AlohaCare

StatutoryFinancialStatements

andSupplementalSchedules

December31,2022and2021

AlohaCare

TableofContents

Page(s)

ReportofIndependentAuditors

StatutoryFinancialStatements

StatementsofAdmittedAssets,Liabilities,CapitalandSurplus

December31,2022and2021........................................................................................................................................4

StatementsofOperationsandChangesinCapitalandSurplus

YearsEndedDecember31,2022and2021...................................................................................................................5

StatementsofCashFlows

YearsEndedDecember31,2022and

2021...................................................................................................................6

NotestoFinancialStatements

December31,2022and2021..................................................................................................................................7–19

SupplementalSchedules

InvestmentSummarySchedule

December31,2022.....................................................................................................................................................20

InvestmentRiskInterrogatories

December31,2022...............................................................................................................................................21–24

ReinsuranceSummarySchedule

December31,2022...............................................................................................................................................25–26

ReportofIndependentAuditors

TotheBoardofDirectorsof

AlohaCare

Opinions

WehaveauditedtheaccompanyingstatutoryfinancialstatementsofAlohaCarewhichcomprisethe

statutorystatementsofadmittedassets,liabilities,capitalandsurplusasofDecember31,2022and2021,

andtherelatedstatutorystatementsofoperationsandchangesincapitalandsurplus,andcashflows

fortheyearsthenended,andtherelatednotestothestatutoryfinancialstatements.

Inouropinion,thestatutoryfinancialstatementsreferredtoabovepresentfairly,inallmaterialrespects,

theadmittedassets,liabilities,capitalandsurplusofAlohaCareasofDecember31,2022and2021,and

theresultsofitsoperationsandchangesincapitalandsurplusandcashflowsfortheyearsthenended,

inaccordancewiththefinancialreportingprovisionsprescribedorpermittedbytheInsuranceDivision

oftheDepartmentofCommerceandConsumerAffairsoftheStateofHawai‘i(“InsuranceDivision”)

asdescribedinNote2.

BasisforOpinions

WeconductedourauditsinaccordancewithauditingstandardsgenerallyacceptedintheUnitedStatesof

America.OurresponsibilitiesunderthosestandardsarefurtherdescribedintheAuditors’Responsibilities

fortheAuditoftheStatutoryFinancialStatementssectionofourreport.Wearerequiredtobe

independentofAlohaCareandtomeetourethicalresponsibilitiesinaccordancewiththerelevantethical

requirementsrelatingtoouraudits.Webelievethattheauditevidencewehaveobtainedissufficient

andappropriatetoprovideabasisforourauditopinion.

BasisofAccounting

WedrawattentiontoNote2ofthestatutoryfinancialstatements,whichdescribesthebasisof

accounting.Thestatutoryfinancialstatementsarepreparedonthebasisofthefinancialreporting

provisionsprescribedorpermittedbytheInsuranceDivision,whichisabasisofaccountingother

thanaccountingprinciplesgenerallyacceptedintheUnitedStatesofAmerica,tocomplywiththe

requirementsoftheInsuranceDivision.Asaresult,thestatutoryfinancialstatementsmaynotbe

suitableforanotherpurpose.Ouropinionisnotmodifiedwithrespecttothatmatter.

ResponsibilitiesofManagementfortheStatutoryFinancialStatements

Managementisresponsibleforthepreparationandfairpresentationofthestatutoryfinancialstatements

inaccordancewiththefinancialreportingprovisionsprescribedorpermittedbytheInsuranceDivision,

andforthedesign,implementationandmaintenanceofinternalcontrolrelevanttothepreparationand

fairpresentationofstatutoryfinancialstatementsthatarefreefrommaterialmisstatement,whether

duetofraudorerror.

Auditors’ResponsibilitiesfortheAuditoftheStatutoryFinancialStatements

Ourobjectivesaretoobtainreasonableassuranceaboutwhetherthestatutoryfinancialstatements

asawholearefreefrommaterialmisstatement,whetherduetofraudorerror,andtoissueanauditors’

reportthatincludesouropinion.Reasonableassuranceisa

highlevelofassurancebutisnotabsolute

assuranceandthereforeisnotaguaranteethatanauditconductedinaccordancewithgenerally

acceptedauditingstandardswillalwaysdetectamaterialmisstatementwhenitexists.Theriskofnot

detectingamaterialmisstatementresultingfromfraudishigherthanforoneresultingfromerror,as

fraudmayinvolvecollusion,forgery,intentionalomissions,misrepresentations,ortheoverrideofinternal

control.Misstatementsareconsideredmaterialif

thereisasubstantiallikelihoodthat,individuallyor

intheaggregate,theywouldinfluencethejudgmentmadebyareasonableuserbasedonthestatutory

financialstatements.

Inperforminganauditinaccordancewithgenerallyacceptedauditingstandards,we:

Exerciseprofessionaljudgmentandmaintainprofessionalskepticismthroughouttheaudit.

Identifyandassesstherisksofmaterialmisstatementofthestatutoryfinancialstatements,whether

duetofraudorerror,anddesignandperformauditproceduresresponsiveto

thoserisks.Such

proceduresincludeexamining,onatestbasis,evidenceregardingtheamountsanddisclosures

inthestatutoryfinancialstatements.

Obtainanunderstandingofinternalcontrolrelevanttotheauditinordertodesignauditprocedures

thatareappropriateinthecircumstances,butnotforthepurposeof

expressinganopiniononthe

effectivenessofAlohaCare’sinternalcontrol.Accordingly,nosuchopinionisexpressed.

Evaluatetheappropriatenessofaccountingpoliciesusedandthereasonablenessofsignificant

accountingestimatesmadebymanagement,aswellasevaluatetheoverallpresentationofthe

statutoryfinancialstatements.

Concludewhether,inour

judgment,thereareconditionsorevents,consideredintheaggregate,

thatraisesubstantialdoubtaboutAlohaCare’sabilitytocontinueasagoingconcernforareasonable

periodoftime.

Wearerequiredtocommunicatewiththosechargedwithgovernanceregardingamongothermatters,

theplannedscopeandtimingofthe

audit,significantauditfindings,andcertaininternalcontrolrelated

mattersthatweidentifiedduringtheaudit.

RequiredSupplementaryInformation

FinancialreportingprovisionsprescribedorpermittedbytheInsuranceDivisionrequirethatthe

SupplementalInvestmentSummarySchedule,InvestmentRiskInterrogatories,andReinsuranceSummary

ScheduleasofDecember31,2022onpages20–26bepresentedtosupplementthebasicstatutory

financialstatements.Suchinformationistheresponsibilityofmanagementand,althoughnotpartofthe

basicstatutoryfinancialstatements,isrequiredbytheNationalAssociationofInsuranceCommissioners,

whoconsidersittobeanessential

partoffinancialreportingforplacingthebasicstatutoryfinancial

statementsinanappropriateoperational,economic,orhistoricalcontext.Wehaveappliedcertain

limitedprocedurestotherequiredsupplementaryinformationinaccordancewithauditingstandards

generallyacceptedintheUnitedStatesofAmerica,whichconsistedofinquiriesofmanagement

aboutthemethodsofpreparingtheinformationandcomparingtheinformationforconsistencywith

management’sresponsestoourinquiries,thebasicstatutoryfinancialstatements,andotherknowledge

weobtainedduringourauditofthebasicstatutoryfinancial

statements.Wedonotexpressanopinion

orprovideanyassuranceontheinformationbecausethelimitedproceduresdonotprovideuswith

sufficientevidencetoexpressanopinionorprovideanyassurance.

RestrictiononUse

ThisreportisintendedsolelyfortheinformationanduseoftheBoardofDirectorsandmanagement

ofAlohaCare,theInsuranceDivision,andtheCentersforMedicareandMedicaidServicesandisnot

intendedtobeandshouldnotbeusedbyanyoneotherthanthesespecifiedparties.

Honolulu,Hawaii

May26,2023

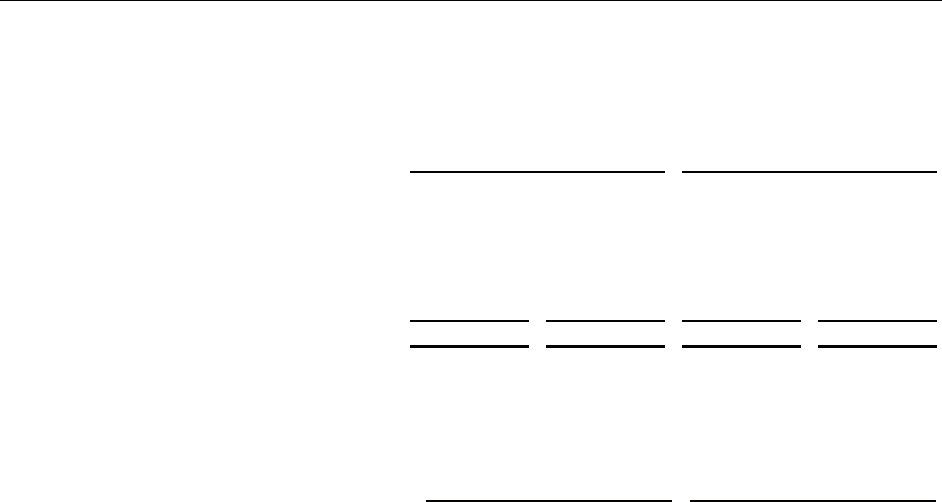

AlohaCare

StatutoryStatementsofAdmittedAssets,Liabilities,CapitalandSurplus

December31,2022and2021

Theaccompanyingnotesareanintegralpartofthestatutoryfinancialstatements.

4

2022 2021

AdmittedAssets

Investments

Bonds($31,368,458and$29,221,824restricted

atDecember31,2022and2021,respectively) 48,810,442$ 47,364,095$

Mutualfunds 3,225,573 3,726,123

Exchangetradedfunds 24,291,732 27,832,764

Totalinvestments 76,327,747 78,922,982

Cash,cashequivalents,andshort‐terminvestments($529,385and

$532,302restrictedatDecember31,2022and2021,respectively) 104,629,461 58,942,213

Totalinvestedassets 180,957,208 137,865,195

Receivables

ReceivablesfromStateofHawaii 17,860,067 19,805,484

Retrospectivepremiumsand

contractssubjecttoredetermination 2,142,794 3,482,330

Reinsurancereceivable 4,890,447 2,650,560

Pharmacyrebates 879,572 1,025,758

Otherreceivables 208,066 172,200

Electronicdataprocessingequipmentatcost,lessaccumulated

depreciationof$1,739,498and$1,513,207atDecember31,2022

and2021,respectively 357,848 253,728

Totaladmittedassets 207,296,002$ 165,255,255$

LiabilitiesandCapitalandSu rplus

Liabilities

Accountspayableandaccruedexpenses 34,699,553$ 17,836,655$

Accruedmedicalclaims 64,559,246 66,815,110

Premiumdeficiencyreserve 1,500,000 600,000

State

risk‐shareandriskadjustmentpayable 35,742,470 16,932,881

Payabletoriskpools 2,770,956 4,044,416

Totalliabilities 139,272,225 106,229,062

Capitalandsurplus

Grosspaidinandcontributedsurplus 1,512,000 1,512,000

Unassignedsurplus 66,511,777 57,514,193

Totalcapitalandsurplus 68,023,777 59,026,193

Totalliabilitiesandcapitalandsurplus 207,296,002$ 165,255,255$

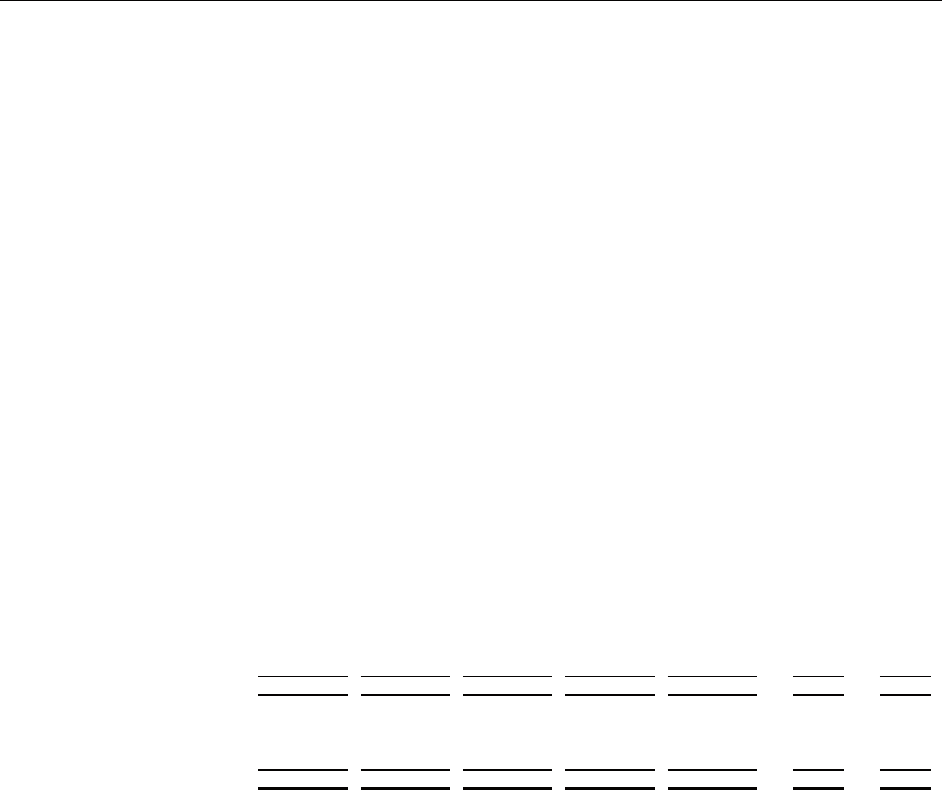

AlohaCare

StatutoryStatementsofOperationsandChangesinCapitalandSurplus

YearsEndedDecember31,2022and2021

Theaccompanyingnotesareanintegralpartofthestatutoryfinancialstatements.

5

2022 2021

Revenue

Capitationpremiums,net 468,280,406$ 450,648,245$

Otherincome 117,656 123,928

468,398,062 450,772,173

Costofservicesrendered

Medicalexpenses,net 408,861,021 396,035,036

Claimsadjustmentexpenses 5,122,970 5,557,629

Costcontainmentexpenses 6,584,012 6,247,891

Qualityprogramexpenses 1,766,939 1,811,380

Administrativeexpenses 39,225,116 35,400,379

461,560,058 445,052,315

Netunderwritingincome 6,838,004 5,719,858

Investmentincome 1,576,582 2,545,709

Otherexpenses ‐ (16,335)

Netincome 8,414,586 8,249,232

Capitalandsurplus

Beginningofyear 59,026,193 51,947,236

Changeinunrealizedgain(loss)oninvestments (4,050,882) 527,840

Changeinnonadmittedassets 4,633,880 (1,698,115)

Endofyear 68,023,777$

59,026,193$

AlohaCare

StatutoryStatementsofCashFlows

YearsEndedDecember31,2022and2021

Theaccompanyingnotesareanintegralpartofthestatutoryfinancialstatements.

6

2022 2021

Cashreceivedfromoperations

Premiumscollected 491,274,948$ 457,608,810$

Benefitandlossrelatedpayments (412,592,250) (388,771,926)

Commissions,expensespaid,andaggregatewrite‐ins (32,837,440) (43,806,521)

Cashreceivedfromunderwriting 45,845,258 25,030,363

Investmentincome 1,523,924 1,038,369

Netcashreceivedfromoperations 47,369,182 26,068,732

Proceedsfrominvestmentssoldormatured

Bonds 7,721,869 11,437,014

Mutualfunds ‐ 638,049

Exchangetradedfunds ‐ 4,007,245

Totalinvestmentproceeds 7,721,869 16,082,308

Costofinvestmentsacquired

Bonds (9,228,453) (26,144,615)

Mutualfunds (9,300) (2,202,942)

Exchangetradedfunds ‐ (19,435,111)

Totalcostofinvestmentsacquired (9,237,753) (47,782,668)

Netcashappliedforinvestments (1,515,884) (31,700,360)

Cashappliedforfinancingandmiscellaneoussources

Othercash (166,050) (2,668,212)

Netcashappliedforfinancingandmiscellaneoussources (166,050) (2,668,212)

Netchangeincash,cashequivalents,andshort‐terminvestments 45,687,248 (8,299,840)

Cash,cashequivalents,andshort‐terminvestments

Beginningofyear 58,942,213 67,242,053

Endofyear 104,629,461$

58,942,213$

AlohaCare

NotestoStatutoryFinancialStatements

December31,2022and2021

7

1. SummaryofOrganization

AlohaCareisaHawaiinon‐profitcorporationthatcontractswiththeStateofHawaii(the“State”),

DepartmentofHumanServices(“DHS”)toprovidemedicalandbehavioralhealthservicestocertain

residentsoftheStateunderthe“HawaiiQUEST”waiver‐onlydemonstrationprogram(“QUEST”)

approvedbythe

CentersforMedicare&MedicaidServices(“CMS”)undertheauthorityoftheSocial

SecurityAct.

InJanuary1,2015,AlohaCarewasawardedacontractwiththeStateundertheQUESTIntegration

program.Thecontracthasbeenamendedmultipletimessincecontractinceptionprimarilytoadjust

thecontract’sscopeofservices

andcompensationandpaymentschedule.ThiscontractincludedQUEST

eligiblerecipientsonallislandswhilealsointegratingaged,blindanddisabledrecipients.AlohaCare

providesmedical,behavioralhealth,andlong‐termcareservicesforallQUESTrecipientsaswellaslong‐

termcareandhomeandcommunity‐basedservicesforaged,blind

anddisabledrecipients.InMarch

2021,AlohaCarewasawardedanewcontract(collectivelythe“Contract”)withtheStatefortheQUEST

IntegrationprogramtocontinueservingQUESTeligiblerecipientsonallislandseffectiveJuly1,2021.

AlohaCarecontractswithphysicians,hospitalsandotherproviderstoprovideservicestoQUESTmembers

inamanagedcareenvironment.Certainunderwritinggainsandlossesaresubjecttoarisk‐sharing

programwiththeproviders.Underwritinggainsorlossesremainingaftertherisk‐sharingprovisions

withparticipatingprovidersaresubjecttorisksharingwiththeState.

OnJanuary1,2006,AlohaCarecommencedaMedicarePartsA,BandDrisk‐basedcontractwithCMS

thatprovidesforinpatient,outpatientandprescriptiondrugbenefitsbasedonMedicareregulations.The

MedicarecontractisrenewedannuallyandcurrentlycoverstheperiodfromJanuary1toDecember31.

EffectiveJanuary1,2015,AlohaCareterminateditsMedicareAdvantagePlan,butstill

offersaMedicare

AdvantageSpecialNeedsPlan.

2. AccountingPolicies

BasisofPresentation

Theaccompanyingstatutoryfinancialstatementshavebeenpreparedinconformitywithstatutory

accountingpractices(“SAP”)asprescribedorpermittedbytheInsuranceDivision,whichvariesinsome

respectsfromaccountingprinciplesgenerallyacceptedintheUnitedStatesof

America(“GAAP”).

TheNationalAssociationofInsuranceCommissioners(“NAIC”)hasadoptedthecodificationofstatutory

accountingprinciplesproject(“Codification”)astheNAIC‐supportedbasisofaccounting.TheCodification

wasapprovedwiththeprovisionforcommissionerdiscretioninthedeterminationofappropriate

statutoryaccountingforinsurers.Suchdiscretionwillallowprescribed

orpermittedaccountingpractices

thatmaydifferfromstatetostate.TheState,andaccordinglyAlohaCare,adoptedtheCodification

effectiveJanuary1,2001.

AlohaCare

NotestoStatutoryFinancialStatements

December31,2022and2021

8

ThemoresignificantdifferencesbetweenGAAPfornon‐profitentitiesandSAPwereasfollows:

Certainassetsdesignatedas“nonadmitted”arechargedtounassignedsurplusunderSAP.

Thepresentationofthestatutorystatementsofadmittedassets,liabilities,capitalandsurplus,and

cashflowsisnotinconformitywith

GAAPwithregardtothereportingofshort‐terminvestments

withcashandcashequivalents.Thestatutorystatementofcashflowsalsodonotincludea

reconciliationofnetincometonetcashreceivedfromoperations.UnderSAP,thestatutory

statementsofcashflowsreconcilechangesincashonhand

andondeposit,cashequivalents,and

short‐terminvestmentswithoriginalmaturitiesofoneyearorless.UnderGAAP,thestatementsof

cashflowsreconcilechangesincashandcashequivalentsandrestrictedcashandcashequivalents.

Cashequivalentsarefinancialinstrumentswithanoriginalmaturityofthreemonthsorless.

InvestmentsareaccountedforasexplainedbelowunderSAP,whileGAAPrequiresinvestments

inequitysecuritieswithreadilydeterminablefairvaluesandallinvestmentsindebtsecurities

classifiedasavailableforsaletobemeasuredatfairvalue,withchangesinfairvalueincluded

inthestatementsofactivities

asincreasesordecreasesinnetassets.

UnderSAP,amountsreceivablefromreinsurersarebasedoncoveredpolicyclaimspaid,withthe

differencebetweencoveredpolicyclaimsincurredandcoveredpolicyclaimspaidnettedagainst

accruedmedicalclaims.UnderGAAP,amountsreceivablefromreinsurersarebasedoncovered

policyclaims

incurred.

UseofEstimates

Thepreparationofstatutorybasisfinancialstatementsrequiresmanagementtomakeestimatesand

assumptionsthataffectthereportedamountsofadmittedassetsandliabilitiesanddisclosureof

contingentassetsandliabilitiesasofthedateofthestatutoryfinancialstatements,andthereported

amountsofrevenues

andexpensesduringtheperiod.Actualresultscouldmateriallydifferfromthose

estimates.

ConcentrationsofRisk

FinancialinstrumentsthatpotentiallysubjectAlohaCaretosignificantconcentrationsofcreditriskconsist

principallyofcash,cashequivalents,andshort‐terminvestments,bonds,mutualfunds,exchangetraded

funds(“ETFs”),andreceivables.AlohaCarehasvariousinvestments

inbonds,mutualfunds,andETFs

whichareexposedtointerestrateandmarketrisks.AlohaCare’scash,cashequivalents,andshort‐term

investmentbalancesexceeddepositoryinsurancelimits;however,AlohaCare’sinvestedassetsarewith

highcreditqualityfinancialinstitutions.Creditriskfromreceivablesisinherentlylimitedastheamounts

are

primarilyduefromthegovernment.

AlohaCare’sprimarysourceofrevenueisearnedunderasinglecontractwiththeDHSundertheQUEST

program.TheQUESTprogramissubjecttoaperiodicrenewalandrenegotiationofcapitatedrateswhich

comprisedapproximately90%and89%ofAlohaCare’srevenuesin2022and2021,respectively.

AlohaCare

NotestoStatutoryFinancialStatements

December31,2022and2021

9

FairValueMeasurements

Forfinancialandnonfinancialassetsandliabilitiesreportedatfairvalue,AlohaCaredefinesfairvalue

asthepricethatwouldbereceivedtosellanassetorpaidtotransferaliabilityintheprincipalormost

advantageousmarketinanorderlytransactionbetweenmarketparticipants.AlohaCare

measuresfair

valueusingobservableandunobservableinputsbasedonthefollowinghierarchy:

Level1–Quotedprices(unadjusted)inactivemarketsforidenticalassetsorliabilitiesthatAlohaCare

hastheabilitytoaccessatthemeasurementdate.

Level2–Inputs,otherthanquotedmarketprices,included

withinLevel1thatareobservable

foranassetorliability,directlyorindirectly.

Level3–UnobservableinputsforanassetorliabilityreflectingtheAlohaCare’sownassumptions.

Level3inputsareusedtomeasurefairvaluetotheextentthatobservableLevel1orLevel2inputs

are

notavailable.

Thelevelinthefairvaluehierarchywithinwhichthefairvaluemeasurementinitsentiretyfallsis

determinedbasedonthelowestlevelinputthatissignificanttothefairvaluemeasurementinits

entirety.

Cash,CashEquivalents,andShort‐TermInvestments

AlohaCareconsidersallhighlyliquid

debtinstruments,exceptforcertificatesofdeposit,purchasedwith

anoriginalmaturityofthreemonthsorlesstobecashequivalents,andanoriginalmaturityofoneyear

orless(excludingcashequivalents)tobeshort‐terminvestments.Certificatesofdepositwithoriginal

maturitydatesofoneyearorlessare

classifiedascash.Cash,cashequivalents,andshort‐term

investmentsareadmittedatcostoramortizedcost.

Investments

InvestmentsinbondsalsoincludeNAICSecuritiesValuationOffice(“SVO”)‐identifiedETFswhichqualify

forbondtreatment.Investmentsinbondsandsecuritiesthatqualifyforbondtreatmentarereportedat

admittedvalues

(generallyamortizedcostforbondsorfairvalueforSVO‐identifiedETFs)establishedby

theNAICorInsuranceDivision.Discountsandpremiumsrelatedtobondsareamortizedintoinvestment

income.InvestmentsinmutualfundsandETFsarereportedatfairvalue,withchangesinunrealizedgains

andlossesaccountedforas

adirectincreaseordecreaseinunassignedsurplus.Realizedgainsandlosses

arecomputedusingthespecificidentificationmethod.

PharmacyRebatesReceivable

PharmacyrebatepaymentstoAlohaCarearedelayeduntilaftertheyarebilledandcollectedfrom

pharmacymanufacturers.AlohaCarerecognizespharmaceuticalrebatesreceivablebasedonpast

collectionpatterns.Estimated

pharmacyrebatesreceivableassociatedwiththethreemonthsprior

toDecember31,2022and2021areconsideredadmittedassets.

CapitationRevenue

AlohaCarereceivescapitationpaymentsundertheQUESTandMedicarecontractsbasedonmonthly

memberenrollment.AlohaCareisrequiredtoprovideallcoveredhealthcareservicestoitsmembers.

Capitationisrecognized

asrevenueinthemonththatmembersareentitledtothebenefitsorupon

executionofaretroactiveamendmenttocapitatedratesintheQUESTcontract.

AlohaCare

NotestoStatutoryFinancialStatements

December31,2022and2021

10

Reinsurance

Capitationpremiumsandmedicalexpensesarereportednetofreinsuranceamounts.AlohaCare

remainsobligatedforamountscededintheeventthereinsurerdoesnotmeetitsobligation.

Reinsurancerecoverableshavebeenreportedbasedontheamountofclaimsincurred.

Depreciation

Depreciationiscomputedusingthestraight‐linemethodover

theassets’estimatedusefullives;leasehold

improvementsareamortizedusingthestraight‐linemethodoverthelesseroftheleasetermorthe

estimatedusefullivesoftheassets.Generally,theestimatedusefullivesoftheassetsareasfollows:

Years

Electronicdataprocessingequipment 3

Furnitureandequipment 5–7

Leaseholdimprovements 3

Computersoftware 3–5

Depreciationexpenseamountedto$2,961,043and$2,374,077in2022and2021,respectively.

AccruedMedicalClaims

Accruedmedicalclaimsincludeclaimsinprocessandaprovisionforincurredbutnotreportedclaims,

whichareactuariallydeterminedbasedonhistoricalclaimspaymentexperienceandotherindustry

statistics.Claimprocessingexpensesarealso

accruedbasedonanestimateofexpensesnecessary

toprocesssuchclaims.Suchreservesarecontinuallymonitoredandreviewedwithanyadjustments

reflectedthroughmedicalandclaimsadjustmentexpenses.Managementbelievesthataccruedmedical

claimsaresufficienttosatisfyAlohaCare’sultimateclaimsliability.Theseestimatesareinherentlysubject

toanumber

ofhighlyvariablecircumstances,andconsequently,theactualresultscoulddiffermaterially

fromtheamountrecordedinthestatutoryfinancialstatements.

PremiumDeficiencyReserve

AlohaCarerecognizesaliabilityforprobablelossesonunprofitableinsurancecontractsifthesumof

expectedclaimscosts,netofreinsurance,andclaimsadjustmentexpensesexceed

thesumofexpected

premiumsforaparticularlineofbusiness.AtDecember31,2022and2021,AlohaCarerecognizeda

premiumdeficiencyreserveassociatedwithitsMedicarespecialneedslineofbusiness.

StateRisk‐ShareandRiskAdjustmentPrograms

For2022,theContractincludesaretroactiveconcurrentriskadjustmentprogramto

transferrevenues

frommanagedcareorganizationswithlowerriskpopulationstomanagedcareorganizationswithhigher

riskpopulationswithintheStatepriortoapplyingtherisk‐sharingprogram.TheContractalsoincludes

arisk‐shareprogramwhichservestoaddressunknowncircumstancesbeyondthecontrolofhealthplans

andthe

State.Theprogramevaluatestheestablishedcapitatedratesagainstactualperformanceor

utilizationofservicesofdifferentenrolledpopulations.Underwritinggainsandlossesbypopulation

andcontractyeararesubjecttosettlementcorridorsthatadjusttheamountofcapitatedrevenues

recognized.

AtDecember31,2022,a$5,074,410retroactiveconcurrentriskadjustment

payablewasincludedinthe

Staterisk‐shareandriskadjustmentpayable.

AlohaCare

NotestoStatutoryFinancialStatements

December31,2022and2021

11

Therisksharefortheretroactiveenrollment(“retro”)groupisseparatelycalculatedfortheMedicaid

ExpansionandFamilyandChildren(“F&C”)populations,andexcludestheaged,blindanddisabled

(“ABD”)population.Retrogroupgainsandlossesarecalculatedasapercentageoftotalrevenueas

definedintheContract.Retro

groupgainsandlossesaresharedequallywithinariskcorridorranging

from0%to2.5%.Retrogroupgainsexceeding2.5%arerecoverablebytheState,whileretrogrouplosses

exceeding2.5%arerecoverablebyAlohaCare.In2022,the2020retrogrouprisk‐sharepayablewas

settledwiththeState.

AtDecember31,2022,$131,616and$1,947,793ofretrogrouplossesrelated

tothe2022and2021years,respectively,wereincludedinthereceivablesfromState.AtDecember31,

2021,$322,310ofretrogroupgainsrelatedtothe2020yearand$1,594,088ofretrogrouplossesrelated

tothe2021year

wereincludedintheStaterisk‐shareandriskadjustmentpayableandreceivablesfrom

State,respectively.

Theriskshareforthenon‐retroactiveenrollment(“aggregate”)groupiscalculatedforMedicaid

Expansion,ABD,andF&Cpopulationsintheaggregate.Aggregategroupgainsandlossesarecalculated

asapercentageoftotal

revenueasdefinedundertheContract.Aggregategroupgainsandlossesupto

3%areretainedbyAlohaCare.Aggregategroupgainsexceeding5%arerecoverablebytheState,while

aggregategrouplossesexceeding5%arerecoverablebyAlohaCare.Aggregategroupgainsandlosses

aresharedequallywithinariskcorridorranging

from3%to5%.In2022,the2020aggregaterisk‐share

payablewassettledwiththeState.AtDecember31,2022,$24,410,698ofaggregategroupgainsrelated

tothe2021yearwereincludedintheStaterisk‐shareandriskadjustmentpayable.Noamountof

aggregategroupgainsorlosses

areexpectedtobereceivedfromorpaidtotheStateforthe2022year.

AtDecember31,2021,$14,645,175ofaggregategroupgainsrelatedtothe2021and2020yearswere

includedintheStaterisk‐shareandriskadjustmentpayable.

TheriskshareforthehighcostdruggroupisseparatelycalculatedfortheMedicaidExpansion,ABD

andF&Cpopulations.Highcostdruggainsandlossesarecalculatedasapercentageoftotalrevenue

asdefinedbytheContract.Highcostdruggroupgainsandlossesupto3%areretainedbyAlohaCare.

Highcostdruggroupgainsexceeding

6%arerecoverablebytheState,whilehighcostdruggrouplosses

exceeding6%arerecoverablebyAlohaCare.Highcostdruggroupgainsandlossesaresharedequally

withinariskcorridorrangingfrom3%to6%.In2022,the2020highcostdrugrisk‐sharepayablewas

settledwiththe

State.AtDecember31,2022and2021,$5,321,888and$1,965,396,respectively,of

accumulatedhighcostdruggroupgains,wereincludedintheStaterisk‐shareandriskadjustment

payable.

Duetothevolatilityofhigh‐risknewborn(“HRNB”)costs,theContractincludesaspecificHRNBgroup

riskcorridor.TheHRNB

groupisbudget‐neutralfromtheState’sperspective,shiftingfundsbetweenthe

managedcareorganizationsthatprovideservicesundertheirrespectiveContract,basedonthemanaged

careorganization’sshareofHRNBcosts.In2022,the2020HNRBrisk‐sharereceivablewassettledwith

theState.AtDecember31,2022,$10,927,915in

HRNBfundsexpectedtobereceivedrelatedtothe

2021yearwereincludedinreceivablesfromState.NoamountofHRNBfundsareexpectedtobe

receivedfromorpaidrelatedtothe2022year.AtDecember31,2021,$1,432,576inaccumulated

HRNBfundsexpectedtobereceivedrelatedto

the2020yearwereincludedinreceivablesfromState.

PayabletoRiskPools

AlohaCarehasrisk‐sharingarrangementswithcertainQUESTproviderswhoassumetheriskofproviding

healthcaretoAlohaCare’smembers.AportionofQUESTrevenuesareallocatedtotheriskpools,with

healthcarecostsdeductedfromtheriskpools

asincurred.Surplusamountsaccumulatedinthepools

(aftertheapplicationofaproviderincentivepaymentlimit)arepayabletoQUESTproviders.

AlohaCare

NotestoStatutoryFinancialStatements

December31,2022and2021

12

Advertising

Advertisingcostsareexpensedasincurred.Advertisingexpensesamountedtoapproximately$82,000

and$352,000in2022and2021,respectively.

IncomeTaxes

AlohaCareisexemptfromfederalandStateincometaxesundersection501(c)(4)oftheInternalRevenue

Code(“IRC”)andsimilarStateprovisions.AlohaCareisalsoexemptfromState

premiumtaxesunderthe

HawaiiRevisedStatutes.

SubsequentEvents

AlohaCarehasreviewedalleventsthathaveoccurredfromJanuary1,2023throughMay26,2023,

thedatethatthestatutoryfinancialstatementswereavailabletobeissued,forproperaccounting

anddisclosureinthestatutoryfinancialstatements.

3. Investments

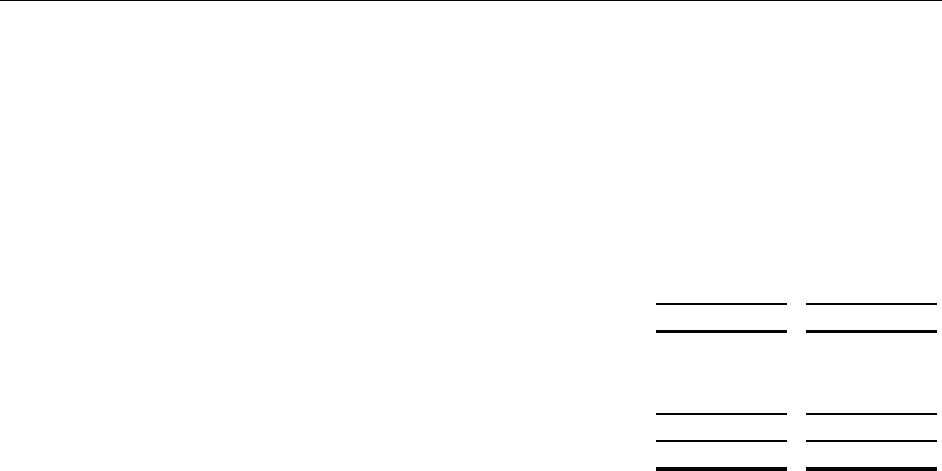

InvestmentsatDecember31,2022and2021werecomprisedofthefollowing:

Gross Gross

Amortized Unrealized Unrealized Estimated

CostorCost Gains Losses FairValue

2022

Bonds

U.S.government 42,105,322$ 56,658$ (3,097,913)$ 39,064,067$

Industrialandmiscellaneous(unaffiliated) 6,705,120 ‐ (484,983) 6,220,137

Totalbonds 48,810,442$ 56,658$ (3,582,896)$ 45,284,204$

Mutualfunds‒Fixedincome 3,763,035$ ‐$ (537,462)$ 3,225,573$

Exchangetradedfunds

Domesticequity 17,212,482$ 142,523$ (176,388)$ 17,178,617$

Foreignequity 7,781,574 ‐ (668,459) 7,113,115

Totalexchangetradedfunds 24,994,056$ 142,523$ (844,847)$ 24,291,732$

2021

Bonds

U.S.government 40,048,399$ 259,744$ (253,673)$ 40,054,470$

Industrialandmiscellaneous(unaffiliated) 7,315,696 109,972 (45,503) 7,380,165

Totalbonds 47,364,095$ 369,716$ (299,176)$ 47,434,635$

Mutualfunds‒Fixedincome 3, 753,735$ 9,572$ (37,184)$ 3,726,123$

Exchangetradedfunds

Domesticequity 17,212,483$ 2,253,152$ (683)$ 19,464,952$

Foreignequity 7,781,574 616,733 (30,495) 8,367,812

Totalexchangetradedfunds 24,994,057$ 2,869,885$ (31,178)$ 27,832,764$

AlohaCare

NotestoStatutoryFinancialStatements

December31,2022and2021

13

Theamortizedcostandestimatedfairvalueofbondsincludedincashequivalents,short‐term

investments,andbondsatDecember31,2022,bycontractualmaturity,areasfollows:

Industrialand

U.S.Government Miscellaneous(Unaffiliated)

Amortized Estimated Amortized Estimated

Cost FairValue Cost FairValue

Dueoneyearorless 6,020,187$ 5,942,327$ 935,904$ 919,444$

Dueafteronetofiveyears 25,999,973 24,363,533 5,024,188 4,681,235

Dueafterfivetotenyears 9,512,795 8,331,708 719,028 595,058

Dueaftertenyears 572,367 426,49 9 26,000 24,400

42,105,322$ 39,064,067$ 6,705,120$ 6,220,137$

InformationpertainingtosecuritieswithgrossunrealizedlossesatDecember31,2022and2021,

aggregatedbyinvestmentcategoryandlengthoftimethattheindividualsecuritieshavebeenina

continuouslossposition,isasfollows:

Gross Estimated Gross Estimated

Unrealized Fair Unrealized Fair

Losses Value Losses Value

2022

Bonds

U.S.government (279,290)$ 12,344,669$ (2,818,623)$ 22,534,126$

Industrialandmiscellaneous(unaffiliated) (177,310) 3,026,568 (307,673) 3,193,569

Mutualfunds–fixedincome (223,308) 962,689 (314,154) 2,262,884

Exchangetradedfunds

Domesticequity (145,792) 8,608,493 (30,596) 829,971

Foreignequity (337,134) 4,755,156 (331,325) 2,357,959

2021

Bonds

U.S.government (253,673)$ 25,744,673$ ‐$ ‐$

Industrialandmiscellaneous(unaffiliated) (45,503) 3,670,349 ‐‐

Mutualfunds–fixedincome (16,732) 1,782,339 (20,452) 757,515

Exchangetradedfunds

Domesticequity (683) 859,884 ‐‐

Foreignequity (30,495) 2,658,790 ‐‐

LessThan

TwelveMonths TwelveMonthsorGreater

Managementevaluatessecuritiesforother‐than‐temporaryimpairmentonaregularbasis,andwhen

economicormarketconcernswarrantsuchevaluation.Considerationgiventobondswherefairvalueis

lessthancostisbasedonwhetherAlohaCare(1)intendstosellthesecurity,(2)hasevidenceindicating

theneedto

sellthesecuritybeforearecoveryofitscost,(3)determinedthedeclineinvaluetobe

AlohaCare

NotestoStatutoryFinancialStatements

December31,2022and2021

14

interestrelated,(4)wouldbeunabletocollectallamountsdueaccordingtothecontractualtermsin

effectatthedateofacquisition,and(5)hasdeterminedanyotherfactorsindicatingthatanimpairment

shouldberecorded,suchasthelengthoftimeandtheextenttowhichthefair

valuehasbeenlessthan

costorthefinancialconditionandnear‐termprospectsoftheissuer.Considerationgiventomutualfunds

andETFsisbasedon(1)thelengthoftimeandtheextenttowhichfairvaluehasbeenlessthancost,

(2)thefinancialconditionandnear

termprospectsoftheissuer,and(3)theintentandabilityof

AlohaCaretoretainitsinvestmentintheissuerforaperiodoftimesufficienttoallowforanyanticipated

recoveryoffairvalue.

Themajorityofinvestmentswithunrealizedlossesresultedprincipallyfromchangestointerestrates

duringthe

year.Managementconsideredwhetherdowngradesbyratingagencieshaveoccurred,and

whetheranyreviewshaveidentifiedproblemswiththeissuer’sfinancialcondition.

ManagementhasalsodeterminedthatAlohaCarehastheabilitytoholdtheirsecuritiesinanunrealized

losspositionuntilarecoveryoffairvalueormaturityofthe

underlyingdebt.Accordingly,nodeclines

weredeemedtobeother‐than‐temporaryin2022or2021.

ThetotalamountsofrestrictedassetsbycategoryatDecember31,2022or2021wereasfollows:

Total Admitted

TotalFrom Admitted& Restricted

PriorYear TotalCurrent Nonadmitted toTotal

Total Total (Admitted&IncreaseYearAdmitted Restrictedto Admitted

Admitted Nonadmitted Nonadmitted) (Decrease) Restricted TotalAssets Assets

2022

Pledgedascollateralnot

capturedinothercategories 31,597,843$ ‐$ 29,454,126$ 2,143,717$ 31,597,843$ 15%15%

OndepositwiththeState 300,000 ‐ 300,000 ‐ 300,000 0%0%

31,897,843$ ‐$ 29,754,126$ 2,143,717$ 31,897,843$ 15%15%

2021

Pledged

ascollateralnot

capturedinothercategories 29,454,126$ ‐$ ‐$ 29,454,126$ 29,454,126$ 18%18%

OndepositwiththeState 300,000 ‐ 21,264,966 (20,964,966) 300,000 0%0%

29,754,126$ ‐$ 21,264,966$ 8,489,160$ 29,754,126$ 18%18%

AlohaCareelectedoneofthealternativeformsofcompliancewiththeperformancebondrequirements

undertheContractbyhavingitslenderissuealetterofcreditfor$27,800,000and$25,461,380in2022

and2021,respectively,withtheStatelistedasthesolebeneficiary.Underthetermsofasecurity

agreement

withitslender,thebalanceofAlohaCare’shypothecatedaccountamountingto$31,597,844

and$29,454,126atDecember31,2022and2021,respectively,werepledgedascollateral.

Acertificateofdepositof$300,000washeldinthenameoftheStateInsuranceCommissionertosatisfy

minimumcapitalandsurplusrequirementsatDecember31,

2022and2021.

AlohaCare

NotestoStatutoryFinancialStatements

December31,2022and2021

15

4. AccruedMedicalClaims

ActivityintheaccruedmedicalclaimsliabilityfortheyearsendedDecember31,2022and2021is

summarizedasfollows:

2022 2021

Balanceatbeginningofyear,netofreinsurancerecoverable 66,815,110$ 60,314,316$

Totalincurred

Currentyear 430,721,335 424,367,847

Prioryears (11,053,330) (17,127,291)

Totalincurred 419,668,005 407,240,556

Totalpaid

Currentyear 366,710,739 357,964,160

Prioryears 55,213,130 42,775,602

Totalpaid 421,923,869 400,739,762

Balanceatendofyear,netofreinsurancerecoverable 64,559,246$ 66,815,110$

Theamountsincurredin2022and2021relatedtoprioryearsreflectthattheaccruedmedicalclaims

liabilityatthebeginningoftheyeardifferedfromactualsubsequentdevelopment.The2022and2021

developmentwereprimarilyduetofavorableclaimdevelopmentsandlowerbenefitpaymentsthan

anticipated.

5. Reinsurance

In

thenormalcourseofbusiness,AlohaCareseekstoreducethelossthatmayarisefromcatastrophe

orothereventsthatmaycauseunfavorableunderwritingresultsthroughreinsurance.Thereinsurance

agreementcoversMedicaidandMedicareprogrammembers.

Forthe2022and2021coveredperiods,medicalclaimsincurredforMedicaidandMedicareprogram

membersweregenerallyreinsuredasfollows:

AlohaCare Reinsurer

Share Share

Upto$1,250,000(retentionpermember) 100%0%

$1,250,001–Unlimited(permember) 10%90%

Cededreinsurancepremiumsrelatedtothereinsuranceagreementamountedto$3,054,394and

$2,559,675fortheyearsendedDecember31,2022and2021,respectively.Fortheyearsended

December31,2022and2021,therewere$8,492,037and$5,197,015,respectively,inestimated

reinsurancerecoveriesnettedagainstmedicalexpenses.AtDecember31,2022

and2021,the

recoverableduetopaidlossesamountedto$4,890,447and$2,650,560,respectively,andwasincluded

inreinsurancereceivable.AtDecember31,2022and2021,therecoverableduetounpaidlosses

amountedto$2,213,808and$922,963,respectively,andwasincludedinaccruedmedicalclaims.

The2022and2021reinsuranceagreements

allowforexperiencerefundsifAlohaCaremeetscertain

conditions.TherewerenoexperiencerefundsunderreinsurancecontractsatDecember31,2022and

2021.

AlohaCare

NotestoStatutoryFinancialStatements

December31,2022and2021

16

6. Leases

AlohaCareleasesofficespaceandequipmentundernoncancelableoperatingleaseagreementsexpiring

atvariousdatesthroughAugust2027.Themajorityoftheseoperatingleasesarenoncancelableand

containleaseincentives,escalation,andrenewalclauses.

Futureminimumrentalpaymentsundernoncancelableoperatingleasesareasfollows:

YearsendingDecember

31,

2023 955,000$

2024 104,000

2025 87,000

2026 16,000

2027 5,000

1,167,000$

Rentexpenseapproximated$1,443,000and$1,412,000fortheyearsendedDecember31,2022and

2021,respectively.

7. RetirementPlans

AlohaCaresponsorsa401(k)plan(the“Plan”)thatcoversemployeeswhomeetspecifiedage

requirements.ThePlanelectedasafeharboremployermatchingcontributionformulawhere100%of

thefirst3%

and50%ofthenext2%ofanemployee’scompensationwouldbematchedbyAlohaCareand

immediatelyvested.Employermatchingcontributionswere$693,253and$699,951fortheyearsended

December31,2022and2021,respectively.

In2005,AlohaCarebegansponsoringtwodeferredcompensationplansunderSection457(f)oftheIRC

for

keyemployees.AtDecember31,2022and2021,thedeferredcompensationliabilityunderthese

plansamountedto$415,159and$425,808,respectively.

8. RelatedPartyTransactions

AlohaCarecontractswithphysicians,hospitalsandotherproviderstoprovidehealthcareservicesto

itsmembers.Thesecostswereincludedinmedicalexpenses.Certainprovidersserve

onAlohaCare’s

BoardofDirectorsandhaveprovidedcapitaltoAlohaCare.Medicalandotherexpensesrelatedtothese

providersamountedto$118,215,237and$113,601,327fortheyearsendedDecember31,2022and

2021,respectively.Netamountspayabletotheseprovidersamountedto$2,770,956and$3,825,781

atDecember31,2022and2021,

respectively.

In2011,AlohaCareinvested$150,000intoMediSenseConsultants,LLC(“MediSense”),amanaged

servicesorganizationthatprovidedbusinessandtechnicalservicessupportingthehealthcareoperations

ofseveralclinicsintheState.SeveralexecutivesoftheseclinicsalsoserveasmembersofAlohaCare’s

BoardofDirectors.MediSensewasdissolvedin2021.

9. CapitalandSurplus

AlohaCareisrequiredtomaintainaminimumstatutorycapitalandsurplusbalance,whichinthe

aggregate,amountedto$25,111,293and$25,200,975atDecember31,2022and2021,respectively.

AlohaCare

NotestoStatutoryFinancialStatements

December31,2022and2021

17

10. FairValueMeasurements

ThefollowingmethodsandassumptionswereusedbyAlohaCareinestimatingthefairvalueoffinancial

instruments:

Cash,CashEquivalents,andShort‐TermInvestments,Receivables,AccountsPayableand

AccruedExpenses,StateRisk‐ShareandRiskAdjustmentPayable,andPayabletoRiskPools

Theadmittedamountsapproximated

fairvalueduetotheshort‐termnatureofthesefinancial

instruments.

Bonds

AlohaCare’sinvestmentsinU.S.governmentandindustrialandmiscellaneous(unaffiliated)securities

wereincludedasbonds.Thefairvalueofbondswasestimatedusingquotedpricesinanactivemarketor

exchangeoranincomeapproachwithboth

observableandmarket‐basedinputsandunobservableinputs

suchasextrapolateddataandproprietarypricingmodels.BondswerecategorizedinLevel1orLevel2of

thefairvaluehierarchy.

MutualFundsandExchangeTradedFunds

ThefairvalueofmutualfundsandETFsarebasedonquotedpricesinactive

marketsorexchangesand

categorizedinLevel1ofthefairvaluehierarchy.

ThefairvaluesandadmittedvaluesoffinancialinstrumentsatDecember31,2022and2021areshown

below:

Estimated Admitted

FairValues Values Level1 Level2 Level3

Cash,cashequivalents,andshort‐terminvestments 104,629,461$ 104,629,461$ ‐$ 104,629,461$ ‐$

Bonds 45,284,204 48,810,442 ‐ 45,284,204 ‐

Mutualfunds 3,225,573 3,225,573 3,225,573 ‐‐

Exchangetradedfunds 24,291,732 24,291,732 24,291,732 ‐‐

Receivables 25,980,946 25,980,946 ‐ 25,980,946 ‐

Accountspayableandaccruedexpenses 34,699,553 34,699,553 ‐ 34,699,553 ‐

Staterisk‐shareandriskadjustmentpayable 35,742,470 35,742,470 ‐ 35,742,470 ‐

Payabletoriskpools 2,770,956 2,770,956 ‐ 2,770,956 ‐

Cash,cashequivalents,andshort‐

terminvestments 58,942,213$ 58,942,213$ ‐$ 58,942,213$ ‐$

Bonds 47,434,635 47,364,095 ‐ 47,434,635 ‐

Mutualfunds 3,726,123 3,726,123 3,726,123 ‐‐

Exchangetradedfunds 27,832,764 27,832,764 27,832,764 ‐‐

Receivables 27,136,332 27,136,332 ‐ 27,136,332 ‐

Accountspayableandaccruedexpenses 17,836,655 17,836,655 ‐ 17,836,655 ‐

Staterisk‐shareandriskadjustmentpayable 16,932,881 16,932,881 ‐ 16,932,881 ‐

Payabletoriskpools 4,044,416 4,044,416 ‐ 4,044,416 ‐

2022

2021

Fairvalueestimatesweremadeataspecificpointintimebasedonrelevantmarketinformationabout

thefinancialinstruments.Theseestimatesaresubjectiveinnatureandinvolveuncertaintiesandmatters

ofsignificantjudgmentandtherefore,cannotbedeterminedwithprecision.Changesinassumptions

couldsignificantlyaffecttheseestimates.

AlohaCare

NotestoStatutoryFinancialStatements

December31,2022and2021

18

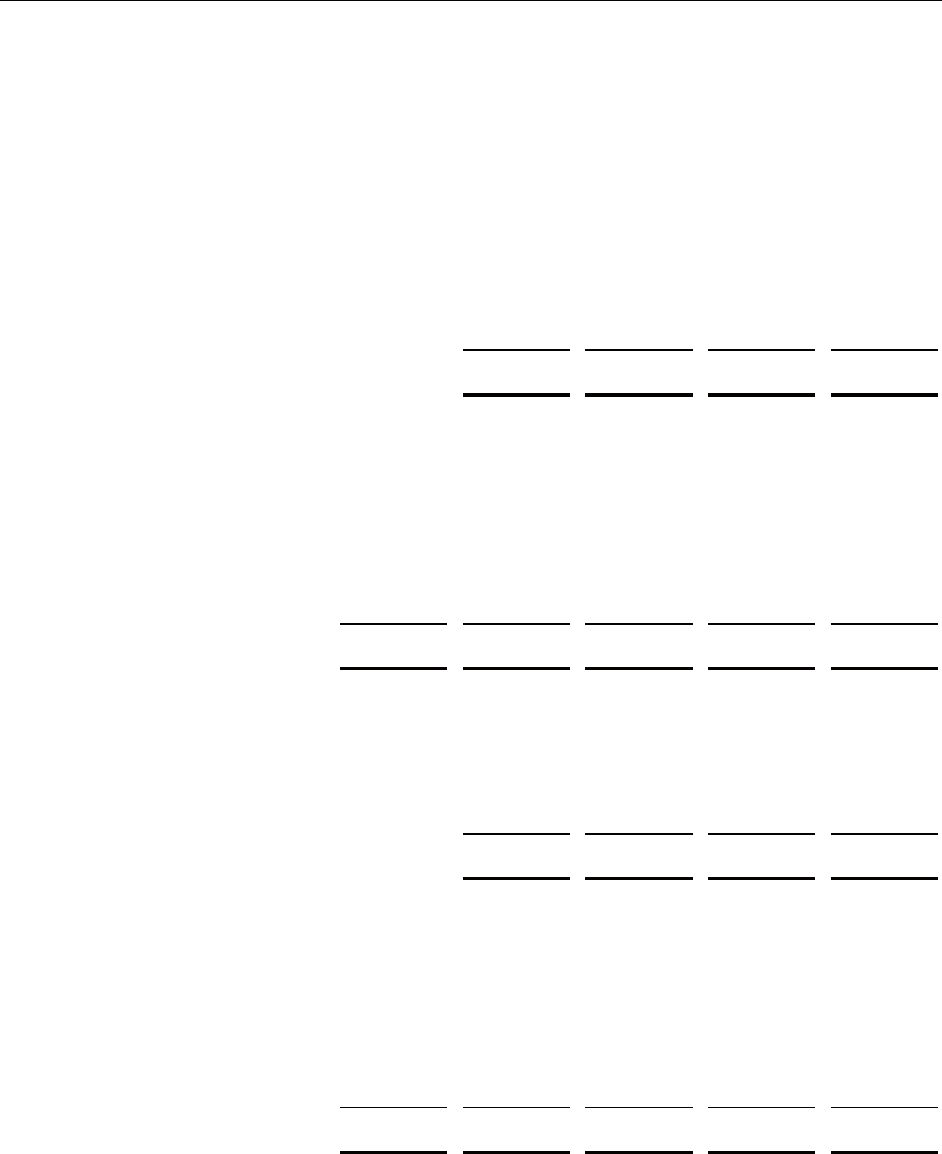

11. AnnualStatementAdjustments

Theaccompanyingauditedstatutoryfinancialstatementsincludeadjustmentsandreclassificationsto

properlyreflectadmittedassets,liabilities,capitalandsurplus,netincome,andcashflowswhichwere

reporteddifferentlyinthe2022and2021annualstatementsfiledwiththeInsuranceDivisioninMarch

2023and2022,respectively.

Admitted Capitaland Net

Assets Liabilities Surplus Income

December31,2022

Asreportedintheannualstatement 207,296,002$ 139,272,225$ 68,023,777$ 8,414,586$

Adjustments ‐‐‐‐

Reclassifications ‐‐‐‐

Asreportedintheaudited

financialstatements 207,296,002$ 139,272,225$ 68,023,777$ 8,414,586$

NetCash

Receivedfrom Beginning Ending

(Appliedfor) Cash,Cash Cash,Cash

NetCash NetCash Financingand Equivalents, Equivalents,

Receivedfrom Appliedfor Miscellaneous andShort‐term andShort‐term

Operations Investments Sources Investments Investments

Asreportedin

theannualstatement 13,493,355$ (1,515,884)$ 33,709,777$ 58,942,213$ 104,629,461$

Adjustments ‐‐‐‐‐

Reclassifications 33,875,827 ‐ (33,875,827) ‐‐

Asreportedintheaudited

financialstatements 47,369,182$ (1,515,884)$ (166,050)$ 58,942,213$ 104,629,461$

Admitted Capitaland Net

Assets Liabilities Surplus Income

December31,2021

Asreportedintheannualstatement 165,420,540$ 111,721,020$ 53,699,520$ 2,922,559$

Adjustments (165,285) (5,491,958) 5,326,673 5,326,673

Reclassifications ‐‐‐‐

Asreportedintheaudited

financialstatements 165,255,255$ 106,229,062$ 59,026,193$ 8,249,232$

NetCash

Receivedfrom Beginning Ending

(Appliedfor) Cash,Cash Cash,Cash

NetCash NetCash Financingand Equivalents, Equivalents,

Receivedfrom Appliedfor Miscellaneous andShort‐term andShort‐term

Operations Investments Sources Investments Investments

Asreportedinthe

annualstatement 6,252,898$ (31,700,360)$ 17,147,622$ 67,242,053$ 58,942,213$

Adjustments ‐‐‐‐‐

Reclassifications 19,815,834 ‐ (19,815,834) ‐‐

Asreportedintheaudited

financialstatements 26,068,732$ (31,700,360)$ (2,668,212)$ 67,242,053$ 58,942,213$

AlohaCare

NotestoStatutoryFinancialStatements

December31,2022and2021

19

The2022and2021reclassificationsrelatedtocashflowswereprimarilyattributabletothefollowing:

DifferencesintheclassificationofthechangeinamountspayableundertheStateRisk‐Share

Program.

Differencesintheclassificationofdepreciationexpense.

The2021adjustmentsrelatedtoadmittedassets,liabilities,capitaland

surplus,andnetincomewere

primarilyattributabletothefollowing:

Risk‐shareadjustmentsincludedinthereceivablesfromStateandStaterisk‐sharepayablerelated

tothe2020year.

SupplementalSchedules

AlohaCare

SupplementalSchedule–InvestmentSummarySchedule

December31,2022

20

SecuritiesLending

ReinvestedCollateral

Amount Percentage Amount Amount Total Percentage

Bonds(ScheduleD,Part1)

U.S.government 42,105,322$ 23.3% 42,105,322$ ‐$ 42,105,322$ 23.3%

Allothergovernments ‐ 0.0% ‐‐ ‐0.0%

U.S.states,territoriesandpossessions,etc.guaranteed ‐ 0.0% ‐‐ ‐0.0%

U.S.politicalsubdivisionofstates,territoriesand

possessions,guaranteed ‐ 0.0% ‐‐ ‐0.0%

U.S.specialrevenueand

specialassessment

U.S.specialrevenueandspecialassessmentobligations,

etc.non‐guaranteed ‐ 0.0% ‐‐ ‐0.0%

Industrialandmiscellaneous(unaffiliated) 6,705,120 3.7% 6,705,120 ‐ 6,705,120 3.7%

Hybridsecurities ‐ 0.0% ‐‐ ‐0.0%

Parent,subsidiariesandaffiliates ‐ 0.0% ‐‐ ‐0.0%

SVOidentifiedfunds ‐ 0.0% ‐‐ ‐0.0%

Unaffiliatedbankloans ‐ 0.0% ‐‐ ‐0.0%

Totallong‐term

bonds 48,810,442 27.0% 48,810,442 ‐ 48,810,442 27.0%

PreferredStock(ScheduleD,Part2,Section1)

Industrialandmiscellaneous(unaffiliated) ‐ 0.0% ‐‐ ‐0.0%

Parent,subsidiariesandaffiliates ‐ 0.0% ‐‐ ‐0.0%

Totalpreferredstocks ‐ 0.0% ‐‐ ‐0.0%

CommonStocks(ScheduleD,Part2,Section2)

Industrialandmiscellaneouspubliclytraded(unaffiliated) 24,291,732 13.4% 24,291,732 ‐ 24,291,732 13.4%

Industrialand

miscellaneousother(unaffiliated) ‐ 0.0% ‐‐ ‐0.0%

Parent,subsidiariesandaffiliatespubliclytraded ‐ 0.0% ‐‐ ‐0.0%

Parent,subsidiariesandaffiliatesother ‐ 0.0% ‐‐ ‐0.0%

Mutualfunds 3,225,573 1.8% 3,225,573 ‐ 3,225,573 1.8%

Unitinvestmenttrusts ‐ 0.0% ‐‐ ‐0.0%

Closed‐endfunds ‐ 0.0% ‐‐ ‐0.0%

Totalcommonstocks 27,517,305 15.2% 27,517,305 ‐ 27,517,305 15.2%

MortgageLoans(Schedule

B)

Farmmortgages ‐ 0.0% ‐‐ ‐0.0%

Residentialmortgages ‐ 0.0% ‐‐ ‐0.0%

Commercialloans ‐ 0.0% ‐‐ ‐0.0%

Mezzaninerealestateloans ‐ 0.0% ‐‐ ‐0.0%

Totalvaluationallowance ‐ 0.0% ‐‐ ‐0.0%

Totalmortgageloans ‐ 0.0% ‐‐ ‐0.0%

InvestmentCategories

Realestate(ScheduleA)

Propertyoccupiedbycompany ‐ 0.0% ‐‐ ‐0.0%

Propertyheldforproductionofincome ‐ 0.0% ‐‐ ‐0.0%

Propertyheldforsale ‐ 0.0% ‐‐ ‐0.0%

Totalrealestate ‐ 0.0% ‐‐ ‐0.0%

Cash,cashequivalents,andshort‐terminvestments

Cash(ScheduleE,Part1) 103,908,117 57.4% 103,908,117 ‐ 103,908,117 57.4%

Cashequivalents(ScheduleE,Part2) 721,344 0.4% 721,344 ‐ 721,344 0.4%

Short‐terminvestments(ScheduleDA)

‐ 0.0% ‐‐ ‐0.0%

Totalcash,cashequivalents,

andshort‐terminvestments 104,629,461 57.8% 104,629,461 ‐ 104,629,461 57.8%

Contractloans ‐ 0.0% ‐‐ ‐0.0%

Derivatives(ScheduleDB) ‐ 0.0% ‐‐ ‐0.0%

Otherinvestedassets(ScheduleBA) ‐ 0.0% ‐‐ ‐0.0%

Receivablesforsecurities ‐ 0.0% ‐‐ ‐0.0%

Securitieslending(ScheduleDL,Part1) ‐ 0.0% ‐‐ ‐0.0

%

Otherinvestedassets ‐ 0.0% ‐‐ ‐0.0%

Totalinvestedassets 180,957,208$ 100.0% 180,957,208$ ‐$ 180,957,208$ 100.0%

GrossInvestmentHoldings AdmittedAssetsasReportedintheAnnualStatement

AlohaCare

SupplementalSchedule–InvestmentRiskInterrogatories

December31,2022

21

AnswerthefollowinginterrogatoriesbystatingtheapplicableU.S.dollaramountsandpercentagesofthe

reportingentity’stotaladmittedassetsheldinthatcategoryofinvestmentsasshownontheSummaryInvestment

Schedule.AllreportingentitiesmustanswerInterrogatories1through4,11through16,18,19and,ifapplicable,

20through23.AnswereachoftheInterrogatories5through10onlyifthereportingentity’saggregateholdingsin

foreigninvestmentsasaddressedinInterrogatory4equalsorexceeds2.5%ofthereportingentity’stotaladmitted

assets.AnswerInterrogatory17onlyifthereportingentitiesaggregateholdingsinmortgageloans

asaddressed

inInterrogatory16equalsorexceeds2.5%ofthereportingentity’stotaladmittedassets.ForLife,Health,and

Fraternalblanks,responsesaretoexcludeSeparateAccounts.

1. Statethereportingentity’stotaladmittedassetsasreportedonPage2ofthe

annualstatement. $207,296,002

2. Statebyinvestmentcategorythe10largestexposurestoasingleissuer/borrower/

investment,excludingU.S.governmentsecurities,U.S.governmentagency

securities,andthoseU.S.governmentmoneymarketfundslistedinthePurposes

andProceduresManualoftheNAICInvestmentAnalysisOfficeasexempt,property

occupiedbytheCompany,policyloans,and

allSECandforeignregisteredfunds

andcommontrustfundsthatarediversifiedwithinthemeaningoftheInvestment

CompanyActof1940.

Percentage

ofTotal

Admitted

InvestmentCategory/Issuer Amount Assets

Bonds

a. AppleInc. 499,417$ 0.24%

b. Amazon.comInc. 391,592$ 0.19%

c. PepsiCo,Inc. 351,783$ 0.17%

d. JohnDeereCapitalCorp. 255,983$ 0.12%

e. HormelFoodCorp. 239,858$ 0.12%

f. BankofNYMellonCorp. 237,936$ 0.11%

g. PfizerInc. 219,503$ 0.11%

h. RepublicServicesInc. 217,877$ 0.11%

Cash,cashequivalents,andshort‐terminvestments

i. Bank

ofHawaii 103,608,119$ 49.98%

j. FirstHawaiianBank 300,000$ 0.14%

AlohaCare

SupplementalSchedule–InvestmentRiskInterrogatories

December31,2022

22

3. Statetheamountsandpercentagesofthereportingentity’stotaladmittedassets

heldinbondsandpreferredstocksbyNAICdesignation.

Percentage

ofTotal

Admitted

Amount Assets

Bonds

NAIC‐1 47,205,615$ 22.77%

NAIC‐2 1,604,827$ 0.77%

Preferredstock

None

4. Statetheamountsandpercentagesofthereportingentity’stotaladmittedassets

heldinforeigninvestments(regardlessofwhetherthereisanyforeigncurrency

exposure)andunhedgedforeigncurrencyexposure(definedinthestatement

valueofinvestmentsdenominatedinforeigncurrencieswhicharenothedgedby

financialinstrumentsqualifyingforhedge

accountingasspecifiedinSSAPNo.31,

DerivativeInstruments),including(i)foreigninvestmentsasdeterminedbythe

rulesorstatutesofthestateofHawaiiof$0,(ii)foreigninvestmentsthatsupport

insuranceliabilitiesdenominatedinthatsameforeigncurrencyof$0,and(iii)the

amountoftheinsuranceliabilities

associatedwiththeinvestmentsreportedin(ii)

andthataredenominatedinthesamecurrencyof$0.

Assetsheldinforeigninvestmentslessthan2.5%ofthereportingentity’s

totaladmittedassets,therefore,detailnotrequiredforInterrogatories5–10. Yes[X]No[]

11. Statetheamountsandpercentagesofthereportingentity’stotaladmittedassets

heldinCanadianinvestments,includingCanadiancurrency‐denominated

investmentsof$0,Canadianinsuranceliabilitiesof$0,andunhedgedCanadian

currencyexposure.

AssetsheldinCanadianinvestmentslessthan2.5%ofthereportingentity’s

totaladmittedassets,thereforedetailnot

requiredforInterrogatory11. Yes[X]No[]

12. Statetheaggregateamountsandpercentagesofthereportingentity’stotal

admittedassetsheldininvestmentswithcontractualsalesrestrictions(defined

asinvestmentshavingrestrictionsthatpreventinvestmentsfrombeingsoldwithin

90days).

Assetsheldininvestmentswithcontractualsalesrestrictionslessthan2.5%of

thereportingentity’stotaladmitted

assets,thereforedetailnotrequiredfor

Interrogatory12. Yes[X]No[]

AlohaCare

SupplementalSchedule–InvestmentRiskInterrogatories

December31,2022

23

13. Statetheamountsandpercentagesofadmittedassetsheldinthelargest10equity

interests(includinginvestmentsinthesharesofmutualfunds,preferredstocks,

publiclytradedequitysecurities,andotherequitysecurities,andexcludingmoney

marketandbondmutualfundslistedinpartsix,sections2(f)and(g)ofthe

PurposesandProceduresManualoftheNAICSecuritiesValuationOfficeas

exemptorClass1).

Assetsheldinequityinterestslessthan2.5%ofthereportingentity’stotaladmitted

assets,thereforedetailnotrequiredforInterrogatory13. Yes[]No[X]

Amount Percentage

EquityInterest

a. VanguardTotalStockMarketETF 7,682,205$ 3.71%

b. VanguardHighDividendYield 5,657,111$ 2.73%

c. VanguardInternationalHighDividendYieldIndexETF 3,703,765$ 1.79%

d. iSharesSelectDividendETF 3,839,301$ 1.85%

e. VanguardFTSEDevelopedETF 2,572,215$ 1.24%

f. T.RowePriceInstitutional 964,541$ 0.47%

g. PIMCOPrefer&Capital‐Inst 962,689$ 0.46%

h. Mainstay

MackayHighBond 882,398$ 0.43%

i. VanguardFTSEEmergingMarketsETF 837,134$ 0.40%

j. VanguardEmergingMarketsBond–Admiral 415,945$ 0.20%

14. Statetheamountsandpercentagesofthereportingentity’stotaladmittedassets

heldinnonaffiliated,privatelyplacedequities(includedinotherequitysecurities)

andexcludingsecuritieseligibleforsaleunderSecuritiesExchangeCommission

(“SEC”)Rule144aorSECRule144withoutvolumerestrictions.

Assetsheldinnonaffiliated,privatelyplacedequitiesless

than2.5%ofthereporting

entity’stotaladmittedassets,thereforedetailnotrequiredforInterrogatory14. Yes[X]No[]

15. Statetheamountsandpercentagesofthereportingentity’stotaladmittedassets

heldingeneralpartnershipinterests(includedinotherequitysecurities).

Assetsheldingeneralpartnershipinterestslessthan2.5%ofthereportingentity’s

totaladmittedassets,thereforedetailnotrequiredforInterrogatory15. Yes[X]No[]

Aggregate

statementvalueofinvestmentsheldingeneralpartnershipinterests None

Largest3investmentswithcontractualsalesrestrictionsNone

16. WithrespecttomortgageloansreportedinScheduleB,statetheamountsand

percentagesofthereportingentity’stotaladmittedassets.

MortgageloansreportedinScheduleBlessthan2.5%ofthereportingentity’s

totaladmittedassets,thereforedetailnotrequiredforInterrogatories16and17. Yes[X]No[]

AlohaCare

SupplementalSchedule–InvestmentRiskInterrogatories

December31,2022

24

Eachofthe10largestaggregatemortgageinterests.Theaggregatemortgage

interestrepresentsthecombinedvalueofallmortgagesecuredbythesame

propertyorcamegroupofproperties. None

18. Statetheamountsandpercentagesofthereportingentity’stotaladmittedassets

heldineachofthefivelargestinvestmentsinoneparcelorgroupofcontiguous

parcelsofrealestatereportedinScheduleA,excludingpropertyoccupiedbythe

company.

Assetsheldineachofthefivelargestinvestmentsin

oneparcelorgroupof

contiguousparcelsofrealestatereportedinScheduleAlessthan2.5%of

thereportingentity’stotaladmittedassets,therefore,detailnotrequired

forInterrogatory18. Yes[X]No[]

19. Statetheaggregateamountsandpercentagesofthereportingentity’s

totaladmittedassetsheldinmezzaninerealestateloans.

Assetsheldinmezzaninerealestateloansarelessthan2.5%ofthereporting

entity’sadmittedassets,thereforedetailnotrequiredforInterrogatory19. Yes [X]No[]

AlohaCare

SupplementalSchedule–ReinsuranceSummarySchedule

December31,2022

25

1. Discloseanycededreinsurancecontracts(ormultiplecontractswiththesamereinsurer

oritsaffiliates)subjecttoA‐791thatincludesaprovision,whichlimitsthereinsurer’s

assumptionofsignificantrisksidentifiedasinA‐791.Examplesofrisk‐limitingfeatures

includeprovisionssuchasadeductible,alossratiocorridor,

alosscap,anaggregate

limit,orsimilareffect. None

a. Iftrue,indicatethenumberofreinsurancecontractstowhichsuchprovisions

apply. N/A

b. ForcontractssubjecttoA‐791,indicateifdepositaccountingwasappliedforall

contracts,whichlimitsignificantrisks. N/A

2. Discloseanycededreinsurancecontracts(ormultiplecontractswiththesame

reinsureroritsaffiliates)notsubjecttoA‐791,forwhichreinsuranceaccounting

wasappliedandincludesaprovisionthatlimitsthereinsurer’sassumptionofrisk.

Examplesofrisk‐limitingfeaturesincludeprovisionssuchasadeductible,alossratio

corridor,alosscap,anaggregatelimit,orsimilareffect.Notethatastoplossor

excessoflossreinsuranceagreementwithdeductiblesorlosscapswhichapplyto

theentirecontractandarenotadjustablebasedonotherfeatures,donotrequire

disclosureunderthisparagraph. None

a. If

true,indicatethenumberofreinsurancecontractstowhichsuchprovisions

apply. N/A

b. Ifaffirmative,indicateifreinsurancecreditwasreducedfortherisk‐limiting

features. N/A

3. Discloseifanyreinsurancecontractscontainfeatures(exceptreinsurancecontracts

withafederalorstatefacility)describedbelowwhichresultindelaysinpaymentin

formorinfact.

a. Provisionswhichpermitthereportingoflosses,orsettlementsaremade,less

frequentlythanquarterlyorpaymentsduefromthereinsurer

arenotmadein

cashwithinninety(90)daysofthesettlementdate(unlessthereisnoactivity

duringtheperiod). None

b. Paymentschedule,accumulatingretentionsfrommultipleyearsoranyfeatures

inherentlydesignedtodelaytimingofthereimbursementtothecedingentity. None

4. Discloseifthereportingentityhasreflectedreinsuranceaccountingcreditforany

contractsnotsubjecttoA‐791andnotyearlyrenewableterm,whichmeettherisk‐

transferrequirementsofSSAPNo.61Randidentifythetypeofcontractsandthe

reinsurancecontracts. Yes

a. Assumptionreinsurance‒asdiscussedin

paragraph60,whichisnewforthe

reportingperiod. No

AlohaCare

SupplementalSchedule–ReinsuranceSummarySchedule

December31,2022

26

5. DiscloseifthereportingentitycededanyriskwhichisnotsubjecttoA‐791andnot

yearlyrenewabletermreinsurance,underanyreinsurancecontract(ormultiple

contractswiththesamereinsureroritsaffiliates)duringtheperiodcoveredbythe

financialstatement,andeither:

a. Accountedforthatcontractas

reinsuranceunderstatutoryaccounting

principles(“SAP”)andasadepositunderU.S.generallyacceptedaccounting

principles(“GAAP”);or N/A

b. AccountedforthatcontractasreinsuranceunderGAAPandasadepositunder

SAP. N/A

IfthereportingentitydoesnotprepareGAAPfinancialstatementsoritsfinancial

statements

arenotpartofupstreamGAAPfinancialstatements,thisdisclosurecan

beanswerednotapplicable.

6. Ifaffirmativedisclosureisrequiredforparagraph83,explainwhythecontract(s)is

treateddifferentlyforGAAPandSAP. N/A