2023 was a milestone year for Mattel. We extended our leadership in our key toy

categories and gained market share overall, achieved extraordinary success with the

Barbie movie, and further strengthened our nancial position.

Full year Net Sales were comparable to the prior year, with growth in three of four

regions,

1

Gross Margin expansion, and a signicant increase in cash ow. We ended

2023 with the strongest balance sheet we have had in years, and with more resources

to continue to execute our strategy. We achieved an investment grade credit rating,

resumed share repurchases for the rst time since 2014, and repurchased $203 million

of our common stock in 2023. Aligned with our capital allocation priorities, Mattel’s

Board of Directors approved a new $1 billion share repurchase program in early 2024.

Execution on our toy strategy was strong, considering we entered 2023 with a challenging retail inventory headwind and

faced a toy industry decline during the year. Among the highlights of the year, we grew market share in our three leader

categories: Dolls, Vehicles, and Infant, Toddler, and Preschool, as well as in Building Sets. Barbie was the #1 Doll

property and #2 toy property overall and Hot Wheels was the #1 Vehicles property.

2

Monster High was the largest

growth property in Dolls,

2

Disney Princess and Disney Frozen performance was strong in its rst full year back at Mattel

and Mattel Creations (our collector direct-to-consumer business) continued to grow strongly, with user trafc up over

90%. Recognizing our innovation in toy design, Mattel received an industry leading 15 Toy of the Year nominations and

seven awards from the Toy Association.

We also made meaningful progress on our entertainment strategy across lm, television, digital, live experiences, and

publishing. The Barbie movie was a showcase for the cultural resonance of our brands, our ability to attract and

collaborate with leading creative talent, and our demand creation expertise. The lm was a cultural phenomenon,

achieving the largest global box ofce in 2023 and becoming the industry’s 14th largest box ofce of all time.

3

The

Barbie movie was nominated for eight Academy Awards, including Best Picture, and received the Oscar for Best

Original Song. Mattel Films has announced the development of our rst animated movie, Bob the Builder, as part of a

robust lm slate that includes 15 movies with some of the leading talent in the industry.

Mattel Television Studios premiered 12 series and specials, including Monster High, Hot Wheels, Polly Pocket, Barbie,

Thomas & Friends, Fireman Sam, and Pictionary, as well as a Monster High movie sequel. In digital gaming, Hot Wheels

Unleashed 2 Turbocharged was released, the first standalone Barbie game on Roblox was launched, achieving over

170 million visits since October 2023,

4

and the Mattel163 mobile gaming joint venture with NetEase grew to almost

$200 million in revenue.

5

Through our live experiences, Mattel fans came together in over 200 global cities to create

meaningful connections with our brands. We also launched our own book publishing business, Mattel Press, with sales

and distribution managed by Simon & Schuster.

We continued to improve operations and successfully concluded the Optimizing for Growth cost savings program,

which achieved total annualized gross cost savings of $343 million between 2021 and 2023, above our initial target of

$250 million and revised target of $300 million. In February 2024, we announced a new Optimizing for Protable Growth

cost savings program, which will target an additional $200 million of annualized gross cost savings between 2024 and

2026. The program’s aim is to achieve additional efciencies and cost savings opportunities that we believe can further

improve our productivity, protability, and competitive position.

Over the last few years, we transformed Mattel from a toy manufacturer into an IP company that is managing franchises.

At its core, Mattel is a creative company driven by innovation. Our iconic brand portfolio, including some of the most

beloved franchises in the world, is our key asset and we engage fans through our franchise brands as well as other

popular properties that we own or license in partnership with global entertainment companies. Toys are foundational to

our strategy, and it is where we create the initial emotional connection with consumers. People who buy our products

are more than just consumers, they are fans, and that relationship enables us to expand fan engagement into new

Ynon Kreiz

Chairman and CEO

entertainment verticals and capture more value for Mattel. Building off our successes to date, we continue to advance our

strategy and now look to grow our toy business protably and capture the full value of our IP outside the toy aisle.

Our commitment to corporate citizenship continued as part of our aim to contribute to a more diverse, equitable,

inclusive, and sustainable future. Mattel received recognition for its workplace culture from Forbes, Fast Company, the

Healthiest 100 Workplaces in America, and the Great Place to Work Institute. For the fourth year in a row, Mattel

received a score of 100 on the Human Rights Campaign Foundation’s Corporate Equality Index, the nation’s foremost

benchmarking survey and report measuring corporate policies and practices related to LGBTQ+ workplace equality. We

published our 2022 Citizenship Report, which highlighted the progress we have made across our three environmental,

social, and governance pillars: sustainable design and development, responsible sourcing and production, and thriving

and inclusive communities.

As a leading global toy and family entertainment company and owner of one of the most iconic brand portfolios in the

world, we are committed to empowering generations to explore the wonder of childhood and reach their full potential.

We do that by creating innovative products and experiences that inspire fans, entertain audiences, and develop children

through play. We are proud of the work we do every day, the societal impact of our brands, and the important

contribution we make in the communities where we live, work, and play. I would like to thank the entire Mattel team for

their dedication to our purpose and mission, and the signicant progress we have made over the past few years.

We appreciate your ongoing support of Mattel and believe we are well positioned to continue the successful execution

of our strategy to protably grow our IP-driven toy business and expand our entertainment offering, and to create

long-term stockholder value.

Sincerely,

Ynon Kreiz

Chairman and Chief Executive Ofcer

(1) Excludes American Girl; (2) Source: Circana/Retail Tracking Service/G10/OCT-DEC 2023/Total Toys and Dolls, Vehicles, Infant Toddler & Preschool, and

Building Sets Supercategories/Projected Dollars; Circana/Retail Tracking Service/G10/JAN-DEC 2022-2023/Total Toys & Dolls Supercategory/Projected

Dollars; Circana/Retail Tracking Service/G10/JAN-DEC 2022-2023/Vehicles Supercategory/Projected Dollars; Circana/Retail Tracking Service/G10/JAN-DEC

2023/Dolls Supercategory/Projected Dollars; (3) Source: Warner Bros.; (4) Source: Roblox; (5) Source: Mattel163 joint venture

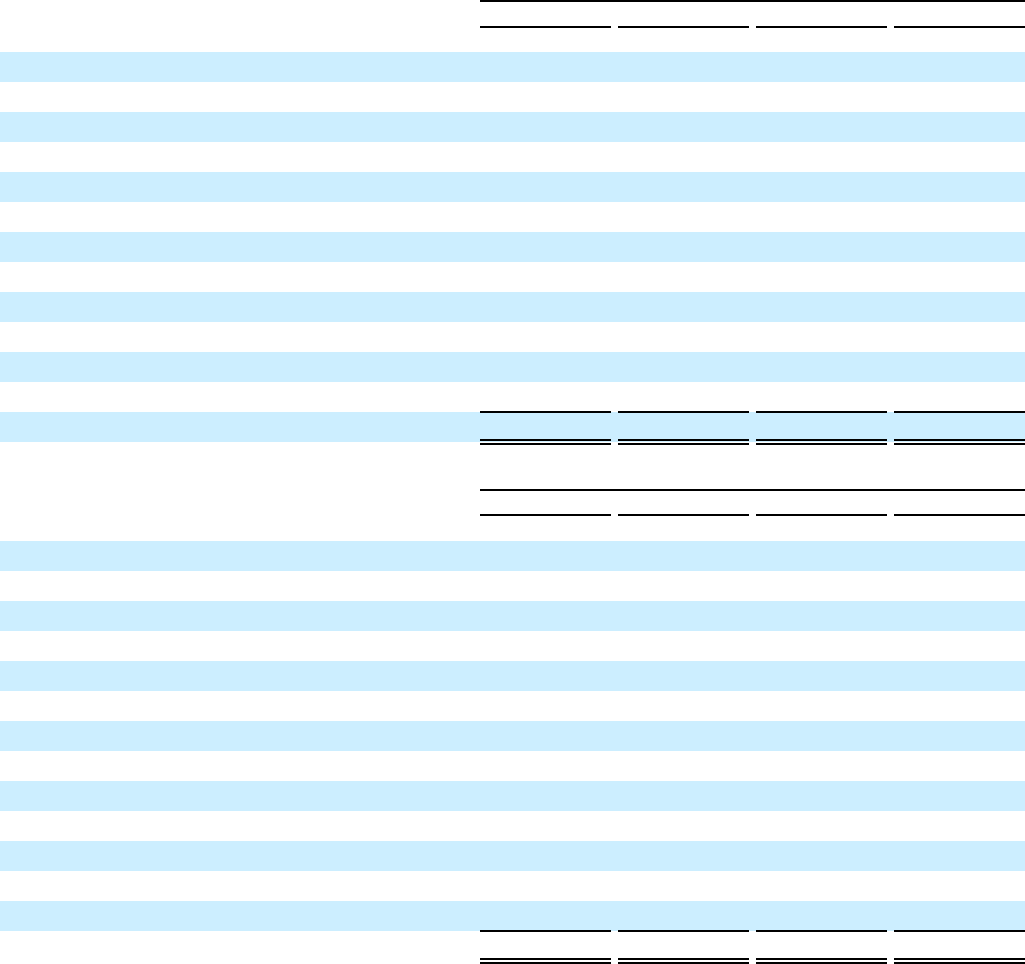

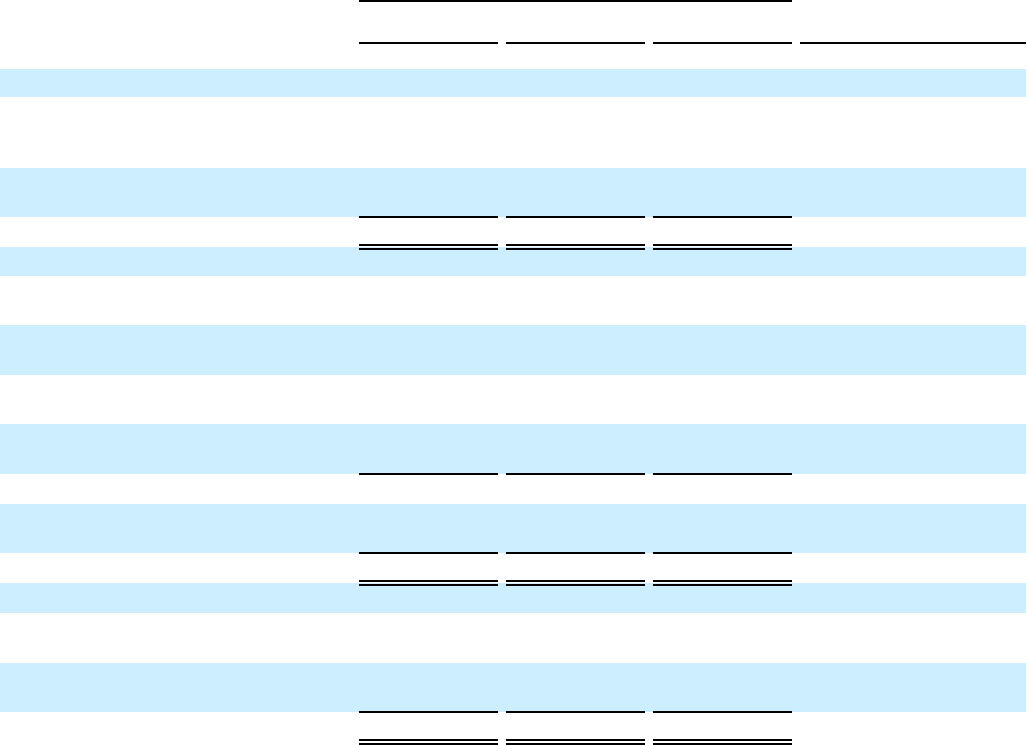

Mattel, Inc.

Form 10-K 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________

FORM 10-K

(Mark One)

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

or

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-05647

______________________________________________________

MATTEL, INC.

(Exact name of registrant as specified in its charter)

Delaware

95-1567322

(State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.)

333 Continental Blvd.

El Segundo, CA 90245-5012

(Address of principal executive offices)

Registrant's telephone number, including area code (310) 252-2000

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Trading Symbol(s) Name of each exchange on which registered

Common stock, $1.00 per share MAT

The Nasdaq Global Select Market

______________________________________________________

Securities registered pursuant to Section 12(g) of the Act:

NONE

______________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90

days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-

T(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging

growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the

Exchange Act.

Large accelerated filer

ý

Accelerated filer

¨

Non-accelerated filer

¨

Smaller reporting company

¨

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over

financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

ý

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the

correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the

registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was $6,916,658,936 based upon the closing market

price as of the close of business June 30, 2023, the last business day of the registrant's most recently completed second fiscal quarter.

Number of shares outstanding of registrant's common stock, $1.00 par value, as of March 4, 2024: 344.0 million shares

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Mattel, Inc. 2024 Proxy Statement, to be filed with the Securities and Exchange Commission ("SEC") within 120 days after the closing of the registrant's

fiscal year (incorporated into Part III to the extent stated herein).

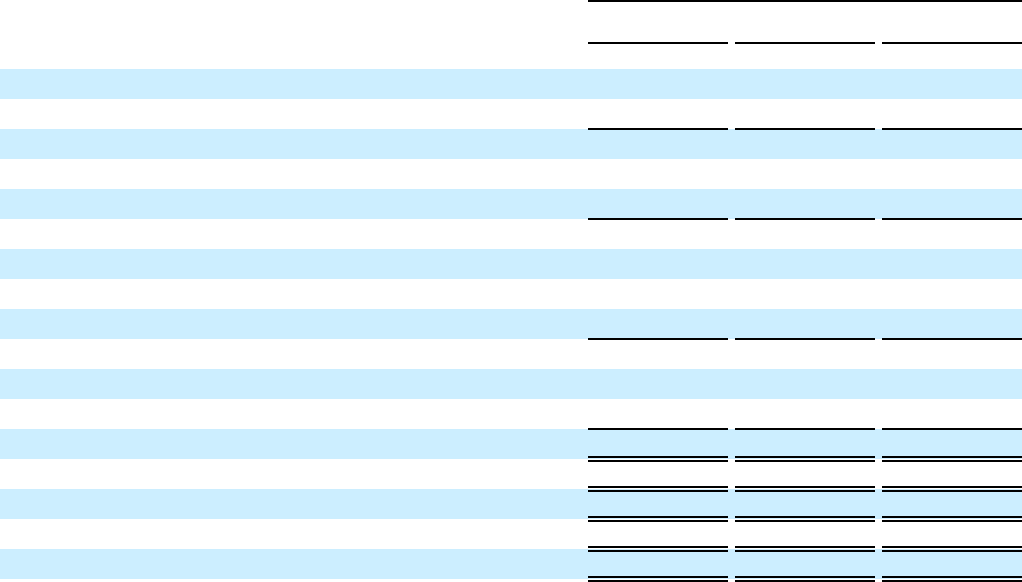

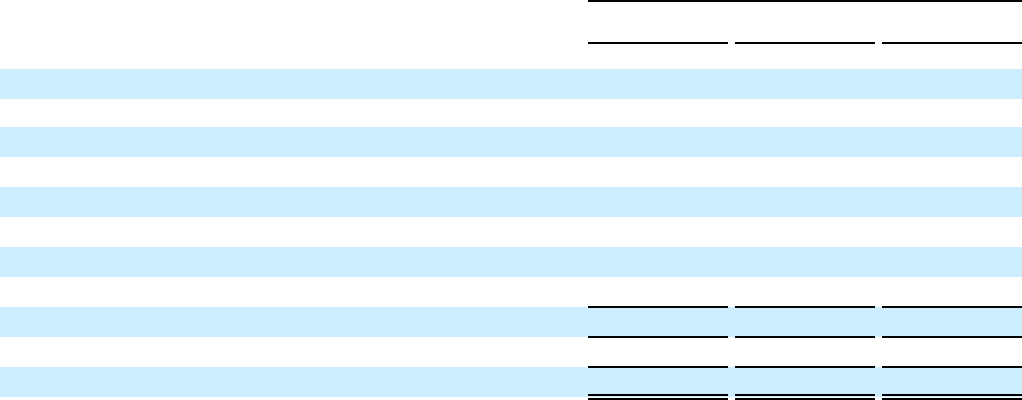

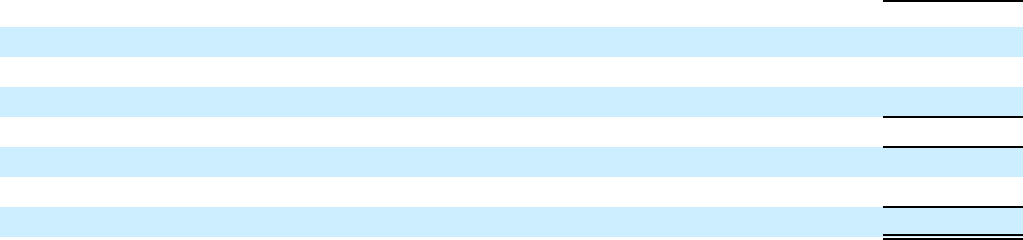

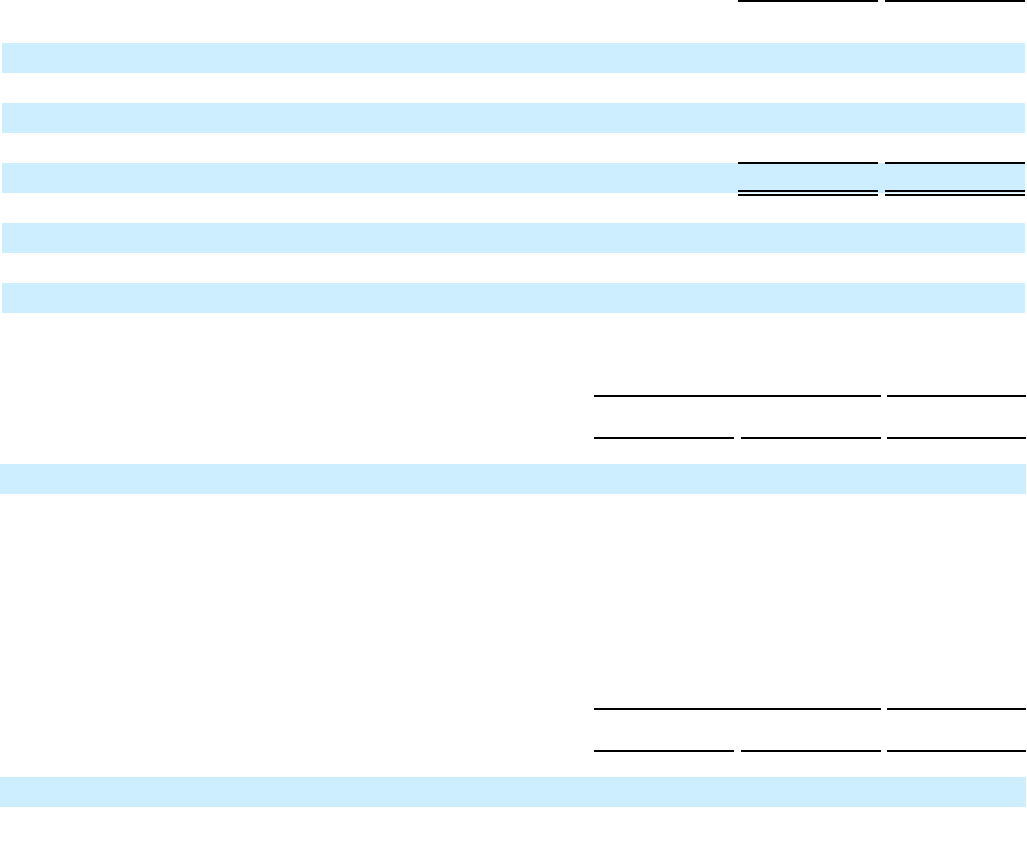

MATTEL, INC. AND SUBSIDIARIES

Page

PART I

Item 1. Business 4

Item 1A. Risk Factors 11

Item 1B. Unresolved Staff Comments 25

Item 1C. Cybersecurity 25

Item 2. Properties 26

Item 3. Legal Proceedings 26

Item 4. Mine Safety Disclosures 26

PART II

Item 5. Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities

27

Item 6. Reserved 29

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations 29

Item 7A. Quantitative and Qualitative Disclosures About Market Risk 47

Item 8. Financial Statements and Supplementary Data 49

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure 95

Item 9A. Controls and Procedures 95

Item 9B. Other Information 95

Item 9C. Disclosure Regarding Foreign Jurisdictions that Prevent Inspections 95

PART III

Item 10. Directors, Executive Officers, and Corporate Governance 96

Item 11. Executive Compensation 96

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters 96

Item 13. Certain Relationships and Related Transactions, and Director Independence 96

Item 14. Principal Accountant Fees and Services 96

PART IV

Item 15. Exhibits and Financial Statement Schedules 97

Item 16. Form 10-K Summary 102

Signature

103

2

(Cautionary Note Regarding Forward-Looking Statements)

Mattel cautions investors that this Annual Report on Form 10-K includes forward-looking statements, which are

statements that relate to the future and are, by their nature, uncertain. Forward-looking statements can be identified by the fact

that they do not relate strictly to historical or current facts. The use of words such as "anticipates," "expects," "intends," "plans,"

"projects," "looks forward," "confident that," "believes," and "targeted," among others, generally identify forward-looking

statements. These forward-looking statements are based on currently available operating, financial, economic, and other

information and assumptions, and are subject to a number of significant risks and uncertainties. A variety of factors, many of

which are beyond Mattel's control, could cause actual future results to differ materially from those projected in the forward-

looking statements. Specific factors that might cause such a difference include, but are not limited to: (i) Mattel's ability to

design, develop, produce, manufacture, source, ship, and distribute products on a timely and cost-effective basis; (ii) sufficient

interest in and demand for the products and entertainment Mattel offers by retail customers and consumers to profitably recover

Mattel's costs; (iii) downturns in economic conditions affecting Mattel's markets which can negatively impact retail customers

and consumers, and which can result in lower employment levels and lower consumer disposable income and spending,

including lower spending on purchases of Mattel's products; (iv) other factors which can lower discretionary consumer

spending, such as higher costs for fuel and food, drops in the value of homes or other consumer assets, and high levels of

consumer debt; (v) potential difficulties or delays Mattel may experience in implementing cost savings and efficiency

enhancing initiatives; (vi) other economic and public health conditions or regulatory changes in the markets in which Mattel

and its customers and suppliers operate, which could create delays or increase Mattel's costs, such as higher commodity prices,

labor costs or transportation costs, or outbreaks of disease; (vii) the effect of inflation on Mattel's business, including cost

inflation in supply chain inputs and increased labor costs, as well as pricing actions taken in an effort to mitigate the effects of

inflation; (viii) currency fluctuations, including movements in foreign exchange rates, which can lower Mattel's net revenues

and earnings, and significantly impact Mattel's costs; (ix) the concentration of Mattel's customers, potentially increasing the

negative impact to Mattel of difficulties experienced by any of Mattel's customers, such as bankruptcies or liquidations or a

general lack of success, or changes in their purchasing or selling patterns; (x) the inventory policies of Mattel's retail customers,

as well as the concentration of Mattel's revenues in the second half of the year, which coupled with reliance by retailers on

quick response inventory management techniques, increases the risk of underproduction, overproduction, and shipping delays;

(xi) legal, reputational, and financial risks related to security breaches or cyberattacks; (xii) work disruptions, including as a

result of supply chain disruption such as plant or port closures, which may impact Mattel's ability to manufacture or deliver

product in a timely and cost-effective manner; (xiii) the impact of competition on revenues, margins, and other aspects of

Mattel's business, including the ability to offer products that consumers choose to buy instead of competitive products, the

ability to secure, maintain, and renew popular licenses from licensors of entertainment properties, and the ability to attract and

retain talented employees and adapt to evolving workplace models; (xiv) the risk of product recalls or product liability suits and

costs associated with product safety regulations; (xv) changes in laws or regulations in the United States and/or in other major

markets, such as China, in which Mattel operates, including, without limitation, with respect to taxes, tariffs, trade policies,

product safety, or sustainability, which may increase Mattel's product costs and other costs of doing business, and reduce

Mattel's earnings and liquidity; (xvi) business disruptions or other unforeseen impacts due to economic instability, political

instability, civil unrest, armed hostilities (including the impact of the war in Ukraine and geopolitical developments in the

Middle East), natural and man-made disasters, pandemics or other public health crises, or other catastrophic events; (xvii)

failure to realize the planned benefits from any investments or acquisitions made by Mattel; (xviii) the impact of other market

conditions or third-party actions or approvals, including those that result in any significant failure, inadequacy, or interruption

from vendors or outsourcers, which could reduce demand for Mattel's products, delay or increase the cost of implementation of

Mattel's programs, or alter Mattel's actions and reduce actual results; (xix) changes in financing markets or the inability of

Mattel to obtain financing on attractive terms; (xx) the impact of litigation, arbitration, or regulatory decisions or settlement

actions; (xxi) Mattel's ability to navigate regulatory frameworks in connection with new areas of investment, product

development, or other business activities, such as artificial intelligence, non-fungible tokens, and cryptocurrency; (xxii) an

inability to remediate the material weakness in Mattel's internal control over financial reporting, or additional material

weaknesses or other deficiencies in the future or the failure to maintain an effective system of internal control; and (xxiii) other

risks and uncertainties detailed in Part I, Item 1A "Risk Factors." Mattel does not update forward-looking statements and

expressly disclaims any obligation to do so, except as required by law.

3

PART I

Item 1. Business.

Throughout this report "Mattel" refers to Mattel, Inc. and/or one or more of its subsidiaries. Mattel is a leading global toy

and family entertainment company and owner of one of the most iconic brand portfolios in the world. Mattel creates innovative

products and experiences that inspire fans, entertain audiences, and develop children through play. Mattel is focused on the

following evolved strategy to grow its intellectual property ("IP") driven toy business and expand its entertainment offering:

• Grow toy business profitably through scaling Mattel's portfolio, optimizing operations, evolving demand creation, and

growing franchise brands; and

• Expand entertainment offering to capture the full value of Mattel's IP outside the toy aisle in highly accretive business

verticals, by growing franchise brands and accelerating content, consumer products, and digital and live experiences.

Mattel is the owner of a portfolio of iconic brands and partners with global entertainment companies to license other IP.

Mattel's portfolio of owned and licensed brands and products are organized into the following categories:

Dolls—including brands such as Barbie, American Girl, Disney Princess and Disney Frozen, Monster High, and Polly

Pocket. Mattel's Dolls portfolio is driven by the flagship Barbie brand and a collection of complementary brands offered

globally. Empowering girls since 1959, Barbie has inspired the limitless potential of every girl by showing them that they

can be anything. American Girl, with an extensive portfolio of dolls and accessories, content, gaming, and lifestyle

products, is best known for imparting valuable life lessons that instill confidence through its inspiring dolls and books,

featuring diverse characters from past and present.

Infant, Toddler, and Preschool—including brands such as Fisher-Price (including Little People and Imaginext) and

Thomas & Friends. As a leader in play and child development, Fisher-Price's mission is to help families by making the

most fun, enriching products for infants, toddlers, and preschoolers. Thomas & Friends is an award-winning preschool

train brand franchise that brings meaningful life lessons of friendship and teamwork to kids through toys, content, live

events, and other consumer products.

Vehicles—including brands such as Hot Wheels (including Hot Wheels Monster Trucks and Hot Wheels Mario Kart

(Nintendo)), Matchbox, and Cars (Disney Pixar). In production for over 50 years, Hot Wheels continues to push the limits

of performance and design, and ignites and nurtures the challenger spirit of kids, adults, and collectors. From die-cast

vehicles to tracks, playsets, and accessories, the Mattel Vehicles portfolio has broad appeal that engages and excites fans

of all ages.

Action Figures, Building Sets, Games, and Other—including brands such as Masters of the Universe, MEGA, UNO,

Jurassic World (NBCUniversal), Minecraft (Microsoft), WWE, and Star Wars (Disney's Lucasfilm). Mattel's Action

Figures portfolio is comprised of product lines associated with licensed entertainment franchises, such as Jurassic World

and WWE, as well as product lines from Mattel-owned IP, such as Masters of the Universe. As the challenger brand in

Building Sets, MEGA inspires creativity through authentic building experiences for builders of all ages and fans of global

franchises. Within Games, UNO is the classic matching card game that is easy to learn and fast fun for everyone. Other

includes Plush, which contains products associated with movie releases from licensed entertainment franchises, as well as

Mattel-owned IP.

Business Segments

Mattel's operating segments are: (i) North America, which consists of the United States and Canada; (ii) International;

and (iii) American Girl. The North America and International segments sell products across Mattel's categories, although some

products are developed and adapted for particular international markets.

For additional information on Mattel's worldwide gross billings by brand category, see Part II, Item 7 "Management's

Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations."

4

North America Segment

The North America segment markets and sells toys and consumer products in the United States and Canada across all of

Mattel's categories.

Dolls

Barbie continues to deliver innovation, purpose-driven marketing campaigns, and engaging toys connected to a strong

system of play. Barbie has broad product offerings, with product lines designed to appeal to children of multiple age groups,

complemented by a Barbie Signature line with high-quality dolls that appeal to fans of all ages. In 2024, Barbie will look to

continue to capitalize on the successful live action theatrical movie to help drive the full Barbie franchise, including toys,

consumer products, and gaming. Barbie will be celebrating its 65

th

anniversary with numerous activations, and also launch

exciting new product lines and play patterns.

Mattel is also excited to build upon its strong partnerships with Disney for the Disney Princess and Disney Frozen

product lines. Monster High will look to build upon the success of its global re-launch, including planned new content and

product offerings.

Infant, Toddler, and Preschool

In 2024, Fisher-Price will continue its focus on engaging consumers as a trusted partner for families with infants,

toddlers and preschoolers, by continuing to create brand love through innovative products and enriching the first five years of

childhood for every family. Consumer-centric innovation will continue to drive new product offerings, including the expansion

of Linked Play within Infant and new innovative toys from Imaginext, including new licensed entertainment offerings. Fisher-

Price will add Fisher-Price Wood and continue its strong momentum in the Little People product line with the expansion of the

Little People Barbie line and Little People Collector line.

Vehicles

In 2024, industry leader Hot Wheels will look to continue its strong momentum as a multigenerational franchise with

consumer interest that remains at historic highs. Hot Wheels product offerings are expected to excite consumers with innovation

in both die-cast vehicles and tracks and playsets. These offerings will be supported by an all-new animated children's series on

Netflix, Hot Wheels Let’s Race, and the expansion of the Hot Wheels Racerverse line. Hot Wheels also seeks to further expand

die-cast vehicle distribution, targeting fans of all ages.

Die-cast pioneer Matchbox expects to continue to bring exciting new products to market following its successful 70

th

anniversary, including new sustainable die-cast products, and new episodes of the globally popular YouTube series, Matchbox

Adventures.

Mattel will continue to partner with Disney Pixar for Cars to drive innovation, including fresh new product offerings to

support key marketing events in 2024.

Action Figures, Building Sets, Games, and Other

Mattel Action Figures will continue to collaborate with key licensor partners, such as Disney Pixar, Microsoft,

NBCUniversal, and WWE, to bring innovative products to the global marketplace. Mattel's 2024 Action Figures product lines

will include toys tied to Netflix content for NBCUniversal’s Jurassic World (Jurassic World: Chaos Theory) and Masters of the

Universe (Masters of the Universe: Revolution) as well as new innovation within Minecraft and WWE.

In Building Sets, MEGA inspires creativity through authentic building experiences for builders of all ages and fans of

global franchises. Partnerships with some of the world's top franchises, including Pokémon and Hot Wheels, invite consumers to

try MEGA building sets, while innovative building play, authentic details, compatible quality, and accessible value encourages

consumers to stay in the MEGA building set collection. Parents of preschoolers can continue to discover how the MEGA Bloks

preschool building system enhances playtime and early childhood development beyond the Big Building Bag.

Mattel Games consists of some of the most beloved Games IP in the world including UNO, Pictionary, Skip-Bo, Blokus,

and many others. Mattel will focus on its expansion of Games into its direct-to-consumer business, collectability, and

innovation. Additionally, Mattel expects to introduce new game extensions and partnerships that celebrate pop culture.

5

International Segment

Products marketed and sold by the International segment are generally the same as those marketed and sold by the North

America segment, although some are developed or adapted for particular international markets. Mattel's products are sold

directly to retailers and wholesalers in most European, Latin American, and Asian countries, in Australia and New Zealand, and

through agents and distributors in those countries where Mattel has no direct presence. No individual country within the

International segment exceeded 8% of worldwide consolidated net sales during 2023.

American Girl Segment

The American Girl segment is a direct marketer, retailer, and children's publisher dedicated to its mission to help girls

grow up with confidence and character. American Girl is best known for its line of historical and contemporary characters that

feature 18" dolls, books, and accessories that inspire girls to face the world with courage, resilience, and kindness. The

contemporary Truly Me and Create Your Own lines encourage girls to express their imaginations and creativity by choosing a

doll that looks like them or custom-creating one that's completely unique from more than one million options. Bitty Baby

introduces younger girls to nurturing play until they are ready for WellieWishers, a sweet group of girls who focus on empathy

and being a good friend. American Girl also publishes best-selling fiction and non-fiction books, as well as an array of popular

digital content. The American Girl segment sells products directly to consumers through its website, proprietary retail stores in

the United States, and at select retailers in the United States.

Competition and Industry Background

Mattel is a worldwide leader in the manufacture, marketing, and sale of toys, games, and other products related to play,

learning, and development. Competition in the toy industry is based primarily on quality, play value, brands, and price. Mattel

offers a diverse range of products for children, fans of all ages, and families that include, among others, toys for infants,

toddlers, and preschoolers, toys for school-aged children, dolls, vehicles, action figures, building sets, games, including digital,

puzzles, plush, educational toys, technology-related products, media-driven products, and fashion-related items. The North

America segment competes with several large toy companies, including Hasbro, Jazwares, LEGO, the Pokémon Company,

Spin Master, many smaller toy companies, and manufacturers of video games and consumer electronics. The International

segment competes with global toy companies including Hasbro, Jazwares, LEGO, the Pokémon Company, Spin Master, other

national and regional toy companies, and manufacturers of video games and consumer electronics. Foreign regions may include

competitors that are strong in a particular toy line or geographical area but do not compete with Mattel or other international toy

companies worldwide. The American Girl segment competes with companies that manufacture dolls and accessories, and with

children's book publishers and retailers.

There is increasing competition among the above companies due to trends towards shorter life cycles for individual toy

products and an increasing use of more sophisticated technology among consumers. In addition, Mattel competes with

companies that sell non-toy products, such as electronic consumer products, video games, as well as content and other

entertainment companies. Competition continues to be heavily influenced by the fact that a small number of retailers account

for a large portion of all toy sales, allocate the shelf space from which toys are viewed, and have direct contact with parents and

children through in-store and online purchases. Such retailers can and do promote their own private-label toys, facilitate the sale

of competitors' toys, showcase toys online based on proprietary algorithms, and allocate shelf space to one type of toy over

another. Online distributors are able to promote a wide variety of toys and represent a wide variety of toy manufacturers.

Seasonality

Mattel's business is highly seasonal, with consumers making a large percentage of all toy purchases during the traditional

holiday season. A significant portion of retailer purchasing typically occurs in the third and fourth quarters of Mattel's fiscal

year in anticipation of holiday buying. These seasonal purchasing patterns and requisite production lead times create risk to

Mattel's business associated with the underproduction of popular toys and the overproduction of less popular toys that do not

match consumer demand. The seasonality of Mattel's business increases the risk that Mattel may not be able to meet demand for

certain products at peak demand times or that Mattel's own inventory levels may be adversely impacted by the need to pre-build

products before orders are placed. In addition, this seasonality may cause Mattel's sales to vary significantly from period to

period.

In anticipation of retail sales during the traditional holiday season, Mattel significantly increases its production in advance

of the peak selling period, resulting in a corresponding build-up of inventory levels in the first three quarters of its fiscal year.

Seasonal shipping patterns generally result in significant peaks in the third and fourth quarters in the respective levels of

inventories and accounts receivable, which may result in seasonal working capital financing requirements.

6

Sales

Mattel's products are sold throughout the world. Products within the North America segment are sold directly to retailers,

including omnichannel retailers, discount and free-standing toy stores, chain stores, department stores, other retail outlets, and,

to a limited extent, wholesalers. Mattel also operates small retail outlets at certain corporate offices as a service to its employees

and as an outlet for its products. Products within the International segment are sold directly to retailers and wholesalers in most

European, Latin American, and Asian countries, in Australia and New Zealand, and through agents and distributors in those

countries where Mattel has no direct presence. Mattel also has retail outlets in Latin America that serve as outlets for its

products. American Girl products and its children's publications are sold directly to consumers and select retailers in the United

States. Mattel has retail space in Chicago, Illinois; Los Angeles, California; and New York, New York for its flagship American

Girl stores, and in five other cities across the United States for its American Girl boutique stores, each of which features

children's products from the American Girl segment. Additionally, Mattel sells certain of its products directly to consumers

through its e-commerce platform and various third-party e-commerce channels.

During 2023, Mattel's three largest customers (Walmart at $1.13 billion, Target at $0.67 billion, and Amazon at

$0.60 billion) accounted for approximately 44% of worldwide consolidated net sales. During 2022, Mattel's three largest

customers (Walmart at $0.95 billion, Target at $0.76 billion, and Amazon at $0.64 billion) accounted for approximately 43% of

worldwide consolidated net sales. Within countries in the International segment, there is also a concentration of sales to certain

large customers that do not operate in the United States, none of which exceeded 10% of worldwide consolidated net sales. The

customers and the degree of concentration vary depending upon the region or nation. See Part I, Item 1A "Risk Factors" and

Part II, Item 8 "Financial Statements and Supplementary Data—Note 14 to the Consolidated Financial Statements—Segment

Information."

License Agreements

Mattel has license agreements with third parties that permit Mattel to utilize the trademark, characters, or inventions of

the licensor in products that Mattel sells. A number of these licenses relate to product lines that are significant to Mattel's

business and operations.

Mattel has entered into agreements to license entertainment properties, including among others, Disney Consumer

Products (including Disney Princess and Disney Frozen, Star Wars, Disney Pixar (including Cars and Toy Story) and certain

other Disney films and television properties), NBCUniversal (including Jurassic World, Trolls, and Fast and Furious),

Paramount (relating to its Nickelodeon properties), Warner Bros. (including DC Universe and Harry Potter), Microsoft

(including Minecraft and Halo), WWE, and Pokémon.

Royalty expense for 2023, 2022, and 2021 was $249.8 million, $230.8 million, and $184.3 million, respectively. See Part

II, Item 7 "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital

Resources—Commitments" and Part II, Item 8 "Financial Statements and Supplementary Data—Note 13 to the Consolidated

Financial Statements—Commitments and Contingencies."

Mattel licenses a number of its trademarks and other property rights to others for use in connection with the sale of their

products.

Trademarks, Copyrights, and Patents

Most of Mattel's products are sold under and are associated with trademarks, trade names, and copyrights, and some of

these products incorporate devices or designs for which patent protection has been, or is being, pursued. Trademarks,

copyrights, and patents are significant assets of Mattel in that they provide product recognition, acceptance, and exclusive rights

to Mattel's innovations around the world.

Mattel customarily seeks trademark, copyright, and/or patent protection covering its products, and it owns or has

applications pending or registrations for U.S. and foreign trademarks, copyrights, and patents covering many of its products.

Although a number of these trademarks, copyrights, and patents relate to product lines that are significant to Mattel's business

and operations, Mattel does not believe it is dependent on a single trademark, copyright, or patent. Mattel believes its rights to

these properties are adequately protected, but there can be no assurance that its rights can be successfully asserted in the future

or will not be invalidated, circumvented, or challenged.

7

Manufacturing and Materials

Mattel manufactures toy products for all segments in both company-owned facilities and through third-party

manufacturers. Products are also purchased from unrelated entities that design, develop, and manufacture those products. To

provide greater flexibility in the manufacture and delivery of its products, and as part of a continuing effort to reduce

manufacturing costs, Mattel has concentrated production of most of its core products in company-owned facilities and generally

uses third-party manufacturers for the production of non-core products.

Mattel's principal manufacturing facilities are located in China, Indonesia, Malaysia, Mexico, and Thailand. In

conjunction with Mattel's cost savings programs, in 2021, Mattel discontinued production at its plant located in Canada. In

addition, Mattel intends to discontinue production at a plant located in China in 2024. To help avoid disruption of its product

supply due to political instability, civil unrest, future pandemics or other health crises, economic instability, changes in

government policies or regulations, natural and manmade disasters, and other risks, Mattel produces its products in various

facilities across multiple countries. Mattel believes that the existing production capacity at its owned and third-party

manufacturers' facilities is sufficient to handle expected volume for the foreseeable future.

Mattel bases its production schedules for toy products on customer orders and forecasts, taking into account historical

trends, results of market research, and current market information. Actual shipments of products ordered and order cancellation

rates are affected by consumer acceptance of product lines, strength of competing products, marketing strategies of retailers,

changes in buying patterns of both retailers and consumers, and overall economic conditions. Unexpected changes in these

factors could result in a lack of product availability or excess inventory in a particular product line.

The majority of Mattel's raw materials are available from numerous suppliers but may be subject to fluctuations in price.

See Part I, Item 1A "Risk Factors."

Advertising and Marketing

Mattel supports its product lines with extensive advertising and consumer promotions. Advertising takes place at varying

levels throughout the year and peaks during the traditional holiday season. Advertising includes television commercials, social

media, catalogs, and internet advertisements. Promotions include in-store displays, merchandising materials, major events

focusing on products, and tie-ins with various consumer products companies.

During 2023, 2022, and 2021, Mattel incurred advertising and promotion expenses of $524.8 million (9.6% of net sales),

$534.3 million (9.8% of net sales), and $545.7 million (10.0% of net sales), respectively.

Financial Instruments

Currency exchange rate fluctuations may impact Mattel's results of operations and cash flows. Mattel seeks to mitigate its

exposure to foreign exchange risk by monitoring its foreign currency transaction exposure for the year and partially hedging

such exposure using foreign currency forward exchange contracts primarily to hedge its purchase and sale of inventory and

other intercompany transactions denominated in foreign currencies. These contracts have maturity dates of up to 24 months. In

addition, Mattel manages its exposure to currency exchange rate fluctuations through the selection of currencies used for

international borrowings. Mattel does not trade in financial instruments for speculative purposes.

For additional information regarding foreign currency contracts, see Part II, Item 7A "Quantitative and Qualitative

Disclosures About Market Risk" and Part II, Item 8 "Financial Statements and Supplementary Data—Note 12 to the

Consolidated Financial Statements—Derivative Instruments."

Government Regulations

Mattel's products sold in the United States are subject to the provisions of the Consumer Product Safety Act, as amended

by the Consumer Product Safety Improvement Act of 2008, and the Federal Hazardous Substances Act, and may also be subject

to the requirements of the Flammable Fabrics Act or the Food, Drug, and Cosmetics Act and the regulations promulgated

pursuant to such statutes. These statutes and the related regulations ban from the market consumer products that fail to comply

with applicable product safety laws, regulations, and standards. The Consumer Product Safety Commission may require the

recall, repurchase, replacement, or repair of any such banned products or products that otherwise create a substantial risk of

injury and may seek penalties for regulatory noncompliance under certain circumstances. Similar laws exist in some U.S. states.

Mattel believes that it is in substantial compliance with these federal and state laws and regulations.

8

Mattel's products sold worldwide are subject to the provisions of similar laws and regulations in many jurisdictions,

including the European Union ("EU") and Canada. Mattel believes that it is in substantial compliance with these laws and

regulations.

Mattel maintains a quality control program to help ensure compliance with applicable product safety requirements.

Nonetheless, Mattel has experienced, and may in the future experience, issues in products that result in recalls, withdrawals, or

replacements of products. A product recall could have a material adverse effect on Mattel's business, financial condition, and

results of operations, depending on the product affected by the recall and the extent of the recall efforts required. A product

recall could also negatively affect Mattel's reputation and the sales of other Mattel products. See Part I, Item 1A "Risk Factors."

Mattel's advertising and marketing activities are subject to the Federal Trade Commission Act and the Children's

Television Act of 1990 and may also be subject to other rules and regulations promulgated by the Federal Trade Commission,

and the Federal Communications Commission, as well as laws of certain countries that regulate advertising, advertising to

children, and related activities. In addition, Mattel's web-based products and services and other online and digital

communications activity are or may be subject to U.S. and foreign privacy-related regulations, including the U.S. Children's

Online Privacy Protection Act of 1998 and the EU General Data Protection Regulation and related national regulations.

Privacy-related laws also exist in some U.S. states, such as the California Consumer Privacy Act, as amended by the California

Privacy Rights Act, and other state laws that took effect in 2023, or are yet to take effect. Mattel believes that it is in substantial

compliance with these laws and regulations.

Mattel's worldwide operations are subject to the requirements of various environmental laws and regulations in the

jurisdictions where those operations are located. Mattel believes that it is in substantial compliance with these laws and

regulations. Mattel's operations are from time to time the subject of investigations, conferences, discussions, and negotiations

with various federal, state, and local environmental agencies within and outside the United States with respect to the discharge

or cleanup of hazardous waste. Mattel is not aware of any material cleanup liabilities. In addition, Mattel continues to monitor

existing and pending environmental laws and regulations within the United States and elsewhere related to climate change and

greenhouse gas emissions.

Mattel is subject to various other federal, state, local, and international laws and regulations applicable to its business.

Mattel believes that it is in substantial compliance with these laws and regulations.

Human Capital

As of December 31, 2023, Mattel had approximately 33,000 employees (including temporary and seasonal employees)

working in over 35 countries worldwide to create innovative products and experiences that inspire fans, entertain audiences,

and develop children through play. Approximately 28,400 employees (86% of the total workforce) are located outside the

United States, with a significant global manufacturing labor workforce of approximately 23,600 employees. The remaining

workforce focuses on the design, marketing, sales, finance, and other aspects of Mattel's business.

Mattel believes recruiting, developing, and motivating a talented global workforce are important to its long-term growth

and success. Through Mattel's focus on employee engagement, diversity, equity, and inclusion, training and development,

health and safety, and employee well-being, Mattel endeavors to create a supportive and rewarding environment where

employees are encouraged to collaborate, innovate, and grow. Mattel's Board of Directors, Compensation Committee, and

Governance and Social Responsibility Committee are involved in the oversight of how the company fosters its culture and

receive regular updates on Mattel's workforce management.

Mattel was ranked among Forbes 2023 World's Best Employers and 2023 America's Best Midsize Employers; named to

Fast Company's list of the Best Workplaces for Innovators in 2023; recognized by U.S. News as one of the Best Companies to

Work For 2023-2024; named to Newsweek America’s Greatest Workplaces for Women 2023 and America's Greatest

Workplaces for Diversity 2024; and honored by Computerworld as one of the Best Places to Work in IT in 2023 and 2024.

Mattel has once again been recognized for its diversity, equity, and inclusion efforts, including by the Human Rights Campaign

Foundation as a 2023-2024 "Equality 100 Award" recipient. For the fourth consecutive year, Mattel received a perfect score on

the Human Rights Campaign Foundation's Corporate Equality Index.

Workplace Culture

Mattel is committed to fostering a culture where all employees have the opportunity to realize their full potential.

Management regularly collects feedback to measure employee engagement and job satisfaction on an ongoing basis through its

annual global engagement survey, which is used to help improve the employee experience and strengthen its workplace culture.

Mattel values a wide range of ideas and voices that help evolve and broaden its perspectives, with a reach that extends to

consumers, customers, business partners, and suppliers.

9

In September 2023, Mattel published its 2022 Citizenship Report, which described goals and initiatives related to its

diversity, equity, and inclusion efforts. The report highlighted Mattel's progress on its goals as of December 31, 2022, including

the following:

• Maintained 100% base pay equity in 2022 for similar work performed in similar markets by gender globally and by

ethnicity in the United States.

*

• Continued to achieve a high level of representation for women, who comprised 57% of Mattel's global workforce and

48% of managers and above in 2022.

*

• Continued to achieve a high level of representation for ethnically diverse employees, who made up 45% of U.S.

employees in 2022.

*

• Mattel remains focused on actions to increase such representation, including strengthening relationships with schools,

networks, and organizations to establish a talent pipeline of women for Technology, Supply Chain, and Finance

positions.

* Excludes manufacturing labor and temporary and seasonal employees.

Mattel believes that Mattel's Employee Resource Groups ("ERGs") are an integral component of fostering an inclusive

culture and enhancing engagement at Mattel. Mattel employees have created and continue to lead ten ERGs, which bring

together members and allies of underrepresented identities across the global organization. The ERGs organize learning

opportunities, cultural celebrations, and community outreach, elevate important issues, encourage open and honest

conversations, and collect critical feedback.

Employee Development and Well-Being

Mattel believes continuously developing skills and capabilities for the future is essential to operating as an IP-driven,

high-performing toy and family entertainment company. Additionally, offering the opportunity for employees to continuously

learn and grow their careers at Mattel is a key driver of its employee engagement strategy. In 2023, employees at all levels

around the globe participated in several hundred thousand hours of online classes and instructor-led training regarding

professional development, management development, and technical training.

Mattel is focused on creating a safe and healthy workplace for all of its employees. This is reflected in a comprehensive

set of standards and oversight processes that establish Mattel's expectations for responsible working conditions, environmental

protections, social compliance, health, and safety in both its own manufacturing facilities and those of its supply chain partners.

Mattel offers several benefits to promote employee well-being, including flexible work hours and/or paid time off, health

and welfare insurance options, retirement plans, and basic and supplemental employee life insurance for eligible individuals, as

well as programs targeted at matters such as maintaining work/life balance and improving health and happiness.

Available Information

Mattel files its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy

Statements, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange

Act of 1934, as amended (the "Exchange Act"), with the SEC. The SEC maintains an Internet website that contains reports,

proxy, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

Mattel's internet website address is http://corporate.mattel.com. Mattel makes available on its internet website, free of

charge, its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements,

and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as

reasonably practicable after such materials are electronically filed with, or furnished to, the SEC.

10

Item 1A. Risk Factors.

If any of the risks, events, and uncertainties described below actually occurs, Mattel's business, financial condition and

results of operations could be adversely affected, and such effects could at times be material. The risk factors listed below are

not exhaustive. Other sections of this Annual Report on Form 10-K include additional factors that could materially and

adversely impact Mattel's business, financial condition and results of operations. Moreover, Mattel operates in a very

competitive and rapidly changing environment. New factors emerge from time to time, and it is not possible for management to

predict the impact of all of these factors on Mattel's business, financial condition, or results of operations, or the extent to

which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-

looking statements. These factors are also currently, and in the future may be, amplified by the global economic or geopolitical

climate and additional or unforeseen circumstances, developments, or risks. Given these risks and uncertainties, investors

should not rely on forward-looking statements as a prediction of actual results. Any or all of the forward-looking statements

contained in this Annual Report on Form 10-K and any other public statement made by Mattel or its representatives may turn

out to be wrong. Mattel expressly disclaims any obligation to update or revise any forward-looking statements, whether as a

result of new developments or otherwise.

Business Operations

Mattel and its license partners are not always able to successfully identify and/or satisfy consumer preferences, which

could cause Mattel's business, financial condition, and results of operations to be adversely affected.

Mattel's business and operating results depend largely upon the appeal of its products, driven by both innovation and

marketing. Consumer preferences, particularly with children as the end users of Mattel's products, are continuously changing

and can vary by geographical markets. Product life cycles and consumer preferences continue to be affected by the rapidly

increasing use and proliferation of social and digital media by consumers, and the speed with which information is shared.

Mattel is not always able to identify trends in consumer preferences or identify and satisfy consumer preferences in a timely

manner. Significant, sudden shifts in demand are caused by "hit" toys and trends, which are often unpredictable and can result

in short consumer life cycles. Mattel offers a diverse range of products for children, fans of all ages, and families that includes,

among others, toys for infants, toddlers, and preschoolers, toys for school-aged children, youth electronics, digital media, hand-

held and other games, puzzles, educational toys, and fashion-related items. Mattel competes domestically and internationally

with a wide range of large and small manufacturers, marketers, and sellers of toys, video games, consumer electronics such as

tablets and mobile devices, and other play products, as well as retailers, which means that Mattel's market position is always at

risk. Mattel's ability to maintain its current product sales and increase its product sales or establish product sales with new,

innovative toys, depends on Mattel's ability to satisfy play preferences, enhance existing products, develop and introduce new

products, and achieve market acceptance of these products. These challenges are intensifying due to trends towards shorter life

cycles for individual toy products, the phenomenon of children outgrowing traditional toys at younger ages, an increasing use of

more sophisticated technology in toys, including machine learning and artificial intelligence ("AI"), and an evolving path to

purchase.

In addition, entertainment media has become increasingly important for consumers to experience Mattel's brands and its

license partners' brands. The extent to which Mattel's and its license partners' entertainment offerings are successful can

significantly impact the demand for Mattel's products and its financial performance. Consumer acceptance of Mattel's and its

license partners' entertainment offerings is impacted by factors beyond its control, including critical reviews, promotions, the

popularity of movies and television programs released into the marketplace at or near the same time, the availability of

alternative forms of entertainment, general economic conditions, and public preferences generally.

Mattel's failure to successfully meet the challenges outlined above in a timely and cost-effective manner could decrease

demand for its products and entertainment offerings and may adversely affect Mattel's business, financial condition, and results

of operations.

High levels of competition and low barriers to entry can make it difficult to achieve, maintain, or build upon the success

of Mattel's brands, products, and product lines.

Mattel faces competitors who are also constantly monitoring and attempting to anticipate consumer tastes, seeking ideas

which will appeal to consumers, and introducing new products that compete with Mattel's products. In addition, competition for

access to entertainment properties has lessened, and may in the future continue to lessen, Mattel's ability to secure, maintain,

and renew popular licenses to entertainment products developed by other parties and licensed to Mattel on beneficial terms, if at

all, or require Mattel to pay licensors higher royalties and higher minimum guaranteed payments to obtain or retain these

licenses. As a licensee of entertainment properties, Mattel has no guarantee that a particular property or brand will translate into

a successful toy, game, or other product. In addition, the barriers to entry for new participants in the toy products industry and

11

entertainment industry are low. In a very short period of time, new market participants with a popular product idea or

entertainment property can become a significant source of competition for Mattel and its products. Reduced demand for

Mattel's brands, products, and product lines as a result of these factors may adversely affect Mattel's business, financial

condition, and results of operations.

Inaccurately anticipating changes and trends in popular culture, media, fashion, or technology can adversely affect

Mattel's sales, financial condition, and results of operations.

Successful movies, television programs, video games, and characters in children's literature affect play preferences, and

many products depend on media-based intellectual property licenses including trademarks, trade names, copyrights, patents,

trade secrets, and rights under intellectual property license agreements and other agreements with third parties. Media-based

licenses can cause a line of toys or other products to gain immediate success among children, parents, or families. Trends in

media, and children's characters change swiftly and contribute to the transience and uncertainty of play preferences. Mattel

attempts to respond to such trends and developments by modifying, refreshing, extending, and expanding its product offerings

on an annual basis.

Mattel spends considerable resources in designing and developing toys and other products based on its and its license

partners' planned content releases. Mattel also relies heavily on the efforts of third parties, such as studios and other content

creators and distributors, with respect to the development of content, marketing support, and release dates, which has an impact

on the success of such content and the associated toys and other products. In many cases, Mattel does not fully control when or

if any particular project will be greenlit, developed, or released. Third parties may change their plans with respect to projects

and release dates, or may decide to cancel development. Other developments, such as labor strikes or theater closures, have at

times caused, and could in the future cause, delays in the release of new movies and television programs, and any such delay or

cancellation may adversely impact Mattel’s sales of the associated toys and other products.

Mattel expects that children will continue to be interested in product offerings incorporating sophisticated technology,

such as video games, consumer electronics, and social and digital media, at increasingly younger ages. To the extent Mattel

seeks to introduce sophisticated technology products, such products tend to have higher design, development, and production

costs, follow longer timelines, and require different competencies compared to Mattel's more traditional toys and games. The

pace of change in product offerings and consumer tastes for sophisticated technology products is potentially even greater than

for Mattel's more traditional products, and consequently the window for consumer interest in such products may be shorter than

for traditional toys and games.

Any inability by Mattel to accurately anticipate trends in popular culture, media, fashion, or technology may cause its

products not to be accepted by children, parents, fans, or families and may adversely affect its sales, financial condition, and

results of operations.

Mattel's failure to successfully market or advertise its products could have an adverse effect on Mattel's business,

financial condition, and results of operations.

Mattel's products are marketed worldwide through a diverse spectrum of advertising, marketing, and promotional

programs, including the use of digital and social media to reach consumers. Mattel's ability to sell products is dependent in part

upon the success of these programs. As such, Mattel's business, financial condition, and results of operations could be adversely

affected by its failure to successfully market its products or by an increase in its advertising, marketing, or promotional costs.

Mattel's business is highly seasonal and otherwise subject to fluctuations in demand, and its operating results depend, in

large part, on sales during the relatively brief traditional holiday season. Events that disrupt Mattel's business during its

peak demand times can adversely and disproportionately affect Mattel's business, financial condition, and results of

operations.

Mattel's business is subject to risks associated with the underproduction of popular toys and the overproduction of toys

that are less popular with consumers. Sales of toy products at retail are highly seasonal, with a large percentage of all toy

purchases occurring during the relatively brief traditional holiday season. As a result, Mattel's operating results depend, in large

part, on sales during the holiday season. Retailers attempt to manage their inventories tightly, which requires Mattel to ship

products closer to the time the retailers expect to sell the products to consumers. This in turn results in shorter lead times for

production. Management believes that the increase in "last minute" shopping during the holiday season and the popularity of

gift cards (which often shift purchases to after the holiday season) may negatively impact customer re-orders during the holiday

season.

In addition, as a result of the seasonal nature of Mattel's business, Mattel may be adversely affected, in a manner

disproportionate to the impact on a company with sales spread more evenly throughout the year, by unforeseen events, such as

12

pandemics or other public health crises, terrorist attacks, economic shocks, severe weather due to climate change or otherwise,

earthquakes or other catastrophic events, that harm the retail environment or consumer buying patterns during its key selling

season, or by events, such as strikes, disruptions in transportation, or port delays, that interfere with the manufacture or

shipment of goods during the critical months leading up to the holiday purchasing season.

If Mattel does not correctly anticipate demand for its products, Mattel may not be able to secure sufficient quantities or

cost-effective production of its products or it could have costly excess production or inventories.

To ensure adequate inventory supply, Mattel must forecast inventory needs. If Mattel fails to accurately forecast customer

demand, it may experience excess inventory levels or a shortage of product to deliver to its customers. Inventory levels in

excess of customer demand have in the past resulted in, and may in the future result in, inventory write-downs or write-offs, and

the sale of excess inventory at discounted prices or through less preferred distribution channels, which could harm Mattel's

profit margins and impair Mattel's brand image. If Mattel underestimates the demand for its products, its manufacturing plants

or third-party manufacturers may not be able to produce products to meet customer requirements, which has in the past resulted

in, and may in the future result in, delays in the shipment of Mattel products.

Mattel has significant customer concentration, such that economic difficulties or changes in the purchasing policies or

patterns of its key customers could have an adverse effect on Mattel's business, financial condition, and results of

operations.

A small number of customers account for a large share of Mattel's worldwide consolidated net sales. In 2023, Mattel's

three largest customers, Walmart, Target, and Amazon, in the aggregate, accounted for approximately 44% of worldwide

consolidated net sales (Walmart at $1.13 billion, Target at $0.67 billion, and Amazon at $0.60 billion) and its ten largest

customers, in the aggregate, accounted for approximately 50% of net sales. This concentration exposes Mattel to risk of a

material adverse effect if one or more of Mattel's large customers were to significantly reduce purchases for any reason, favor

competitors or new entrants, redeploy their retail floor space to other product categories, or increase their direct competition

with Mattel by expanding their private-label business. Customers make no binding long-term commitments to Mattel regarding

purchase volumes and make all purchases by delivering one-time purchase orders. Any customer reducing its overall purchases

of Mattel's products, reducing the number and variety of Mattel's products that it carries, and the shelf space allotted for Mattel's

products, or otherwise seeking to materially change the terms of the business relationship at any time could adversely affect

Mattel's business, financial condition, and results of operations.

Liquidity problems or bankruptcy of Mattel's key customers could have an adverse effect on Mattel's business, financial

condition, and results of operations.

Mattel's sales to customers are typically made on credit without collateral. There is a risk that key customers will not pay,

or that payment may be delayed, because of bankruptcy, contraction of credit availability to such customers, weak retail sales,

or other factors beyond the control of Mattel, which could increase Mattel's exposure to losses from bad debts. In addition,

when key customers cease doing business with Mattel as a result of bankruptcy, or significantly reduce the number of stores

operated, it can have an adverse effect on Mattel's business, financial condition, and results of operations.

Failure to successfully implement new initiatives or meet product introduction schedules can have an adverse effect on

Mattel's business, financial condition, and results of operations.

Mattel has in the past announced, and in the future may announce, initiatives to reduce its costs, optimize its

manufacturing footprint, increase its efficiency, improve the execution of its core business, globalize and extend Mattel's

brands, catch new trends, create new brands, offer new innovative products and improve existing products, enhance product

safety, develop people, improve productivity, simplify processes, and maintain customer service levels, as well as initiatives

designed to drive sales growth, capitalize on Mattel's scale advantage, and improve its supply chain. These initiatives involve

investment of capital and complex decision-making as well as extensive and intensive execution, and the success of these

initiatives is not assured. Failure to achieve any of these initiatives could harm Mattel's business, financial condition, and results

of operations.

From time to time, Mattel anticipates introducing new products, product lines, or brands at a certain time in the future.

There is no guarantee that Mattel will be able to manufacture, source, ship, and distribute new or continuing products in a

timely manner and on a cost-effective basis. Unforeseen delays or difficulties in the development process or significant

increases in the planned cost of development for new Mattel products may cause the introduction date for products to be later

than anticipated or, in some situations, may cause a product or new product introduction to be discontinued. Failure to

successfully implement any of these initiatives or launches, or the failure of any of these initiatives or launches to produce the

13

results anticipated by management, could have an adverse effect on Mattel's business, financial condition, and results of

operations.

Mattel's business depends in large part on the success of its vendors and outsourcers, and Mattel's brands and

reputation are subject to harm from actions taken by third parties that are outside Mattel's control. In addition, any

significant failure, inadequacy, or interruption from such vendors or outsourcers could harm Mattel's ability to

effectively operate its business.

As a part of its efforts to cut costs, achieve better efficiencies, and increase productivity and service quality, Mattel relies

significantly on vendor and outsourcing relationships with third parties for services and systems including manufacturing,

transportation, logistics, and information technology. Any shortcoming of a Mattel vendor or outsourcer, particularly an issue

related to compliance or reputation, or affecting the quality of these services or systems, risks damage to Mattel's reputation and

brand value, and potentially adverse effects to Mattel's business, financial condition, and results of operations. In addition,

problems with transitioning these services and systems to, or operating failures with, these vendors and outsourcers cause

delays in product sales and reduce the efficiency of Mattel's operations, and significant capital investments could be required to

remediate the problem.

The production and sale of private-label toys by Mattel's retail customers may result in lower purchases of Mattel-

branded products by those retail customers.

In recent years, consumer goods companies, including those in the toy business, generally have experienced the

phenomenon of retail customers developing their own private-label products that directly compete with the products of

traditional manufacturers. Some retail chains and online retailers that are customers of Mattel, including three of its largest

retail customers, Walmart, Amazon and Target, sell private-label toys designed, manufactured, and branded by the retailers

themselves. These toys may be sold at prices lower than comparable toys sold by Mattel and may result in lower purchases of

Mattel-branded products by these retailers and reduce overall consumer demand for Mattel products. In some cases, retailers

who sell these private-label toys are larger than Mattel and have substantially more resources than Mattel.

Mattel depends on key personnel and may not be able to hire, retain, and integrate sufficient qualified personnel to

maintain and expand its business.

Mattel's future success depends partly on the continued contribution of key executives, designers, and technical, sales,

marketing, manufacturing, entertainment, and other personnel. If Mattel fails to retain, hire, train, and integrate key personnel,

Mattel's ability to maintain or expand its business could be harmed. Recruiting and retaining qualified personnel is costly and

highly competitive. Labor shortages and increased labor costs as a result of increased competition for qualified talent, higher

employee turnover rates, increases in employee benefit costs, wage inflation, or other disruptions to Mattel's workforce can

negatively impact its business. In addition, changes to Mattel's current and future work environments may not meet the needs or

expectations of its employees or be perceived as less favorable compared to other companies' policies, which could negatively

impact Mattel's ability to hire and retain qualified personnel.

Market Conditions

The deterioration of global economic conditions could adversely affect Mattel's business, financial condition, and results

of operations.

Mattel designs, manufactures, and markets a wide variety of toy products worldwide through sales to retailer customers

and directly to consumers. Mattel's performance is impacted by the level of discretionary consumer spending, which remains

relatively weak in many countries around the world in which Mattel does business. Consumers' discretionary purchases of toy

products are often impacted by a number of factors beyond Mattel's control, including, inflation, job losses, foreclosures,

bankruptcies, reduced access to credit, interest rates, tax rates, investment losses, lower consumer confidence, and other macro-

economic factors that affect consumer spending behavior. These or other factors can reduce the amount that consumers spend

on the purchase of Mattel's products. Deterioration of global economic conditions have at times adversely affected Mattel's

business and financial results. Unfavorable economic conditions can also impair the ability of those with whom Mattel does

business to satisfy their obligations to us. Future deterioration of global economic conditions or disruptions in credit markets in

the markets in which Mattel operates could potentially have a material adverse effect on Mattel's liquidity and capital resources,

including increasing Mattel's cost of capital or its ability to raise additional capital if needed, or otherwise adversely affect

Mattel's business, financial condition, and results of operations.

In addition to experiencing potentially lower revenues during times of economic difficulty, in an effort to maintain sales

during such times, Mattel may need to increase promotional spending or take other steps to encourage retailer and consumer

14

purchase of its products. Those steps may increase costs and/or decrease profit margins and are not always successful. During

periods of increased inflation, such as Mattel is currently facing, Mattel has increased prices of certain products, and may in the

future need to increase prices further in order to cover increased costs of goods sold, which may reduce demand for products.

There can be no guarantee that Mattel will be able to successfully increase prices in the future or that the price increases Mattel

has already taken will offset the entirety of additional costs it has incurred and may incur in the future. The inability to

adequately increase prices to offset increased costs and inflationary pressures, or otherwise mitigate the impact of these macro-

economic conditions and market disruptions, may also increase costs and/or decrease profit margins.