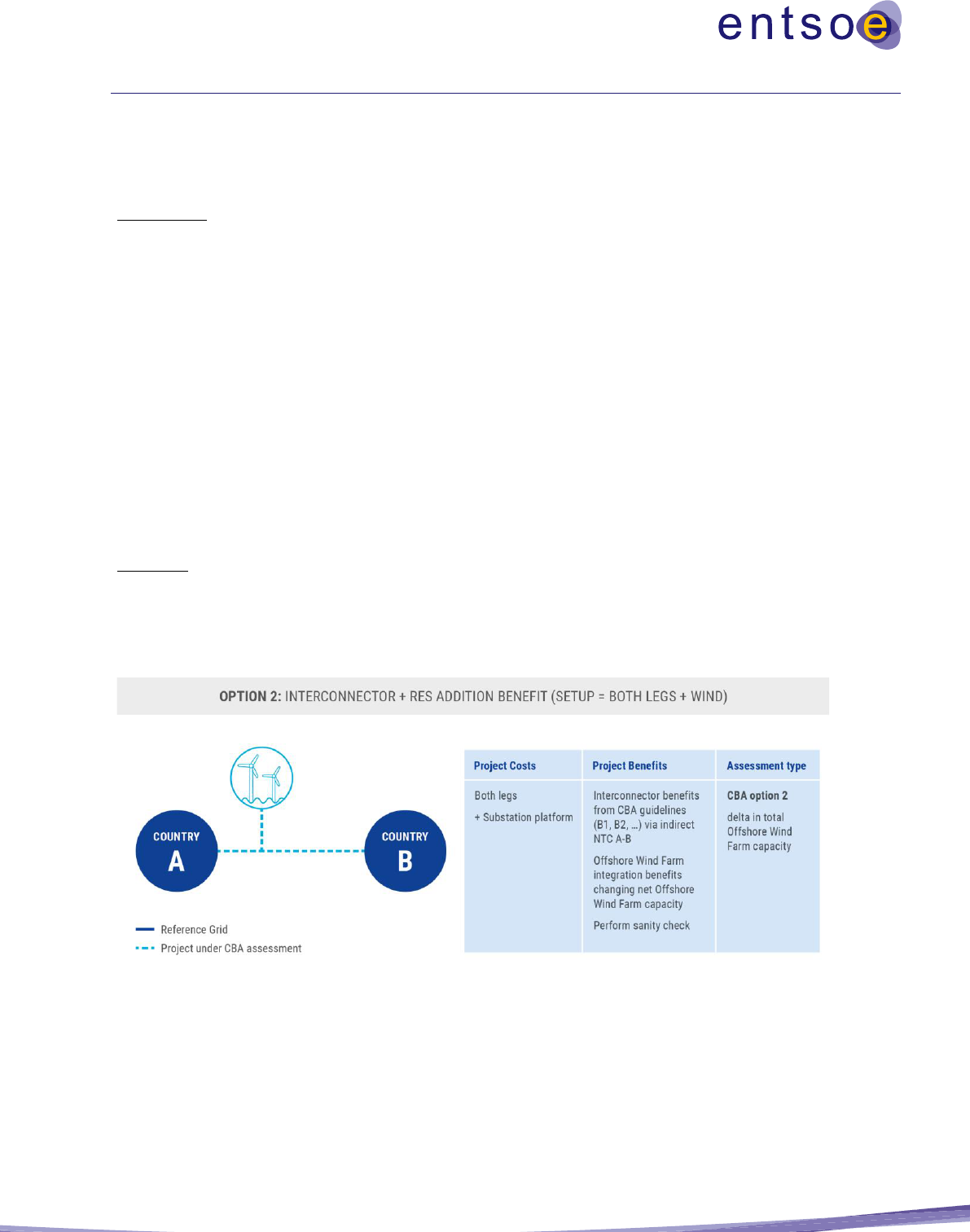

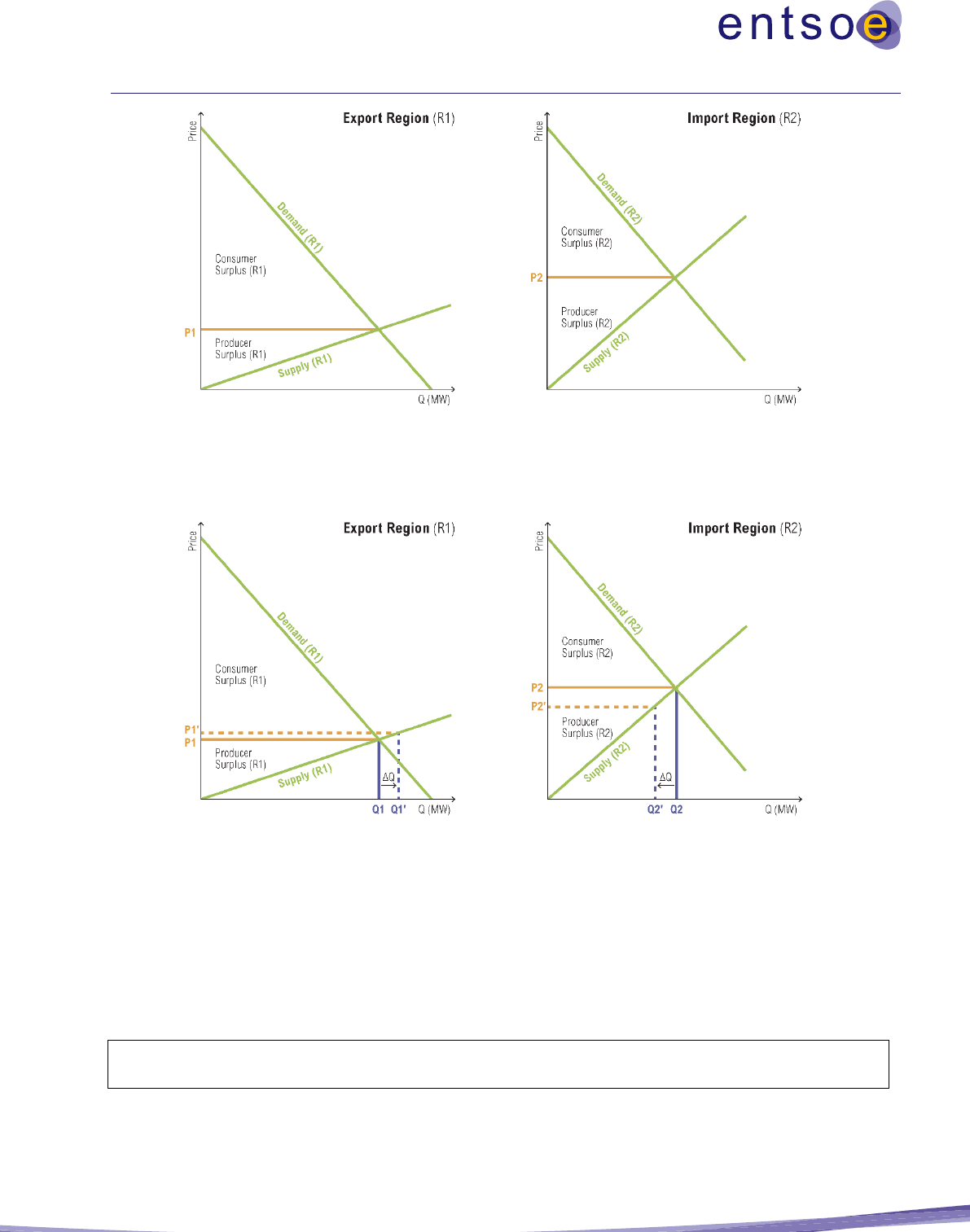

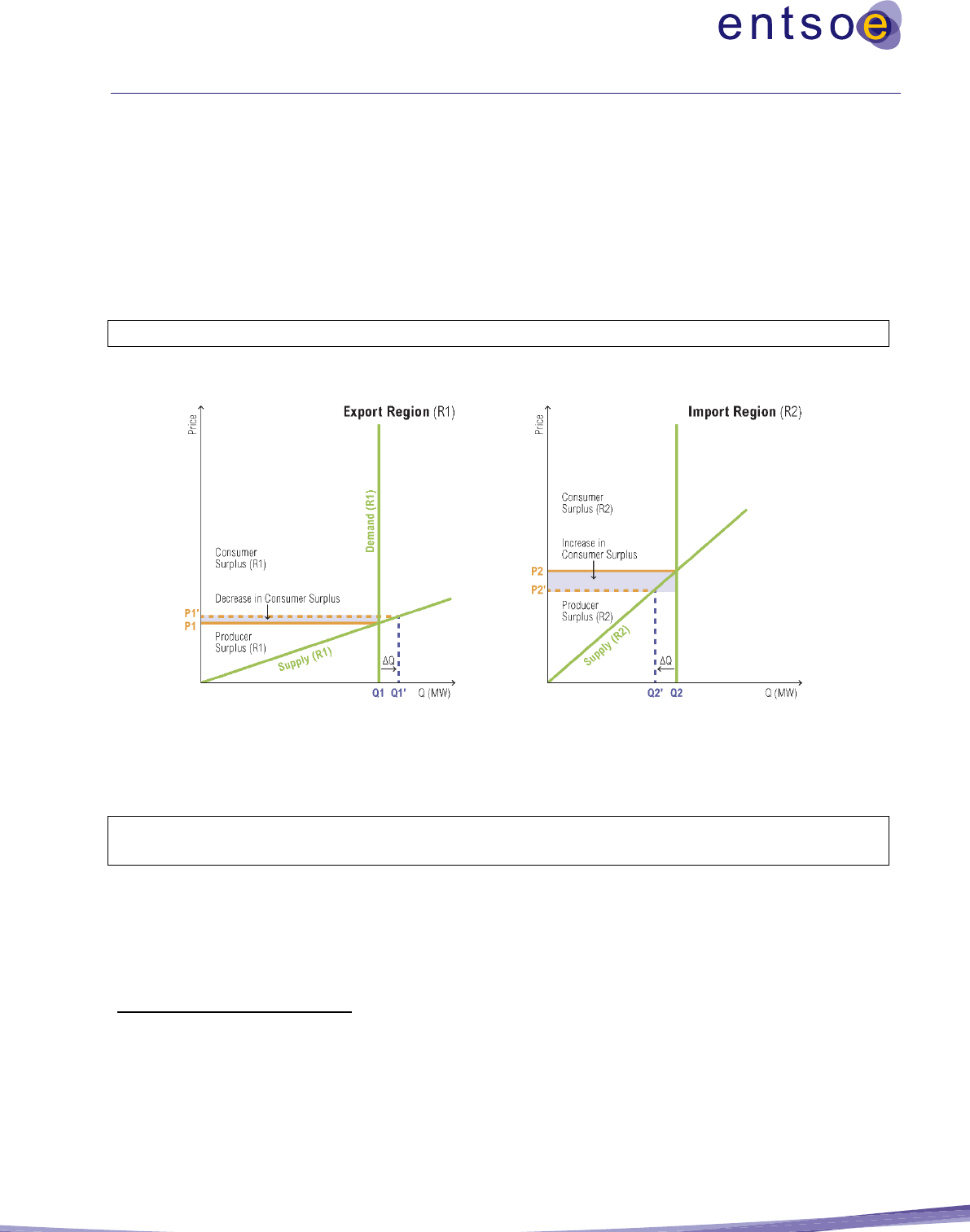

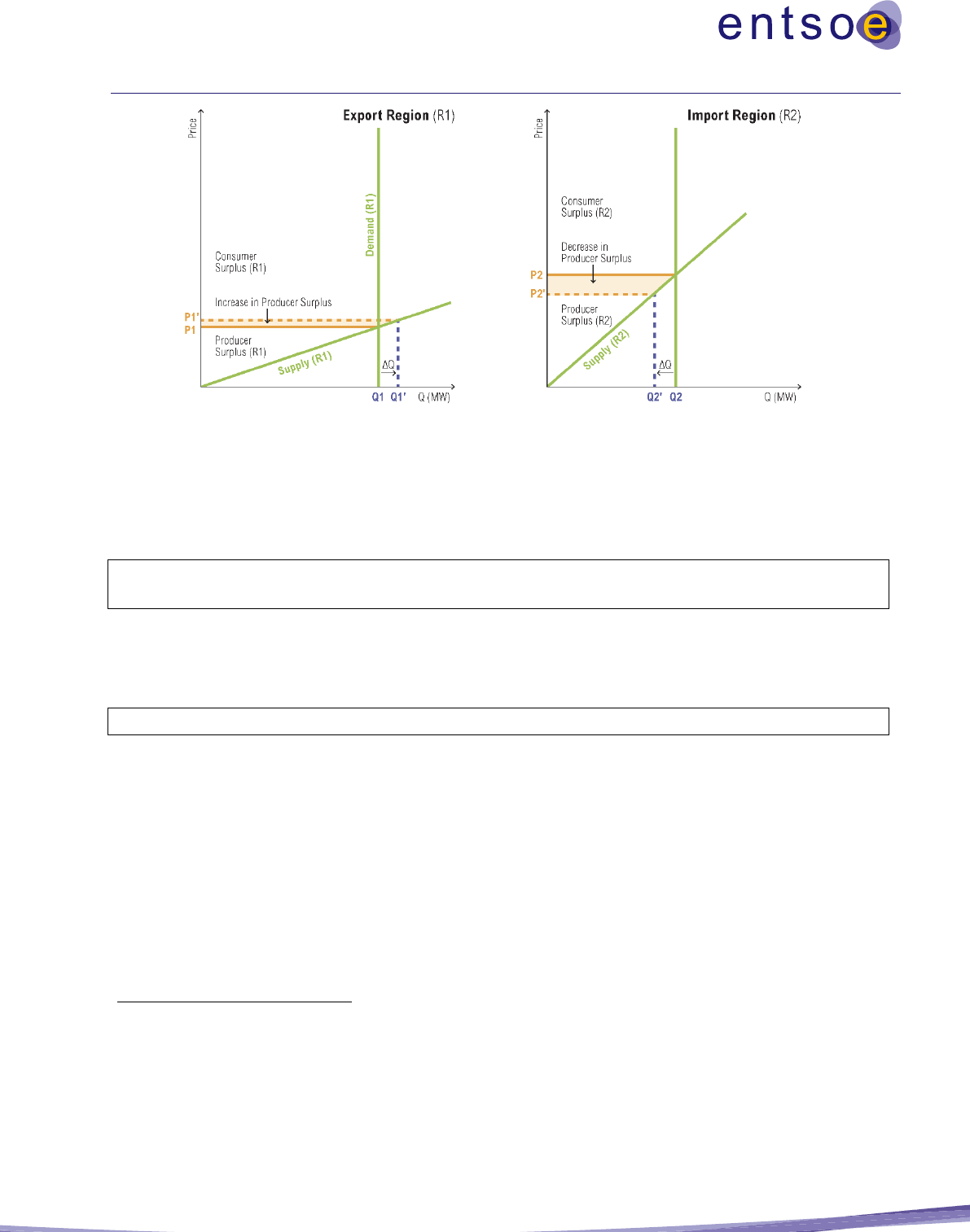

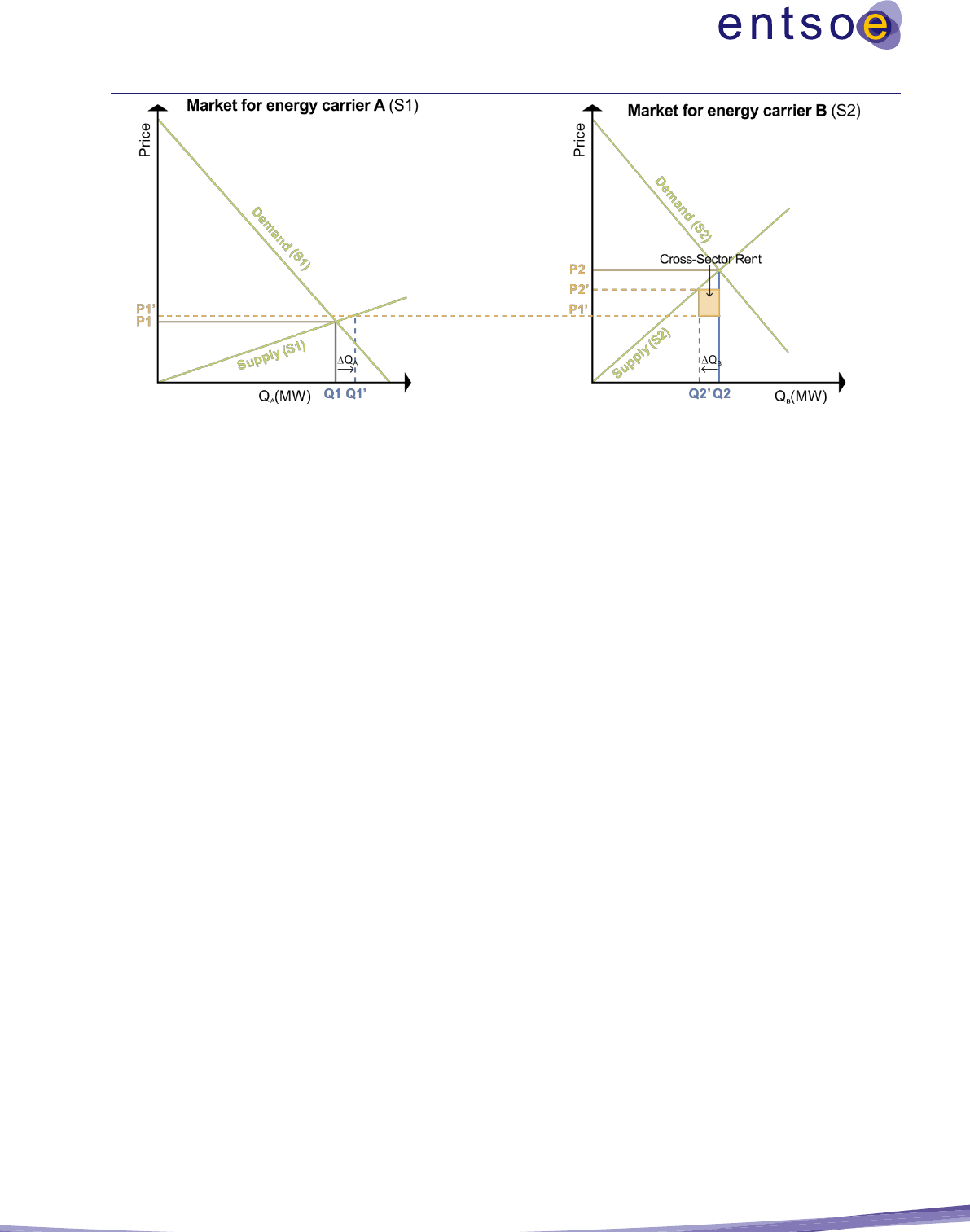

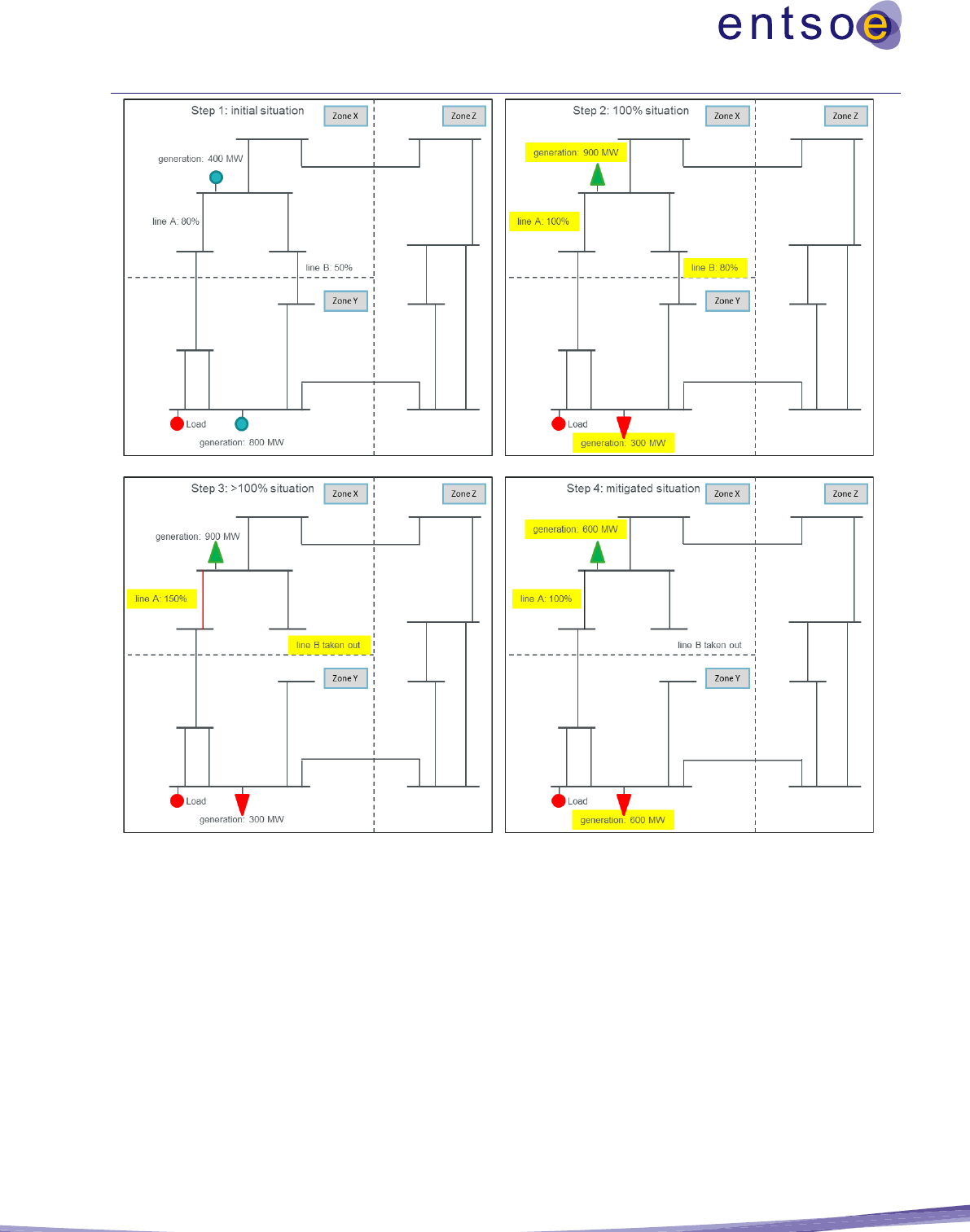

• The commissioning date of various projects