CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

--------------------------------------------------------------------------------------------------------------------------------

Nordea Bank Abp Spółka Akcyjna

Oddział w Polsce [Branch in Poland]

FINANCIAL STATEMENTS

FOR THE PERIOD

FROM 01/01/2023 TO 31/12/2023

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

--------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 2

Contents

Statement of comprehensive income .......................................................................................................................... 3

Assets .......................................................................................................................................................................... 4

Equity and liabilities..................................................................................................................................................... 4

Cash flow statement .................................................................................................................................................... 5

Notes to the Financial Statements ............................................................................................................................... 6

Note 1 - General information about the branch ........................................................................................................... 6

Note 2 - Basis for the preparation of financial statements ........................................................................................... 6

Note 3 - Description of significant accounting policies applied .................................................................................... 9

Note 4 - Revenue from sale of services ...................................................................................................................... 14

Note 5 - Costs of wages and salaries, including surcharges and other employee benefits .......................................... 15

Note 6 - Third-party IT services .................................................................................................................................. 15

Note 7 - Other administrative expenses ..................................................................................................................... 16

Note 8 – Depreciation ................................................................................................................................................ 16

Note 9 - Other operating expenses and other operating income ............................................................................... 16

Note 10 - Costs of operation and maintenance of the premises ................................................................................. 17

Note 11 - Financial income and expenses .................................................................................................................. 17

Note 12 - Income tax .................................................................................................................................................. 18

Note 13 - Property, plant, and equipment, including right of use assets under lease Property, plant, and equipment

from 01/01/2023 to 31/12/2023................................................................................................................................ 21

Note 14 - Intangible assets ......................................................................................................................................... 23

Note 15 - Deferred tax assets and deferred tax liabilities ........................................................................................... 24

Note 16 - Long-term investments ............................................................................................................................... 25

Note 17 - Trade receivables, uninvoiced receivables and other receivables ............................................................... 26

Note 18 - Cash and cash equivalents .......................................................................................................................... 26

Note 19 - Long-term liabilities due to settlements with Branch’s Head Office ........................................................... 26

Note 20 - Liabilities due to loans, borrowings and other debt instruments ................................................................ 27

Note 21 - Contingent liabilities ................................................................................................................................... 27

Note 22 - Provisions ................................................................................................................................................... 28

Note 23 - Trade liabilities and other liabilities 31/12/2023 ........................................................................................ 28

Note 24 - Lease .......................................................................................................................................................... 29

Note 25 -Transactions with affiliates ......................................................................................................................... 31

Note 26 - Financial instruments, fair value, and other disclosures ............................................................................. 33

Note 27 - Financial risk management ......................................................................................................................... 34

Note 28 - Employment ............................................................................................................................................... 37

Note 29 - Fee for the entity authorised to audit financial statements ........................................................................ 37

Note 30 - Impact of the COVID-19 pandemic and Russia’s aggression against Ukraine on the company’s financial

position...................................................................................................................................................................... 38

Note 31 - Events after the end of the reporting period .............................................................................................. 38

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

--------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 3

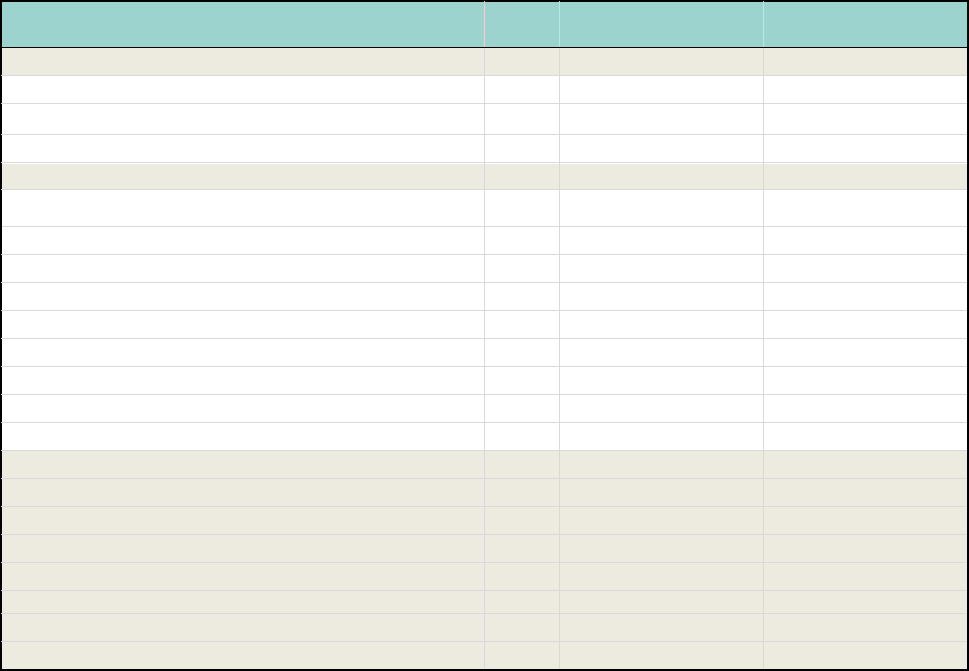

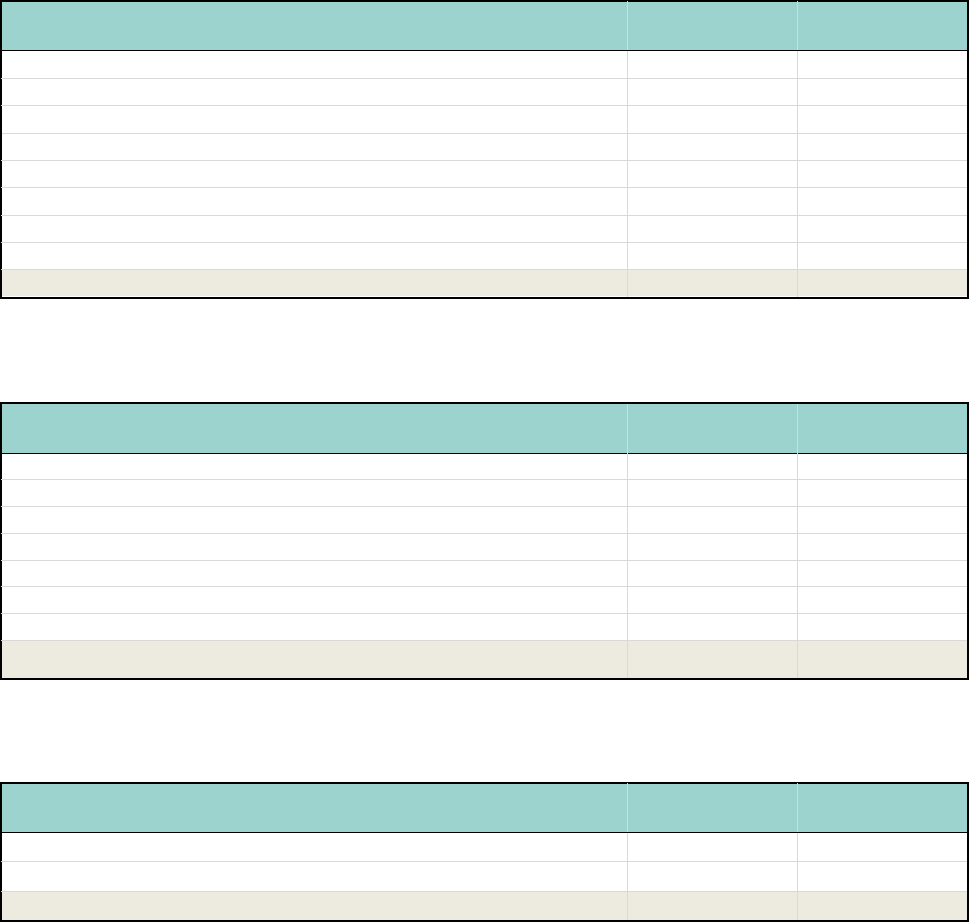

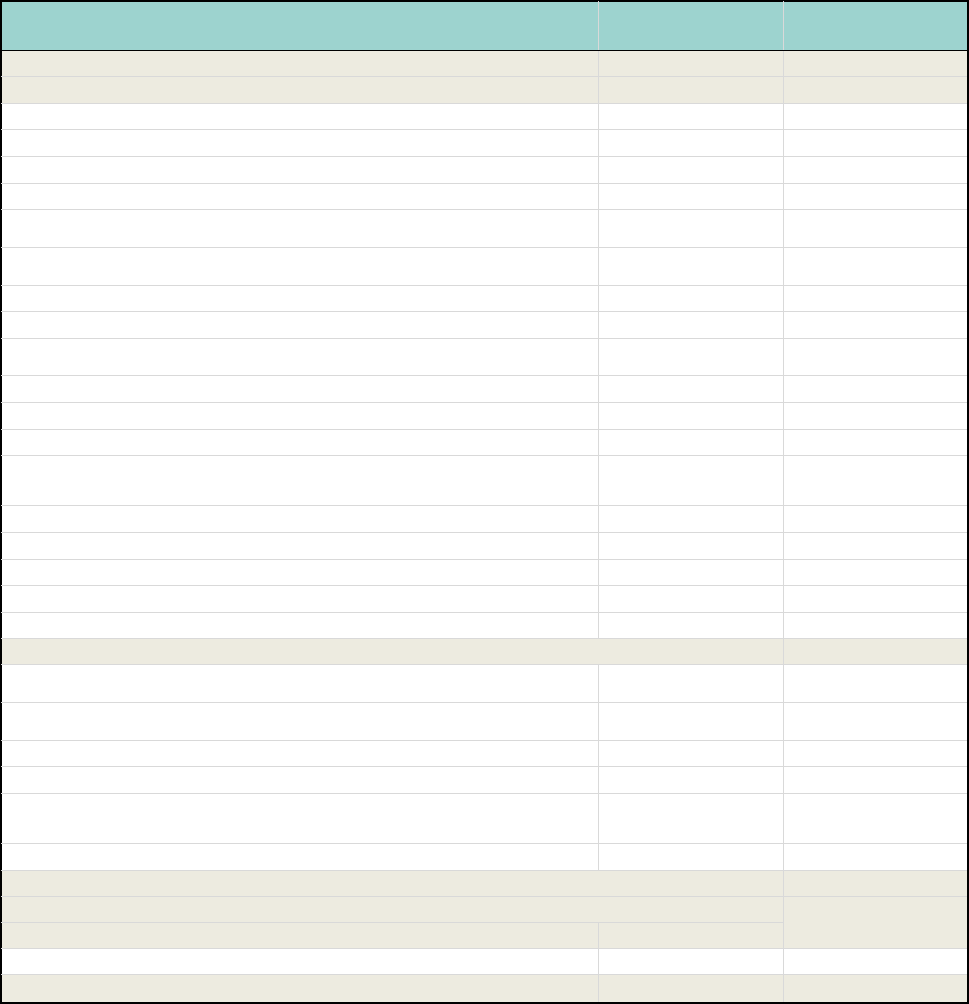

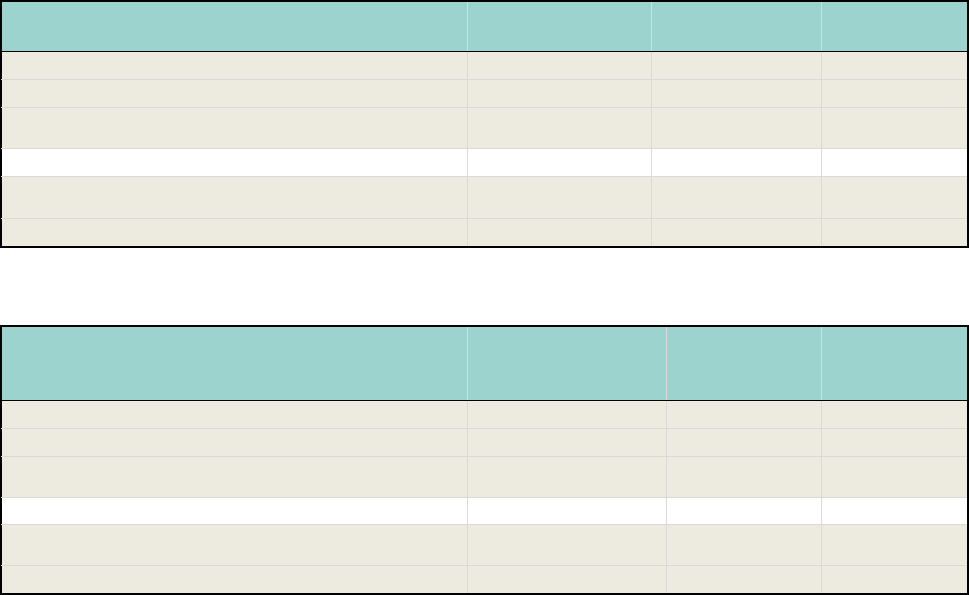

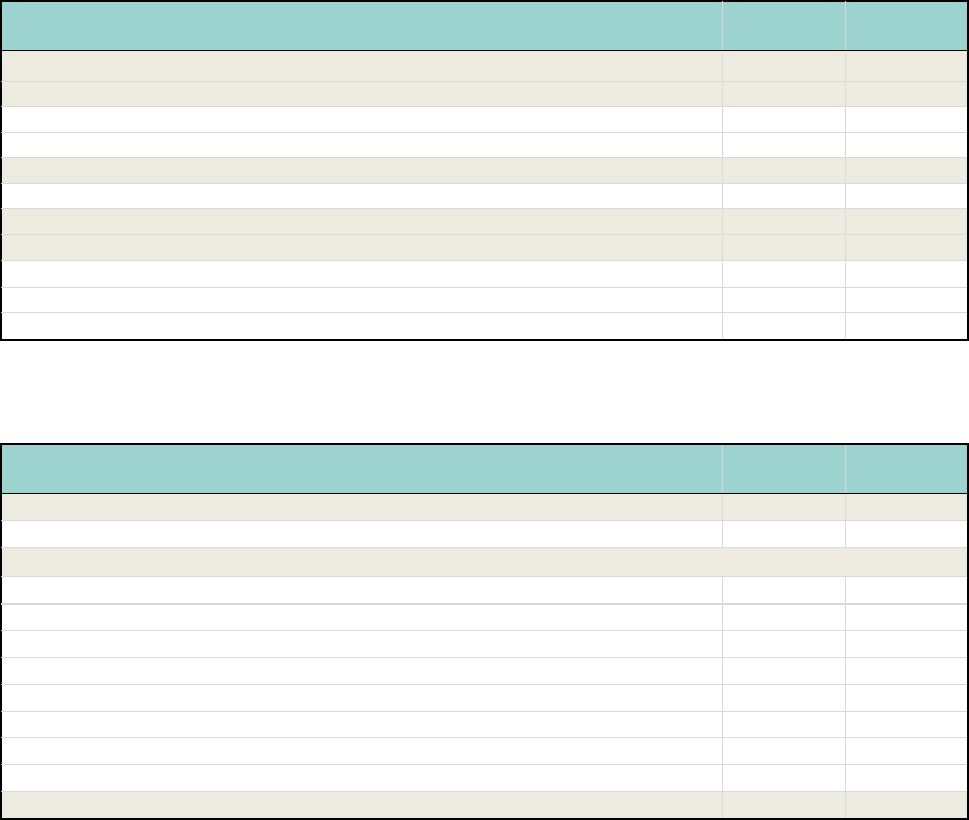

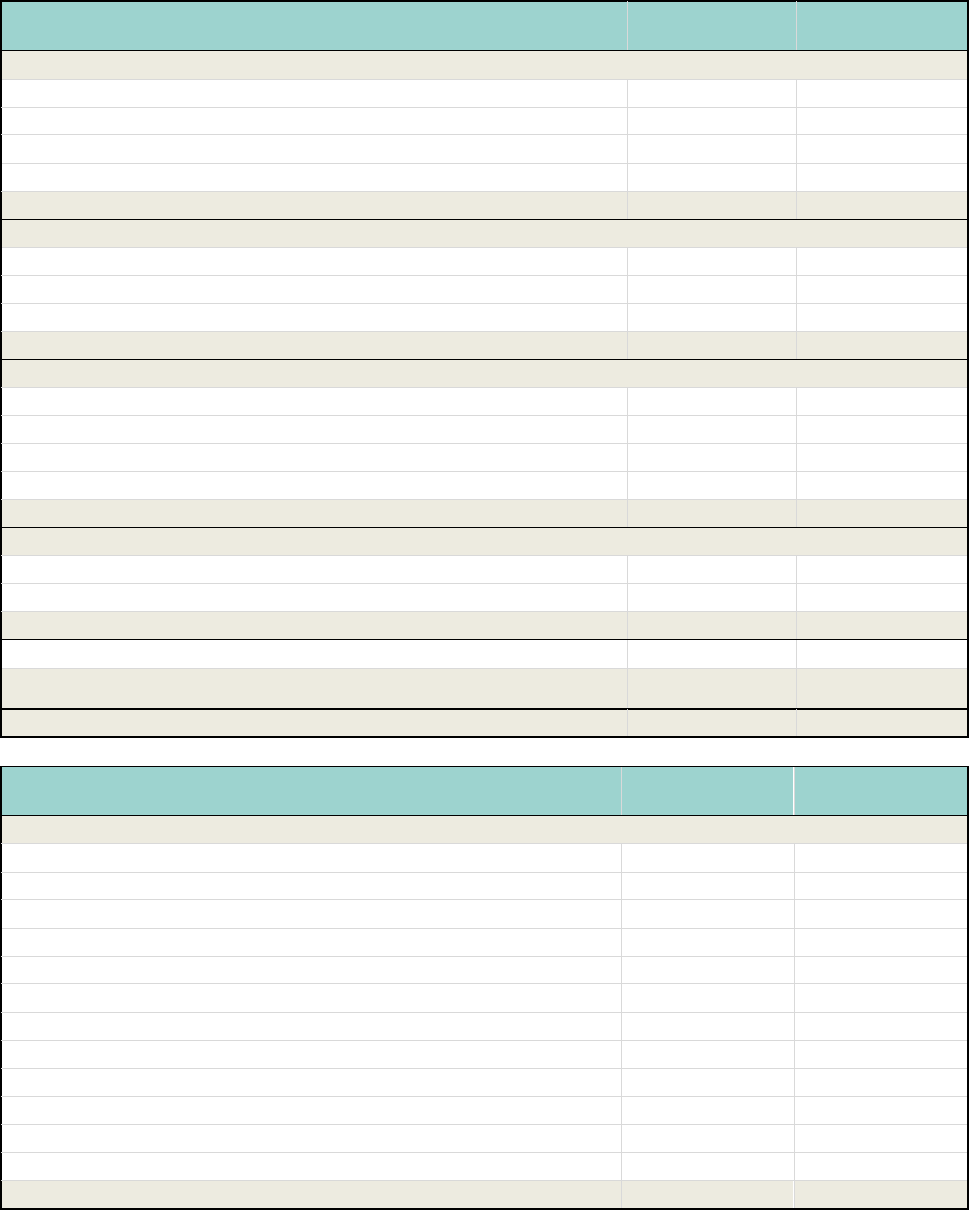

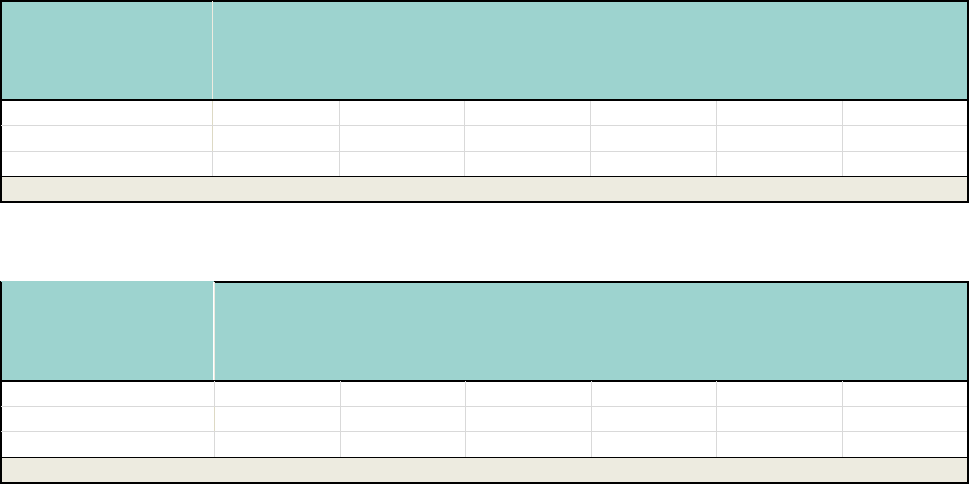

Statement of comprehensive income

Note

01/01/2023 - 31/12/2023

01/01/2022 - 31/12/2022

Revenues, of which:

1,280,302

1,022,280

Revenue from sale of services

4

1,259,897

1,016,420

Other operating income

9

4,063

3,704

Finance revenue

11

16,342

2,156

Expenses, of which:

(1,189,166)

(972,659)

Costs of salaries with overheads and other employee benefits

5

(1,024,155)

(811,708)

Depreciation/amortisation

8

(63,117)

(63,467)

Outsourced IT services

6

(26,628)

(29,273)

Consulting services

(71)

(368)

Other administrative expenses

7

(32,663)

(28,915)

Business travel expenses

(10,884)

(7,219)

Costs of operation and maintenance of the premises

10

(29,633)

(23,856)

Other operating expenses

9

(1,527)

(923)

Financial costs

11

(488)

(6,930)

Profit before tax

91,136

49,621

Income tax

12

(19,995)

(11,610)

Net profit for the reporting period

71,141

38,011

Other comprehensive income

650

106

Items which will be recognised in the profit and loss account

0

0

Items which will not be recognised in the profit and loss account

650

106

Other comprehensive net income for the reporting period

0

0

Total comprehensive income for the reporting period

71,791

38,117

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

--------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 4

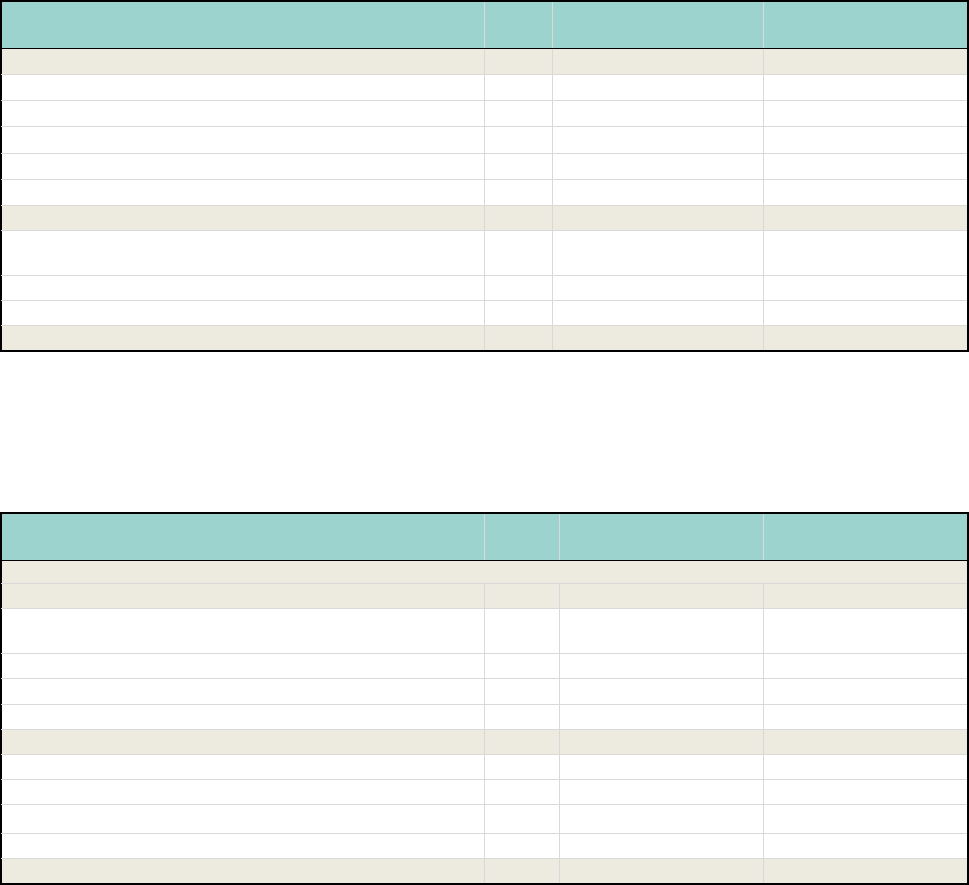

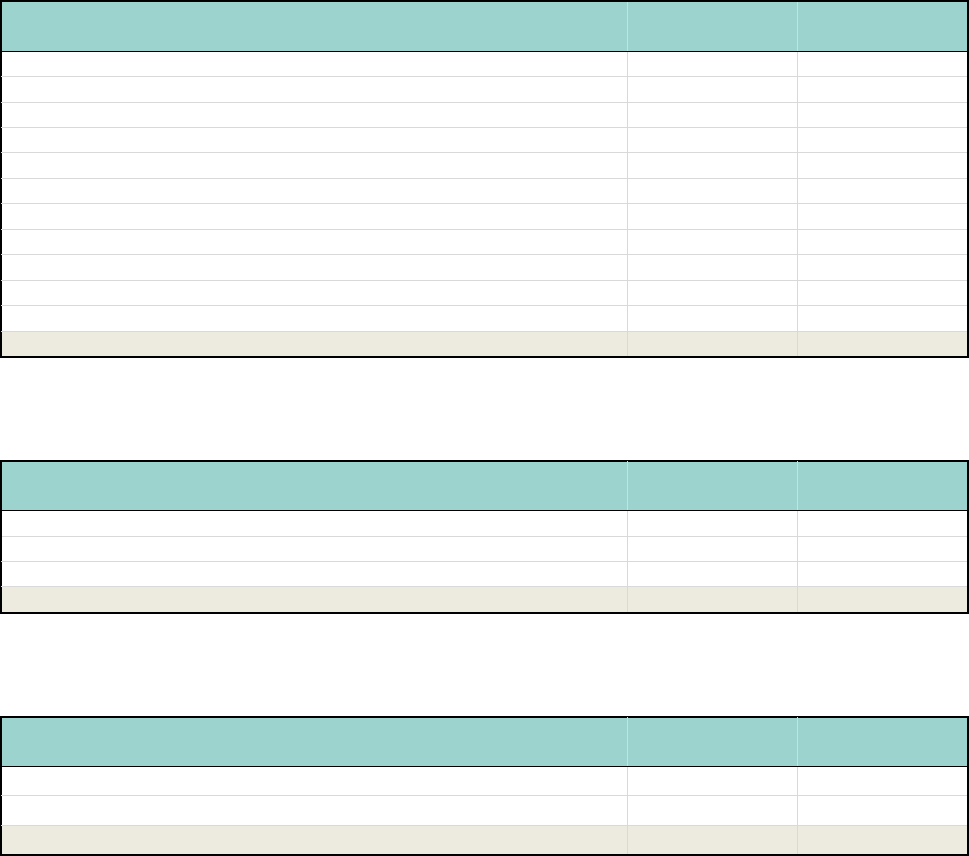

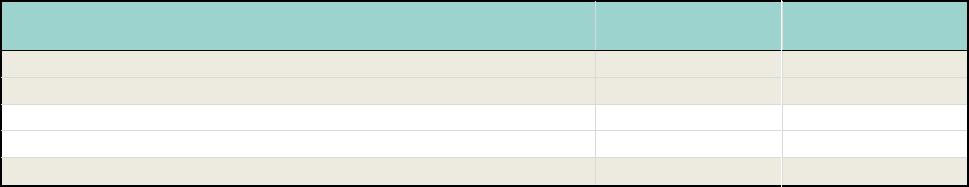

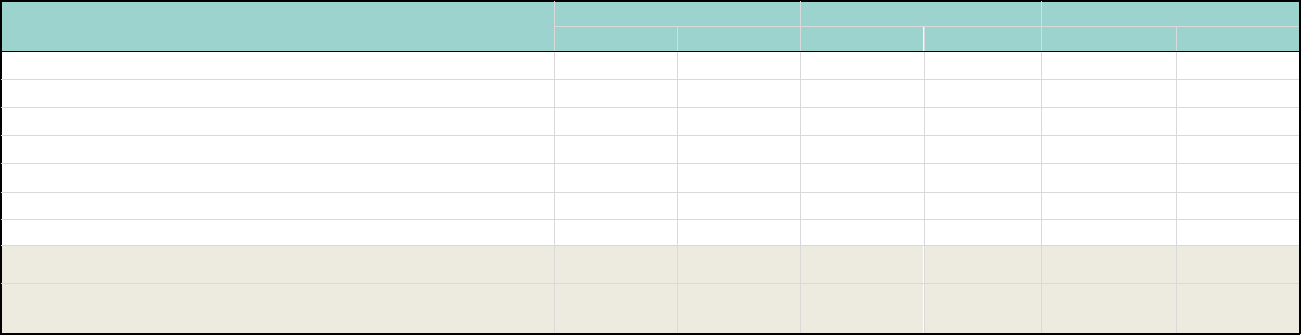

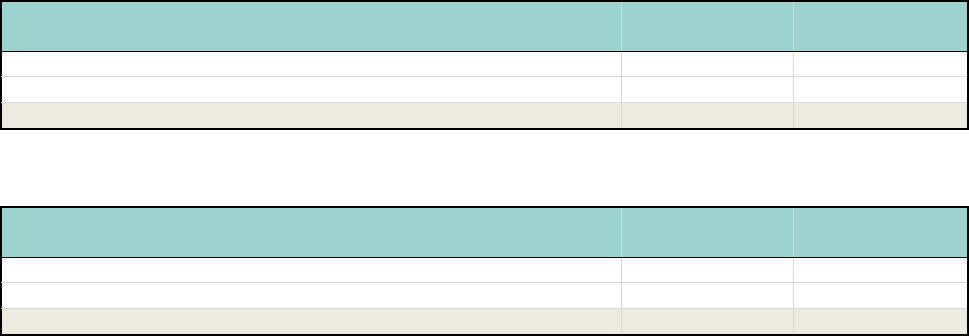

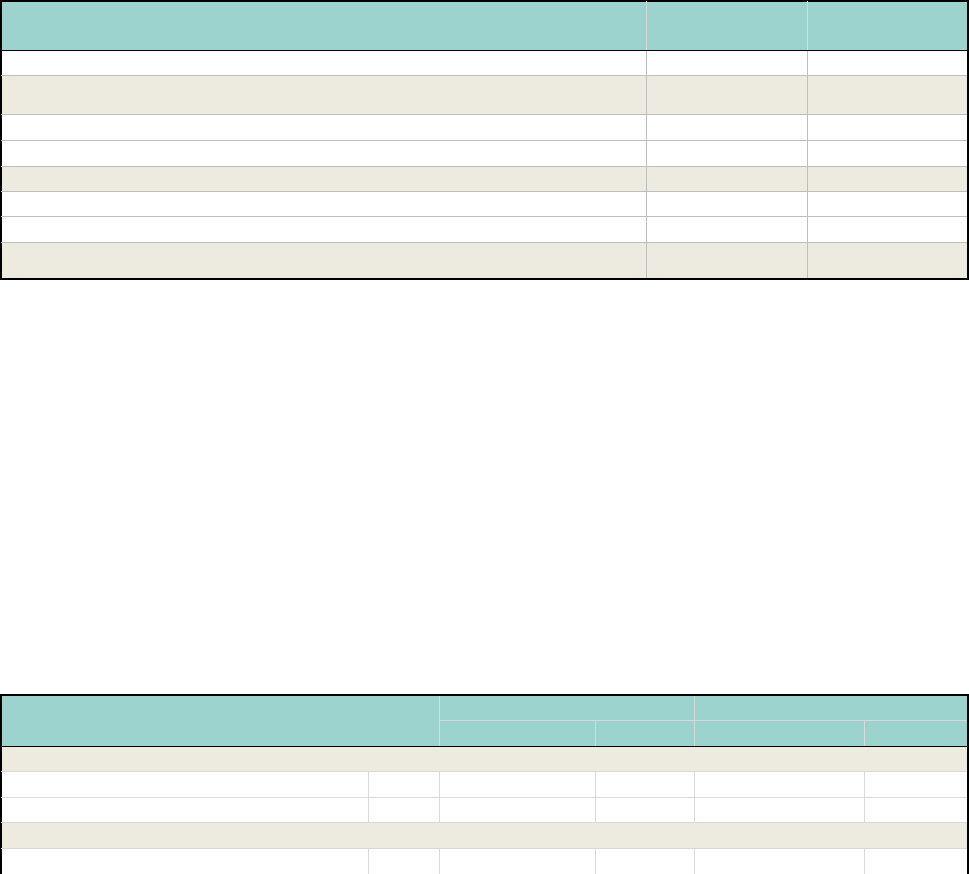

Statement of financial position

Assets

Note

31/12/2023

31/12/2022

Fixed assets

298,782

333,574

Assets from the right of use of assets under lease

13

198,891

223,110

Property, plant, and equipment

13

75,757

81,623

Intangible assets

14

14

18

Deferred tax assets

15

21,476

25,549

Long-term investments

16

2,644

3,274

Operating assets

271,352

267,463

Trade receivables, non-invoiced receivables, and other

receivables

17

155,726

156,124

Short-term prepayments

991

1,475

Cash and cash equivalents

18

114,635

109,864

Total assets

570,134

601,037

Statement of financial position

Equity and liabilities

Note

31/12/2023

31/12/2022

Liabilities

Long-term liabilities

321,246

388,115

Long-term liabilities due to settlements with the Branch Head

Office

19

110,477

142,167

Long-term lease liabilities

24

168,112

211,346

Other long-term liabilities

23

461

146

Long-term provisions

22

42,196

34,456

Short-term liabilities

248,888

212,922

Short-term lease liabilities

24

45,281

46,886

Trade liabilities

23

695

542

Other short-term liabilities

23

200,357

163,267

Short-term provisions

22

2,555

2,227

Total liabilities and equity

570,134

601,037

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

--------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 5

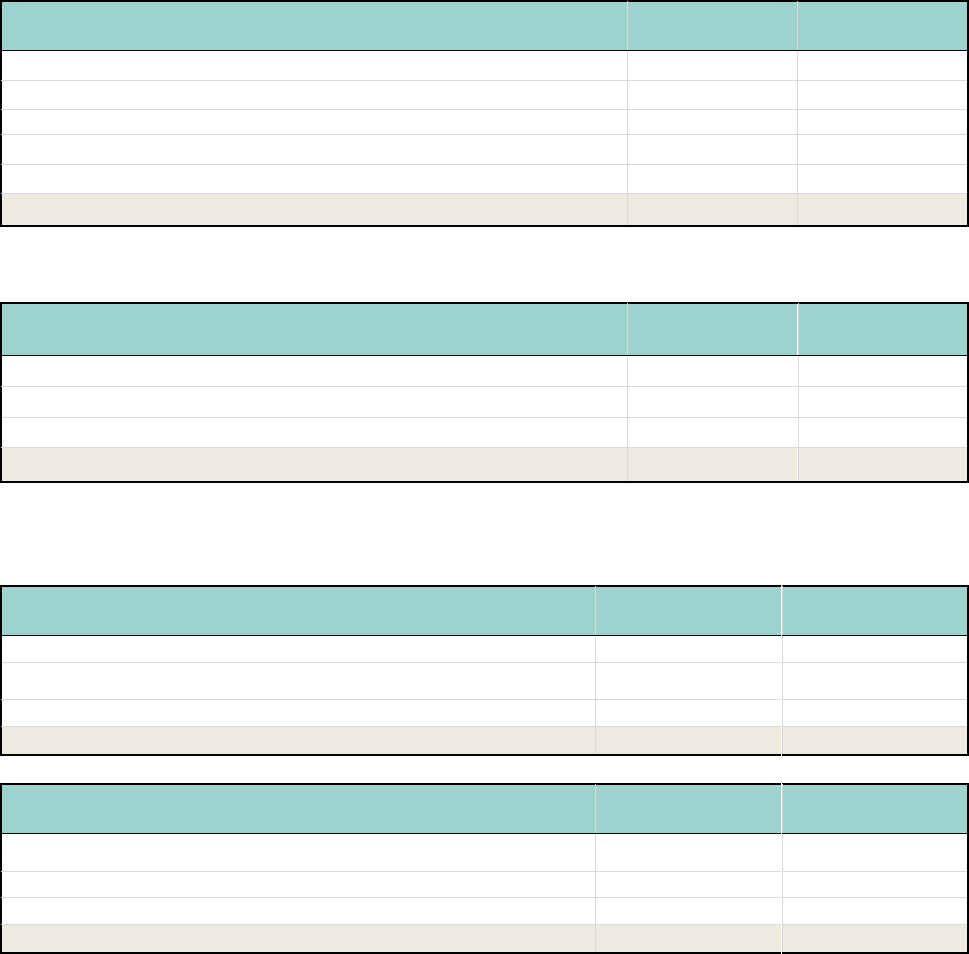

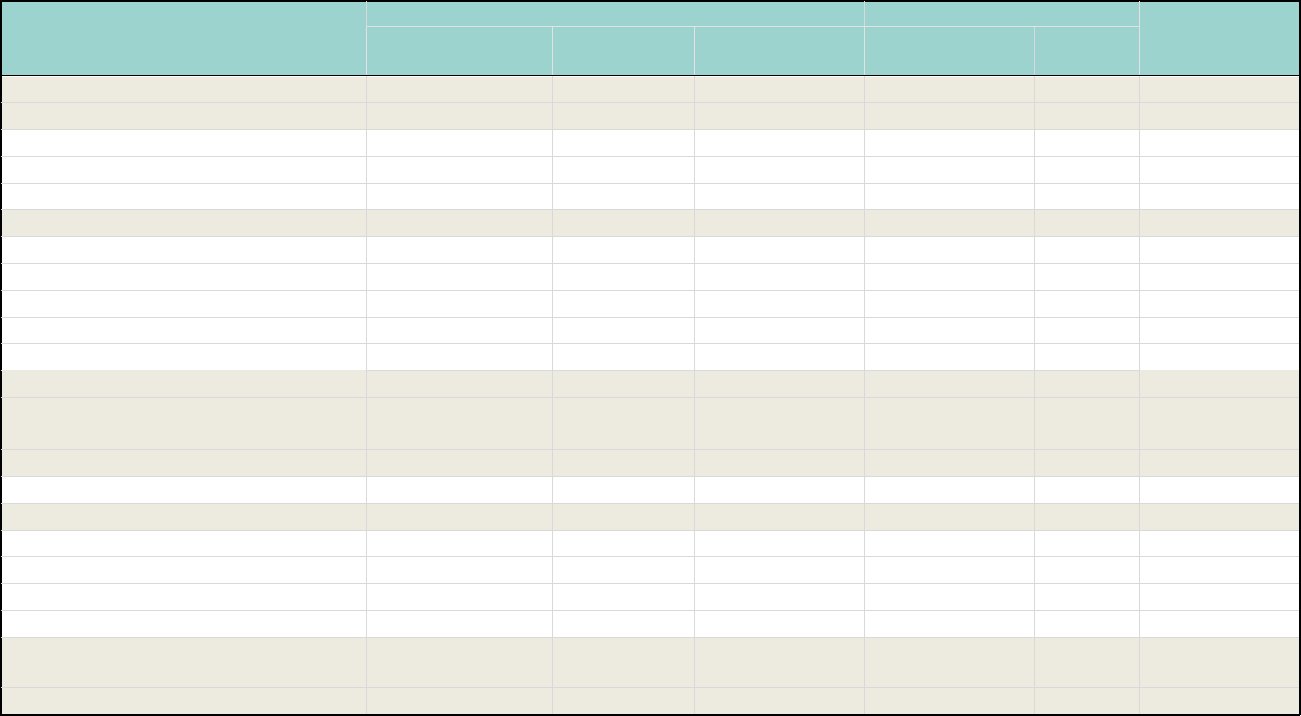

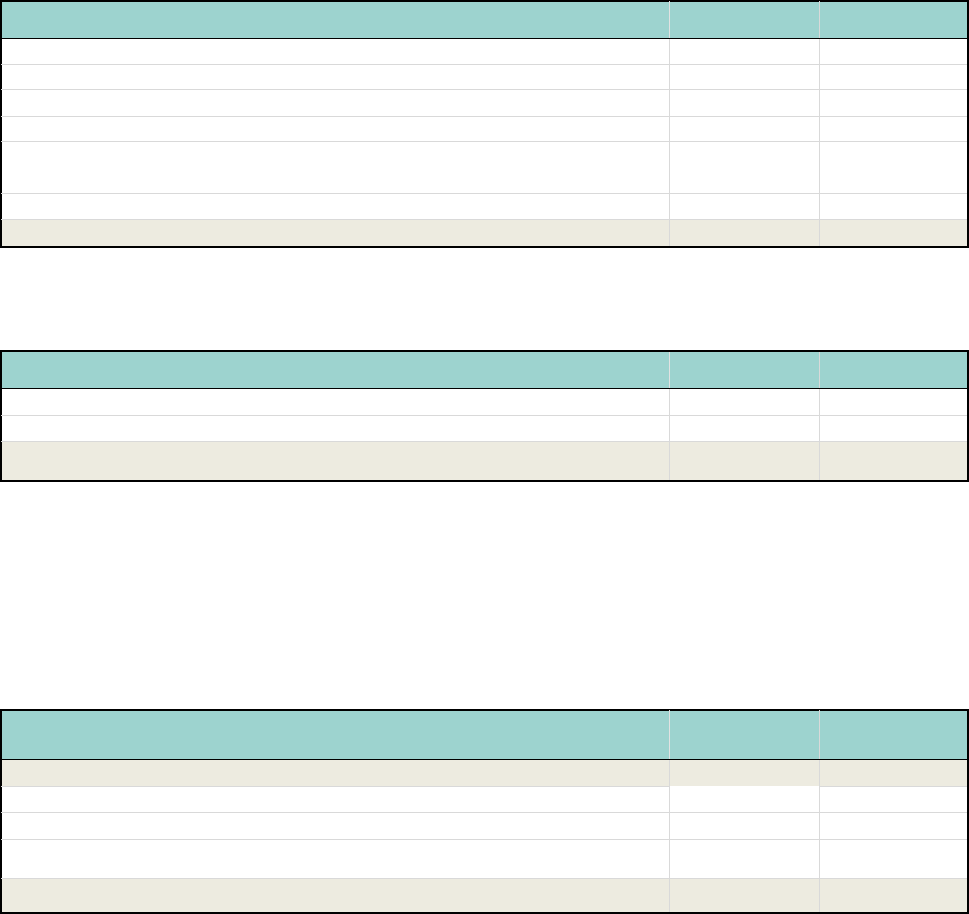

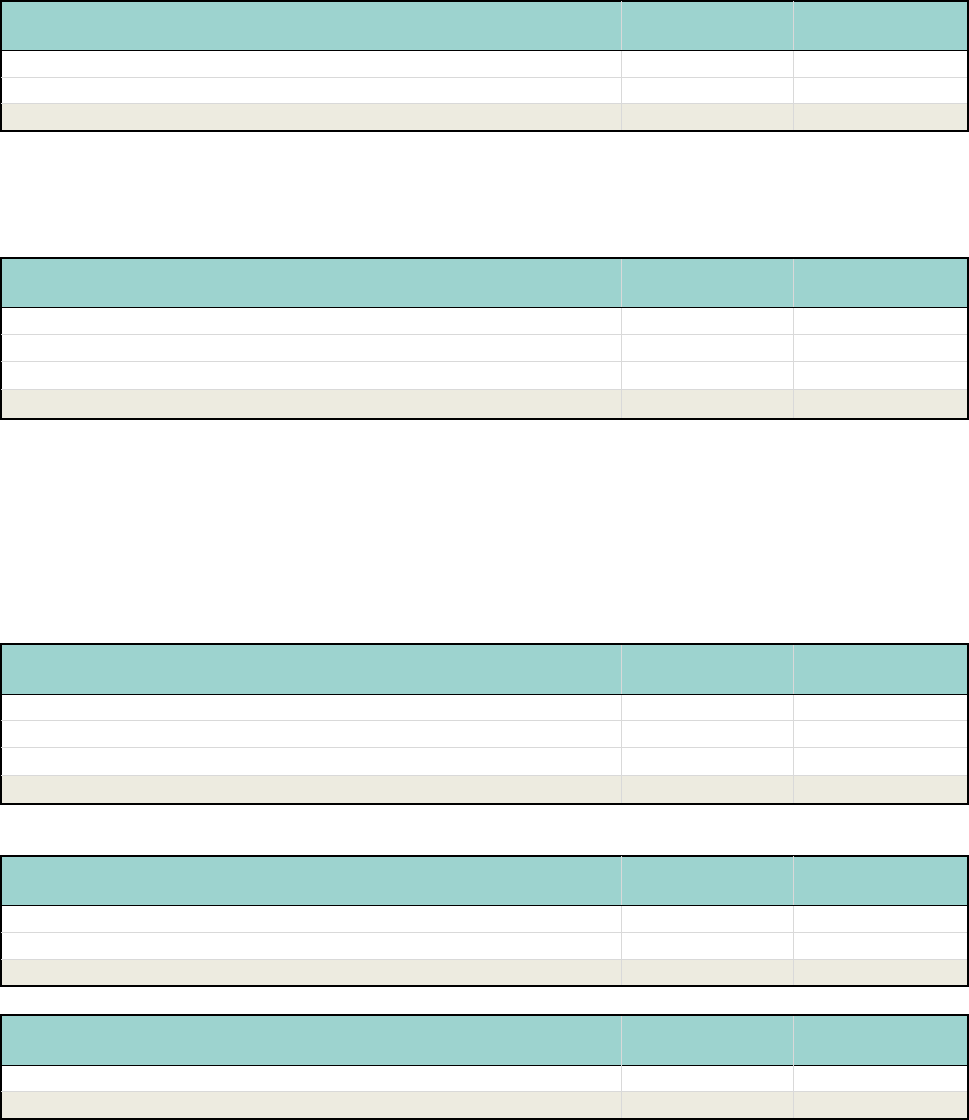

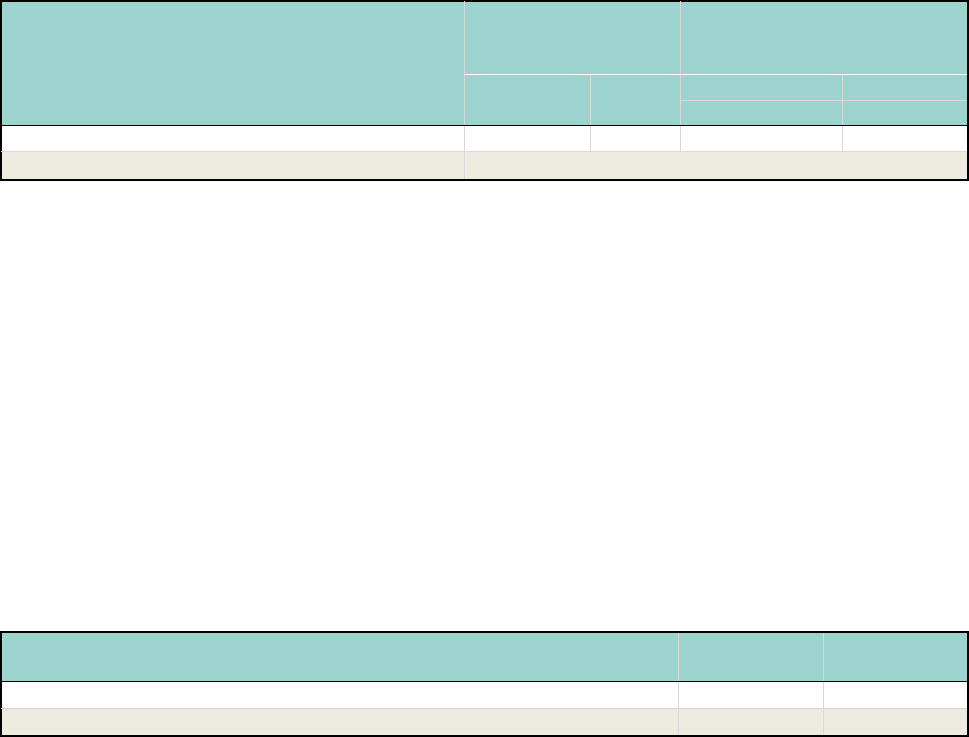

Cash flow statement

Note

31/12/2023

31/12/2022

Cash flow from operating activities

166,195

81,613

Net profit for the reporting year

71,791

38,117

Adjustments:

94,404

43,496

Depreciation of property, plant, and equipment, including rights to

use of assets under lease

13

63,117

63,464

Depreciation of intangible assets

14

4

3

Foreign exchange gain/loss

(11,093)

6,449

Loss on investing activities

267

91

Change in trade and other receivables

17

399

(57,332)

Change in accruals, prepayments, and deferred income

484

487

Change in trade and other liabilities

23

37,558

34,566

Change in deferred tax assets

15

4,073

(3,807)

Income tax payments

(12,779)

(21,779)

Current tax liability

12

9,484

15,442

Change in provisions

22

8,067

7,874

Interest received

(5,249)

(2,156)

Interest paid

488

481

Other adjustments

(417)

(287)

Cash flow from investing activities

(11,997)

(10,835)

Disposal of property, plant, and equipment

1,444

2,169

Purchase of property, plant, and equipment

13

(13,441)

(13,004)

Cash flows from financial activities

(149,427)

(93,559)

Interest received

5,249

2,156

Loans and borrowings incurred (+)/repaid (-)

20

(57)

(30)

Expenses for repayment of interest on loans, borrowings, and leasing

(488)

(481)

Funds transferred to Head Office from the settlement of result of

previous years

19

(103,482)

(41,432)

Payment of lease liabilities

24

(50,649)

(53,772)

Total net cash flows

4,771

(22,781)

Balance sheet change in cash, of which:

4,771

(22,781)

Change in cash due to foreign exchange differences

35

3

Cash at the beginning of the period

109,864

132,645

Cash at the end of the period

114,635

109,864

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

--------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 6

Notes to the Financial Statements

Note 1 - General information about the branch

Information about Nordea Bank ABP S.A. Oddział w Polsce [Branch in Poland]

Nordea Bank ABP S.A. Branch in Poland (hereinafter: the Branch) has its registered office in Poland: 93-281 Łódź,

Al. Śmigłego-Rydza 20, Tax ID NIP PL 105-000-11-72; Statistical No REGON 100926668, is registered with the District

Court for Łódź-Śródmieście in Łódź, 20

th

Division of the National Court Register, Entry No KRS 0000360398.

The Branch’s business activity consists of:

- other activities auxiliary to financial services, except insurance and pension funding;

- other monetary intermediation;

- activities of call centres;

- computer IT software activities and related activities;

- information service activities;

- accounting, bookkeeping and auditing activities; tax consultancy;

- other financial service activities, except insurance and pension funding not elsewhere classified;

- data processing, hosting, and related activities.

The Branch is a branch of a foreign bank: Nordea Bank Abp, with its registered office in Finland, FI-00020, in Helsinki at

Satamaradankatu 5.

The Financial Statements and annual reports of Nordea Bank Abp are available at

https://www.nordea.com/en/investors/reports-presentations.

The entity is exempt from preparing the Report on Activities in accordance with the Accounting Act.

Note 2 - Basis for the preparation of financial statements

2.1 Statement of compliance

Annual separate financial report of Nordea Bank Abp S.A. Branch in Poland for the period ending 31 December 2023 has

been prepared in accordance with the International Financial Reporting Standards, as approved by the European Union,

and other applicable laws.

The Financial Statements have been prepared on the assumption that the Branch will continue to operate for the

foreseeable future and on a substantially unchanged going concern basis.

The Financial Statements were approved by the Management of the Branch on 05/03/2024.

2.2 New and amended standards and interpretations applied

Amendments to the following standards that were effective have been applied in these Financial Statements in 2023:

a) IFRS 17 “Insurance Contracts” and amendments to IFRS 17

IFRS 17 “Insurance Contracts” was issued by the International Accounting Standards Board on 18 May 2017, while the

amendments to IFRS 17 were published on 25 June 2020.

IFRS 17 Insurance Contracts replaced previous IFRS 4, which allowed for a variety of accounting practices for insurance

contracts. The new standard fundamentally changes accounting for all entities that deal with insurance contracts and

investment contracts; however, the scope of the standard is not limited to insurance companies only, and contracts

entered into by entities other than insurance companies may also contain an element that meets the definition of an

insurance contract (as defined in IFRS 17). This change has no impact on the Branch’s Financial Statements.

b) Amendment to IFRS 17 “Insurance Contracts”

The amendment relates to the transitional requirements in connection with the first-time application of IFRS 17

“Insurance Contracts” and IFRS 9 “Financial Instruments”. The purpose of the amendment is to ensure the usefulness of

financial information for investors in the period of first application of the new standard by introducing certain

simplifications with regard to the presentation of comparative figures.

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

--------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 7

The amendment relates only to the application of new IFRS 17 and does not affect any other requirements in IFRS 17.

c) Amendments to IAS 1 “Presentation of Financial Statements” and the IFRS Board’s guidance on disclosure of

accounting policies in practice

The amendment to IAS 1 requires disclosure of material information about accounting policies, as defined in the

standard. The amendment clarifies that information on accounting policies is material if, in its absence, users of the

Financial Statements would not be able to understand other relevant information in the Financial Statements.

In addition, the Board’s guidance on applying the concept of materiality in practice were also revised to provide guidance

on the application of the concept of materiality to accounting policy disclosures. The amendments to the standard were

incorporated into the Branch’s Financial Statements.

d) Amendments to IAS 8 “Accounting Policies, Changes in Accounting Estimates and Errors”

In February 2021, the Board published an amendment to IAS 8 “Accounting Policies, Changes in Accounting Estimates

and Errors” regarding the definition of estimates. The amendment to IAS 8 clarifies how entities should distinguish

between changes in accounting policies and changes in accounting estimates. The amendments to the standard have no

impact on the Branch’s Financial Statements.

e) Amendments to IAS 12 “Income Taxes”

The amendments to the standard, published in 2021, clarify how to account for deferred tax on transactions such as

leases and decommissioning obligations. Prior to the amendments to the standard, there was ambiguity as to whether

the recognition of equal amounts of an asset and a liability for accounting purposes (e.g. the initial recognition of lease)

that has no impact on current taxable income triggers the recognition of deferred tax balances or whether what is known

as the initial recognition exemption, which states that deferred tax balances are not recognised if the recognition of an

asset or liability has no impact on accounting or taxable profit at the time of that recognition, applies. Revised IAS 12

addresses this issue by requiring the recognition of deferred tax in the above situation by additionally stating that the

initial recognition exemption does not apply if a company simultaneously recognises an asset and an equivalent liability,

and each creates temporary differences.

In May 2023, the Board published further amendments to IAS 12 “Income Taxes” in response to the global minimum

income tax Pillar Two regulations issued by the Organisation for Economic Co-operation and Development (OECD) in

connection with international tax reform. The amendment to IAS 12 provides a temporary exemption from the

requirement to recognise deferred tax arising from tax law enacted that implements the Pillar Two model rules.

Companies may apply the guidance of amended IAS 12 immediately, while certain disclosures are required for annual

periods beginning on or after 1 January 2023.

2.3 Published standards and interpretations that are not yet in force and have not been previously applied by the

Branch but may have an impact on the Financial Statements.

In these separate Financial Statements, the Branch has not decided to apply the following published standards,

interpretations, or amendments to existing standards before their effective date:

a) Amendment to IFRS 16 “Leases”

In September 2022, the Board amended IFRS 16 “Leases” by supplementing the requirements for the subsequent

measurement of lease obligations for sale and leaseback transactions where the criteria of IFRS 15 are met and the

transaction should be accounted for as sale. The amendment requires the seller lessee to subsequently measure lease

obligations arising from leasebacks in such a way that no gain or loss on retained right-of-use is recognised. The new

requirement is particularly relevant where leaseback includes variable lease payments that do not depend on an index

or rate, as these payments are excluded from “lease payments” under IFRS 16. The amended standard includes a new

example that illustrates the application of the new requirement in this regard. The amendment is effective from

1 January 2024. The Branch does not expect the standard to have a material impact on its Financial Statements.

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

--------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 8

b) Amendments to IAS 1 “Presentation of Financial Statements”

In 2020, the Board published amendments to IAS 1 that clarify the presentation of liabilities as long- and short-term

liabilities. In October 2022, the Board issued further amendments to IAS 1, which address the classification of liabilities

as long- and short-term liabilities, for which a company is required to meet certain contractual requirements known as

covenants. Revised IAS 1 states that liabilities are classified as either short- or long-term liabilities, depending on the

rights that exist at the end of the reporting period. Neither the company’s expectations nor events after the reporting

date (for example, waiver or breach of a covenant) affect the classification.

The amendments, as published, are effective for financial statements for periods beginning on or after 1 January 2024.

c) Amendments to IAS 7 “Statement of Cash Flows” and IFRS 7 “Financial Instruments: Disclosures” - disclosure of

supplier finance arrangements

In May 2023, the Board published amendments to IAS 7 “Statement of Cash Flows” and IFRS 7 “Financial Instruments:

Disclosures”. The amendments to the standards introduce disclosure requirements for vendor finance arrangements

(known as reverse factoring). The amendments require specific disclosures for such contracts to enable users of financial

statements to assess the impact of these contracts on liabilities and cash flows and a company’s exposure to liquidity

risk. These amendments are intended to increase the transparency of disclosures about liability financing arrangements,

but do not affect recognition and measurement principles. The new disclosure obligations will be effective for annual

reporting periods beginning on or after 1 January 2024.

As at the date of this Financial Statements, the improvements have not yet been approved by the European Union.

d) Amendments to IAS 21 “The Effects of Changes in Foreign Exchange Rates”

In August 2023, the Board issued amendments to IAS 21 “The Effects of Changes in Foreign Exchange Rates”. The

amendments are intended to make it easier for companies to determine whether a currency is convertible into another

currency and to estimate the spot exchange rate when a currency is not convertible. In addition, the amendments to the

standard introduce additional disclosures when currencies are not convertible on how to determine the alternative

exchange rate.

The amendments, as published, are effective for financial statements for periods beginning on or after 1 January 2025.

As at the date of this Financial Statements, the improvements have not yet been approved by the European Union.

e) IFRS 14 “Regulatory Deferral Accounts”

This standard allows entities that prepare financial statements in accordance with IFRS for the first time (as at 01 January

2016) to recognise amounts resulting from rate-regulated activities in accordance with the accounting principles applied

so far. To improve comparability with companies that already apply IFRS and do not present such amounts, according to

IFRS 14 published, the amounts resulting from rate-regulated activities should be presented in a separate item in the

statement of financial position, profit and loss account as well as statement of other comprehensive income.

By the decision of the European Union, IFRS 14 will not be approved.

f) Amendments to IFRS 10 and IAS 28 regarding the sale or contribution of assets between the investor and its affiliates

or joint ventures

The amendments solve the problem of the current inconsistency between IFRS 10 and IAS 28. The accounting treatment

depends on whether non-monetary assets sold or contributed to an associate or joint venture are “business”.

If the non-monetary assets constitute “business”, the investor reports the full profit or loss on the transaction. If, on the

other hand, the assets do not meet the definition of business, the investor recognises a gain or loss from only to the

extent of the portion representing the interests of other investors.

The amendments were published on 11 September 2014. At the preparation date of these Financial Statements,

approval of this amendment is deferred by the European Union.

2.4 Basis for measurement

The Financial Statements were prepared on the basis of the historical cost principle.

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

--------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 9

2.5 Functional and presentation currency

The figures in the Financial Statements were presented in Polish zloty (PLN), rounded up to full thousands. PLN is the

functional currency of the Branch.

2.6 Comparative data

The comparative figures include data for the period 01/01/2022 to 31/12/2022.

Note 3 - Description of significant accounting policies applied

The accounting principles below have been applied to all reporting periods presented in the Financial Statements.

Foreign currency transactions

Transactions expressed in foreign currencies are recognised in the functional currency of the Branch and converted at

the average exchange rate of the NBP published on the day preceding the transaction date, except for the situations

described below in the Lease Contracts section.

Non-monetary items measured at historical cost in a foreign currency are converted by the Branch using the exchange

rate, as published before the transaction date. Exchange rate differences are recognised in the profit or loss for the

current period.

Financial instruments

Classification

As at the balance sheet date, the Branch did not have any financial instruments classified as financial liabilities measured

at fair value through profit or loss. The Branch’s only financial assets measured at fair value are cash measured at fair

value through profit or loss.

Measurement

At initial recognition, a financial asset or financial liability is measured at fair value, increased or reduced, in the case of

a financial asset or liability that is not classified as measured at fair value through profit or loss, by transaction costs that

can be directly assigned to acquisition or issue of a financial asset or financial liability.

The exceptions are trade receivables that do not have a significant financing component: the Branch recognises them in

the transaction price.

After the initial recognition, the Branch measures financial assets and financial liabilities according to the category to

which they are classified.

Measurement at amortised cost is made using the effective interest rate method to the gross carrying amount of the

financial asset, taking into account impairment.

After initial recognition, other financial liabilities are measured at amortised cost using the effective interest rate

method. Other liabilities include loans, borrowings, overdraft facilities, trade payables and other liabilities.

Subsidies

Government subsidies are initially recognised as deferred income at fair value, if there is sufficient certainty that they

will be obtained and that the conditions related to them will be met; then, they are recognised in profit or loss of the

current period and presented in other operating revenue.

In the case of uncertainty as to meeting the terms of the contract, the subsidy is presented in regulatory liabilities item.

Hedge accounting

The Branch does not apply hedge accounting.

Operating segments

The Branch operates in one operating segment.

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

--------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 10

Impairment of financial assets

Financial assets measured at amortised cost are evaluated by the Branch at each balance sheet date whether there is

any objective evidence that any financial asset (or a group of financial assets) has lost value. Cash in foreign currencies

is measured at the exchange rate of the National Bank of Poland at the balance sheet date.

Property, plant, and equipment

Items of property, plant, and equipment and intangible assets are initially measured at purchase cost or production cost.

After the initial recognition of property, plant, and equipment and intangible assets, the Branch presents them at the

purchase price less accumulated depreciation and accumulated impairment write-offs. Fixed assets with a low unit value

(less than PLN 4,500) are charged to expense in the month they are commissioned. For intangible assets, the limit is

PLN 1,500.

This item also includes right of use assets according to IFRS 16: see “Lease contracts” below for details.

Depreciation/amortisation

The value of depreciation write-offs is determined based on the purchase price of a given asset less its residual value.

Depreciation write-offs are made according to the straight-line method for the useful life of the property, plant, and

equipment or intangible assets and are presented in the profit and loss account.

The land is not depreciated. The estimated useful lives are as follows:

- investments in third-party fixed assets, according to the contract term

- plant and machinery 3–5 years

- equipment 5–10 years

- means of transport 5 years

- computer software 5 years

- licenses 1–5 years

-

right of use assets, according to the contract term.

The residual value is subject to an annual estimation.

For tax accounting purposes, depreciation rates resulting from current legislation are adopted.

Cash and cash equivalents

For the purpose of the cash flow statement, cash and cash equivalents include items payable within three months of the

acquisition date, including: unrestricted cash on hand and cash at bank.

The Branch offsets the bank balance of the Company Social Benefit Fund against the liabilities of this Fund: the surplus

is presented as cash or as other short-term liabilities. This approach, consistent with common practice, is applied because

the Branch does not control the Fund.

The Branch has funds in a restricted-availability VAT account.

Impairment write-off on assets other than financial assets

The carrying amounts of the Branch’s assets are reviewed as at the balance sheet date to determine whether there is

any reason for an impairment loss. If there is such a reason, the Branch estimates the recoverable amount of individual

assets. The write-down of receivables is calculated on a simplified basis, according to IFRS 9, at an amount equal to the

expected loss in value over their lifetime.

An impairment write-off is recognised if the book value of the asset or its cash-generating unit exceeds its estimated

recoverable amount. The impairment write-off is recognised in the profit and loss account.

Calculation of recoverable amount

The recoverable amount for assets other than financial assets is the greater of selling value less costs to sell and value in

use. To determine the value in use, the estimated future cash flows are discounted to their present value by a pre-tax

discount rate, which reflects the current market expectations as to the money value and the asset-specific risk. For assets

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

--------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 11

that do not generate independent cash inflows, the recoverable amount is determined for a given cash-generating unit

to which these assets belong.

Reversal of impairment write-offs

An impairment write-off in relation to goodwill is not reversed. An impairment write-off on other assets is reversed if

there has been a change in the estimates used for determining the recoverable amount.

An impairment write-off may be reversed only to the level at which the carrying amount of the asset does not exceed

its book value, which would be established reduced by depreciation amount if the impairment write-off was not

recognised.

Lease contracts

Liabilities show the remaining lease payments to be made and use the marginal interest rate at the date of first

application of IFRS 16 to discount.

As required by the standard, this choice has been applied consistently to all leases in which the Company is a lessee

except for short-term and low value leases.

The Branch decided to use the following practical simplification and applied a single discount rate to a portfolio of leases

with broadly similar characteristics:

* cars: 3%

* office space and car parks, depending on the length of the contract term: 0% – 2.26%

The Branch did not use any other practical simplification allowed and for leases that ended within 12 months of the date

of first application also used the new model.

In addition, the Branch did not apply the new model for line leases (either short-term or long-term leases) due to

immateriality.

The Branch has treated as short-term and low-value assets and liabilities for all leases with a term of more than

12 months, except where the asset is of low value.

In this case, the Branch considers USD 5,000 to be low. For the purpose of converting this threshold into PLN, the Branch

applies the exchange rate of the NBP prior to the date of commencement of the lease.

Also, the Branch acts as a subtenant with respect to:

a) sublease of office space for drink and snack vending machines, but due to the immateriality of the amounts, did not

recognise them under the principles of IFRS 16;

b) sublease of a separate floor of office space with allocated car parks, which it has recognised under the principles of

IFRS 16 due to materiality.

After the date of commencement of the lease, an asset by virtue of the right of use is systematically depreciated for the

term of the contract and the liability by virtue of the lease is settled (reduced) using an appropriate discount rate, with

simultaneous recognition of interest.

The leased are calculated by the Branch in the original currency for a contract, and the conversion into PLN is made:

- for depreciation of asset, revaluation of asset and liability as a result of amendments, at the Nordea Group’s exchange

rate used for the first recognition of the contract;

- for recognition of a new contract, at the Nordea Group’s exchange rate at the end of the month in which the contract

was entered into the books;

- for settlement of liability, at the Nordea Group’s current exchange rate, i.e. on the last day of the month. As at the

balance sheet date, liabilities are measured at the NBP rate.

In the case of an amendment to a lease contract causing a change in the amount and distribution of future cash flows

(e.g. as a result of indexation, reducing or extending the contract term) without changing the scope of the contract, the

Branch adjusts the value of the leasing asset and liability in the following manner:

a) it calculates the new value of the liability taking into account the provisions of the amended contract discounted at

the beginning of the month in which the modification of the agreement was approved;

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

--------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 12

b) it compares the value in a) with the value of the liability as at the same date calculated under the previous contractual

terms;

c) the amount of the difference between the values in a) and b) is recognised as an adjustment to the value of the lease

liability;

d) the same amount is recognised as an adjustment to the net value of assets under lease, and the value of assets so

adjusted is the basis for calculating the updated monthly depreciation amount, taking into account any extension or

reduction of the lease term, subject to point e;

e) if, as at the date of the reconciliation of the change, the value of the lease asset is 0, then the amount in c) is recognised

in profit or loss.

In the case of an amendment to a lease contract resulting in an increase in the scope, e.g. an increase in the leased area,

with a simultaneous proportional increase in the fee for the lease, such a change is treated as a separate lease.

In the case of lease contract amendment resulting in an increase in scope, e.g. an increase in the leased space, without

a simultaneous commensurate increase in the lease consideration, such a change is treated as lease modification and

the procedure is analogous to that in a–e above.

Both the modification of the original contract and the formation of a separate lease are calculated using the current

discount rate.

In the case of an amendment to the lease which results in a reduction in scope, e.g. a decrease in the leased area, such

a change is treated as a modification of the lease and is accounted for as follows:

a) it calculates the new value of the liability taking into account the provisions of the amended contract discounted at

the beginning of the month in which the modification of the agreement was approved;

b) the net asset value of the lease is reduced in proportion to the reduction in the scope of the lease, e.g. by the

percentage of reduction in the area leased;

c) a comparison is made between the amount from a and the amount of net assets after the reduction referred to in b;

d) any difference from c is charged to the financial result;

e) the amount of the assets after the reduction referred to in b) forms the basis for calculating the updated monthly

depreciation amount.

In the case of early termination of the lease contract, the value of the lease liabilities as of the date of contract

termination is written off to zero in correspondence with the lease assets. The possible amount of the difference is

referred to the profit or loss.

Employee benefits

The Branch maintains the employee pension plan (PPE) for its employees in the form of group life insurance. As an

employer, fulfilling the obligations imposed by law, the Branch is obliged to pay social security and health insurance

contributions related to hiring employees and contributions to the Labour Fund and the Guaranteed Employee Benefits

Fund. The Branch also operates the Company Social Benefits Fund, making write-offs in accordance with the generally

applicable provisions of law. All these payments constitute an element of short-term employee benefits whose main

components are salaries, bonuses and paid holidays. Short-term benefits are recognised in operating costs on general

terms. The only elements of long-term employee benefits are provision for pension, disability and survivor benefits,

provision for jubilee bonuses and liabilities for bonuses, in the part in which the payment will be made in the period after

12 months from the balance sheet date. These provisions/liabilities are updated once a year.

Provisions

Provisions are recognised in the balance sheet if the Branch has a liability arising from past events, as well as if it is

probable that fulfilment of this obligation will result in the outflow of resources embodying economic benefits. If the

effect is material, the provision amount is determined using the discounted expected cash flows at the pre-tax rate,

reflecting the current market assessment of the time value of money and where it applies to the risk associated with

a given liability.

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

--------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 13

Service revenue

The Branch recognises revenue when the performance is rendered by transferring the promised good (i.e. asset) or

service to the customer, according to the contracts. An asset is transferred when the client obtains control over the

asset. Services provided by the Branch are performed under internal contracts on a continuous basis with billing periods

set in the contract. Invoicing takes place at the end of the contractually agreed billing period. Once the service has been

performed in a billing period (monthly or quarterly), the Branch recognises as revenue an amount equal to the

transaction price that has been attributed to the performance of the service. The Branch attributes the transaction price

to each performance in an amount reflecting the amount of the fee to which it is entitled in exchange for the transfer of

promised goods or services to the customer.

If the Branch has met the obligation, it presents the contract as a contract asset in the statement of financial position.

The Branch presents all unconditional rights to receive compensation separately as receivables.

As a general rule, revenue invoicing is done on a monthly or quarterly basis, whereby:

a) invoices for banking process support services rendered in a month are generally issued by the 15th of the following

month;

b) invoices for IT services rendered in a month are generally issued by the end of the month;

c) invoices for IT services (under DC and C&C) rendered during the quarter are generally issued by the 15th of the

following month after the close of the quarter;

d) Invoices for IT services provided to an external customer provided in a month are generally issued by the 15th of the

following month.

In addition, for business and administrative support services of banking processes, due to the cost-plus method used,

provisions are made for the revenue of the period (receivables not invoiced at the balance sheet date) in the last month

of the year, according to the invoicing process adopted. The payment period for services rendered is 30 days after

invoicing.

Other revenues

Items not related directly to the operating activities of the Branch are presented as part of other revenue. In particular,

the following are recognised here: revenue arising from the sale and liquidation of property, plant, and equipment,

revenue from re-invoicing, compensation received, revenue from adjustments of annual VAT and government subsidies.

Financial income and expenses

Financial income and expenses include interest income related to cash invested by the Branch. Interest income is

recognised in profit or loss on the accrual basis, using the effective interest rate.

Interest expense for financial instruments is recognised in the profit and loss account in the amount resulting from the

measurement at amortised cost using the effective interest rate method. Financial expenses include interest expenses

related to external financing, unwinding of discounts on provisions and contingent payments.

The effective interest rate is the rate that exactly discounts estimated future cash inflows or payments made in the

expected period to the expiry of the financial instrument and, in reasonable cases, in a shorter period, to the net carrying

amount of the financial asset or liability. When calculating the effective interest rate, the Branch estimates the cash

flows, taking into account all the provisions of the financial instrument contract; however, it does not take into account

potential future losses related to the non-recoverability of loans. The calculation includes all fees and points paid and

received by the parties to the contract as an integral part of the effective interest rate, as well as transaction and discount

costs.

Foreign exchange gains and losses are presented in the net amount as financial income or financial expenses, depending

on their total net position.

General and administrative expenses

The costs are recognised on an accrual basis, i.e. in the periods to which they relate, regardless of the date of receipt or

payment. The main cost items of the Branch’s activities include costs of wages and salaries, costs of maintenance and

rental of premises, costs of external IT services, business travel costs, and amortisation and depreciation.

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

--------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 14

Income tax

Income tax consists of current and deferred tax. Income tax is recognised in the profit and loss account.

The current tax is the expected tax liability relating to taxable income using the tax rate effective as at the balance sheet

date, including all adjustments to the tax liability for previous years.

Deferred tax assets and provisions are calculated using the balance method, by calculating temporary differences

between the carrying amount of assets and liabilities and their tax value.

Deferred income tax provision and assets are recognised in the statement of financial position as net value or as:

Deferred tax assets, or as: Deferred tax provision. Deferred tax assets in relation to all deductible temporary differences

are made up to the amount to which it is probable that taxable income will be achieved, which will allow for deducting

deductible temporary differences. The carrying value of deferred income tax assets is verified as at each balance sheet

date and is reduced to the extent that it is not probable to realise the financial gains associated with the assets.

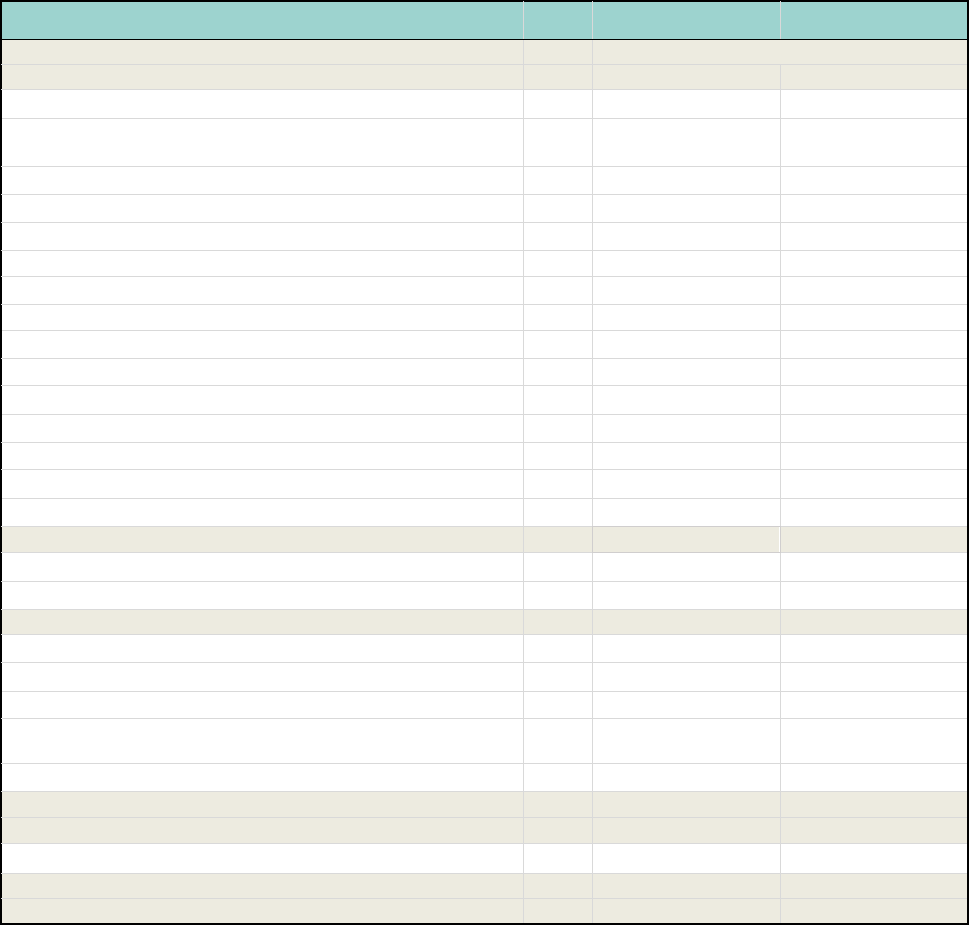

Note 4 - Revenue from sale of services

The Branch provides various support services of administrative and operating processes to Nordea Group companies

located primarily in the Nordic countries and companies associated with Nordea Group located in the Baltic States. The

Branch provides only very limited services to external customers.

The following breakdown reflects the structure of business lines as at the balance sheet date.

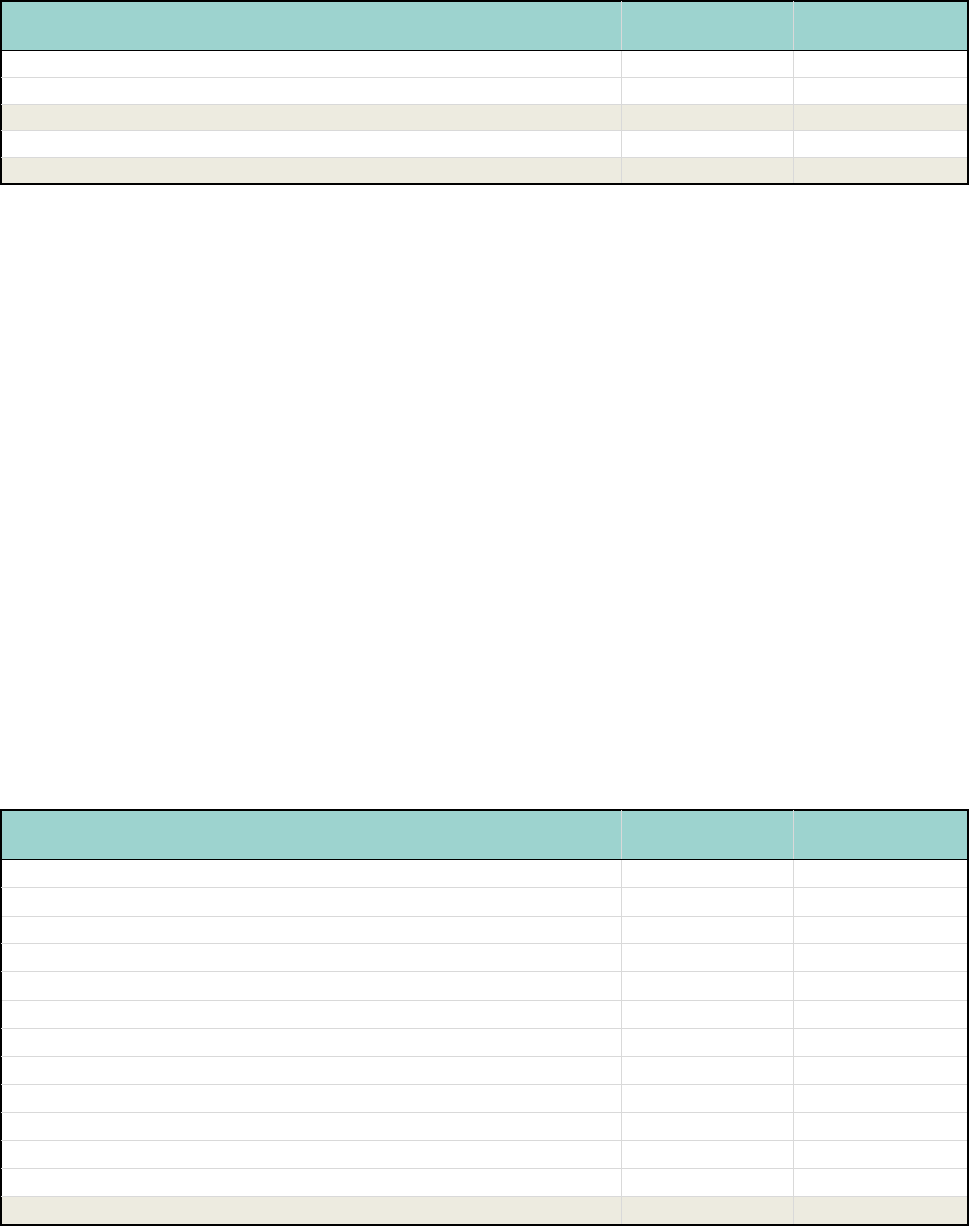

Sales revenue, business structure

01/01/2023 -

31/12/2023

01/01/2022 -

31/12/2022

Area of banking process support services

Group Functions

655,124

512,082

Commercial and Business Banking

17,878

15,519

Personal Banking

2,577

2,103

Corporate banking (Large Corporates & Institutions)

204

0

Investment banking (Asset and Wealth Management)

2,623

1,875

Total revenue in the area

678,406

531,579

Area of IT services

Group Functions

573,885

475,703

Personal Banking

7,606

9,138

Total revenue in the area

581,491

484,841

Total revenues from sales of services

1,259,897

1,016,420

Total revenues from sales of services

1,259,897

1,016,420

In addition to the revenues, as above, the Branch also generated other revenues that do not relate to its core operating

activities. They are presented under “other operating revenue” and include the following amounts:

Other revenues from sales

01/01/2023 -

31/12/2023

01/01/2022 -

31/12/2022

Re-invoice revenue

496

346

Other sales

57

1

Income from the sale of fixed assets

101

0

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

--------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 15

Sales by area

01/01/2023 -

31/12/2023

01/01/2022 -

31/12/2022

Sweden

404,837

325,264

Denmark

306,018

249,091

Finland

292,701

234,032

Norway

254,757

206,440

United Kingdom

1,057

1,121

Estonia

375

334

United States of America

100

91

China

52

47

Total sales

1,259,897

1,016,420

Note 5 - Costs of wages and salaries, including surcharges and other employee benefits

01/01/2023 -

31/12/2023

01/01/2022 -

31/12/2022

Wages and salaries

808,376

642,504

Compulsory social security contributions

143,509

112,656

Other employee benefits

37,091

28,798

Contributions to defined contribution plans

13,597

10,375

CSBF costs

9,833

8,081

Costs of National Fund for the Rehabilitation of Disabled fees

8,644

6,832

Training costs

3,105

2,462

Total costs of salaries with overheads and other employee benefits

1,024,155

811,708

Note 6 - Third-party IT services

01/01/2023 -

31/12/2023

01/01/2022 -

31/12/2022

IT costs

26,628

29,248

IT consultant services

0

25

Total outsourced IT services

26,628

29,273

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

--------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 16

Note 7 - Other administrative expenses

01/01/2023 -

31/12/2023

01/01/2022 -

31/12/2022

Administrative costs

10,028

10,223

Accounting and payroll services

5,346

4,423

Purchase of other materials

6,582

4,322

Promotion and advertising services

2,440

2,782

Services of recruitment companies

997

1,744

Postal and telecommunications charges

1,631

1,663

Costs of external consultants

1,920

539

Advisory costs

735

514

Leasing

357

440

Bank services

453

422

Other

2,173

1,843

Total other administrative expenses

32,663

28,915

Note 8 – Depreciation

01/01/2023 -

31/12/2023

01/01/2022 -

31/12/2022

Assets from the right of use of assets under lease

44,852

45,093

Fixed assets

18,261

18,371

Intangible assets

4

3

Total depreciation

63,117

63,467

Note 9 - Other operating expenses and other operating income

Other operating expenses

01/01/2023 -

31/12/2023

01/01/2022 -

31/12/2022

Loss on disposal of non-financial non-current assets

267

91

Other costs

1,260

832

Total other operating costs:

1,527

923

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

--------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 17

Other operating income

01/01/2023 -

31/12/2023

01/01/2022 -

31/12/2022

Reversal of unused provisions

814

1,848

Revenues from employee benefits

1,398

1,160

Re-invoiced cost revenues

496

346

Revenue from VAT adjustments for previous years

704

1

Other income

651

349

Total other operating revenue:

4,063

3,704

Note 10 - Costs of operation and maintenance of the premises

01/01/2023 -

31/12/2023

01/01/2022 -

31/12/2022

Operating costs

21,928

17,886

Other rental costs

6,029

4,105

Security services

1,676

1,865

Total

29,633

23,856

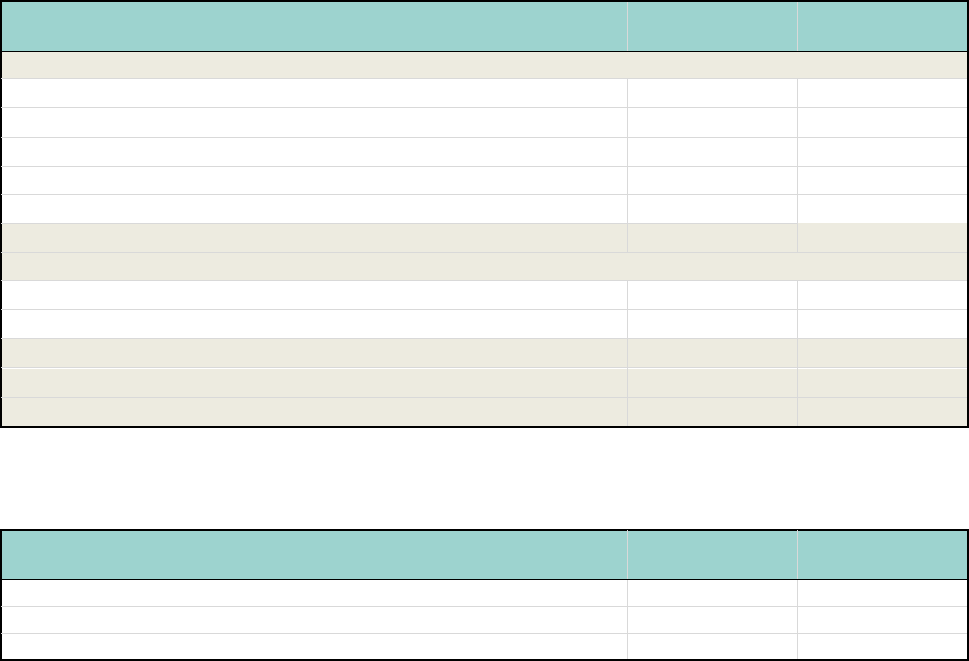

Note 11 - Financial income and expenses

Finance revenue

01/01/2023 -

31/12/2023

01/01/2022 -

31/12/2022

Revenue from interest on funds in bank accounts

5,243

2,150

Revenue on account of interest on lease, calculated at amortised cost

6

6

Net exchange differences

11,093

0

Financial income, total

16,342

2,156

Financial costs

01/01/2023 -

31/12/2023

01/01/2022 -

31/12/2022

Costs on account of interest on lease, calculated at amortised cost

431

451

Other interest expense

57

30

Net exchange differences

0

6,449

Total financial costs

488

6,930

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

--------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 18

Note 12 - Income tax

Income tax

01/01/2023 -

31/12/2023

01/01/2022 -

31/12/2022

Current part

16,075

15,442

Income tax for the reporting period

16,075

15,442

Deferred part (calculation Note 15), included in profit or loss

3,920

(3,832)

Origination of temporary differences

3,920

(3,832)

Income tax, total

19,995

11,610

Deferred part (calculation Note 15), included in other comprehensive

income

153

25

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

--------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 19

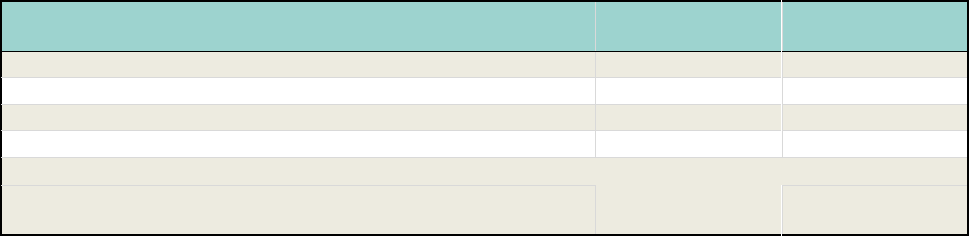

Calculation of corporate income tax

01/01/2023 -

31/12/2023

01/01/2022 -

31/12/2022

Gross profit

91,136

49,621

Amounts that increase the tax base

117,002

132,203

Foreign exchange losses

26,288

28,589

Balance sheet depreciation of fixed assets and intangible assets

18,264

18,247

Cost of liquidated, unamortised fixed assets

1,046

812

Rights of use of assets under lease - depreciation

44,852

45,092

Rights of use of assets under lease - interest on lease

425

445

Rights of use of assets under lease - loss on completion

0

1

Representation costs

130

91

Provision for costs

2,564

16,931

Rights to use assets under lease - other rights, including sublease

674

648

Actuarial reserve

8,869

7,537

National Fund for the Rehabilitation of Disabled costs

8,644

6,832

Donations, non-tax deductible expenses

0

1

Tax costs relating to previous periods recognised in the balance sheet in

the current period

1,051

2,988

Trade union costs

32

32

Operating costs of passenger cars

1,078

1,183

VAT payable on the free transfer of services and goods

1,179

1,188

Revenues from VAT adjustments

0

81

Other costs not constituting tax deductible costs

1,906

1,505

Amounts that reduce the tax base

123,693

97,571

Tax depreciation of fixed assets and intangible assets

23,251

21,807

Rights of use assets under lease, space and cars

49,325

53,400

Tax value of liquidated fixed assets

932

172

Balance sheet recognition of tax costs in the previous period

7,074

0

Unrealised and realised foreign exchange gains not constituting tax

income

43,112

22,171

Other non-tax revenues

(1)

21

Tax base

84,445

84,253

Tax base at the end of the financial year

84,445

84,253

Income tax

16,045

16,008

Adjustments related to current income tax for previous years

30

(566)

Total current income tax

16,075

15,442

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

--------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 20

Reconciliation of effective tax rate

01/01/2023 -

31/12/2023

01/01/2022 -

31/12/2022

Profit/loss before tax

91,136

49,621

Tax based on the applicable tax rate (19%)

(17,316)

(9,428)

Expenses not deductible for tax purposes

(2,429)

(2,044)

Other

(250)

(138)

Tax in the Statement of Comprehensive Income

(19,995)

(11,610)

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 21

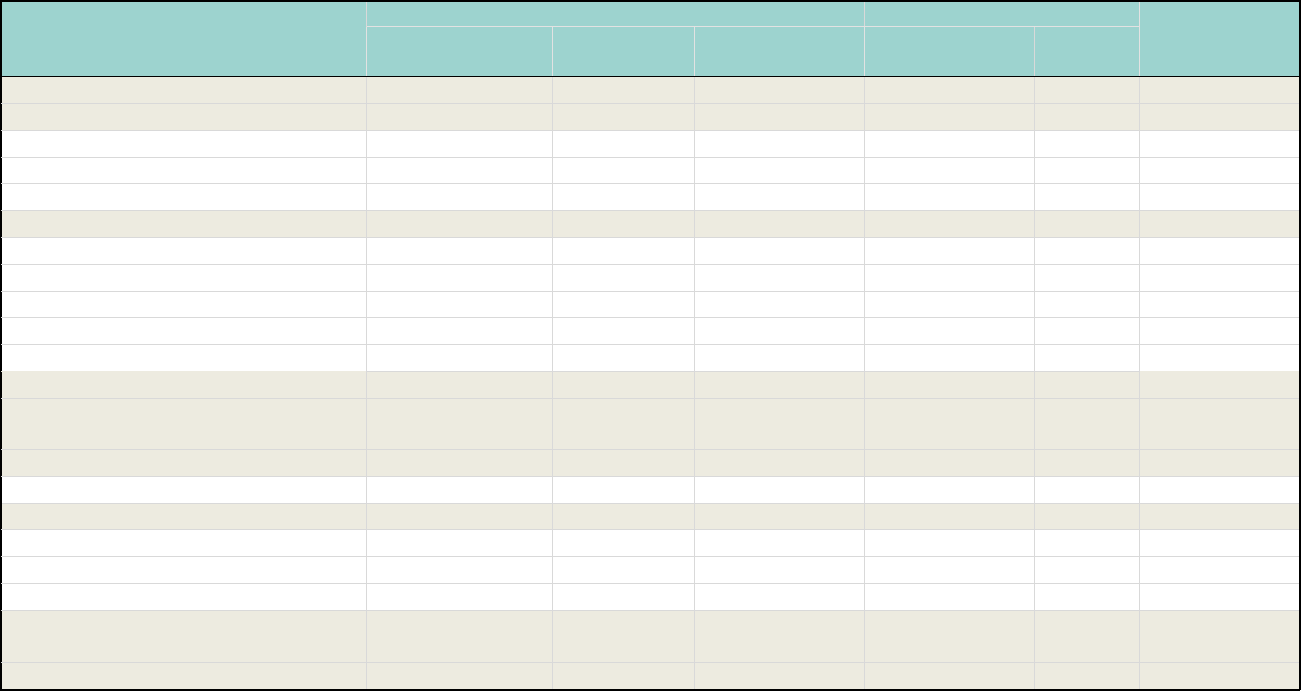

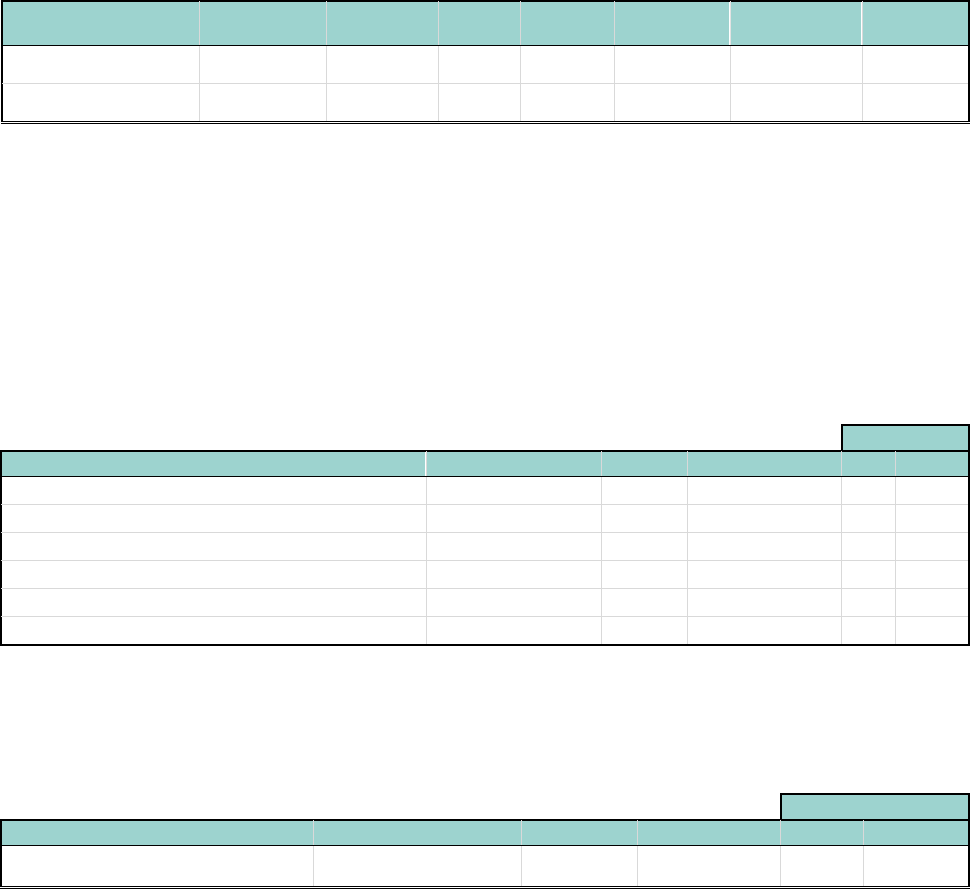

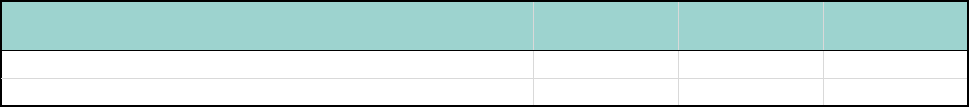

Note 13 - Property, plant, and equipment, including right of use assets under lease Property, plant, and equipment from 01/01/2023 to

31/12/2023

Own fixed assets

Right of use assets under lease

Total

Investments in third

party fixed assets

Machinery and

equipment

Capital work in

progress

Office premises

and parking areas

Cars

Gross value as at 01/01/2023

76,011

104,100

7,292

369,884

1,342

558,629

Increases

200

14,404

13,441

21,032

0

49,077

purchase

0

0

13,441

0

0

13,441

lease contract conclusion/amendment

0

0

0

21,032

0

21,032

reclassification

200

14,404

0

0

0

14,604

Reductions

(1,764)

(19,367)

(14,604)

(16,545)

(266)

(52,544)

reclassification

0

0

(14,604)

0

0

(14,604)

lease contract termination

0

0

0

(16,158)

(253)

(16,411)

liquidation

(1,764)

(459)

0

0

0

(2,222)

sales

0

(9,995)

0

0

0

(9,995)

other

0

(8,913)

0

(387)

(13)

(9,312)

Gross value as at 31/12/2023

74,447

99,136

6,129

374,373

1,076

555,162

Depreciation and impairment losses as at

01/01/2023

(32,696)

(73,083)

0

(147,312)

(804)

(253,895)

Increases

(6,929)

(11,332)

0

(44,546)

(306)

(63,113)

amortisation/depreciation

(6,929)

(11,332)

0

(44,546)

(306)

(63,113)

Reductions

1,764

18,322

0

16,158

253

36,497

lease contract termination

0

0

0

16,158

253

16,411

liquidation

1,764

394

0

0

0

2,158

sales

0

9,457

0

0

0

9,457

other

0

8,471

0

0

0

8,471

Depreciation and impairment losses as at

31/12/2023

(37,861)

(66,093)

0

(175,701)

(857)

(280,512)

Net value as at 31/12/2023

36,585

33,043

6,129

198,672

219

274,649

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 22

Property, plant, and equipment from 01/01/2022 to 31/12/2022

Own fixed assets

Right of use assets under lease

Total

Investments in third

party fixed assets

Machinery and

equipment

Capital work in

progress

Office premises

and parking areas

Cars

Gross value as at 01/01/2022

77,146

111,377

2,192

375,945

1,826

568,486

Increases

223

7,682

13,004

11,212

14

32,135

purchase

0

0

13,004

0

0

13,004

lease contract conclusion/amendment

0

0

0

11,212

14

11,226

reclassification

223

7,682

0

0

0

7,905

Reductions

(1,357)

(14,959)

(7,904)

(17,274)

(498)

(41,992)

reclassification

0

0

(7,904)

0

0

(7,904)

lease contract termination

0

0

0

(15,790)

(498)

(16,288)

liquidation

(1,357)

(12,218)

0

0

0

(13,575)

sales

0

(2,741)

0

0

0

(2,741)

other

0

0

0

(1,484)

0

(1,484)

Gross value as at 31/12/2022

76,011

104,100

7,292

369,884

1,342

558,630

Depreciation and impairment losses as at

01/01/2022

(26,685)

(76,354)

0

(118,390)

(921)

(222,350)

Increases

(7,319)

(11,052)

0

(44,712)

(381)

(63,464)

amortisation/depreciation

(7,319)

(11,052)

0

(44,712)

(381)

(63,464)

Reductions

1,308

14,323

0

15,790

498

31,919

lease contract termination

0

0

0

15,790

498

16,288

liquidation

1,308

12,167

0

0

0

13,475

sales

0

2,156

0

0

0

2,156

Depreciation and impairment losses as at

31/12/2022

(32,696)

(73,083)

0

(147,312)

(804)

(253,895)

Net value as at 31/12/2022

43,315

31,017

7,292

222,572

538

304,733

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

---------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 23

Capital work in progress

As at 31 December 2023, the Branch classified as capital work in progress the funds which will be put into use in

subsequent fiscal years with a value of PLN 6,129,000 (investments in a third-party facility, computer equipment,

conference equipment, server equipment, furniture, and mobile phones).

Impairment

As at 31 December 2023, the Branch Director ordered an impairment test of property, plant, and equipment and the

right of use assets under lease, which showed no need for impairment losses.

Note 14 - Intangible assets

Table of movements of intangible assets 01/01/2023 to 31/12/2023

Title

Licenses, computer

software

Intangible assets

under construction

Total

Gross value as at 01/01/2023

61

0

61

Gross value as at 31/12/2023

61

0

61

Depreciation and impairment losses as at 01/01/2023

(43)

0

(43)

amortisation/depreciation

(4)

0

(4)

Depreciation and impairment losses as at 31/12/2023

(47)

0

(47)

Net value as at 31/12/2023

14

0

14

Table of movements of intangible assets 01/01/2022 to 31/12/2022

Title

Licenses, computer

software

Intangible assets

under

construction

Total

Gross value as at 01/01/2022

61

0

61

Gross value as at 31/12/2022

61

0

61

Depreciation and impairment losses as at 01/01/2022

(40)

0

(40)

amortisation/depreciation

(3)

0

(3)

Depreciation and impairment losses as at 31/12/2022

(43)

0

(43)

Net value as at 31/12/2022

18

0

18

Impairment

As at 31 December 2023, the Management of the Branch carried out an impairment test on intangible assets, which

showed no need for write-downs.

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 24

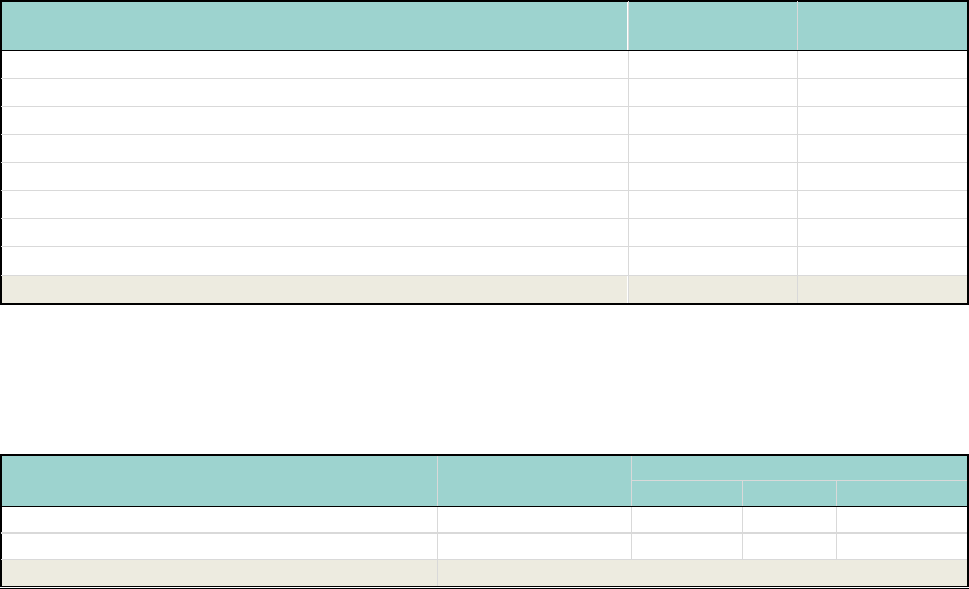

Note 15 - Deferred tax assets and deferred tax liabilities

Deferred tax assets and liabilities were recognised with respect to the following components of assets and liabilities:

Assets

Liabilities

Net value

31/12/2023

31/12/2022

31/12/2023

31/12/2022

31/12/2023

31/12/2022

Property, plant, and equipment and intangible assets

0

0

5,075

4,142

(5,075)

(4,142)

Cash and cash equivalents

0

0

7

2

(7)

(2)

Trade and other receivables

0

14

0

0

0

14

Provisions

24,304

23,628

0

0

24,304

23,628

Liabilities for the right of use assets under lease

40,545

49,064

0

0

40,545

49,064

Receivables from right of use of assets under lease

0

0

37,789

42,391

(37,789)

(42,391)

Receivables from sublease leased space

0

0

502

622

(502)

(622)

Deferred income tax assets/liabilities

64,849

72,706

43,373

47,157

21,476

25,549

Deferred income tax assets/liabilities recognised in the

statement of financial position

64,849

72,706

43,373

47,157

21,476

25,549

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

---------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 25

Note 16 - Long-term investments

as at

01/01/2023

receipt

increases

interest

accrued

repayment

reductions

as at

31/12/2023

Lease receivables

3,274

302

0

6

(705)

(233)

2,644

The Branch signed a sublease contract in August 2021 for one floor in a group of buildings in Gdynia. The company

reclassified the corresponding value of the right of use in long-term investments (receivable from sublease of office

space).

Lease receivables by maturity

01/01/2023 - 31/12/2023

01/01/2022 - 31/12/2022

Up to 1 year

673

664

from 1 to 2 years

675

665

from 2 to 3 years

676

666

from 3 to 4 years

620

667

from 4 to 5 years

0

613

Total

2,644

3,274

Invoices for subleases are issued with a 30-day payment date. At the moment, the Branch has not recorded any payment

delays.

Financial result on office sublease

01/01/2023 - 31/12/2023

01/01/2022 - 31/12/2022

Lease costs relating to leased space

(674)

(219)

Sublease inflows

709

213

Sublease result

35

(6)

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

---------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 26

Note 17 - Trade receivables, uninvoiced receivables and other receivables

31/12/2023

31/12/2022

Trade receivables from affiliates

153,977

148,906

of which not invoiced at the balance sheet date

13

0

Other trade receivables

138

108

of which not invoiced at the balance sheet date

26

5

Receivables from taxes, subsidies, customs, social security, health insurance, and

other benefits

1,593

7,001

Other receivables

18

109

Total

155,726

156,124

Note 18 - Cash and cash equivalents

31/12/2023

31/12/2022

Cash in hand and at bank

114,635

109,864

Restricted cash (VAT account)

0

0

Cash and cash equivalents presented in the statement of cash flows

114,635

109,864

Note 19 - Long-term liabilities due to settlements with Branch’s Head Office

The Bank’s branch does not have equity. Settlements with the Bank’s Head Office form the profits or losses for the

financial years of the Branch. In 2022, the Branch paid PLN 41,432,000 to Nordea ABP, with its registered office in Finland,

as settlement of retained earnings. In 2023, there were further disbursements with a total amount of PLN 103 482,000.

The Branch’s operations are financed from its working capital.

Long-term liabilities for settlements with the Bank’s Head Office

01/01/2023 -

31/12/2023

01/01/2022 -

31/12/2022

Balance at beginning of period

142,168

145,631

Net profit/loss

71,791

38,117

Profit transfer

(103,482)

(41,432)

Value of Head Office shares granted to employees under the bonus scheme

0

(148)

Balance at end of period

110,477

142,168

The value of the Head Office shares granted to employees under the bonus scheme at the end of 2023 is PLN 0. The

Branch is not obliged to return the liability for the granted shares to the Head Office.

CERTIFIED TRANSLATION FROM THE POLISH LANGUAGE

---------------------------------------------------------------------------------------------------------------------------------

Nordea Bank ABP S.A.

Financial Statements for the period from 01/01/2023 to 31/12/2023

The Notes are an integral part of the Financial Statements. 27

Note 20 - Liabilities due to loans, borrowings and other debt instruments

Terms and schedule for repayment of loans and borrowings

As at 31/12/2023, the Branch has no bank overdraft facility; the loan agreement expired on 24/11/2020.

The allocated global limit for credit cards is PLN 8M as at 31/12/2023.

The table below shows reconciliation of the changes in liabilities arising from the financial position:

Item

As at

01/01/2023

increases

interest

accrued

repayment

measurement

lease contract

termination

As at

31/12/2023

Credit card liabilities

786

4,627

0

(4,430)

0

0

983

Lease liabilities

258,232

23,081

431

(49,324)

(18,623)

(404)

213,393

Note 21 - Contingent liabilities

As at the balance sheet date of 31/12/2023, the Branch has no loan commitments.

Bank guarantees

Bank guarantees were opened in connection with the Branch’s lease contracts for office space. Guarantees were

concluded between the landlords (beneficiaries) and the tenant (Branch) to secure claims in the event of damage caused

by non-performance or improper performance of the lease contract. The security is the equivalent of a 3-month rent

and the amount of rent VAT, down payment for the Maintenance Fee for 3 months and the amount of VAT on the fee.

Bank guarantees were granted by mBank SA.

31/12/2023

Beneficiary

Guarantee number

Currency

Expiry date

EUR

PLN

Tensor Poland Sp. z o.o.

13029KPA19

EUR

31 March 2025

655

0

EPP Office - Symetris Business Park Sp. z o.o.

13042KPA18

EUR

11 January 2024

225

0

Olivia Star S.A.

13085KPA18

PLN

31 August 2024

0

3,730

Łużycka Park Investment Sp. z o.o.

13127KPA17

PLN

31 August 2025

0

1,378

Łużycka Park Investment Sp. z o.o.

13128KPA17

PLN

31 August 2025

0

1,336

Pancole Sp. z o.o.

13203KPA19

EUR

31 January 2024

571

686

Guarantees received:

Under an agreement concluded on 30/08/2021, the Branch subleases office space in Gdynia. As collateral for the

receivables, it received a bank guarantee of PLN 331,000.

31/12/2023

Debtor

Guarantee number

Currency

Expiry date

EUR

PLN

Schenker Sp. z o.o.

MT22397KPA21

PLN

30 August 2026

0