Page 1 of 55

PUBLIC

RECOMMENDATION No 02/2023

OF THE EUROPEAN UNION AGENCY

FOR THE COOPERATION OF ENERGY REGULATORS

of 22 June 2023

on good practices for the treatment of the investment requests,

including Cross Border Cost Allocation requests,

for Projects of Common Interest

THE EUROPEAN UNION AGENCY FOR THE COOPERATION OF ENERGY

REGULATORS,

Having regard to Regulation (EU) 2019/942 of the European Parliament and of the Council of

5 June 2019 establishing a European Union Agency for the Cooperation of Energy Regulators

(ACER), and, in particular, Article 6(2) thereof,

Having regard to Regulation (EU) 2022/869 of the European Parliament and of the Council on

guidelines for trans-European energy infrastructure, and in particular, Article 16(11).

Having regard to the favourable opinion of the Board of Regulators of 16 June 2023, delivered

pursuant to Article 22(5) of Regulation (EU) 2019/942,

Whereas:

(1) Regulation (EU) 2022/869 of the European Parliament and of the Council of 30 May 2022

on guidelines for trans-European energy infrastructure (hereinafter also ‘TEN-E

Regulation’)

1

, provides for the identification of projects of common interest (hereinafter

also ‘PCIs’) and of projects of mutual interest (hereinafter also ‘PMIs’), which are

necessary to implement priority corridors and areas covering electricity transmission,

smart electricity grids, smart gas grids, hydrogen, electrolysers and carbon dioxide

2

.

1

OJ L 152, 3.6.2022, p. 45–102.

2

Article 1(2)(a) of Regulation (EU) No 2022/869.

PUBLIC

Recommendation No 02/2023

Page 2 of 55

(2) A net negative impact

3

affecting at least one country hosting

4

a PCI/PMI constitutes a

potential barrier to its development. As each PCI has an overall net positive impact at EU

level, it should generally be possible to provide compensation to eliminate the country-

specific net negative impact. Where possible, a harmonised approach should be applied

in order to identify the TSO or the project promoter which should provide such

compensation and those which should receive it.

(3) Regulation (EU) 2022/869 facilitates investments in PCIs/PMIs by envisaging decisions

by National Regulatory Authorities (hereinafter also ‘NRAs’) or by the European Union

Agency for the Cooperation of Energy Regulators (hereinafter ‘the Agency’) on the

allocation of the costs of such projects across borders if project promoters

5

submit an

investment request, including a request for a cross-border cost allocation (hereinafter also

‘CBCA’).

(4) In deciding on CBCA, NRAs should allocate efficiently incurred investment costs across

borders and include them in the national tariffs, and, afterwards, if relevant, determine

whether their impact on national tariffs could represent a disproportionate burden for

consumers in their respective Member States

6

.

(5) As soon as such a PCI or PMI has reached sufficient maturity and is estimated to be ready

to start the construction phase within the next 36 months, the project promoters, after

having consulted the TSOs from the Member States which are assessed as potentially

having a significant net positive impact from it, shall submit an investment request,

including a request for CBCA. That investment request could include a request proposal

for a cross-border cost allocation and shall be submitted to all the NRAs concerned.

(6) Article 16(4) of Regulation (EU) 2022/869 specifies the features of the investment

request to be submitted by project promoters. It requires that an investment request is

accompanied by a project specific cost benefit analysis (hereinafter also ‘CBA’)

consistent with the single sector methodologies drawn up pursuant to Article 11 of the

same Regulation. However, Article 16(4) does not specify the level of detail of the

information to be submitted by project promoters. A clarification of the details to be

submitted is essential to facilitate a consistent approach among project promoters and

NRAs for a given PCI or PMI. This should at the same time enable the submission of

complete investment requests of adequate quality and facilitate the minimisation of

delays.

(7) There is a time gap between the initial assessment of the positive impact of a project as

PCI/PMI and when the investment request is submitted. Within this period, the level of

3

See Section 2.4 this Recommendation about the term “net impact” and its calculation.

4

For the purpose of this Recommendation, “hosting country” is a country where the project is territorially located.

5

The term “project promoters” in this Recommendation applies also to the cases of PCIs/PMIs with one project

promoter.

6

Recital (47) of Regulation (EU) 2022/869.

PUBLIC

Recommendation No 02/2023

Page 3 of 55

maturity of the project as well as various elements of the assessment framework have the

potential to undergo modifications, which could consequently affect the costs and

benefits associated with the project.

(8) Because of the importance of the cross-border cost allocation process for advancing

infrastructure projects of EU-wide relevance, identification of good practices for NRAs

is of utmost importance to facilitate a proper treatment of the investment requests.

Experience with decisions on investment requests showed that the identification of

expected costs and expected benefits (and of robust scenarios for which benefits are

calculated) proved to be complex over the last years.

(9) In particular, concerning the assumptions underlying the project benefits, their

assessment is based on scenarios which depict potential paths that energy demand and

supply may take in the future. These scenarios are not predictions and, as such, the

societal and financial consequences of a project's implementation will always carry a

level of uncertainty. Additionally, different scenarios may even lead to opposite outcomes

when evaluating the project's cost-benefit analysis.

(10) The latest Agency’s Monitoring Report on CBCAs

7

reveals that, since 2013, there have

been 45 decisions regarding CBCAs, covering over 40% of the eligible current PCIs

(electricity and gas) and an approximate total investment cost of 16.5 billion euro. Given

the expansion of the CBCA instrument to include also new project categories and the

growing integration of the energy system across Europe, the importance of CBCAs is

expected to increase in the future. The Agency’s monitoring report also shows that the

majority of CBCA decisions taken since 2013 foresee that the hosting countries will bear

the costs of the projects based on the “territorial principle”

8

while less than 30% of

decisions deviate from this “traditional principle” and set cross-border payments.

(11) In this context, the Agency already issued its Recommendation No 07/2013 regarding the

cross-border cost allocation requests submitted in the framework of the first Union list of

electricity and gas PCIs. It revised the document in its Recommendation No 05/2015 in

the light of the experience gained with the assessment of the investment requests for the

PCIs included in the first Union list and the related decision

9

. The current

Recommendation, pursuant to Article 16(11) of Regulation (EU) 2022/869 and as

foreseen in the Agency’s Single Programming Document 2023-2025

10

, builds upon the

previous Agency’s recommendations, the results of the extensive public consultation, the

7

https://www.acer.europa.eu/Official_documents/Acts_of_the_Agency/Publication/2020-09_4th-ACER-

CBCA-report.pdf

8

I.e. without any cross-border financial contributions involved.

9

As summarised in the accompanying summary report “Experience with Cross-Border Cost Allocation,

September 2015” and forthcoming reports [https://www.acer.europa.eu/gas/infrastructure/ten-e/cross-border-

cost-allocation]

10

European Union Agency for the Cooperation of Energy Regulators Single Programming Document 2023-2025

p. 61-62; ACER_Programming_Document_2023-2025.pdf (europa.eu)

PUBLIC

Recommendation No 02/2023

Page 4 of 55

past experience with CBCA decisions as well as taking into account the new legal

provisions,

HAS ADOPTED THIS RECOMMENDATION:

PUBLIC

Recommendation No 02/2023

Page 5 of 55

1. INTRODUCTION AND SCOPE OF THIS RECOMMENDATION

Article 16 of Regulation (EU) 2022/869 applies to Projects of Common Interest and Projects

of Mutual Interest falling under the energy infrastructure categories of electricity

infrastructures

11

, hydrogen infrastructures

12

and smart gas grid infrastructures

13

, as long as

these projects fall under the competence of National Regulatory Authorities.

The Agency Recommendation No 05/2015, which was originally published on 18 December

2015, has been revisited in line with the provisions stated in Regulation (EU) 2022/869.

The aim of this Recommendation is to define good practices for the preparation, submission

and treatment of investment requests. This Recommendation is composed of a set of general

guidelines and good practices which can be applied to any infrastructure category, plus specific

section for specific project categories where adequate maturity of the current methodologies

and regulatory practices already exist.

For this reason, this Recommendation is addressed to project promoters submitting an

investment request, which includes a request for cross-border cost allocation, as well as to

National Regulatory Authorities seeking agreement on such requests.

This Recommendation does not apply to investment requests already submitted by project

promoters to NRAs before the date of its publication.

This Recommendation will be regularly updated in accordance with Article 16(11) of

Regulation (EU) 2022/869 and in light of the experiences gained with the future CBCAs.

11

Cf. Annex II (1)(a)-(f) of Regulation (EU) 2022/869.

12

Cf. Annex II (3) of Regulation (EU) 2022/869.

13

Cf. Annex II (2) of Regulation (EU) 2022/869.

PUBLIC

Recommendation No 02/2023

Page 6 of 55

2. ON THE PREPARATION AND SUBMISSION OF AN INVESTMENT REQUEST

This section covers the main elements to be considered when preparing an investment request

(and potentially a CBCA proposal). It provides indications to project promoters on how to

submit an investment request to the concerned NRAs, as well as on the information to be

included as part of the submitted investment request.

Identification of the subject of the investment request

As part of the submitted investment request, project promoters should clearly identify which

are the PCIs/PMIs and the related investment items

14

subject of the investment request. Project

promoters should also indicate the PCI/PMI identification code the project(s) refers to.

In certain situations, developing a PCI/PMI may have a significant impact for other PCIs/PMIs,

i.e. in case of complementary or competing projects.

Projects may be considered complementary if the aggregated benefits of a joint development

of the relevant PCIs/PMIs are higher than the sum of projects’ benefits estimated on a stand-

alone basis for each project.

Project promoters should always aim at identifying significant complementarities between

projects, discuss them with the relevant TSOs and aim at preparing joint analyses. In case of

significant complementarities with other PCIs/PMIs, project promoters should submit joint

investment requests.

The clustering of complementary PCIs/PMIs as part of the assessment carried out by the

Regional Groups should be considered by project promoters.

When clustering projects, project promoters should clearly identify, quantify and explain the

significant complementarities/dependencies of each project with the rest of the cluster. Where

the project cluster differs from the cluster published in the latest available Union list of

PCIs/PMIs, project promoters should include in the investment request an evaluation of the

differences between the original cluster and the chosen one, including a justification for

diverging from the original project cluster.

14

While there are no uniform definitions in the TEN-E, an investment item can be considered as the smallest set

of assets that together can be used to transmit electrical power and that effectively add transmission infrastructure

capacity. An example of an investment in the electricity is a new circuit and the necessary terminal equipment.

PUBLIC

Recommendation No 02/2023

Page 7 of 55

Also, when applying clustering, project promoters should adhere to the following general

principles:

a) projects should only be clustered together if they contribute significantly to the

realisation of the full potential of a main project

15

;

b) if no joint investment request for all complementary PCIs/PMIs is not submitted, the

individual investment requests should include references to the other complementary

projects, and should explain the dependencies and the reasons for separate processes;

c) all concerned projects need to have reached sufficient maturity (as per Section 2.3 of

this Recommendation).

In line with the above recommendations, for hybrid and multi-purpose projects

16

across

multiple countries, project promoters are encouraged to submit a shared cost-benefit analysis

and shared investment request, to ensure that the project accurately accounts for the impacts to

all countries involved, and that all sides are aligned in their approach, definitions and scope.

It is also important to note that a CBA provided for (any) cluster of projects only is not suitable

for deciding on a cross-border cost allocation. Therefore, the CBA accompanying the

investment request for complementary projects (see Annex I) should be completed by evidence

about the benefits and the necessity of each individual project.

Competing projects

Project promoters should aim at identifying any project competing with the projects subject of

the submitted investment request.

Competing projects are projects that fully or partially address the same identified infrastructure

gap or regional infrastructure need. Projects may be considered competing if the added value

of one project is significantly reduced by the presence of the other project (e.g. if they address

15

Projects that only marginally contribute to the realization of the full potential of a main project should not be

clustered together.

16

According to ENTSO-E TYNDP 2022 System Needs Study, hybrid projects are solutions that serve dual (or

even multi-) purposes such as the connection function of offshore RES to demand centres and by interconnecting

countries or bidding zones to facilitate trade, which then enables price convergence and indirect RES connection.

Hybrid interconnection projects are mainly expected offshore and are linked to the European Offshore RES

strategy but, in theory, onshore cases could also exist. The main difference between a radial interconnection and

a hybrid project or a multi-purpose interconnection is that the grid has a dual functionality combining electricity

interconnection between two or more Member States, and transportation of offshore renewable energy, to its sites

of consumption.

PUBLIC

Recommendation No 02/2023

Page 8 of 55

the same investment need, and the realisation of both of them would result in a lower overall

net impact than implementing only one).

Competing projects should always be identified and never be clustered together.

Sufficient Maturity

As soon as the project has reached sufficient maturity, and it is estimated to be ready to start

the construction phase within the next 36 months, Article 16(4) of Regulation (EU) 2022/869

allows project promoters to submit an investment request including a request for cross border

cost allocation.

In the Agency’s view, a “sufficiently mature” project is a project fulfilling all of the following

conditions:

a) sufficient certainty about the costs assessed by the project-specific CBA;

b) good knowledge of the factors affecting expected costs and their ranges;

c) as regards investment costs, a cost uncertainty range should be identified. The

maximum investment cost should not exceed the minimum investment cost by more

than 20%. If cost uncertainty is higher, the project promoters should illustrate the

underlying uncertainty factor(s) and justify why they do not adversely affect the

maturity of the project;

d) reasonable foresight of the benefits assessed by the project-specific CBA as described

in Annex I to this Recommendation;

e) reasonable knowledge of factors affecting benefits and their ranges, also with regard to

different scenarios and sensitivity analyses;

f) permitting procedures having started in all hosting countries. Where required, the

project promoters should already have notified in writing the project(s) to all competent

authorities of the Member States hosting the project(s), pursuant to Article 10(3) of

Regulation (EU) 2022/869, and the competent authorities should have acknowledged

in writing the notifications, confirming that they consider the project(s) mature enough

to enter the permit granting process;

PUBLIC

Recommendation No 02/2023

Page 9 of 55

g) commissioning to be achieved indicatively within 60 months from the date of

submission of the investment request

17

. If the expected commissioning date is beyond

such a period, project promoters should justify the underlying reason(s).

Calculation of national net impacts

Pursuant to Annex V(7) of Regulation (EU) 2022/869, the CBA Methodology used for the

CBCA shall ensure that the Member States on which the project has net positive impacts

(beneficiaries) and those Member States on which the project has a net negative impact (cost

bearers), which may be Member States other than those on which the infrastructure is

constructed, are identified. The Agency recommends that in addition to the Member States any

other significantly net impacted country is identified.

In the Agency’s view, for the identification of net beneficiary countries and net cost-bearers

countries, the calculation of the national net impact applicable to each of the countries

18

affected by the project should consist of three steps:

a) an analysis of the costs assessed by the project-specific CBA;

b) an analysis of the benefits assessed by the project-specific CBA;

c) an analysis of other cross-border monetary flows (as listed in Annex II to this

Recommendation).

The concept of “benefits” (which potentially include negative effects) is used to measure (in

monetary terms) all advantages (or disadvantages) of a project to society or to parts of society,

such as TSOs. Some – but not necessarily all - of the economic benefits (or negative effects)

can translate into cash flows. When this is not the case, they constitute externalities.

The first two steps described above are instrumental for a system-wide CBA (where monetary

flows across countries are neglected, because they offset each other), while the third step

completes the calculation with an analysis of how the cross-border monetary flows associated

with the project affect the net impact per country. If not already included in the benefits from

17

The timeline for the expected commissioning date may change depending on the complexity of the project.

According to the data collected through the Agency’s PCI monitoring exercise, the average duration for

completing a transmission project from the start of construction to commissioning is approximately 48 months.

When duly justified, NRAs might decide to extend the 60-months limit. To ensure that the evaluated benefits and

costs do not become excessively outdated, the Agency recommends limiting such extension to a maximum of 24

months.

18

Including non-Member States.

PUBLIC

Recommendation No 02/2023

Page 10 of 55

the system-wide CBA, these cross-border monetary flows may concern revenues or payments

related to capacity bookings, to Entry-Exit tariffs including surcharges resulting from auctions

in gas (or hydrogen), to congestion rents, to the ITC mechanism in electricity, to grants and to

other charges.

A country is a net beneficiary if the present value of the net benefit is positive.

A country is a net cost-bearer if the present value of the net benefit is negative.

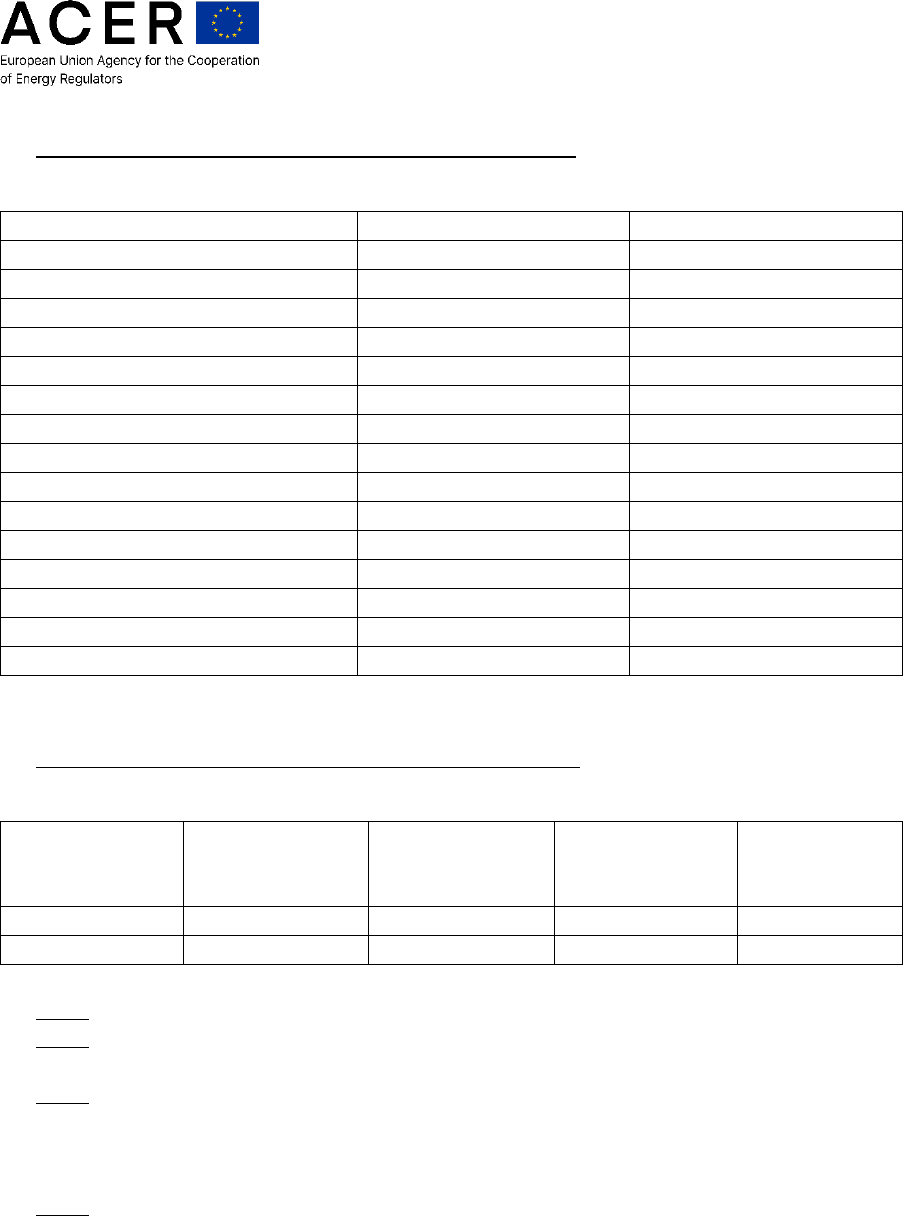

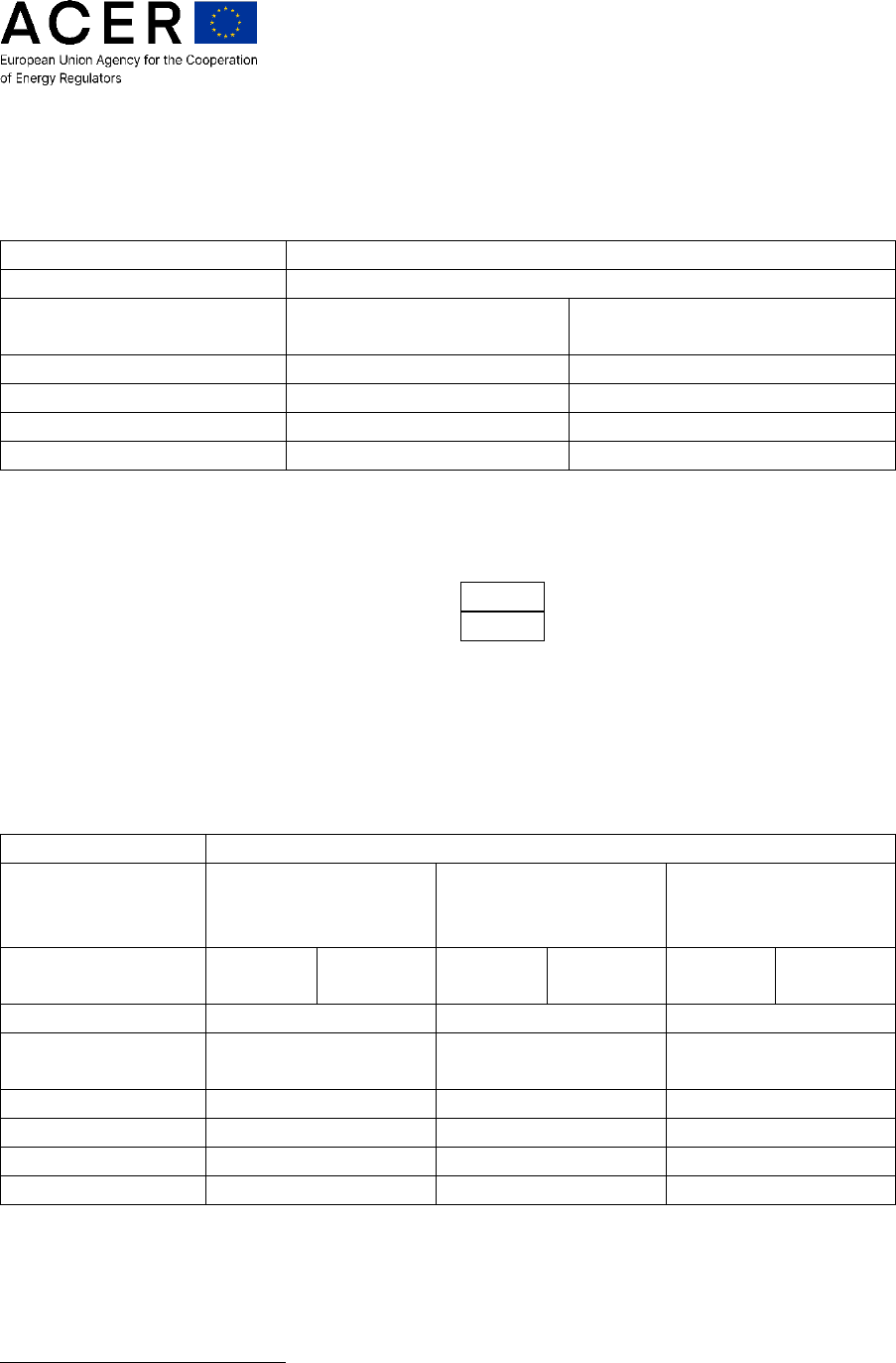

For each concerned country, the calculation of the net impacts can be described by the

following formula.

Where,

• f is the first year where costs are incurred

• c is the first full year of operation of the project (or project cluster)

• x is the years considered for the assessment time horizon (see Annex I)

• y is the year of the analysis (i.e. the year of the submission of the investment request)

• r is the discount rate used to discount benefits and costs

• B are all the benefits assessed by the project-specific CBA

• F are all the benefits assessed in the analysis of other cross-border monetary flows

• C is the sum of costs (see Annex II)

The calculation of the national net impacts should avoid double-counting the effects.

Furthermore, national monetary transfers (e.g. payments of taxes and national grants) should

not be considered, as these are offset inside the respective country. The recognition of the

financing costs is dependent on the respective national regulatory systems

19

, but they should

not be counted as affecting the net impact per country. Potential grants (i.e. not already awarded

as of the date of the submission of the investment request) are not to be counted in the net

impacts calculation, but the project promoters should inform the NRAs of any potential grant

and notify them without delay if a grant is actually awarded thereafter.

19

Financing costs until commissioning of a project may be treated as investment costs under some regulatory

systems.

PUBLIC

Recommendation No 02/2023

Page 11 of 55

The choice of the scenarios for the calculation of net impacts

According to Article 16(4)(a) of Regulation (EU) 2022/869, as part of the investment request,

project promoters shall provide an up-to-date project-specific cost-benefit analysis by

considering at least the joint scenarios established by the European Network of Transmission

System Operators for Gas (hereinafter also ‘ENTSOG’) and the European Network of

Transmission System Operators for Electricity (hereinafter also ‘ENTSO-E’) for network

development planning. Where additional scenarios are used, those shall be consistent with the

Union’s 2030 targets for energy and climate and its 2050 climate neutrality objective and be

subject to the same level of consultation and scrutiny as the scenarios jointly developed for

network development planning.

Article 12 of Regulation 2022/869 requires the Agency to publish and regularly update

framework guidelines

20

for the joint scenarios to be developed by ENTSOG and ENTSO-E.

The Framework Guidelines establish criteria for a transparent, non-discriminatory and robust

development of scenarios and criteria to ensure their compliance with the energy efficiency

first principle and with the Union’s 2030 targets for energy and climate and its 2050 climate

neutrality objective.

In this respect, the Agency recommends that any additional scenario used by project promoters

for the project-specific cost-benefit analysis follow the principles and the criteria established

in the Agency’s Scenario Framework Guidelines.

When submitting the investment request to the NRAs, project promoters should provide a

thorough explanation of the reasoning behind the choice of any additional scenario. The project

promoters should also provide clear evidence of how the additional scenarios used and the

process to develop such scenarios, are compliant with the Agency’s Scenario Framework

Guidelines. When choosing additional scenarios, project promoters are also encouraged to take

into account the relevant Agency’s Opinions on scenarios and TYNDPs

21

.

20

https://www.acer.europa.eu/sites/default/files/documents/Official_documents/Acts_of_the_Agency/Framework_

Guidelines/Framework%20Guidelines/FG_For_Joint_TYNDP_Scenarios.pdf

21

E.g. the Agency’s Opinion on TYNDP 2022 scenarios is available at this link:

https://www.acer.europa.eu/sites/default/files/documents/Official_documents/Acts_of_the_Agency/Opinions/O

pinions/ACER%20Opinion%2006-2022%20on%20draft%20TYNDP%202022%20Scenario%20Report.pdf

PUBLIC

Recommendation No 02/2023

Page 12 of 55

TSO consultation

Pursuant to Article 16(4) of Regulation (EU) 2022/869, prior to submitting an investment

request, project promoters should have duly consulted the TSOs from the Member States to

which the project provides a significant net positive impact. The assessment of the significant

net positive impact should be based on the project-specific CBA subsequently (potentially)

updated and submitted as part of the investment request. The Agency recommends that project

promoters also consult the TSO (if any) of each of the non-EU countries for which a significant

net positive impact is identified.

For the purpose of the consultation with the TSOs, the Agency recommends that all countries

above a specific significance threshold (see Section 3.9 of this Recommendation) should be

deemed as being subject to a significant net positive impact by the project. In the Agency’s

view, all TSOs of such countries (including non-Member States) should be consulted, in order

to favour adequate quality of the project-specific CBA.

In case of doubts concerning the presence of a "significant net positive impact" for a Member

State, the Agency recommends that project promoters consult also the TSOs of such a Member

State, so as to ensure that the consultation requirement established by Article 16(4) of

Regulation (EU) 2022/869 is fulfilled if the project turned out to provide a significant net

positive impact to such a Member State, as well as not to unduly hinder the decision-making

process.

The Agency recommends that the project promoters consult the TSOs of the concerned

countries to which the project provides a significant net positive impact also on the project

promoters’ CBCA proposal, if any, based on the net positive impacts identified by the project

promoters.

The consultation requirement, should be considered as fulfilled, if the consultation meets all

the following conditions:

a) the project promoters have formally informed the TSOs of the Member States to which

the project provides a significant net positive impact that they are being consulted for

an investment request under Article 16 of Regulation (EU) 2022/869;

b) the project promoters have provided the TSOs with a detailed technical description of

the project and a project-specific CBA (including scenarios used, input data and

calculations) as well as a description of other cross-border monetary flows;

c) the project promoters have allowed the TSOs a sufficient period of time to evaluate and

provide written feedback to them on the robustness and plausibility of the scenarios

used as well as on the project-specific CBA. The sufficiency of the period of time for

consultation depends on a series of relevant factors, such as the complexity of the

project, the previous cooperation at European, regional and bilateral level and the

PUBLIC

Recommendation No 02/2023

Page 13 of 55

degree of previous knowledge of the project. The Agency recommends that the project

promoters strive for a consultation period lasting indicatively from 4 to 8 weeks;

d) after having provided to TSOs sufficient time to provide feedback and after having

accordingly adapted the net impacts calculation, the project promoters have provided

the TSOs with a detailed description of how the provided feedback was considered (or

the reason why they were not considered) in the updated project-specific CBA;

e) the project promoters have ensured appropriate coordination, exchange of (potentially

different) views and a thorough discussion during and soon after the consultation period

in order to improve the project-specific CBA and, if any, the CBCA proposal, before

the submission of the investment request.

For the sake of facilitating the NRAs’ planning and later decision-making process, the Agency

recommends that project promoters inform the NRAs of the Member States whose TSOs are

consulted and provide them with the consultation documents, as soon as those are distributed

to or received from the TSOs.

Addressees and language of the investment request

The Agency recommends that project promoters address the investment request to the NRAs

of:

a) the Member State(s) hosting the project; and

b) any other Member State(s) having a potentially significant overall net positive impact

based on the project-specific CBA (i.e. the NRAs of the Member States whose TSOs

should be consulted by the project promoters).

The investment request and the accompanying documents should be submitted:

a) in the official languages of the addressed NRAs, if so required by the law of the

respective Member State; and

b) in English, being the internal working language of the Agency

22

.

22

Decision AB No 15/2014 of the Administrative Board of the European Union Agency for Cooperation of

Energy Regulators of 18 December 2014 on the internal language regime of the European Union Agency for the

Cooperation of Energy Regulators.

PUBLIC

Recommendation No 02/2023

Page 14 of 55

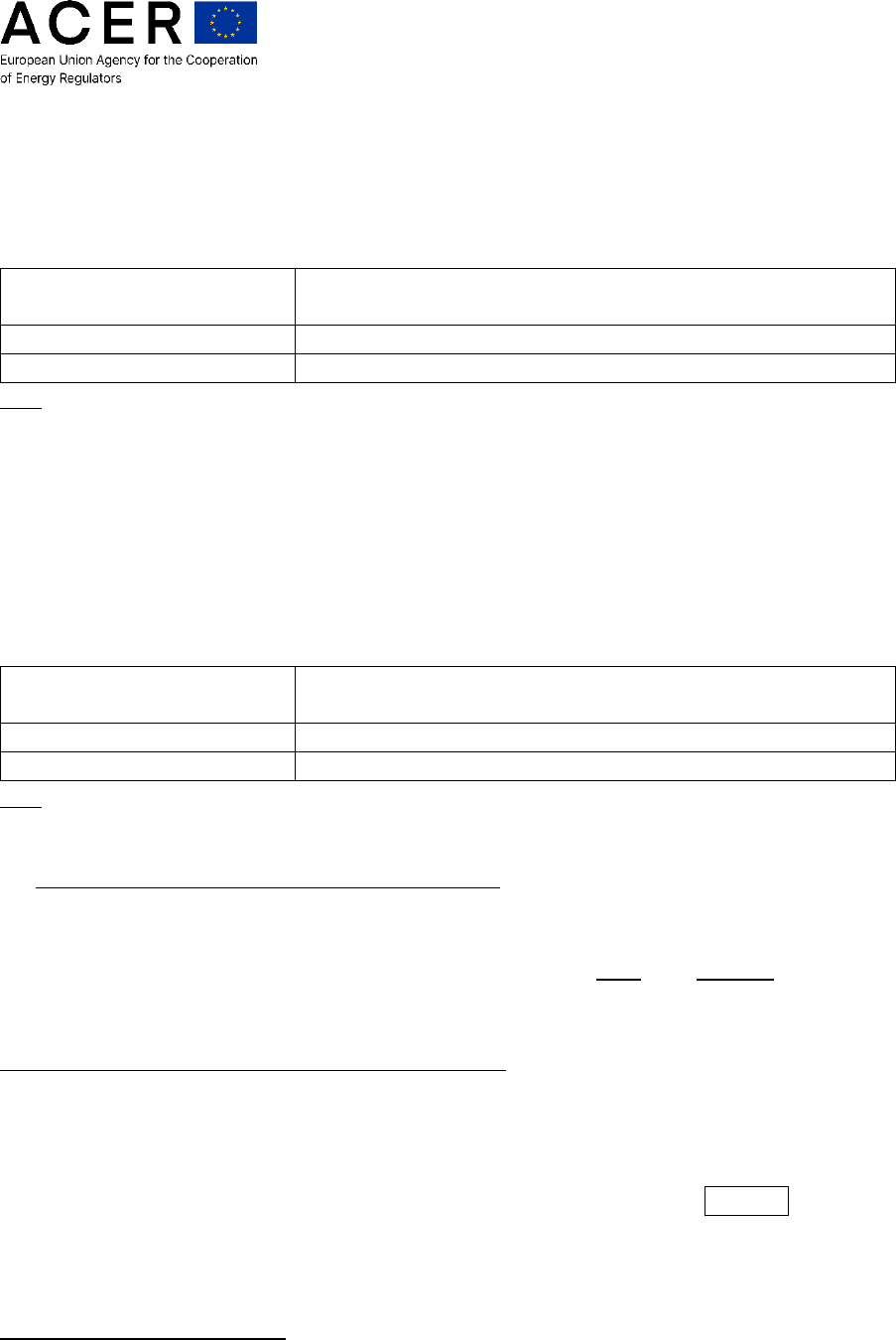

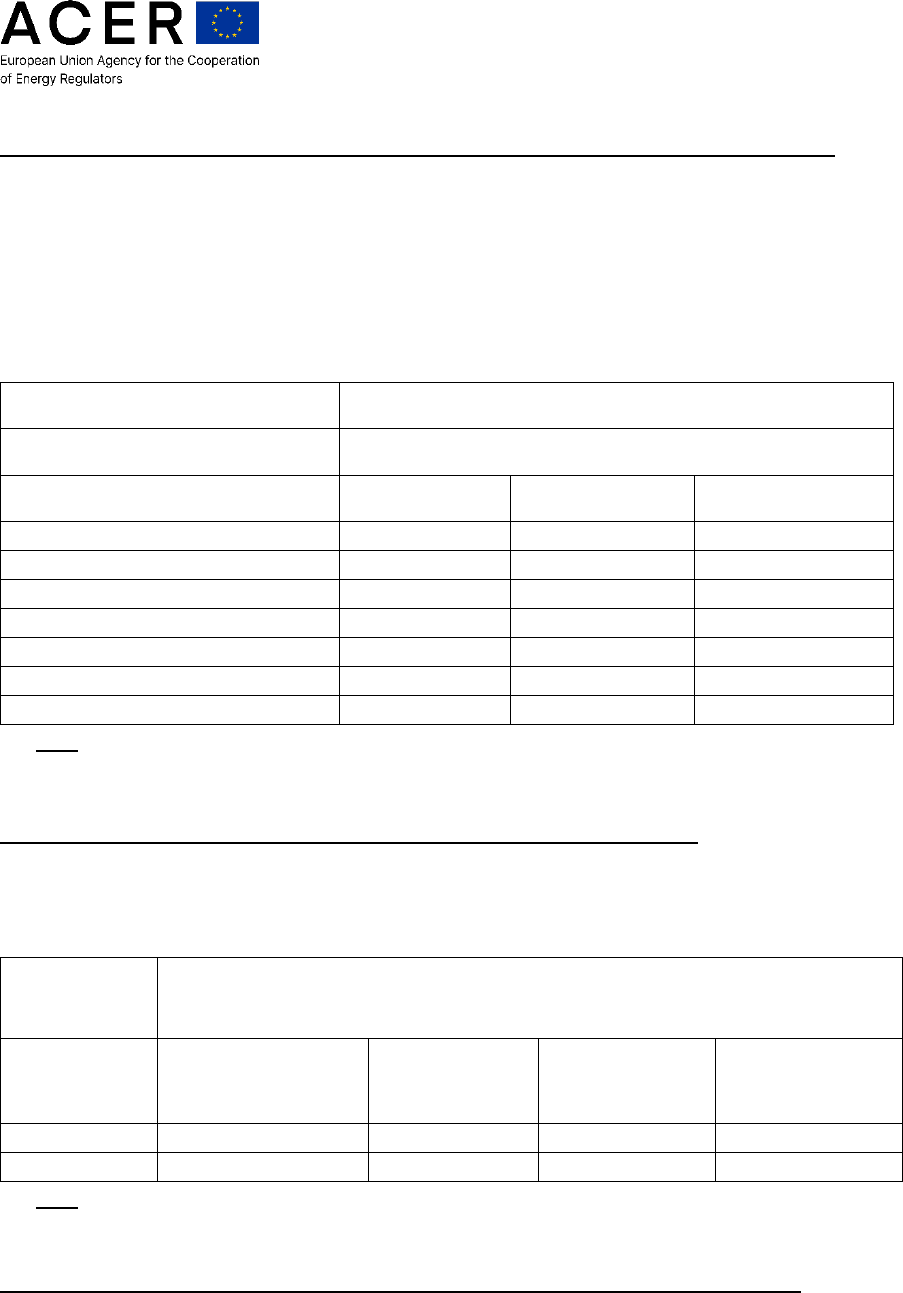

Information to be provided with the investment request

The Agency recommends that an investment request submitted by project promoters provides

the following information and, where appropriate, supporting evidence (in electronic form and,

where required at national level, in hard copy):

a) a detailed technical description of the project, including a description of the rationale

behind the choice of the technology, and a map of the planned route of the project in

case of transmission projects;

b) a detailed implementation plan of the project, which should provide substantial

information about the progress achieved in the development of the project and its status,

as well as a (probability) assessment of the critical and risk factors for the project and

the risk mitigation measures adopted in relation to those factors which could have the

most negative impact. The Agency recommends that, in the detailed implementation

plan, the project progress and status are described with reference to the main progress

steps in the development of the project, with an indication of the start and end dates for

each step. Dates could be either actual, as some of the steps will already have been

completed or expected. In line with the Agency’s infrastructure monitoring activities,

the following progress steps, which include the four stages outlined in Article 5(1) of

Regulation (EU) 2022/869, are identified in the development of projects of EU-wide

importance, and should be used as reference for the detailed implementation plan

23

:

i. under consideration: planning of studies (power flow and hydraulic simulations,

pre-feasibility and feasibility, including the techno-economic analysis of the

project) and consideration for inclusion in the national development plan(s)

(NDPs), regional plans and the TYNDPs of ENTSOG and of ENTSO-E;

ii. planning approval, but not yet in permitting: planning approval is the approval

(at the level of national development planning) by the NRA, by the competent

Ministry or by any other national competent authority, as foreseen in the

national law of each country. The planning approval may “start” with the

inclusion of the project in the draft NDP (e.g. release of the draft NPD,

submission to the NRA for approval, etc.) and “end” with the approval of the

NDP;

iii. preliminary design studies, which would include basic engineering design, etc.;

iv. environmental assessment, date of the request of the environmental assessment

and the (expected) approval date of the environmental assessment;

23

The steps are not strictly time-sequential, rather they usually partly overlap.

PUBLIC

Recommendation No 02/2023

Page 15 of 55

v. expected start and end dates of market test

24

(for gas and hydrogen PCIs/PMIs

only);

vi. preliminary investment decision

25

(if applicable);

vii. public consultation under Article 9(4) and 9(5) of Regulation (EU) 2022/869;

viii. permit granting process (including a pre-application procedure

26

and a statutory

permit granting procedure

27

when provisions of Chapter 3 of Regulation (EU)

2022/869) apply;

ix. expected start and end dates of cross-border cost allocation;

x. exemption from third party access (if applicable);

xi. expected date of the final investment decision

28

;

xii. expected start and end dates of detailed engineering design;

xiii. expected start and end dates of tendering (if foreseen), from call for tenders to

contract award(s);

xiv. expected start and end dates of construction;

xv. expected date of commissioning;

xvi. expected date on decision on the financing scheme.

c) a preliminary investment decision (e.g. a - possibly conditional - board decision on

intended investment), if applicable;

d) a short description of the status of the project permitting process in all hosting countries,

including a detailed schedule (in line with Article 10(6) and Annex VI(2) of Regulation

(EU) 2022/869) and corresponding evidence;

24

The market test is an open, transparent and non-discriminatory procedure which is carried out by the concerned

Transmission System Operator to assess the market demand through a non-binding phase where interested parties

may submit non-binding demand indications for new/incremental capacity, followed by a binding phase as a result

of which investment decisions are taken to proceed with the expansion of transmission infrastructure.

25

Please, see footnote 36.

26

The pre-application procedure start date is the date of signature of the acknowledgement by the competent

authority of the project promoter’s last notification.

27

The statutory procedure end date is the date of taking of the comprehensive decision pursuant to Article 10(1)

of Regulation (EU) No 2022/869.

28

According to Article 2(3) of Regulation (EC) 256/2014, “final investment decision” means the decision taken

at the level of an undertaking to definitively earmark funds for the investment phase of a project. It is therefore

the point in the project planning when the decision to make (major) financial commitment is taken.

PUBLIC

Recommendation No 02/2023

Page 16 of 55

e) information and evidence about the sufficient maturity of the project (see Section 2.3

of this Recommendation);

f) information on TSO consultations and the results of the consultations (see Section 2.6

of this Recommendation). The information should describe the documents shared, the

feedback (the elements on which TSOs agreed and did not agree and the reasons for

agreement/disagreement) of the consulted TSO(s), and explain in sufficient detail how

their comments were accepted and implemented or why they were rejected;

g) a project-specific CBA (see Annex I), consistent with the single sector energy system-

wide CBA methodologies drawn up pursuant to Article 11 of Regulation (EU)

2022/869, for all scenarios established for TYNDP and any other additional scenario.

The project-specific CBA should also include:

i. a sensitivity analysis and accompanying studies (for more details see Annex I

to this Recommendation);

ii. an assessment showing that the project fulfils a proven infrastructure need and

that no lower cost/impact alternative is available;

iii. a detailed assessment of the efficiency of the expected costs of the project,

including their comparison with unit investment costs or other information

(standard costs, historical costs) available at national, European or international

level and an explanation for any deviations;

iv. an analysis of the expected impact of the project on the Inter-TSO

Compensation (ITC) revenues and payments (for electricity PCIs/PMIs only);

v. an analysis of any other revenues/charges; and

vi. a summary of national net impacts for each country.

h) for the scenarios which are considered in addition to the ones developed for the

TYNDPs, a detailed explanation of the compliance with both European 2030 and 2050

targets, as well as with the Agency’s Scenario Framework Guidelines (see Section 2.5

of this Recommendation);

i) a business plan including a description of the chosen financing solution (including

tariffs), and information on grants and loans (awarded, applied for and expected), also

differentiating between national, European and other sources, as well as on the

estimated financing costs (indicating an estimation of the part of financing costs to be

incurred until commissioning of the project). In Members States where the tariff

calculation is carried out by TSOs, a description of the respective applicable national

methodologies for tariff calculation and of the project’s impact on network tariffs

should be provided in sufficient detail (for more details, see Annex III to this

Recommendation);

j) a substantiated proposal for cross-border cost allocation (if agreed by the project

promoters).

In addition, the Agency recommends that project promoters use a summary data template (only

in English) for submission of each investment request to the NRAs (see Annex IV to this

Recommendation).

PUBLIC

Recommendation No 02/2023

Page 17 of 55

3. ON THE TREATMENT OF AN INVESTMENT REQUEST

This section provides guidelines to NRAs (and the Agency in case of acting as a residual

decision taker for a CBCA decision) on the elements to be considered when assessing project

promoters’ investments requests and cross-border cost allocation proposals.

Cooperation and coordination between NRAs

To ensure a timely and efficient treatment of an investment request, the NRAs receiving such

a request should jointly define a single “coordinating NRA”. The coordinating NRA should be

preliminarily identified as follows:

a) for projects situated in one Member State, the NRA of that Member State;

b) for cross-border projects, the NRA of the Member State in which the highest investment

costs are estimated based on the investment request submitted by the project promoters

to the concerned NRAs.

Unless otherwise required under national law, the coordinating NRA should:

a) serve as a single point of contact for project promoters and TSOs, while circulating all

documents to all other involved NRAs;

b) identify and collect NRAs’ needs for further information, and if necessary, request it

from the relevant parties (e.g. from project promoters and TSOs);

c) propose a process (timing, meetings, consultation, etc.) for NRA’s treatment of the

investment request and the drafting of an agreement on the investment request;

d) organise consultation of project promoters in cooperation with the other involved

NRAs, per Article 16(5) of Regulation (EU) 2022/869.

All involved NRAs should:

a) cooperate fully among themselves, in particular in relation to requests for further

information;

b) endeavour to meet any timeline or deadline agreed upon the proposal of the

coordinating NRA;

c) keep the other involved NRAs informed of progress on the timetable for delivering an

agreement on the investment request.

PUBLIC

Recommendation No 02/2023

Page 18 of 55

Treatment of complementary and competing projects

As mentioned in Section 2.1, project promoters should aim at identifying all relevant

interdependencies among projects, also with projects not subject of the investment request.

Before identifying the costs to be allocated, NRAs should evaluate whether all relevant

interdependencies have been considered by the project promoters when submitting the

investment request.

When competing projects are recognised by the NRAs, after receiving the investment request,

the Agency recommends that NRAs invite all project promoters of projects competing with the

one(s) for which the investment request was submitted, to provide their observations regarding

the investment request and any relevant information required by the NRAs on their projects to

make a well informed decision.

Completeness of the investment request

Given that the completeness of the investment request constitutes an essential element for

timely decisions, it is essential that an investment request includes all information listed in

Section 2.8 of this Recommendation.

The Agency recommends that NRAs conduct a preliminary assessment regarding the

completeness of the investment request, indicatively within one month of its receipt by the last

NRA. If the investment request lacks any of the required information listed in Section 2.8 of

this Recommendation, the Agency recommends that the NRAs jointly request, through the

coordinating NRA, the project promoters to provide the missing information within a

reasonable period of time, to be set on a case-by-case basis in relation to the volume and the

nature of the missing information.

The Agency recommends that, if the preliminary assessment reveals that some required

information has not been provided with the investment request, NRAs consider the date of

receipt of the last piece of missing information (to complete the required information as

specified in Section 2.8 of this Recommendation) by the last concerned NRA as the date of

receipt of the investment request pursuant to Article 16(5) of Regulation (EU) 2022/869 and

subsequently the start of the six-month period to take the coordinated cross-border cost

allocation decisions. If all requested data cannot be provided by the project promoters within

the given period of time, the investment request may be treated as incomplete. An incomplete

request should not lead to a cross-border cost allocation decisions.

In particular, when a cluster of PCIs/PMIs is the subject of the investment request (see Section

2.1 of this Recommendation), it is possible for NRAs to collectively decide to exclude one or

more projects from the cluster if the project promoters do not provide enough evidence of

complementarities. Conversely, NRAs can also collectively agree on the need to include

projects that were not originally part of the cluster but show complementarities with the

PUBLIC

Recommendation No 02/2023

Page 19 of 55

clustered projects. In both situations, NRAs should invite all relevant project promoters to

resubmit an investment request that includes all relevant complementary projects.

In addition to the information to be provided by project promoters in line with Section 2.8 of

this Recommendation, NRAs may jointly request additional information without effects on the

six-month period to take coordinated cross-border cost allocation decisions.

Quality of the information provided with the investment request

It is essential that an investment request is of an adequate quality to enable NRAs to take well-

informed and robust decisions. NRAs should assess the robustness of the scenario analysis and

the quality of the CBA submitted by project promoters.

The Agency recommends that, if the involved NRAs agree that the information provided by

the project promoters is not of adequate quality

29

and that, therefore, the investment request

needs to be updated with regard to certain elements, the coordinating NRA requests the project

promoters to provide the required information (i.e. update the investment request) accordingly,

and project promoters do so. Additionally, the Agency recommends that project promoters

propose an update of the information provided with the investment request in case

developments become known which have a substantial impact on the investment request.

An update of the investment request does not affect the six-month period to take coordinated

cross-border cost allocation decisions unless it is significant.

The Agency recommends that in case of a significant update of the investment request the six-

month period to take coordinated cross-border cost allocation decisions should start from the

date of receipt of the significant update by the last NRA, and thus be considered as the date of

receipt of the investment request pursuant to Article 16(5) of Regulation (EU) 2022/869. In the

Agency’s view, an update of the investment request should be considered as significant if it

reflects one or more of the following developments:

a) a significant variation in total costs (i.e. exceeding the cost uncertainty range identified

in Section 2.8 of this Recommendation);

b) a significant change in the national net impacts calculated in the project-specific CBA

such that the latter attributes a significant net impact to a Member State which was not

identified in the initial investment request;

c) a change in the project cluster composition initiated by project promoters or by NRAs;

29

E.g. the information is not correct, not accurate or misleading.

PUBLIC

Recommendation No 02/2023

Page 20 of 55

d) an update of the information provided with the investment request deemed to be

significant by all NRAs.

Identification of costs to be allocated

Article 16(1) of Regulation (EU) 2022/869 states that the efficiently incurred investment costs,

which exclude maintenance costs, shall be borne by the relevant TSOs (or the project

promoters) of the transmission infrastructure of the Member States to which the project

provides a net positive impact.

Whereas a project-specific CBA accompanying an investment request has to take into account

the total costs of a project

30

, the cross-border cost allocation decisions need only to consider

31

,

as a basis for the allocation, the “efficiently incurred” investment costs of the project subject

of the investment request.

Investment costs usually cover items related to the development, construction and

commissioning of projects, such as those listed in the first four rows of the table in Annex II

to this Recommendation. Replacement costs during the lifetime of the project are not to be

considered for cross-border cost allocation purposes.

Only investment costs which are related to the project(s) subject of the investment request, and

which are considered in the respective Regulatory Asset Base (hereinafter also ‘RAB’) are to

be included in the basis for cost allocation.

“Efficiently incurred” refers to two aspects:

a) the presence of an actual infrastructure need for the PCI(s) subject of the investment

request, as well as the absence or non-feasibility of any alternative project which would

be able to fulfil the same infrastructure need at a lower total cost. The infrastructure

need can be assessed by comparing the key features of the project (e.g. increase of

transmission capacity between zone A and zone B and unit cost expressed e.g. in

Meuro/MW) to the results of ‘infrastructure gaps/needs’ studies carried out at

European, regional or national level;

b) the comparison with the comparable costs of an efficient TSO. In fact, the more precise

level of the efficiently incurred investment costs can only be evaluated after the

realisation of the project. Therefore, a preliminary evaluation of expected efficient

investment costs should be conducted during the evaluation of an investment request

30

Cf. Annex V(8) of Regulation (EU) 2022/869.

31

Cf. Article 16(1) of Regulation (EU) 2022/869.

PUBLIC

Recommendation No 02/2023

Page 21 of 55

based on published (reference) values for unit investment costs

32

, historic costs, or

studies of the planned costs, taking into account the regulatory framework applicable

in each country. The outcome of the preliminary evaluation does not prejudice that an

evaluation of the efficiently incurred investment costs after the realisation of the

project is carried out in line with the legislative and regulatory framework applicable

in the relevant Member State.

In case of hybrid interconnection projects which include also investment in generation projects

(e.g. offshore wind generation), the NRAs, together with the project promoters, should be able

to identify the costs related to the generation assets separately from the costs related to the

transmission assets before allocating the relevant investment costs to the transmission projects,

the latter being the category eligible for CBCA under Article 16(1) and Article 16(2) of

Regulation (EU) 2022/869.

The evaluation of the scenarios in allocating costs across borders

Article 16(5) of Regulation 2022/869 states that in allocating costs across borders, the relevant

NRAs, after consulting the TSOs concerned, shall seek a mutual agreement based on, but not

limited to, the information specified by the project promoters in the submitted investment

request (see Section 2.5, Section 2.8 and Section 3.3 of this Recommendation).

According to the same Article, the NRAs’ assessment shall consider all scenarios jointly

developed by the ENTSOs for the TYNDPs and potentially other scenarios for network

development planning. Where additional scenarios are used, they shall be consistent with the

Union’s 2030 targets for energy and climate and its 2050 climate neutrality objective and be

subject to the same level of consultation and scrutiny as the process provided for the scenarios

jointly developed by the ENTSOs.

Scenarios depict potential paths that energy demand and supply may take in the future. These

scenarios are not predictions and, as such, the societal and financial consequences of a project's

implementation will always carry a level of uncertainty. Additionally, different scenarios may

even lead to opposite outcomes when evaluating the project's cost-benefit analysis.

The Agency’s Scenario Framework Guidelines adopted on 25 January 2023 request ENTSOG

and ENTSO-E to build a set of scenarios which shall include, at least, a best-estimate central

scenario (based on National Energy and Climate Plans, ‘NECPs’) and low-economy and high-

economy variants (as a stress test on network and project development).

32

According to Article 11(9) of Regulation (EU) 2022/869, every three years, the Agency shall establish and

publish a set of indicators and corresponding reference values for the comparison of unit investment costs for

comparable projects of the energy infrastructure categories included in Annex II of Regulation (EU) 2022/869.

PUBLIC

Recommendation No 02/2023

Page 22 of 55

In the Agency’s view, benefit results significantly depend on the input scenarios and related

assumptions. The quality of the scenarios used for project assessment is a critical element for

a robust allocation of costs among countries. Therefore, it is essential that NRAs consider

uncertainties, especially with regard to long-term scenarios, and take them into account when

taking decisions.

In line with Article 16(5) of Regulation (EU) 2022/869, the Agency recommends that the

involved NRAs, before taking a decision on how to allocate costs across-borders, duly assess

the project(s)’s costs and benefits from all scenarios used by the project promoter(s) in

accordance with Section 2.5 of this Recommendation.

The choice of the scenarios in allocating costs across borders

In line with the provisions of Regulation (EU) 2022/869, consideration of additional scenarios

to the ones developed according to Article 12 of Regulation (EU) 2022/869 can be necessary

to ensure proper robustness of the CBCA decision. For example, this could be the case when

certain drivers behind the evaluation of projects are more relevant at regional-level than at pan-

European-level, or when more updated information becomes available compared to when the

scenarios for TYNDPs were prepared or there are significant changes in some of the parameters

considered.

When considering additional scenarios (including those instances where the scenarios for

TYNDPs are updated for one or more input parameters) than the ones used by the project

promoter(s) for the submitted investment request, NRAs should provide an explanation of the

reasoning behind such choice. Within this framework, when allocating costs across borders,

NRAs could jointly agree to attribute different weights to the CBA results and identified

country impacts based on the different scenarios. The cross-border cost allocation decisions

should contain a thorough explanation of the reasoning behind the weights attributed to the

different impacts.

Without prejudice to the provisions in Article 16(4) regarding the use of scenarios for the

purpose of cross-border cost allocation, the Agency recommends that concerned NRAs agree

on how to take into account, for the purpose of consistent calculation of the benefits and of the

subsequent cross-border cost allocation, each robust and plausible scenario.

In case NRAs cannot agree on how to take into account each of the robust and plausible

scenarios for the purpose of consistent calculation of the country impacts and of the subsequent

cross-border cost allocation, the Agency recommends NRAs to base the decision on the

investment request and the cost allocation at least on the TYNDPs’ best-estimate central

scenario as defined in the Agency Scenario Framework Guidelines, as long as such scenario is

deemed robust and plausible by the concerned NRAs. If NRAs agree, they may base the

decision on additional robust and plausible scenarios.

PUBLIC

Recommendation No 02/2023

Page 23 of 55

The allocation of costs

The Agency is of the opinion that the following considerations should be taken into account:

a) Regulation (EU) 2022/869 aims at enabling investments with a cross-border impact;

b) any benefit analysis encompasses uncertainties with respect to the future benefits per

country, especially with respect to different scenarios and CBA indicators, and

c) a pragmatic and workable approach is needed in deciding on investment requests.

Therefore, unless NRAs agree otherwise, the Agency recommends that, once NRAs have

jointly agreed on the scenarios, compensations are provided if:

a) at least one Member State hosting the project has an overall net negative impact as per

Section 3.7, and;

b) each of the identified contributing countries has an overall net positive impact as per

Section 3.7.

In case the NRAs cannot agree on the level of compensation, the Agency recommends NRAs

to compensate the net negative impact in the relevant Member States, so that they become

neutral. Agreements that go beyond the compensation of the net negative impact, taking into

account the uncertainties in the analysis of benefits or unreasonably different net impacts across

Member States after cost allocation, are possible.

If the net negative impact is higher than the total amount of the expected efficient investment

costs

33

, the cross-border cost allocation decisions should compensate the net negative impact

up to the maximum amount of the expected efficient investment costs.

When deciding on cross-border cost allocation, in line with Article 16(5) of Regulation (EU)

2022/869

34

, NRAs should allocate 100% of the expected efficient investment costs in

accordance with calculation of national net impacts in Section 2.4 of this Recommendation and

with the principles explained in this Section.

33

This may be the case if a project has significant operational costs.

34

Recital (47) of Regulation 2022/869.

PUBLIC

Recommendation No 02/2023

Page 24 of 55

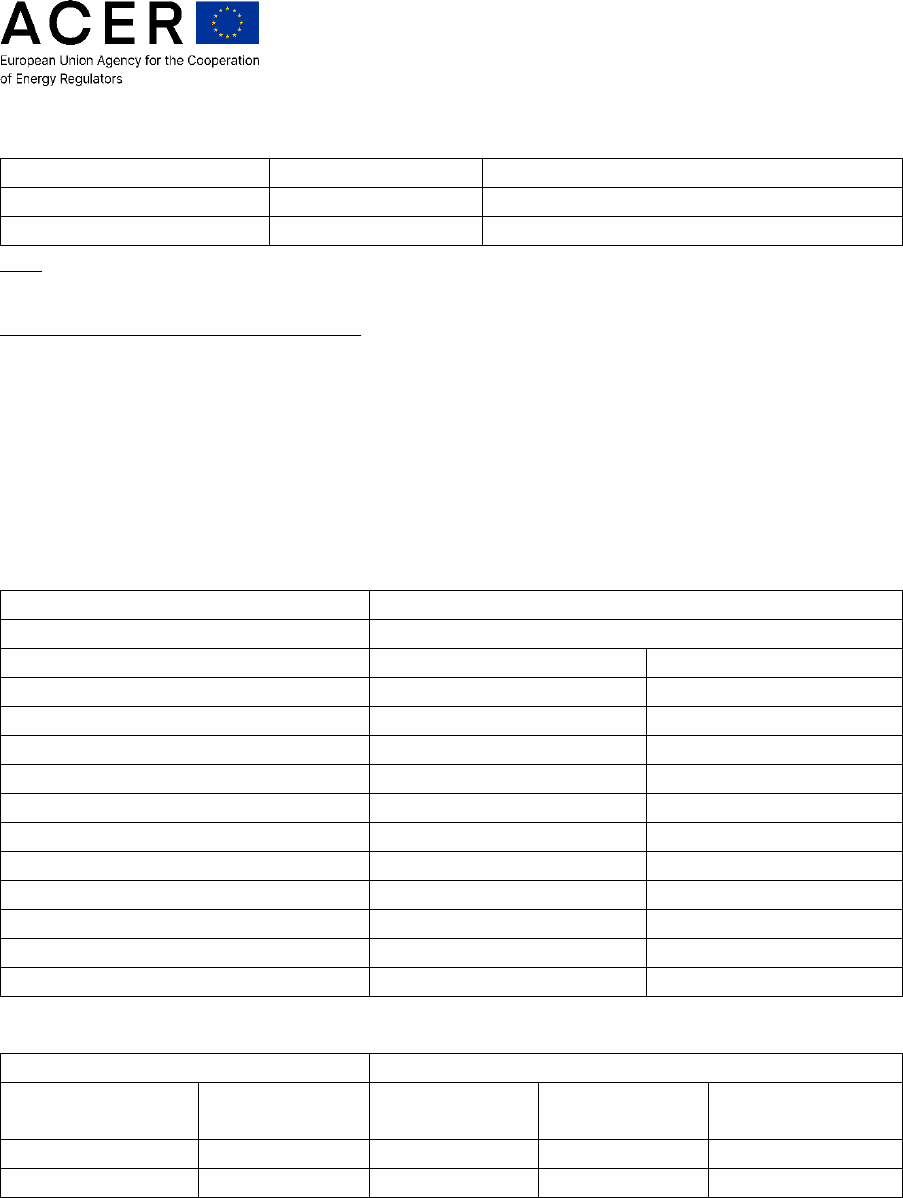

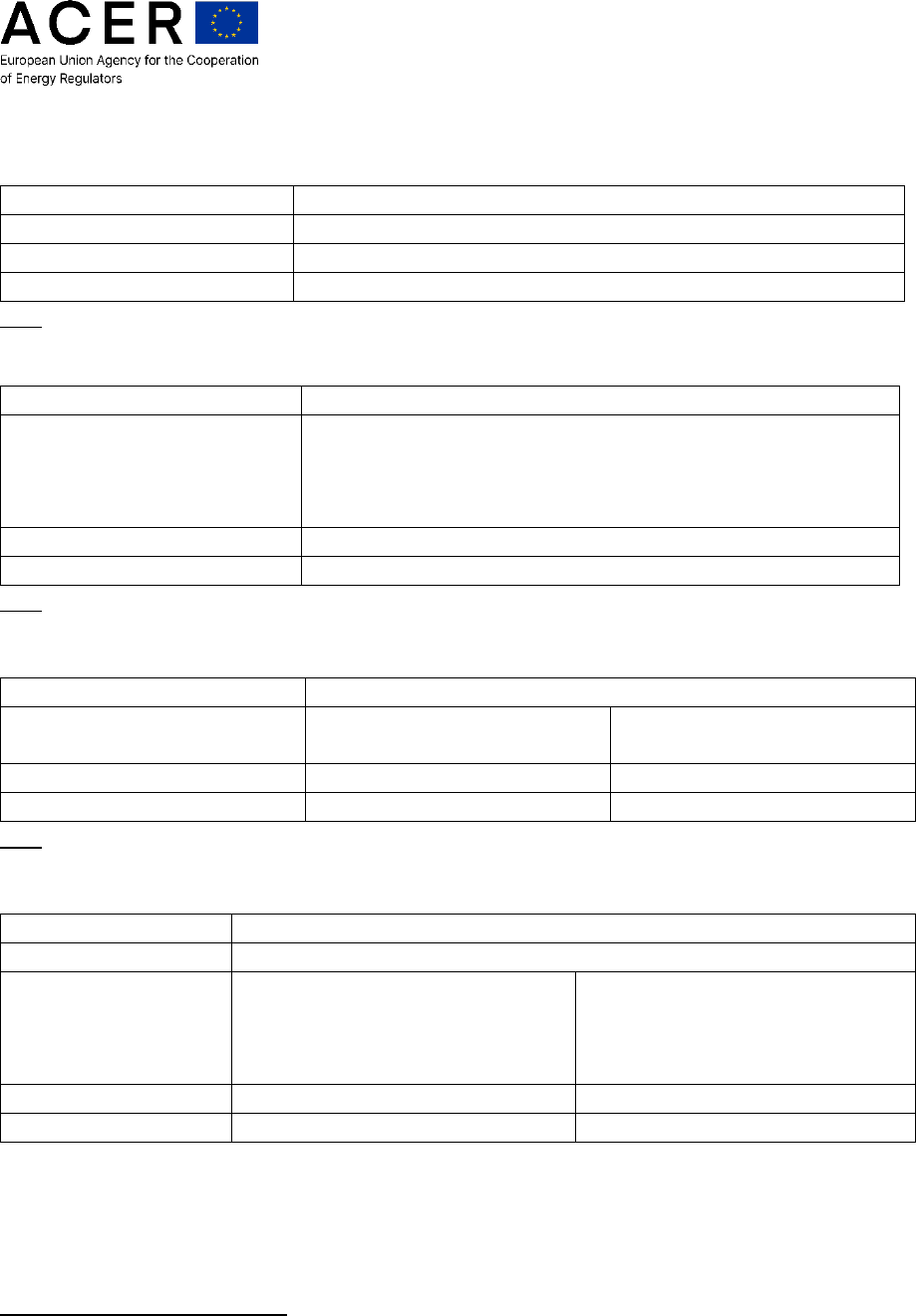

Significant threshold when allocating costs

In general, countries to which a project provides a net positive impact should provide

compensation. However, it is possible that not every expected net positive impact for a country

actually justifies that this country provides compensation. This may be the case where small

contributions would be required from a large number of countries, thus causing significant

negotiation and administrative costs. Involvement of countries with small net positive impacts

would unnecessarily increase the complexity of the procedure for the cross-border cost

allocation.

As Article 16(4) of Regulation (EU) 2022/869 states that an investment request shall be

submitted after the project promoters have consulted the TSOs from Member States

35

to which

the project provides a significant net positive impact, the Agency recommends that a

‘significance threshold’ is applied such that only countries with an overall net positive impact

exceeding the significance threshold provide compensation.

In this context, the significance threshold should be, in principle, equal to 10% of the sum of

net positive impacts accruing to all beneficiary countries.

The Agency recommends that, for the countries whose net positive impact exceeds the

significance threshold, the required compensation is allocated proportionally to the following

Compensation Indicator (CI): [overall net positive impact exceeding the significance threshold

for the country] / [sum of overall net positive impacts exceeding the significance threshold for

all countries whose overall net positive impacts exceed the significance threshold].

The CI ensures that the compensation is divided proportionally between the countries with

significant net positive impacts according to their shares of the overall net positive impacts

exceeding the significance threshold. For equal treatment of countries below and above the

threshold, the CI should be applied only to the absolute value corresponding to the overall net

positive impacts exceeding the significance threshold.

If the net positive impacts of the contributing Member States above the 10% significance

threshold are not sufficient to cover the compensation required, the significance threshold

should be lowered step-wise by 1% per step, until the sum of net positive impacts accruing to

all beneficiary Member States is sufficient to cover the required compensation.

NRAs may, upon joint agreement, apply a significance threshold that differs from the 10%

threshold defined above. Also, NRAs may, upon joint agreement, establish a minimum

significance threshold to limit the step-wise reduction or take other appropriate measures. This

35

In line with Section 2.6, this Recommendation suggests that project promoters also consult the TSO of each of

the non-EU countries for which a significant net positive impact is identified.

PUBLIC

Recommendation No 02/2023

Page 25 of 55

might be particularly relevant in cases in which the significance threshold leads, in terms of

contribution/cost allocation, to unreasonable results or to an excessive fragmentation across

Member States and/or in the case the uncertainties associated to the CBA benefits justifies it.

If a minimum significance threshold is considered, in line with its previous Recommendation,

the Agency recommends a minimum significance threshold of 5%.

Treatment of uncertainties and mechanisms for the adjustments of the cost

allocation

Uncertainty can describe a situation where the outcome of an event or of a decision is not

(completely) known, and the probability of different outcomes is unclear or unpredictable.

To facilitate the implementation of PCIs/PMIs, a stable and predictable regulatory framework

is key for legal certainty and clarity for all involved parties.

Cross-border cost allocation decisions should clearly specify ex-ante the conditions and terms

under which pre-defined adjustments of the cost allocation should be implemented after the

commissioning of the project. The Agency therefore recommends that all mechanisms to deal

with uncertainty should be agreed ex-ante in the CBCA decision.

To achieve this, when preparing and evaluating a CBCA request, it is necessary to address

uncertainties which concern at least:

a) the scenarios used and the related assumptions;

b) the benefits delivered by the actual availability of the infrastructure and the input used

to monetise those benefits;

c) the variation in the investment cost estimates;

d) future public funding.

While some adjustment may be useful to foresee, NRAs should aim at limiting the number of

cases and the complexity of adjustment payments.

3.10.1. Uncertainties related to scenarios assumptions and scenarios evolution

By jointly agreeing on the relevance of the scenarios in the CBCA decision process, NRAs

strive at ensuring a long-term predictability of the identified net impacts. In case of new

TYNDP scenarios would be available after the CBCA decision has been taken, the already

PUBLIC

Recommendation No 02/2023

Page 26 of 55

agreed cost allocation among the concerned countries should not be subject to ex-post revisiting

(unless this has been agreed in the CBCA decision).

3.10.2. Uncertainties related to benefits and their monetisation

Benefits uncertainty can also refer to delays in the implementation of the project or to the actual

technical availability of the infrastructure the beneficiary countries are contributing to through

their respective cost-compensation share. This could be particularly relevant for CBCAs

involving also countries where the infrastructure is not located (i.e. non-hosting countries).

Different circumstances could lead to delays in the realisation of the project or the

unavailability of the infrastructure (like for example in the case of a prolonged outage).

It is therefore recommended that project promoters and NRAs evaluate the risks (and related

probabilities) affecting delays in the realisation of a project as well as affecting the availability

of the infrastructure(s), subject of the investment request, once commissioned. The outcomes

of such analysis, if not already considered when calculating the different countries net impacts,

should be used to identify those conditions under which the infrastructure(s) realisation delays

or its (temporary) unavailability would justify adjustments of the cost-compensation or other

forms of mechanisms (e.g. periodic payments related to the progress of the project; refunding

mechanisms if certain infrastructure availability criteria are not met; etc.). The mechanisms

and the circumstances when to apply those should be agreed and defined in the CBCA decision.

For gas projects

36

creating bookable capacity, the Agency recommends that NRAs define in

their coordinated cross-border cost allocation decisions adjustments of the cost allocation in

relation to the updated estimate or actual amount of revenues from capacity bookings.

The assumptions used to monetise benefits can also influence the level of uncertainty around

the identified net impacts. The assumptions used to monetise benefits and the complementing

sensitivity analyses (see Annex I) should be properly scrutinised at the stage of the preparation

of the CBCA (by project promoters) and at the stage of the assessment of the investment request

(by NRAs). Changes in the reference input

37

used to monetise benefits should not justify the

reopening of the agreed cross-border cost allocation.

36

Article 24 of Regulation 2022/869 includes derogation for PCI gas interconnections for Cyprus and Malta.

37

Changes in the reference input used to monetise benefits could for example happen in case of the availability

of updated CBA Methodologies and related Implementation Guidelines, since the analysis included in the

investment request has to be consistent with those. See also Annex I of this Recommendation.

PUBLIC

Recommendation No 02/2023

Page 27 of 55

3.10.3. Uncertainties related to costs variations

At the time of the submission of the investment request, the project promoter(s) has to provide

an estimation of the expected costs to be incurred as well as an estimation of the uncertainty

range concerning such costs (see Section 2.8 of this Recommendation). This element of

uncertainty should therefore already be included in the investment request and in the CBCA

proposal (if any).

However, investment costs could experience unexpected significant variations exceeding the

cost uncertainty range initially provided by the project promoter(s).

The Agency recommends that NRAs incorporate ex-ante into the CBCA decision, adjustment

mechanisms which would enable predefined adjustments to the agreed cost allocation or other

provisions on how to treat cost variations beyond the scope of the adjustment mechanism.

In case of cost variations, adjustment mechanism that are pre-defined should only address

additional costs that are caused by external factors beyond the control of project promoters and

respective NRAs and other relevant national authorities

38

.

For cost variations which occur in a country hosting the project and facing a net negative

impact, those adjustment mechanisms should take into account that:

a) if the actual amount of efficient investment costs turns out to be lower than the expected

costs at the time of the cross-border cost allocation decisions, the sum of the

compensations from the contributing countries should be decreased by the

corresponding amount and the individual compensations reduced proportionately;

b) if the actual amount of efficient investment costs turns out to be higher than the

expected costs at the time of the cross-border cost allocation decisions, except if NRAs

agree otherwise, the sum of the compensation from the contributing countries should

be increased according to the same cost-allocation key and up to a specific threshold

defined in the cross-border cost allocation decisions (e.g. based on the expected

inflation growth). Beyond such threshold the additional incurred costs should be

allocated among the concerned countries according to the territorial principle

39

.

38

If, for instance, the competent authority decides on a more expensive solution for the project than the one

initially proposed by the project promoter, such as underground lines instead of overhead lines because crossing

potentially sensitive areas, any increase in cost should be solely covered by the country where the project is being

hosted.

39

For offshore interconnection concerning two countries, the territorial principle would be reflected in 50%/50%

split of the costs.

PUBLIC

Recommendation No 02/2023

Page 28 of 55

For cost variations which emerge in a country hosting the project and facing a positive or zero

net impact, the Agency recommends the adjustment mechanisms to take into account that:

a) if the actual amount of investment costs turns out to be lower than the expected costs

at the time of the cross-border cost allocation decisions, the compensations from the

contributing countries should be adjusted applying the same principles adopted for cost

allocation in the cross-border cost allocation decisions;

b) if the actual amount of investment costs turns out to be higher than the expected costs

at the time of the cross-border cost allocation decisions, except if NRAs agree

otherwise, the sum of the compensation from the contributing countries should be

increased according to the same cost-allocation key and up to a specific threshold

defined in the cross-border cost allocation decisions. Beyond such threshold the

additional incurred costs should be allocated among the concerned countries according

to the territorial principle.

3.10.4. Public funding

To ensure legal certainty and clarity for all involved parties, cross-border cost allocation

decisions should not be conditional on potential future public funding.

However, it should be clear from the CBCA decision how potential future public funding

impacts the allocated amounts of payments. In addition, as described in Section 2.8, project

promoters should indicate at the moment of the investment request if they have applied for

grants and the expected pending amount.

PUBLIC

Recommendation No 02/2023

Page 29 of 55

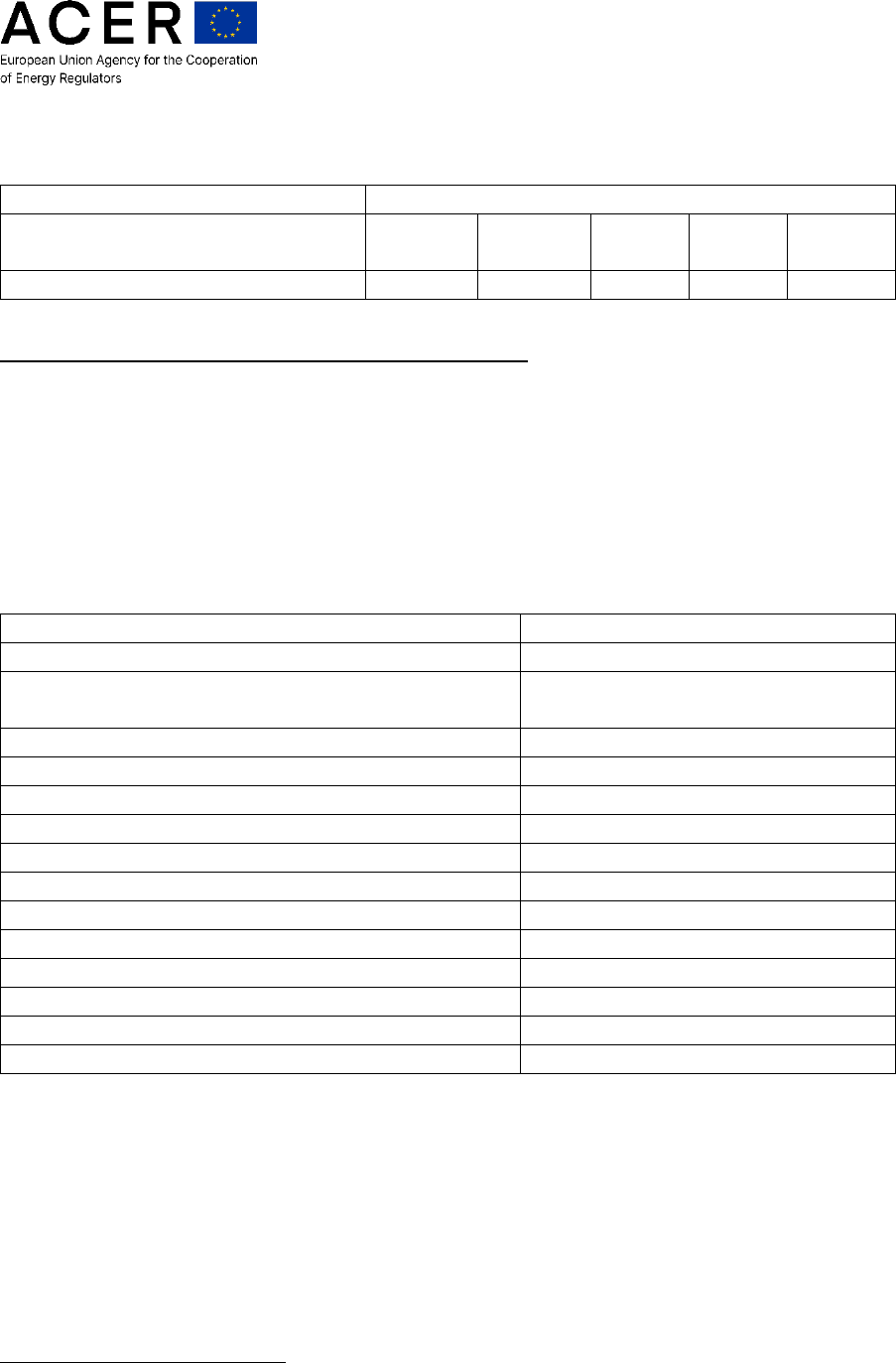

4. AGREEMENT ON THE INVESTMENT REQUEST AND ADDRESSEES OF

COORDINATED DECISIONS

In line with Article 16(5) of Regulation (EU) 2022/869, NRAs should reach an agreement on

the investment request, to be implemented by taking coordinated cross-border cost allocation

decisions after consultation of the project promoters.

The Agency recommends that the agreement on the investment request forms a solid basis for

coordinated national cross-border cost allocation decisions. This agreement should:

a) identify the Member States facing significant net positive impact, and their respective

TSOs;

b) summarise and justify the outcomes of the evaluations covered by Sections 3.5 to 3.10

of this Recommendation;

c) be accompanied by a “relevant information” document, including the elements in points

(a) to (d) of Article 16(6) of Regulation (EU) 2022/869 (about the evaluation of the

impacts on network tariffs, see Annex III to this Recommendation).

The agreement on the investment request may include other relevant elements, such as rules:

a) for promoting a timely implementation of the project; and

b) for ensuring technical performance (e.g. about availability rates).

Each NRA should address its coordinated decision to the project promoters and TSOs of its

own Member State.

Pursuant to Article 16(6) of Regulation (EU) 2022/869 the cost allocation decision shall be

published. The Agency recommends each concerned NRA to publish a copy of the relevant

coordinated decision on its own website together with an English translation.

PUBLIC

Recommendation No 02/2023

Page 30 of 55

5. PAYMENTS FOR IMPLEMENTATION OF THE COST ALLOCATION

Any cross-border compensation should be expressed in monetary values of the year of the

expected payment. Therefore, payments should be projected by using an appropriate rate (see

Annex I to this Recommendation).

In the Agency’s view, a lump-sum payment shortly after commissioning of the project should

be considered as the default option. After having discussed with the concerned project

promoters, NRAs may implement different payment methods by taking into account at least

the following elements:

a) the risk associated with the realisation of the project;

b) the size of the overall compensation;

c) the number of involved countries in the cross-border payments;

d) the need to ensure a stable financing framework (as per Article 16(5) of Regulation

(EU) 2022/869), by also considering possible financial risks for the involved parties

that different payment methods could lead to;

e) the time-lag for the cost recovery;

f) the financial sustainability of the companies involved.

PUBLIC

Recommendation No 02/2023

Page 31 of 55

6. INCLUSION OF ALLOCATED COSTS IN TARIFFS

As set out in Article 16(1) of Regulation (EU) 2022/869, the efficiently incurred investment

costs, to the extent not covered by congestion rents or other charges, shall be paid for by

network users through tariffs for network access. The Agency notes that NRAs should avoid

the risks of double support for projects

40

by remunerating for costs which are already recovered

via other means. Therefore, the Agency recommends carefully to consider any possible risk of

double remuneration, including if also due to any other contributions from third parties, to the

(positive net) revenues deriving from the ITC mechanism in electricity (where relevant) and to

the revenues from Entry-Exit tariffs including premiums resulting from auctions in gas.

The Agency recommends that NRAs take timely decisions on the inclusion of the allocated

investment costs in tariffs in line with Article 16(5) of Regulation (EU) 2022/869. The Agency

recommends that the allocated investment costs are included in tariffs of the respective

Member State, in line with the applicable legislative and regulatory framework for transmission

network elements in that Member State. The concrete way of how they are reflected in tariffs

is the responsibility of the respective NRAs.

After having included the efficiently incurred investments costs in tariffs, NRAs shall assess,

where appropriate, whether any affordability issues might arise and determine whether the

impact on tariffs could represent a disproportionate burden for consumers in their respective

Member States

41

.

40

Recital (47) of Regulation (EU) 2022/869.

41

Recital (47) of Regulation (EU) 2022/869 and Article 16(5) of Regulation 2022/869.

PUBLIC

Recommendation No 02/2023

Page 32 of 55

7. INFORMATION TO BE PROVIDED BY NRAS TO THE AGENCY

Article 16(4) of Regulation (EU) 2022/869 requires NRAs to inform the Agency about

investment requests and to transmit a copy of each investment request to the Agency for

information without delay.

The Agency expects that NRAs also keep the Agency informed about the treatment of the

investment requests. In particular, NRAs should inform the Agency without delay about:

a) the receipt of an investment request and the date in which it was received by each NRA;

b) the date in which NRAs consider the six-month period pursuant to Article 16(5) of

Regulation (EU) 2022/869 to have started; and

c) requests for information, as referred to in Sections 3.3 and 3.4 of this Recommendation,

sent to project promoters and the project promoters’ responses to such requests,

including the relevant dates and their consequences on the treatment of the investment

request.

Pursuant to Article 6(6) of Regulation (EU) 2022/869, in case NRAs took coordinated cross-

border cost allocation decisions, each involved NRA shall notify without delay to the Agency

its own cross-border cost-allocation decision, together with all the relevant information with

respect to the decision.

In case NRAs cannot reach an agreement within six months

42

, or in case of a joint request from

the NRAs, the Agency recommends that NRAs submit to the Agency a joint referral report

explaining:

a) their treatment of the investment request;