MARYLAND STATE DEPARTMENT OF

ASSESSMENTS AND TAXATION

Public Utilities Section

301 West Preston Street, Room 801 ● Baltimore, Maryland 21201

(410) 767-1940

FORM 18

2024 RAILROAD OPERATING PROPERTY RETURN

File this report at address listed above by April 15, 2024 Attach the $300 Annual

Report Filing Fee

SECTION I

The business has been approved by MaylandSaves for a waiver of its 2024 Annual Report filing fee. [ ] Yes [ ] No

1.

Department ID Number:

2.

Name:

3.

Mailing Address:

Check if new address

4.

Email Address:

5.

Place where principal business in the State is transacted:

6.

State and Date of Incorporation or Formation:

7.

Names & Addresses of Officers:

OFFICERS

President Secretary

Vice-President Treasurer

8.

Names of Directors:

DIRECTORS

*Required information for certain corporations, MD Code, Tax Property Article §11-101 –

Please see instructions on the next page.

*Total number of directors *Total number of female directors

MARYLAND STATE DEPARTMENT OF ASSESSMENTS & TAXATION 301 WEST PRESTON STREET, BALTIMORE, MARYLAND 21201-2395

TPS_Public Utility - 2024 Form 18 Maryland

DEPARTMENT OF

P ag e 1 of 16 http://dat.maryland.gov

ASSESSMENTS AND TAXATION

Completion Required Pursuant to MD Code, Tax Property Article §11-101

A. Is this business a (1) commercial enterprise or business that is formed in Maryland or does

business in Maryland; or (2) a corporation, foundation, school, hospital, or other legal entity for

which none of the earnings inure to the benefit of any private shareholder or individual holding

an interest in the entity? [ ] Yes

[ ] No

If you answer “Yes” to Question A, please proceed to questions B, C, D, and the rest of the return.

If you answered “No” to Question “A,” please skip Questions B, C, and D and proceed to the rest of the

return. Your signing of this operating return confirms, under penalties of perjury, that the entity filing

this return is not required to submit a Corporate Diversity Addendum.

B. Is this business a limited liability company (LLC) owned by a single member? [ ] Yes [ ] No

C. Is this business a privately held company with at least 75% of the company’s shareholders who

are family members? [ ] Yes [ ] No

D. Is this business an entity that (1) has an annual operating budget or annual sales less than

$5,000,000; and (2) has neither qualified for nor applied for, and does not intend to apply for, a

State benefit*? [ ] Yes [ ] No

*A “State Benefit” means (1) a State capital grant funding totaling $1.00 million or more in a single fiscal

year; (2) State tax credits totaling $1.00 million or more in a single fiscal year; or (3) the receipt of a

State contract with a total value of $1.00 million or more. “State contract” means a contract that (a)

resulted from a competitive procurement process and (b) is not federally funded in any way.

If you answered "No” to Questions B, C, and D, you are legally obligated to complete and return to SDAT

a Corporate Diversity Addendum that is required by COMAR 24.01.07. The Addendum is available at

https://dat.maryland/gov/Pages/sdatforms.aspx. Failure to complete and return the Addendum to

SDAT may prohibit you from receiving certain state benefits. Please see the 2024 Form 1 instructions

for additional information.

Starting in 2024, entities may be required to report Beneficial Ownership Information to the U.S.

Department of the Treasury’s Financial Crimes Enforcement Network. More information may be found

at http://www.fincen.gov/boi

.

MARYLAND STATE DEPARTMENT OF ASSESSMENTS & TAXATION 301 WEST PRESTON STREET, BALTIMORE, MARYLAND 21201-2395

TPS_Public Utility - 2024 Form 18 Maryland

DEPARTMENT OF

P ag e 2 of 16 http://dat.maryland.gov

ASSESSMENTS AND TAXATION

REMINDERS FOR 2024

Regulatory reports including SEC 10-K; Annual Reports to Stockholders; FERC 1, 2,

and 6; FCC 499A; and R-1 forms may be submitted electronically in PDF format to

sdat.utilitytax@maryland.gov. Electronic reports MUST be in PDF format. Links to

urls are NOT acceptable.

Always include the complete name of the entity and Maryland ID number in the

subject line of the email.

Check this box if Regulatory reports are filed electronically.

*Report total number of Directors and total number of female Directors on page 1.

Due to the passage of Chapter 513 during the 2019 General Assembly Session, a new

request for data has been included on the Form 18. The Total number of Directors,

Total number of Female Directors only applies to tax exempt, domestic non- stock

corporations with an operating budget exceeding $5,000,000; or domestic stock

corporations with total sales exceeding $5,000,000. If one of the former applies to the

corporation, these questions must be completed unless 75% of the corporation’s

shareholders are family members. This question is required by law, Tax Property

Article §11-101.

2024 RAILROAD OPERATING PROPERTY RETURN EXTENSION

60-Day Extension Requests may be submitted and verified online at

http://pprextensions.dat.maryland.gov. Our office is no longer accepting extensions

requested via paper documents. Extension requests can be submitted from

December 2023 through April 14, 2024. You will receive a confirmation number as

proof of your submission. Please print and keep a copy of the confirmation page.

Please submit extension requests as early as possible to avoid delays due to the

heavy usage of the system the last week prior to April 15. Returns must be filed by

June 15, 2024.

Public Utility Forms are available online at

https://dat.maryland.gov/businesses/Pages/franchise-and-public-utilities.apsx

MARYLAND STATE DEPARTMENT OF ASSESSMENTS & TAXATION 301 WEST PRESTON STREET, BALTIMORE, MARYLAND 21201-2395

TPS_Public Utility - 2024 Form 18 Maryland

DEPARTMENT OF

P ag e 3 of 16 http://dat.maryland.gov

ASSESSMENTS AND TAXATION

SECTION II

1.

Does the company or its parent file an Annual Report to Stockholders or SEC Form

10K?

Yes No

If a stockholder's report or SEC Form 10K is filed, a copy of the company's or its

parent's Annual Report to Stockholders and SEC Form 10K must be submitted

with this return.

2.

Does the company file an R-1 Annual Report with the Surface Transportation Board

(STB)?

Yes No

If the company answered "yes" to question 2, a copy of the company’s R-1 must be

submitted with this return.

Electronic reports MUST be in PDF format. Links to urls are NOT acceptable.

Check this box if Regulatory reports are filed electronically.

If the company answered "no" to question 2, Forms 18-1, Balance Sheet, and 18-2,

Income Statement, must be completed. If a federal or state regulatory return is

submitted to the Department, Forms 18-1 and 18-2 should not be completed.

3.

Did the company have any funded debt outstanding on December 31?

Yes No

If yes, a statement detailing the market value of all funded debt outstanding on

December 31 must be submitted to the Department.

4.

Did the company control any property under an operating lease on December 31?

Yes No

If yes, a schedule detailing the operating leases must be submitted to the Department.

For each lease, the schedule must include the following items: original cost, net book

value, annual rent, annual depreciation, term of the lease, and age of the lease.

MARYLAND STATE DEPARTMENT OF ASSESSMENTS & TAXATION 301 WEST PRESTON STREET, BALTIMORE, MARYLAND 21201-2395

TPS_Public Utility - 2024 Form 18 Maryland

DEPARTMENT OF

P ag e 4 of 16 http://dat.maryland.gov

ASSESSMENTS AND TAXATION

5.

Does the company operate in any state other than Maryland?

Yes No

If no, proceed to question 6. If yes, provide the following information:

a)

All Track Miles

(Exclude trackage rights)

b)

Main Line Track Miles

c)

Locomotive Unit Miles

d)

Freight Train Miles

e)

Car Miles

f)

Net Ton Miles

g)

Railway Operating Revenues

h)

Orig. & Terminating Carloads

i)

Orig. & Terminating Tons

j)

Original Cost - Road

k)

Net Book - Road

l)

Materials & Supplies

MD

_

_

TOTAL

MARYLAND STATE DEPARTMENT OF ASSESSMENTS & TAXATION 301 WEST PRESTON STREET, BALTIMORE, MARYLAND 21201-2395

TPS_Public Utility - 2024 Form 18 Maryland

DEPARTMENT OF

P ag e 5 of 16 http://dat.maryland.gov

ASSESSMENTS AND TAXATION

6.

On Form 18-3, provide a complete list of all motor vehicles licensed in Maryland.

Indicate the original cost of each vehicle and the year of acquisition.

7.

Operating land of a railroad is valued land assessed by the Department as part

of the operating unit and is not valued and assessed by the Supervisor of

Assessments of the county where the land is located. (TP 8-108 (c) (4)

Operating land should be reported on Form 18-4 and should be included in

real property reported by taxing jurisdiction on Form 18-5

8.

Most computer software and related documentation is now exempt. Embedded

software residing permanently in the internal memory of a computer system and

computer software sold from inventory in a tangible medium ready to use as is

remains taxable. All other software is exempt.

A business may not reduce the original cost of computer hardware by the value of

software that is acquired as part of computer hardware. (Tax Property 7-238 (d))

9.

If an ICC or PSC Annual Report is not submitted with this return, the company must

provide specific data on the type of property used in the railroad operation. The

information should be provided on Form 18-4. NOTE: Form 18-4 should not be

completed if the company is submitting an ICC or PSC Annual Report.

10.

On Form 18-5, provide the original cost of all railroad operating real and personal

property permanently located in Maryland. The information must be provided by

taxing jurisdiction. Note that Form 18-5 contains a list of all counties, incorporated

towns, and special taxing jurisdictions in Maryland. If the company owns property in

any of these locations, the original cost should be reported. NOTE: Reported real

property should INCLUDE land.

11.

For each jurisdiction where the company operates, provide the all track miles

excluding trackage rights. All taxing jurisdictions are listed on Form 18-5. All track

mileage should be reported on Form 18-6.

MARYLAND STATE DEPARTMENT OF ASSESSMENTS & TAXATION 301 WEST PRESTON STREET, BALTIMORE, MARYLAND 21201-2395

TPS_Public Utility - 2024 Form 18 Maryland

DEPARTMENT OF

P ag e 6 of 16 http://dat.maryland.gov

ASSESSMENTS AND TAXATION

SECTION III

IMPORTANT REMINDERS

• A Railroad Operating Property Return must be filed by all railroads that operate in the State

of Maryland. The return must be filed even if the company owns no property in the State or

has not conducted business during the year.

• The due date for filing the return is April 15th.

Extensions of the filing deadline of up to

60 days may be granted. The only way to file an extension is via the website, as

explained on the Extension Request page at the beginning of the Form 18. All

companies which receive an extension must file a completed return by the extension

expiration date. All returns and accompanying payments should be mailed to:

State Department of Assessments & Taxation

Public Utilities Section

301 W. Preston Street, 8

th

Floor

Baltimore, Maryland 21201-2395

• All items on the return must be completed. If a question is not applicable, please state that

fact. The information provided in this return, excluding page 1, is held confidential by the

Department and is not available for public inspection. Page 1 is public record. (Tax-Property

Article 2-212).

• The annual report filing fee is $300 for most legal entities. Please be sure to enclose the

correct fee with the Form 18. Make the check payable to: Department of Assessments &

Taxation. Please include the Department ID number on the check.

• For assistance in preparing the return, call (410) 767-1940.

Name and phone number of person to contact regarding the return

Email Address of person to contact regarding the return

I declare under the penalties of perjury, pursuant to Tax-Property Article 1-201 of the

Annotated Code of Maryland, that this return, including any accompanying

schedules and statements, has been examined by me and to the best of my

knowledge and belief is a true, correct and complete return.

Printed Name of Officer or Principal

Signature of Officer or Principal Date

The return must be signed by an officer of the company.

MARYLAND STATE DEPARTMENT OF ASSESSMENTS & TAXATION 301 WEST PRESTON STREET, BALTIMORE, MARYLAND 21201-2395

TPS_Public Utility - 2024 Form 18 Maryland P ag e 7 of 16 http://dat.maryland.gov

DEPARTMENT OF

ASSESSMENTS AND TAXATION

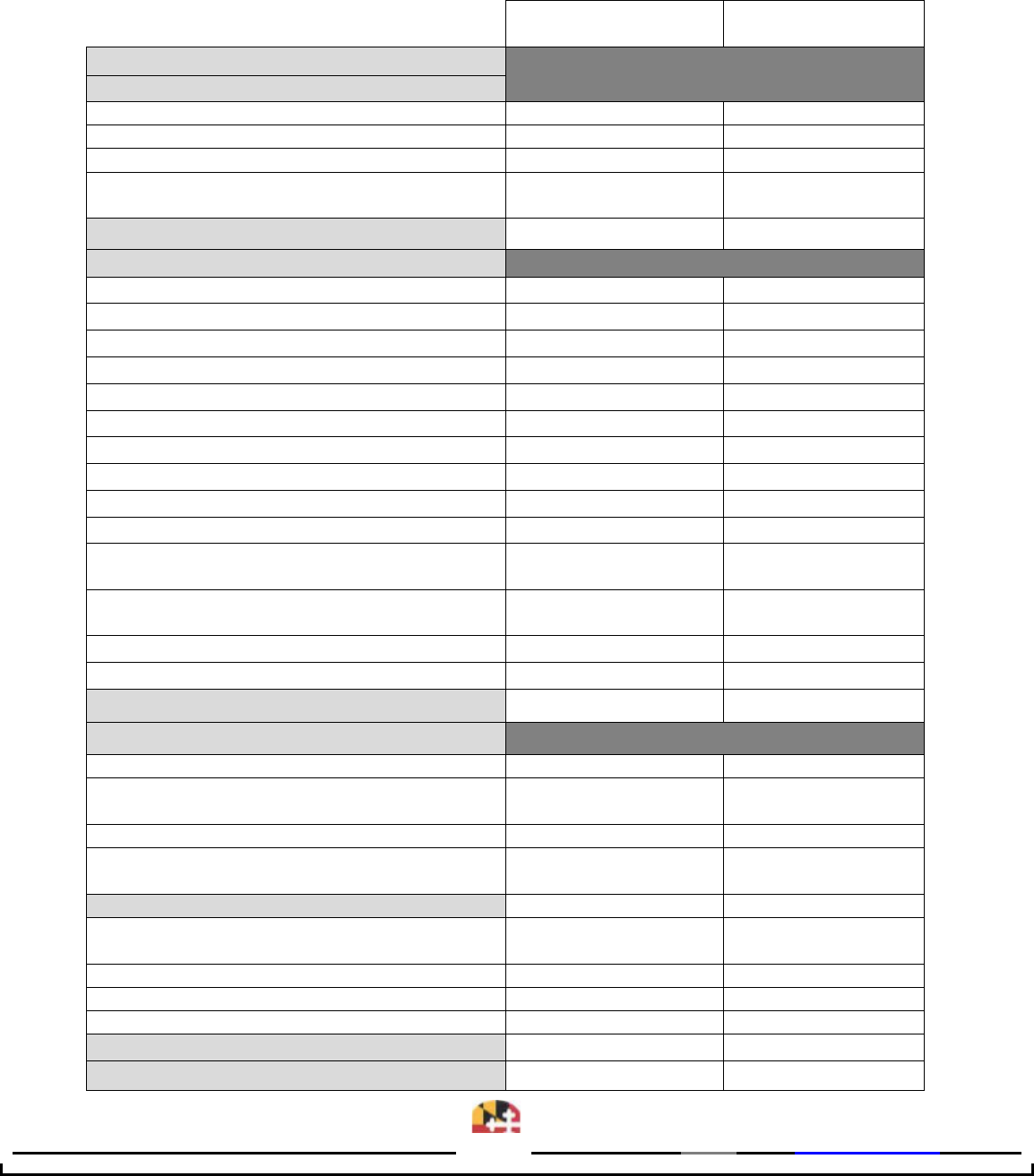

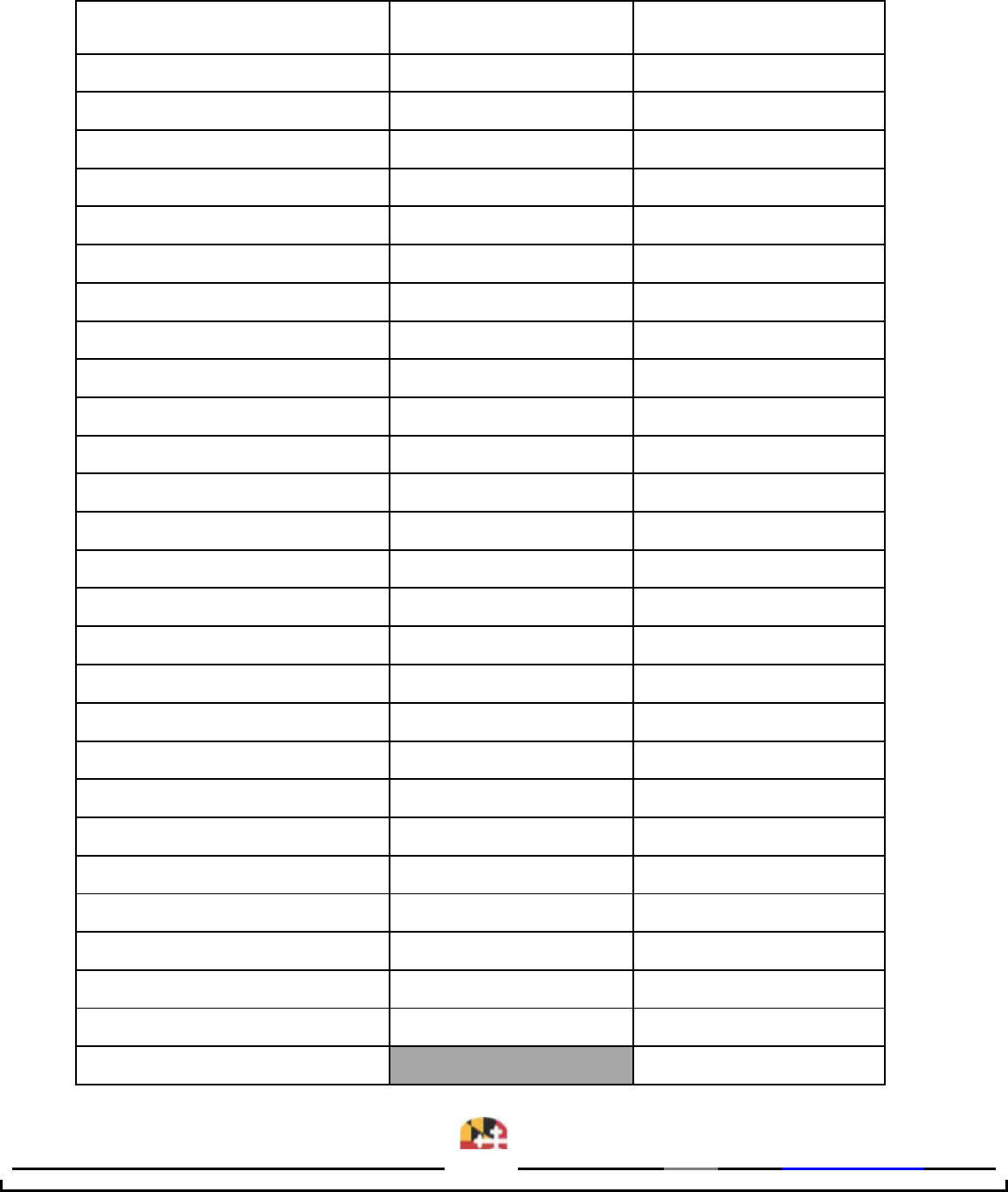

Maryland Form 18-1, January 1, 2024

BALANCE SHEET

Balance at

Beginning of Year

Balance at

End of Year

ASSETS AND OTHER DEBITS

ROAD AND EQUIPMENT

1. Road

2. Equipment

3. CWIP and Unallocated Items

4. (Less) Accumulated Depreciation &

Amortization

NET ROAD AND EQUIPMENT

CURRENT ASSETS

5. Cash

6. Temporary Cash Investments

7. Special Deposits

8. Accounts Receivable

Loans and Notes

Interline and Other Balances

Customers

Other

Accrued Accounts Receivable

Receivables from Affiliated Companies

Less: Allowance for Uncollectible

Accounts

9. Working Funds, Prepayments, Deferred

Income Tax Debits

10. Materials and Supplies

11. Other Current Assets

TOTAL CURRENT ASSETS

OTHER ASSETS

12. Special Funds

13. Investments and Advances Affiliated

Companies

14. Other Investments and Advances

15. Allowances for Net Unrealized Loss on

Noncurrent

Marketable Equity Securities

16. Property Used in Other than Carrier

Operations (Net)

17. Other Assets

18. Other Deferred Debits

19. Accumulated Deferred Income Tax Debits

TOTAL OTHER ASSETS

TOTAL ASSETS & OTHER DEBITS

MARYLAND STATE DEPARTMENT OF ASSESSMENTS & TAXATION 301 WEST PRESTON STREET, BALTIMORE, MARYLAND 21201-2395

TPS_Public Utility - 2024 Form 18 Maryland

DEPARTMENT OF

P ag e 8 of 16 http://dat.maryland.gov

ASSESSMENTS AND TAXATION

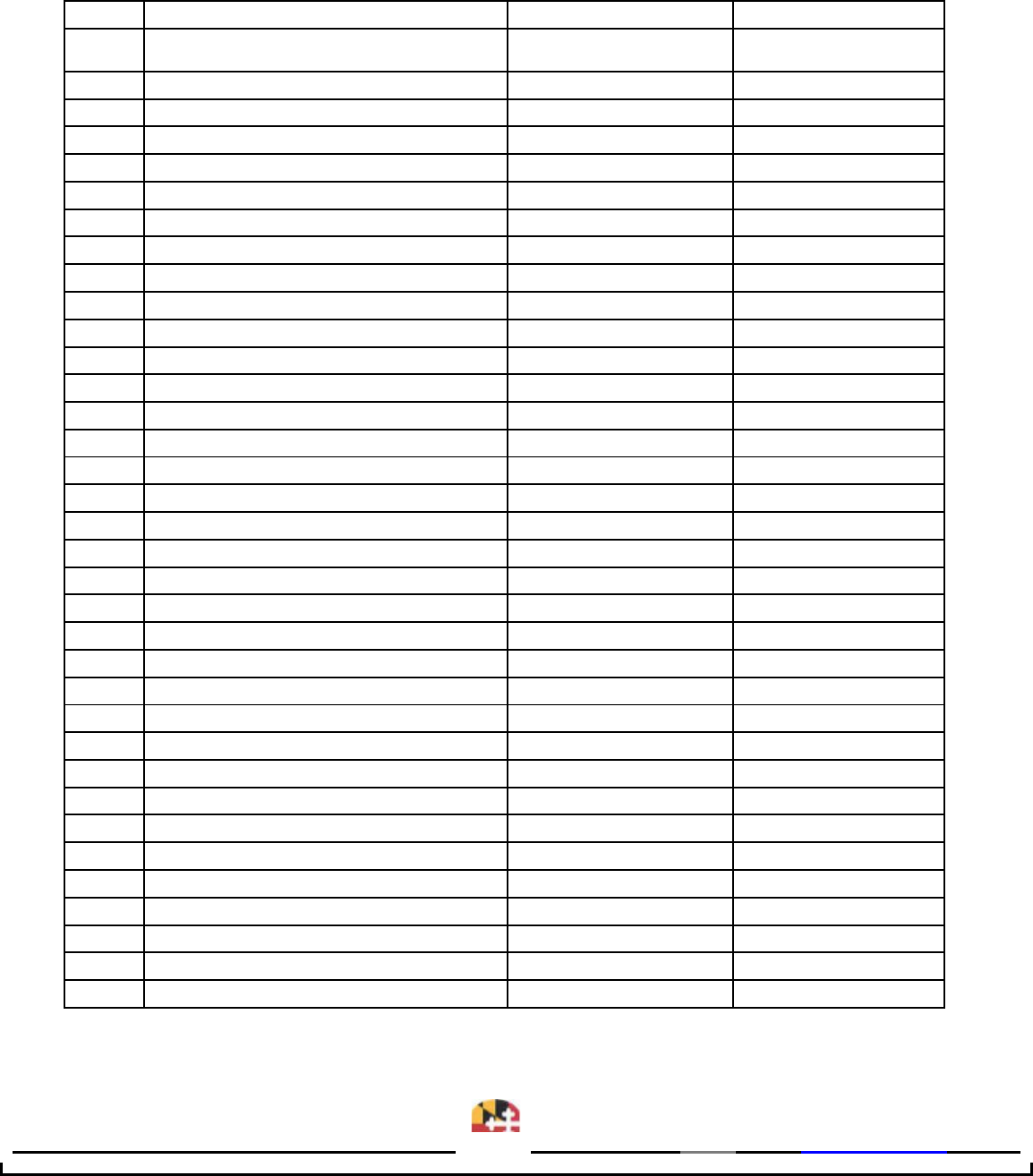

Maryland Form 18-1b, January 1, 2024

BALANCE SHEET

Balance at

Beginning of Year

Balance at

End of Year

LIABILITIES AND SHAREHOLDERS EQUITY

CURRENT LIABILTIES

1. Loans and Notes Payable

2. Accounts Payable: Interline and Other Balances

3. Audited Accounts and Wages

4. Other Accounts Payable

5. Interest and Dividends Payable

6. Payables to Affiliated Companies

7. Accrued Accounts Payable

8. Taxes Accrued

9. Other Current Liabilities

10. Long-Term Debt Due within One Year

TOTAL CURRENT LIABILTIES

NON-CURRENT LIABILITIES

11. Funded Debt Unmatured

12. Equipment Obligations

13. Capitalized Lease Obligations

14. Debt in Default

15. Accounts Payable: Affiliated Companies

16. Unamortized Debt Premium

17. Interest in Default

18. Accumulated Deferred Income Tax Credit

19. Other Long- Term Liabilities and Credits

TOTAL NONCURRENT LIABILITIES

SHAREHOLDERS EQUITY

20. Total Capital Stock:

Common Stock

Preferred Stock

21. Discount on Capital Stock

22. Additional Capital

23. Retained Earnings:

Appropriated

Unappropriated

24. (Less) Treasury Stock

NET STOCKHOLDERS EQUITY

TOTAL LIABILITIES & SHAREHOLDERS EQUITY

MARYLAND STATE DEPARTMENT OF ASSESSMENTS & TAXATION 301 WEST PRESTON STREET, BALTIMORE, MARYLAND 21201-2395

TPS_Public Utility - 2024 Form 18 Maryland

DEPARTMENT OF

P ag e 9 of 16 http://dat.maryland.gov

ASSESSMENTS AND TAXATION

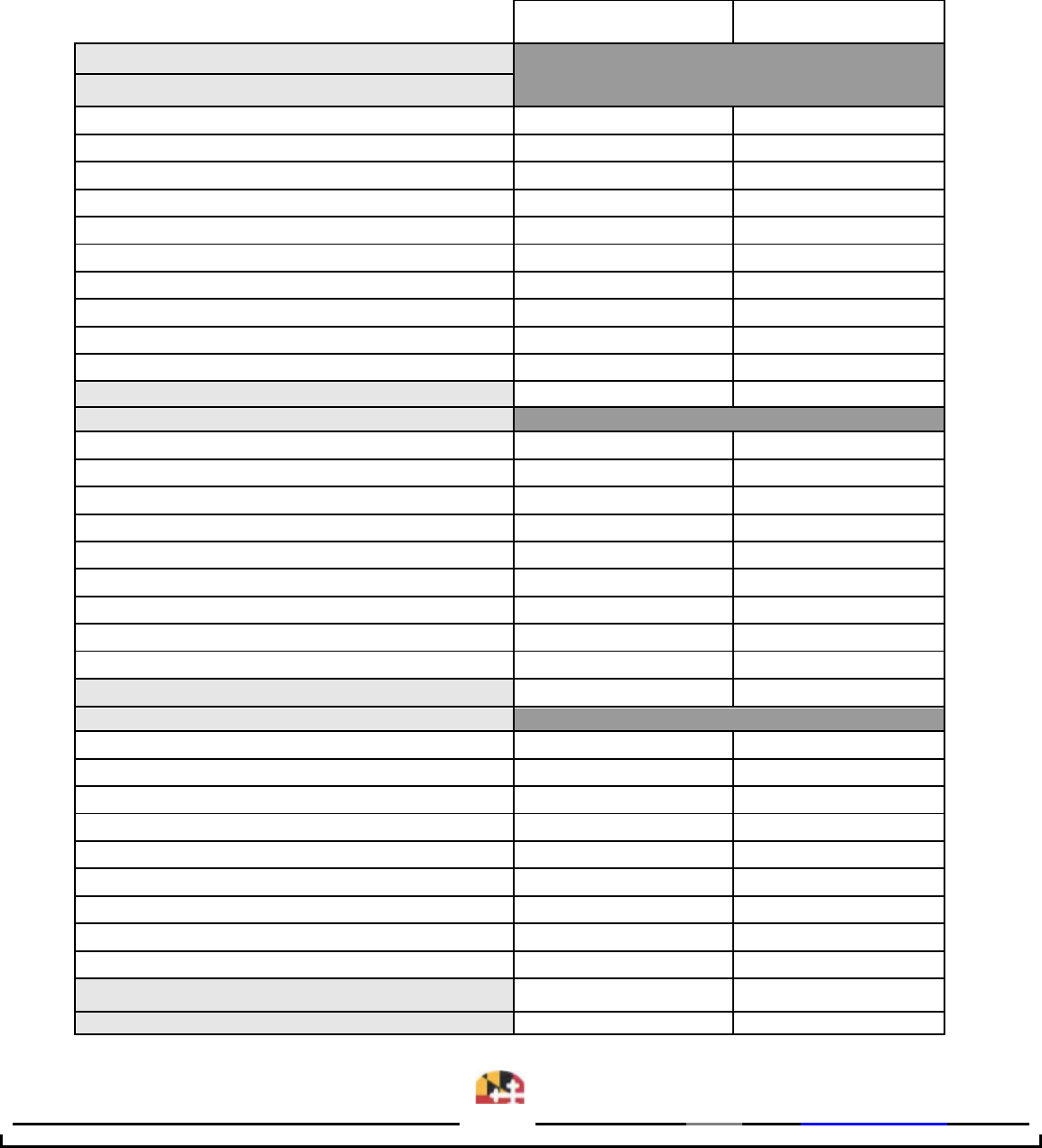

Maryland Form 18-2, January 1, 2024

INCOME STATEMENT

Current Year Previous Year

RAILWAY OPERATING INCOME

1. Total Railway Operating Revenues

2. Railway Operating Expenses

NET REVENUE FROM RAILWAY OPERATIONS

OTHER INCOME

3. Revenue from Other than Carrier Property

4. Miscellaneous Rent Income

5. Dividend Income

6. Interest Income

7. Miscellaneous Income

8. Other Income

TOTAL OTHER INCOME

TOTAL INCOME

MISCELLANEOUS DEDUCTIONS FROM INCOME

9. Expenses from other than Carrier Property

10. Miscellaneous Taxes

11. Miscellaneous Income Charges

12. Uncollectible Accounts

13. Other Miscellaneous Deductions

TOTAL MISCELLANEOUS DEDUCTIONS

INCOME AVAILABLE FOR FIXED CHARGES

FIXED CHARGES

14. Interest on Funded and Unfunded Debt

15. Amortization of Discount on Funded Debt

TOTAL FIXED CHARGES

INCOME AFTER FIXED CHARGES

UNUSUAL OR INFREQUENT ITEMS

16. Unusual or Infrequent Items:

PROVISIONS FOR INCOME TAXES

17. Income Taxes on Ordinary Income

Federal, State, and Other

18. Provision for Deferred Taxes

TOTAL PROVISION FOR INCOME TAXES

NET INCOME

MARYLAND STATE DEPARTMENT OF ASSESSMENTS & TAXATION 301 WEST PRESTON STREET, BALTIMORE, MARYLAND 21201-2395

TPS_Public Utility - 2024 Form 18 Maryland

DEPARTMENT OF

P ag e 10 of 16 http://dat.maryland.gov

ASSESSMENTS AND TAXATION

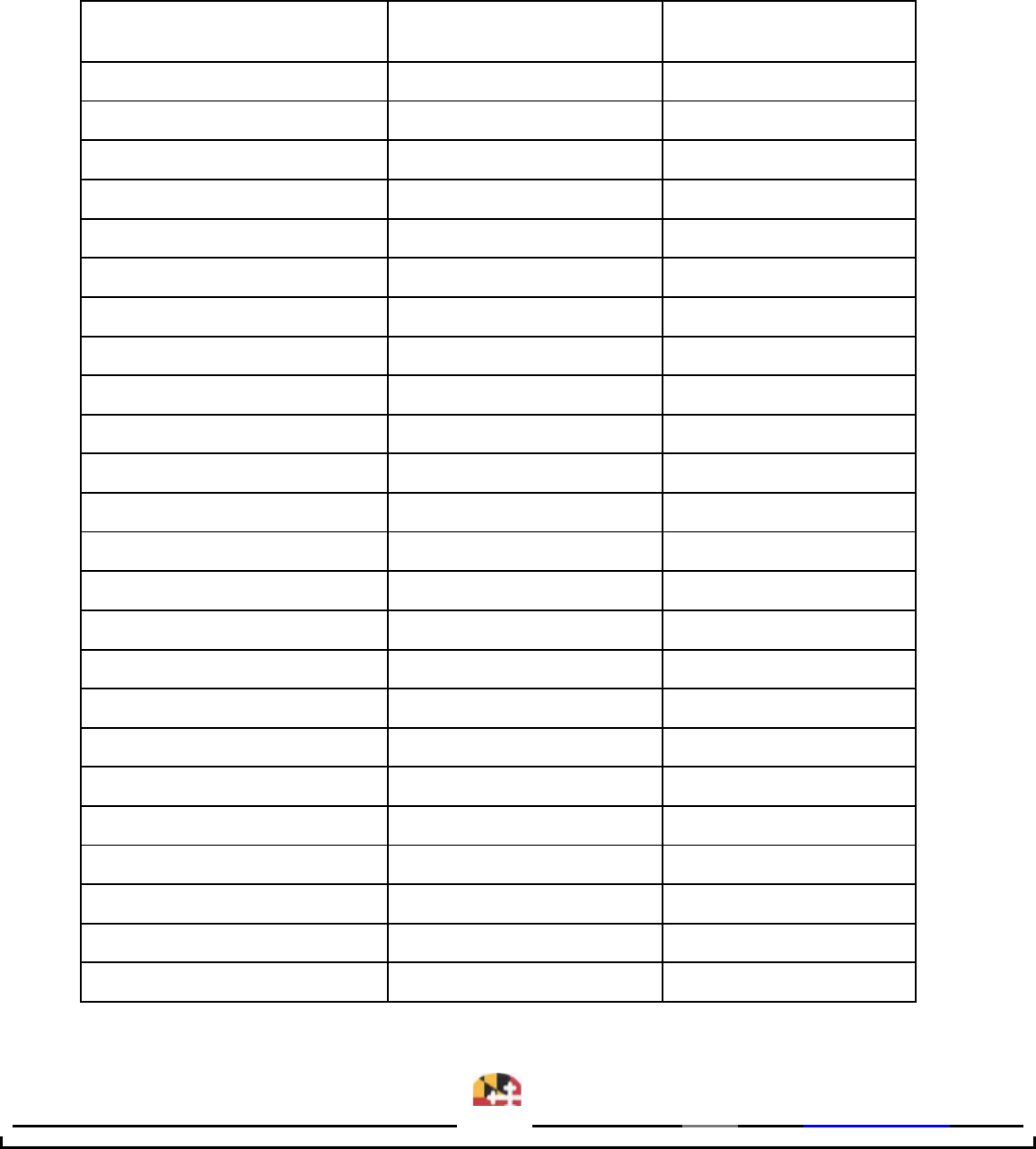

Maryland Form 18-3, January 1, 2024

SCHEDULE OF MARYLAND LICENSED MOTOR VEHICLES

DESCRIPTION OF VEHICLE YEAR OF ACQUISITION ORIGINAL COST

TOTAL

MARYLAND STATE DEPARTMENT OF ASSESSMENTS & TAXATION 301 WEST PRESTON STREET, BALTIMORE, MARYLAND 21201-2395

TPS_Public Utility - 2024 Form 18 Maryland

DEPARTMENT OF

P ag e 11 of 16 http://dat.maryland.gov

ASSESSMENTS AND TAXATION

Maryland Form 18-4, January 1, 2024

ROAD AND EQUIPMENT

Description of Property

Original Cost

Net Book

R-1

Acct#

REAL

(2)

1. Land for Transportation Purposes

(3)

2. Grading and Other ROW Expenditures

(4)

3. Tunnels and Subways

(6)

4. Bridges, Trestles, and Culverts

(7)

5. Elevated Structures

(8) 6. Ties

(9)

7. Rail and Other Track Material

(11)

8. Ballast

(13)

9. Fences, Snowsheds and Signs

(16-17)

10. Station, Office and Roadway Buildings

(18-19) 11. Water and Fuel Stations

(20)

12. Shops and Enginehouses

(22)

13. Storage Warehouses

(23) 14. Wharves and Docks

(25)

15. TOFC/COFC Terminals

(27) 16. Signals and Interlockers

(35)

17. Miscellaneous structures

(39)

18. Public Improvements - Construction

19. Other (Specify)

TOTAL REAL

PERSONAL

(26)

20. Communications Systems

(29)

21. Power Plants

(31) 22. Power Transmission Systems

(37)

23. Roadway Machines

(44-45)

24. Shop & Power Plant Machinery

(52) 25. Locomotives

(53)

26. Freight-Train Cars

(55)

27. Highway Revenue Equipment

(56)

28. Floating Equipment

(57)

29. Work Equipment

(58) 30. Miscellaneous Equipment

(59)

31. Computer Systems

TOTAL PERSONAL

MARYLAND STATE DEPARTMENT OF ASSESSMENTS & TAXATION 301 WEST PRESTON STREET, BALTIMORE, MARYLAND 21201-2395

TPS_Public Utility - 2024 Form 18 Maryland

DEPARTMENT OF

P ag e 12 of 16 http://dat.maryland.gov

ASSESSMENTS AND TAXATION

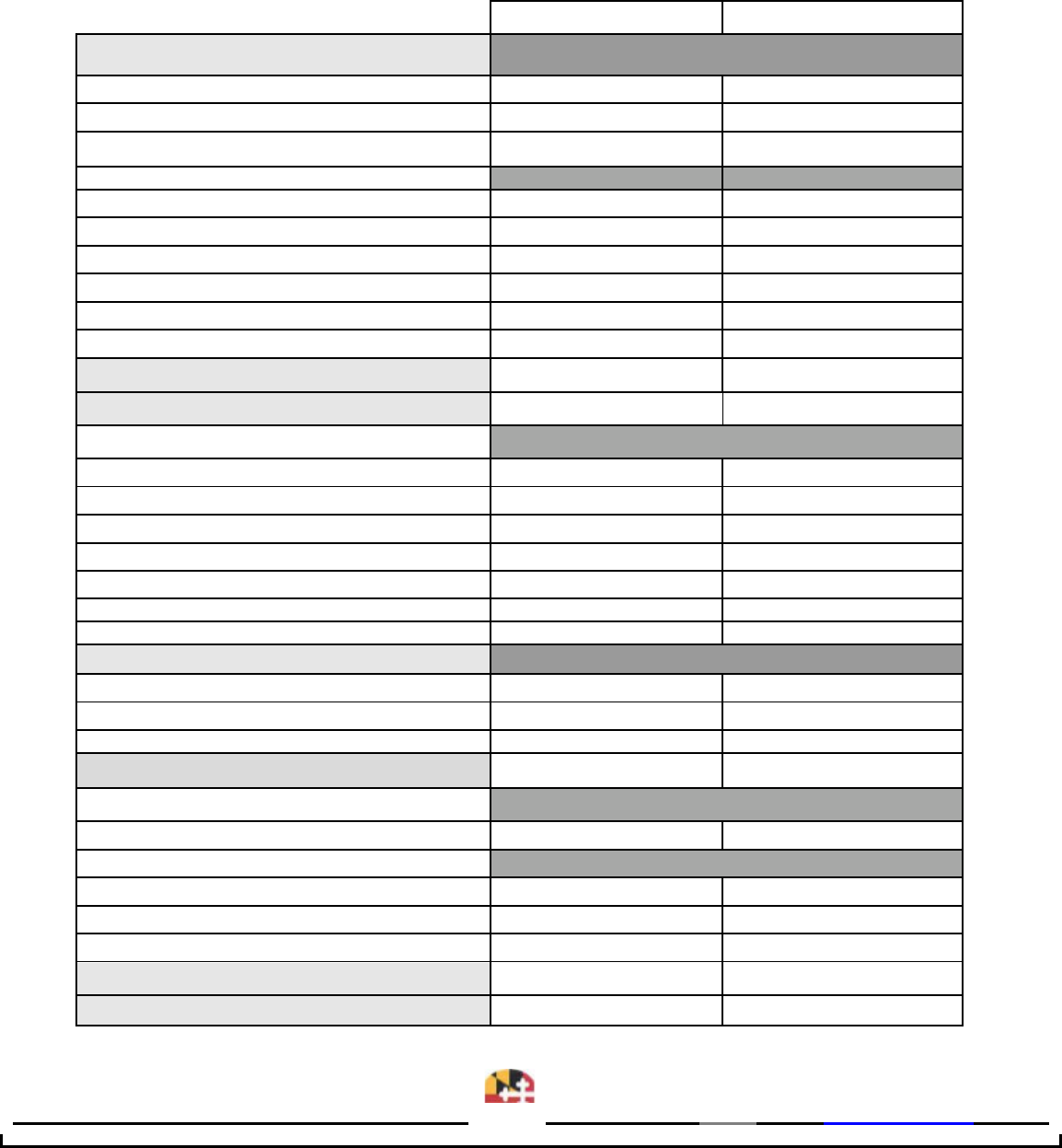

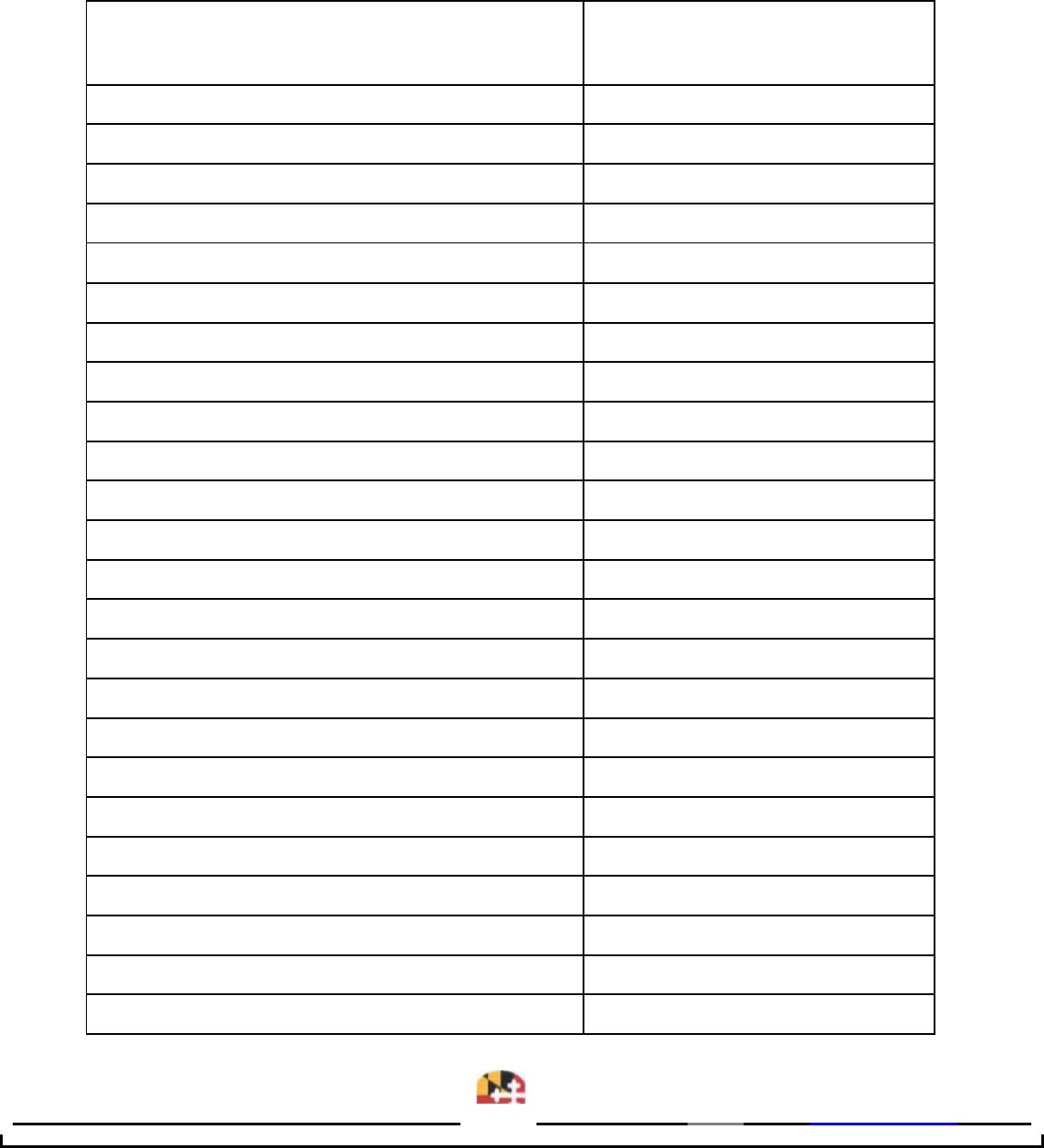

Maryland Form 18-5, January 1, 2024

SCHEDULE OF MARYLAND REAL AND PERSONAL PROPERTY BY TAXING

JURISDICTION

JURISDICTION

REAL PROPERTY *

ORIGINAL COST

PERSONAL PROPERTY

ORIGINAL COST

*Real Property should INCLUDE land.

MARYLAND STATE DEPARTMENT OF ASSESSMENTS & TAXATION

TPS_Public Utility - 2024 Form 18 Maryland

DEPARTMENT OF

ASSESSMENTS AND TAXATION

301 WEST PRESTON STREET, BALTIMORE, MARYLAND 21201-2395

P ag e 13 of 16 http://dat.maryland.gov

Maryland Form 18-6, January 1, 2024

ALL-TRACK MILES BY JURISDICTION

ALL-TRACK MILES

JURISDICTION Exclude

Trackage Rights

MARYLAND STATE DEPARTMENT OF ASSESSMENTS & TAXATION 301 WEST PRESTON STREET, BALTIMORE, MARYLAND 21201-2395

TPS_Public Utility - 2024 Form 18 Maryland

DEPARTMENT OF

P ag e 14 of 16 http://dat.maryland.gov

ASSESSMENTS AND TAXATION

MARYLAND COUNTIES, INCORPORATED CITIES, AND SPECIAL DISTRICTS

The following is a list of counties, incorporated towns and special taxing districts in Maryland. If a company owns property in any of these

locations, the Property should be reported on Form 18-5, as outlined in Section II, 11.

ALLEGANY COUNTY

Incorporated Cities:

Barton

Cumberland

Frostburg

Lonaconing

Luke

Midland

Westernport

Special Districts:

Cresaptown Sanitary

Potomac Park

Bowling Green Sanitary

Bedford Road Sanitary

Bedford Road Fire

Bowling Green Light

Bowling Green Fire

Cresaptown Fire

LaVale Fire

LaVale Rescue

LaVale Sanitary

Bel Air

Cresaptown Water

Mt. Savage

Braddock Run Sanitary

Jennings Run Sanitary

Ellerslie

McCoole

ANNE ARUNDEL COUNTY

Anne Arundel Districts:

Annapolis District

Dist. excluding Annap.

Incorporated Cities:

Annapolis

Highland Beach

BALTIMORE CITY

Downtown District

Port Covington

BALTIMORE COUNTY

No Additional Jurisdictions

CALVERT COUNTY

Incorporated Cities:

Chesapeake Beach

North Beach

CAROLINE COUNTY

Incorporated Cities:

Denton

Federalsburg

Goldsboro

Greensboro

Henderson

Hillsboro

Marydel

Preston

Ridgely

Templeville

CARROLL COUNTY

Incorporated Cities:

Hampstead

Manchester

Mt. Airy

New Windsor

Sykesville

Taneytown

Union Bridge

Westminster

CECIL COUNTY

Incorporated Cities:

Cecilton

Charlestown

Chesapeake City

Elkton

North East

Perryville

Port Deposit

Rising Sun

CHARLES COUNTY

Incorporated Cities:

Indian Head

LaPlata

Port Tobacco

DORCHESTER

Incorporated Cities:

Brookview

Cambridge

Church Creek

East New Market

Eldorado

Galestown

Hurlock

Secretary

Vienna

FREDERICK

Incorporated Cities:

Brunswick

Burkittsville

Emmitsburg

Frederick

Middletown

Mt. Airy

Myersville

New Market

Rosemont

Thurmont

Walkersville

Woodsboro

GARRETT COUNTY

Incorporated Cities:

Accident

Deer Park

Friendsville

Grantsville

Kitzmiller

Loch Lynn Heights

Mountain Lake Park

Oakland

HARFORD COUNTY

Incorporated Cities:

Aberdeen

Bel Air

Havre de Grace

HOWARD COUNTY

Howard Districts:

Metropolitan

KENT COUNTY

Incorporated Cities:

Betterton

Chestertown

Galena

Millington

Rock Hall

MONTGOMERY COUNTY

Montgomery District 1

Incorporated Cities:

Laytonsville

Special District:

Gaithersburg Fire

Montgomery District 2

No Additional Jurisdictions

Montgomery District 3

Incorporated Cities:

Poolesville

Montgomery District 4

Incorporated Cities:

Garrett Park

Rockville

Special Districts:

Regional District

MD-Wash. Metropolitan

Sanitary District

Suburban District

MARYLAND STATE DEPARTMENT OF ASSESSMENTS & TAXATION 301 WEST PRESTON STREET, BALTIMORE, MARYLAND 21201-2395

TPS_Public Utility - 2024 Form 18 Maryland

DEPARTMENT OF

P ag e 15 of 16 http://dat.maryland.gov

ASSESSMENTS AND TAXATION

Montgomery District 5

Special Districts:

Regional District

MD-Wash. Metropolitan

Sanitary District

Hillendale Fire

Burtonsville Fire

Montgomery District 6

Special Districts:

Gaithersburg Fire

Montgomery District 7

Incorporated Cities:

Glen Echo

Somerset

Chevy Chase

Chevy Chase Section 3

Chevy Chase Section 5

Martin’s Additions

Chevy Chase Village

North Chevy Chase

Special Districts:

Bethesda Parking Area

Battery Park

Regional District

MD-Wash. Metropolitan

Sanitary District

Suburban District

Bethesda Fire

Chevy Chase Fire

Conduit Road Fire

Bethesda Library

Cabin John Fire

Drummond Citizen’s

Friendship Heights

Oakmont

Montgomery District 8

Incorporated Cities:

Brookeville

Special Districts:

Regional District

Montgomery District 9

Incorporated Cities:

Gaithersburg

Washington Grove

Special Districts:

Sanitary District

Gaithersburg Fire

Montgomery District 10

Special Districts:

Regional District

MD-Wash. Metropolitan

Sanitary District

Cabin John Fire Area

Montgomery District 11

Incorporated Cities:

Barnesville

Montgomery District 12

No Additional Jurisdictions

Montgomery District 13

Incorporated Cities:

Kensington

Takoma Park

Chevy Chase View

Special Districts:

Regional District

MD-Wash. Metropolitan

Sanitary District

Suburban District

Silver Spring Fire

Kensington Fire

Takoma Park Fire

Wheaton Parking

Montg. Hills Parking

Silver Spring Parking

PRINCE GEORGE’S COUNTY

Incorporated Cities:

Berwyn Heights

Bladensburg

Bowie

Brentwood

Capitol Heights

Cheverly

College Park

Colmar Manor

Cottage City

District Heights

Eagle Harbor

Edmonston

Fairmount Heights

Forest Heights

Glenarden

Greenbelt

Hyattsville

Landover Hills

Laurel

Morningside

Mt. Rainer

New Carrollton

North Brentwood

Riverdale

Seat Pleasant

University Park

Upper Marlboro

Special Districts:

Wash-Suburban Sanitary

MD-Park & Planning

Metropolitan Area

QUEEN ANNE’S COUNTY

Incorporated Cities:

Barclay

Centreville

Church Hill

Millington

Queen Anne

Queenstown

Sudlersville

Templeville

ST. MARY’S COUNTY

District 1

District 2

District 3

Incorporated Cities:

Leonardtown

District 5

District 6

District 7

District 8

District 9

SOMERSET COUNTY

Incorporated Cities:

Crisfield

Princess Anne

TALBOT COUNTY

Incorporated Cities:

Easton

Oxford

Queen Anne

St. Michael’s

Trappe

WASHINGTON COUNTY

Incorporated Cities:

Boonsboro

Clearspring

Funkstown

Hagerstown

Hancock

Keedysville

Sharpsburg

Smithsburg

Williamsport

WICOMICO COUNTY

Incorporated Cities:

Delmar

Fruitland

Hebron

Mardela Springs

Pittsville

Salisbury

Sharptown

Willards

WORCESTER COUNTY

Incorporated Cities:

Berlin

Ocean City

Pocomoke City

Snow Hill

MARYLAND STATE DEPARTMENT OF ASSESSMENTS & TAXATION 301 WEST PRESTON STREET, BALTIMORE, MARYLAND 21201-2395

TPS_Public Utility - 2024 Form 18 Maryland

DEPARTMENT OF

P ag e 16 of 16 http://dat.maryland.gov

ASSESSMENTS AND TAXATION