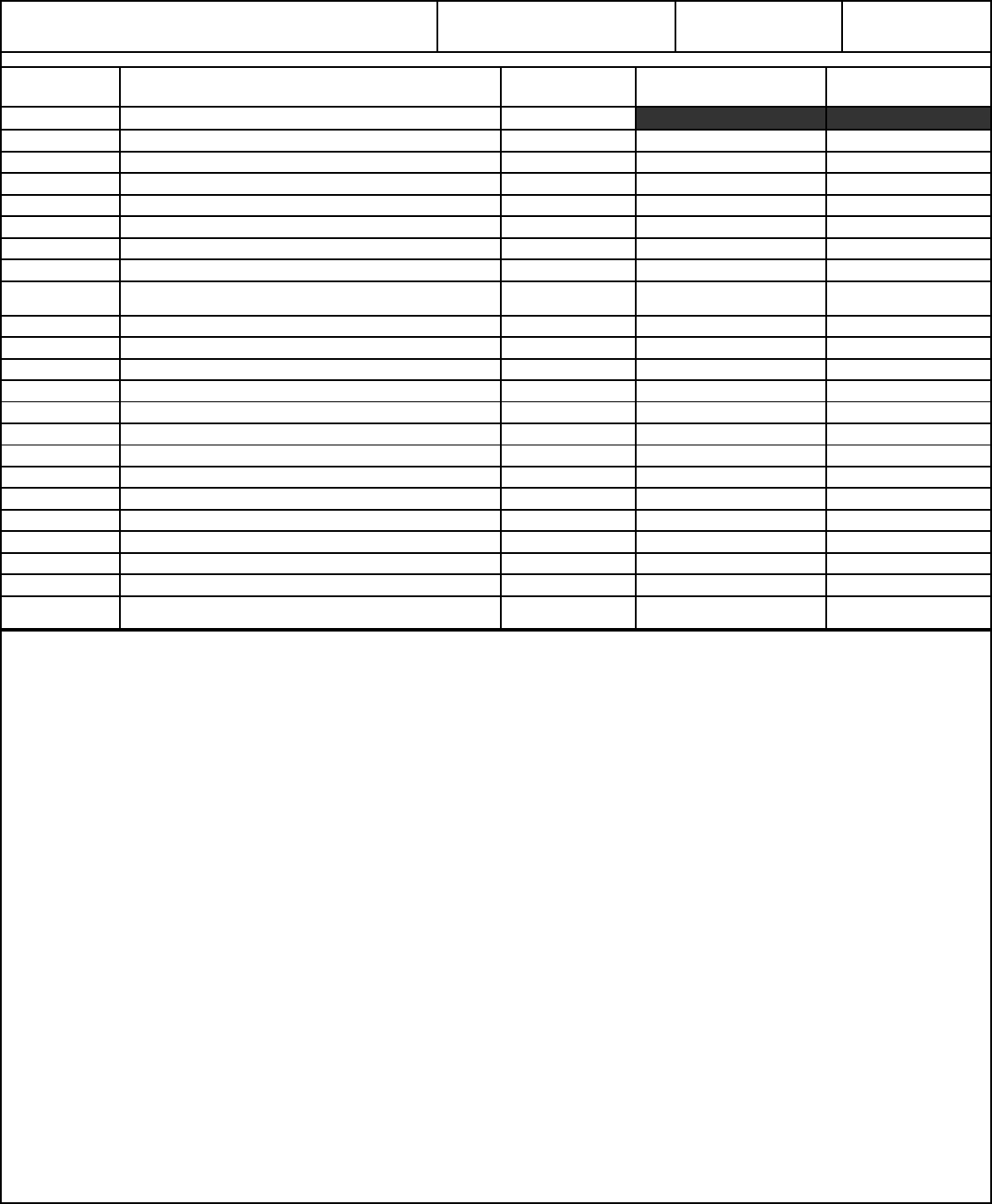

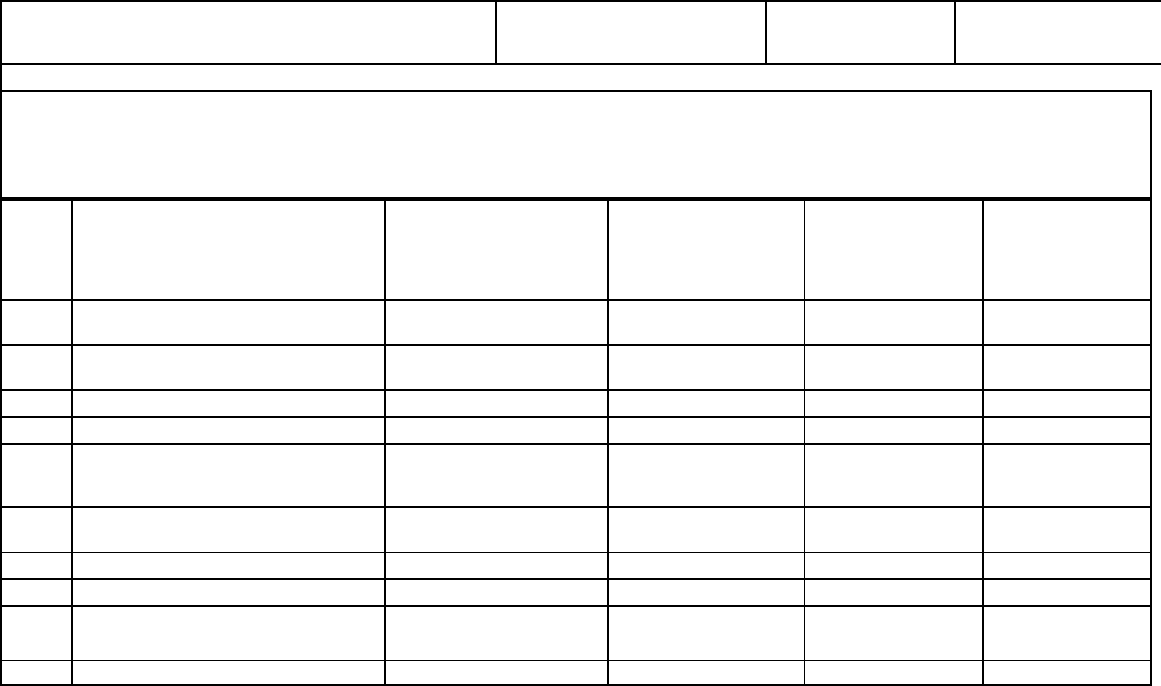

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -1-

Name of Respondent This Form is:

(1)

G

An Original

(2)

G A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec 31,

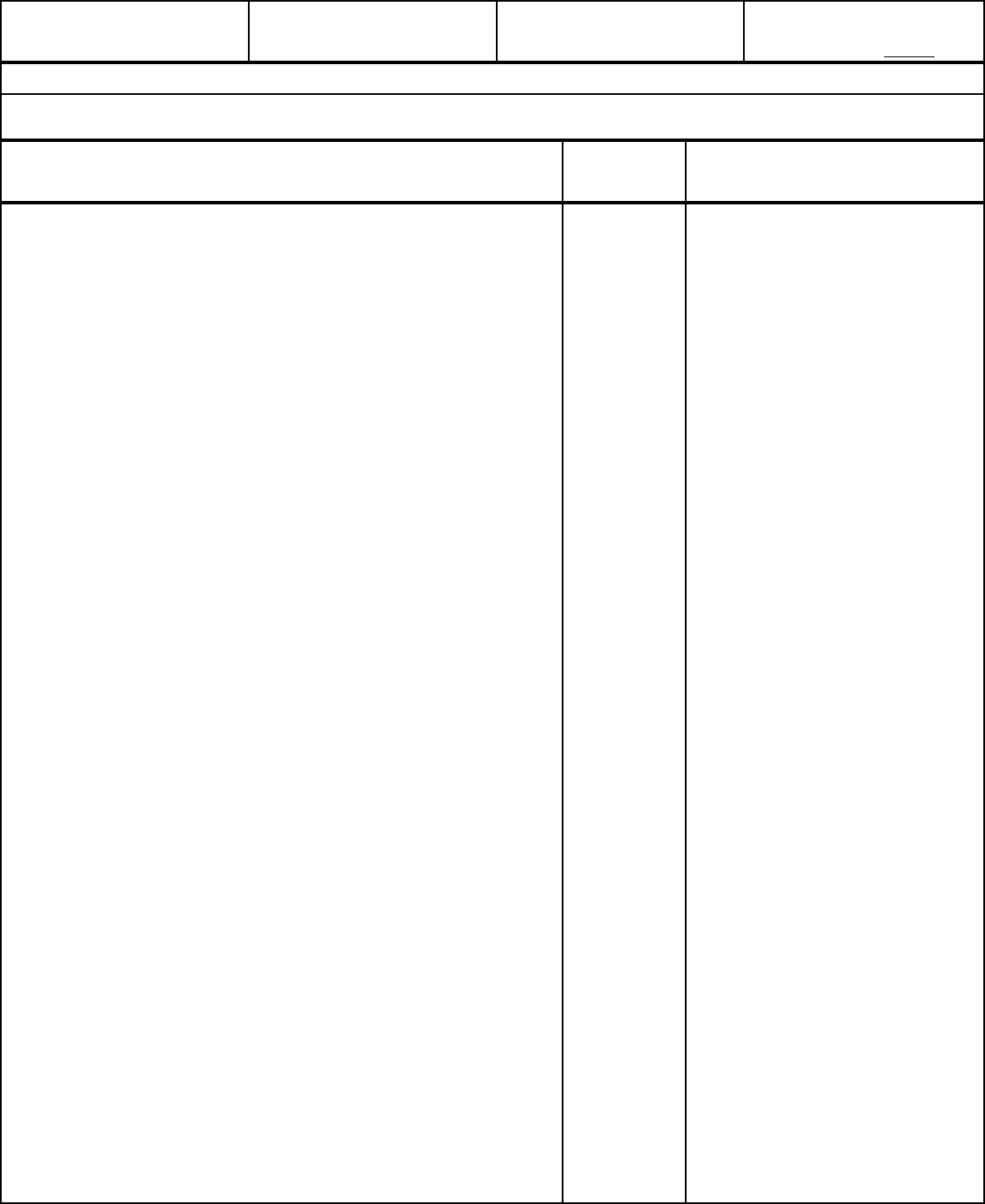

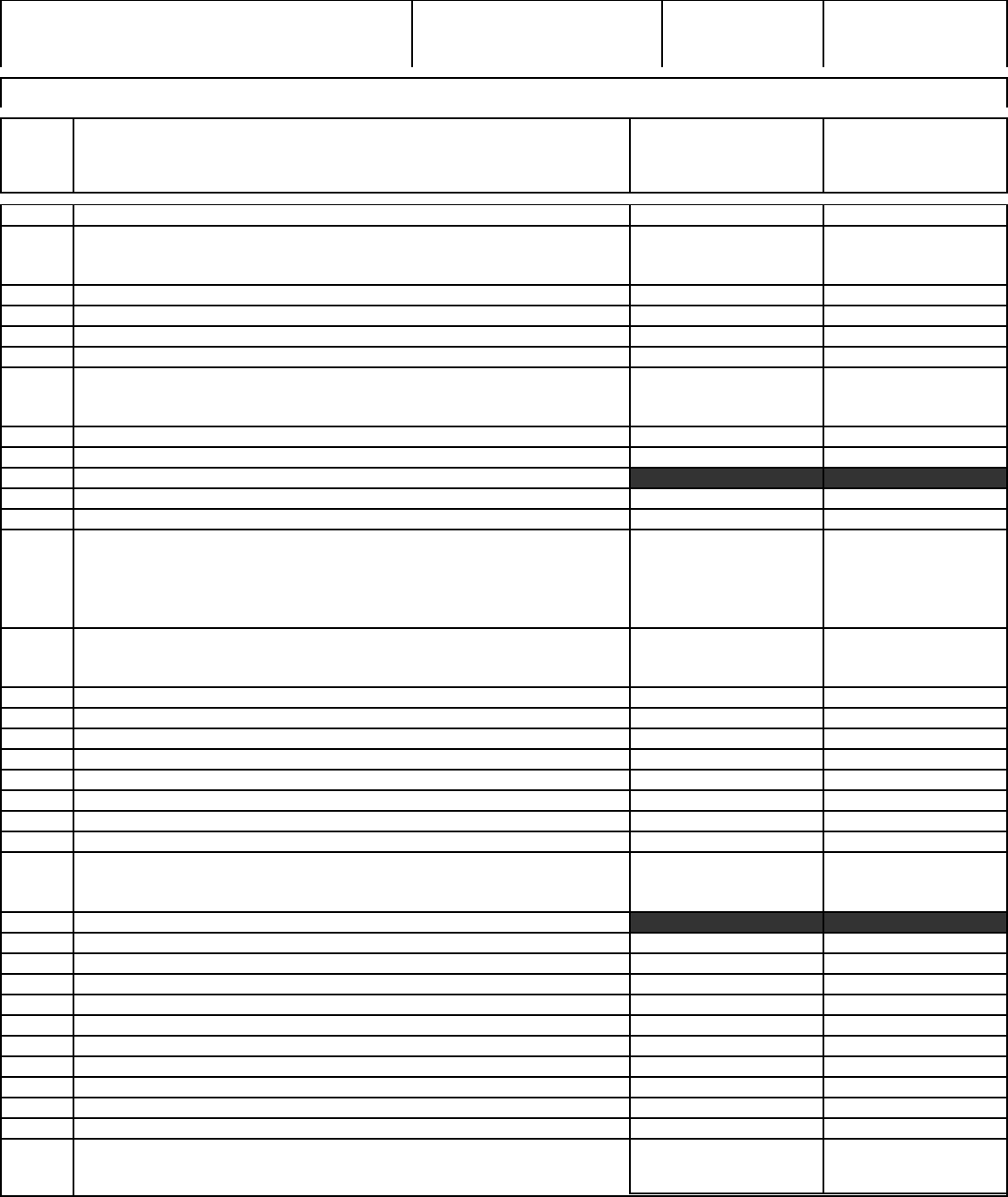

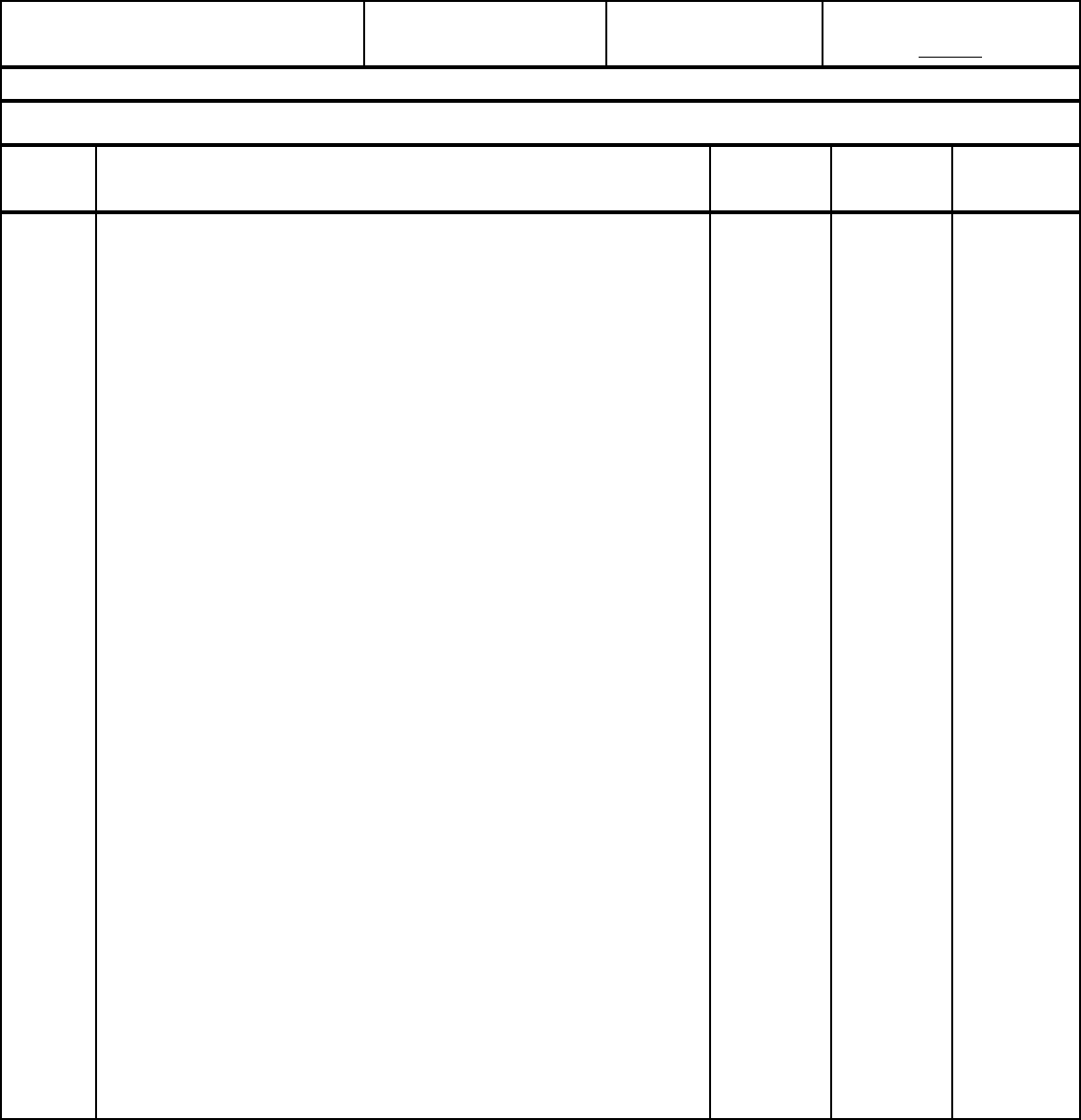

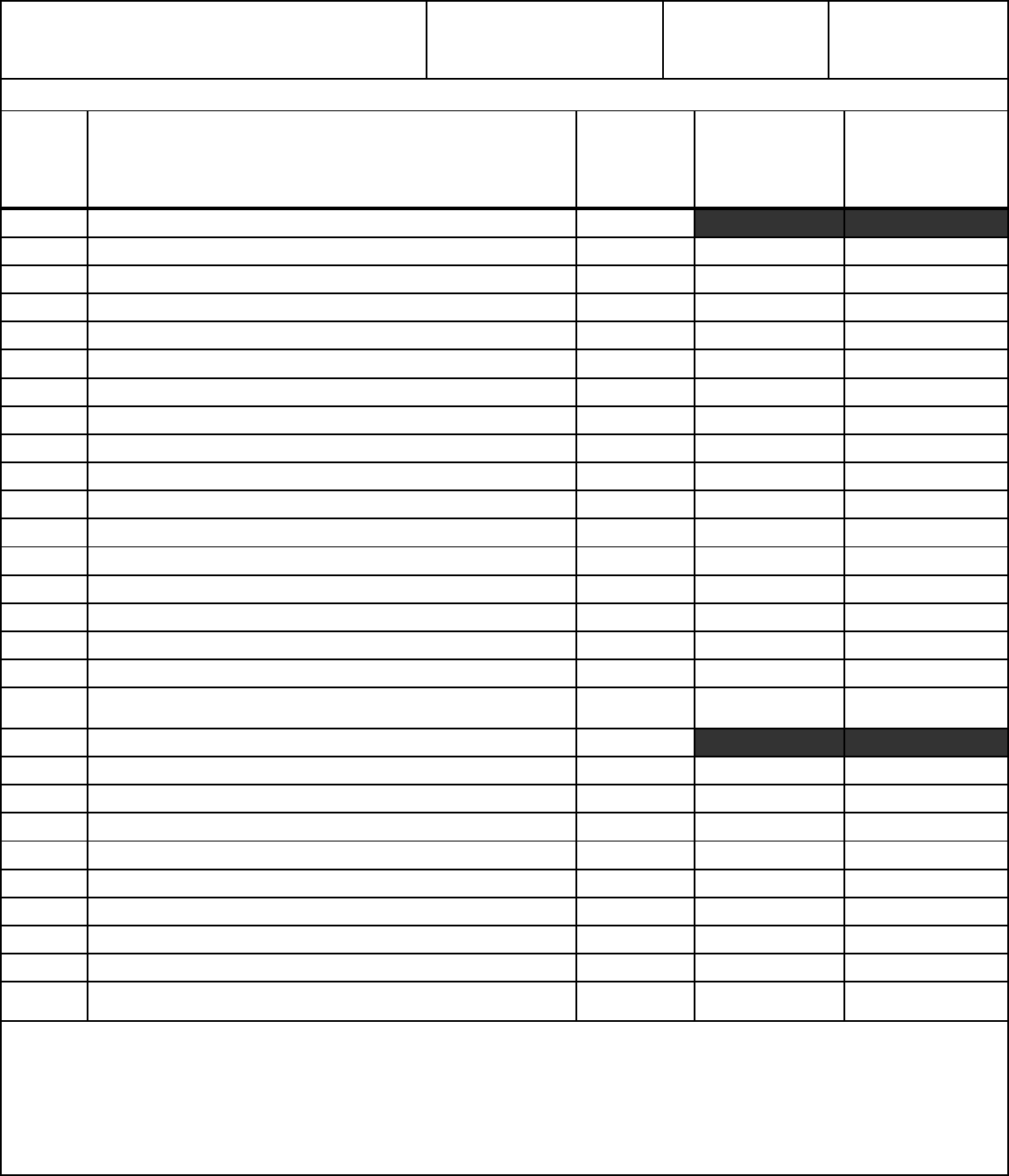

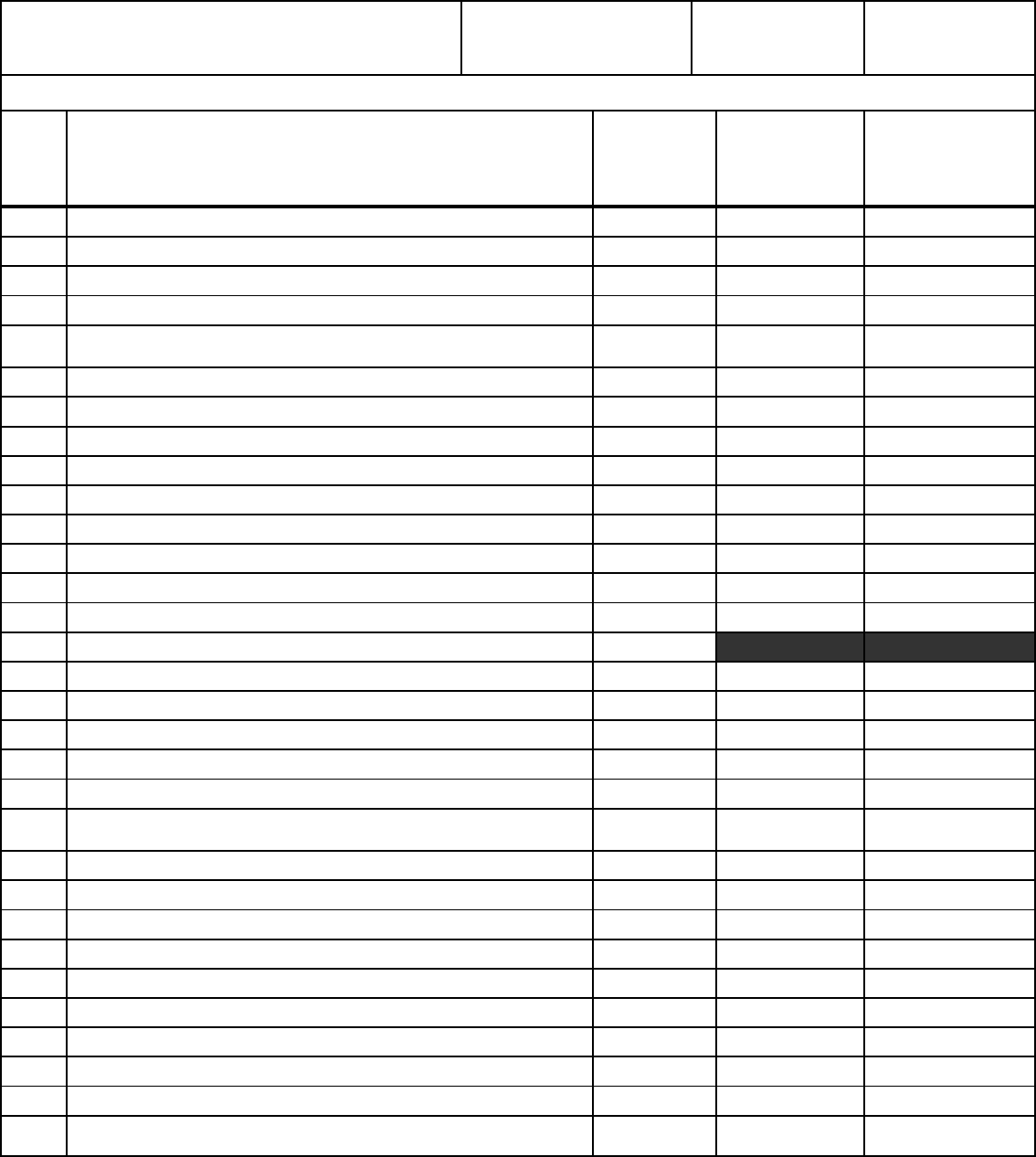

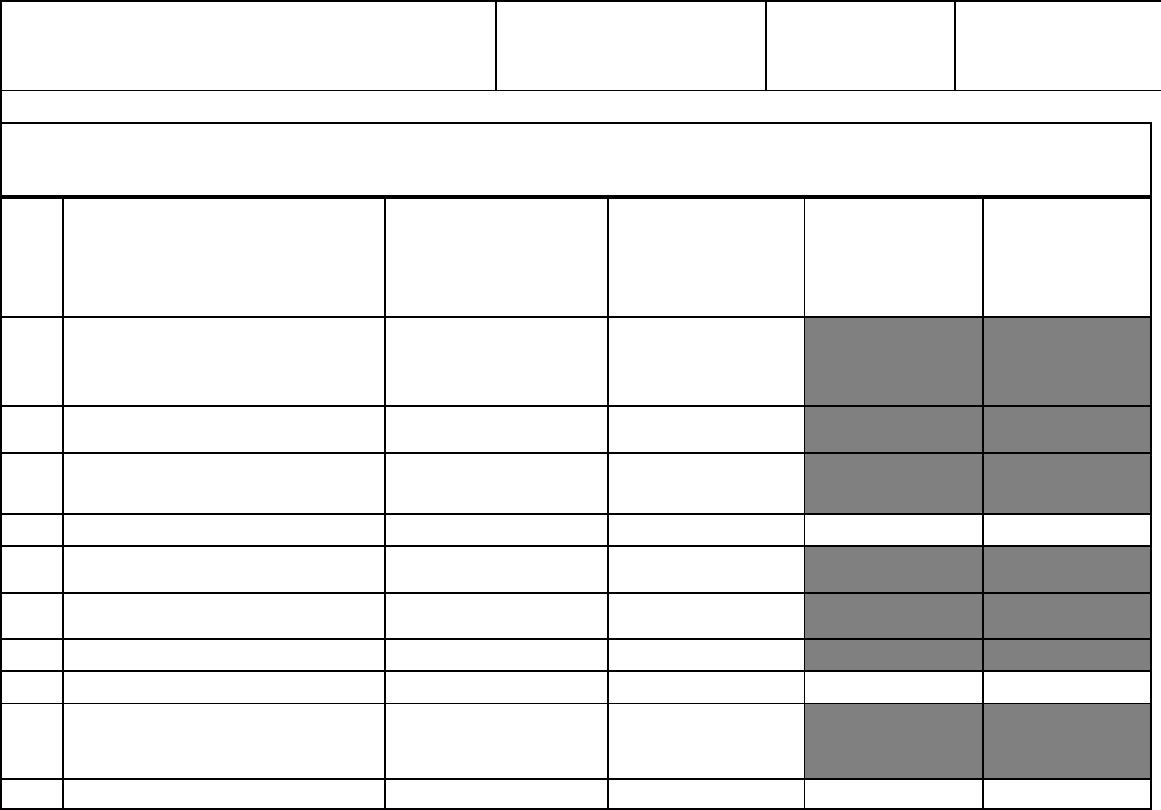

List of Schedules

Enter in column (c) the terms "none", "not applicable or "NA" as appropriate, where no information or amounts have been reported for

certain pages. Omit pages where the respondents are "none," "not applicable," or "NA"

Title of Schedule

(a)

Reference

Page No.

(b)

Remarks

(c)

GENERAL CORPORATE INFORMATION AND

FINANCIAL STATEMENTS

General Information.........................................................................................

Control Over Respondent ...............................................................................

Corporations Controlled by Respondent .........................................................

Officers............................................................................................................

Directors..........................................................................................................

Security Holders and Voting Powers...............................................................

Important Changes During the Year................................................................

Comparative Balance Sheet............................................................................

Statement of Income for the Year..................................................................

Statement of Retained Earnings for the Year..................................................

Statement of Cash Flows................................................................................

Statement of Accumulated Comprehensive Income and Hedging Activities...

Notes to Financial Statements........................................................................

BALANCE SHEET SUPPORTING SCHEDULES

(Assets and Other Debits)

Summary of Utility Plant and Accumulated Provisions for................................

Depreciation, Amortization, and Depletion

Nuclear Fuel Materials ....................................................................................

Electric Plant in Service ..................................................................................

Electric Plant Leased to Others.......................................................................

Electric Plant Held for Future Use ..................................................................

Construction Work in Progress -- Electric ......................................................

Construction Overheads -- Electric ................................................................

General Description of Construction Overhead Procedure..............................

Accumulated Provision for Depreciation of Electric Utility Plant......................

Nonutility Property ..........................................................................................

Investment in Subsidiary Companies .............................................................

Materials and Supplies ...................................................................................

Allowances .....................................................................................................

Extraordinary Property Losses .......................................................................

Unrecovered Plant and Regulatory Study Costs ............................................

Other Regulatory Assets ...............................................................................

Miscellaneous Deferred Debits.......................................................................

Accumulated Deferred Income Taxes (Account 190) .....................................

BALANCE SHEET SUPPORTING SCHEDULES

(Liabilities and Other Credits)

Capital Stock .................................................................................................

Capital Stock Subscribed, Capital Stock Liability for

Conversion, Premium on Capital Stock, and installments

Received on Capital Stock ............................................................................

Other Paid-in Capital .....................................................................................

Discount on Capital Stock .............................................................................

Capital Stock Expense ...................................................................................

Long-Term Debt.............................................................................................

101

102

103

104

105

106-107

108-109

110-113

114-117

118-119

120-121

122(a)(b)

123

200-201

202-203

204-207

213

214

216

217

218

219

221

224-225

227

228-229

230

230

232

233

234

250-251

252

253

254

254

256-257

FERC FORM NO. 1 (Revised 10-02) Page 2

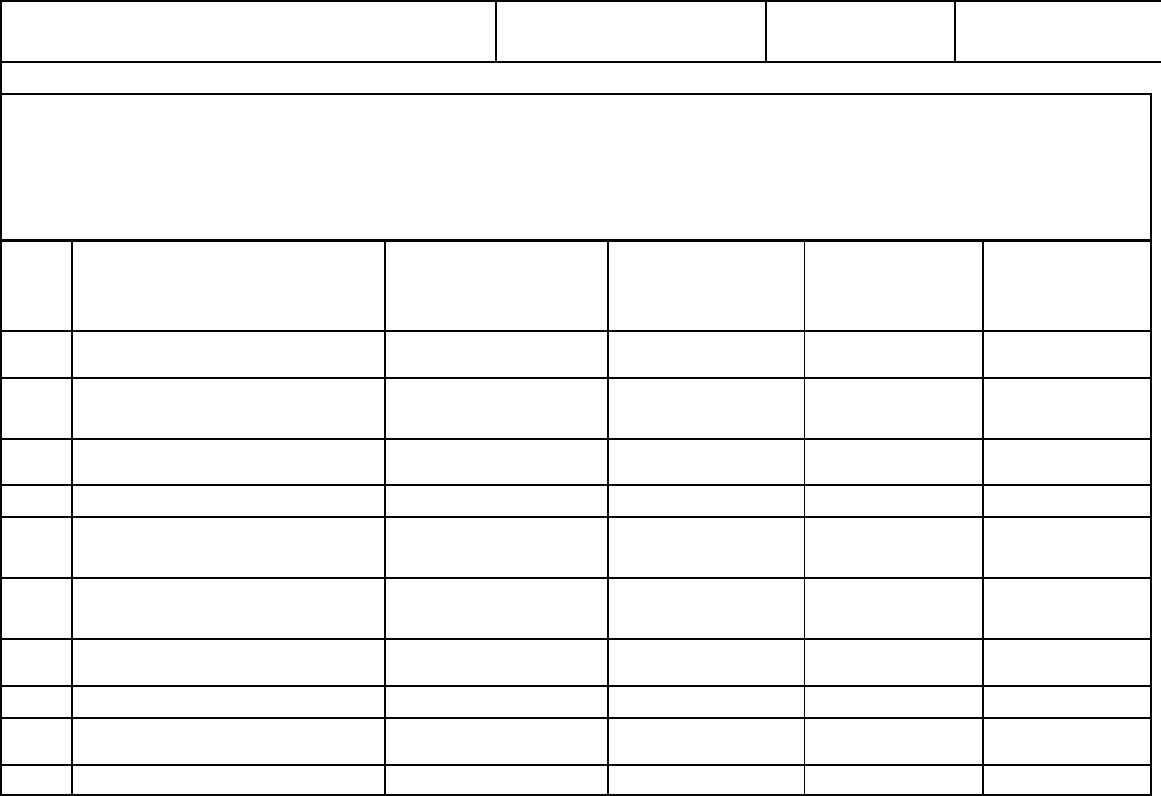

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -2-

Name of Respondent This Report is:

(1) G An Original

(2) G A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec 31, _____

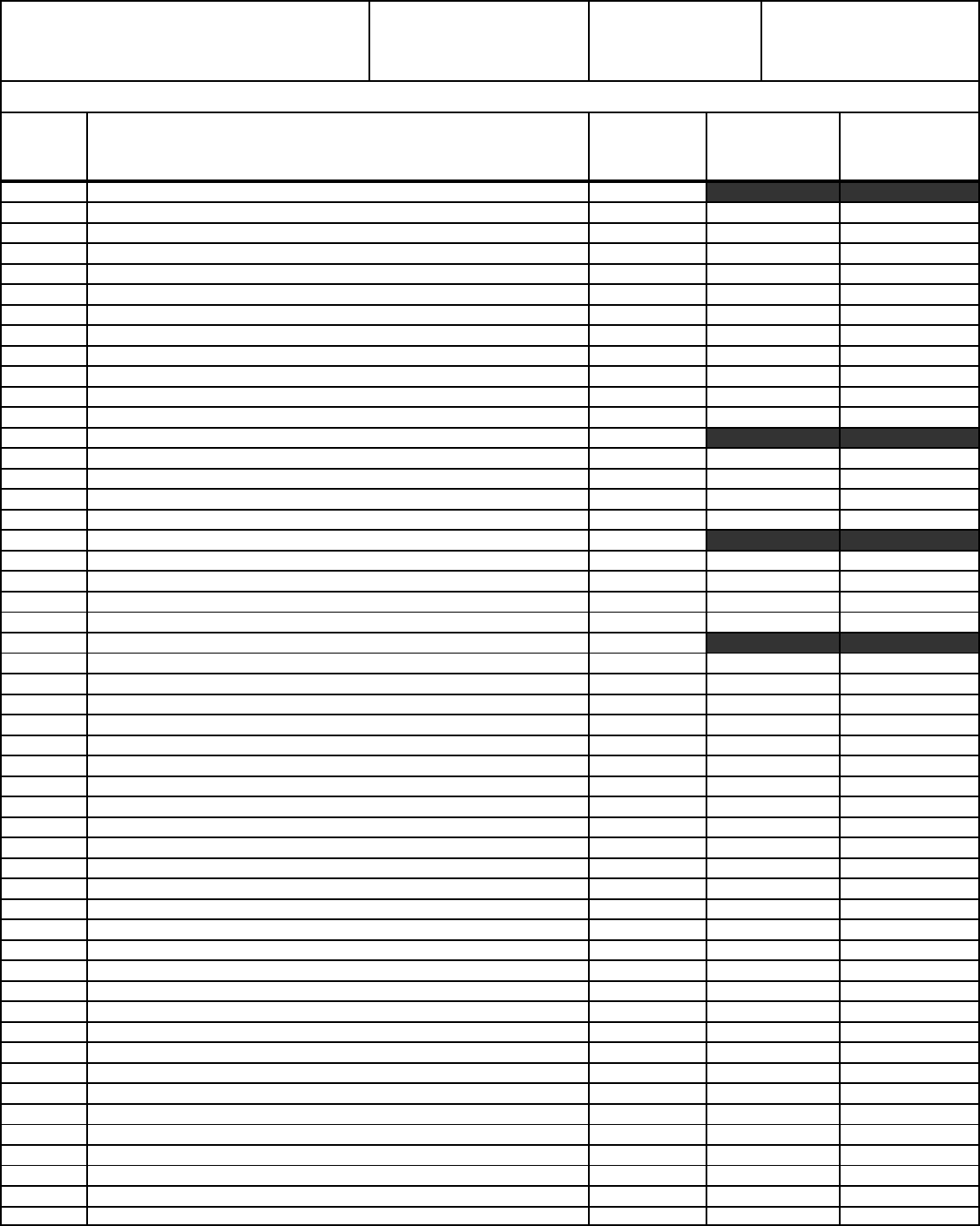

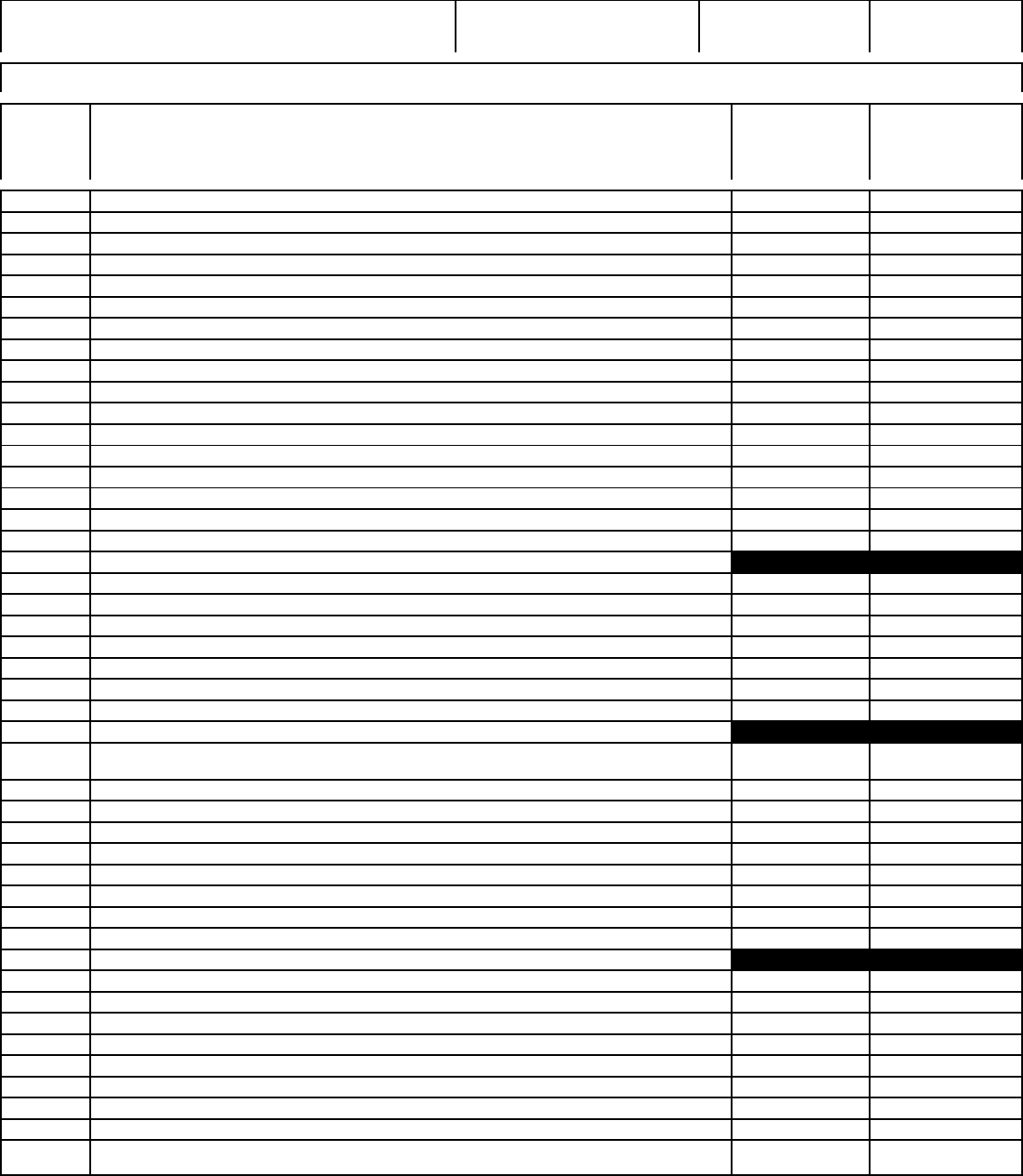

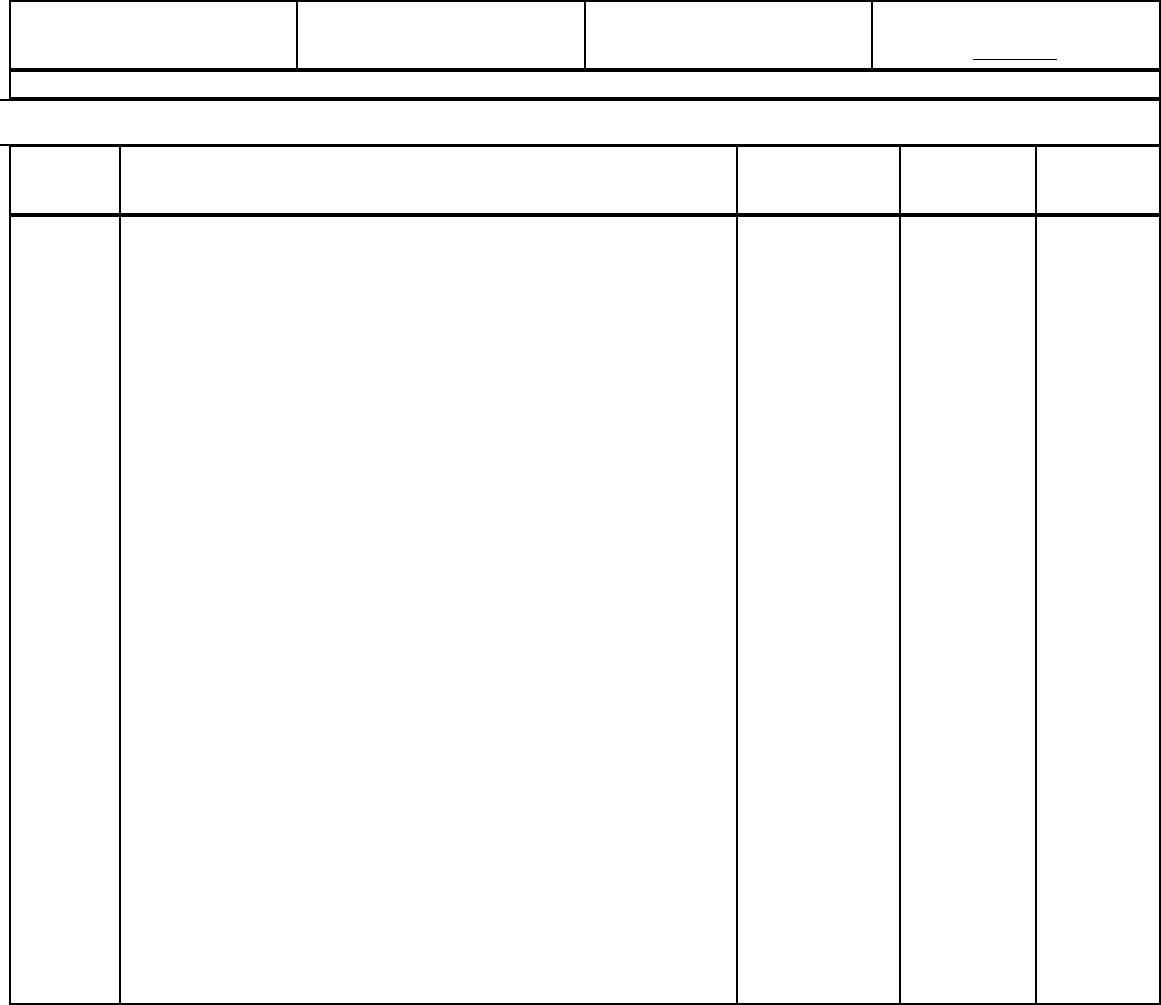

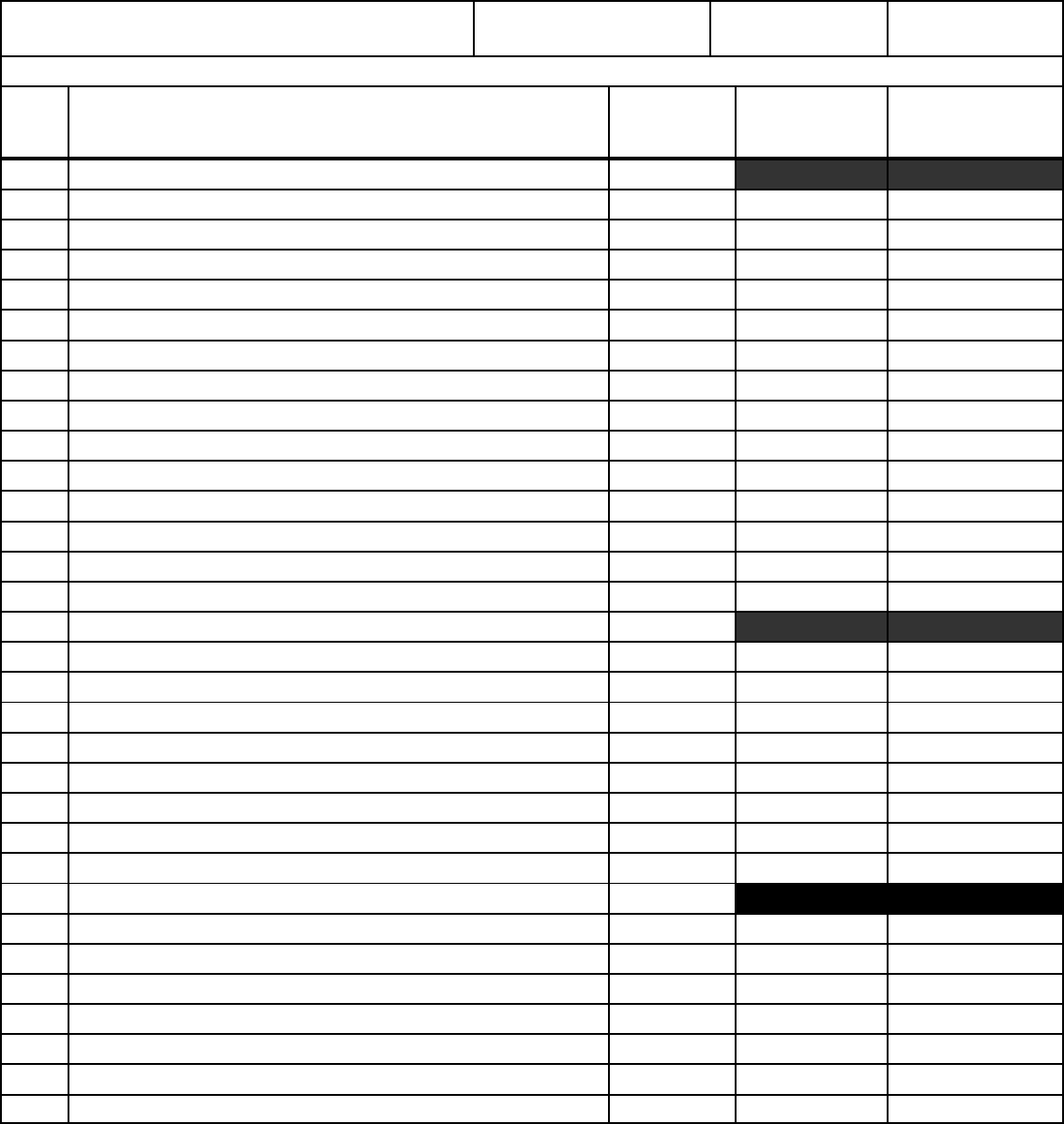

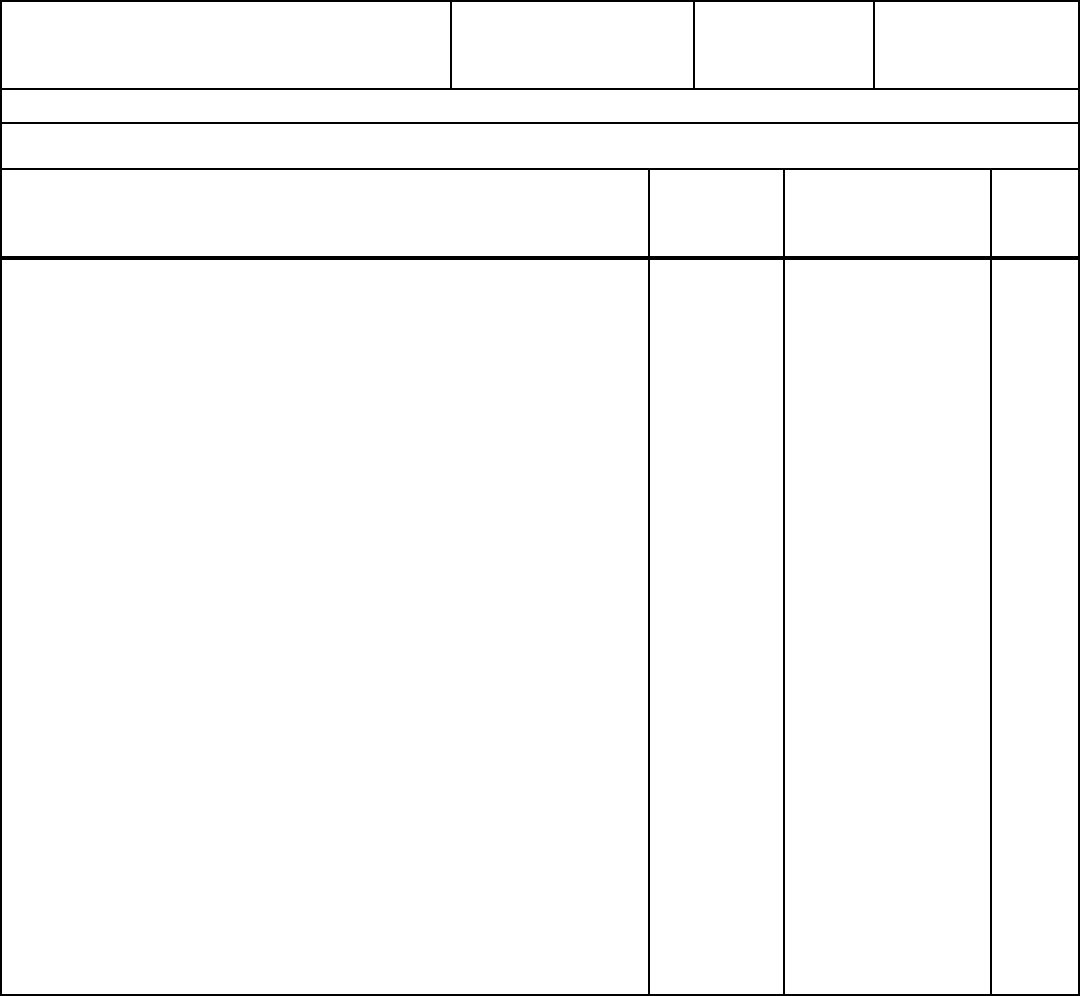

COMPARATIVE BALANCE SHEET (ASSETS AND OTHER DEBITS)

Line

No Title of Account

(a)

Ref.

Page No.

(b)

Balance at

Beginning of

year

(c)

Balance at

End of Year

(d)

1 UTILITY PLANT

2 Utility Plant (101)-106, 114) 200-201

3 Construction Work in Progress (107) 200-201

4 TOTAL UTILITY PLANT (Enter Total of Lines 2 and 3)

5 (Less) Accum. Prov. For Depr. Amort. Depl. (108, 111, 115) 200-201

6 Net Utility Plant (Enter Total of Line 4 less 5) -

7 Nuclear Fuel (120.1-120.4, 120.6) 202-203

8 (Less) Accum. Prov. For Amort. Of Nucl. Fuel Assemblies (120.5) 202-203

9 Net Nuclear Fuel (Enter Total of Lines 7 Less 8) -

10 Net Utility Plant (Enter Total of Line 6 and 9) -

11 Utility Plant Adjustments (116) 122

12 Gas Stored Underground-Noncurrent (117) -

13 OTHER PROPERTY AND INVESTMENTS

14 Nonutility Property (121) 221

15 (Less) Accum. Prov. For Depr. And Amort. (122) -

16 Investments in Associated Companies (123) -

17 Investment in Subsidiary Companies (123.1) 224-225

18 (For Cost of Account 123.1, See Footnote Page 224, Line 42) -

19 Noncurrent Portion of Allowances 228-229

20 Other Investments (124) -

21 Special Funds (125-128) -

22 TOTAL Other Property and Investments (Total of Lines 14--17, 19--21)

23 CURRENT AND ACCRUED ASSETS

24 Cash (131) -

25 Special Deposits (132-134) -

26 Working Fund (135) -

27 Temporary Cash Investments (136) -

28 Notes Receivable (141) -

29 Customer Accounts Receivable (142) -

30 Other Accounts Receivable (143) -

31 (Less) Accum. Prov. For Uncollectible Acct. - Credit (144) -

32 Notes Receivable from Associated Companies (145) -

33 Accounts Receivable from Assoc. Companies (146) -

34 Fuel Stock (151) 227

35 Fuel Stock Expenses Undistributed (152) 227

36 Residuals (Elec) and Extracted Products (153) 227

37 Plant Materials and Operating Supplies (154) 227

38 Merchandise (155) 227

39 Other Material and Supplies (156) 227

40 Nuclear Materials held for Sale (157) 202-203/227

41 Allowances (158.1 and 158.2) 228-229

42 (Less) Noncurrent Portion of Allowances 228-229

43 Stores Expenses Undistributed (163) -

44 Gas Stored Underground-Current (164.1) -

45 Liquefied Natural Gas Stored and Held for Processing (164.2-164.3) -

46 Prepayments (165) -

47 Advances for Gas (166-167) -

48 Interest and Dividends Receivable (171) -

49 Rents Receivable (172) -

50 Accrued Utility Revenues (173) -

51 Miscellaneous Current and Accrued Assets (174) -

FERC FORM NO. 1 (Revised 10-02) Page 110

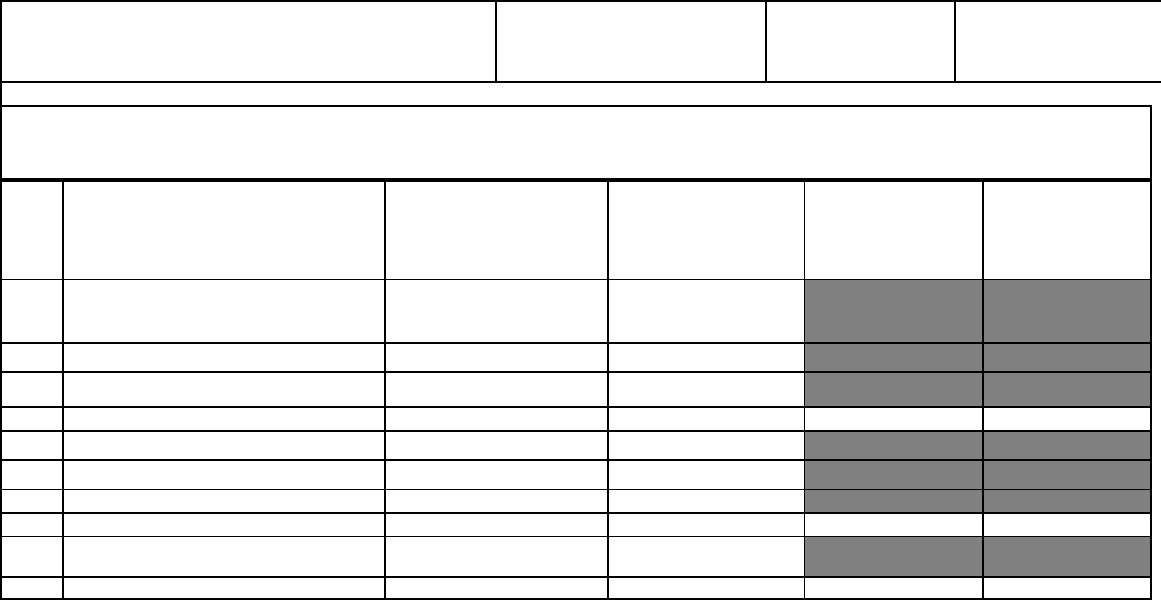

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -3-

Name of Respondent This Report is:

(1)

G

An Original

(2)

G

A Resubmission

Date of

Report

(Mo, Da, Yr)

Year of

Report

Dec 31, _____

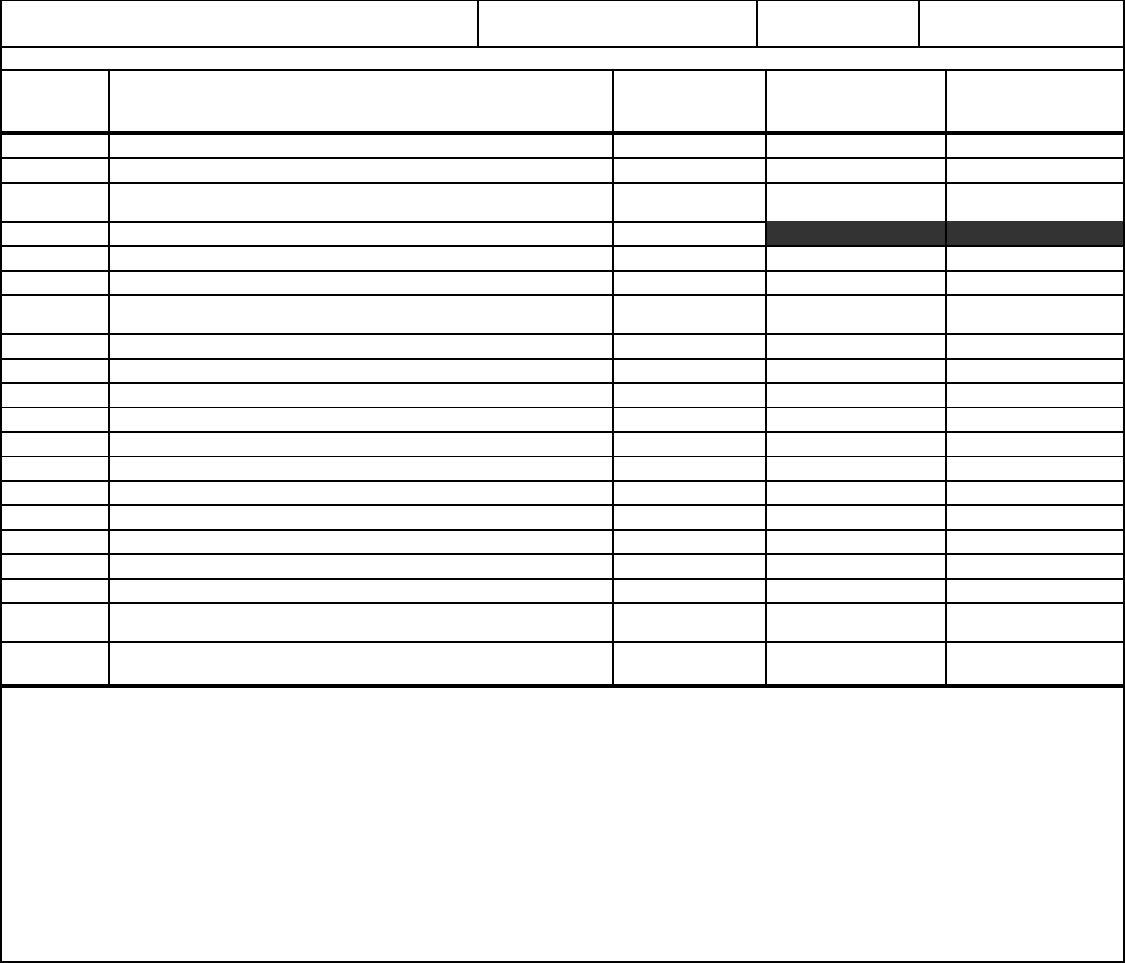

COMPARATIVE BALANCE SHEET (ASSETS AND OTHER DEBITS) (Continued)

Line

No.

Title of Account

(a)

Ref

Page No.

(b)

Balance at

Beginning of

Year

(c)

Balance at

End of Year

(d)

52 Derivative Instrument Assets (175)

53 Derivative Instrument Assets - Hedges (176)

54

TOTAL Current and Accrued Assets (Enter Total of Lines 24 thru

53)

55 DEFERRED DEBITS

56 Unamortized Debt Expenses (181) -

57 Extraordinary Property Losses (182.1) 230

58 U n recovered Plant and Regulatory Study Costs

(182.2)

230

59 Other Regulatory Assets (182.3) 232

60 Prelim. Survey and Investigation Charges (Elec) (183) 231

61 Prelim. Sur. and Invest. Charges (Gas) (183.1, 183.2) -

62 Clearing Accounts (184) -

63 Temporary Facilities (185) -

64 Miscellaneous Deferred Debits (186) 233

65 Def.-Losses from Disposition of Utility Plant (187) -

66 Research, Devel. and Demonstration Expend. (188) 352-353

67 Unamortized Loss on Reacquired Debt (189) -

68 Accumulated Deferred Income Taxes (190) 234

69 Unrecovered Purchased Gas Costs (191) -

70 TOTAL Deferred Debits (Enter Total of Lines 56 thru

69)

71 TOTAL Assets and Other Debits

(Enter Total of

Lines 10, 11, 12, 22, 54, and 70)

FERC FORM NO. 1 (Revised 10-02) Page 111

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -4-

Name of Respondent This Report is:

(1)

G

An Original

(2)

G

A Resubmission

Date of

Report

(Mo, Da, Yr)

Year of

Report

Dec 31, _____

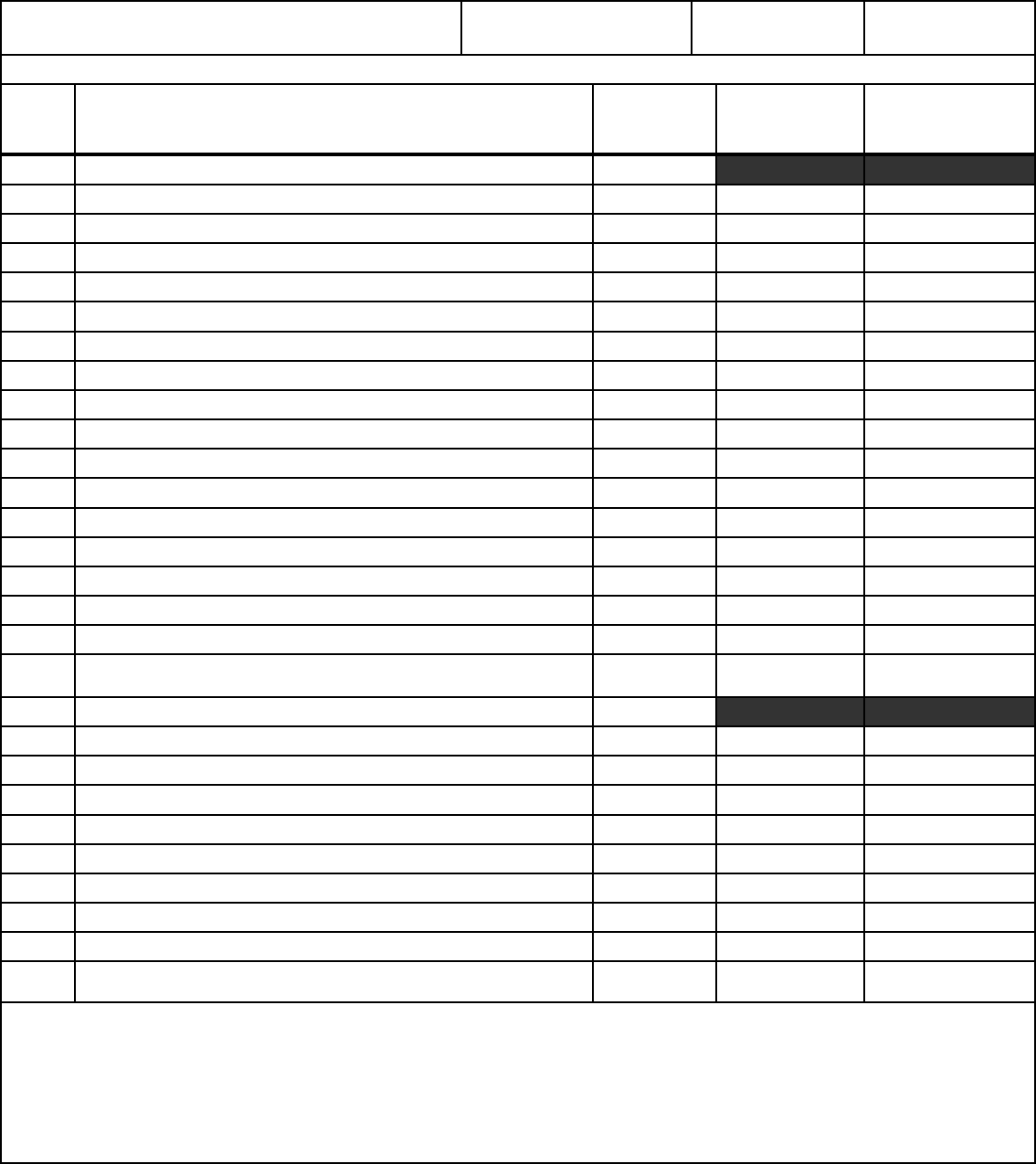

COMPARATIVE BALANCE SHEET (LIABILITIES AND OTHER CREDITS)

Line

No.

Title of Account

(a)

Ref

Page

No.

(b)

Balance at

Beginning of Year

(c)

Balance at

End of Year

(d)

1 PROPRIETARY CAPITAL

2

Common Stock Issued (201) 250-251

3 Preferred Stock Issued (204) 250-251

4 Capital Stocked Subscribed (202, 205) 252

5 Stock Liability for Conversion ( 203, 206) 252

6 Premium on Capital Stock (207) 252

7 Other Paid-In Capital (208-211) 253

8 Installments Received on Capital Stock (212) 252

9 (Less) Discount on Capital Stock (213) 254

10 (Less) Capital Stock Expense (214) 254

11 Retained Earnings (215, 215.1, 216 ) 118-119

12 Unappropriated Undistributed Subsidiary Earnings (216.1) 118-119

13 (Less) Reacquired Capital Stock (217) 250-251

14 Accumulated Other Comprehensive Income (219) 122(a)(b)

15 TOTAL PROPRIETARY CAPITAL (Enter Total of lines 2 thru 14)

16 LONG-TERM DEBT

17 Bonds (221) 256-257

18 (Less) Reacquired Bonds (222) 256-257

19 Advances from Associated Companies (223) 256-257

20 Other Long-term Debt (224) 256-257

21 Unamortized Premium on Long-Term Debt (225) -

22 (Less) Unamortized Discount on Long-Term Debt - Debit (226) -

23 TOTAL Long-Term Debt (Enter Total of Lines 17 thru 22)

24 OTHER NONCURRENT LIABILITIES

25 Obligations Under Capital Leases - Noncurrent (227) -

26 Accumulated Provision for Property Insurance (228.1) -

27 Accumulated Provision for Injuries and Damages (228.2) -

28 Accumulated Provision for Pensions and Benefits (228.3) -

29 Accumulated Miscellaneous Operating Provisions (228.4) -

30 Accumulated Provision for Rate Refunds (229) -

31 TOTAL OTHER NONCURRENT LIABILITIES (Enter Total of lines

25 thru 30)

32 CURRENT AND ACCRUED LIABILITIES

33 Notes Payable (231) -

34 Accounts Payable (232) -

35 Notes Payable to Associated Companies (233) -

36 Accounts Payable to Associated Companies (234) 262-263

37 Customer Deposits (235) -

38 Taxes Accrued (236) -

39 Interest Accrued (237) -

40 Dividends Declared (238) -

41 Matured Long-Term Debt (239) -

42 Matured Interest (240) -

43 Tax Collections Payable (241) -

44 Miscellaneous Current and Accrued Liabilities (242) -

45 Obligations under Capital Leases - Current (243) -

46 Derivative Instrument Liabilities (244)

47 Derivative Instrument Liabilities -Hedges (245)

48 TOTAL CURRENT & ACCRUED LIABILITIES (Enter Total of Lines

33-47)

-

FERC FORM NO. 1 (Revised 10-02) Page 112

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -5-

Name of Respondent This Report is:

(1) G An Original

(2) G A Resubmission

Date of

Report

(Mo, Da, Yr)

Year of

Report

Dec 31, _____

COMPARATIVE BALANCE SHEET (LIABILITIES AND OTHER CREDITS) (Continued)

Line

No.

Title of Account

(a)

Ref.

Page No.

(b)

Balance at

Beginning of Year

(c)

Balance at

End of Year

(d)

49 DEFERRED CREDITS

50 Customer Advances for Construction (252)

51 Accumulated Deferred Investment Tax Credits (255) 266-267

52 Deferred Gains from Disposition of Utility Plant (256)

53 Other Deferred Credits (253) 269

54 Other Regulatory Liabilities (254) 278

55 Unamortized Gain on Reacquired Debt (257) -

56 Accumulated Deferred Income Taxes (281-283) 272-277

57 TOTAL DEFERRED CREDITS (Enter Total of lines 50

thru 56)

58

59

60

61

62

63

64

65

66

67

68

69

70

71 TOTAL Liabilities and Other Credits (Enter Total of lines

15, 23, 31, 48 and 57)

FERC FORM No. 1 (REVISED 10-02) Page 113

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -6-

Name of Respondent This Report is:

(1) G An Original

(2) G A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec 31, _____

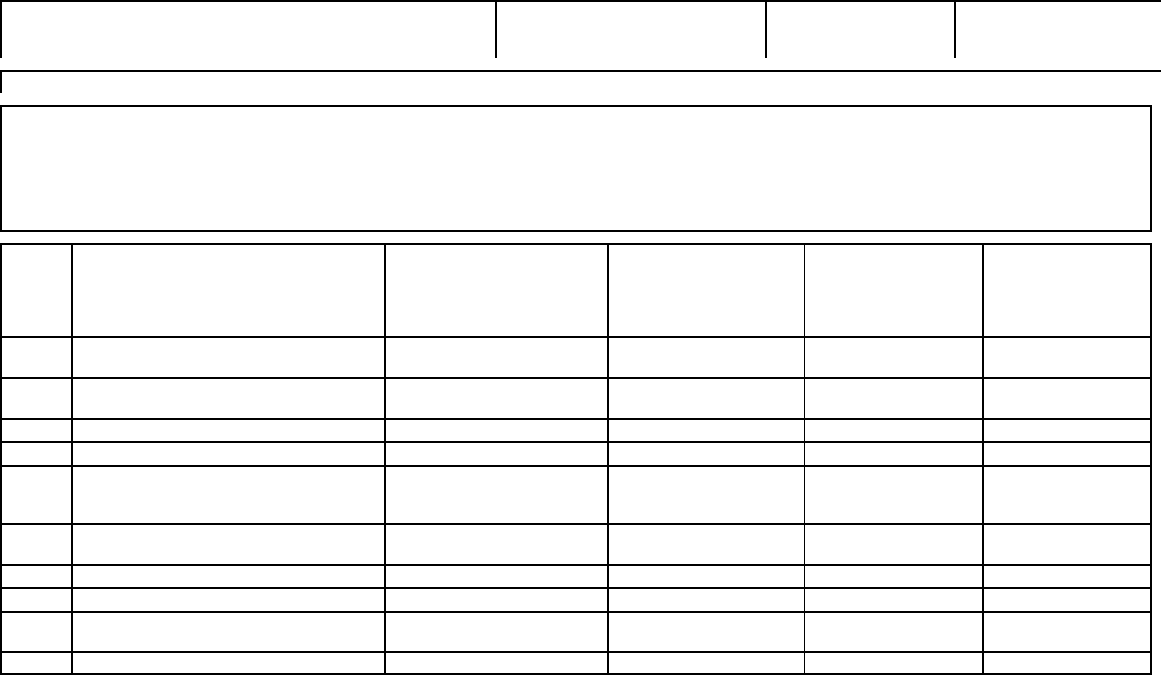

STATEMENT OF ACCUMULATED COMPREHENSIVE INCOME AND HEDGING ACTIVITIES

1. Report in columns (b) (c) (d) and (e) the amounts of accumulated other comprehensive income items, on a net-of-tax basis,

where appropriate.

2. Report in columns (f) and (g) the amounts of other categories of other cash flow hedges.

3. For each category of hedges that have been accounted for as "fair value hedges", report the accounts affected and the related

amounts in a footnote.

Line Item (a)

Unrealized Gains

and Losses on

Available-for-Sale

Securities

(B)

Minimum Pension

Liability

adjustment (net

amount)

(C)

Foreign

Currency

Hedges

(D)

Other

Adjustments

(E)

1 Balance of Account 219 at

Beginning of Preceding Year

2 Preceding yr. Reclassification

from Account 219 to Net

Income

3 Preceding Year Changes in Fair

Value

4 Total (lines 2 and 3)

5 Balance of Account 219 at End

of Preceding Year/

Beginning of Current Year.

6 Current Year Reclassification

From Account 219 to Net

Income

7 Current Year Changes in Fair

Value

8 Total (lines 6 and 7)

9 Balance of Account 219 at End

of Current Year

FERC FORM NO. 1 (NEW 10-02) Page 122(a)

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -7-

Name of Respondent

This Report is:

(1) An Original

(2) A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec 31, _____

STATEMENT OF ACCUMULATED COMPREHENSIVE INCOME, COMPREHENSIVE INCOME, AND HEDGING ACTIVITIES

Other Cash Flow Hedges

[Insert Category]

(F)

Other Cash Flow Hedges

[Insert Category]

(G)

Totals for each

category of

items recorded in

Account 219

(H)

Net Income (Carried

Forward from Page

117, Line 72)

(I)

Total

Comprehensive

Income

(J)

1

2

3

4

5

6

7

8

9

FERC FORM NO. 1 (NEW 10-02) Page 122(b)

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -8-

TABLE OF CONTENTS

PART TITLE PAGE

Instructions ............... ..................................................... 2

I Identification .............. ..................................................... 3

II Attestation ................ ..................................................... 3

III Comparative Balance Sheet ...... ........................................... 4-5

IV Statement of Income for the Year .......................................... 6-8

V Statement of Retained Earnings . ............................................ 9

VI Statement of Cash Flows ........ .......................................... 10-11

VII Statement of Accumulated Comprehensive Income and Hedging

Activities.............................................. 12(a)(b)

VIII Notes to Financial Statements. . ......................................... 13-14

IX Allowances .... ....................................................... 15-16

X Other Regulatory Assets ................... ........................................ 17

XI Data on Security Holders and Voting Powers . . ................................ 18

XII Data on Officers and Directors ........................................ ......................... 18

XIII Accumulated Provision for Depreciation and Amortization of Utility Plant ...... .......... 19

XIV Capital Stock Data ............ ................................................ 19

XV Long-Term Debt Data .......... ............................................... 19

XVI Other Regulatory Liabilities ..... ............................................. 20

XVII Electric Sales Data for the Year ....... ......................................... 21

XVIII Electric Operation and Maintenance Expense .................................. 21

XIX Sales for Resale .............. ................................................. 22

XX Purchased Power ............. ................................................ 23

XXI Utility Plant Data .............. ................................................. 24

XXII Footnote Data ..... ....................................................... 25

SUBSTITUTE PAGES FOR NONMAJOR RESPONDENTS USING ACCOUNTS

DESIGNATED FOR MAJOR CLASSIFICATION (Part 101)

III Comparative Balance Sheet (110-113)

IV Statement of Income for the Year (114-117)

V Statement of Retained Earnings for the Year (118-119)

XXI Summary of Utility Plant and Accumulated Provisions for Depreciation, Amortization

and Depletion (200-201, 204-207)

XIII Accumulated Provision for Depreciation of Electric Utility Plant (219)

XVII Electric Operating Revenues (300-301)

XIX Sales for Resale (310-311)

XVIII Electric Operation and Maintenance Expenses (320-323)

XX Purchased Power (326-327)

INSTRUCTIONS FOR FILING FERC Form No. 1-F

GENERAL INFORMATION

1. Purpose

This form is a regulatory requirement (18 CFR 141.2). It is

designed to collect financial information from privately owned

electric utilities and licensees who have generation,

transmission, distribution and sales of electric energy,

however produced throughout the United States and its

possessions, subject to the jurisdiction of the Federal Energy

Regulatory Commission.

II. Who Must Submit

Each Nonmajor Public Utility or Licensee, as classified in the

Commission's Uniform System of Accounts Prescribed for

Public Utilities

and Licensees Subject to the Provisions of the Federal

Power Act (18 CFR 101 (US of A.) must submit this form.

Each Nonmajor public utility or licensee classified as Class

C or Class D prior to January 1, 1984, may continue to file

only the basic financial statements -Parts 111, IV and V.

Note: Nonmajor means having total annual sales of

10,000 megawatt hours or more in the previous

calendar year and not classified as "Major."

FERC FORM NO. 1-F (REVISED 10-02) Page 1

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -9-

Name of Respondent This Report is:

(1)

G

An Original

(2)

G

A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec 31, _____

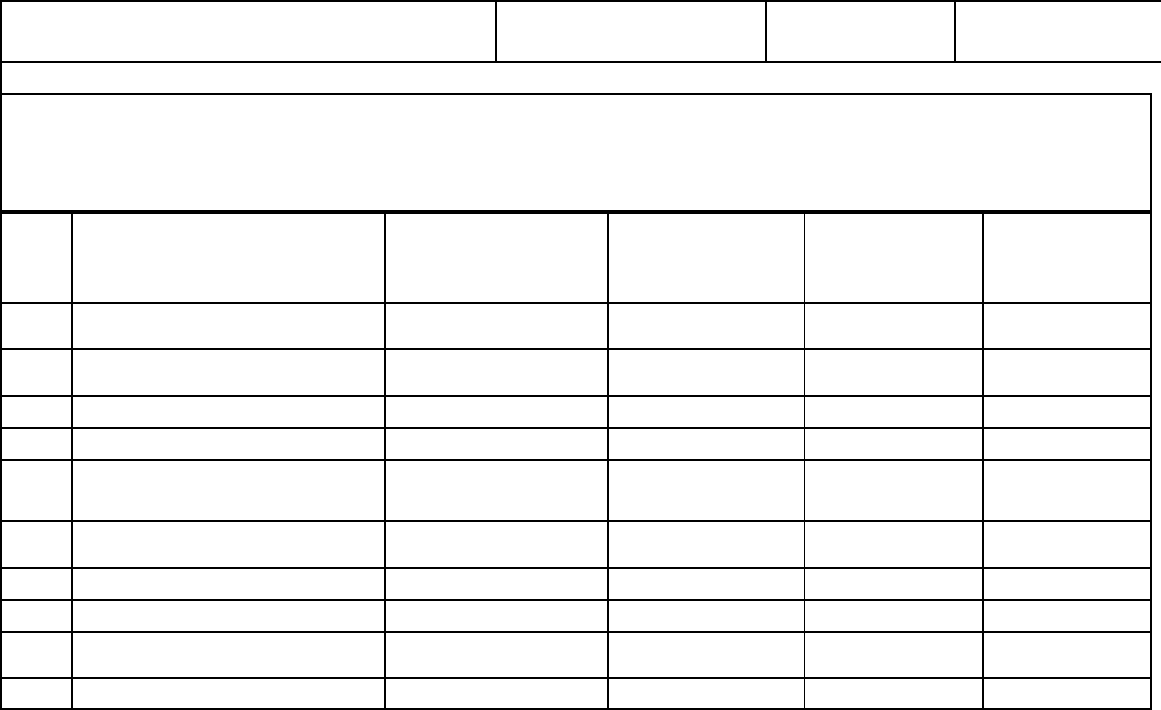

PART III: COMPARATIVE BALANCE SHEET

Assets and Other Debits

(a)

Balance at

Beginning

of year

(b)

Balance at End

of Year

(c)

01 Utility plant

(101 - 107, 114, 118)

02 Accumulated Provision for Depreciation and Amortization

(110, 119)

03 NET UTILITY PLANT

(Enter total of line 01 less 02)

04 Utility Plant Adjustments

(116)

05 Gas Stored Underground - Noncurrent

06 Nonutility Property

(121)

07 Accumulated Provision For Depreciation and Amortization -

Credit

(122)

08 Noncurrent Portion of Allowances

09 Other Investments and Special Funds

(124-129)

10 CURRENT AND ACCRUED ASSETS:

11 Cash and Working Funds

(130)

12 Temporary Cash Investments

(136)

13 Notes and Accounts Receivable

(141, 142, 143, 145,

146)(Report amounts applicable to associated companies in a

footnote)

14 Accumulated provision for Uncollectible Accounts - Credit

(144)

15 Plant Materials and Operating Supplies

(154)

16 Allowances

(158.1 and 158.2)

17 (Less) Noncurrent Portion of Allowances

18 Gas Stored

(164.1, 164.2)

19 Prepayments

(165)

20 Miscellaneous Current and Accrued Assets

(174)

21 Derivative Instrument Assets (175)

22 Derivative Instruments Assets - Hedges (176)

23 TOTAL CURRENT AND ACCRUED ASSETS

(Enter total of

lines 11 thru 22)

24 DEFERRED DEBITS:

25 Unamortized Debt Expense

(181)

26 Extraordinary Property Losses

(182.1)

27 Unrecovered Plant and Regulatory Study Costs

(182.2)

28 Other Regulatory sets

(182.3)

29 Miscellaneous Deferred Debits

(186)

30 Deferred Losses from Disposition of Utility Plant

(187)

31 Unamortized Loss on Reacquired Debt

(189)

32 Accumulated Deferred Income Taxes

(190)

33 Unrecovered Purchased Gas Costs

(191)

34 TOTAL DEFERRED DEBITS

(Enter total of Lies 25 thru 33)

35 TOTAL ASSETS AND OTHER DEBITS

(Enter total lines 03 thru

09, 23 and 34)

FERC FORM NO. 1-F (Revised 10-02) Page 4

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -10-

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -11-

Name of Respondent This Report is:

(1) G An Original

(2) G A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec 31, _____

PART III: COMPARATIVE BALANCE SHEET (Continued)

Liabilities and Other Credits

(a)

Balance at

Beginning

of year

(b)

Balance at End

of

Year

(c)

01 Common Stock Issued (201)

02 Preferred Stock Issued (204)

03 Miscellaneous Paid-in Capital (211)

04 Installments Received on Capital Stock (212)

05 Discount on Capital Stock (213)

06 Capital Stock Expenses - Debit (214)

07 Retained Earnings (215-216)

08 Reacquired Capital Stock - Debit (217)

09 Noncorporate Proprietorshi[p (218)

10 Accumulated Other Comprehensive Income (219)

11 TOTAL PROPRIETORSHIP CAPITAL (Enter Total of Lines 01 thru 10)

12 Bonds (221)

13 Advances from Associated Companies (223)

14 Other Long-term Debt (Specify in footnote) (224)

15 Unamortized Premium on Long-term Debt (225)

16 Unamortized Discount on Long-term Debt - Debit (226)

17 TOTAL LONG-TERM DEBT (Enter Total of Lines 12 thru 16)

18 OTHER NONCURRENT LIABILITIES:

19 Obligations Under Capital Leases - Noncurrent (227)

20 Accumulated Provision for Property Insurance (228.1)

21 Accumulated Provision for Injuries and Damages (228.2)

22 Accumulated Provision for Pensions and Benefits (228.3)

23 Accumulated Miscellaneous Operating Provisions (228.4)

24 Accumulated Provision for Rate Refunds (229)

25 TOTAL OTHER NONCURRENT LIABILITIES (Enter Total of Lines 19 thru 24)

26 CURRENT AND ACCRUED LIABILITIES:

27 Notes and Accounts Payable (Report amounts applicable to associated companies

in a footnote) (231 to 234)

28 Customer Deposits (235)

29 Taxes Accrued (236)

30 Interest Accrued (237)

31 Miscellaneous Current and Accrued Liabilities (242)

32 Obligations Under Capital Leases - Current (243)

33 Derivative Instrument Liabilities (244)

34 Derivative Instrument Liabilities - Hedges (245)

35 TOTAL CURRENT AND ACCRUED LIABILITIES (Enter Total of Lines 27 thru 34)

36 DEFERRED CREDITS:

37 Customer Advances for Construction (252)

38 Other Deferred Credits (253)

39 Other Regulatory Liabilities (254)

40 Accumulated Deferred Investment Tax Credits (255)

41 Deferred Gains from Disposition of Utility Plant (256)

42 Unamortized Gain on on Reacquired Debt (257)

43 Accumulated Deferred Income Taxes (281-283)

44 TOTAL DEFERRED CREDITS (Enter Total of Lines 37 thru 43)

45 TOTAL LIABILITIES AND OTHER CREDITS (Enter Total of Lines 11, 17, 25, 35 and

44)

FERC FORM NO. 1-F (REVISED 10-02) Page 5

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -12-

Name of Respondent This Report is:

(1)

G

An Original

(2)

G

A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec 31, _____

STATEMENT OF ACCUMULATED COMPREHENSIVE INCOME AND HEDGING ACTIVITIES

1. Report in columns (b) (c) (d) and (e) the amounts of accumulated other comprehensive income items, on a net-of-tax basis, where appropriate.

2. Report in columns (f) and (g) the amounts of other categories of other cash flow hedges.

3. For each category of hedges that have been accounted for as "fair value hedges", report the accounts affected and the related amounts in a footnote.

Line Item (a)

Unrealized Gains and

Losses on available-

for-sale securities

(B)

Minimum Pension

liability Adjustment

(net amount)

(C)

Foreign Currency

Hedges

(D)

Other

Adjustments

(E)

1 Balance of Account 219 at Beginning

of Preceding Year

2 Preceding Year Reclassification from

Account 219 to Net Income

3 Preceding Year Changes in Fair Value

4 Total (lines 2 and 3)

5 Balance of Account 219 at End of

Preceding Year/Beginning of

Current Year

6 Current Year Reclassifications From

Account 219 to Net Income

7 Current Year Changes in Fair Value

8 Total (lines 6 and 7)

9 Balance of Account 219 at End of

Current Year

FERC FORM NO. 1-F (NEW 10-02) Page 12(a)(b)

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -13-

Name of Respondent

This Report is:

(1) An Original

(2) A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec 31, _____

STATEMENT OF ACCUMULATED COMPREHENSIVE INCOME AND HEDGING ACTIVITIES

Other Cash Flow Hedges

[Insert Category]

(F)

Other Cash Flow Hedges

[Insert Category]

(G)

Totals for each

category of

items recorded in

Account 219

(H)

Net Income (Carried

Forward from Page

8, Line 63)

(I)

Total

Comprehensive

Income

(J)

1

2

3

4

5

6

7

8

9

FERC FORM NO. 1 (NEW 10-02) Page 12(b)

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -14-

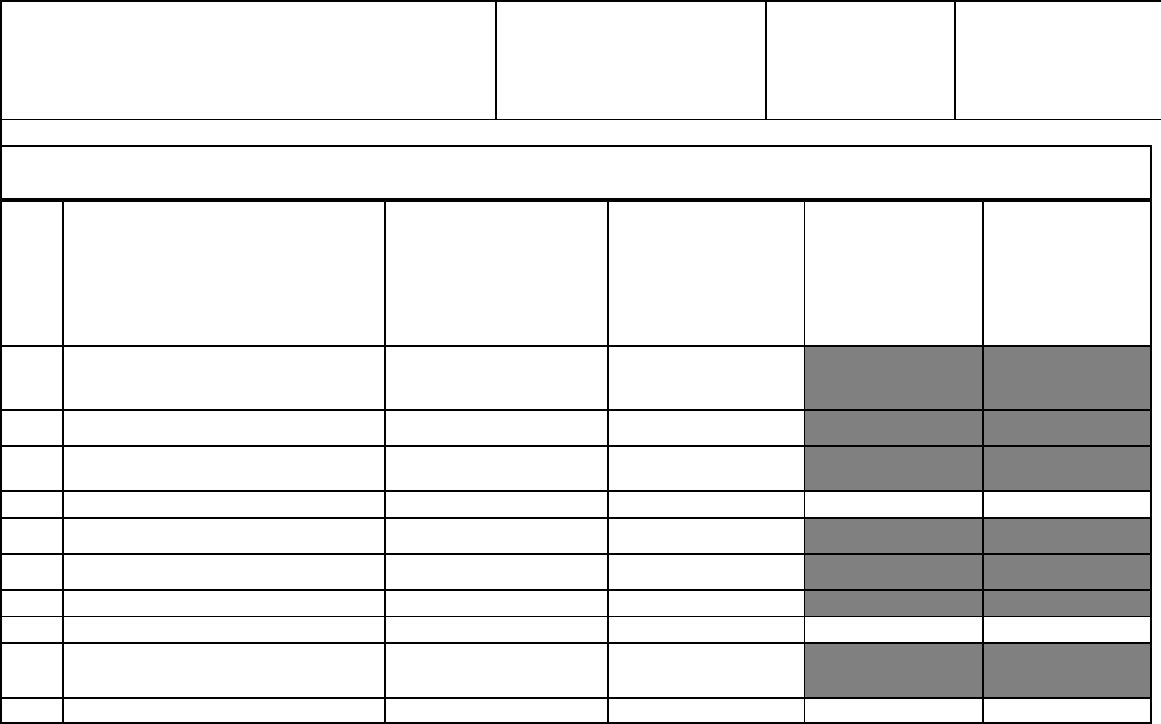

Name of Respondent This Report is:

G

An Original

G

A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec 31,

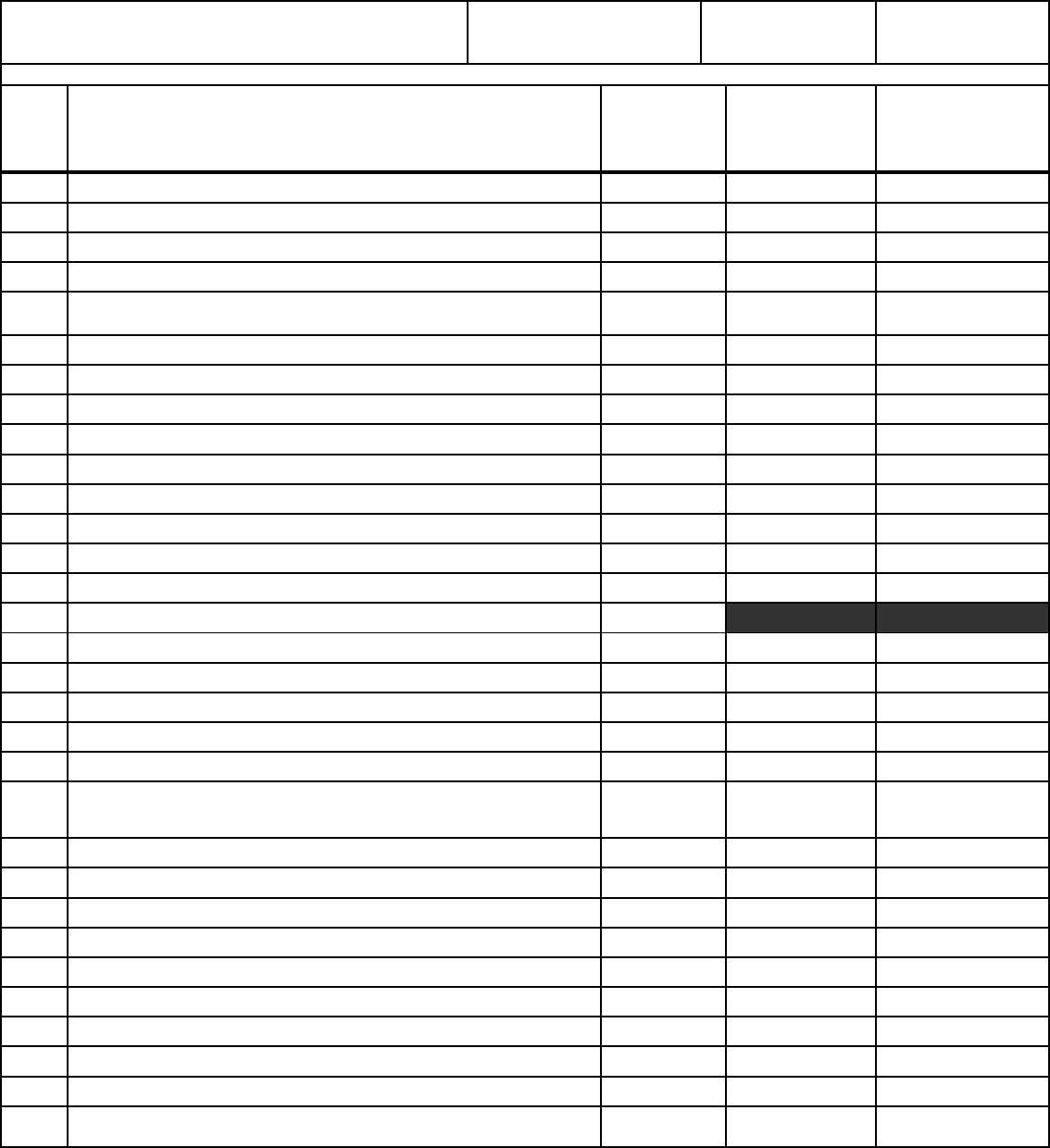

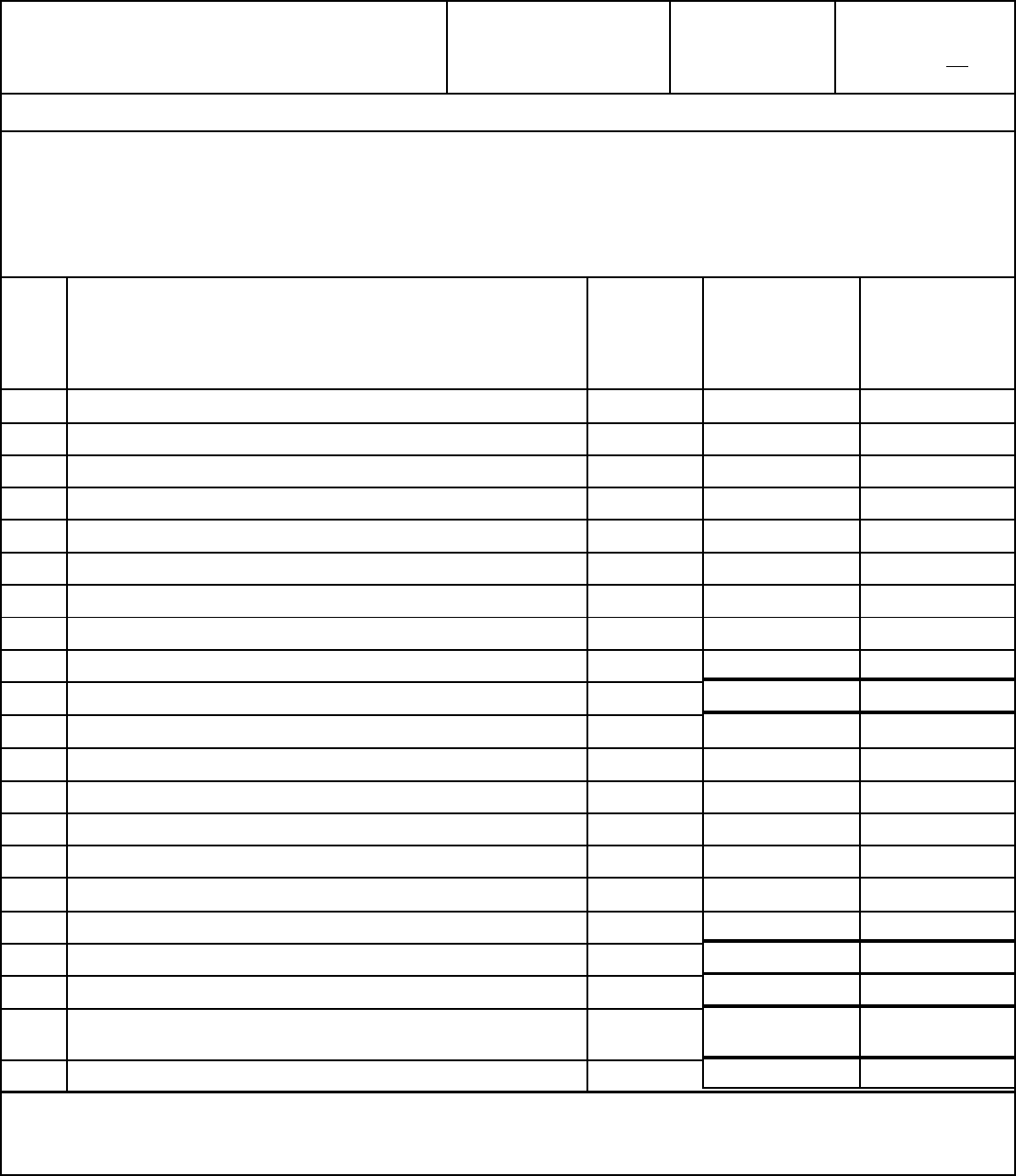

List of Schedules

Enter in column (d) the terms "none," "not applicable," or "NA" as appropriate, where no information or amounts

have been reported for certain pages Omit pages where the responses are "none," "not applicable," or "NA

Line

No.

Title of Schedule

(a)

Reference

Page No.

(b)

Date

Revised

(c)

Remarks

(d)

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

GENERAL CORPORATE INFORMATION AND FINANCIAL

STATEMENTS

General Information

Control over Respondent

Corporations Controlled by Respondent

Security Holders and Voting Powers

Important Changes During the Year

Comparative Balance Sheet

Statement of Income for the Year

Statement of Accumulated Comprehensive Income and

Hedging Activities

Statement of Retained Earnings for the Year

Statement of Cash Flows

Notes to the Financial Statements

BALANCE SHEET SUPPORTING SCHEDULES

(Assets and Other Debits)

Summary of Utility Plant and Accumulated Provisions for

Depreciation, Amortization, and Depletion

Gas Plant in Service

Gas Property and Capacity Leased from Others

Gas Property and Capacity Leased to Others

Gas Plant Held for Future Use

Construction Work in Progress - Gas

General Description of Construction Overhead Procedure

Accumulated Provision for Depreciation of Gas Utility Plant

Gas Stored

Investments

Investments in Subsidiary Companies

Prepayment

Extraordinary Property Losses

Unrecovered Plant and Regulatory Study Costs

Other Regulatory Assets

Miscellaneous Deferred Debits

Accumulated Deferred Income Taxes

BALANCE SHEET SUPPORTING SCHEDULES

(Liabilities and Other Credits)

Capital Stock

Capital Stock Subscribed, Capital Stock Liability for

Conversion, Premium on Capital Stock, and Installments

Received on

Capital Stock

Other Paid-in Capital

Discount on Capital Stock

Capital Stock Expense

Securities Issued or Assumed and Securities Refunded or

Retired During the Year

Long-Term Debt

Unamortized Debt Expense, Premium, and Discount on

Long-Term Debt

Unamortized Loss and Gain on Reacquired Debt

Reconciliation of Reported Net Income with Taxable Income

for Federal Income Taxes

101

102

103

107

108

110-113

114-116

117

118(a)(b)

120-121

122

200-201

204-209

212

213

214

216

218

219

220

222-223

224-225

230

230

230

232

233

234-235

250-251

252

253

254

254

255

256-257

258-259

260

261

FERC FORM NO. 2 (Revised 10-02) PAGE 2

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -15-

Name of Respondent This Report is:

G

An Original

G

A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec 31,

LIST OF SCHEDULES (Natural Gas Company)

Enter in column (d) the terms "none," "not applicable," or "NA" as appropriate, where no information or amounts

have been reported for certain pages Omit pages where the responses are "none," "not applicable," or "NA

Line

No

.

Title of Schedule

(a)

Reference

Page No.

(b)

Dat

e

Received

(c)

Remarks

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

BALANCE SHEET SUPPORTING SCHEDULES

(Liabilities and Other Credits) (Continued)

Taxes Accrued, Prepaid, and Charged During Year

Miscellaneous Current and Accrued Liabilities

Other Deferred Credits

Accumulated Deferred Income Taxes-Other Property

Accumulated Deferred Income Taxes-Other

Other Regulatory Liabilities

INCOME ACCOUNT SUPPORTING SCHEDULES

Gas Operating Revenues

Revenues from Transportation of Gas of Others Through

Gathering Facilities

Revenues from Transportation of Gas of Others Through

Transmission Facilities

Revenues from Storage Gas of Others

Other Gas Revenues

Gas Operation and Maintenance Expenses

Exchange and Imbalance Transactions

Gas Used in Utility Operations

Transmission and Compression of Gas by Others

Other Gas Supply Expenses

Miscellaneous General Expenses-Gas

Depreciation, Depletion, and Amortization of Gas Plant

Particulars Concerning Certain income Deduction and

Interest Charges Accounts

COMMON SECTION

Regulatory Commission Expenses

Distribution of Salaries and Wages

Charges for Outside Professional and Other Consultative

Services

GAS PLANT STATISTICAL DATA

Compressor Stations

Gas Storage Projects

Transmission Lines

Transmission System Peak Deliveries

Auxiliary Peaking Facilities

Gas Account-Natural Gas

System Map

Footnote Reference

Footnote Text

Stockholders’ Reports (check appropriate box)

262-263

268

269

274-275

276-277

278

300-301

302-303

304-305

306-307

308

317-325

328

331

332

334

335

336-338

340

350-351

354-355

357

508-509

512-513

514

518

519

520

522

551

552

G

Four copies will be submitted

G

No annual report to stockholders is prepared

FERC FORM NO. 2 (10-02) Page 3

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -16-

Name of Respondent This Report is:

G

An Original

G

A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec 31, _____

COMPARATIVE BALANCE SHEET (ASSETS AND OTHER DEBITS) (Continued)

Lin

e

No.

Title of Account

(a)

Reference

Page

Number

(b)

Balance at

End

of Current

Year

(in dollars)

(c)

Balance at End

of Previous Year

(in dollars)

(d)

44 Allowances (158 1 and 158 2)

45

(Less)

Noncurrent Portion of Allowances

46 Stores Expenses Undistributed (163)

47 Gas Stored Underground - Current (164 1) 220

48 Liquefied Natural Gas stored and Held for Processing (164 2

thru 164 3)

220

49 Prepayments (165) 230

50 Advances for Gas (166 and 167)

51 Interest and Dividends Receivable (171)

52 Rents Receivable (172)

53 Accrued Utility Revenues (173)

54 Miscellaneous Current and Accrued Assets (174)

55 Derivative Instrument Assets (175)

56 Derivative Instrument Assets - Hedges (176)

57 TOTAL Current and Accrued Assets (Total of lines 27 thru 56)

58 DEFERRED DEBITS

59 Unamortized Debt Expense (181)

60 Extraordinary Property Losses (182 1) 230

61 Unrecovered Plant and Regulatory Study Costs (182 2) 230

62 Other Regulatory Assets (182 3) 232

63 Preliminary Survey and Investigation Charges (Electric ) (183)

64 Preliminary Survey and Investigation Charges (Gas) (183 1

and

183 2)

65 Clearing Accounts (184)

66 Temporary Facilities (185)

67 Miscellaneous Deferred Debits (186) 233

68 Deferred Losses from Disposition of Utility Plant (187)

69 Research, Development, and Demonstration Expend (188)

70 Unamortized Loss on Reacquired Debt (189)

71 Accumulated Deferred Income Taxes (190) 234-235

72 Unrecovered Purchased Gas Costs (191)

73 TOTAL Deferred Debits (Total of lines 59 thru 72)

74 TOTAL Assets and Other Debits (Total of lines 10-15, 25, 57

and 73)

FERC FORM NO. 2 (Revised 10-02) Page 111

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -17-

Name of Respondent This Report is

:

G

An Original

G

A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec 31, _____

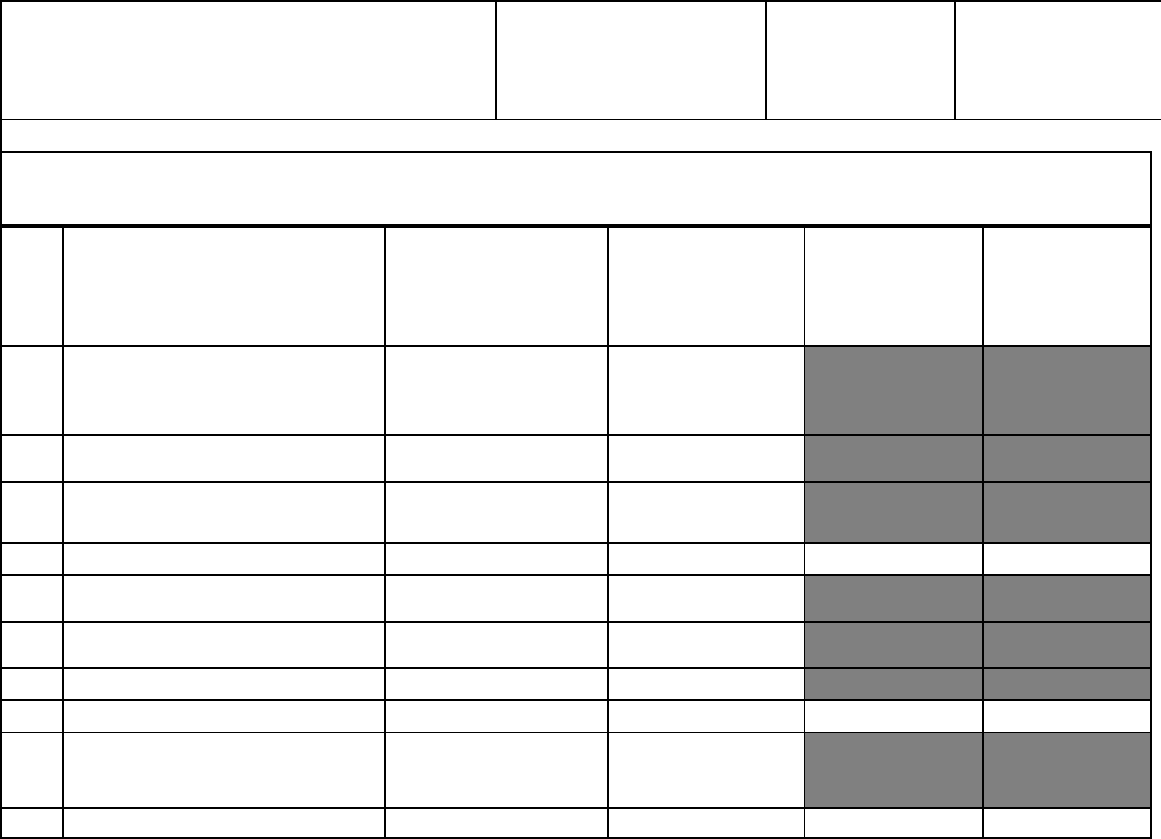

COMPARATIVE BALANCE SHEET (LIABILITIES AND OTHER CREDITS)

Line

No.

Title of Account

(a)

Reference

Page

Number

(b)

Balance at End

of Current Year

(in dollars)

(c)

Balance at End

of Previous Year

(in dollars)

(d)

1 PROPRIETARY CAPITAL

2 Common Stock Issued (201) 250-251

3 Preferred Stock Issued (204) 250-251

4 Capital Stock Subscribed (202, 205) 252

5 Stock Liability for Conversion (203, 206) 252

6 Premium on Capital Stock (207) 252

7 Other Paid-In Capital (208-211) 253

8 Installments Received on Capital Stock (212) 252

9

(Less)

Discount on Capital Stock (213) 254

10

(Less)

Capital Stock Expense (214) 254

11 Retained Earnings (215, 215 1, 216) 118-119

12 Unappropriated Undistributed Subsidiary Earnings (216

1)

118-119

13

(Less)

Reacquired Capital Stock (217) 250-251

14 Accumulated Other Comprehensive Income (219) 118(a)(b)

15 TOTAL Proprietary Capital (Total of line 2 thru 14)

16 LONG TERM DEBT

17 Bonds (221) 256-257

18

(Less)

Reacquired Bonds (222) 256-257

19 Advances from Associated Companies (223) 256-257

20 Other Long-Term Debt (224) 256-257

21 Unamortized Premium on Long-Term Debt (225) 258-259

22 (Less) Unamortized Discount on Long-Term Debt-Dr

(226)

258-259

23 (Less) Current Portion of Long-Term Debt

24 TOTAL Long-Term Debt (Total of lines 17 thru 23)

25 OTHER NONCURRENT LIABILITIES

26 Obligations Under Capital Leases -- Noncurrent (227)

27 Accumulated Provision for Property Insurance (228 1)

28 Accumulated Provision for Injuries and Damages (228 2)

29 Accumulated Provision for Pensions and Benefits (228 3)

30 Accumulated Miscellaneous Operating Provision (228 4)

31 Accumulated Provision for Rate Refunds (229)

32 TOTAL Other Noncurrent Liabilities (total of lines 26 thru

31)

FERC FORM NO. 2 (Revised 10-02) Page 112

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -18-

Name of Respondent This Report is:

G

An Original

G

A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec 31, _____

COMPARATIVE BALANCE SHEET (LIABILITIES AND OTHER CREDITS) (Continued)

Line

No.

Title of Account

(a)

Reference

Page

Number

(b)

Balance at End

of Current Year

(in dollars)

(c)

Balance at End

of Previous Year

(in dollars)

(d)

33 CURRENT AND ACCRUED LIABILITIES

34 Current Portion of Long-Term Debt

35 Notes Payable (231)

36 Accounts Payable (232)

37 Notes Payable to Associated Companies (233)

38 Accounts Payable to Associated Companies (234)

39 Customer Deposits (235)

40 Taxes Accrued (236) 262-263

41 Interest Accrued (237)

42 Dividends Declared (238)

43 Matured Long-Term Debt (239)

44 Matured Interest (240)

45 Tax Collections Payable (241)

46 Miscellaneous Current and Accrued Liabilities (242) 268

47 Obligations Under Capital Leases -- Current (243)

48 Derivative Instrument Liabilities (244)

49 Derivative Instrument Liabilities - Hedges (245)

50 TOTAL Current and Accrued Liabilities (Total of lines 34 thru

49)

51 DEFERRED CREDITS

52 Customer Advances for Construction (252)

53 Accumulated Deferred Investment Tax Credits (255)

54 Deferred Gains from Disposition of Utility Plant (256)

55 Other Deferred Credits (253) 269

56 Other Regulatory Liabilities (254) 278

57 Unamortized Gain on Reacquired Debt (257) 260

58 Accumulated Deferred Income Taxes (281-283)

59 TOTAL Deferred Credits (Total of lines 52 thru 58)

60 TOTAL Liabilities and Other Credits (Total of lines 15, 24,

32, 50, and 59)

FERC FORM NO. 2 (Revised 10-02) Page 113

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -19-

Name of Respondent This Report is:

(1) G An Original

(2) G A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec 31, _____

STATEMENT OF ACCUMULATED COMPREHENSIVE INCOME AND HEDGING ACTIVITIES

1. Report in columns (b) (c) (d) and (e) the amounts of accumulated other comprehensive income items, on a net-of-tax basis, where appropriate.

2. Report in columns (f) and (g) the amounts of other categories of other cash flow hedges.

3. For each category of hedges that have been accounted for as "fair value hedges", report the accounts affected and the related amounts in a footnote.

Line Item (a)

Unrealized Gains and

Losses on available-

for-sale securities

(B)

Minimum Pension

liability Adjustment

(net amount)

(C)

Foreign Currency

Hedges

(D)

Other

Adjustments

(E)

1 Balance of Account 219 at Beginning

of Preceding Year

2 Preceding Year Reclassification from

Account 219 to Net Income

3 Preceding Year Changes in Fair Value

4 Total (lines 2 and 3)

5 Balance of Account 219 at End of

Preceding Year / Beginning of

Current Year

6 Current Year Reclassifications From

Account 219 to Net Income

7 Current Year Changes in Fair Value

8 Total (lines 6 and 7)

9 Balance of Account 219 at End of

Current Year

FERC FORM NO. 2 (NEW 10-02) Page 118(a)

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -20-

Name of Respondent

This Report is:

(1) An Original

(2) A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec 31, _____

STATEMENT OF ACCUMULATED COMPREHENSIVE INCOME AND HEDGING ACTIVITIES

Other Cash Flow Hedges

[Insert Category]

(F)

Other Cash Flow Hedges

[Insert Category]

(G)

Totals for each

category of

items recorded in

Account 219

(H)

Net Income (Carried

Forward from Page

116, Line 72)

(I)

Total

Comprehensive

Income

(J)

1

2

3

4

5

6

7

8

9

FERC FORM NO. 2 (NEW 10-02) Page 118(b)

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -21-

Name of Respondent This Report is:

G An Original

G A Resubmission

Date of Report

(Mo, Da, Yr)

Year of

Report

Dec 31,

_____

LIST OF SCHEDULES (Natural Gas Company)

Enter in column (d) the terms "none," "not applicable," or "NA" as appropriate, where no information or amounts have been reported for

certain pages Omit pages where the responses are "none," "not applicable," or "NA

Line

No

Title of Schedule

(a)

Reference

Page No

(b)

Date Revised

(c)

Remarks

(d)

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

GENERAL CORPORATE INFORMATION AND FINANCIAL STATEMENTS

Security Holders and Voting Powers

Comparative Balance Sheet

Statement of Income for the Year

Statement of Accumulated Comprehensive Income and Hedging Activities

Statement of Retained Earnings for the Year

Statements of Cash Flows

Notes to Financial Statements

BALANCE SHEET SUPPORTING SCHEDULES

(Assets and Other Debits)

Gas Plant in Service

General Information on Plant and Operations

Gas Property and Capacity Leased From and to Others

Accumulated Provision for depreciation of Gas Utility Plant

Other Regulatory Assets - Gas

BALANCE SHEET SUPPORTING SCHEDULES

(Liabilities and Other Credits)

Capital Stock and Long-Term Debt Data

Other Regulatory Liabilities

INCOME ACCOUNT SUPPORTING SCHEDULES

Gas Operating Revenues

Gas Operation and Maintenance Expenses

GAS PLANT STATISTICAL DATA

Gas Account-Natural Gas

Footnote Reference

Footnote Text

107

110-113

114-116

117

118-119

120-121

122

204-209

211

212-213

219

232

250

278

300-301

317-325

520

551

552

FERC FORM NO. 2-A (Revised 10-02) Page 2

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -22-

Name of Respondent This Report is:

G An Original

G A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec 31, _____

COMPARATIVE BALANCE SHEET (ASSETS AND OTHER DEBITS) (Continued)

Line

No.

Title of Account

(a)

Reference

Page

Number

(b)

Balance at End

of Current Year

(in dollars)

(c)

Balance at End

of Previous Year

(in dollars)

(d)

44 Allowances (158 1 and 158 2)

45

(Less)

Noncurrent Portion of Allowances

46 Stores Expenses Undistributed (163)

47 Gas Stored Underground - Current (164 1) 220

48 Liquefied Natural Gas stored and Held for Processing (164 2

thru 164 3)

220

49 Prepayments (165) 230

50 Advances for Gas (166 and 167)

51 Interest and Dividends Receivable (171)

52 Rents Receivable (172)

53 Accrued Utility Revenues (173)

54 Miscellaneous Current and Accrued Assets (174)

55 Derivative Instrument Assets (175)

56 Derivative Instrument Assets - Hedges (176)

57 TOTAL Current and Accrued Assets (Total of lines 27 thru 56)

58 DEFERRED DEBITS

59 Unamortized Debt Expense (181)

60 Extraordinary Property Losses (182 1) 230

61 Unrecovered Plant and Regulatory Study Costs (182 2) 230

62 Other Regulatory Assets (182 3) 232

63 Preliminary Survey and Investigation Charges (Electric ) (183)

64 Preliminary Survey and Investigation Charges (Gas) (183 1 and

183 2)

65 Clearing Accounts (184)

66 Temporary Facilities (185)

67 Miscellaneous Deferred Debits (186) 233

68 Deferred Losses from Disposition of Utility Plant (187)

69 Research, Development, and Demonstration Expend (188)

70 Unamortized Loss on Reacquired Debt (189)

71 Accumulated Deferred Income Taxes (190) 234-235

72 Unrecovered Purchased Gas Costs (191)

73 TOTAL Deferred Debits (Total of lines 59 thru 72)

74 TOTAL Assets and Other Debits (Total of lines 10-15, 25, 57

and 73)

FERC FORM NO. 2A (Revised 10-02) Page 111

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -23-

Name of Respondent This Report is:

G

An Original

G

A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec 31, _____

COMPARATIVE BALANCE SHEET (LIABILITIES AND OTHER CREDITS)

Line

No.

Title of Account

(a)

Reference

Page

Number

(b)

Balance at End

of Current Year

(in dollars)

(c)

Balance at End

of Previous Year

(in dollars)

(d)

1 PROPRIETARY CAPITAL

2 Common Stock Issued (201) 250-251

3 Preferred Stock Issued (204) 250-251

4 Capital Stock Subscribed (202, 205) 252

5 Stock Liability for Conversion (203, 206) 252

6 Premium on Capital Stock (207) 252

7 Other Paid-In Capital (208-211) 253

8 Installments Received on Capital Stock (212) 252

9

(Less)

Discount on Capital Stock (213) 254

10

(Less)

Capital Stock Expense (214) 254

11 Retained Earnings (215, 215 1, 216) 118-119

12 Unappropriated Undistributed Subsidiary Earnings (216 1) 118-119

13

(Less)

Reacquired Capital Stock (217) 250-251

14 Accumulated Other Comprehensive Income (219) 117

15 TOTAL Proprietary Capital (Total of line 2 thru 14)

16 LONG TERM DEBT

17 Bonds (221) 256-257

18

(Less)

Reacquired Bonds (222) 256-257

19 Advances from Associated Companies (223) 256-257

20 Other Long-Term Debt (224) 256-257

21 Unamortized Premium on Long-Term Debt (225) 258-259

22 (Less) Unamortized Discount on Long-Term Debt-Dr (226) 258-259

23 (Less) Current Portion of Long-Term Debt

24 TOTAL Long-Term Debt (Total of lines 17 thru 23)

25 OTHER NONCURRENT LIABILITIES

26 Obligations Under Capital Leases -- Noncurrent (227)

27 Accumulated Provision for Property Insurance (228 1)

28 Accumulated Provision for Injuries and Damages (228 2)

29 Accumulated Provision for Pensions and Benefits (228 3)

30 Accumulated Miscellaneous Operating Provision (228 4)

31 Accumulated Provision for Rate Refunds (229)

32 TOTAL Other Noncurrent Liabilities (total of lines 26 thru 31)

FERC FORM NO. 2A (Revised 10-02) Page 112

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -24-

Name of Respondent This Report is:

G

An Original

G

A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec 31, _____

COMPARATIVE BALANCE SHEET (LIABILITIES AND OTHER CREDITS) (Continued)

Line

No.

Title of Account

(a)

Reference

Page

Number

(b)

Balance at End

of Current Year

(in dollars)

(c)

Balance at End

of Previous Year

(in dollars)

(d)

33 CURRENT AND ACCRUED LIABILITIES

34 Current Portion of Long-Term Debt

35 Notes Payable (231)

36 Accounts Payable (232)

37 Notes Payable to Associated Companies (233)

38 Accounts Payable to Associated Companies (234)

39 Customer Deposits (235)

40 Taxes Accrued (236) 262-263

41 Interest Accrued (237)

42 Dividends Declared (238)

43 Matured Long-Term Debt (239)

44 Matured Interest (240)

45 Tax Collections Payable (241)

46 Miscellaneous Current and Accrued Liabilities (242) 268

47 Obligations Under Capital Leases -- Current (243)

48 Derivative Instrument Liabilities (244)

49 Derivative Instrument Liabilities - Hedges (245)

50 TOTAL Current and Accrued Liabilities (Total of lines 34 thru

49)

51 DEFERRED CREDITS

52 Customer Advances for Construction (252)

53 Accumulated Deferred Investment Tax Credits (255)

54 Deferred Gains from Disposition of Utility Plant (256)

55 Other Deferred Credits (253) 269

56 Other Regulatory Liabilities (254) 278

57 Unamortized Gain on Reacquired Debt (257) 260

58 Accumulated Deferred Income Taxes (281-283)

59 TOTAL Deferred Credits (Total of lines 52 thru 58)

60 TOTAL Liabilities and Other Credits (Total of lines 15, 24, 32,

50, and 59)

FERC FORM NO. 2A (Revised 10-02) Page 113

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -25-

Name of Respondent This Report is:

(1) G An Original

(2) G A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec 31, _____

STATEMENT OF ACCUMULATED COMPREHENSIVE INCOME AND HEDGING ACTIVITIES

1. Report in columns (b) (c) (d) and (e) the amounts of accumulated other comprehensive income items, on a net-of-tax basis, where appropriate.

2. Report in columns (f) and (g) the amounts of other categories of other cash flow hedges.

3. For each category of hedges that have been accounted for as "fair value hedges", report the accounts affected and the related amounts in a footnote.

Line Item (a)

Unrealized Gains and

Losses on available-for-

sale securities

(B)

Minimum Pension

liability Adjustment (net

amount)

(C)

Foreign Currency

Hedges

(D)

Other

Adjustments

(E)

1 Balance of Account 219 at Beginning of

Preceding Year

2 Preceding Year Reclassification from

Account 219 to Net Income

3 Preceding Year Changes in Fair Value

4 Total (lines 2 and 3)

5 Balance of Account 219 at End of

Preceding Year / Beginning of Current

Year

6 Current Year Reclassification From

Account 219 to Net Income

7 Current Year Changes in Fair Value

8 Total (lines 7 and 8)

9 Balance of Account 219 at End of

Current Year

FERC FORM NO. 2A (NEW 10-02) Page 117(a)

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -26-

Name of Respondent

This Report is:

(1) An Original

(2) A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec 31, _____

STATEMENT OF ACCUMULATED COMPREHENSIVE INCOME, COMPREHENSIVE INCOME, AND HEDGING ACTIVITIES

Other Cash Flow Hedges

[Insert Category]

(F)

Other Cash Flow Hedges

[Insert Category]

(G)

Totals for each

category of

items recorded in

Account 219

(H)

Net Income (Carried

Forward from Page

116, Line 63)

(I)

Total

Comprehensive

Income

(J)

1

2

3

4

5

6

7

8

9

FERC FORM NO. 2A (NEW 10-02) Page 117(b)

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -27-

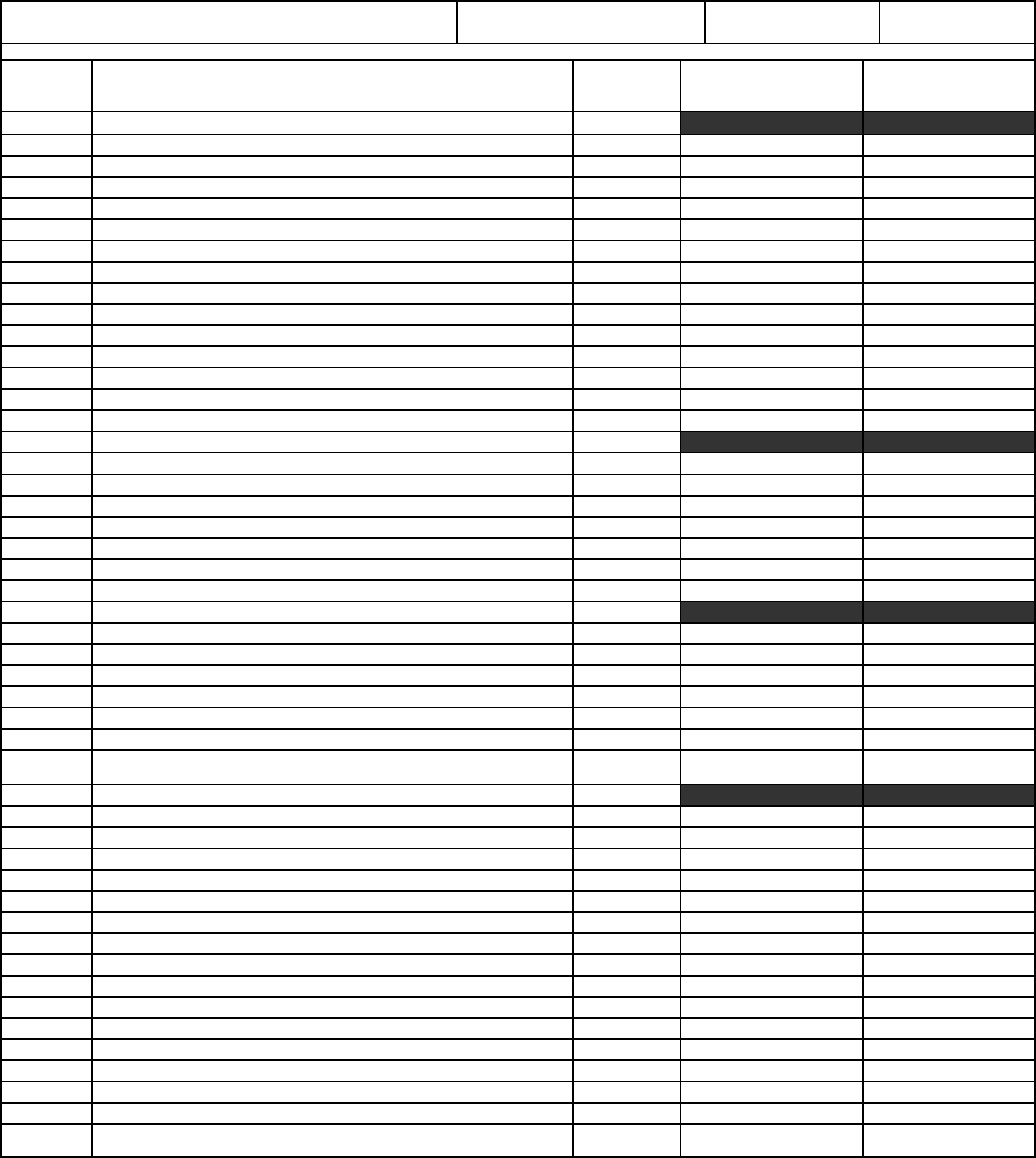

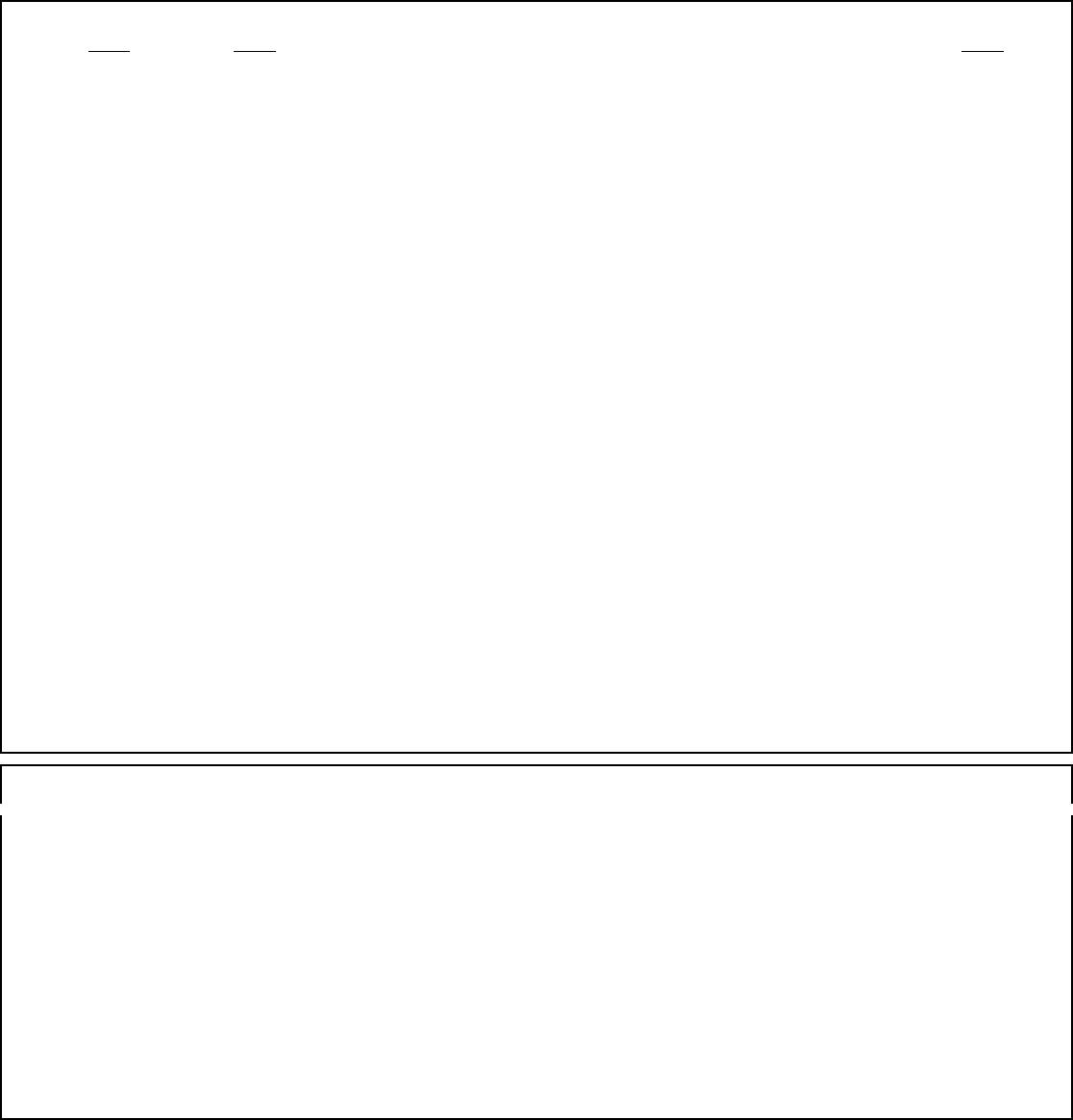

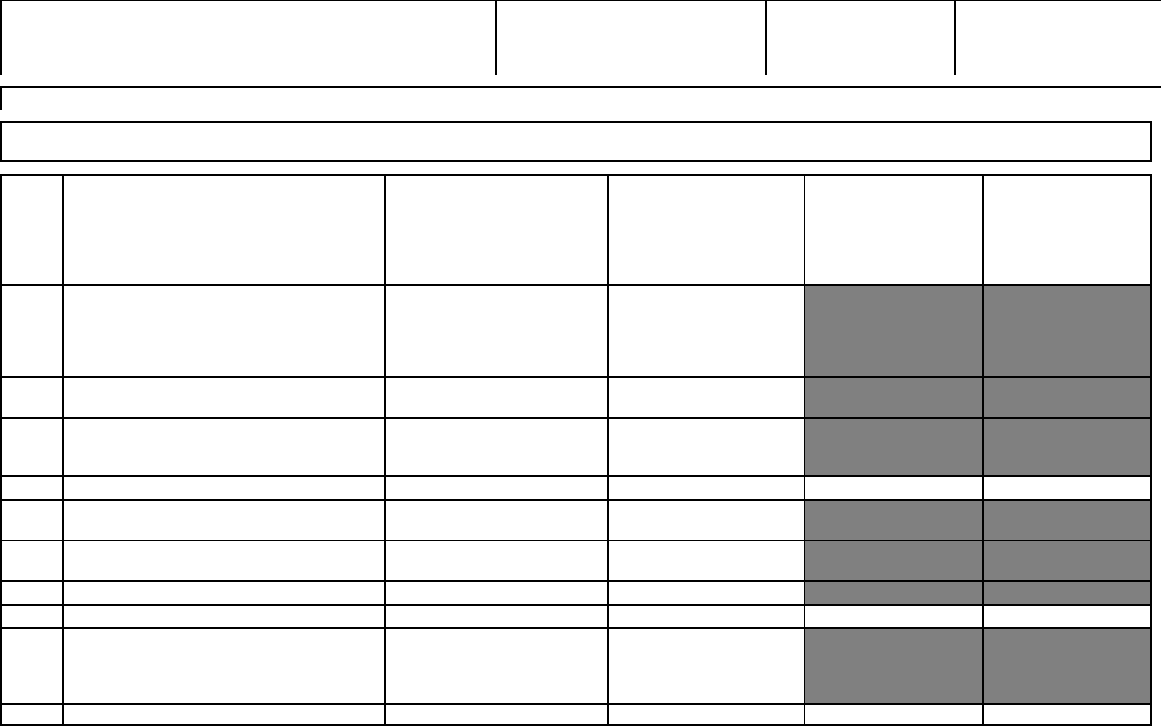

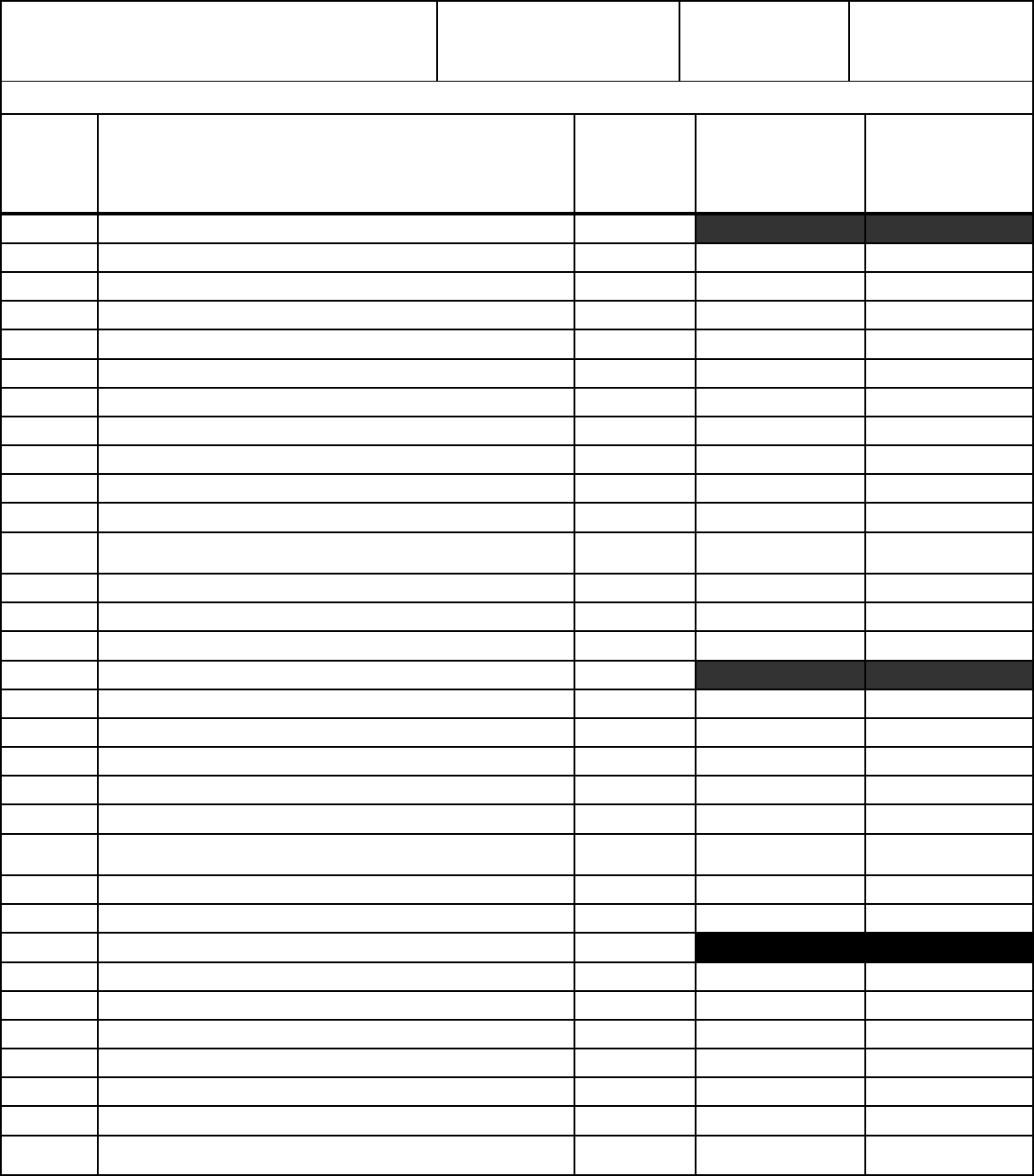

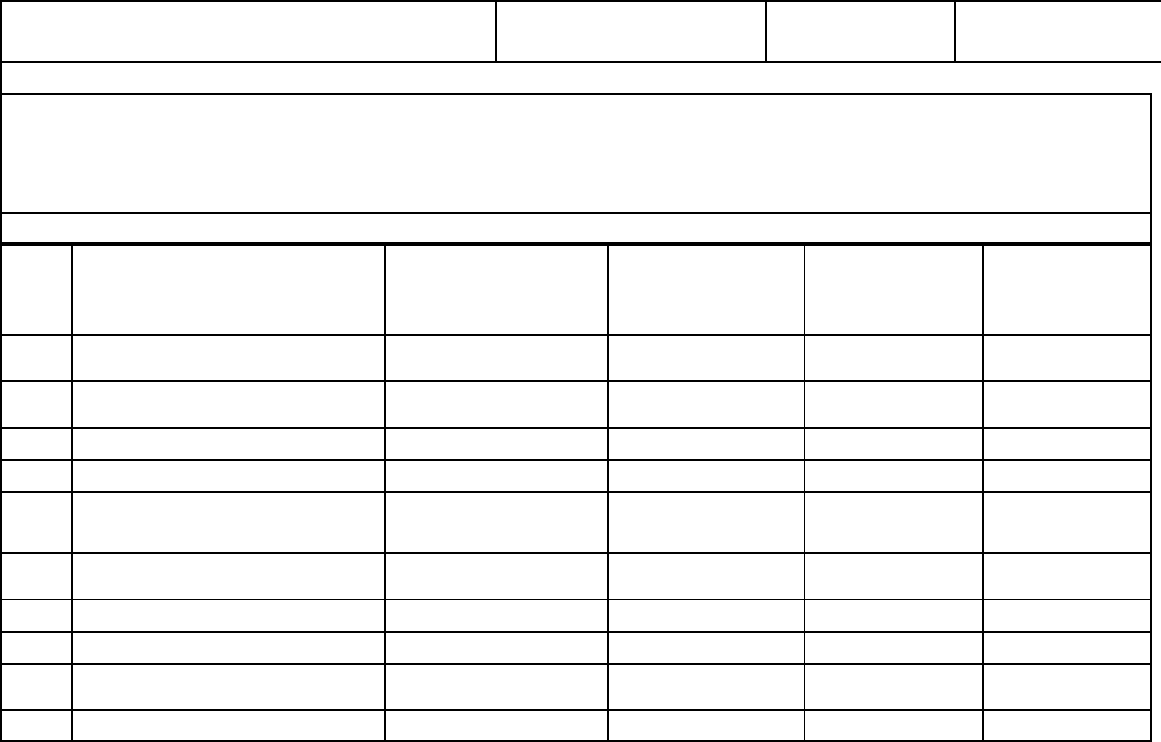

Name of Respondent This Report Is:

(1)

9

An Original

(2)

9

A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec. 31, 20___

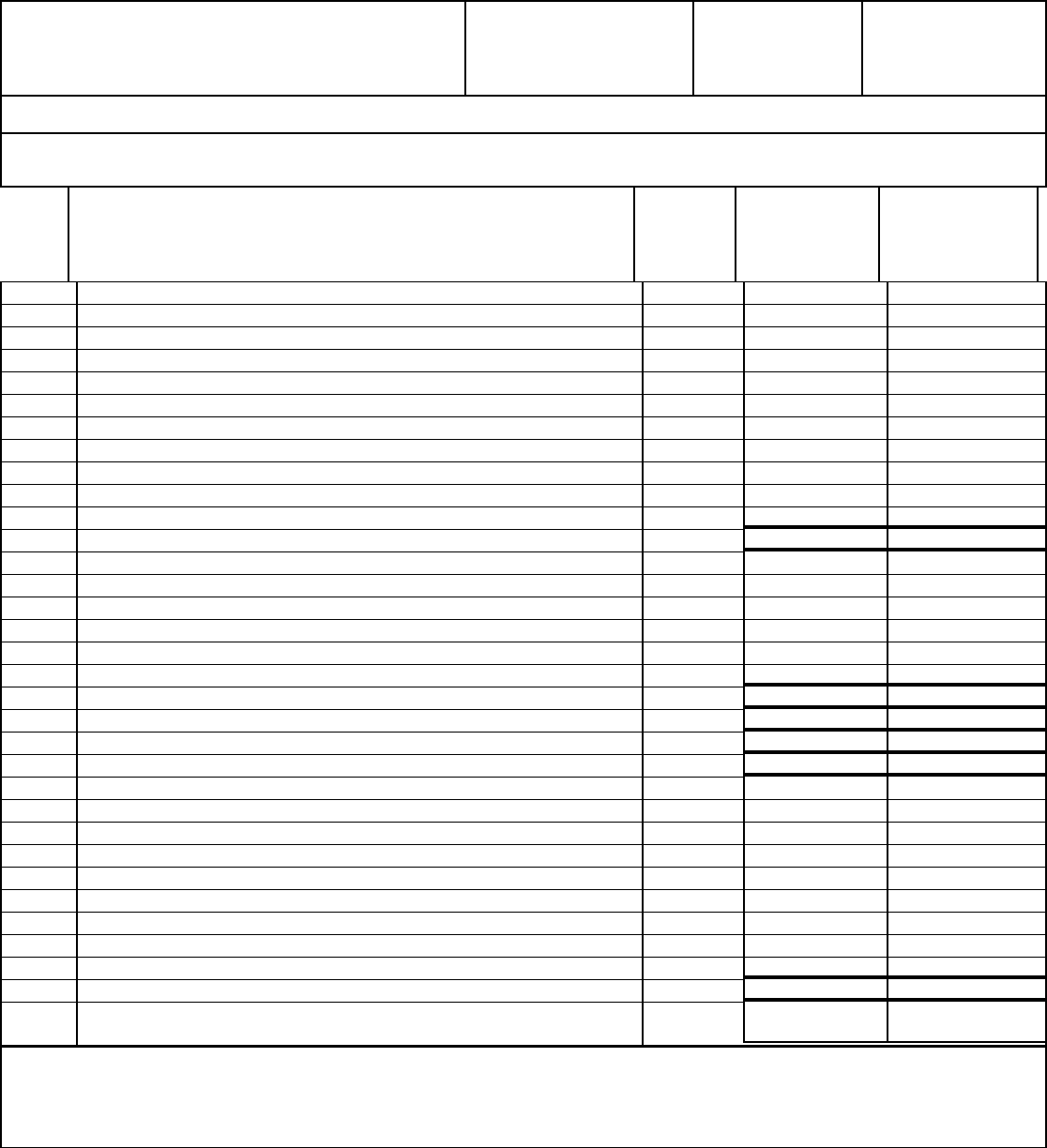

LIST OF SCHEDULES

Enter in column (d) the terms "none," "not applicable," or "NA," as appropriate, where no information or amounts have

been reported for certain pages. Omit pages where the responses are "none," "not applicable," or "NA.”

Title of Schedule

(a)

Reference

Page No.

(b)

Date

Revised

(c)

Remar

ks

(d)

GENERAL CORPORATE INFORMATION AND

FINANCIAL STATEMENTS

General Information

................................................

Control Over Respondent

...........................................

Companies Controlled by Respondent

...............................

Principal General Officers

...........................................

Directors

..........................................................

Important Changes During the Year

.................................

Comparative Balance Sheet Statement

..............................

Income Statement

..................................................

Statement of Accumulated Comprehensive Income and Hedging

Activities....................

Appropriated Retained Income

......................................

Unappropriated Retained Income Statement

.........................

Dividend Appropriations of Retained Income

.........................

Statement of Cash Flows

...........................................

Notes to Financial Statements

......................................

BALANCE SHEET SUPPORTING SCHEDULES

(Assets and Other Debts)

Receivables From Affiliated Companies ....................................

General Instructions Concerning Schedules 202 thru 205 .......................

Investments in Affiliated Companies .......................................

Investments in Common Stocks of Affiliated Companies .......................

Companies Controlled Directly by Respondent Other Than Through

Title to Securities ........................................

Instructions for Schedules 212 Thru 217 ....................................

Carrier Property .......................................................

Undivided Joint Interest Property .........................................

Accrued Depreciation-Carrier Property .....................................

Accrued Depreciation-Undivided Joint Interest Property ........................

Amortization Base and Reserve ..........................................

Noncarrier Property ....................................................

Other Deferred Charges ................................................

BALANCE SHEET SUPPORTING SCHEDULES

(Liabilities and Other Credits)

Payables to Affiliated Companies .........................................

Long-Term Debt ......................................................

Analysis of Federal Income and Other Taxes Deferred .........................

Capital Stock .........................................................

Capital Stock Changes During the Year ....................................

Additional Paid-in Capital ...............................................

101

102

103

104

105

108-109

110-113

114

115(a)(b)

118

119

119

120-121

122-123

200

201

202-203

204-205

204-205

211

212-213

214-215

216

217

218-219

220

221

225

226-227

230-231

250-251

252-253

254

ED 12-91

REV 12-95

NEW 12-95

ED 12-91

REV 12-95

REV 12-95

REV 12-01

ED 12-96

NEW 12-01

REV 12-95

REV 12-95

REV 12-95

REV 12-95

REV 12-95

REV 12-00

REV 12-95

ED 12-91

ED 12-91

ED 12-91

REV 12-00

REV 12-00

REV 12-00

REV 12-00

REV 12-00

REV 12-95

REV 12-00

REV 12-00

REV 12-00

ED 12-00

REV 12-00

REV 12-95

ED 12-91

ED 12-87

FERC FORM NO. 6 (REV. 10-02) Page 2

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -28-

Name of Respondent

This Report Is:

(1)

9

An Original

(2)

9

A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec. 31, 20___

COMPARATIVE BALANCE SHEET STATEMENT - ASSETS

For instructions covering this schedule, see the text and instructions pertaining to Balance Sheet Accounts in the

USofA. The entries

in this balance sheet should be consistent with those in the supporting schedules on the pages indicated.

Line

No.

Item

(a)

Reference

Page No.

(b)

Balance at End

of Current

Year

(In dollars)

(c)

Balance at

End

of Previous

Year

(In dollars)

(d)

CURRENT ASSETS

1 Cash (10)

2 Special Deposits (10-5)

3 Temporary Investments (11)

4 Notes Receivable (12)

5 Receivables from Affiliated Companies (13) 200

6 Accounts Receivable (14)

7 Accumulated Provision For Uncollectible Accounts (14-5)

8 Interest and Dividends Receivable (15)

9 Oil Inventory (16)

10 Material and Supplies (17)

11 Prepayment (18)

12 Other Current Assets (19)

13 Deferred Income Tax Assets (19-5) 230-231

14 TOTAL Current Assets

(Total of lines 1 thru 13)

INVESTMENTS AND SPECIAL FUNDS

Investments in Affiliated Companies (20):

15 Stocks 202-203

16 Bonds 202-203

17 Other Secured Obligations 202-203

18 Unsecured Notes 202-203

19 Investment Advances 202-203

20

Undistributed Earnings from Certain Invest. in Acct.

20

204

Other Investments (21):

21 Stocks

22 Bonds

23 Other Secured Obligations

24 Unsecured Notes

25 Investment Advances

26 Sinking and Other Funds (22)

27

TOTAL Investment and Special Funds

(Total lines 15

thru 26)

FERC FORM NO. 6 (REV. 10-02) Page 110

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -29-

Name of Respondent

This Report Is:

(1)

9

An Original

(2)

9

A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec. 31, 20

COMPARATIVE BALANCE SHEET STATEMENT - ASSETS (Continued

)

1.) For instructions covering this schedule, see the text

and

instructions pertaining to Balance Sheet Accounts

in the

USofA. The entries in this balance sheet should be

consistent with those in the supporting schedules

on the pages indicated.

2.) On line 30, include depreciation applicable to

investment

in property.

Line

No.

Item

(a)

Reference

Page No.

(b)

Balance at End

of Current

Year

(In dollars)

(c)

Balance at End

of Previous

Year

(In dollars)

(d)

TANGIBLE PROPERTY

28 Carrier Property (30) 212-215

29 (Less) Accrued Depreciation - Carrier Property (31) 216-217

30 (Less) Accrued Amortization - Carrier Property (32) 218-219

31 Net Carrier Property

(Line 28 less 29 and 30)

32 Operating Oil Supply (33)

33 Noncarrier Property (34) 220

34 Less Accrued Depreciation - Noncarrier Property

35 Net Noncarrier Property

(Line 35 less 36)

36 TOTAL Tangible Property

(Total of lines 31, 32 and 35)

OTHER ASSETS AND DEFERRED CHARGES

37 Organization Costs and Other Intangibles (40)

38 (Less ) Accrued Amortization of Intangibles (41)

39 Reserved

40 Miscellaneous Other Assets (43)

41

Other

Deferred Charges (44)

221

42 Accumulated Deferred Income Tax Assets (45) 230-231

43

Derivative Instrument Assets (46)

44 Derivative Instrument Assets - Hedges (47)

45

TOTAL Other Assets and Deferred Charges

(37 thru

44)

46 TOTAL Assets

(Total of lines 14, 27, 36 and 45)

FERC FORM NO. 6 (REV. 10-02) Page 111

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -30-

Name of Respondent This Report Is:

(1) 9 An Original

(2) 9 A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec. 31, 20___

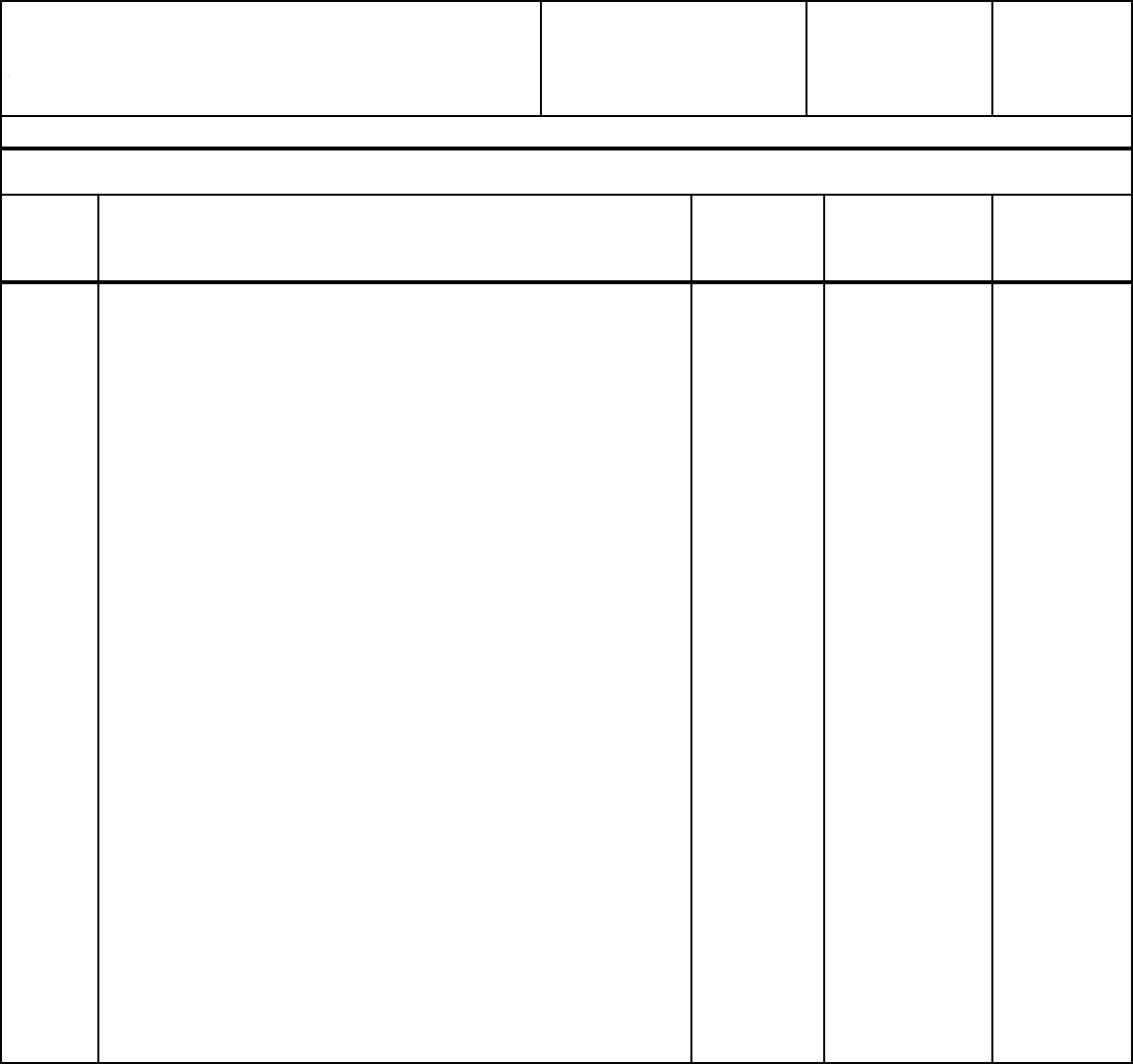

COMPARATIVE BALANCE SHEET STATEMENT - LIABILITIES (Continued)

For instructions covering this schedule, see the text and instructions pertaining to Balance Sheet Accounts in the USofA. The entries

in this balance sheet should be consistent with those in the supporting schedules on the pages indicated.

Line

No.

Item

(a)

Reference

Page No.

(b)

Balance at End

of Current Year

(In dollars)

(c)

Balance at End

of Previous Year

(In dollars)

(d)

CURRENT LIABILITIES

47 Notes Payable (50)

48 Payables to Affiliated Companies (51)

49 Accounts Payable (52)

50 Salaries and Wages Payable (53)

51 Interest Payable (54)

52 Dividends Payable (55)

53 Taxes Payable (56)

54 Long - Term Debt - Payable Within One Year (57) 226-227

55 Other Current Liabilities (58)

56 Deferred Income Tax Liabilities (59) 230-231

57 TOTAL Current Liabilities (Total of lines 47 thru 56)

NONCURRENT LIABILITIES

58 Long-Term Debt - Payable After One Year (60) 226-227

59 Unamortized Premium on Long-Term Debt (61)

60 (Less) Unamortized Discount on Long-Term Debt-Dr. (62)

61 Other Noncurrent Liabilities (63)

62 Accumulated Deferred Income Tax Liabilities (64) 230-231

63 Derivative Instrument Liabilities (65)

64 Derivative Instrument Liabilities - Hedges (66)

65 TOTAL Noncurrent Liabilities (Total of lines 58 thru 64)

66 TOTAL Liabilities (Total of lines 57 and 65)

STOCKHOLDERS' EQUITY

67 Capital Stock (70) 250-251

68 Premiums on Capital Stock (71)

69 Capital Stock Subscriptions (72)

70 Additional Paid-In Capital (73) 254

71 Appropriated Retained Income (74) 118

72 Unappropriated Retained Income (75) 119

73 (Less) Treasury Stock (76)

74 Accumulated Other Comprehensive Income (77) 115

75 TOTAL Stockholders' Equity (Total of lines 67 thru 74)

76

TOTAL Liabilities and Stockholders' Equity

(Total of lines 66 and 75)

FERC FORM NO. 6 (REV. 10-02) Page 113

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -31-

Name of Respondent This Report is:

(1) G An Original

(2) G A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec 31, _____

STATEMENT OF ACCUMULATED COMPREHENSIVE INCOME AND HEDGING ACTIVITIES

1. Report in columns (b) (c) (d) and (e) the amounts of accumulated other comprehensive income items, on a net-of-tax basis, where appropriate.

2. Report in columns (f) and (g) the amounts of other categories of other cash flow hedges.

3. For each category of hedges that have been accounted for as "fair value hedges", report the accounts affected and the related amounts in a footnote.

Line Item (a)

Unrealized Gains and

Losses on available-for-

sale securities

(B)

Minimum Pension

liability Adjustment

(net- amount)

(C)

Foreign Currency

Hedges

(D)

Other

Adjustments

(E)

1 Balance of Account 77 at Beginning of

Preceding Year

2 Preceding Year Reclassification from

Account 77 to Net Income

3 Preceding Year Changes in Fair Value

4 Total (lines 2 and 3)

5 Balance of Account 77 at End of

Preceding Year / Beginning of Current

Year

6 Current Year Reclassifications From

Account 77 to Net Income

7 Current Year Changes in Fair Value

8 Total

9 Balance of Account 77 at End of

Current Year

FERC FORM NO. 6 (NEW 10-02) Page 115(a)

Appendix B Revised Schedules for FERC Forms 1, 1-F, 2, 2-A, and 6 -32-

Name of Respondent

This Report is:

(1) An Original

(2) A Resubmission

Date of Report

(Mo, Da, Yr)

Year of Report

Dec 31, _____

STATEMENT OF ACCUMULATED COMPREHENSIVE INCOME AND HEDGING ACTIVITIES

Other Cash Flow Hedges

[Insert Category]

(F)

Other Cash Flow Hedges

[Insert Category]

(G)

Totals for each

category of

items recorded in

Account 77

(H)

Net Income (Carried

Forward from Page

114, Line 29)

(I)

Total

Comprehensive

Income

(J)

1

2

3

4

5

6

7

8

9

FERC FORM NO. 6 (NEW 10-02) Page 115(b)